|

市場調查報告書

商品編碼

1433888

網路分析器:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Network Analyzers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

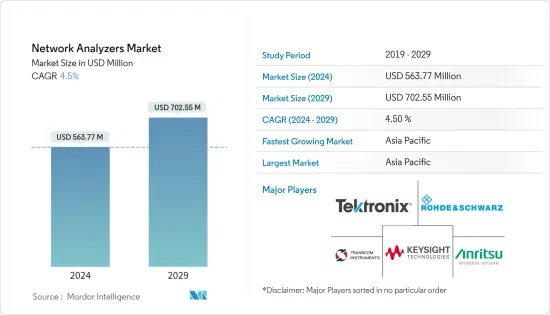

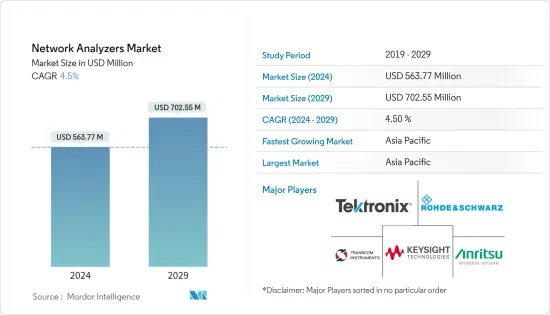

網路分析儀市場規模預計到 2024 年為 5.6377 億美元,預計到 2029 年將達到 7.0255 億美元,預測期內(2024-2029 年)複合年成長率為 4.5%。

網路分析儀與大多數電子設備一樣,需要定期校準。這通常每年執行一次,由製造商或校準實驗室的第三方執行。從 3G 到 LTE 技術的過渡催生了整個通訊領域對測試設備的需求,並擴大了網路分析儀的市場。此外,5G 技術發展的快速加速動能正在增強,部分原因是對需要更高可靠性和更低延遲的新物聯網用例的需求快速成長。

主要亮點

- 對精密製造的興趣日益濃厚是市場的主要驅動力。精密製造之所以受到如此多的關注,是因為製造商降低了投入成本,從而提高了報酬率。此外,半導體產業的成長也加強了精密製造,推動了市場研究。根據半導體產業協會(SIA)統計,2020年半導體市場規模2019年為4,123億美元,預計2021年將達4,600億美元。

- 許多供應商提供網路分析儀,以降低半導體、行動裝置和其他產品精密製造商的測試成本。例如,National Instrument 提供 PXI 向量網路分析儀,透過快速、自動化的測量來降低測試成本。其 PXI Express 模組整合了先進的 VNA 測量功能,以完成基於 PXI 的測試系統,其中包含精密直流、高速類比和數位測量等。

- 此外,作為網路分析儀主要採用者的各種最終使用者正在顯著擴展。 近年來,現代汽車的電子技術在數量和複雜性方面都經歷了顯著增長。 因此,人們認為需要設計一個用於控制電子技術的車載網路。 此外,在公用事業和能源領域,供應商依賴無線和光纖技術,這使他們能夠通過改善運營和創造安全的環境來更有效地運營。 因此,光纖和無線技術需要適當的測試和測量以確保正確的結果,從而推動網路分析儀市場。

- 然而,網路分析儀市場在各行業的採用方面受到持續的 COVID-19感染疾病的影響。雖然電訊業等一些產業在這場危機期間對網路分析儀部署的需求有所增加,但汽車、航太和國防等這些產業的生產和製造過程對網路分析儀的需求也有所增加。預計這種下降將減緩需求。

- 此外,全球 COVID-19 檢測數量的增加導致醫療機構越來越多地採用檢測設備和試劑盒。 例如,羅氏於 2020 年 3 月開始向其遍佈美國的醫院和參考實驗室網路運送第一批 COVID-19 (Cobas) SARS-CoV-2 檢測試劑盒,以實現對大量患者的自動化檢測。 預計這一趨勢將增加危機期間對網路分析儀的需求。

網路分析儀市場趨勢

汽車市場實現顯著成長

- 汽車產業正在快速發展,融合了人工智慧、機器學習、物聯網和 5G 技術等多項技術,推動了全球聯網汽車和自動駕駛汽車的成長和發展。

- 雖然寶馬、特斯拉和奧迪等公司已經能夠很快將這些車輛推向公共道路,但其他幾家公司也在激烈競爭,以提升自動駕駛汽車/自動駕駛汽車作為其產品群組的一部分。

- 自動駕駛汽車的成長預計將增加感測器的採用,以幫助了解有關車輛周圍環境的資訊。此外,現代車輛配備了 100 多個控制單元,這些控制單元會產生更多的資訊。這些聯網汽車的自動駕駛車輛不斷發送和接收多個資料,增加了產業對網路分析儀的需求。

