|

市場調查報告書

商品編碼

1434490

生物辨識:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

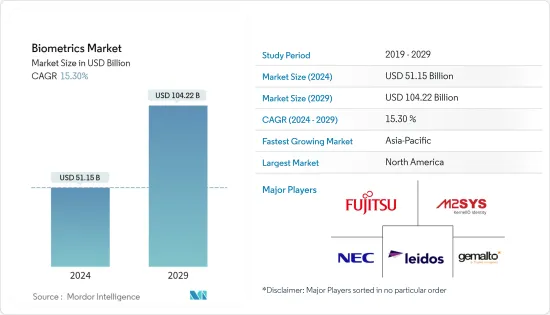

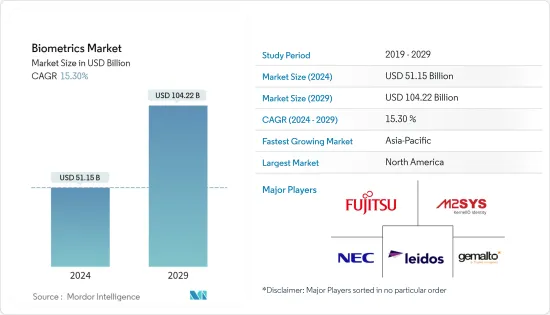

生物辨識市場規模預計2024年為511.5億美元,預計到2029年將達到1042.2億美元,在預測期內(2024-2029年)複合年成長率為15.30%成長。

由於恐怖活動增加以及與關鍵資料和資訊相關的盜竊活動增加,引起國家安全擔憂,生物識別市場預計將以顯著的速度發展。

主要亮點

- 在所研究的市場中觀察到的主要趨勢之一是業務討論中的模式轉變,以增強隱私並減少安全威脅。最終用戶越來越需要整合解決方案,而不是依賴傳統方法。

- 近年來,由於行動裝置的普及,消費者生物辨識應用迅速擴展。由於採用生物辨識系統,消費性電器產品產業以安全和存取控制設備為主。從而支持市場成長。例如,流行的通訊應用程式 WhatsApp 在其 Android 平台上推出了額外的隱私措施。該公司聲稱,用戶很快將能夠透過指紋感應器以生物辨識技術的形式保護他們的帳戶。

- 此外,最近,多模型或混合生物識別系統已成為用於身份驗證目的的重要識別技術。多模型生物辨識系統使用不同的特徵(臉部、虹膜、指紋)來驗證使用者身分。這將在需要支援各種物理屬性的大型系統以及需要嚴格身份驗證的使用情況下實現更可靠、更快速、更準確的身份驗證。

- 由於擴大採用可靠、高效的生物辨識技術,混合生物辨識系統被認為是成長最快的複合年成長率。透過多層次身份驗證,多模態生物辨識技術增強了防冒充和篡改的安全性。目前,混合生物辨識系統由多種模式(語音、臉部、虹膜)組成,並被世界各地的政府機構用於邊防安全、執法、人力資源、國防、醫療等各種與安全相關的業務。和醫療保健。我們使用混合生物識別系統。和企業安全。

- 例如,2021 年 8 月,歐盟通過了多模型生物辨識系統的互通性要求,以改善資料流。多重身份檢測器 (MID)資料庫評估各種其他資料庫,以查看搜尋的身份資料是否在多個資訊系統中可用。

生物辨識市場趨勢

軟體和服務業佔據最大的市場佔有率

- 生物辨識軟體可確保生物辨識設備及其所連接的電腦和網路彼此相容且可操作。它還可以兼容不同作業系統上的各種應用軟體並實現高效連接。軟體是生物辨識系統的重要組成部分。例如,簽名檢驗系統軟體會比較簽名並檢查其原創性。詐欺簽名對於操作人員來說並不總是顯而易見的,因此人眼很難準確識別詐欺簽名。因此,簽名檢驗軟體擴大被採用,以節省時間,防止簽名過程中的人為錯誤,並減少詐騙的機會。

- 生物辨識軟體進一步與人工智慧等先進技術結合,以偵測詐欺。例如,IntelliVision的臉部辨識軟體是一款針對整合商和開發人員的基於深度學習的臉部辨識解決方案,可從影像資料庫中偵測和識別所有種族的臉部,而不會產生種族偏見。使用公共標準資料集實現約 99.5% 的臉部辨識辨識準確率。此外,它可以在伺服器或雲端中使用。

