|

市場調查報告書

商品編碼

1851569

雷達感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Radar Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

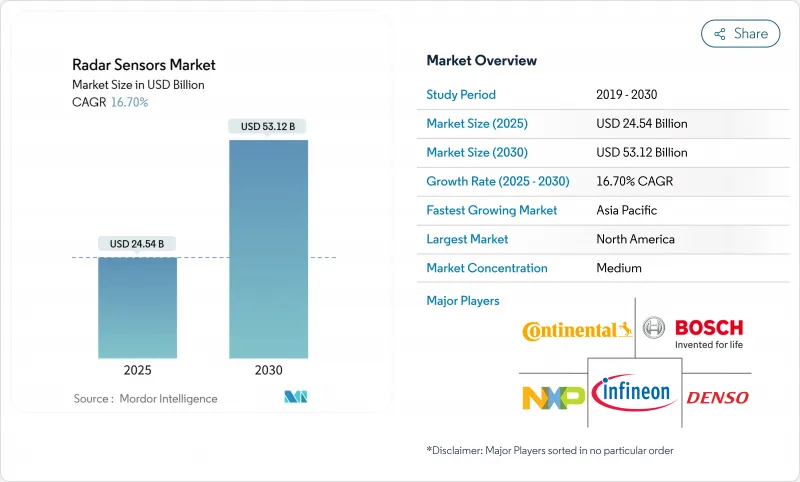

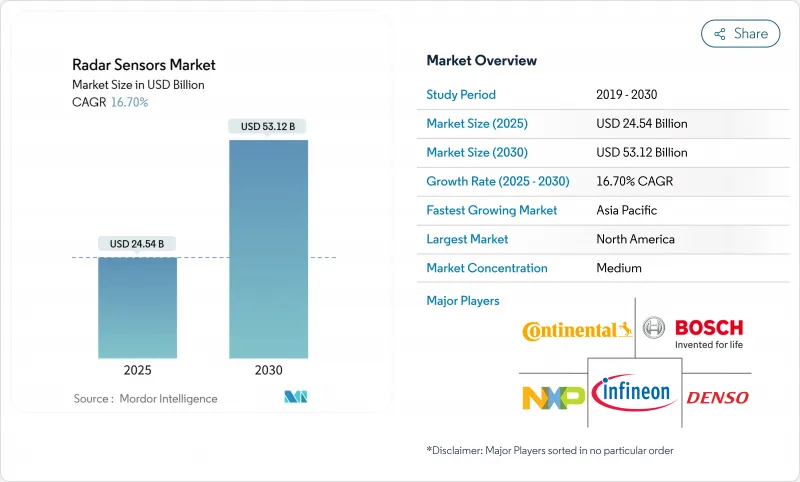

預計到 2025 年雷達感測器市場規模將達到 245.4 億美元,到 2030 年將達到 531.2 億美元,年複合成長率為 16.7%。

該技術的快速發展反映了其應用範圍已從單純的防禦性應用擴展到大規模汽車安全、工業自動化、無人機測繪和智慧基礎設施項目等領域。歐盟《通用安全條例》(General Safety Regulation)等安全法規正在推動該技術的應用,該條例強制要求新車配備使用77-81 GHz雷達的自動緊急煞車系統。供應方面的催化劑包括價格合理的毫米波晶片組和氮化鎵功率元件,這些元件在提高測距解析度的同時,還能降低尺寸、重量和功耗。亞太地區強勁的軍事現代化、歐洲不斷擴展的5G道路計劃以及全球氣候適應型氣象雷達網路的建設,都進一步擴大了潛在需求。近期面臨的挑戰包括10 GHz以下頻段的擁塞、成像陣列的校準成本以及由於中國98%的生產控制而導致的鎵供應風險。

