|

市場調查報告書

商品編碼

1433823

數位金庫:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Digital Vault - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

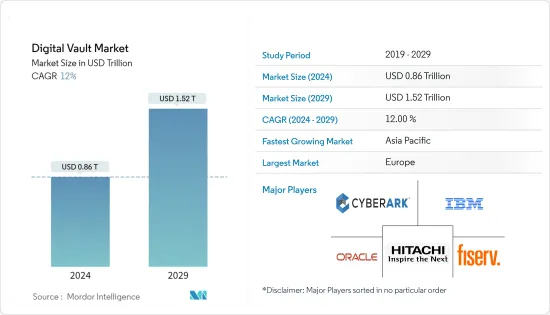

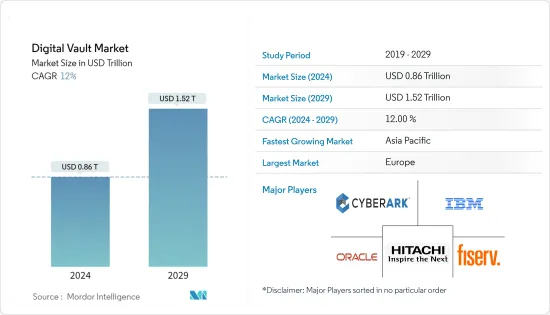

全球數位金庫市場規模預計將在 2024 年達到 8,600 億美元,並在 2024-2029 年預測期內以 12% 的複合年成長率成長,到 2029 年將達到 1.52 兆美元。

COVID-19的疫情對全球數位金庫市場的成長產生了有益的影響。線上業務趨勢對數位金庫市場佔有率和市場規模產生了積極影響。隨著網路攻擊風險的增加和企業安全受到損害,數位保管解決方案的使用增加,促進了市場成長。

主要亮點

- 一個例子是蒙大拿州歷史學會 (MHS) 採用數位檔案,為該組織提供了一個平台來組織和提供照片、地圖、信件、報紙、報導和其他類型資源的背景資訊。

- 這些公司透過收購、聯盟和合併等競爭手段以及技術改進不斷擴大其全球影響力。為了因應日益激烈的市場競爭,公司也在研發方面進行投資。例如,2022 年 2 月,Digital Vault Services GmbH (DVS) 和 Trinity Management Systems GmbH (Trinity) 宣布合作。 Trinity 和 DVS 合作,將 Trinity 的 Trinity 金庫管理系統 (TMS) 連接到擔保金庫(Guarantee Vault),後者是數位擔保和擔保的中央註冊商。 Trinity 客戶現在可以透過Guarantee Vault 直接從他們的TMS 要求和管理數位保固。

- 為了吸引更多客戶,銀行透過網路銀行業務系統提供標準金融服務以外的新服務和產品。其中一項服務需要使用一種網上銀行業務服務(例如銀行網站或行動應用程式)查看所有銀行帳戶資訊,包括各種銀行交易和帳戶餘額,並將其提供給人們。一些銀行還提供收集和儲存其他客戶文件的選項,例如通訊和電子商務申請、付款通知和醫療文件。有些銀行允許您將文件直接上傳到您的網路銀行業務帳戶。透過集中所有資訊集中在一處,客戶可以更好地了解其金融資產和業務,從而受益匪淺。

- 政府為實現公民數位化、最大限度地減少實體文件的處理、創建真實文件以最大限度地減少詐騙和偽造、降低政府行政成本、隨時隨地進行各種努力而實現資料訪問是推動數位金庫市場的基本因素。

- 然而,未來幾年阻礙數位金庫業務發展的主要因素是高昂的成本以及各種競爭性網路安全解決方案的存在。開發中國家缺乏相容性和知識是全球數位金庫業務的障礙。

數位金庫市場趨勢

雲端基礎的數位金庫正在顯著成長

- 雲端基礎的數位金庫允許最終用戶將所需資訊儲存在供應商的伺服器上,並隨時隨地遠端訪問,從而降低本地維護成本。

- 雲端基礎的數位金庫可協助最終用戶將所需資訊儲存在供應商的伺服器上。與本地解決方案相比,雲端基礎的數位金庫被廣泛選擇,因為它們可以顯著減少前期投資和 IT 開銷。推動業務成長的另一個方面是,公司越來越依賴雲端解決方案來進行資料儲存、處理和資料連接。

- Digital Locker是印度政府通訊和IT部下屬電子和資訊技術部(DEITY)的一項舉措,旨在為公民提供10MB的免費線上儲存空間,以各種格式的軟拷貝形式儲存重要文件和證書. ,如果需要,可以透過電子郵件共用。

- 資料外洩的增加預計將推動企業選擇數位金庫,從而推動預測期內的市場需求。例如,根據《HIPAA日誌》發布的資料,2022 年 1 月,美國醫療機構遭遇了 2021 年以來最多的重大資料外洩事件。近年來此類案件數量不斷增加,從2016年的329起增加到2021年的712起。