- 2021 年 9 月,對話式 AI 和語音安全領域的參與者 Gnani.ai 宣布推出語音生物辨識軟體 Christenedarmor365。生物辨識解決方案適用於銀行、國防和醫療保健等產業。

- 本地生物辨識系統需要伺服器和網路等IT基礎設施。該基礎設施價格昂貴且需要維護。因此,生物辨識服務越來越受到人們的關注,因為生物辨識計劃的實施不需要任何特殊的IT基礎設施基礎設施或維護。

- 此外,企業正在採用高度擴充性的生物辨識服務。註冊人數依公司規模而有所不同。生物辨識服務可協助企業根據需求訂閱服務。透過更改訂閱計劃也可以非常輕鬆地擴展或收縮您的設施。

- Aware Inc.等公司提供獨立於獨立供應商(即硬體供應商和系統整合商)的生物辨識軟體產品和服務。這些好處包括降低與硬體和軟體過時相關的風險和成本,並減少可能導致效能下降和解決方案壽命縮短的系統維護挑戰。

亞太地區預計將成為成長最快的市場

- 行動付款交易的增加以及私人公司和政府擴大實施生物識別系統的舉措預計將成為該地區生物識別市場的主要驅動力。根據戰略與國際研究中心 (CSIS) 2021 年報告,中國處於全球數位付款革命的前沿。

- 基於全球5.4兆美元的數位商務和行動付款市場,預計2020年中國企業將產生2.9兆美元的交易額。中國的主要關注點是影響世界數位基礎設施、電子商務以及數位人民幣等新計劃以及提案的新智慧財產權,這表明中國可能會走上一條更專制的數位化道路。例如,2021年,開通企業錢包超過351萬個,個人錢包超過2087萬個,總交易量7075萬筆,交易金額54.1億美元(約合人民幣345億元)。

- 另一方面,包括零售、遊戲、銀行和金融部門、醫院等在內的各種最終用戶對生物識別系統的需求不斷增加,極大地影響了全國市場的成長。例如,中國建設銀行(CCB)決定與 IDEX Biometrics 合作,在其數位人民幣實驗中使用生物辨識卡。該銀行已經發布了數位人民幣錢包應用程式。支援 NFC 的生物辨識智慧卡允許用戶無需智慧型手機即可使用數位貨幣。這些生物辨識卡充當中國數位貨幣試驗(DCEP)成員的數位硬錢包。指紋感應器和生物辨識軟體可保護這些智慧卡的安全。

- 此外,BFSI 和醫療保健等最終用戶產業還有許多重要且極具價值的資產。安全漏洞或失誤可能會導致災難性的損失和成本以及收益損失。因此,該國這些產業採取了嚴格的措施,利用尖端技術來保護客戶的敏感資料。例如,2021 年 2 月,顧客將可以透過刷臉和手掌驗證身份進入日本橫濱科技塔酒店的 Green Leaves+ Shop and Go 商店。您可以使用多生物識別技術,從智慧型手機應用程式連結臉部和手掌靜脈身份驗證資訊。您也可以透過掃描 Green Leaves+ 應用程式上顯示的2D碼來存取商店。

- 同樣,2021 年 7 月,Fingerprint Cards(瑞典生物辨識公司)和 MorX(日本電子公司)合作在日本開發和推出生物辨識付款卡。據新聞稿稱,這款新卡配備了 Fingerprints 的 T 形模組,該模組具有超低功耗,旨在使用常規自動化製造方法整合到支付卡中。此外,該公司表示,“日本消費者對卡片交易的興趣日益成長”,他們正在尋找非接觸式、安全且流暢的支付方式。

生物辨識行業概況

生物辨識市場高度分散,NEC、富士通有限公司、Leidos Holdings Inc.、金雅拓 NV(泰雷茲集團)等供應商遍布全球。該市場見證了各個最終用戶產業擴大採用生物辨識解決方案。此外,該供應商正在進行重大產品開發,以擴大其在市場上的影響力。市場也將策略聯盟和收購視為利潤豐厚的擴張途徑。

- 2021 年 10 月 - 泰雷茲與 Inetum 合作,將旅客生物辨識自動到達控制 (ABC) 系統的實施範圍擴大到三個西班牙機場。這些系統包括臉部辨識和文件檢驗。預計這些將加快邊境管制流程並顯著減少旅客的等待時間。

- 2021 年 10 月 - ImageWare Systems 透過開發支援生物辨識的區塊鏈驅動的自主主權 ID 解決方案,進入自主主權 ID 市場。在身分區塊鏈中添加生物辨識保護可確保數位錢包中的資料安全,提供只有授權用戶才能存取的最後一層保護。