全球雷達感測器市場趨勢與洞察

汽車安全系統中77-81GHz雷達的應用日益廣泛

監管機構和汽車製造商更青睞77-81 GHz頻段,因為與傳統的24 GHz設備相比,該頻段具有更遠的探測距離和更高的角度解析度。大陸集團的ARS640雷達偵測距離超過300米,能夠實現與L2+級自動駕駛相容的目標分類。中國工業和資訊化部於2022年暫停發放新的24 GHz雷達牌照,迫使國內OEM廠商遷移到該頻段。博世也已將該頻寬應用於摩托車,為KTM摩托車配備了210公尺探測距離的雷達,用於自我調整巡航和盲點警告。這些市場發展趨勢推動了感測器在各類車輛中的持續普及,並促進了雷達感測器市場的成長。

基於無人機的地形測繪推動了對小型成像雷達的需求激增。

多旋翼無人機利用輕型合成孔徑雷達產生亞米級高程模型,即使在光學載重失效的情況下,例如植被或雲層遮蔽時,也能正常運作。研究表明,目前72.73%的礦業探勘任務採用多旋翼無人機而非直升機平台,在提高空間精度的同時,降低了60%的測量成本。美國地質調查局的移動雷達站可在野火發生後數分鐘內採集降雨徑流數據,進而助力緊急應變。這些應用案例正在推動對更寬頻寬晶片組和機載處理器的研發投入,並擴大雷達感測器市場。

10 GHz 以下頻寬的頻率分配限制

雷達開發商正與通訊業者和衛星通訊業者爭奪稀缺的10GHz以下頻寬。美國國防部運作超過120部3GHz以下的雷達,限制了民用頻譜的再利用潛力。為了符合全球相關規定,美國聯邦通訊委員會(FCC)近期收緊了24GHz頻寬以外的限制,迫使雷達設計進行變更。認證等待時間有時長達九個月,導致產品發布延遲,並限制了雷達感測器市場近期的普及應用。

細分市場分析

到2024年,非成像設備將佔總收入的71%,這表明它們在泊車輔助和基礎自我調整巡航等領域已廣泛應用。然而,隨著L2+自動駕駛技術的日益普及,影像解決方案預計到2030年將以18.4%的複合年成長率成長。恩智浦半導體(NXP)和sinPro的48通道入門4D單元可實現1度方位角和每幀2000個點雲,展現了高解析度感知技術的普及。影像處理功能使自動煞車能夠區分行人和道路標誌,從而推動OEM廠商在高階車型之外的車型上也應用該技術。預計到2030年,具備影像處理功能的雷達感測器市場規模將達到113億美元,佔據不斷成長的軟體定義車輛預算。另一方面,在對識別精度要求不高的領域,例如送貨機器人、堆高機碰撞預警和降雨量估算,成本最佳化的非成像類別仍將佔據主導地位。製造商將簡單的 FMCW晶粒捆綁到天線封裝設計中,降低了物料清單成本,擴大了雷達感測器市場。

目前,競爭對手的藍圖將嵌入式訊號處理器與邊緣AI加速相結合,以降低延遲。大陸集團的ARS640整合了神經網路濾波功能,可即時識別弱勢道路使用者,進而提升功能安全指標。在材料方面,矽鍺前端對現有的砷化鎵(GaAs)前端構成挑戰,預計在大規模生產中實現低於10美元的晶粒。這項成本優勢支援中階車型逐步升級,並為雷達感測器在Scooter和超小型移動出行領域的市場滲透鋪平道路。

77-81 GHz頻段是路徑損耗和天線孔徑之間的最佳平衡點,預計將佔2024年收入的43%,能夠在保持成本效益的同時實現250米的車載探測。歐洲、中國和北美地區的監管協調降低了認證的複雜性,推動了雷達感測器市場的發展。義法半導體(STMicroelectronics)的77 GHz收發器在冰雪和泥濘路面上仍能保持性能,證明了其在惡劣路況下的適用性。 94 GHz以上的超寬頻通道可實現亞厘米級解析度,在路面裂縫監測和醫療微多普勒成像領域備受青睞。隨著晶圓級氮化鎵(GaN)功率放大器技術的日益成熟,預計到2030年,94 GHz以上頻段的出貨量將成長兩倍以上,複合年成長率(CAGR)將達到21.7%。

