|

市場調查報告書

商品編碼

1432361

分散式太陽能發電:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Distributed Solar Power Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

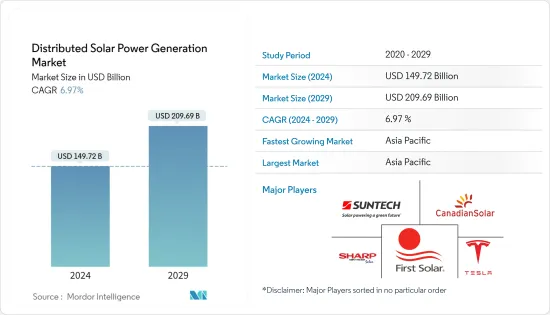

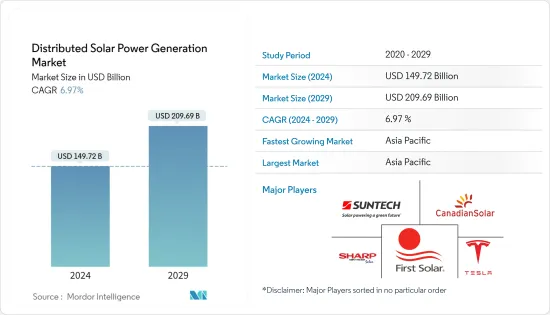

分散式太陽能發電市場規模預計2024年為1,497.2億美元,預計2029年將達2,096.9億美元,預測期內(2024-2029年)複合年成長率為6.97%,預計還會成長。

2020 年市場受到 COVID-19 的負面影響。目前市場處於大流行前的水平。

主要亮點

從中期來看,人們對環境問題的認知不斷提高,政府對太陽能電池板安裝的激勵和稅收優惠政策以及電網擴建的高成本也預計將推動所研究市場的成長。

另一方面,分散式太陽能作為主要電源的功能喪失可能會對市場成長產生負面影響,是市場的主要限制因素之一。

然而,鈣鈦礦太陽能電池等技術進步易於製造、表現出高效率和優異的半導體行為,預計在預測期內提供成長機會。

亞太地區在市場上佔據主導地位,並且在預測期內也可能實現最高的複合年成長率。這種成長的主要原因是,由於人們對環境問題的日益關注,來自中國和印度等國家的需求佔了大部分需求。

分散式太陽能發電市場趨勢

太陽能發電系統價格和安裝成本的下降預計將推動市場

過去十年,全球太陽能發電面板的平均成本下降了近90%。自 2011 年以來,其他組件價格也大幅下降,降低了分散式和公用事業規模太陽能光電的電費(LCOE)。

由於技術經濟和地緣政治因素的綜合作用,預計太陽能發電面板的價格將小幅下降。儘管如此,太陽能發電面板的價格預計在預測期內將繼續下降。

根據美國可再生能源實驗室(NREL)的數據,自2010年以來,美國住宅、商業屋頂和公共規模太陽能光電系統的成本分別下降了64%、69%和82%。這主要是由於歐洲和美國太陽能板價格下降。這種情況將對市場產生積極影響並推動這些地區的太陽能板需求

由於價格下降,許多住宅和商業消費者選擇屋頂太陽能發電系統,以降低能源成本和投資回收時間。而且,到2020年為止,光電模組的價格已經下降了90%左右。然而,這一切在 2021 年發生了變化,價格十年來首次大幅上漲 18%。

根據美國國家可再生能源實驗室(NREL)的數據,2022年第二季單晶C-Si太陽能模組的平均售價為0.25美元/W,低於2022年第一季的0.26美元/W。組件價格的下降正在增加分散式太陽能發電的需求。

這些高度模組化技術的工業化正在從規模經濟、改進的製造流程以及競爭性供應鏈的競爭加劇中產生顯著的效益。太陽能發電系統成本的整體下降也得益於德國等國家實施有效的上網電價補貼。

近年來,太陽能發電成本的下降和電池成本的下降一直是分散式太陽能市場的主要推動力。預計這一趨勢將在預測期內持續下去。鋰離子電池價格下降超過86%,從2010年的1000美元/kWh降至2021年的132美元/kWh。因此,在預測期內,提高電池和光伏組件的成本效益可能有利於分散式太陽能市場。

亞太地區預計將主導市場

亞太地區將在 2022 年主導分散式太陽能市場,並預計未來將保持其主導地位。該地區具有擴大分散式能源系統(DES)的巨大潛力,特別是離網太陽能和住宅太陽能發電。電網基礎設施效率低下、電力供不應求以及分散技術的可擴展擴充性正在為該地區(尤其是中國和印度)的擴張鋪平道路。