由於GDPR的引入,預計歐洲將出現顯著增長

- 數位化的興起和對資料隱私的需求促使我們以安全的數位格式儲存所有重要文件和密碼,例如數位金庫和儲物櫃。

- 歐盟委員會的線上平台「數位單一市場」是某種數位金庫庫,讓公民和文化創新產業 (CCI) 能夠訪問歐洲各地 3,700 多個圖書館、檔案館、博物館、畫廊和音訊館藏。訪問超過5300 萬個項目,包括圖像、文字、音訊、視訊和3D 資產。

- 歐洲地區多家銀行和新興企業的大量開拓預計將在預測期內為該地區的數位金庫市場創造機會。例如,2022年2月,Magyar Bankholding與Thought Machine簽署協議,建立新的數位銀行。 Magyar Bankholding 成立了一家名為 Foundation 的新子公司,該子公司受委託開發一家現代數位銀行,為私人客戶提供貸款、儲蓄和付款解決方案。 Vault 將作為新興企業的主要金融基礎設施。

- 此外,2022 年 5 月,一家比利時新興企業為企業建立了數位金庫。 Hypervault 系統適用於企業、服務供應商以及任何想要以符合 GDPR 的方式安全儲存敏感資料的人。據該公司稱,該儲存設施的建設考慮了歐洲的法律結構。

數位金庫產業概述

數位金庫市場競爭中等,有多家大公司。該市場的主要參與者包括 CyberArk Software Ltd.、IBM、Oracle、Hitachi, Ltd. 和 Fiserv, Inc.。這些參與者在產品上的不斷創新使他們比市場上其他參與者俱有競爭優勢。數位金庫市場對研發活動、策略合作夥伴關係和併購的大量投資正在推動公司提高盈利和市場佔有率。

- 2022 年 3 月 - 總部位於密蘇裡州的金融諮詢和財富管理公司 SRG Financial Advisors 宣布與業界領先的安全文件交換和數位金庫解決方案提供商 FutureVault 合作推出 Mile Marker Vault。

- 2021 年 6 月 - CyberArk 宣布了 CyberArk 身份安全平台的演變。這些進步擴展了保護範圍,並有助於保護雲端和混合環境中的高風險存取。 CyberArk 提供的雲端服務用於保護機器和人類身分。

- 2021 年 5 月 - 江森自控宣布與 DigiCert 合作,利用物聯網設備管理器來改善智慧建築中的網路安全、數位身分管理和公開金鑰基礎建設(PKI)。該設備管理器基於 DigiCert ONE 數位證書平台構建,為智慧建築解決方案提供先進且安全的連接。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場概況

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 對資料隱私和安全文件共用的擔憂

- 處理透過連接設備產生的資料

- 市場限制因素

- 使用實體存儲

第6章市場區隔

- 依發展

- 本地

- 雲

- 依類型

- 解決方案

- 服務

- 依最終用戶

- BFSI

- 資訊科技/通訊

- 政府機關

- 其他最終用戶

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- IBM

- CyberArk Software Ltd.

- Hitachi Limited

- Fiserv, Inc.

- Oracle Corporation

- Keeper Security

- Multicert

- Accruit LLC

第8章投資分析

第9章市場的未來

The Digital Vault Market size is estimated at USD 0.86 trillion in 2024, and is expected to reach USD 1.52 trillion by 2029, growing at a CAGR of 12% during the forecast period (2024-2029).

The COVID-19 outbreak had a beneficial impact on worldwide digital vault market growth. The growing trend of conducting online businesses positively impacted the digital vault market's share and size. As the risk of cyber-attacks increased, putting businesses' security at risk, organizations increasingly use digital vault solutions, thus boosting market growth.

Key Highlights

- The adoption of the digital vault by the Montana Historical Society (MHS) is one such instance that provides MHS with a platform that organizes and provides context for photographs, maps, letters, newspapers, articles, and other types of resources.

- These companies are continuously expanding their worldwide reach through technological improvements as well as competitive techniques such as acquisitions, collaborations, and mergers. Companies also invest in R&D to keep up with the rising market rivalry. For instance, in February 2022, Digital Vault Services GmbH (DVS) and Trinity Management Systems GmbH (Trinity) announced cooperation. Trinity and DVS partnered to connect Trinity Treasury Management System (TMS) with Guarantee Vault, a central register for digital guarantees and sureties. Trinity customers will be able to request and manage their digital guarantees directly from their TMS via Guarantee Vault.

- To attract more clients, banks offer new services and products through online banking systems that go beyond standard financial services. One of these services is providing consumers with the opportunity to view all bank account information, including transactions and account balances from various banks, using a single online banking service (e.g., a bank website or a mobile application). Some banks also give the option of collecting and storing other customer documents, such as telecommunication or e-commerce invoices, payment notices, medical care documentation, and so on. Some banks even allow users to upload documents directly to their online banking accounts. By aggregating all information in one place, customers can benefit from a better overview of their financial assets and operations.

