|

市場調查報告書

商品編碼

1433908

BOPP 薄膜:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)BOPP Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

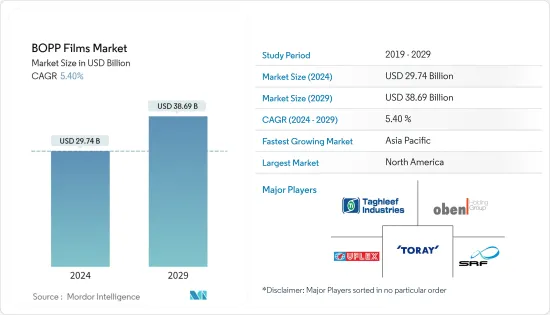

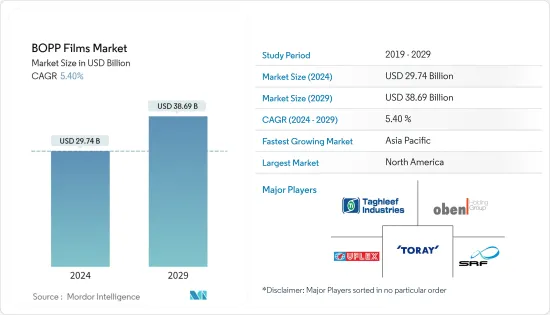

BOPP薄膜市場規模預計2024年為297.4億美元,預計到2029年將達到386.9億美元,在預測期內(2024-2029年)年複合成長率為5.40%成長。

BOPP薄膜比其他包裝材料更彈性,可以更快地包裝,並且具有更好的密封性能,因此市場趨勢預計將增加對BOPP薄膜的需求。

主要亮點

- 近年來,用於包裝食品產業的BOPP薄膜市場成長顯著。 BOPP薄膜因其優異的阻隔性、透明度和印刷適性而被廣泛用於各種食品的包裝。各公司正在共同努力,利用廢棄物和殘渣流設計產品。 2022年10月,北歐化工和Vibac集團開發的一種新型BOPP基食品包裝薄膜在PP回收過程中易於分類。根據 Vibac 的 Bornnewables 產品組合,「V-Fresh」薄膜由一種「完全來自廢棄物和殘渣流」的環狀聚烯製成。這些等級的製造商聲稱它們提供與原生 PP 相同的性能品質,同時減少碳排放。

- 由 BOPP 薄膜製成的袋子和小袋越來越受歡迎,因為它們環保、價格實惠且 100% 可回收。 BOPP 袋和小袋的視覺吸引力為用於包裝的產品增添了一層廣告效果。食品和飲料、電子商務的擴張、經濟的改善以及可支配收入的增加促使包裝商品(包括包裝食品)的消費增加,需要包裝來保護商品免受污染和損害。這種趨勢可能會增加供應商的製造能力,並促使預期年份的成長。

- 軟質包裝比硬包裝產生的廢棄物更少,因為它可以最佳化材料的使用。 BOPP 薄膜的軟性特性可以有效利用儲存和運輸空間,減少包裝材料的數量並最佳化物流。這些薄膜還具有優異的阻隔性能,可保護包裝食品免受水分、氧氣和光線等外部因素的影響。延長食品的保存期限也有助於減少食品廢棄物,這是一個主要的環境問題。

- 此外,2022 年 7 月,Vakumet India 在印多爾附近達爾的製造工廠運作了第三條 BOPP 薄膜生產線。本公司BOPP薄膜產能已增加至年產12萬噸,生產線寬度10.4米,年產能5.5萬噸。第三條BOPP薄膜生產線運作後,由於產能增加,該公司將能夠提供更快的交貨和更廣泛的產品範圍。新生產線是一條長10.4公尺的三層全自動布魯克納生產線,能夠生產12至60微米厚的薄膜。該公司將能夠透過高速生產線自動切換來運行不同的產品組合。

