|

市場調查報告書

商品編碼

1432786

控制閥:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Control Valve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

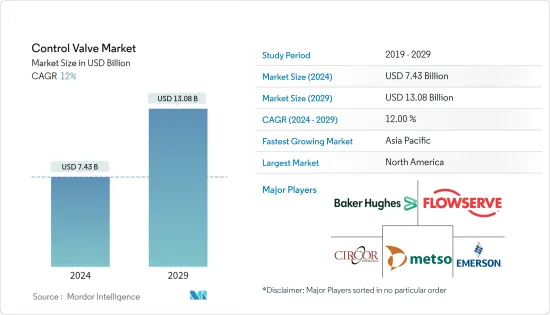

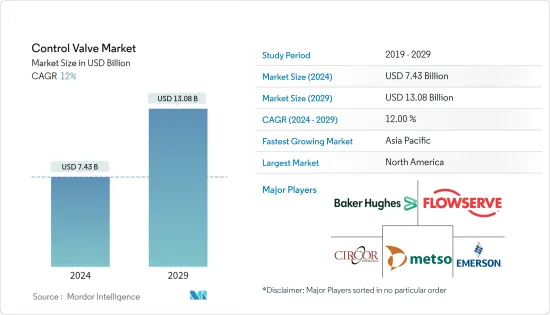

2024年控制閥市場規模估計為 74.3 億美元,預計到 2029 年將達到 130.8 億美元,在預測期間(2024~2029 年)以 12% 的複合年增長率增長。

在預測期內,由於近期管道投資和基礎設施擴建的增加,控制閥的需求預計將增加。

主要亮點

- 技術進步形成了創新的解決方案,可以簡化加工廠的運作並進一步提高效率。隨著行業要求的發展和變化,控制閥和閥門自動化解決方案供應商預計將繼續開發能夠應對這些新課題的產品和流程。

- 控制閥市場的成長是由諸如對無線基礎設施監控各種工廠設備的需求不斷增加、對自動化的日益關注以及製程工業中設施數量不斷增加等因素所推動的。

- 具有嵌入式處理器和網路功能的閥門技術在石油、天然氣和製藥等重要行業中越來越普及。這些技術與先進的監控設備結合使用,並透過中央控制站進行協調。

- 為了響應市場需求,開發了具有高循環率和耐高溫能力的控制閥。此外,對替代能源(尤其可再生能源)投資的日益關注,為控制閥帶來了機會和新的潛在應用。例如,IEA預測全球能源投資的70%將投向可再生能源。

- 此外,隨著製造自動化變得普及,控制閥供應商正在尋求透過併購來加強其市場地位。例如,2021年10月,阿姆斯壯國際完成了蒸氣調節器、工業泵浦、熱水器和控制系統製造商Leslie Controls的收購。萊斯利的各種控制閥和蒸氣熱水器都包含在交易中。

- COVID-19 的爆發在世界各地引發了經濟危機。疫情對油氣產業造成嚴重影響,原油價格大幅下跌。主要石油生產商耗盡了其開採的石油的儲存空間,從而減少了需求。根據美國石油協會 2020 年 4 月月度統計報告,美國石油需求下降近 27%,至 1,420 萬桶/日。

- 這種情況造成了供需之間的巨大差距。石油和天然氣行業是使用控制閥的主要行業之一。新的石油和天然氣探勘計劃、運輸管道計劃和維護活動是全球市場控制閥的主要需求來源。

控制閥市場趨勢

能源來源控制閥推動市場成長

- 關鍵的市場促進因素之一是可再生能源計劃的勢頭。由於太陽能熱電廠數量的迅速增加,控制閥的應用領域正在不斷擴大。然而,全球低效率的物流和供應系統預計將阻礙控制閥市場的發展。

- 感測器和閥門技術的進步使能源來源產業的製造商能夠透過降低設備的整體擁有成本、最大限度地延長運作和降低維護成本來提高製造能力。

- 對可再生能源計劃的日益關注促使太陽能熱電廠數量迅速增加,在一些地區也擴大了控制閥的應用領域。此外,具有高水準能力和廣泛資金籌措選擇的勞動力正在推動對可再生能源計劃的需求。

- 此外,由於區域需求不斷成長,能源公司正在該地區探索石油和天然氣生產機會。例如,2021年11月,海洋能源管理局(BOEM)舉行了墨西哥灣石油和天然氣租賃銷售活動。此次租賃銷售吸引了 308 個街區的超過 1.91 億美元的競標。關於租賃銷售,我們共收到33家公司的317份提案。

- 各行業製造商引入新技術,使得控制閥行業能夠開發出與無菌閥門相結合的新配件,以提供高水準的控制和完整準確的閥門狀態。

北美佔有很大的市場佔有率

- 北美是世界上最重要的控制閥市場之一。美國和加拿大各行業都有龐大的需求,包括石油和天然氣、電力、食品和包裝以及化學品。隨著工業自動化的快速發展,該地區預計將成為控制閥需求的前沿。

