|

市場調查報告書

商品編碼

1432584

蒸發冷卻:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Evaporative Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

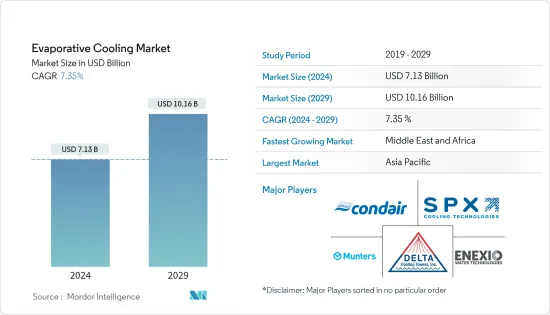

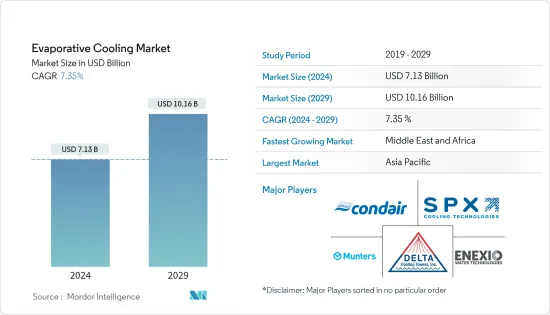

蒸發冷卻市場規模預計到 2024 年為 71.3 億美元,預計到 2029 年將達到 101.6 億美元,在預測期內(2024-2029 年)複合年成長率為 7.35%。

主要亮點

- 氣候變遷使熱浪更加頻繁,使數百萬人面臨暴露在致命高溫下的風險。隨著世界各地的人們感受到氣溫上升的影響,迫切需要在不減少碳排放下滿足冷卻需求。

- 蒸發冷卻器會用比空調系統更少的零件(例如風扇、幫浦和水)來冷卻房間,因此它們可以以一小部分成本和最低的營業成本來冷卻各種空間。這種蒸發冷卻系統的主要優點之一是擁有低成本。

- 此外,世界各國政府也提供儲蓄計畫來推廣節能技術。例如,蒸發冷卻已被證明是一種永續的冷卻技術,因此這些系統有資格獲得荷蘭的能源投資補貼(EIA),可提供超過11%的整體投資淨回報。

- 此外,這些系統使用的零件更少,能源效率更高,使蒸發冷卻成為市場上最實惠的冷卻選項之一。例如,Canstar Blue 估計典型的逆循環分離式系統空調的運作成本約為每小時 0.60 美元。然而,如果在水中添加 0.02 美元,蒸發冷卻系統的成本將低於每小時 0.10 美元。

- 這些蒸發冷卻系統的主要缺點之一是它們高度依賴周圍空氣的品質。蒸發冷卻過程是由周圍空氣的乾球溫度和濕球溫度之間的溫差驅動的,在中等或高濕度的地區可以忽略不計,從而限制了冷卻能力。

- 與此同時,印度供暖、冷凍和空調工程師協會 (ISHRAE) 以及其他全球監管機構敦促在當前的大流行情況下增加新鮮空氣的攝入和通風。這迫使最終用戶考慮安裝蒸發冷卻系統。蒸發冷卻系統有潛力顯著改善室內空氣質量,並在使用更少能源的同時提供更安全的工作空間。

蒸發冷卻市場趨勢

直接蒸發冷卻佔有很大佔有率

- 透過利用將液態水轉化為水蒸氣的汽化潛熱,直接蒸發冷卻可以降低溫度並增加空氣濕度。這是最基本、最傳統的蒸發冷卻類型,應用廣泛。預計這些蒸發式空調在美國南部的利基市場有限,因為 7 月中旬的相對濕度超過 40%。

- 直接蒸發冷卻系統也適用於需要大量熱負荷更換並且願意使用外部空氣來實現這一目的的應用。廣泛應用於舒適度標準寬鬆的建築、倉庫、商務用廚房、住宅。因此,系統要求取決於最終使用者和既定的操作性能標準。大多數建築物的蒸發冷卻系統是自然的,但也有間接類型。