- 2021 年 6 月 - Phonexia 利用其在全球數百個公共安全計劃中的經驗,開發了用於音訊調查的新軟體 Phoenixia Orbis。這種本地解決方案允許執法部門自動有效地從大量音訊中提取複雜的見解,使調查變得簡單明了。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第4章市場動態

- 市場促進因素

- 消費者應用中對生物辨識解決方案的需求增加

- 新興國家公共和政府部門的招募增加

- 導致生物辨識技術商品化的關鍵技術發展

- 市場挑戰

- 關於隱私、安全和投資報酬率的營運問題

- 市場機會

- 產業相關人員分析

第5章 COVID-19 對生物辨識市場影響的關鍵主題

- 處於技術創新前沿的語音和語音辨識

- 移動生物辨識技術的興起

- 非消費者生物辨識技術仍占主導地位

- 持續認證成為關鍵趨勢

- 關於生物辨識資料收集的監管問題仍然是主要相關人員面臨的主要挑戰

- 使用穿戴式裝置進行心率檢測等新領域的研究工作

- 生物辨識即服務將逐步取代在消費者家中部署生物辨識解決方案的傳統模式

第6章市場區隔

- 按類型

- 硬體

- 軟體和服務(專業和託管)

- 依生物辨識類型

- 虹膜識別

- 手的幾何形狀

- 臉部認證

- 簽名檢驗

- 指紋認證

- 自動指紋辨識系統

- 非 AFIS(自動指紋辨識系統)

- 語音辨識

- 手掌靜脈

- 按接觸類型

- 接觸式

- 非接觸式

- 按最終用戶

- 政府和執法部門

- 商業和零售

- 衛生保健

- BFSI

- 旅行和移民

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Gemalto NV(Thales Group)

- Leidos Holdings Inc.

- NEC Corporation

- M2SYS Technology

- BioEnable Technologies Pvt. Ltd

- Phonexia SRO

- ImageWare Systems Inc.

- SIC Biometrics Global Inc.

- Fujitsu Limited

- Aware Inc.

- Nuance Communications Inc.

- IDEMIA France SAS

- Cognitec Systems GmbH

- BioID AG

- Assa Abloy AB

- Hitachi Corporation

第8章 投資展望

第9章市場的未來

The Biometrics Market size is estimated at USD 51.15 billion in 2024, and is expected to reach USD 104.22 billion by 2029, growing at a CAGR of 15.30% during the forecast period (2024-2029).

The biometrics market is anticipated to develop at a significant growth rate, owing to the rising number of terrorist activities and the increasing theft activities pertaining to crucial data and information that have raised concerns regarding national security.

Key Highlights

- One of the key trends witnessed in the market studied is a model shift in business discourse toward more privacy and fewer security threats. The end-users are increasingly looking for integrated solutions rather than depending on conventional methods.

- Consumer biometric applications have expanded rapidly over the recent years, with the increased adoption of mobile devices. The consumer electronics sector is dominated majorly by security and access control devices, owing to the adoption of biometric systems. Thus, it supports the growth of the market. For instance, WhatsApp, a popular messaging app, launched an additional privacy measure on the Android platform. The company claims that users will soon be able to secure their accounts in the form of biometric authentication through fingerprint sensors.

- Additionally, multi-model or hybrid biometric systems have recently become a vital identification technique for authentication purposes. The multi-model biometric recognition system uses various features (facial, iris, and fingerprint) to authenticate users. This allows more reliability, high-speed, and high-precision authentication in large-scale systems that must respond to a variety of physical properties, as well as in usage scenarios that demand tight identity verification.

- The increasing adoption of reliable and efficient biometrics is credited with the fastest growing CAGR for hybrid biometric systems. Through multi-level authentication, multimodal biometric technologies provide increased security against spoofing or falsification. Nowadays, hybrid biometric systems comprise a wide range of modalities (voice, facial, and iris), and government agencies worldwide employ them in a variety of security-related tasks, including border control, law enforcement, human resources, national defense, healthcare, and enterprise security.

- For instance, in August 2021, the EU adopted interoperability requirements for multi-model biometric systems to improve data flows. The Multiple Identity Detector (MID) database evaluates a variety of other databases to see if the identity data for which the search was done is available in more than one information system.