10GHz以下的頻譜正面臨飽和,迫使開發商向更高頻段遷移。中國已停止核准24GHz車載雷達,加速其全球版面。德克薩斯(TI)的單晶片雷達無需攝影機即可將兒童存在警報的準確率提升至98%。融合24GHz角部、77GHz前部和60GHz內部的多頻段架構,從多個層面拓展了雷達感測器市場。

區域分析

北美地區在先進駕駛輔助系統部署和重大國防升級的推動下,仍將是2024年最大的區域貢獻者。然而,鎵供應風險威脅著美國6,020億美元的經濟產出,促使政策制定者將氮化鎵外延技術在地化並回收廢棄物。由於認證延遲,美國民用部署也面臨延誤;同時,加拿大正在擴大汽車雷達測試設施,而墨西哥則受益於一級供應商生產線的近岸外包。

由於統一的安全法規和大規模的智慧道路投資,歐洲未來將實現最高的複合年成長率。歐盟的自動緊急煞車(AEB)強制令將確保各類車輛統一安裝感測器,而各國道路管理機構正在部署雷達進行擁塞分析。供應鏈資源配置將有助於緩解半導體短缺問題,而5G走廊將把雷達與車聯網(V2X)信標技術結合。

亞太地區在國防和氣象領域的支出領先。日本的AN/SPY-7飛彈部署和韓國的L-SAM II計劃是推動國內氮化鎵(GaN)晶圓代工產業發展的高預算計畫的代表。在中國,從24GHz汽車雷達轉向77GHz雷達的政策正加速本土OEM廠商的轉型。印度價值5000萬美元的氣象雷達訂單顯示了公共部門對精準氣象的需求。總而言之,這些舉措將把雷達感測器市場從民用移動領域拓展到更廣泛的範圍。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車安全系統中77-81GHz雷達的應用日益廣泛

- 無人機地形測繪對緊湊型成像雷達的需求激增

- 亞太地區軍方加大對主動相控陣雷達(AESA雷達)的投入

- 工業機器人對用於避障的毫米波感測器的需求日益成長

- 在歐洲推廣智慧公路和交通監控雷達基礎設施

- 氣候變遷導致多普勒天氣雷達在沿海地區的普及

- 市場限制

- 10 GHz 以下頻段頻率分配的限制

- 成像雷達陣列的校準和維護成本很高

- 高功率毫米波晶片組的溫度控管挑戰

- 零售業3D人體追蹤雷達的資料隱私問題

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭威脅

第5章 市場規模與成長預測

- 按類型

- 成像雷達

- 非成像雷達

- 按頻段

- 10GHz以下(高頻/超高頻/ L波段)

- 24 GHz ISM頻段

- 60-64 GHz

- 77-81 GHz

- 94GHz 或更高

- 按範圍

- 短程雷達感測器(小於30公尺)

- 中程雷達感測器(30-150公尺)

- 遠距雷達感測器(超過150公尺)

- 透過技術

- 脈衝雷達

- 調頻連續波(FMCW)雷達

- 相位陣列/主動相控陣雷達

- 數位調變與MIMO雷達

- 最終用戶

- 車

- 航太/國防

- 安防監控(固定和移動)

- 工業自動化與機器人

- 環境和氣象監測

- 交通監控和智慧基礎設施

- 醫療保健和生活協助

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(MandA、資金籌措、夥伴關係)

- 市佔率分析

- 公司簡介

- Robert Bosch GmbH

- Continental AG

- Infineon Technologies AG

- NXP Semiconductors NV

- Denso Corporation

- Hella GmbH and Co. KGaA

- Veoneer Inc.