- 在大規模部署直接蒸發冷卻器的推動下,工業領域在所有最終用戶應用中佔據了最大的市場佔有率。直接蒸發冷卻器的工業應用包括建築物、倉庫、工廠、製造單位、發電、石油和天然氣、建築等。

- 此外,工業部門正在實施先進的蒸發冷卻系統,以便在問題發生之前預測維護需求。現代冷卻技術採用物聯網 (IoT) 技術,包括感測器、連接、軟體和其他允許系統與其他連接設備通訊的組件。物聯網解決方案透過收集有關設備健康狀況和空氣品質的資訊來增強預防性保養。

- 因此,許多公司都專注於直接蒸發冷卻 (DEC),這是最節能的資料中心冷卻方法。例如,為了發展其資料中心冷卻部門(包括自然蒸發冷卻),Munters 於 2021 年 4 月將其維吉尼亞員工轉移到新設施。這座佔地 365,000 平方英尺的生產、研發和銷售設施是該公司 3,600 萬美元的投資目標。

亞太地區佔主要市場佔有率

- 預計東南亞地區空調銷售需求強勁,在氣溫上升和收益增加的推動下,到2040年空調銷售量預計將達到3億台,其中印尼預計將供應全球空調台的一半。

- 此外,根據國際能源總署的研究,冷卻設備的銷售主要在中國、美國和日本,其中印度和印尼的銷售量增幅最為顯著。雖然中國過去十年銷售超過5億台,但印度和印尼的空調需求成長相對較快,兩國安裝量年均成長超過15%。 (印度)

- 南亞地區對空調的需求快速成長,需要經濟且簡單的冷卻技術。考慮到這些國家的碳排放目標,蒸發冷卻是最好的解決方案之一。東南亞是亞太地區成長最快的資料中心市場之一。

- 然而,隨著微軟、谷歌和蘋果等世界領先的科技公司製定了碳中和和零永續性目標的標準,隨著尖端節能技術的開發,永續性將成為資料中心提供商之間的關鍵差異化因素在亞洲。

- 資料中心冷卻佔總能源需求的 35% 至 40%,使其成為亞洲永續性的主要障礙。目前,亞洲大多數資料中心都採用風冷,這是一種效率極低且昂貴的解決方案。

- 該地區的公司正在轉向蒸發冷卻技術。例如,蒸發冷卻等冷卻技術使資料中心永續。隨著資料中心越來越需要滿足數位化的需求,這些技術使公司能夠採用間接蒸發式、直接蒸發式、混合系統和液體冷卻來提高電力使用效率(PUE),並整體減少能源使用。

蒸發冷卻產業概述

蒸發冷卻市場競爭適中,由多家大型企業組成。從市場佔有率來看,目前幾家大公司佔據市場主導地位。憑藉主導市場佔有率,這些領先公司正專注於擴大海外基本客群。主要企業包括 Delta Cooling Towers Inc.、Condair Group AG 和 SPX Cooling Technologies 等公司。競爭和快速的技術進步預計將在預測期內對公司的成長構成威脅。

2023年5月,小米有品推出米家智慧蒸發冷風扇,提供顧客清爽舒適的室內環境。該公司推出的智慧電風扇旨在實現通風、降溫、加濕三效合一。配備循環水冷卻系統,可透過添加水或結晶來提供各種冷卻效果。創新的無線水箱專利設計,隨時可將水箱從主機上拆下清洗,衛生便捷。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 評估 COVID-19 對產業的影響

- 蒸發冷卻熱點分析

- 住宅和商業領域部署的替代/替代冷卻技術的比較分析

第5章市場動態

- 市場促進因素

- 對經濟高效的冷卻解決方案的需求

- 市場限制因素

- 對外部氣候的依賴

第6章市場區隔

- 按冷卻方式分

- 直接蒸發冷卻

- 間接蒸發冷卻

- 兩級蒸發冷卻

- 按用途

- 住宅

- 商業用途

- 工業的

- 農場

- 其他用途

- 按分銷管道

- 大型零售店

- 暖通空調承包商和經銷商

- 其他分銷管道

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Delta Cooling Towers Inc.

