|

市場調查報告書

商品編碼

1433818

自動液體處理機:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Automated Liquid Handlers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

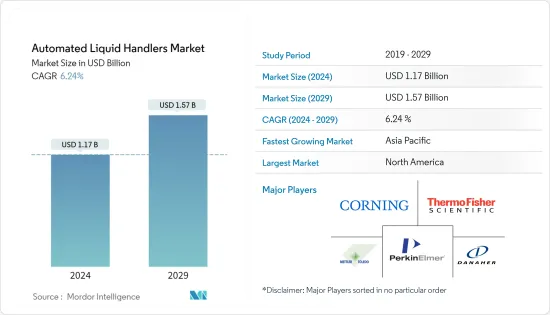

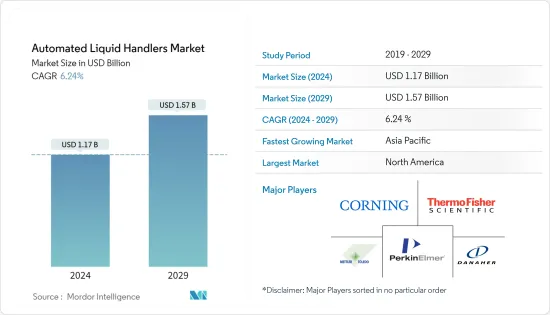

全球自動液體處理機市場規模預計將在 2024 年達到 11.7 億美元,並在 2024-2029 年預測期內以 6.24% 的複合年成長率成長,到 2029 年將達到 15.7 億美元。

由於新冠肺炎 (COVID-19) 疫情的爆發,全球診斷實驗室的測試、追蹤和追溯要求不斷增加,自動化液體處理機市場的需求顯著增加。隨著樣本的不斷湧入,尤其是與疫情相關的樣本,實驗室需要更多的能力來每天測試數千個樣本。

主要亮點

- 由於自動化系統的彈性和適應性,自動液體處理設備已廣泛應用於實驗室自動化領域。高效率的死體積分配可減少處理時間和潛在的樣品污染。液體處理器還能夠分配少量納升,這使其對於分配工作非常有用。

- 市面上有各種自動液體處理系統。這些系統可以是基於空氣的或液體主導的,並使用一個或兩個吸頭和拋棄式吸頭的組合進行移液。具有液體檢測系統的自動化平台可記錄抽吸運動,在生物分析樣本量較小時非常有用。

- 此外,隨著世界各地(尤其是美國)臨床試驗和臨床前試驗的迅速擴展,對樣本分析的速度提出了要求。臨床研究機器連續運作,需要大量勞動力才能確保正常運作。此外,現有疾病的快速傳播和新疾病的發現增加了對早期治療和診斷的需求。預計這將提高臨床診斷的應用率並刺激自動液體處理機的採用。

- 此外,2021 年 1 月,SPT Labtech 收購了 Apricot Designs。透過此次收購,SPT 旨在擴大其液體處理技術範圍,作為其結構生物學、藥物發現、樣本管理、基因組學、生物銀行和冷凍電子顯微鏡自動化解決方案系列的一部分。此類新興市場的開拓預計將進一步推動市場成長。

- 對快速週轉時間 (TAT)、高吞吐量、減少人為錯誤和降低營運成本的需求日益成長,是推動採用自動化液體處理機的一些關鍵因素。液體處理機通常用於生物化學和化學實驗室。自動液體處理機器人協助在實驗室中分配樣本和其他液體。液體處理機使用軟體控制器和整合系統來客製化批量傳輸的處理程序。

- 此外,2021年6月,德國默克公司宣布計劃在法國投資1.75億歐元。吉倫特省的研究所將投資約 5,000 萬歐元,該研究所計劃將產量增加兩倍,專門研究基於生物技術的癌症治療藥物。

- 此外,先進的液體處理技術(例如自動體積分配裝置)使用戶能夠在較小的體積範圍內處理更廣泛的液體,從高黏度到高揮發性。貝克曼庫爾特宣布推出適用於基因組、細胞、蛋白質和其他工作流程的新系列可擴展液體處理解決方案。新發布的 Biomek 4000 自動液體處理機可協助您標準化日常移液程序、維持樣本品質並產生可重複且可靠的結果。

自動液體處理機市場趨勢

臨床診斷正在經歷顯著成長

- 醫學實驗室的自動化正在興起,包括臨床化學、血液學和分子生物學等研究和診斷實驗室。模組化實驗室自動化廣泛應用於臨床診斷的各種應用,包括樣品製備、分配、篩檢和歸檔。此外,美國美國衛生研究院(NIH)為臨床研究提供的資金逐年增加,這大大推動了市場的發展。