Biometrics Market Trends

Software and Services Segment to Account for Largest Market Share

- Biometric software allows biometric devices and the computers and networks they are connected to be compatible and operable with each other. It also allows various application software on different operating systems to be compatible and allows for an effective connection. Software is an important part of biometric systems. For instance, software in signature verification systems compares signatures and checks for originality. As signature fraud is not always evident to human operators, it can become difficult for the human eye to identify fraudulent signatures accurately. Thus, signature verification software is being increasingly adopted, as it saves time, prevents human error during the signature process, and lowers the chances of fraud.

- Software in biometrics is further integrated with advanced technologies such as AI to detect fraud. For instance, IntelliVision's face recognition software is a deep learning-based facial recognition solution for integrators and developers that can detect faces of all ethnicities without racial bias and recognize them from the database of images. It provides facial recognition accuracy of about 99.5% on public standard data sets. Moreover, it can also be used on-server and in-cloud.

- In September 2021, Gnani.ai, a player in the conversational AI and voice security domain, announced the launch of its voice biometrics software, Christened armour365. The biometric solution is suitable for industries such as Banks, Defense, Healthcare, among others.

- The on-premise biometric systems need IT infrastructures, such as servers and networks. This infrastructure is expensive and requires maintenance. Thus, biometric service is increasingly gaining traction, as it does not need any specialized IT infrastructure or maintenance for the deployment of a biometric project.

- Moreover, companies are embracing biometric service as it is extremely scalable. The number of enrollments varies from business to business, according to their size. Biometric service helps companies to subscribe to services as per their needs. It is also very easy to scale up or scale down the facilities by changing the subscription plan.

- Companies, such as Aware Inc. and others, offer biometrics software products and services as independent suppliers, i.e., independent from hardware vendors and system integrators. These benefits include the mitigation of risks and costs associated with hardware and software obsolescence and system maintenance challenges that have the potential to weaken the performance and shorten the life of a solution.

Asia Pacific is Expected to be the Fastest Growing Market

- Increasing mobile payment transactions coupled with increasing private corporations and government initiatives towards adopting biometric authentication systems are expected to be the major drivers for the biometrics market in the region. According to the Center for Strategic & International Studies Report (CSIS) 2021, China is at the forefront of the global digital payment revolution.

- Chinese enterprises generated an anticipated USD 2.9 trillion in transaction value in 2020, based on a global market of USD 5.4 trillion in transaction value in digital commerce and mobile payments. China's major emphasis on influencing global digital infrastructure, e-commerce, and new projects like the digital yuan and the proposed new IP could lead to a more authoritarian path for digitization. For instance, in 2021, more than 3.51 million corporate wallets and 20.87 million personal wallets were opened, with a total transaction volume of 70.75 million and a transaction value of USD 5.41 billion (RMB 34.5 billion).

- On the other hand, the increasing demand for biometric authentication systems across various end-users, including retail, gaming, banking and financial sector, hospitals, etc., are significantly influencing the market's growth across the country. For instance, The China Construction Bank (CCB) has decided to use biometric cards in its digital renminbi experiments in collaboration with IDEX Biometrics. The bank has already released a digital yuan wallet app. The NFC-enabled biometric smart card will allow users to utilize digital currency without the need for a smartphone. These biometric cards will serve as digital hard wallets for members of the Chinese digital currency trial, known as DCEP. Fingerprint sensors and biometric software will protect these smart cards.

- Additionally, end-user industries, such as BFSI and healthcare, are home to many critical and highly valuable assets. Any breach or lapse in security can be disastrous and costly, with revenue loss. Thus, these industries in the country are enforcing stringent measures to protect sensitive customer data with cutting-edge technology. For instance, in February 2021, customers can enter the Green Leaves+ shop-and-go store at Japan's Yokohama Techno Tower Hotel using their faces and a swipe of their palms to verify their identity. Customers can use the smartphone application's multi-biometric authentication technology, connecting their face and palm vein recognition information. Customers can also scan a QR code displayed on the Green Leaves+ app to access the store.

- Similarly, in July 2021, Fingerprint Cards (a Swedish biometrics company) and MoriX (a Japanese electronics company) formed cooperation to develop and launch biometric payment cards in Japan. According to the press release, the new card will have Fingerprints' T-Shape module, which has ultra-low power consumption and is designed to be integrated into payment cards using normal automated manufacturing methods, according to the business. Furthermore, the company stated that there is an "increasing desire for card transactions among Japanese consumers," who seek touchless, secure, and frictionless payment methods.

