|

市場調查報告書

商品編碼

1433015

硬體錢包:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Hardware Wallet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

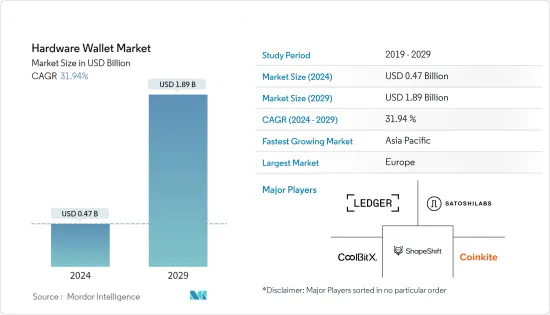

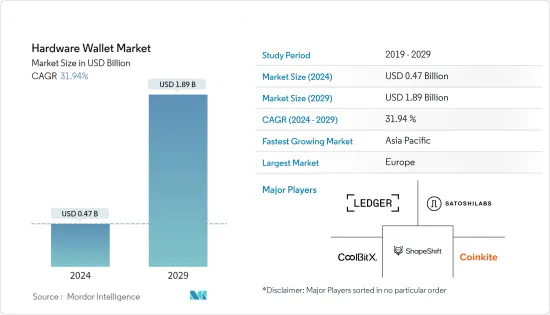

硬體錢包市場規模預計到 2024 年為 4.7 億美元,預計到 2029 年將達到 18.9 億美元,預測期內(2024-2029 年)複合年成長率為 31.94%,預計還會成長。

主要亮點

- 私人加密金鑰可以使用硬體錢包離線儲存在加密裝置上。這些錢包允許交易者安全地觀察他們的私鑰,同時保護他們使用加密貨幣所需的資訊。

- 對硬體錢包的需求正在迅速成長。隨著擁有大量加密貨幣的人數不斷增加,對錢包的需求也不斷增加。與軟體、網路錢包和紙錢包相比,這些解決方案提供的彈性正在影響所研究市場的成長。

- 由於對所研究市場的投資增加,公司正在專注於多貨幣設備和無線技術的創新。例如,2022 年 8 月,著名的數位資產保護硬體製造商 Ledger 打算投資至少 1 億美元來發展公司。去年,該公司在 10T Holdings 領投的 C 輪資金籌措中籌集了 3.8 億美元,估值達到 15 億美元。該公司預計在新一輪資金籌措中籌集的資金將超過其估值。

- 公司逐漸專注於為其產品添加額外的安全層。 2021年3月,金邦達集團聘請IDEX Biometrics作為其在中國數位貨幣計劃的技術合作夥伴。該公司現在計劃在新的基於硬體的數位錢包中部署 IDEX 的指紋感應器,該錢包可能支援該國新的數位貨幣/電子付款(DC/EP) 計劃。 DC/EP 基本上是法定貨幣人民幣的數位版本。

- 此外,預計世界各國政府將推出針對加密貨幣的法規,這將影響硬體錢包的需求,同時也將成為影響各地區加密貨幣使用趨勢的關鍵因素。

- 此外,一些司法管轄區更進一步對加密貨幣投資施加限制,但其程度因司法管轄區而異。一些國家(阿爾及利亞、摩洛哥、尼泊爾、巴基斯坦、玻利維亞、越南)已禁止所有涉及加密貨幣的活動。

- 2022 年 8 月的攻擊從約 8,000 名投資者那裡竊取了價值 800 萬美元的加密貨幣,但許多人認為受普通加密貨幣投資者歡迎的 Solana 網路和熱錢包對其提供的安全性表示懷疑。首席數位顧問提案投資者選擇冷錢包或硬體錢包而不是熱錢包,因為大多數駭客的目標是熱錢包。投資者應該只保留他們立即需要的內容,並將大部分內容保留在離線狀態,即使某些交易需要線上上進行。您的資金存取金鑰儲存在一個 USB 磁碟機大小的冷加密錢包中。投資人可以選擇設定私鑰。

