|

市場調查報告書

商品編碼

1433787

殭屍網路偵測:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Botnet Detection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

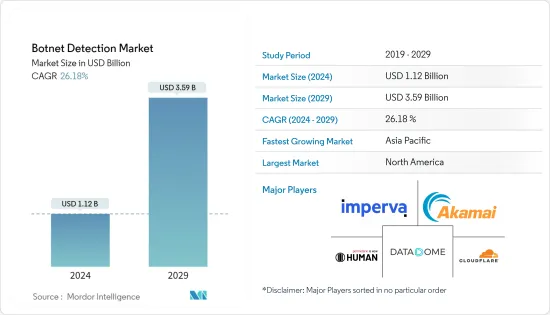

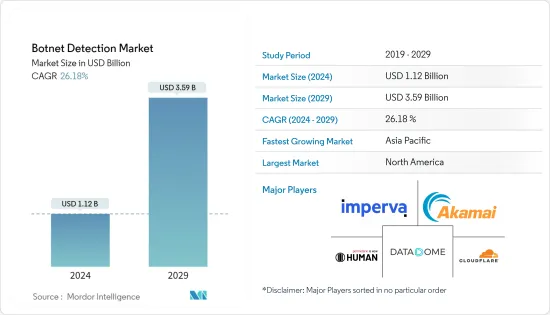

全球殭屍網路偵測市場規模預計將在 2024 年達到 11.2 億美元,並在 2024-2029 年預測期內以 26.18% 的複合年成長率成長,到 2029 年將達到 35.9 億美元。

殭屍網路偵測受到了全球網路安全專家和科技公司的廣泛關注。隨著世界各地技術的進步,過去幾年與濫用先進技術相關的風險也有所增加。殭屍網路攻擊是一種侵犯用戶隱私的行為,其中用戶的電腦由第三方控制和管理。由於網路犯罪分子滲透到世界各地任何網路連線裝置的能力不斷增強,殭屍網路正在發展成為主要威脅之一。

主要亮點

- 近年來,物聯網 (IoT) 技術的普及增加了攻擊者的端點數量。新的分散式阻斷服務 (DDoS) 機器人的定期出現也促使了這種不斷變化的模式。在 2016 年 Mirai 殭屍網路被通報以及惡意軟體原始碼隨後被洩露後,該殭屍網路家族的變種數量穩步增加,並且由於物聯網設備管理不善的環境,它的成功也得到了增強。

- 越來越多的行動裝置和雲端運算成為攻擊目標,使得惡意機器人更容易偽裝自己。駭客傳統上利用惡意機器人賺錢。現在它被用於行業間諜活動,甚至影響選舉。公司必須對攻擊進行集中索引和研究,然後再製定策略進行反擊。 2021 年 12 月,Google摧毀了 Grupteba(一個殭屍網路)的“關鍵命令和控制基礎設施”,並起訴了其營運商。

- 實體安全和 IP 網路的融合擴大了網路犯罪分子的攻擊面。犯罪分子正在從針對特定使用者帳戶或地理位置擴大到征服整個網路營業單位。 2021 年 9 月,俄羅斯搜尋引擎Yandex 受到 Meris 殭屍網路的分散式阻斷服務攻擊,攻擊規模創歷史新高。這次攻擊透過數百萬個 HTTP 請求破壞了公司的 Web 基礎設施,尖峰時段達到每秒 2,180 萬個請求 (RPS),破壞了公司現有基礎設施的穩定性。俄羅斯 DDoS 緩解服務 Qrator Labs 識別了此次攻擊,並指出 DDoS 攻擊利用了源自 Mikrotik 超過 250,000 個受感染網路設備的 HTTP 管道。

- 然而,缺乏熟練的網路安全專業人員來阻止此類攻擊仍然是企業面臨的弱點。公司正在招募新的網路安全專業人員,以了解殭屍網路的演變,並培訓他們使用偵測軟體來防止潛在的攻擊。市場領先公司之間的合併也是公司為加強其服務和產品系列而提出的解決方案。

- COVID-19 垃圾郵件是封鎖期間的常見問題,可分為兩種主要類型:附附件和無附件。供應商必須快速推出新服務,以跟上世界各地攻擊者的步伐。 2021年7月,隨著第二波病毒激增,Neustar Inc.推出了UltraBot Protect,它允許用戶透過直覺、全面的用戶介面或公司的可擴展API檢查流量模式以確定風險,為用戶提供了增強的功能,例如作為更簡單的規則配置和阻止惡意 Web 應用程式流量。