- 這些國家的快速工業化和交通運輸業的成長預計將增加對石油和天然氣的需求。為不斷成長的人口提供飲用水的需要還需要安裝海水淡化廠,這反過來又產生了對控制閥的需求。廢棄物和污水管理也是預計推動未來需求的關鍵領域。

- 與加拿大相比,美國在該地區需求成長方面發揮著重要作用。該國幾乎所有最終用戶產業的需求都在成長,特別是石油和天然氣、精製和發電產業。

- 石油和天然氣、可再生能源、水和廢水處理等國內主要產業正轉向採用嵌入式處理器和網路功能的閥門技術,並透過中央控制站協調先進的監控技術。

- 美國石油產量持續快速擴張。例如,美國最大的石油生產商之一埃克森美孚計畫最早在 2024 年擴大在德克薩斯州西部二疊紀盆地的業務,每日產量超過 100 萬桶石油當量 (bpd)。生產活動。與目前的產能相比,這意味著增加了近80%。同樣,雪佛龍預計將增加其淨石油當量產量,到2020年達到每天60萬桶,到2023年達到每天90萬桶。

- 隨著該地區可再生能源計劃的勢頭不斷增強,控制閥的應用領域也不斷擴大,促使太陽能熱電廠數量迅速增加。該地區擁有風能、太陽能、地熱能、水能和生質能資源。豐富的資金籌措機會和高技能的勞動力也是推動可再生能源計劃需求的因素。

控制閥產業概況

控制閥市場競爭適度,由幾個主要參與者組成。隨著控制閥需求的不斷增加,許多新興企業正在擴大其市場佔有率並在新興國家開拓客戶。

- 2022年5月 - Flowserve宣布改進了Valtek FlowTop控制閥的設計,以滿足一般服務和中等要求的服務應用的要求。 新型FlowTop通用閥門建立在久經考驗的FlowTop GS和Valtek GS控制閥的基礎上,通過提供一個標準化的多功能控制閥、高精度控制、多種內件和填料選項以及簡化的維護來滿足廣泛的要求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 產業供應鏈分析

- 市場促進因素

- 新興市場越來越重視電力、水和用水和污水

- 最終用戶關注環境問題和老化基礎設施維修以保持競爭力

- 市場課題

- 最終用戶關注環境問題並維修老化基礎設施以保持競爭力

- 油價的動態變化預計將影響整體計劃支出

- 市場機會

第6章市場區隔

- 依類型

- 手套

- 球

- 蝴蝶

- 插頭

- 隔膜

- 其他閥門

- 依最終用戶

- 油和氣

- 化工、石化、化肥

- 能源/電力

- 水處理/污水處理

- 金屬/礦業

- 其他最終用戶(食品和飲料、藥品、紙漿/造紙製造等)

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章 競爭形勢

- 公司簡介

- Emerson Electric Co.

- Flowserve Corporation

- Baker Hughes Company

- Metso Corporation

- CIRCOR International Inc.

- IMI PLC

- Christian Burkert GmbH & Co. KG

- GEA Group Aktiengesellschaft

- Neway Valve(Suzhou)Co. Ltd

第8章投資分析

第9章 未來趨勢

The Control Valve Market size is estimated at USD 7.43 billion in 2024, and is expected to reach USD 13.08 billion by 2029, growing at a CAGR of 12% during the forecast period (2024-2029).

Over the projection period, it is expected that increasing recent investments in pipeline and infrastructure expansion will boost demand for control valves.

Key Highlights

- Advancements in technology have shaped innovative solutions that can improve process plants to become increasingly efficient by streamlining their operations. As industry requirements evolve and change, control valves and valve automation solutions suppliers are expected to continue developing products and processes that address these new challenges.

- The control valve market growth is driven by factors such as the increasing need for wireless infrastructure to monitor equipment in various plants, augmented focus on automation, and expanding number of process industry establishments.

- Valve technology with embedded processors and networking capabilities is becoming more popular in essential industries like oil and gas and pharmaceuticals. These technologies will function with sophisticated monitoring equipment and will be coordinated through a central control station.

- Control valves with a high number of cycles and the ability to withstand high temperatures have been developed in response to market demand. Furthermore, opportunities and new potential uses for control valves have been made possible by the growing emphasis on investing in alternative energy sources, especially renewable energy. For instance, the IEA predicts that 70% of all global energy investment will go toward renewable energy.

- Besides, because manufacturing automation is proliferating, control valve suppliers are attempting to enhance their market positions through mergers and acquisitions. For instance, in October 2021, Armstrong International finalized the acquisition of Leslie Controls, a producer of steam regulators, industrial pumps, water heaters, and control systems. Various control valves and steam water heaters from Leslie were included in the deal.

- The outbreak of COVID-19 has resulted in an economic crisis across the world. The pandemic has severely affected the oil and gas industry, with oil prices slashing down. Significant oil producers ran out of storage space for extracted oil, and the demand declined. According to the American Petroleum Institute's April 2020 Monthly Statistical Report, the petroleum demand in the United States declined nearly by 27% to 14.2 million barrels per day (b/d).

- This scenario has resulted in a massive gap between supply and demand. The oil and gas sector is one of the key industries using control valves. New oil and gas exploration projects, transportation pipeline projects, and maintenance activities are some of the major sources of demand for control valves in the global market.

