|

市場調查報告書

商品編碼

1433922

精簡型用戶端:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Thin Client - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

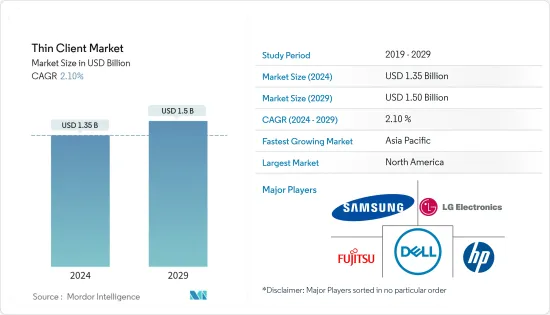

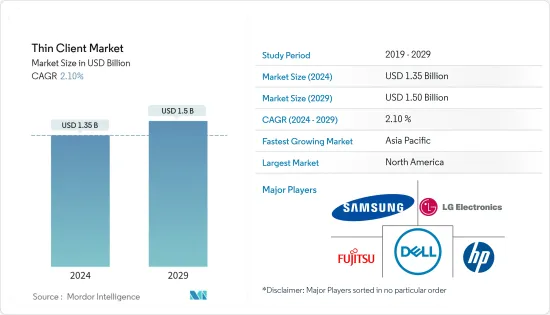

精簡型用戶端市場規模預計到 2024 年為 13.5 億美元,預計到 2029 年將達到 15 億美元,在預測期內(2024-2029 年)年複合成長率為 2.10%。

精簡型用戶端市場預計將在預測期內成長,主要是由於這些設備提供的成本和能源消費量降低、集中且易於存取的可管理性以及增強的基礎設施安全性等優勢。

主要亮點

- 各行業都在尋求低成本設備,以顯著減少桌面空間並輕鬆更換/升級舊系統。精簡型用戶端系統滿足這些要求。它還可以減少一段時間內的能源消耗。這是各行業對這些設備的需求不斷增加的主要原因。由於這些設備的安全優勢,醫療保健產業也廣泛採用這些設備作為計算解決方案。相較之下,IT和通訊業安裝這些設備主要是為了促進虛擬網路的發展。在企業和其他區域部署精簡型用戶端設備可以透過限制使用者侵入本機電腦設定來提供更高的安全相關優勢。該應用程式將使您的系統更加安全和受到保護。

- 包括大學、研究機構和研究實驗室在內的各種教育機構擴大實施精簡型用戶端解決方案,以集中管理 IT 管理部門的顯示器並降低能耗。這些設備還可以減少系統升級的成本以及每次登入時設定 PC 或筆記型電腦所需的時間。

- 雲端運算的日益普及也推動了市場的成長。一些組織使用雲端運算來降低成本並存取未安裝在電腦或伺服器上的資料和應用程式。雲端已經成為一種基礎設施,可以以動態可擴展和虛擬的方式快速提供運算資源作為公共事業。世界各地的組織正在轉向混合和多重雲端環境。精簡型用戶端有助於提供相對便宜且安全的硬體解決方案,從而推動市場成長。

- 由於多家企業擴大採用工作空間即服務 (WaaS),預計在預測期內市場需求將會增加。 WaaS 是多個組織用來為其員工提供應用程式遠端存取的虛擬桌面。然而,新興國家雲端運算的網路問題預計將限制所研究市場的成長。

- 從事地緣政治敏感產業的能源公司經常成為網路攻擊的目標,尤其是來自外國政府的網路攻擊。然而,使用雲端作為虛擬桌面的基礎,您可以集中儲存敏感資訊並設定身份驗證策略來保護您的雲端環境。預計這一因素將產生精簡型用戶端市場的需求。

- 在過去的幾十年裡,遠端工作的趨勢一直在穩步成長。 然而,COVID-19 的影響在很短的時間內大大加速了這一趨勢,迫使公司,無論規模大小,都必須迅速適應世界各地政府建議的自我隔離措施。 大流行迫使更多人遠端工作,引發了對員工之間數據共用安全性的擔憂。 這反過來又推動了對瘦客戶端設備的需求。