- Molex 也為聯網汽車和自動駕駛車輛開發了新一代乙太網路功能,強調了聯網汽車通訊整合的影響,以滿足連網和自動駕駛車輛未來自適應應用的需求。

- 此外,黑莓還推出了 QNX Black Channel Communications Technology,這是一種針對OEM和內建軟體開發人員的新軟體解決方案,可確保安全關鍵系統內的安全資料通訊交換。技術提供商的這些創新和發展預計將為汽車行業的網路分析儀創造巨大的需求。

- 最近,羅德與施瓦茨開發了針對汽車領域嵌入式設計和高速數位介面的測試解決方案。 TC9工作小組指定的測試在使用 1000Base-T1 連接的 R&S ZNB 向量網路分析儀上進行了演示。

歐洲佔主要市場佔有率

- 歐洲市場因經濟穩定成長和工業化進程加速而呈現高成長態勢。確保該地區市場成長的其他因素是主要市場參與者持續的技術創新和產品改進。在歐洲,法國、德國和英國的市場收益最高,其次是歐洲其他國家。

- 對 4G 和 5G 的需求不斷成長以及先進技術的增強是推動整個歐洲網路分析儀市場的關鍵因素。例如,根據 5G Americas 的數據,西歐預計 2019 年將佔全球 5G 連線數的 28.56%。此外,愛立信表示,西歐、中歐和東歐的5G行動用戶數量預計將超過2.89億。預計到 2025 年,它們的人口將分別達到 1.55 億。

- 網路分析儀測量電氣網路中的網路參數,支援無數現代無線技術,並廣泛用於射頻和射頻應用,增加了連接設備的需求和智慧型設備的採用,並且使用量不斷增加。支援物聯網的設備將在預測期內推動市場成長。

- 例如,根據歐洲電訊網路營運商(ENTO)的數據,2016年歐盟(EU)物聯網智慧建築的活躍連接數為508萬個連接,到2025年預計將達到15,406萬個連接。預計到2025年,工業領域物聯網活躍鏈路數量將達到1,861萬個連接。

- 汽車產業正在不斷增加車輛中的技術含量。在歐洲地區,汽車產業的技術進步促使乙太網路等新技術在整個車輛中得到全面應用,使得當今的車載通訊網路更加複雜。例如,Anritsu 的 OTDR 和 GigE 分析儀用於確保英國汽車網路中所有點的高傳輸速度。

- 根據歐洲汽車製造商協會的數據,2020年6月歐盟、英國、冰島、挪威和瑞士的乘用車銷量同比下降24.4%。 然而,從市場環比來看,歐洲市場向客戶銷售了113萬台,規模幾乎翻了一番,預計將推動該地區市場的增長。

網路分析儀產業概述

網路分析儀市場由幾家主要企業組成。從市場佔有率來看,目前佔據市場主導地位的公司寥寥可數。該市場被視為利潤豐厚的市場機會,因此吸引了沒有與該市場相關產品的各種製造商的投資。由於市場競爭日益激烈,玩家不斷創新產品以改進產品。主要廠商包括泰克公司、羅德與施瓦茨公司等。市場的最新發展包括:

- 2020 年 9 月 - 是德科技宣布魅族將使用其射頻自動化工具集來檢驗性能關鍵的增強型行動寬頻(eMBB),以在 5G 智慧型手機上交付多媒體應用,並宣布其已被選中。

- 2020 年 8 月 - Anritsu 公司推出 ShockLine ME7868A 系列模組化 2 埠向量網路分析儀 (VNA),可在長達 100 公尺的遠距內執行全向量 S 參數測量。 ME7868A VNA 由兩個具有 PhaseLyncTM 同步可選硬體和附件的 MS46131A 1 端口 VNA 組成,使用 MS46131 作為榛子可攜式VNA 端口,直接連接到被測設備 (DUT),以實現以較低的成本達到更遠的距離。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 技術簡介

- 市場促進與市場約束因素介紹

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 人們對精密製造的興趣日益濃厚

- 終端用戶產業的擴張

- 市場限制因素

- 缺乏技術純熟勞工

- 不願接受新技術

第5章市場區隔

- 目的

- 通訊

- 航太/國防

- 車

- 電子產品

- 其他用途

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- Tektronix Inc.