殭屍網路偵測市場趨勢

媒體和娛樂業預計將經歷顯著成長

- 媒體和娛樂公司在廣告上花費很大一部分,以提高品牌知名度並獲取新客戶。殭屍網路偵測技術主要應用於媒體和娛樂產業,以減少廣告的脆弱性。由於透過廣告詐騙進行的機器人攻擊的增加,預計該行業將快速成長。隨著各種平台上的廣告數量增加,相關的風險和端點也隨之增加。

- 殭屍網路攻擊可以進行非法活動,例如傳播詐騙內容、價格抓取以及其他影響您品牌的活動。廣告商不斷監控其網路和伺服器,以偵測異常流量模式並評估銷售業績下降的原因。這可以使組織和用戶免受網路攻擊、資料外洩以及財務和資訊損失。

- 隨著數位化和普及,媒體和娛樂公司意識到需要殭屍網路偵測解決方案來保護其資料庫、應用程式和網站。由於接受度不斷提高,線上媒體娛樂產業正在高速擴張,這主要是由數位媒體推動的。

- Netflix 是全球Over-the-Top的 OTT 平台之一。公司上年度收益296.97億美元,年增19%。此外,該公司還與多家電視製造商合作,提供智慧電視的應用程式,預計將進一步增加用戶數量。因此,殭屍網路攻擊事件預計將會增加,從而推動市場成長。

北美佔據主要市場佔有率

- 北美預計將成為殭屍網路偵測和管理供應商收益最高的地區之一。美國和加拿大注重技術研發(R&D)和創新。該地區的成長主要得益於對殭屍網路偵測解決方案的投資增加,以保護網站、API 和行動應用程式免受機器人攻擊。

- 此外,預計該地區將成為一個生產力顯著提高的區域市場。在這些地區的國家中,殭屍網路對整個政府造成損害的威脅正在增加,從而推動了需求。

- 美國政府定期對常見和大規模的殭屍網路威脅採取嚴格措施。 2022 年 4 月,美國司法部宣佈了一項由 2022 年 3 月進行的法院批准的行動,以摧毀一個由數千台受感染網路硬體設備組成的兩層全球殭屍網路,該殭屍網路由被稱為 Sandworm 的威脅行為者控制。 在此操作中,惡意軟體被複製並從 Sandworm 用於命令和控制底層殭屍網路 (C2) 的易受攻擊的 Internet 連接防火牆設備中刪除。

- 這也是由於大眾對資料隱私的認知不斷提高,這可能會推動北美地區對殭屍網路偵測解決方案的需求。此外,政府對資料隱私的監管日益嚴格,預計也將顯著推動市場的未來成長。

殭屍網路偵測產業概述

殭屍網路偵測市場的競爭是溫和的,並由幾個大型參與者組成。從市場佔有率來看,目前少數主要參與者佔據主導地位,而新參與者正在進入市場。服務的需求與組織中殭屍網路偵測解決方案的實施程度直接相關。這些公司正在利用策略合作計劃來提高市場佔有率和盈利。此外,在該市場營運的公司正在收購專注於企業網路設備技術的新興企業,以增強其產品能力。

- 2022 年 7 月 - Fastly, Inc. 宣布與 HUMAN Security, Inc. 建立經銷商合作夥伴關係。該合作夥伴關係將為客戶提供機器人保護、詐騙和帳戶詐欺保護,以防止網路犯罪分子滲透線上應用程式和服務。

- 2022 年 4 月 - Akamai Technologies, Inc. 宣布推出 Audience Hijacking Protector,這是一款專為線上企業設計的新解決方案,旨在最大限度地增加商機並最大限度地減少行銷詐騙。 Akamai 還宣布了新的應用程式安全功能,以保護客戶免受任何線上環境中的威脅,包括網路瀏覽器、Bot Manager 管理的警報、行動應用程式、API互動期間和邊緣。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與市場約束因素介紹

- 市場促進因素

- 連接設備數量增加

- 組織中殭屍網路的安全需求增加

- 線上業務中 API 的使用增加

- 市場限制因素

- 用戶教育缺乏,工具利用率低

- 使用傳統的機器人保護方法,例如驗證碼和帳戶創建

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術概覽

第5章市場區隔

- 依成分

- 解決方案

- 服務

- 依部署類型

- 本地

- 雲

- 依組織規模

- 中小企業

- 主要企業

- 依最終用戶產業

- 零售

- BFSI

- 旅遊/酒店業

- 資訊科技/通訊

- 媒體娛樂

- 其他最終用戶產業(教育、醫療保健、房地產)

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 其他地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Imperva Inc.