- 硬體錢包市場受到疫情導致的虛擬需求快速成長的正面影響。像比特幣這樣的加密貨幣正在穩步從投機投資工具轉變為付款手段。由於COVID-19大流行,付款非物質化的呼聲越來越高,人們的注意力集中在付款行為和金融生命週期。

硬體錢包市場趨勢

NFC類型佔有較大佔有率

- 儘管加密貨幣有可能成為一種方便、快速和安全的付款方式,但它們在實體店的採用進展緩慢。像比特幣這樣的加密貨幣不需要銀行牌照,可以及時在現實環境中使用。它還可以用來為商家節省成本並保護客戶隱私。

- NFC 技術透過提供儲存手段來實現加密貨幣的靈活使用。更重要的是,它允許您在日常購買中使用加密資產。使用這項技術,您可以將加密貨幣變成一種簡單的支付方式,只需將它們與您的行動應用程式配對即可。

- 根據付款請求的類型,即使收款人或付款人未連接到網際網路,NFC 也允許付款。這種安排對於不想支付高額漫遊費或身處網路訊號不穩定或根本不存在的地方的旅行者來說是有利的。

- 大多數傑出的企業家和公司都對連接熱存儲和冷資料儲存並找到兩全其美感興趣。例如,2022 年 8 月,比特幣企業 Coinkite 發布了最新的硬體錢包 Tapsigner,以簡化比特幣在冷資料儲存儲存中的自我儲存。該新產品已開始向客戶出貨,它將安全組件(硬體錢包中使用的安全晶片)整合到 NFC 卡中。

- 此外,該產品售價 40 美元,旨在作為一種更方便用戶使用的比特幣簽名設備,讓世界各地更多的人進入更安全的比特幣自我託管設定。它看起來更像信用卡而不是傳統的硬體錢包。 Coinkite 的 Tapsigner 旨在透過更方便用戶使用的介面來彌合熱儲存和冷資料儲存世界之間的差距。

- NFC(近場通訊)作為一種在商家終端進行加密貨幣付款的方式越來越受歡迎,目的是加快透過智慧型手機使用電子設備購買產品時的加密貨幣付款週期。到2022年,可以輕鬆購買比特幣的Blockchain.com錢包的用戶數量將超過8,100萬。 2021 年,所有加密貨幣應用程式的用戶數量顯著增加。

亞太地區預計將出現顯著成長

- 隨著亞太地區加密貨幣的使用增加,硬體錢包市場正以最快的速度擴張,印度、日本和韓國等國家也增加了無現金和數位經濟的趨勢。

- 該地區的經濟可能會因中國對數位貨幣交易的限制而受到阻礙。儘管如此,該地區的其他地區也擴大擁抱數位經濟,特別是印度、日本、澳洲和韓國,形成了加密貨幣的重要市場。這些國家也是硬體錢包採用率最高的地區。

- 該地區加密貨幣市場網路攻擊的增加也推動了該地區硬體錢包市場的成長。例如,2021 年 9 月,馬來西亞的一家網頁寄存服務遭到勒索軟體攻擊,索取 90 萬美元的加密貨幣。 2021 年 5 月,一家跨國保險公司位於泰國、馬來西亞、香港和菲律賓的四家子公司遭到勒索軟體攻擊,要求支付 2,000 萬美元。

- 當地硬體錢包市場成長的主要驅動力是全部區域越來越多的新興企業採用區塊鏈技術發展。根據創業投資公司 White Star Capital 2022 年 6 月的研究,東南亞有超過 600 家加密貨幣和區塊鏈營運商。報告稱,加密貨幣、區塊鏈和 Web3 行業的新興企業為近期全部區域創業投資資金籌措的成長做出了重大貢獻。這些新興企業在 2022 年籌集了近 10 億美元的資金,預計將超過 2021 年的 14.5 億美元總合。