Biometrics Industry Overview

The Biometrics Market is highly fragmented due to the presence of various vendors like NEC Corporation, Fujitsu Limited, Leidos Holdings Inc., Gemalto NV (Thales Group), etc., across the world. The market features increasing adoption of Biometrics solutions in various end-user industries. Also, the vendors are making significant product developments to expand their market presence. The market is also viewing strategic partnerships and acquisitions as a lucrative path for expansion.

- October 2021 - Thales partnered with Inetum to expand the deployment of its Automated Border Control (ABC) system to three Spanish airports for biometric authentication of travelers. These systems include facial recognition and document verification; these are expected to speed up the border control process, significantly reducing travelers' wait times.

- October 2021 - ImageWare Systems developed a biometrically enabled Blockchain-Powered Self Sovereign Identity solution and entered the Self Sovereign Identity market. Adding biometric protection to the identity blockchain provides the final layer of protection the data is secure in digital wallets and only accessible to authorized users.

- June 2021 - Phonexia developed new software for audio investigations - Phoenixia Orbis by leveraging its experience from hundreds of public security projects worldwide. This on-premises solution enables law enforcement agencies to extract complex insights from substantial amounts of audio automatically and efficiently, making investigations effortless and straightforward.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 MARKET INSIGHTS

- 3.1 Market Overview

- 3.2 Industry Attractiveness- Porter's Five Forces Analysis

- 3.2.1 Bargaining Power of Suppliers

- 3.2.2 Bargaining Power of Consumers

- 3.2.3 Threat of New Entrants

- 3.2.4 Threat of Substitutes

- 3.2.5 Intensity of Competitive Rivalry

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Biometric Solutions in Consumer-facing Applications

- 4.1.2 Rising Adoption from the Public and Government Sectors in Emerging Countries

- 4.1.3 Key Technological Developments Leading to the Commodification of Biometrics

- 4.2 Market Challenges

- 4.2.1 Operational Concerns Related to Privacy, Security, and ROI

- 4.3 Market Opportunities

- 4.4 Industry Stakeholder Analysis

5 KEY THEMES RELATED TO THE IMPACT OF COVID-19 ON THE BIOMETRICS MARKET

- 5.1 Voice and Speech Recognition to be at the Forefront of Technological Change

- 5.2 Rise of Mobile Biometrics

- 5.3 Non-consumer Biometrics to Retain Dominance

- 5.4 Continuous Authentication to Emerge as the Key Trend

- 5.5 Regulatory Concerns around the Collection of Biometric Data to Remain a Key Challenge Faced by the Major Stakeholders

- 5.6 Research Efforts to Focus on New Areas, such as Heartbeat Detection through Wearables

- 5.7 Biometrics-as-a-Service to Gradually Replace Traditional Model of Deploying Biometric Solutions at the Consumer Premises

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.2 Software and Services (Professional & Managed)

- 6.2 By Biometric Type

- 6.2.1 IRIS Recognition

- 6.2.2 Hand Geometry

- 6.2.3 Facial Recognition

- 6.2.4 Signature Verification

- 6.2.5 Fingerprint

- 6.2.5.1 Automated Fingerprint Identification System

- 6.2.5.2 Non-AFIS (Automated Fingerprint Identification System)

- 6.2.6 Voice Recognition

- 6.2.7 Palm Vein

- 6.3 By Contact Type

- 6.3.1 Contact-based

- 6.3.2 Non-contact based

- 6.4 By End-User

- 6.4.1 Government and Law Enforcement

- 6.4.2 Commercial and Retail

- 6.4.3 Healthcare

- 6.4.4 BFSI

- 6.4.5 Travel and Immigration

- 6.4.6 Other End-Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Russia

- 6.5.2.5 Rest of Europe

- 6.5.3 Asia Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 South Korea

- 6.5.3.4 Rest of Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Gemalto NV (Thales Group)

- 7.1.2 Leidos Holdings Inc.

- 7.1.3 NEC Corporation

- 7.1.4 M2SYS Technology

- 7.1.5 BioEnable Technologies Pvt. Ltd

- 7.1.6 Phonexia SRO

- 7.1.7 ImageWare Systems Inc.

- 7.1.8 S.I.C. Biometrics Global Inc.

- 7.1.9 Fujitsu Limited

- 7.1.10 Aware Inc.

- 7.1.11 Nuance Communications Inc.

- 7.1.12 IDEMIA France SAS

- 7.1.13 Cognitec Systems GmbH

- 7.1.14 BioID AG

- 7.1.15 Assa Abloy AB

- 7.1.16 Hitachi Corporation