- STMicroelectronics NV

- Texas Instruments Incorporated

- Analog Devices Inc.

- Renesas Electronics Corporation

- Aptiv PLC

- ZF Friedrichshafen AG

- Valeo SA

- Hitachi Astemo Ltd.

- Smart Microwave Sensors GmbH

- InnoSenT GmbH

- Baumer Group

- Banner Engineering Corp.

- Lockheed Martin Corporation

- Raytheon Technologies Corp.

- Northrop Grumman Corp.

- Thales Group

- Honeywell International Inc.

第7章 市場機會與未來展望

The radar sensor market size is at USD 24.54 billion in 2025 and is projected to reach USD 53.12 billion by 2030, expanding at a 16.7% CAGR.

The rapid scaling reflects the technology's migration from exclusive defense use to high-volume automotive safety, industrial automation, drone mapping, and smart infrastructure programs. Adoption is propelled by safety regulations such as the European Union General Safety Regulation, which mandates automatic emergency braking using 77-81 GHz radar in new vehicles. Supply-side catalysts include affordable millimeter-wave chipsets and gallium-nitride power devices that enhance range resolution while lowering size, weight, and power requirements. Robust military modernization in Asia-Pacific, expanding 5G-enabled road projects in Europe, and climate-resilient weather radar networks worldwide deepen addressable demand. Near-term challenges center on below-10 GHz spectrum congestion, calibration expenses for imaging arrays, and gallium supply risks stemming from China's 98% production dominance.

Global Radar Sensors Market Trends and Insights

Increasing adoption of 77-81 GHz radars in automotive safety systems

Regulators and automakers endorse 77-81 GHz because it delivers longer detection ranges and sharper angular resolution than legacy 24 GHz devices. Continental's ARS640 exceeds 300 m range and enables object classification fit for Level 2+ autonomy. China's Ministry of Industry and Information Technology halted new 24 GHz radar approvals in 2022, compelling local OEMs to shift frequency bands. Bosch extended the band to motorcycles, equipping KTM bikes with 210 m range radar for adaptive cruise and blind-spot warning. These developments reinforce steady sensor penetration across vehicle classes, underpinning radar sensor market growth.

Surging demand for compact imaging radars in drone-based terrain mapping

Multirotor drones use lightweight synthetic-aperture radars to generate sub-meter elevation models even in vegetation or cloud cover where optical payloads fail. Research shows 72.73% of mining exploration missions now favor multirotor over helicopter platforms, cutting survey cost by 60% while improving spatial granularity. The U.S. Geological Survey's mobile radar observatory captures rainfall-runoff data minutes after wildfires, supporting emergency response. Such proof points fuel R&D investment in higher-bandwidth chipsets and on-board processing, broadening the radar sensor market.

Spectrum allocation constraints in sub-10 GHz bands

Radar developers compete with telecom and satellite operators for scarce sub-10 GHz slots. The U.S. Department of Defense runs more than 120 radars below 3 GHz, limiting civilian spectrum re-farm potential. The FCC recently tightened 24 GHz out-of-band limits to satisfy global rulings, forcing design changes. Certification queues can stretch nine months, delaying product launches and curbing near-term radar sensor market adoption.

Other drivers and restraints analyzed in the detailed report include:

- Rising military spend on AESA radars in Asia-Pacific

- Growing need for mm-wave sensors in industrial robot collision avoidance

- High calibration & maintenance cost of imaging radar arrays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-imaging devices represented 71% of 2024 revenue, illustrating entrenched use in parking assistance and basic adaptive cruise. Imaging solutions, however, are forecast to post an 18.4% CAGR through 2030 as Level 2+ autonomy proliferates. NXP and sinPro's 48-channel entry-level 4D unit reaches 1-degree azimuth and 2,000 point clouds per frame, signaling democratization of high-resolution perception. Imaging capability lets automated brakes distinguish pedestrians from roadside signs, pushing OEM fitment beyond luxury trims. The radar sensor market size for imaging-enabled modules is projected to reach USD 11.3 billion by 2030, capturing escalating software-defined vehicle budgets. Conversely, the cost-optimized non-imaging category retains dominance in delivery robots, forklift collision alerts, and rainfall estimation where identification finesse is less critical. Manufacturers bundle simple FMCW dies with antenna-in-package designs to lower bill-of-material cost and sustain the wider radar sensor market.