- 韓國已成為硬體錢包的主要市場之一,推動了該地區的成長。韓國電信業者SK Telecom 宣布推出一款方便用戶使用的加密錢包,可能會影響普及。截至 2021 年 12 月,已有 3,000 萬人(約佔韓國人口的 58%)與 SK Telecom 簽訂了行動合約。

- 同時,印度正在推出立法,禁止加密貨幣,並對任何被發現在該國持有、出售或擁有加密貨幣的人處以罰款。此舉符合政府一月份的策略,該戰略呼籲為公共虛擬貨幣奠定基礎,同時禁止比特幣等私人加密貨幣。

- 如果該禁令成為法律,印度將成為第一個將擁有加密貨幣視為非法的已開發國家。中國禁止採礦甚至貿易,但持有不構成犯罪。這些障礙可能會阻礙該地區的市場擴張。

硬體錢包市場概況

硬體錢包市場高度整合。市場研究表明,進入門檻較低,一些新參與企業透過以具有競爭力的價格提供功能豐富的產品來引領市場。研究市場的特徵是產品普及不斷上升、產品差異化程度中等/高度、競爭程度較高。

2022 年 2 月,Ledger 和 Coinbase 合作創建了一款帶有 Coinbase 標誌的限量版硬體錢包,作為發布的一部分。 Coinbase Wallet 的瀏覽器擴充功能中增加了對 Ledger 硬體錢包的支持,Coinbase Wallet 是著名加密貨幣交易所 Coinbase 提供的內部錢包服務。用戶可以使用 Chrome Web Store 上提供的非包含 Coinbase 錢包外掛程式來儲存和交換加密貨幣和不可熔代幣。 Ledger 相容性的增加允許 Coinbase 用戶將錢包的離線私鑰儲存在實體 Ledger 裝置上。

2021 年 10 月,CoolBitX 與國際著名加密貨幣平台 Crypto.com 之間的合作曝光。 CoolBitX 是 CoolWallet Pro 的製造商,這是一款針對 DeFi 用戶的藍牙硬體錢包。 CoolWallet 的官方網站整合了 Crypto.com Pay,這是一種強大的支付方式,可以在用戶以現金回饋發送和接收資金時為用戶提供現金回饋和其他好處。它還包括對 CRO 代幣的整合支援。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 增加加密貨幣的投資

- 更加重視安全

- 市場限制因素

- 加密貨幣法規

- 消費者意識有限

第6章市場區隔

- 按類型

- USB

- NFC

- Bluetooth

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Ledger SAS

- Satoshi Labs SRO

- ShapeShift AG

- Coinkite Inc.

- CoolbitX Ltd

- SHIFT Cryptosecurity

- Penta Security Systems Inc.

第8章投資分析

第9章市場的未來

The Hardware Wallet Market size is estimated at USD 0.47 billion in 2024, and is expected to reach USD 1.89 billion by 2029, growing at a CAGR of 31.94% during the forecast period (2024-2029).

Key Highlights

- Private crypto keys can be kept offline on an encrypted device using hardware wallets. These wallets allow traders to safely observe the private keys while safeguarding the information necessary for spending cryptocurrency.

- The demand for hardware wallets is rising rapidly. The need for wallets is growing along with the number of people who own numerous cryptocurrencies. The market's growth under study is being impacted by the flexibility these solutions provide compared to software, web wallets, and paper wallets.

- The companies are concentrating on innovation with devices that handle numerous currencies and wireless technologies due to increased investments in the market under study. For instance, in August 2022, Ledger, a prominent hardware manufacturer for securing digital assets, intends to invest at least USD 100 million to grow its company. After obtaining USD 380 million in the Series C financing round headed by 10T Holdings last year, the company was valued at USD 1.5 billion. The company expects to raise more money with its new fundraising round than that valuation.