Control Valve Market Trends

Control valves in Energy Sources to Drive the Market Growth

- One of the crucial market drivers is the thrust on renewable energy projects. A rapidly growing number of solar thermal energy plants have increased the application areas of control valves. However, inefficient logistics and supply systems worldwide are expected to hinder the control valve market.

- Advancements in sensor and valve technology have enabled manufacturers in the Energy sources industry to up their manufacturing capabilities by reducing the overall cost of equipment ownership, maximizing uptime, and lowering maintenance costs.

- With the increased emphasis on renewable energy projects, which sparked a sharp rise in the number of solar thermal energy plants, several regions have also seen raised application areas for control valves. A workforce is also driving the demand for renewable energy projects with a high level of competence and a force with plenty of financing options.

- Moreover, energy companies are looking for oil and gas production opportunities in the region, owing to the growing regional demand. For instance, in November 2021, the Bureau of Ocean Energy Management (BOEM) held an oil and gas lease sale for the Gulf of Mexico. This lease sale attracted over USD 191 million in bids for 308 blocks. In the lease sale, a total of 33 companies submitted 317 proposals.

- The implementation of new technologies by manufacturers across industries has aided the control valve industry in creating new accessories that, in conjunction with aseptic valves, offer high levels of control and complete and accurate status of a valve.

North America to Hold Significant Market Share

- North America is one of the world's most significant markets t for control valves. In both the United States and Canada, there is immense demand from various industries, including oil and gas, electricity, food and packaging, and chemicals. With rapid industrial automation, the region is expected to spearhead the need for control valves.

- Rapid industrialization and the growing transportation sector in these nations are expected to increase the demand for oil and gas. The need to provide potable water to the ever-increasing population also leads to the setting up of desalination plants, further resulting in the demand for control valves. Waste and wastewater management is also a considerable segment expected to drive future demand.

- The United States plays a critical role in increasing the demand from the region when compared to Canada. The country has an increasing demand from almost all the end-user segments, especially from the oil and gas, refining, and power generation segments.

- Major industries in the country, such as oil and gas, renewable energy, and water and wastewater treatment, are moving toward valve technology with embedded processors and networking capability to work alongside sophisticated monitoring technology coordinated through a central control station.

- Oil production in the United States continues to expand rapidly. For instance, ExxonMobil, one of the leading oil producers in the country, announced its plans to increase the production activity in the Permian Basin of West Texas by producing more than 1 million barrels per day (bpd) of oil equivalent by as early as 2024. This is equivalent to an increase of nearly 80% compared to the present production capacity. Similarly, Chevron is expected to increase its net oil-equivalent production to reach 600,000 bpd by 2020 and 900,000 bpd by 2023.

- The region has also witnessed increased application areas of control valves with the increased thrust on renewable energy projects, which led to the rapid increase in the number of solar thermal energy plants. The region features wind, solar, geothermal, hydro, and biomass resources. Ample financing opportunities and a highly skilled workforce are the other factors driving the demand for renewable energy projects.

Control Valve Industry Overview

The control valve market is moderately competitive and consists of several significant players. With the growing demand for control valves, many new companies are increasing their market presence, tapping customers across emerging economies.

- May 2022 - Flowserve announced that it had improved the design of the Valtek FlowTop control valve to meet the global requirements for general service and moderately severe service applications. The new FlowTop General Service valve builds on the proven FlowTop GS and Valtek GS control valves to meet a broad range of requirements by providing: One standardized, versatile control valve, Precision control, A variety of trim and packing options, and Simplified maintenance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Industry Supply Chain Analysis

- 5.2 Market Drivers

- 5.2.1 Growing emphasis on Power and Water & Wastewater in Emerging Markets

- 5.2.2 Focus of End Users on Environmental Issues and Refurbishment of Aging Infrastructure to Stay Competitive

- 5.3 Market Challenges

- 5.3.1 Focus of End Users on Environmental Issues and Refurbishment of Aging Infrastructure to Stay Competitive

- 5.3.2 Dynamic Change in Oil Prices is Expected to Influence the Overall Spending on the Projects

- 5.4 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Globe

- 6.1.2 Ball

- 6.1.3 Butterfly

- 6.1.4 Plug

- 6.1.5 Diaphragm

- 6.1.6 Other Types of Valves

- 6.2 By End User

- 6.2.1 Oil and Gas

- 6.2.2 Chemical, Petrochemical, and Fertilizer

- 6.2.3 Energy and Power

- 6.2.4 Water and Wastewater Treatment

- 6.2.5 Metal and Mining

- 6.2.6 Other End User (Food and Beverage, Pharmaceutical, Pulp and Paper, etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Flowserve Corporation

- 7.1.3 Baker Hughes Company

- 7.1.4 Metso Corporation

- 7.1.5 CIRCOR International Inc.

- 7.1.6 IMI PLC

- 7.1.7 Christian Burkert GmbH & Co. KG

- 7.1.8 GEA Group Aktiengesellschaft

- 7.1.9 Neway Valve (Suzhou) Co. Ltd