Competitive roadmaps now combine embedded signal processors with edge AI acceleration to shrink latency. Continental's ARS640 integrates neural network filtering to classify vulnerable road users in real time, raising functional safety metrics. On the materials side, silicon germanium front-ends challenge GaAs incumbents, promising sub-USD 10 die price at high volumes. This cost curve supports incremental imaging upgrades in mid-segment cars and paves the way for radar sensor market penetration in scooters and micro-mobility.

The 77-81 GHz tier held 43% 2024 revenue due to a sweet spot between path loss and antenna aperture, enabling 250 m automotive detection while remaining cost-effective. Regulatory harmonization in Europe, China, and North America cut certification complexity and boosted the radar sensor market. STMicroelectronics' 77 GHz transceiver sustains performance in snow or dirt, validating use in harsh roadside units. Above 94 GHz, ultra-wideband channels achieve sub-centimeter resolution prized in pavement crack monitoring and medical micro-Doppler imaging. With a 21.7% CAGR, >=94 GHz shipments are set to more than triple by 2030 as wafer-scale GaN power amplifiers mature.

Spectrum below 10 GHz faces saturation, pushing developers to migrate upward. China no longer approves new 24 GHz automotive radars, accelerating global pivot. Short-range 60 GHz gear excels in cabin sensing, occupancy detection, and gesture control; Texas Instruments' single-chip radar improves child presence alert accuracy to 98% without cameras. Blended multi-band architectures deploy 24 GHz corners, 77 GHz front units, and 60 GHz interiors, expanding the radar sensor market across multiple tiers.

The Radar Sensor Market is Segmented by Type (Imaging Radar, Non-Imaging Radar), Frequency Band (More Than 10 GHz, 24 GHz ISM Band, and More), Range (Short-Range Radar Sensor, Medium-Range Radar Sensor, and More), Technology (Pulsed Radar, Phased-Array / AESA Radar, and More), End-User and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the largest regional contributor in 2024, supported by advanced driver-assistance deployment and sizable defense upgrades. Gallium supply risk, however, threatens USD 602 billion of U.S. economic output, pushing policymakers to localize GaN epitaxy and recycle scrap csis.org. The United States also grapples with certification delays that slow civilian rollouts, while Canada scales automotive radar test facilities and Mexico benefits from near-shoring Tier-1 production lines.

Europe posts the highest forward CAGR due to unified safety laws and expansive smart-road investments. The EU's AEB mandate ensures uniform sensor installation across vehicle classes, while national road agencies deploy radar for congestion analytics. smartmicro UK surpassed 1,000 roadside units, illustrating integrator momentum smartmicro.com. Supply-chain reshoring counters semiconductor scarcity, and 5G corridors embed radar hand-in-hand with V2X beacons.

Asia-Pacific leads defense and weather spending. Japan's AN/SPY-7 roll-out and South Korea's L-SAM II project typify high-budget programs driving domestic GaN foundry growth. China's policy shift away from 24 GHz automotive radar accelerates migration to 77 GHz across local OEM plants. India's USD 50 million weather radar order demonstrates public-sector appetite for precision meteorology. Collectively, these initiatives expand the radar sensor market beyond consumer mobility.

- Robert Bosch GmbH

- Continental AG

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Denso Corporation

- Hella GmbH and Co. KGaA

- Veoneer Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Analog Devices Inc.