- Companies are gradually focusing on adding an extra layer of security to their products. For instance, in March 2021, the Goldpac Group selected IDEX Biometrics as its technology partner for its digital currency project in China. The company now plans to deploy IDEX's fingerprint sensors in a new hardware-based digital wallet that may be compatible with the country's new Digital Currency/Electronic Payment (DC/EP) program. DC/EP is essentially a digital version of the fiat CNY.

- Additionally, governments worldwide are expected to bring in regulations for cryptocurrencies, which is expected to be a major factor influencing the cryptocurrency usage trend across regions while impacting the demand for hardware wallets.

- Furthermore, some jurisdictions have gone further and imposed restrictions on investments in cryptocurrencies, the extent of which varies from one jurisdiction to another. Some countries (Algeria, Morocco, Nepal, Pakistan, Bolivia, and Vietnam) have banned all activities involving cryptocurrencies.

- The attack in August 2022, which saw cryptocurrency holdings worth over USD 8 million stolen from roughly 8,000 investors, has many people wondering about the security provided by the Solana network and hot wallets, which are very popular with the average crypto investor. Chief digital advisors suggest that investors choose cold or hardware wallets instead of hot wallets because most hackers target them. Investors should only maintain what they immediately need and keep most of it offline, even though they may require a part online for transactions. An access key to your money is stored in a cold crypto wallet, around the size of a USB drive. Investors have the option of setting their private keys.

- The market for hardware wallets has been positively impacted by the pandemic's quickly expanding demand for cryptocurrencies. Cryptocurrencies like Bitcoin steadily shift from speculative investment instruments to payments. The COVID-19 epidemic has increased calls for the dematerialization of payments, drawing more attention to payment behaviors and the financial life cycle.

Hardware Wallet Market Trends

NFC Type to Hold Significant Share

- The adoption of cryptocurrencies in real-world stores is progressing slowly, even though it has the potential to be a convenient, fast, and secure way of paying for goods. Cryptocurrencies, such as Bitcoin, can be used in real-world environments in a timely matter without requiring a banking license. They can also be used to save merchants money and to safeguard the privacy of customers.

- NFC technology enables the flexible usage of cryptocurrency by providing means of storage. More importantly, it enables the usage of crypto assets in everyday purchases. By using this technology, cryptocurrency can be turned into a simple way of payment, and it works just by pairing it with a mobile app.

- By utilizing NFC, payment is allowed even if the payee or payer is not connected to the Internet, depending on the type of payment request. This scheme is beneficial for tourists who are not willing to pay high roaming fees or are at places where the Internet reception is unreliable or not present at all.

- Most prominent entrepreneurs and businesses are interested in bridging hot and cold storage to find the best of both worlds. For instance, in August 2022, Coinkite, a bitcoin business, released Tapsigner, its newest hardware wallet, to simplify cold-storage bitcoin self-custody. The new item has already begun delivering to customers and integrates a secure component-the security chip used in hardware wallets-into an NFC card.

- Moreover, the product costs USD 40 and seeks to act as a more user-friendly Bitcoin-signing device to onboard a larger range of people worldwide onto more secure Bitcoin self-custody settings. It resembles a credit card more than previous hardware wallets. With a more user-friendly interface, Coinkite's Tapsigner aims to close the gap between the hot and cold storage worlds.

- NFC (Near Field Communication) has grown in popularity as a means of conducting cryptocurrency payments at merchant terminals for the purpose of accelerating the cryptocurrency payment cycle while purchasing products utilizing electronic devices via smartphones. In 2022, there were more than 81 million users of Blockchain.com wallets, which made it easy to buy Bitcoin. In 2021, the number of users across all cryptocurrency apps significantly increased.

Asia-Pacific Expected to Witness Significant Growth

- The market for hardware wallets is expanding at the quickest rate in Asia-Pacific due to the region's increasing use of cryptocurrencies and the growing trend toward a cashless and digital economy in nations like India, Japan, and South Korea.