- Rohde & Schwarz

- Keysight Technologies

- Transcom Instruments Co. Ltd

- Anritsu Corporation

- Teledyne LeCroy Inc.

- National Instruments Corporation

- Advantest Corporation

第7章 投資分析

第8章 市場機會及未來趨勢

The Network Analyzers Market size is estimated at USD 563.77 million in 2024, and is expected to reach USD 702.55 million by 2029, growing at a CAGR of 4.5% during the forecast period (2024-2029).

A network analyzer, like most electronic instruments, requires periodic calibration; typically, this is performed once per year and is performed by the manufacturer or by a 3rd party in a calibration laboratory. The shift from 3G to LTE technology has generated a demand for test equipment across the communication sector, thereby boosting the network analyzers' market. Furthermore, the rapid acceleration of 5G technology development, which is partly driven by a rapidly increasing demand for newer IoT use cases, where higher reliability and lower latency is required, is gaining traction.

Key Highlights

- The growing interest in precisive manufacturing is a major driving factor for the market. The precisive manufacturing has caught such huge attention due to the efforts put by the manufacturers to decrease the input cost, thus resulting in an increase in their profit margins. Furthermore, the semiconductor industry's growth is also augmenting precisive manufacturing, which is driving the studied market. According to the Semiconductor Industry Association (SIA), the semiconductor market size in 2020 accounted for USD 412.3 billion in 2019 and is expected to reach USD 460 billion in 2021.

- Various vendors offer network analyzers for the precisive manufacturer, such as semiconductors and mobile devices, to reduce their cost of testing. For instance, National Instrument offers a PXI Vector Network Analyzer that reduces tests' cost through fast, automated measurements. Its PXI Express module integrates advanced VNA measurement capabilities to complete PXI-based test systems incorporating precision DC, high-speed analog and digital measurements, among others.

- Further, a huge expansion has been noticed in the various end-users that are the prominent adopters of network analyzers. In recent years, electronic technologies in modern vehicles have achieved considerable growth both in quantity and complexity. As a result, the need for designing the in-vehicle networking to control electronic technologies is felt. Further, in the utility and energy sector, providers rely on wireless and fiber optic technologies, which helps them operate more efficiently by improving their operations and creating a safe environment. Thus, fiber optic and wireless technology need proper testing and measurement to ensure the appropriate result, thereby driving the network analyzer market.

- However, the network analyzer market is impacted by the ongoing COVID-19 pandemic, with respect to its adoption in various industries. Some industries, such as the telecommunications industry, witnessed an increase in demand for the adoption of network analyzers during the crisis, while several industries, such as automotive, aerospace, and defense are expected to witness a slowdown in demand due to a decrease in the production and manufacturing processes in these industries.

- Also, the increase in the number of Covid-19 testing across the globe has led to an increase in the adoption of testing devices and kits across medical institutions. For instance, Roche began shipping the first allotment of its Cobas SARS-CoV-2 Test for COVID-19 to a network of hospital and reference laboratories, in March 2020, across the United States to enable automated high-volume patient testing. The trends are expected to increase the demand for network analyzers during the crisis.

Network Analyzer Market Trends

Automotive to Witness Significant Market Growth

- The automotive sector is growing rapidly to incorporate several technologies, such as artificial intelligence, machine learning, IoT, 5G technology, and many more, to foster the growth and development of connected and autonomous cars globally.

- Companies like BMW, Tesla, Audi, and many more are already in a position to introduce these cars on the road shortly, whereas several other companies are also competing intensely to raise autonomous cars/vehicles as part of their product portfolio.

- The growth of autonomous cars/vehicles is expected to increase the adoption of sensors, which help in ascertaining the information regarding the vehicle's surroundings. Also, more than 100 control units are available in a modern vehicle, which further generates a vast amount of information. These connected and autonomous cars continuously send and receive several data, which increases the demand for network analyzers in the industry.

- Also, Molex developed the next-generation Ethernet capabilities for the connected and autonomous car, highlighting the impact of merging in-vehicle communications to meet the future demand for adaptive applications for the connected and autonomous vehicles.

- Further, Blackberry introduced a new software solution for the OEMs and the embedded software developers, QNX Black Channel Communications Technology, to ensure safe data communication exchanges within their safety-critical systems. Suh innovations and developments by the technology providers are expected to create a significant demand for the network analyzers in the automotive industry.