- 然而,這些環保薄膜替代品的出現正在課題BOPP薄膜的優越性。隨著永續性成為包裝的重要考慮因素,製造商和消費者擴大考慮和採用這些替代薄膜。然而,值得注意的是,每種薄膜類型都有優點和局限性,而特定薄膜的適用性取決於特定的包裝要求和最終用途。 BOPP 薄膜製造商也在探索永續的選擇,例如生物基 BOPP 薄膜和改進的回收工藝,以保持競爭力並滿足對環保包裝解決方案不斷成長的需求。這些努力旨在減少替代薄膜的威脅並保持 BOPP 薄膜在包裝行業的地位。

- BOPP 薄膜市場面臨著導致交易大幅波動的幾個問題。樹脂價格波動、貿易關稅、貿易壁壘和貨幣衝擊都會影響營運成本和產業計畫。在經濟動盪和金融危機時期,企業的行動比往年更加謹慎。 COVID-19感染疾病進一步加劇了這種情況,擾亂了原料的供應和分銷業務。儘管面臨諸多課題,但由於過剩產能減少和有利的原料成本,BOPP薄膜業務的整體報酬率已較兩年前的最低點有所上升。雖然中國一直是投資的主要焦點(迄今為止最大的市場),但印度近年來的投資增幅最大。印度零售業的開放、不斷壯大的中階以及相關的消費者在加工食品和其他日常必需品上的支出,使得印度的生產能力在過去五年中幾乎加倍。近期BOPP投資大幅增加,年標牌產能超過4.5萬噸。

BOPP薄膜市場趨勢

飲料業可望推動市場成長

- 乳製品產量不斷增加,BOPP薄膜市場穩步擴大。牛奶和乳製品必須小心儲存,遠離空氣和光線。 Danaflex 以經濟高效的方式為所有乳製品提供各種主要透明和不透明的白色 BOPP 薄膜包裝。保護漆可保護油墨層免受機械和熱衝擊,並確保填充操作期間良好的滑動性能。

- 此外,東南亞是美國乳製品出口的第二大市場,2021年將達14億美元,與前一年同期比較成長11%。此外,據 USDEC(美國乳製品出口委員會)稱,東南亞的消費者對人造食品成分很在意。他們更喜歡軟包裝,這種包裝在很大程度上保持了天然和潔淨標示產品的完整性。上述因素正在增加該地區對BOPP薄膜的需求。

- 過濾水、茶和碳酸飲料市場不斷成長的需求進一步增加了對先進包裝的需求。 BOPP薄膜因其健康特性和廉價的成本結構而成為主要用於飲料行業的包裝類型。

- 例如,根據克朗斯預測,2022年包裝水的消費量將超過4,720億公升,成為全球消費量最大的包裝飲料之一。排名第二和第三名的是包裝酒精飲料和牛奶及乳製品,銷量分別為2,720億公升和2,585億公升。

- 同樣,全球有機飲料需求的增加將在預測期內推動市場成長。此外,根據美國農業部外國農業服務局的數據,2022 年印度有機加工食品和飲料的總消費額達到 1.08 億美元,高於前一年的 9,600 萬美元。從長遠來看,所有這些因素預計將支持市場成長。

北美佔據主要市場佔有率

- 北美對環保包裝選擇的需求促使許多 BOPP 薄膜供應商更新其產品線。 BOPP薄膜為產品包裝帶來透明度,方便顧客快速檢查貨物。這種能力擴大了該地區的食品、飲料、製藥和工業市場。美國是一些世界上最大的寵物食品公司的所在地。該行業的知名企業包括瑪氏寵物護理公司、雀巢普瑞納寵物護理公司和希爾寵物營養公司。

- 該國寵物食品產業受到日益成長的寵物數量、消費者對高品質寵物食品的強勁需求以及重視為寵物提供營養均衡用餐的寵物主人文化的驅動而強大。預計這將增加預測期內寵物食品包裝中對 BOPP 薄膜的需求。

- BOPP 薄膜等軟包裝產品已成為北美地區的首選包裝類型,尤其是在食品和飲料行業。 BOPP 薄膜適應性強,可根據您的特定需求進行客製化。它們還可以有效地節約資源,隨著人們對環保解決方案的日益關注,它們被認為永續的。此外,根據國際瓶裝水協會預測,2022年瓶裝水將成為美國最受歡迎的飲料,佔飲料總消費量的25%。機能飲料和付加水佔最不受歡迎飲料的 1.5%。

- 北美市場在肉品消費和出口方面也很重要。該市場是由對牛肉和豬肉產品的需求不斷成長推動的,主要是透過該地區規模龐大、實力雄厚的零售連鎖店實現的。因此,為了滿足不斷成長的最終用戶需求,推出了許多增強功能和新產品。

- 總體而言,環保、透明、適應性、資源節約和便利性的結合正在推動 BOPP 薄膜的市場擴張和採用,成為北美的首選包裝選擇,特別是在食品和肉品領域。

BOPP薄膜產業概況

BOPP薄膜市場正變得碎片化。 Taghleef Industries、Uflex Limited、SRF Limited、Oben Holding Group、Toray Industries Inc. 等公司活躍於市場。包裝行業由多個全球和地區參與者組成,它們在競爭激烈的市場中爭奪注意力。

此外,東南亞是美國乳製品出口的第二大市場,2021年達到14億美元,同比成長11%。 此外,根據USDEC(美國乳製品出口委員會)的數據,東南亞的客戶對人造食品成分有所瞭解。 他們更喜歡軟包裝,這種包裝可以顯著保持天然和清潔標籤產品的完整性。 上述因素增加了該地區對BOPP薄膜的需求。

2022 年 3 月,奧本控股集團和布魯克納機械製造有限公司進入了長期合作關係的下一階段。該公司擴建了最新的10.5公尺高速BOPET生產線,歐本控股集團簽署了第二條高速BOPP生產線。 BOPP Films Columbia 位於巴蘭基亞,每年生產 70,500 噸薄膜。新建10.6米線生產速度為625公尺/分鐘,產能為8.8噸/小時。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19對全球BOPP薄膜市場的影響

第5章市場動態

- 市場促進因素

- 包裝食品的需求不斷擴大

- 由於環境法規,對軟質材料(相對於硬包裝材料)的需求不斷增加

- 新興地區需求穩定成長

- 市場課題

- 對一些主要市場利用率低和產能過剩的擔憂

- 其他環保薄膜的威脅日益嚴重

第6章市場區隔

- 依最終用戶產業

- 食品

- 飲料

- 製藥/醫療

- 產業

- 其他最終用戶產業

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Toray Industries Inc.

- Taghleef Industries LLC

- SRF Limited

- NAN YA Plastics Corporation

- Vacmet India Limited

- Uflex Ltd.

- Polyplex Corporation Ltd.

- Trefan Group

- Oben Holding Group

- Tatrafan SRO

- Jindal Poly Film

- Biofilm SA

- Altopro SA de CV

第8章投資分析

第9章市場的未來

The BOPP Films Market size is estimated at USD 29.74 billion in 2024, and is expected to reach USD 38.69 billion by 2029, growing at a CAGR of 5.40% during the forecast period (2024-2029).

Owing to its flexibility and speedier packaging with better-sealing properties than other packaging materials, the market trend is forecasted to increase the demand for BOPP films.

Key Highlights

- The packaged food industry's BOPP film market has grown significantly recently. BOPP films are widely used in packaging various food products due to their excellent barrier properties, transparency, and printability. Companies are collaborating to design products from waste and residue streams. In October 2022, A novel BOPP-based food packaging film developed by Borealis and the Vibac Group was easy to sort in PP recycling processes. The "V-Fresh" film is made from a grade of circular polyolefins that are "completely derived from waste and residue streams," according to Vibac's Bornewables portfolio. The manufacturers of these grades assert that they offer the same performance qualities as virgin PP while lowering carbon emissions.

- The bags and pouches made of BOPP films are becoming increasingly popular since they are environmentally friendly, reasonably priced, and 100% recyclable. The visual appeal of BOPP bags and pouches adds an extra layer of advertising to the goods used for packaging. The expansion of food and beverage, e-commerce, the improving economy, and increased disposable income contributed to increased consumption of packaged goods (including packaged food), which need packaging to protect the commodities from contamination and damage. This tendency will likely increase the vendor's manufacturing capacity and growth over the anticipated year.

- Flexible packaging can be designed with optimized material usage, leading to less waste generation than rigid packaging. The flexible nature of BOPP films allows for efficient space utilization in storage and transportation, reducing the amount of packaging material and optimizing logistics. Also, these films provide superior barrier properties, protecting the packaged food from external factors such as moisture, oxygen, and light. Extending the shelf life of food products also helps reduce food waste, a significant environmental concern.

- Further, in July 2022, Vacmet India commissioned its third BOPP film line at the company's manufacturing plant in Dhar, close to Indore. The company's capacity for BOPP film has increased to 1,20,000 MT per year with a 10.4 meters-wide line with a 55,000 MT annual capacity. After it commissioned its third BOPP film line, the company will be able to provide quick delivery and a wider range of products thanks to the capacity boost. The new line, a 10.4 meters long, three-layer, fully automated Bruckner line, can create films with a thickness ranging from 12 to 60 microns. The company will be able to run a variety of product combinations through its high-speed line's automated changeovers.

- However, the emergence of these environmentally friendly film alternatives poses a challenge to the dominance of BOPP films. As sustainability becomes a key consideration for packaging, manufacturers, and consumers are increasingly exploring and adopting these alternative films. However, it's important to note that each film type has advantages and limitations, and the suitability of a particular film depends on the specific packaging requirements and end-use applications. BOPP film manufacturers are also exploring sustainable options, such as bio-based BOPP films and improved recycling processes, to stay competitive and address the growing demand for environmentally friendly packaging solutions. These efforts aim to mitigate the threat of alternative films and maintain BOPP films' position in the packaging industry.

- The BOPP film market faces several issues causing substantial trading volatility; resin price variations, trade tariffs, trade barriers, and currency shocks all impact working capital and business planning. Businesses act more cautiously during economic turbulence and financial danger than in prior years. This was compounded by the COVID-19 pandemic, which disrupted raw material supply and distribution operations. Despite many problems, the BOPP film business experienced an increase in overall margins since its low point two years ago, owing to a reduction in overcapacity and more favorable raw material costs. While China has been the primary focus of investment (by far the largest market), India has seen the highest rise in investment in recent years. Over the last five years, India's capacity has roughly doubled, owing to the opening up of its retail sector, an increase in the middle classes, and accompanying consumer spending on packaged food and other commodities. Recent BOPP investments have been substantially high, with a yearly nameplate capacity of more than 45,000 tons.

BOPP Films Market Trends

Beverage Vertical is Expected to Drive the Market Growth

- The production of dairy products is rising, causing the BOPP film market to expand steadily. Milk and dairy products must be stored carefully and shielded from air and light. Danaflex offers a large selection of BOPP film packaging for all cost-effective dairy products, primarily transparent and opaque white. Their protective lacquer protects the ink layer from mechanical and heat impact, together with good sliding behavior during filling operations.

- Additionally, Southeast Asia held the second-largest market for US dairy exports, valued at USD 1.4 billion in 2021, an increase of 11% over the previous year. And according to USDEC (US Dairy Export Council), Southeast Asian customers are consciously aware of artificial food ingredients. They prefer flexible packaging that significantly preserves the integrity of natural and clean-label products. The above factor increases the demand for BOPP films in this region.

- Expanding demand from the filtered water, tea, and carbonated soda pop markets further increases the need for advanced packaging. BOPP films are the type of packaging mainly used in the beverages industry owing to their healthy characteristics and inexpensive cost structure.

- For instance, according to Krones, 2022, packed water consumption surpassed 472 billion liters, making it one of the world's most consumed packaged beverage types. Packed alcoholic beverages and milk and dairy ranked second and third, with 272 billion liters and 258.5 billion liters, respectively.

- In line with the same, increasing demand for organic beverages globally will boost market growth in the forecast time frame. Further, as per USDA Foreign Agricultural Service, the total consumption value of organic packaged food and beverage across India reached USD 108 million in 2022, from USD 96 million in the previous year. All such factors are anticipated to support market growth in the long run.