- Renesas Electronics Corporation

- Aptiv PLC

- ZF Friedrichshafen AG

- Valeo SA

- Hitachi Astemo Ltd.

- Smart Microwave Sensors GmbH

- InnoSenT GmbH

- Baumer Group

- Banner Engineering Corp.

- Lockheed Martin Corporation

- Raytheon Technologies Corp.

- Northrop Grumman Corp.

- Thales Group

- Honeywell International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of 77-81 GHz Radars in Automotive Safety Systems

- 4.2.2 Surging Demand for Compact Imaging Radars in Drone-based Terrain Mapping

- 4.2.3 Rising Military Spend on Active Electronically Scanned Array (AESA) Radars in Asia-Pacific

- 4.2.4 Growing Need for mm-Wave Sensors in Industrial Robot Collision Avoidance

- 4.2.5 Infrastructure Push for Smart Highways and Traffic-Monitoring Radars in Europe

- 4.2.6 Climate-change-driven Uptake of Doppler Weather Radars in Coastal Regions

- 4.3 Market Restraints

- 4.3.1 Spectrum Allocation Constraints in Sub-10 GHz Bands

- 4.3.2 High Calibration and Maintenance Cost of Imaging Radar Arrays

- 4.3.3 Thermal Management Challenges in High-power mm-Wave Chipsets

- 4.3.4 Data-privacy Concerns Over 3-D People-tracking Radars in Retail

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Threat of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Imaging Radar

- 5.1.2 Non-Imaging Radar

- 5.2 By Frequency Band

- 5.2.1 Less than 10 GHz (HF/UHF/L-Band)

- 5.2.2 24 GHz ISM Band

- 5.2.3 60-64 GHz

- 5.2.4 77-81 GHz

- 5.2.5 94 GHz and Above

- 5.3 By Range

- 5.3.1 Short-range Radar Sensor (less than 30 m)

- 5.3.2 Medium-range Radar Sensor (30-150 m)

- 5.3.3 Long-range Radar Sensor ( greater than 150 m)

- 5.4 By Technology

- 5.4.1 Pulsed Radar

- 5.4.2 Frequency-Modulated Continuous-Wave (FMCW) Radar

- 5.4.3 Phased-Array / AESA Radar

- 5.4.4 Digital Modulation and MIMO Radar

- 5.5 By End-User

- 5.5.1 Automotive

- 5.5.2 Aerospace and Defense

- 5.5.3 Security and Surveillance (Fixed and Mobile)

- 5.5.4 Industrial Automation and Robotics

- 5.5.5 Environment and Weather Monitoring

- 5.5.6 Traffic Monitoring and Smart Infrastructure

- 5.5.7 Healthcare and Assisted-Living

- 5.5.8 Other End-Users

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 Israel

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 United Arab Emirates

- 5.6.4.4 Turkey

- 5.6.4.5 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, Funding, Partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 Infineon Technologies AG

- 6.4.4 NXP Semiconductors N.V.

- 6.4.5 Denso Corporation

- 6.4.6 Hella GmbH and Co. KGaA

- 6.4.7 Veoneer Inc.

- 6.4.8 STMicroelectronics N.V.

- 6.4.9 Texas Instruments Incorporated

- 6.4.10 Analog Devices Inc.

- 6.4.11 Renesas Electronics Corporation

- 6.4.12 Aptiv PLC

- 6.4.13 ZF Friedrichshafen AG

- 6.4.14 Valeo SA

- 6.4.15 Hitachi Astemo Ltd.

- 6.4.16 Smart Microwave Sensors GmbH

- 6.4.17 InnoSenT GmbH

- 6.4.18 Baumer Group

- 6.4.19 Banner Engineering Corp.

- 6.4.20 Lockheed Martin Corporation

- 6.4.21 Raytheon Technologies Corp.

- 6.4.22 Northrop Grumman Corp.

- 6.4.23 Thales Group

- 6.4.24 Honeywell International Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment