|

市場調查報告書

商品編碼

1433508

雲端監控:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Cloud Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

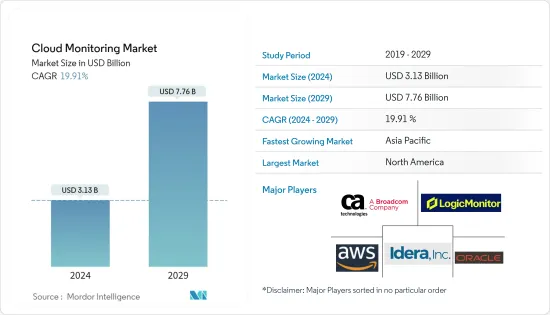

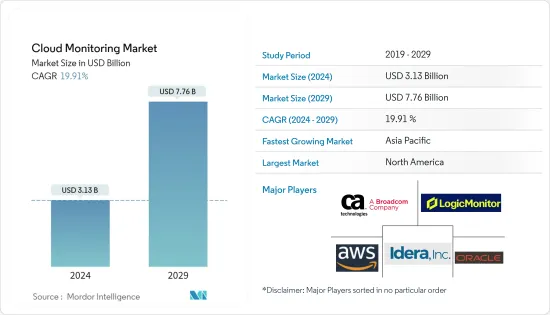

雲端監控市場規模預計 2024 年為 31.3 億美元,預計到 2029 年將達到 77.6 億美元,預測期內(2024-2029 年)複合年成長率為 19.91%

主要亮點

- 雲端監控市場是指提供監控和管理雲端基礎的基礎架構、應用程式和服務的工具、解決方案和服務的產業。雲端監控涉及收集、分析和視覺化與雲端資源的效能、可用性和安全性相關的資料。

- 雲端監控解決方案可協助組織維持雲端環境平穩運作、偵測和解決效能問題、最佳化資源利用率並確保遵守服務等級協定。這些解決方案通常提供即時監控、效能分析、警報、日誌分析、安全監控和容量規劃等功能。

- 最終用戶產業正在採用雲端來實現規模和敏捷性。然而,清楚地了解雲端環境的效能可能很困難。智慧管理複雜且不斷變化的應用程式和基礎架構需要像雲端一樣動態的監控解決方案。

- 此外,銀行、金融服務和保險 (BFSI)、資訊技術 (IT) 和零售等行業擴大採用雲端技術,正在推動雲端監控市場的成長。雲端監控是整體雲端管理策略的關鍵要素,它允許 IT 管理員查看雲端基礎的資源的運作狀態。

- 客戶關係管理、人力資本管理、企業資源管理和其他財務應用程式等軟體即服務 (SaaS) 產品的採用正在不斷成長,特別是在正在實施雲端監控的大型組織中。被創建。

- 在雲端環境中實現全面的可視性可能很困難,特別是那些具有複雜架構、分散式系統以及多重雲端或混合雲端配置的環境。組織可能難以有效監控和管理雲端資源,從而導致營運效率降低、效能問題風險增加以及潛在的停機時間。可見性限制可能是由於不同雲端平台之間缺乏標準化監控介面、監控工具不足以及難以關聯不同來源的資料等因素所造成的。

- 隨著組織迅速過渡到遠距工作環境,COVID-19感染疾病加速了雲端技術的採用。雲端平台對於確保業務連續性和實現遠端協作至關重要。對雲端的日益依賴增加了對雲端監控解決方案的需求,以確保雲端環境的效能、可用性和安全性。即使在疫情大流行之後,由於各種最終用戶對雲端的採用率不斷增加,市場仍繼續快速成長。

雲端監控市場趨勢

最終用戶增加雲端採用預計將推動市場成長

- 提高最終用戶的雲端採用率是雲端監控市場的關鍵驅動力。隨著越來越多的組織將其基礎架構、應用程式和資料遷移到雲端中,雲端環境的有效監控和管理變得至關重要。

- 雲端監控涉及收集、分析和視覺化有關雲端資源和服務的效能、可用性和安全性的資料。這有助於組織確保其雲端基礎架構的最佳運行,識別和解決效能問題,並確保遵守服務等級協定。

- 雲端環境提供了根據需求擴展或縮減資源的能力。然而,這種動態性質使得資源難以監控和管理。雲端監控工具提供資源使用情況的即時可見性,以確保最佳的可擴展性和成本效率。

- 組織擴大將IT基礎設施從本地遷移到雲端環境,例如 Amazon Web Services (AWS)、Microsoft Azure、Oracle、阿里巴巴、IBM Cloud 和 Google Cloud Platform。在此過渡期間,監控解決方案對於追蹤雲端中應用程式和基礎架構組件的效能至關重要。據 Flexera Software 稱,到 2023 年,47% 的受訪者將已經在 Amazon Web Services (AWS) 上運行關鍵工作負載。

- 雲端基礎的應用程式通常具有複雜的架構,其中包含各種元件、微服務和相依性。監控這些分散式環境需要專用的工具來追蹤不同服務的效能並提供對系統互動和依賴關係的洞察。

亞太地區預計將成為成長最快的地區

- 亞太地區 (APAC) 的雲端監控市場正在顯著成長。該地區擴大採用雲端技術、數位轉型計畫以及資料中心的激增,都有助於亞太地區雲端監控市場的擴張。

- 中國、日本、新加坡和澳洲等亞太國家的雲端採用率正在迅速增加。銀行、醫療保健、製造和零售等行業的組織正在將其基礎設施和應用程式遷移到雲端。這種廣泛的採用增加了對雲端監控解決方案的需求,以確保雲端環境的效能、可用性和安全性。

- 亞太地區國家正積極推行數位轉型,以加強業務營運、改善客戶體驗並推動創新。雲端技術在實現數位轉型方面發揮關鍵作用,監控這些雲端環境以確保無縫營運和資源的最佳利用非常重要。

- 根據中國資訊通訊研究院(CAICT)統計,2022年中國雲端運算業務成長56.6%,達到2,091億元人民幣(329億美元)。預計未來三年市場將快速擴張,到2023年將突破4,000億元。

- 由於對雲端服務的需求不斷成長以及企業產生的資料量不斷增加,亞太地區正在對資料中心進行大量投資。雲端監控解決方案對於管理和監控這些資料中心的效能並確保服務的高效運作和高可用性至關重要。

雲端監控產業概況

雲端監控市場適度分散,主要參與者包括 AWS、Broadcom Inc. (CA Technologies)、IDERA Inc.、LogicMonitor Inc. 和 Oracle Corporation。市場參與者正在採取合作夥伴關係、創新和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2023 年 4 月,Amazon Web Services (AWS) 推出了 AWS 雲端營運能力。 AWS 雲端營運涵蓋五個基本解決方案領域:雲端財務管理、雲端管治、雲端監控和可觀察性、雲端合規性和審核以及雲端營運管理。新的能力允許客戶選擇檢驗的AWS 合作夥伴,這些合作夥伴透過跨多個領域的整合方法提供全面的解決方案。

2022 年 6 月,思科發布了 AppDynamics Cloud,這是一個雲端原生可觀測平台,適用於建置在日益複雜的分散式架構和服務上的現代應用程式。它專為簡單性、效用和直覺性而設計,使 IT 團隊能夠創造組織、客戶和最終用戶當今所需的出色數位體驗。目前的 AppDynamics 客戶可以升級到 AppDynamics Cloud 並繼續使用現有的應用程式效能監控 (APM) 代理程式或同時為兩個平台提供服務。 AppDynamics Cloud 支援 AWS 雲端原生託管 Kubernetes配置,並計劃擴展到 Microsoft Azure、Google Cloud Platform 和其他雲端供應商。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 擴大最終用戶對雲端的採用

- 有效管理雲端平台效能和安全性的需求日益成長

- 市場挑戰

- 可見度有限且成本高

第6章市場區隔

- 按型號

- IaaS

- SaaS

- PaaS

- 按最終用戶產業

- BFSI

- 零售

- 資訊科技/通訊

- 衛生保健

- 政府機關

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 新加坡

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- AWS

- Broadcom Inc.(CA Technologies)

- IDERA Inc.

- LogicMonitor Inc.

- Oracle Corporation

- Microsoft Corporation

- IBM Corporation

- Datadog Inc.

- Zenoss Inc.

第8章 市場機會及未來趨勢

第9章投資分析

The Cloud Monitoring Market size is estimated at USD 3.13 billion in 2024, and is expected to reach USD 7.76 billion by 2029, growing at a CAGR of 19.91% during the forecast period (2024-2029).

Key Highlights

- The cloud monitoring market refers to the industry that provides tools, solutions, and services for monitoring and managing cloud-based infrastructure, applications, and services. Cloud monitoring involves collecting, analyzing, and visualizing data related to the performance, availability, and security of cloud resources.

- Cloud monitoring solutions help organizations ensure the smooth functioning of their cloud environments, detect and address performance issues, optimize resource utilization, and ensure compliance with service-level agreements. These solutions typically offer features such as real-time monitoring, performance analytics, alerting, log analysis, security monitoring, and capacity planning.

- End-user industries are incorporating the cloud for scale and agility. However, gaining a clear view of performance in cloud environments can be challenging. To intelligently manage complex, ever-changing applications and infrastructure, a monitoring solution is needed that's as dynamic as the cloud.

- Moreover, the growing adoption of cloud technology across industries such as banking, financial services, and insurance (BFSI), information technology (IT), retail, and other industries is driving the growth of the cloud monitoring market. Cloud monitoring is a crucial component of an overall cloud management strategy, enabling IT administrators to review the operational status of cloud-based resources.

- The growing deployment of software-as-a-service (SaaS) offerings such as customer relationship management, human capital management, enterprise resource management, and other financial applications form a favorable environment for adopting cloud monitoring, especially in large organizations.

- Cloud environments, especially those with complex architectures, distributed systems, and multi-cloud or hybrid cloud setups, can pose difficulties in achieving comprehensive visibility. Organizations may struggle to monitor and manage their cloud resources effectively, resulting in reduced operational efficiency, increased risk of performance issues, and potential downtime. Limited visibility can arise from factors such as the lack of standardized monitoring interfaces across different cloud platforms, inadequate monitoring tools, and difficulties correlating data from disparate sources.

- The COVID-19 pandemic accelerated the adoption of cloud technologies as organizations rapidly transitioned to remote work setups. Cloud platforms became essential for ensuring business continuity and enabling remote collaboration. This increased reliance on the cloud created a greater need for cloud monitoring solutions to ensure cloud environments' performance, availability, and security. Post-pandemic also, the market is growing rapidly with the growth in cloud adoption across various end users.

Cloud Monitoring Market Trends

Growth in Cloud Adoption Across End Users is Expected to Drive the Market Growth

- The growth in cloud adoption across end users has been a significant driver for the cloud monitoring market. Effective monitoring and managing cloud environments become crucial as more organizations migrate their infrastructure, applications, and data to the cloud.

- Cloud monitoring involves collecting, analyzing, and visualizing data regarding the performance, availability, and security of cloud resources and services. It helps organizations ensure the optimal functioning of their cloud infrastructure, identify and address performance issues, and ensure compliance with service-level agreements.

- Cloud environments offer the ability to scale resources up or down based on demand. However, this dynamic nature makes monitoring and managing resources challenging. Cloud monitoring tools provide real-time visibility into resource utilization, ensuring optimal scalability and cost efficiency.

- Organizations are increasingly moving their IT infrastructure from on-premises to cloud environments such as Amazon Web Services (AWS), Microsoft Azure, Oracle, Alibaba, IBM Cloud, Google Cloud Platform, and others. During this migration, monitoring solutions are essential for tracking the performance of applications and infrastructure components in the cloud. According to Flexera Software, in 2023, 47 percent of respondents are already running significant workloads on Amazon Web Services (AWS).

- Cloud-based applications often have complex architectures with various components, microservices, and dependencies. Monitoring these distributed environments requires specialized tools to track performance across different services and provide insights into system interactions and dependencies.

Asia-Pacific Expected to be the Fastest Growing Region

- The Asia-Pacific (APAC) region has been witnessing significant growth in the cloud monitoring market. The increasing adoption of cloud technologies, digital transformation initiatives, and the proliferation of data centers in the region have contributed to the expansion of the cloud monitoring market in APAC.

- APAC countries such as China, Japan, Singapore, and Australia have experienced a surge in cloud adoption. Organizations in various sectors, including banking, healthcare, manufacturing, and retail, are migrating their infrastructure and applications to the cloud. This widespread adoption has increased the demand for cloud monitoring solutions to ensure cloud environments' performance, availability, and security.

- APAC countries actively pursue digital transformation initiatives to enhance business operations, improve customer experiences, and drive innovation. Cloud technologies play a vital role in enabling digital transformation, and monitoring these cloud environments is crucial to ensure seamless operations and optimal utilization of resources.

- According to the China Academy of Information and Communications Technology (CAICT), China's cloud computing business increased by 56.6% in 2022 to CNY 209.1 billion (USD 32.9 billion). The market is expected to expand quickly in the next three years, surpassing CNY 400 billion by 2023.

- APAC has seen significant investments in data centers driven by the growing demand for cloud services and the increasing volume of data generated by businesses. Cloud monitoring solutions are essential for managing and monitoring the performance of these data centers, ensuring efficient operations and high availability of services.

Cloud Monitoring Industry Overview

The cloud monitoring market is moderately fragmented, with the presence of major players like AWS, Broadcom Inc. (CA Technologies), IDERA Inc., LogicMonitor Inc., and Oracle Corporation. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In April 2023, Amazon Web Services (AWS) launched the AWS Cloud Operations Competency. AWS Cloud Operations covers five fundamental solution areas: cloud financial management, cloud governance, cloud monitoring and observability, cloud compliance and auditing, and cloud operations management. Due to the new competence, customers can select verified AWS partners that provide comprehensive solutions with an integrated approach across several domains.

In June 2022, Cisco released AppDynamics Cloud, a cloud-native observability platform for modern applications built on increasingly complex, distributed architectures and services. It is designed for simplicity, usefulness, and intuitiveness, and it enables IT teams to create the excellent digital experiences that organizations, customers, and end users currently demand. Current AppDynamics customers may upgrade to AppDynamics Cloud and continue to use their existing application performance monitoring (APM) agents or feed both platforms concurrently. AppDynamics Cloud supports AWS cloud-native, managed Kubernetes deployments, with a planned extension to Microsoft Azure, Google Cloud Platform, and other cloud providers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Cloud Adoption Across End Users

- 5.1.2 Rising Need for Efficiently Managing the Performance and Security of Cloud Platforms

- 5.2 Market Challenges

- 5.2.1 Limited Visibility and High Costs

6 MARKET SEGMENTATION

- 6.1 By Model

- 6.1.1 IaaS

- 6.1.2 SaaS

- 6.1.3 PaaS

- 6.2 By End-User Industry

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 IT and Telecommunications

- 6.2.4 Healthcare

- 6.2.5 Government

- 6.2.6 Manufacturing

- 6.2.7 Other End-User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Singapore

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AWS

- 7.1.2 Broadcom Inc. (CA Technologies)

- 7.1.3 IDERA Inc.

- 7.1.4 LogicMonitor Inc.

- 7.1.5 Oracle Corporation

- 7.1.6 Microsoft Corporation

- 7.1.7 IBM Corporation

- 7.1.8 Datadog Inc.

- 7.1.9 Zenoss Inc.