North America Account for Significant Market Share

- The demand for eco-friendly packaging options in North America has led to numerous BOPP film suppliers updating their product lines. BOPP films offer transparency in product packaging, allowing customers to inspect the goods quickly. This feature has expanded the region's food, beverage, pharmaceutical, and industrial market. The United States is home to some leading pet food companies globally. Among the prominent players in the industry are Mars Petcare Inc., Nestle Purina PetCare, and Hill's Pet Nutrition.

- The pet food industry in the country is robust, driven by a large and growing pet population, strong consumer demand for high-quality pet food, and a culture of pet ownership that places importance on providing nutritious and balanced diets to pets. This is expected to boost the demand for BOPP film in pet food packaging during the forecast timeframe.

- Flexible packaging goods like BOPP films have become the preferred type of packaging in North America, particularly in the food and beverage industry. BOPP films are adaptable and can be customized to meet specific needs. They are also effective in preserving resources and are considered sustainable, aligning with the increasing focus on environmentally friendly solutions. Further, according to International Bottled Water Association, In 2022, bottled water was the most popular beverage in the United States, with 25% of total beverage consumption. Energy drinks and value-added water accounted for 1.5% of the least preferred beverages.

- The North American market is also significant regarding meat product consumption and export. The market has been boosted by increased demand for beef and pork products, mainly through the extensive and powerful retail chains present in the region. As a result, there have been numerous expansions and new product debuts in response to the growing demands of end users.

- Overall, the combination of eco-friendliness, transparency, adaptability, resource preservation, and convenience has driven the market expansion and adoption of BOPP films as a favored packaging option in North America, especially in the food and meat product sectors.

BOPP Films Industry Overview

The BOPP film market is moving toward a fragmented market. Players such as Taghleef Industries, Uflex Limited, SRF Limited, Oben Holding Group., Toray Industries Inc., and more are operating in the market. Packaging comprises several global and regional players vying for attention in a contested market.

In June 2023, Toray Industries planned to increase production capacity for its Torayfan biaxially oriented polypropylene (BOPP) film at Tsuchiura in Japan's Ibaraki prefecture by 40%, given the rising demand for automotive capacitor film from the electric vehicle (EV) sector. The new growth is expected to be completed in 2025.

In March 2022, The Oben Holding Group and Bruckner Maschinenbau entered into the next round of a long-term partnership. The company extended its latest 10.5-meter high-speed BOPET line, and Oben Holding Group signed its second high-speed BOPP. BOPP Films Colombia is located in Barranquilla and produces 70,500 tons of film annually. The new 10.6-meter line had a production speed of 625 meters/minute and 8.8 tons/hour capacity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Global BOPP Films Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For Packaged Food

- 5.1.2 Environmental Regulation Paving Way for Flexible Packaging Requirements (over Rigid Packaging Materials)

- 5.1.3 Steady Rise in Demand from Emerging Regions

- 5.2 Market Challenges

- 5.2.1 Poor Utilization and Overcapacity Remains a Concern in a Few Major Markets

- 5.2.2 Growing Threat from Other Environmentally Friendly Films

6 MARKET SEGMENTATION

- 6.1 End-User Vertical

- 6.1.1 Food

- 6.1.2 Beverage

- 6.1.3 Pharmaceutical and Medical

- 6.1.4 Industrial

- 6.1.5 Other End-user Verticals

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Australia

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Mexico

- 6.2.4.4 Rest of Latin America

- 6.2.5 Middle East and Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 South Africa

- 6.2.5.3 Egypt

- 6.2.5.4 Rest of Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Toray Industries Inc.

- 7.1.2 Taghleef Industries LLC

- 7.1.3 SRF Limited

- 7.1.4 NAN YA Plastics Corporation

- 7.1.5 Vacmet India Limited

- 7.1.6 Uflex Ltd.

- 7.1.7 Polyplex Corporation Ltd.

- 7.1.8 Trefan Group

- 7.1.9 Oben Holding Group

- 7.1.10 Tatrafan SRO

- 7.1.11 Jindal Poly Film

- 7.1.12 Biofilm SA

- 7.1.13 Altopro SA de CV