- PerimeterX Inc.(HUMAN Security, Inc.)

- Akamai Technologies Inc.

- Cloudflare, Inc.

- DATADOME Group

- Reblaze Technologies Ltd

- Radware Ltd

- Oracle Corporation

- Intechnica Ltd(Netacea Ltd.)

- Barracuda Networks, Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The Botnet Detection Market size is estimated at USD 1.12 billion in 2024, and is expected to reach USD 3.59 billion by 2029, growing at a CAGR of 26.18% during the forecast period (2024-2029).

Botnet detection has accumulated widespread attention among cybersecurity professionals and technology companies worldwide. As technology progresses across the globe, the risk connected with the misuse of advanced technology has also grown over the past years. Botnet attack is one such violation of the user's privacy where a user's computer is being controlled and managed by a third party. The botnet has been developing as one of the principal threats owing to the growing cybercriminals' capacity to infiltrate any of the devices which are attached to the internet across the globe.

Key Highlights

- In recent years, there has been a proliferation in the Internet of Things (IoT) technology, which added additional endpoints for attackers. The emergence of new distributed denial of service (DDoS) bots at an increasing regularity attributes to the changes in the landscape. After the reporting of the Mirai botnet in 2016 and the subsequent leak of the malware's source code, the number of variants of this family of botnets has been growing steadily, its success being augmented by an environment of poorly-managed IoT devices.

- Due to the growth of mobile devices and cloud computing that act as attack surfaces, it has become easier for malicious bots to disguise themselves. The hackers traditionally used malicious bots for money-making activities. Now, they are increasingly used for industrial espionage and even influencing elections. Companies have to index attacks intensively and study them before countering them with their strategies. In December 2021, Google disrupted the 'key command and control infrastructure' of Glupteba, a botnet that compromised nearly one million Windows devices worldwide, and filed a lawsuit against its operators.

- The convergence of physical security with the IP network expands the attack surface for cybercriminals. Criminals have expanded from targeting specific user accounts or regions to conquering entire internet entities. In September 2021, the Russian search engine Yandex was attacked at a record level by a distributed denial of service attack by the Meris botnet. The attack destroyed the company's web infrastructure with millions of HTTP requests before hitting a peak of 21.8 million requests per second (RPS) and destabilizing its existing infrastructure. The Russian DDoS mitigation service Qrator Labs identified the attack and noted that the DDoS attacks leveraged HTTP pipelining originating from over 250,000 infected network devices from Mikrotik.

- However, the lack of skilled cybersecurity professionals to disrupt such attacks continues to be a vulnerability that companies face. The companies are recruiting new cybersecurity professionals to train them with the evolution of botnets and use detection software to prevent potential attacks. Mergers among the big players in the market are another solution the companies have come up with to strengthen their services and product portfolio.

- COVID-19 spam was a prevalent issue during the lockdown period and can be primarily divided into two types: with and without attachments. Vendors have had to rapidly roll out new offerings that match the pace of attackers worldwide. In July 2021, as the second wave of the virus surged, Neustar Inc. introduced UltraBot Protect to deliver enhanced capabilities to users to examine traffic patterns to determine risk, easily set rules, and block nefarious web application traffic through an intuitive and comprehensive user interface or the company's extensible API, which deliver actionable data to manage incoming traffic or risks better.

Botnet Detection Market Trends

Media and Entertainment Industry is Expected to Register Significant Growth

- Media & entertainment enterprises spend a significant share on advertisements to create brand awareness and attract new customers. Botnet detection techniques are majorly adopted in media & entertainment industries to reduce vulnerabilities towards advertisements. This sector is expected to be the fastest growing due to the increasing bot attacks on this sector through ad frauds. The involved risks and end-points increase with the rising number of advertisements on different platforms.