- Condair Group AG

- SPX Cooling Technologies

- Baltimore Aircoil Company Inc.

- Munters Group AB

- Colt Group Limited

- Phoenix Manufacturing Inc.

- Bonaire

- ENEXIO Water Technologies GmbH

- CFW Evapcool

- Celsius Design Limited

第8章投資分析

第9章 未來趨勢

The Evaporative Cooling Market size is estimated at USD 7.13 billion in 2024, and is expected to reach USD 10.16 billion by 2029, growing at a CAGR of 7.35% during the forecast period (2024-2029).

Key Highlights

- As heat waves happen more frequently owing to climate change, millions of people are in danger of exposure to temperatures that could be fatal. People worldwide have been impacted by rising temperatures, making it imperative to address the need for cooling without having a negative carbon footprint, which has been a significant element driving the industry.

- Because evaporative coolers employ fewer parts than air conditioning systems, such as a fan, pump, and water, to chill the room, they can cool various spaces for a meager cost and with minimal operational costs. These evaporative cooling systems' low ownership costs are one of their main benefits.

- Additionally, various governments worldwide have been offering saving programs to promote energy-efficient technologies. For example, as evaporative cooling has been a proven sustainable cooling technology, these systems have been made eligible for the Energy Investment Deduction (EIA) in the Netherlands, which could result in more than 11% net benefit on the entire investment.

- Furthermore, because these systems use fewer components and are, therefore, more energy efficient, evaporative cooling has been one of the most affordable cooling options on the market. For instance, Canstar Blue estimates that the typical reverse cycle split system air conditioner may run at about USD 0.60 per hour. However, with an additional USD 0.02 for water, an evaporative cooling system may cost less than USD 0.10 per hour.

- These evaporative cooling systems' high reliance on the surrounding air quality has been one of their main disadvantages. Since the evaporative cooling process is driven by the temperature difference between the ambient air's dry and wet bulb temperatures, this difference is negligible for moderate and highly humid regions, which results in a constrained cooling capacity.

- On the other hand, the Indian Society of Heating, Refrigerating and Air Conditioning Engineers (ISHRAE), among other regulating authorities globally, has urged more fresh air intake and ventilation in the current pandemic scenario. Due to this, end users are now compelled to consider integrating evaporative cooling systems, which might significantly improve indoor air quality and offer secure workspaces with less energy use.

Evaporative Cooling Market Trends

Direct Evaporative Cooling to Hold a Major Share

- By utilizing the latent heat of evaporation, which transforms liquid water into water vapor, direct evaporative cooling reduces the temperature and raises air humidity. It is the most basic, traditional, and widely utilized form of evaporative cooling. These evaporative coolants are anticipated to have a limited niche market in the United States, mainly in the south, where the relative humidity at noon in July is above 40%.

- The direct evaporative cooling systems are also appropriate for applications that require significant heat-load replacement and are willing to use outside air to do it. Their applications are widely used in buildings, warehouses, commercial kitchens, and residential settings with laxer comfort standards. The system requirements, therefore, depend on the end users and the established operational performance criteria. Most buildings' evaporative coolers are natural systems, while some indirect ones are also employed.

- The industrial sector accounts for the largest market share among all end-user applications, driven by the large-scale deployment of direct evaporative coolers. The industrial applications for direct evaporative coolers include Buildings, warehouses, factories, manufacturing units, power generation, oil and gas, construction, and many more.

- Additionally, the industrial sectors implement advanced evaporative cooling systems to foresee the need for maintenance before a problem arises. The most recent cooling technologies, which employ Internet of Things (IoT) techniques, contain sensors, connections, software, and other components that let the system communicate with other connected devices. IoT solutions enhance preventative maintenance by collecting information on equipment status and air quality.

- As a result, many businesses concentrate on direct evaporative cooling (DEC), frequently the most energy-efficient method of cooling a data center. To grow its data center cooling sector, which includes natural evaporative cooling, Munters, for instance, shifted its Virginia staff to the new facility in April 2021. A 365,000-square-foot facility for manufacturing, R&D, and sales was the company's USD 36 million investment target.