- 臨床診斷已被證明有益於治療感染疾病和慢性病。世界衛生組織(WHO)估計,心血管疾病、癌症、呼吸道疾病等慢性病每年導致約3,800萬人死亡,佔全球死亡人數的62%。

- 此外,根據美國國立衛生研究院的數據,2022年臨床研究支出預計約為183.2億美國,預計將成為未來市場成長的驅動力。

- 根據美國心臟協會統計,每天約有2,300名美國人死於心血管疾病,平均每38秒就有1人死亡。

- 領先的製藥公司羅氏控股公司表示,臨床診斷在疾病的預防、檢測和管理中發揮重要作用。儘管臨床診斷僅佔醫療保健支出的 2%,但它們影響了約三分之二的臨床決策。自動化臨床診斷是一項巨大的課題,因為它需要持續、高品質的客戶服務。這對於獲得可靠的測試結果和確保患者安全至關重要。

- 此外,2022年5月,商工部的資料顯示,2021-2022會計年度,印度醫院和診斷中心產業的外國直接投資(FDI)資本注入增加了39%,促使印度醫院和診斷中心產業的資本注入總額成長了39%。達到約6.975億美元。

北美市場佔有率最大

- 北美的自動化液體處理解決方案供應商不斷創新,以整合最多數量的臨床設備。此外,根據基金會-Keybridge設備和軟體投資動量監測,2021年第二季美國臨床設備投資年化成長0.7%,2021年8月年增19%。

- 此外,美國面臨臨床實驗室技術人員和實驗室人員短缺的問題,預計將在全國測試自動化方面處於領先地位。美國勞工統計部預測,未來臨床實驗室技術人員的短缺將超過 15 萬名,而未來幾年的退休潮將導致許多有才華的人離開勞動力隊伍,這一情況將進一步加劇。每年約有 5,000 名美國臨床實驗室技術人員加入勞動力隊伍,不到每年約 12,000 名臨床實驗室技術人員的一半,以滿足不斷成長的服務需求。

- 研發領域的發展預計將促使許多公共機構在全國範圍內加強實驗室能力,從而推動對實驗室自動化設備的需求。例如,位於馬裡蘭州弗雷德里克的美國陸軍傳染病醫學研究所 (USAMRIID) 正在進行最終試運行。該建築預計於 2021 年入住。這座佔地 835,000 平方英尺的建築預計將成為美國生物防禦研究計畫的主要設施。

- 此外,由於美國政府和美國食品藥物管理局(FDA)實施嚴格的監管,以及由於心血管疾病和糖尿病等各種疾病的增加而對藥物發現和研究實驗室的日益重視,診斷市場的需求不斷增加。該地區的神經系統疾病。擴張正在推動藥物發現和臨床診斷領域的需求。

- 該地區新實驗室基礎設施的發展正在加速。例如,2021 年 4 月,高階分析測量技術領先供應商 Analytique Jena 宣佈在 Endress+Hauser 園區開設應用實驗室。該實驗室旨在為美國內部客戶支援和演示提供一個中心位置。該實驗室將進行演示,展示 Analytique Jena 儀器在液體處理和自動化、化學分析和生命科學等領域的精確度和精度。

- 新軟體創新解決方案和擴展的趨勢改變了區域自動液體處理機市場的需求,並主導了北美和全球市場。

自動化液體處理機產業概述

自動液體處理機市場適度分散,存在一些知名參與者,而新增加的新興企業和合作夥伴的創新正在增加市場上的新競爭對手。 Thermo Fisher Scientific、Perkin Elmer Inc.、Beckman Coulter Inc.、Corning Inc.是主要的市場參與者。產品創新、聯盟和收購是擴大市場佔有率的重要發展。

- 2022 年 2 月 - 生命科學實驗室自動化專家 SPT Labtech 在波士頓舉行的 SLAS 2022 國際會議暨展覽會上推出了 apricot DC1,這是一款四合一自動化液體處理平台。本公告推出了一款緊湊型自動移液器,可協助實驗室簡化跨應用的日常手動或半手動移液流程。

- 2021 年 1 月 - QIAGEN NV 宣佈在全球推出 QIAcube Connect MDx,這是一個靈活的自動化樣品處理平台,適用於美國、加拿大、歐盟和其他全球市場的分子診斷實驗室。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 評估 COVID-19 對市場的影響

市場動態

- 市場促進因素

- 實驗室自動化系統的彈性和適應性

- 市場限制因素

- 中小型組織的採用率下降

市場區隔

- 依用途

- 藥物發現

- 癌症/基因組研究

- 生物技術

- 其他用途

- 依最終用戶產業

- 合約研究組織

- 製藥/生物技術

- 學術/研究機構

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Thermo Fisher Scientific

- Perkin Elmer Inc.