精簡型用戶端市場趨勢

醫療保健產業預計將推動市場成長

- 醫療保健提供者嚴格提供最高標準的患者照護。他們對用於改善每個護理階段患者體驗的技術非常敏感。從急診室入院到復健和門診護理,該技術可顯著影響患者的治療結果,並對醫療保健提供者的生產力和營運成本產生重大影響。對於整個醫療保健行業無處不在的桌面計算基礎設施來說尤其如此。傳統的桌面 PC 模型、資料和應用程式本地駐留在分佈在網路上的各個 PC 上,通常會形成單獨配置和管理的 PC叢集。這些與敏感的患者資料相關,並且通常具有很少或沒有參數一致性。

- 然而,使用精簡型用戶端,資料和應用程式可以在資料中心或雲端基礎架構中遠端管理、儲存和集中。精簡型用戶端只是存取門戶,管理員和臨床醫生可以在其憑證允許的情況下即時存取應用程式和病患資料。

- 由於其架構的性質,精簡型用戶端提供了各種安全優勢,有助於確保符合 HIPAA 和其他醫療保健法規,同時最大限度地減少安全威脅。透過使用者身份驗證和權限檢驗來嚴格控制授權使用者對雲端基礎的資料和應用程式的存取。這些安全措施可以透過 USB/連接埠保護、智慧卡和防火牆進一步增強。

- 這些需求正在推動一個強大的夥伴關係結構,該結構旨在最大限度地提高所提供的能力。 例如,Stratodesk 是現代工作空間安全管理端點的先驅,於 2023 年 3 月宣佈,幾款 LG Business Solutions 瘦用戶端通過了 Stratodesk NoTouch OS 認證。可以為IT團隊提供信心和靈活性,以從兩個平臺部署交鑰匙設備。 私有雲端和公有雲端。 通過自動化交付現代應用程式和 Web 技術,Stratodesk 使共同客戶能夠輕鬆地使用熟悉的 Windows 或非 Windows 業務軟體在任何地方保持高效。

預計北美將佔據主要市場佔有率

- 北美預計將主導市場,主要是由於擴大採用雲端技術和需要活動性和彈性的先進技術導向產品等因素。該地區的大多數企業都可以獲得 IT 支援。該地區市場領導的存在、大量的雲端服務供應商以及不斷增加的託管伺服器數量是該地區市場成長的重要因素。

- 該地區的組織是新技術的早期採用者,這是該地區優勢的關鍵驅動力。領先的雲端服務供應商在該地區雲端基礎的精簡型用戶端部署的成長中發揮關鍵作用。

- 雲端運算和虛擬在廣播領域變得越來越重要。透過網路通訊協定遠端存取的虛擬機器和電腦可以對現場可用的實體硬體進行最佳補充。

- 北美 IT 和電訊業是其他區域市場中最大的市場之一。處理大量敏感資訊的行業(例如銀行、醫療保健和政府機構)正在尋求精簡型用戶端解決方案。您可以比胖客戶更好地維護知識產權的完整性。

- 硬體開發也投入了大量精力,供應商定期發布競爭版本。 2022 年 2 月,IGEL Ready 計畫合作夥伴 OnLogic 宣布推出新的 IGL130 和 IGL160 IGEL Ready精簡型用戶端。這些新系統採用無風扇溫度控管和 AMD Ryzen 嵌入式處理,將 IGEL 著名的通用桌上型硬體系列的性能與源自其工業應用血統的 OnLogic 的可靠運作相結合。該產品計劃在美國進行首次發布,然後再進軍海外市場。

精簡型用戶端產業概述

精簡型用戶端市場競爭非常激烈,因為有許多大公司向國內和國際市場提供產品。該市場似乎適度集中,主要企業採取產品和服務創新、合作、併購和收購等策略來擴大其地理覆蓋範圍並保持領先於競爭對手。該市場的主要企業包括戴爾公司、惠普開發公司、三星集團和 LG 電子公司。

- 2022 年 10 月:升騰和卡巴斯基簽署協議,在 CyberImmune 端點方面展開合作。作為合作夥伴關係的一部分,卡巴斯基將提供KasperskyOS作業系統以及相關的網路免疫產品和解決方案,升騰將提供硬體。

- 2022 年 8 月:10ZiG 推出 7500q精簡型用戶端系列。配備 1.10-2.60 GHz(突發)Intel四核心處理器、15.6 吋顯示器、FHD (1920 x 1080)、16:9 面板、8GB DDR4 2,666 MHz RAM、2 個 USB 連接埠 2.0、1 個 USB 連接埠。 3.0、1 個 USB 連接埠 C、1 個 HDMI、1 個 SD 讀卡機、電池續航時間長達 10 小時。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 加強網路基礎設施安全

- 降低成本和能源消耗

- 市場課題

- 雲端運算新興國家的網路問題

第6章市場區隔

- 依類型

- 硬體

- 軟體服務

- 依最終用戶

- BFSI

- 資訊科技/通訊

- 衛生保健

- 政府機關

- 其他最終用戶(零售、製造、教育)

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Dell Inc.