The Asia-Pacific Region to Hold Significant Market Share

- The Southeast Asian region is anticipated to experience a significant demand for AC sales, driven by rising temperatures and rising earnings, expected to reach 300 million units by 2040; it is anticipated that Indonesia will supply half of the world's air conditioning units.

- In addition, research from the International Energy Agency states that cooling equipment sales are dominated by China, the United States, and Japan, with India and Indonesia experiencing the most significant rise. Although China sold over 500 million units in the past ten years, India and Indonesia had a relative increase in demand for air conditioning that was more rapid, with average yearly installations expanding at a pace of over 15% in both countries. (India)

- South Asia is experiencing exponential growth in the demand for air conditioning, driving the need for economic and simple cooling techniques. When considering these nations' targets for reducing carbon emissions, evaporative cooling is one of the finest solutions. Southeast Asia boasts among the Asia-Pacific region's fastest-growing data center marketplaces, although the sustainability of these facilities is still a problem for the area.

- Nevertheless, it is anticipated that in the upcoming years, sustainability will become a key differentiator in Asia between data center providers, particularly as leading tech companies around the world, like Microsoft, Google, and Apple, set standards with carbon neutral and zero sustainability goals and as cutting-edge energy-efficient technology is developed.

- Since data center cooling accounts for between 35% and 40% of overall energy demand, it represents a significant hurdle to sustainability in Asia. Most data centers in the area currently employ air-based cooling, a very ineffective and expensive solution.

- Companies in the area are switching more and more to evaporative cooling techniques. For instance, data centers can be sustainable thanks to cooling technology like evaporative cooling. As data centers become more prominent to accommodate the demands of digitalization, these technologies enable businesses to employ indirect evaporative, direct evaporative, hybrid systems, and liquid cooling to reduce Power Usage Effectiveness (PUE) and overall energy usage.

Evaporative Cooling Industry Overview

The Evaporative Cooling Market is moderately competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. With a prominent share in the market, these major players are focusing on expanding their customer base across foreign countries. The major players include companies like Delta Cooling Towers Inc., Condair Group AG, SPX Cooling Technologies, etc. The competition and rapid technological advancements are expected to pose a threat to the growth of the companies during the forecast period.

In May 2023, Xiaomi Youpin launched the MIJIA Smart Evaporative Cooling Fan, which provides its customers with a refreshing and comfortable indoor environment. The smart fan launched by the company has been designed to provide three effects in one - blowing, cooling, and humidifying. It would be equipped with a circulating water cooling system, which allows the addition of water and ice crystals to bring different cooling effects. The innovative wireless water tank patent design allows the tank to be removed from the body for cleaning at any time, ensuring hygiene and convenience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes Products

- 4.4 An Assessment of the Impact of COVID-19 on the industry

- 4.5 Analysis of the Evaporative Cooling Hotspot

- 4.6 Comparative Analysis of Alternative/Substitute Cooling Technologies Deployed in the Residential and Commercial Sectors

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Cost-effective Cooling Solution

- 5.2 Market Restraints

- 5.2.1 Dependency on External Climate

6 MARKET SEGMENTATION

- 6.1 By Type of Cooling

- 6.1.1 Direct Evaporative Cooling

- 6.1.2 Indirect Evaporative Cooling

- 6.1.3 Two-stage Evaporative Cooling

- 6.2 By Application

- 6.2.1 Residential Applications

- 6.2.2 Commercial Applications

- 6.2.3 Industrial Applications

- 6.2.4 Confinement Farming

- 6.2.5 Other Applications

- 6.3 By Distribution Channel

- 6.3.1 Big-box Retailers

- 6.3.2 HVAC Contractors and Distributors

- 6.3.3 Other Distribution Channels

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Delta Cooling Towers Inc.

- 7.1.2 Condair Group AG

- 7.1.3 SPX Cooling Technologies

- 7.1.4 Baltimore Aircoil Company Inc.

- 7.1.5 Munters Group AB

- 7.1.6 Colt Group Limited

- 7.1.7 Phoenix Manufacturing Inc.

- 7.1.8 Bonaire

- 7.1.9 ENEXIO Water Technologies GmbH

- 7.1.10 CFW Evapcool

- 7.1.11 Celsius Design Limited