- The regional economy may be hampered by China's restriction on the exchange of digital currencies. Still, the rest of the region is increasingly embracing the digital economy, particularly in India, Japan, Australia, and South Korea, creating a significant market for cryptocurrencies. These nations also rank among those in the region where hardware wallet adoption is highest.

- The growing number of cyberattacks in the cryptocurrency market in the region also fuels the growth of the regional hardware wallet market. For instance, a Malaysian web hosting service was the subject of a ransomware assault in September 2021 that demanded USD 900,000 in cryptocurrencies. A ransomware assault in May 2021 targeted four subsidiaries of a multinational insurance business in Thailand, Malaysia, Hong Kong, and the Philippines and demanded USD 20 million in payment.

- A key driver of the growth of the local hardware wallet market is the increasing number of startup firms evolving in blockchain technology across the region. According to a venture capital company White Star Capital survey in June 2022, Southeast Asia is home to more than 600 cryptocurrency or blockchain businesses. According to the report, startups in the crypto, blockchain, and web3 industries have contributed significantly to the recent growth in venture capital funding across the region. These startups have raised almost USD 1 billion in funding in 2022 and were on track to surpass the USD 1.45 billion total in 2021.

- South Korea is emerging as one of the significant markets for a hardware wallet, thereby driving regional growth. Launching a user-friendly crypto wallet by SK Telecom, a South Korean telecommunications company, may impact adoption there. Thirty million South Koreans, or around 58% of the country's population, had mobile subscriptions with SK Telecom as of December 2021.

- While on the other hand, India wants to introduce a law that will outlaw cryptocurrencies and fine anyone found holding, selling, or even possessing them in the nation. The action is consistent with a government strategy from January that called for outlawing private virtual currencies like Bitcoin while establishing a foundation for an official digital currency.

- If the ban became law, India would be the first developed nation to make cryptocurrency possession illegal. Even mining and trading are forbidden in China, yet possession is not a crime. Such obstacles will hamper the market expansion in the area.

Hardware Wallet Market Overview

The hardware wallet market is highly consolidated. As the market study poses low barriers to entry for new players, several new entrants have gained traction in the market by offering products that are rich in features at competitive prices. The market studied is characterized by increasing product penetration levels, moderate/high product differentiation, and high levels of competition.

In February 2022, Ledger and Coinbase partnered to create a limited-edition hardware wallet with the Coinbase logo as part of the launch. Support for Ledger hardware wallets has been added to the browser extension for Coinbase Wallet, an internal wallet service provided by the well-known cryptocurrency exchange Coinbase. Users can store and exchange cryptocurrencies and nonfungible tokens using the noncustodial Coinbase Wallet plugin, which is offered in the Chrome Web Store. With the addition of Ledger compatibility, Coinbase users can store their offline private keys for their wallets on a physical Ledger device.

In October 2021, A collaboration between CoolBitX and Crypto.com, a prominent international cryptocurrency platform, was revealed. CoolBitX is the maker of the Bluetooth hardware wallet CoolWallet Pro for DeFi users. The official website for CoolWallet has integrated Crypto.com Pay, a powerful payment method that gives users cashback and other advantages for sending and receiving money in cryptocurrencies. It also includes integrated support for the CRO token.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in Cryptocurrency

- 5.1.2 Rising Focus on Security

- 5.2 Market Restraints

- 5.2.1 Regulations against Cryptocurrencies

- 5.2.2 Limited Consumer Awareness

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 USB

- 6.1.2 NFC

- 6.1.3 Bluetooth

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the world

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ledger SAS

- 7.1.2 Satoshi Labs SRO

- 7.1.3 ShapeShift AG

- 7.1.4 Coinkite Inc.

- 7.1.5 CoolbitX Ltd

- 7.1.6 SHIFT Cryptosecurity

- 7.1.7 Penta Security Systems Inc.