- HP Development Company LP

- Samsung Group

- LG Electronics Inc.

- NEC Corporation

- Fujitsu Ltd

- Lenovo Group Limited

- Cisco Systems Inc.

- Advantech Co. Ltd

- Siemens AG

- IGEL Technology GmbH

第8章投資分析

第9章 市場機會及未來趨勢

The Thin Client Market size is estimated at USD 1.35 billion in 2024, and is expected to reach USD 1.5 billion by 2029, growing at a CAGR of 2.10% during the forecast period (2024-2029).

The thin client market is anticipated to grow during the forecast period, primarily due to the advantages, such as cost reduction and lesser energy consumption, centralized and accessible manageability, and the enhanced infrastructure security these devices offer.

Key Highlights

- Various industries seek low-cost devices that significantly decrease desk space and offer an easy replacement/upgrade for conventional systems. The thin client systems qualify for these requirements. They can also reduce energy consumption over a period, which is the primary reason for the increasing demand for these devices in various industries. The healthcare industry is also witnessing an extensive adoption of these devices as a computing solution, owing to their security benefits. In contrast, the IT and telecom industry is installing these devices primarily to facilitate the development of a virtual network. Implementing thin client devices in enterprises or other areas can provide better security-related advantages, as they limit the user from any intrusion in a local machine setting. This application renders the system more secure and protected.

- Various educational institutions, such as colleges, research institutes, and labs, are increasingly adopting thin client solutions to control the monitors centrally at the IT control department, thereby reducing energy consumption. These devices also decrease the cost of system upgrades and the time consumed in setting up the PC or laptop at each login.

- The growing adoption of cloud computing is also driving market growth. Several organizations use cloud computing to reduce costs and access the data and applications not installed on the computers or servers. Clouds emerged as an infrastructure that may enable the rapid delivery of computing resources as a utility in a dynamically scalable and virtual manner. Various organizations across the world are moving to a hybrid and multi-cloud environment. A thin client contributes to a comparatively less expensive and secure hardware solution, driving the market's growth.

- With the rising adoption of workspace-as-a-service (WaaS) in several enterprises, the market is anticipated to witness augmented demand during the forecast period. WaaS is a desktop virtualization used by multiple organizations to provide their employees access to applications remotely. However, network issues in developing countries for cloud computing are expected to restrain the growth of the studied market.

- Energy companies operating in a geopolitically sensitive industry face frequent cyberattack targets, especially from foreign governments. However, using the cloud as a base for desktop virtualization allows sensitive information to be stored centrally, and authentication policies can be set to secure the cloud environment. This factor is anticipated to generate demand for the thin client market.

- The trend toward remote work has been steadily growing for the past decades. However, the effect of COVID-19 dramatically accelerated this trend in an extremely short period, forcing companies, irrespective of their size, to adapt quickly to the self-isolation measures recommended by governments worldwide. With the pandemic requiring more people to be working remotely, the concern regarding the security of data sharing among employees increased. This has been driving the adoption of the demand for thin-client devices.

Thin Client Market Trends

The Healthcare Segment is Expected to Drive the Market's Growth

- Healthcare providers are stringent in offering the highest standards of patient care. They are acutely attuned to the technologies they use to improve the patient experience at every stage of care. From admissions to the emergency room to rehabilitation and outpatient care, the technology can significantly impact patient outcomes and critically impact providers' productivity and operational costs. This holds especially true for the ubiquitous desktop computing infrastructure across the healthcare domain. The legacy desktop PC model, data, and applications reside locally on individual PCs distributed across the network, often yielding a cluster of individually configured and managed PCs. These are associated with sensitive patient data, often with little to no parameter uniformity.

- However, with thin clients, data and applications are remotely administered, stored, and centralized in the data center or cloud infrastructure. The thin client is simply the access portal, giving administrators and clinicians immediate access to their applications and patient data as their credentials allow.

- By the nature of their architecture, thin clients offer various security advantages to help ensure compliance with HIPAA and other healthcare regulations while minimizing exposure to security threats. Authorized user access to cloud-based data and applications is strictly controlled via user authentication and permissions verification. USB/port protections, smart cards, and firewalls can further augment these security measures.