- Danaher Corporation(Beckman Coulter Inc.)

- Formulatrix Inc.

- Mettler-Toledo International Inc.

- Agilent Technologies Inc.

- Hamilton Company

- Becton Dickinson and Company

- Synchron Lab Automation

- Tecan Group Ltd

- Aurora Biomed Inc.

- Eppendorf AG

- Analytik Jena AG(Endress+Hauser Group Services AG)

- Hudson Robotics Inc.

第8章投資分析

第9章市場的未來

The Automated Liquid Handlers Market size is estimated at USD 1.17 billion in 2024, and is expected to reach USD 1.57 billion by 2029, growing at a CAGR of 6.24% during the forecast period (2024-2029).

With the outbreak of COVID-19, the automated liquid handler market witnessed a significant increase in demand due to the increasing requirement for testing, tracing, and tracking in diagnostic labs globally. As the volume of incoming samples, especially related to the pandemic situation, laboratories need many capabilities to test up to thousands of samples daily.

Key Highlights

- Automation systems' flexibility and adaptability made automated liquid handlers' equipment widely used in lab automation. They reduce processing time and the possibility of sample contamination by dispensing dead volumes efficiently. Liquid handlers can work with volumes as small as nanoliters, making them helpful in dispensing operations.

- There is a wide range of automated liquid handling systems on the market. They are air-based or liquid-filled systems for pipetting with either/or a combination of fixed and disposable tips. Automation platforms with liquid detection systems record aspiration action and assist when bioanalytical sample volumes are low.

- Furthermore, the rapid expansion of several clinical and pre-clinical studies worldwide, particularly in the United States, has created a need for speed in sample analysis. The machines in clinical studies run continuously and require a large workforce to ensure proper operation. Furthermore, the rapid spread of existing diseases and the discovery of new diseases raises the demand for early treatments and diagnoses. This is expected to boost the rate of clinical diagnostic application, fueling the adoption of automated liquid handlers.

- Furthermore, in January 2021, SPT Labtech acquired Apricot Designs. Through this purchase, SPT aimed to extend its range of liquid handling technologies as part of its collection of automation resolutions for structural biology, drug discovery, sample managing, genomics, biobanking, and cryo-electron microscopy. Such developments are anticipated to further drive the market growth.

- The increasing need for faster turn-around times (TAT), higher throughput, reduced human errors, and lower operational costs are some of the major factors driving the adoption of automated liquid handlers. Liquid handlers are typically employed in biochemical and chemical laboratories. Automatic liquid handling robots aid in the dispensing of samples and other liquids in laboratories. Liquid handlers use a software controller and an integrated system to customize handling procedures for large transfer volumes.

- Further, in June 2021, the German laboratory Merck announced its plan to invest EUR 175 million in France. About EUR 50 million was invested in the Gironde laboratory, which planned to triple its production, specializing in drugs derived from biotechnologies to treat cancer.

- Furthermore, advanced liquid handling technologies, such as automatic positive displacement pipetting systems, allow users to handle highly viscous to highly volatile liquids in lower volume ranges and with a broader range of liquid types. Beckman Coulter has introduced a new line of scalable liquid handling solutions for genomic, cellular, protein, and other workflows. The newly released Biomek 4000 Automated Liquid Handler aids in standardizing daily pipetting routines, preserving sample quality, and generating repeatable and reliable results.

Automated Liquid Handlers Market Trends

Clinical Diagnostics to Witness Significant Growth

- Automation in medical laboratories has been witnessing an increasing trend, including research and diagnostic laboratories, such as clinical chemistry, hematology, and molecular biology. Modular laboratory automation is widely employed in clinical diagnostics for various applications that include sample preparation, distribution, screening, and archiving. Further, year to year, growth in funding provided by NIH (National Institutes of Health) in clinical research is significantly driving the market.

- Clinical diagnostics have been proven beneficial in treating infectious and chronic disease conditions. World health organization (WHO) estimates that chronic disease conditions, like cardiovascular diseases, cancer, and respiratory diseases, are responsible for about 38 million people every year, accounting for 62% of all deaths worldwide.

- Moreover, according to the National Institutes of Health, clinical research funding in 2022 is expected to be around 18.32 billion US dollars, which is expected to drive market growth in the future.

- Statistics from American Heart Association indicate that about 2,300 Americans die of cardiovascular diseases each day, an average of 1 death every 38 seconds, thus indicating the need to treat them and find a solution via clinical diagnostics research.

- According to Roche Holding AG, a leading pharmaceutical company, clinical diagnostics play a crucial role in disease prevention, detection, and management. Though they account for just 2% of healthcare spending, they influence roughly two-thirds of clinical decision-making. Implementation of automation for clinical diagnostics is quite challenging as the processes need continuous, high-quality customer service. This is very important to obtain reliable test results and to provide patient safety.