- Botnet attacks may run illegal activities such as spreading fraudulent content, price scraping, and others that affect the brand. Advertisers constantly monitor networks and servers to detect unusual traffic patterns and evaluate the reason for declining sales performance. This helps save organizations and users from cyber-attacks, data breaches, and monetary and information losses.

- With digitalization and the proliferation, the media and entertainment companies have realized the need for botnet detection solutions to protect and secure their databases, applications, and websites. Due to the increasing acceptability, the online media and entertainment industry is expanding at a high pace and is primarily driven by digital media.

- Netflix has been one of the prominent over-the-top, or OTT platforms globally. The company's annual revenue accounted for USD 29,697 million, recording a growth of 19% compared to the previous financial year. Furthermore, the company partners with diverse TV makers to offer its application to smart TVs, which is expected to further increase the number of users. As a result, the incident for botnet attacks is projected to increase, which is likely to foster market growth.

North America to Hold a Major Market Share

- North America is expected to be one of the most significant revenue-generating regions for botnet detection management vendors. The US and Canada focus on innovations obtained from Research and Development (R&D) and technologies. The region owes its growth as a significant contributor to the rising investments in botnet detection solutions to safeguard websites, APIs, and mobile apps from bot attacks.

- Further, the region is anticipated to be a markedly productive regional market. The rising menace of the damage that botnets can do across the government in countries of these regions is boosting the demand.

- The US government has regularly taken stringent measures against prevalent and mass-level botnet threats. In April 2022, the United States Department of Justice announced a court-authorized operation conducted in March 2022 to disrupt a two-tiered global botnet of thousands of infected network hardware devices under the control of a threat actor known as Sandworm. The operation copied and removed malware from vulnerable internet-connected firewall devices that Sandworm used for command and control (C2) of the underlying botnet.

- Also, this can be attributed to the growing awareness among the population regarding data privacy which is supposed to promote the demand for botnet detection solutions across North America. Furthermore, increasingly harsh government regulations regarding data privacy are considered to promote the market's future growth significantly.

Botnet Detection Industry Overview

The botnet detection market is moderately competitive and consists of several major players. In terms of market share, few significant players currently dominate, with new players entering the market. The demand for services is directly related to the adoption level of botnet detection solutions among organizations. These companies leverage strategic collaborative initiatives to increase their market share and profitability. The companies operating in the market are also acquiring start-ups working on enterprise network equipment technologies to strengthen their product capabilities.

- July 2022 - Fastly, Inc. announced a reseller partnership with HUMAN Security, Inc. The partnership would offer customers bot protection and fraud and account abuse prevention to keep cybercriminals out of their online applications and services.

- April 2022 - Akamai Technologies, Inc. announced the availability of Audience Hijacking Protector, a new solution designed for online businesses to maximize revenue opportunities and minimize marketing fraud. Akamai also unveiled several new application security features designed to help organizations defend customers from threats across all online environments, including internet browsers, managed alerting for Bot Manager, mobile applications, during API interactions, and at the edge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Number of Connected Devices

- 4.3.2 Increasing Need For Security against Botnet in Organizations

- 4.3.3 Increasing Usage of APIs By Online Businesses

- 4.4 Market Restraints

- 4.4.1 Lack of Education among Users and Low Usage of Tools

- 4.4.2 Use of Conventional BOT Protection Methods, Such as Captcha Or Create Account

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Overview

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 By Deployment Type

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Organization Size

- 5.3.1 SMEs

- 5.3.2 Large Enterprise

- 5.4 By End-user Vertical

- 5.4.1 Retail

- 5.4.2 BFSI

- 5.4.3 Travel & Hospitality

- 5.4.4 IT &Telecom

- 5.4.5 Media & Entertainment

- 5.4.6 Other End-user Verticals (Education, Healthcare, and Real Estate)

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Latin America

- 5.5.4.2 Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Imperva Inc.

- 6.1.2 PerimeterX Inc. (HUMAN Security, Inc.)

- 6.1.3 Akamai Technologies Inc.

- 6.1.4 Cloudflare, Inc.

- 6.1.5 DATADOME Group

- 6.1.6 Reblaze Technologies Ltd

- 6.1.7 Radware Ltd

- 6.1.8 Oracle Corporation

- 6.1.9 Intechnica Ltd (Netacea Ltd.)

- 6.1.10 Barracuda Networks, Inc.