- Various government initiatives to digitally empower the citizens, minimizing the handling of physical documents, authentic documentation to minimize fraud and forgery, reducing government administrative overheads, and access to data at any time and anywhere are the other factors which are fundamental in driving the digital vault market.

- However, some of the primary factors impeding the development of the digital vault business in the foreseeable years are the significant cost involved and the existence of various competing cybersecurity solutions. Compatibility and absence of knowledge in developing nations are some problems that may function as a stumbling obstacle for the global digital vault business.

Digital Vault Market Trends

Cloud-Based Digital Vaults to Register a Significant Growth

- Cloud-based digital vaults enable the end-users to store the required information on the vendor's servers, which can be accessed remotely anywhere and at any time, thus, reducing their cost factor for on-premise maintenance.

- Cloud-based digital vault help ends users store the necessary information on the vendor's servers. These are widely chosen above on-premise versions since they save significantly on upfront expenditures and IT overhead. Another encouraging aspect of business growth is enterprises' growing reliance on cloud solutions for data storage, processing, and data connectivity.

- Digital locker is an initiative of the Department of Electronics and Information Technology (DEITY) under the Ministry of Communications and IT, Government of India, which provides its citizens 10MB of free online storage space to store important documents and certificates as soft copies in different formats, which can be shared through e-mails, if needed.

- The growing number of data breaches is expected to influence businesses to opt for a digital vault, thereby boosting the market demand over the forecast period. For instance, as per the data published by HIPAA Journal, in January 2022, healthcare organizations in the United States saw the highest number of large-scale data breaches to date in 2021. The number of such cases has increased in recent years, going from 329 cases in 2016 to 712 cases in 2021.

Europe is Expected to Share Significant Growth Owing to GDPR Adoption

- The increase in digitization and the need for data privacy have given rise to storing all the important documents and passwords in a secure digital format, as in digital vaults or lockers.

- European commission's online platform, Digital Single Market, is a kind of digital vault that has given access to citizens and the Cultural and Creative Industries (CCIs) to over 53 million items, including images, texts, sounds, videos, and 3D materials from the collections of over 3700 libraries, archives, museums, galleries, and audio-visual collections, across Europe.

- Numerous developments by several banks and startups in the European region are expected to create opportunities for the digital vault market in the region over the forecast period. For instance, in February 2022, Magyar Bankholding signed an agreement with Thought Machine to build a new digital bank. Magyar Bankholding established a new subsidiary named Foundation, which is entrusted with developing a modern digital bank that would provide retail customers with loan, savings, and payment solutions. Vault will serve as the key financial infrastructure for the startup.

- Furthermore, In May 2022, a Belgian startup created a digital vault for businesses. The Hypervault system is intended for enterprises, service providers, and anyone that want a GDPR-compliant method of securely storing sensitive data. According to the company, the company is constructing the vault while considering the European legal structure.

Digital Vault Industry Overview

The Digital Vault Market is moderately competitive, owing to the presence of several major players. Some of the major players operating in the market include CyberArk Software Ltd., IBM, Oracle, Hitachi, Ltd., and Fiserv, Inc., among others. The continuous innovations brought out by these players in their products have allowed them to gain a competitive advantage over other players in the market. Significant investments in R&D activities, strategic partnerships, and mergers and acquisitions in the digital vault market have enabled the companies to increase profitability and market share.

- March 2022 - SRG Financial Advisors, a financial advisory and wealth management firm headquartered in Missouri, announced the launch of the Mile Marker Vault through its partnership with FutureVault, an industry-leading provider of secure document exchange and digital vault solutions.

- June 2021 - CyberArk announced the advancements to its CyberArk Identity Security Platform. These advancements help to broaden protection, and secure high-risk access across cloud and hybrid environments. This cloud-delivered service from CyberArk is used to protect the machine and human identities.

- May 2021 - Johnson Controls announced a partnership with DigiCert to take advantage of IoT Device Manager for improving smart building cybersecurity, management of digital identities, and Public Key Infrastructure (PKI). This device manager is built on DigiCert ONE digital certificate platform, which provides advanced secure connectivity in smart building solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Data Privacy and Secured File Sharing Concerns

- 5.1.2 Handling of Data Generated through Connected Devices

- 5.2 Market Restraints

- 5.2.1 Use of Physical Vault

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Type

- 6.2.1 Solutions

- 6.2.2 Services

- 6.3 By End-User

- 6.3.1 BFSI

- 6.3.2 IT and Telecommunication

- 6.3.3 Government

- 6.3.4 Other End-Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM

- 7.1.2 CyberArk Software Ltd.

- 7.1.3 Hitachi Limited

- 7.1.4 Fiserv, Inc.

- 7.1.5 Oracle Corporation

- 7.1.6 Keeper Security

- 7.1.7 Multicert

- 7.1.8 Accruit LLC