- Further, in May 2022, according to data from the Ministry of Commerce and Industry, the hospitals and diagnostic centers sector in India experienced a 39% increase in Foreign Direct Investment (FDI) fund infusion during the fiscal year 2021-22, with fund infusion totaling approximately USD 697.5 million, this is expected to provide positive boost to the market growth.

North America Accounts For Largest Market Share

- Automated liquid handling solution providers in North America continuously innovate to integrate a maximum number of clinical equipment. Further, according to the Foundation-Keybridge Equipment & Software Investment Momentum Monitor, US investment in clinical equipment increased at a 0.7% annualized rate in Q2 2021 and was up 19% year over year in August 2021.

- Besides, the United States faces a shortfall in laboratory scientists and lab personnel, which is expected to spearhead lab automation across the country. The Department of Labor and Statistics predicts a future shortage of more than 150,000 clinical laboratory scientists exacerbated by a wave of retirements that would see much-qualified personnel leave the workforce over the coming years. Around 5,000 American lab professionals enter the labor pool each year, less than half of the approximately 12,000 workers a year necessary to meet the rising demand for their services.

- Due to the developments in the field of R&D, many public institutions are expected to enhance their laboratory capabilities across the country, boosting the demand for lab automation equipment. For instance, final commissioning is underway at the U.S. Army Medical Research Institute of Infectious Diseases (USAMRIID) in Fort Detrick in Frederick, Maryland. The building is anticipated to be open for occupancy in 2021. This 835,000-square-foot building is expected to serve as the lead facility for the U.S. Biological Defense Research Program.

- Furthermore, strict regulations imposed by the U.S. government and the FDA, along with the growing demand in the diagnostic market with the increasing emphasis on drug discovery and research laboratories owing to the rising presence of various diseases such as cardiovascular diseases and neurological diseases in the region, fueled the demand of drug discovery and clinical diagnostics sector.

- New lab infrastructure setup has been accelerated in the region. For instance, in April 2021, Analytik Jena, a leading provider of high-end analytical measuring technology, announced the opening of its applications lab within the Endress+Hauser campus. The lab aimed to offer a centralized location in the United States for in-house customer support and demonstrations. This lab is set to provide demos to showcase the precision and accuracy of Analytik Jena instruments in liquid handling and automation, chemical analysis, and life science groups.

- The trend towards new software innovation solutions and expansion has translated the demand for automated liquid handlers market in the region, leading to dominating the North American and the global markets.

Automated Liquid Handlers Industry Overview

The Automated Liquid Handlers Market is moderately fragmented due to the presence of a few prominent players, and newly added startups and partnership innovations are increasing new rivalry in the market. Thermo Fisher Scientific, Perkin Elmer Inc., Beckman Coulter Inc., Corning Inc., and others are key market players. Product innovation, partnerships, and acquisition are vital developments to increase their market share.

- February 2022 - SPT Labtech, a laboratory automation specialist for life sciences, debuted the apricot DC1, a 4-in-1 automated liquid handling platform, at the SLAS 2022 International Conference and Exhibition in Boston. The launch introduces a compact automatic pipettor to help laboratories streamline daily manual or semi-manual pipetting processes across applications.

- Match 2021 - QIAGEN N.V. announced the global launch of the QIAcube Connect MDx, a flexible platform for automated sample processing available to molecular diagnostic laboratories in the U.S. and Canada, the European Union, and other markets worldwide.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Flexibility and Adaptability of Lab Automation Systems

- 5.2 Market Restraints

- 5.2.1 Slower Adoption Rates in Small- and Medium-sized Organizations

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Drug Discovery

- 6.1.2 Cancer and Genomic Research

- 6.1.3 Biotechnology

- 6.1.4 Other Applications

- 6.2 By End-user Vertical

- 6.2.1 Contract Research Organizations

- 6.2.2 Pharmaceutical and Biotechnology

- 6.2.3 Academic and Research Institutes

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thermo Fisher Scientific

- 7.1.2 Perkin Elmer Inc.

- 7.1.3 Danaher Corporation (Beckman Coulter Inc.)

- 7.1.4 Formulatrix Inc.

- 7.1.5 Mettler-Toledo International Inc.

- 7.1.6 Agilent Technologies Inc.

- 7.1.7 Hamilton Company

- 7.1.8 Becton Dickinson and Company

- 7.1.9 Synchron Lab Automation

- 7.1.10 Tecan Group Ltd

- 7.1.11 Aurora Biomed Inc.

- 7.1.12 Eppendorf AG

- 7.1.13 Analytik Jena AG (Endress+Hauser Group Services AG)

- 7.1.14 Hudson Robotics Inc.