- Recently, Rohde & Schwarz developed test solutions for the embedded designs in the automotive sector and high-speed digital interfaces. The tests specified by the TC9 working group will be demonstrated on an R&S ZNB vector network analyzer using a 1000Base-T1 connection.

Europe Accounts for Significant Market Share

- The European market has a strong growth rate due to robust economic growth and accelerated industrialization. Other factors assuring the market growth in this region are consistent technological innovations and product improvements by major market players. In Europe, the maximum market revenue comes from France, Germany, and the United Kingdom, followed by Europe's remaining countries.

- Growing demand for 4G and 5G and sophisticated technological enhancements is a significant factor driving the Network Analyzer market across Europe. For instance, according to 5G Americas, Western Europe was forecast to account for 28.56% of 5G connections worldwide in 2019. Also, according to Ericsson, the number of 5G mobile subscriptions in Western Europe and Central & Eastern Europe is forecast to exceed 289 million and 155 million, respectively, by 2025.

- As network analyzers measure the network parameters of electrical networks, have made countless modern wireless technologies possible, and are used in a wide range of RF and high-frequency applications, the rising need of connected devices, increasing adoption of smart devices, and rising use of IoT enabled devices are boosting the growth of the market during the forecast period.

- For instance, according to European Telecommunications Network Operators (ENTO), the number of IoT smart buildings' active connections in the European Union (EU) was 5.08 million connections in 2016, and it is expected to reach 154.06 million contacts by 2025. The number of IoT active links in the industry sector is forecast to reach 18.61 million connections by 2025.

- The automotive industry is continuously increasing the presence of technology in vehicles. In the European region, due to technological advancements in the automotive industry, today's in-vehicle communication networks are becoming more sophisticated as new technologies like Ethernet are fully deployed alongside the entire car. For instance, Anritsu's OTDR and GigE analyzers are used for ensuring the high transmission rates in all points of the in-vehicle network in the United Kingdom.

- According to the European Automobile Manufacturers Association, in June 2020, passenger car sales in the European Union, the United Kingdom, Iceland, Norway, and Switzerland were down by 24.4% Y-o-Y. Though, when comparing the market on a month-to-month basis, it almost doubled in size, i.e., 1.13 million units were sold to customers in the European market, which is anticipated to fuel the growth of the market in the region.

Network Analyzer Industry Overview

The network analyzers market consists of several major players. In terms of market share, few of the players currently dominate the market. This market is being viewed as a lucrative market opportunity, and therefore, the market is attracting investments from various manufacturers who do not have products related to the market. Due to increased competition in the market, players are continuously innovating the product in order to gain product innovation. Key players are Tektronix Inc., Rohde & Schwarz, and others. Recent developments in the market are -

- September 2020 - Keysight Technologies announced that Meizu selected the company's Radio Frequency Automation Toolset in order to validate enhanced mobile broadband (eMBB) performance-critical in delivering multi-media applications in 5G smartphones.

- August 2020 - Anritsu Corporation introduced the ShockLine ME7868A family of modular 2-port vector network analyzers (VNAs) that can conduct full vector S-parameter measurements over wide distances of up to 100 meters. Consisting of two MS46131A 1-port VNAs with the PhaseLyncTM synchronization option hardware and accessories, the ME7868A VNA uses the MS46131 as Hazelnut portable VNA ports to directly connect to the device under test (DUT) to deliver vector transmission measurements over longer lengths and at a lower cost.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Introduction to Market Drivers and Restraints

- 4.6 Assessment of Impact of COVID-19 on the Industry

- 4.7 Market Drivers

- 4.7.1 Growing Interest In Precisive Manufacturing

- 4.7.2 Expansion of End-user Industries

- 4.8 Market Restraints

- 4.8.1 Lack of Skilled Labor

- 4.8.2 Reluctance to Newer Technology

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Communication

- 5.1.2 Aerospace and Defense

- 5.1.3 Automotive

- 5.1.4 Electronics

- 5.1.5 Other Applications

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Tektronix Inc.

- 6.1.2 Rohde & Schwarz

- 6.1.3 Keysight Technologies

- 6.1.4 Transcom Instruments Co. Ltd

- 6.1.5 Anritsu Corporation

- 6.1.6 Teledyne LeCroy Inc.

- 6.1.7 National Instruments Corporation

- 6.1.8 Advantest Corporation