- Although the industry is currently transitioning into digitization, it has been notoriously recognized to be resistant to changes since any failure of unreliable technology translates into issues that affect patient health. Any deviation from predetermined workflows can adversely affect a hospital's operations. Despite the hesitancy, the industry must accelerate technology adoption to remain compliant with the constantly changing regulations and agreements.

- Such needs have encouraged robust partnership structures designed around maximizing offering capabilities. For instance, in March 2023, Stratodesk, the pioneer of securely managed endpoints for modern workspaces, announced that several LG Business Solutions Thin Clients are now certified with Stratodesk NoTouch OS, providing IT teams with the confidence and flexibility to deploy the turnkey devices from both private and public clouds. Stratodesk makes it easier for joint customers to stay productive from anywhere using Windows or non-Windows business software that they are familiar with by automating the delivery of the latest applications and web technologies.

North America is Expected to Hold a Major Market Share

- North America is expected to dominate the market, primarily due to the factors such as the increasing adoption of cloud technology and highly technology-oriented products, which require activity and flexibility. IT support is available to the majority of companies in the region. The presence of market leaders, a significant number of cloud service providers, and an increasing number of hosted servers in the area are essential contributors to the market's growth in the region.

- The organizations in the region are early adopters of new technologies, which is the primary driving force behind the region's dominance. Large cloud service providers play a significant role in the region's growth of cloud-based thin client deployment.

- Cloud computing and virtualization are becoming increasingly important in broadcasting. The physical hardware available on site can be optimally supplemented by virtual machines and computers, remotely accessed via network protocols.

- The North American IT and telecommunications industry is one of the largest among other regional markets. Industries such as banking, healthcare, and government organizations, which handle a large amount of sensitive information, are looking forward to adopting thin client solutions. They can preserve the integrity of the intellectual property better than a fat client.

- Hardware development has also been considerably worked on, with regular competitive releases by vendors. In February 2022, OnLogic, an IGEL Ready program partner, announced the availability of the new IGL130 and IGL160 IGEL Ready thin clients. These new systems, which feature fanless thermal management and AMD Ryzen Embedded processing, combine the performance of IGEL's famous Universal Desktop line of hardware with OnLogic's dependable operation derived from its industrial application lineage. The product is expected to register an initial release in the States before working towards overseas markets.

Thin Client Industry Overview

The thin client market is highly competitive due to the presence of many large players in the market providing products in the domestic and international markets. The market appears to be mildly concentrated, with the key players adopting strategies like product and service innovations, partnerships, mergers, and acquisitions to extend their geographic reach and stay ahead of the competitors. Some of the major players in the market are Dell Inc., H.P. Development Company LP, Samsung Group, and L.G. Electronics Inc.

- October 2022: Centerm and Kaspersky signed an agreement to collaborate on Cyber Immune Endpoints. Kaspersky plans to provide the KasperskyOS operating system and related cyber immune products and solutions as part of the collaboration, while Centerm plans to provide hardware.

- August 2022: The 7500q thin client series was introduced by 10ZiG. It has an Intel Quad Core processor with 1.10 to 2.60 GHz (Burst), a 15.6" display, FHD (1920 x 1080), a 16:9 panel, 8GB DDR4 2,666 MHz RAM, 2 x USB Port 2.0, 1 x USB Port 3.0, 1 x USB Port C, 1 x HDMI, and 1 x SD Card Reader, and a battery life of up to 10 hours.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Enhanced Network Infrastructure Security

- 5.1.2 Reduction of Cost and Energy Consumption

- 5.2 Market Challenges

- 5.2.1 Network Issues in Developing Countries for Cloud Computing

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.2 Software and Services

- 6.2 By End User

- 6.2.1 BFSI

- 6.2.2 IT and Telecom

- 6.2.3 Healthcare

- 6.2.4 Government

- 6.2.5 Other End Users (Retail, Manufacturing, Education)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dell Inc.

- 7.1.2 HP Development Company LP

- 7.1.3 Samsung Group

- 7.1.4 LG Electronics Inc.

- 7.1.5 NEC Corporation

- 7.1.6 Fujitsu Ltd

- 7.1.7 Lenovo Group Limited

- 7.1.8 Cisco Systems Inc.

- 7.1.9 Advantech Co. Ltd

- 7.1.10 Siemens AG

- 7.1.11 IGEL Technology GmbH