在中國,由於經濟成長和都市化,電力需求不斷增加。自2015年以來,該國電力需求每年成長7%。 2022年電力需求將成長3.6%,達到8637TWh。

根據國際可再生能源機構的數據,2022年中國總設備容量約為3,924.4GW,較2021年成長28%。根據中國國家能源局統計,2023年1月至2月新增太陽能發電裝置2,023千萬瓦,使中國太陽能發電裝置容量超過413萬千瓦。中國長期以來致力於增加分散式太陽能發電,鼓勵住宅和商業終端用戶安裝屋頂太陽能板。

新加坡的太陽能發電能力在過去幾年中有所增加。根據國際可再生能源機構預測,2022年新加坡太陽能發電裝置容量將達572MW,較2021年成長15%。此外,該國的目標是到 2030 年太陽能發電量至少達到 2 GWp。

印度也是亞太地區分散式太陽能發電有重大進展的國家之一。印度太陽能發電累積設備容量已達約62.8吉瓦,2022年將新增約13吉瓦。

新能源和可再生能源部正在實施屋頂太陽能計畫二期,加速屋頂太陽能發電系統的推廣。該計劃將為住宅領域提供高達 4GW 的太陽能屋頂容量。與上年度相比,還有一些條款為績效提升提供獎勵。綜上所述,亞太地區預計將在預測期內主導分散式太陽能發電市場。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年之前的市場規模與需求預測

- 最新趨勢和發展

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東/非洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Suntech Power Holdings Co. Ltd

- First Solar Inc.

- Activ solar Schweiz Gmbh

- Yingli Energy Developent Co., Ltd.

- Trina Solar Limited

- Sharp Solar Energy Solutions Group

- Canadian Solar Inc.

- Tesla Inc.

- JinkoSolar Holding Co. Ltd.

第7章 市場機會及未來趨勢

The Distributed Solar Power Generation Market size is estimated at USD 149.72 billion in 2024, and is expected to reach USD 209.69 billion by 2029, growing at a CAGR of 6.97% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, rising environmental concerns and government policies for incentives and tax benefits for solar panel installation, high cost of grid expansion are also expected to drive the growth of the market studied.

- On the other hand in ability of distributed solarto serve as aprime power source may negatively impact the market's growth and is one of the major restraints for the market.

- Nevertheless, Technological advancements such as perovskite-based PV cells which offers high ease of manufacture, high efficiency, and excellent semiconductor behaviour, are expected to provide growth opportunities in the forecast period.

- The Asia-Pacific region dominates the market and is also likely to witness the highest CAGR during the forecast period. The growth is mainly driven by the majority of the demand coming from the countries such as the China and India, over rising environmental concerns.

Distributed Solar Power Generation Market Trends

Declining Price of Solar PV Systems and Installations Cost Expected to Drive the Market

- Since the last decade, the average cost of a solar PV panel has dropped by nearly 90% worldwide. Prices of other components have also fallen significantly since 2011, reducing the levelized cost of electricity (LCOE) for distributed and utility-scale solar PV generation.

- Due to a combination of techno-economic and geopolitical factors, it is estimated that the cost of solar PV panels prices will reduce slightly. Still, solar PV panel prices will continue to decline during the forecast period.

- According to the United States National Renewable Energy Laboratory (NREL), since 2010, there has been a 64%, 69%, and 82% reduction in the cost of residential, commercial-rooftop, and utility-scale PV systems in the United States, respectively. The decline in the prices of solar panels in Europe and the United States is primarily due to the drop in solar panel prices. This scenario will positively impact the market and drive the demand for solar panels in these regions.

- Due to the price decline, many residential and commercial consumers opted for rooftop solar PV systems to reduce energy costs and recovery time. Further, till 2020, the prices of solar PV modules declined by approximately 90%. However, this changed in 2021, when for the first time in the last decade, the prices went significantly up by 18%.

- According to National Renewable Energy Laboratory (NREL), the average selling price of the Mono C-Si solar PV module was 0.25 USD/watt in Q2 2022, lower than 0.26 USD/watt in Q1 2022. The declining module price has increased the demand for distributed solar power generation.

- The industrialization of these highly modular technologies has yielded impressive benefits from economies of scale and greater competition to improved manufacturing processes and competitive supply chains. The overall decline in solar PV system costs can also be attributed to the effective feed-in tariff programs in countries like Germany.

- The decline in the cost of solar PV and the declining cost of batteries have been significant drivers of the distributed solar energy market in recent years. This trend is expected to continue during the forecast period.

- Prices of lithium-ion batteries have declined by over 86%, from 1,000 USD/kWh in 2010 to 132 USD/kWh in 2021.

- Thus, the improved cost-effectiveness of batteries and solar PV modules will benefit the distributed solar energy market during the forecast period.

Asia Pacific Expected to Dominate the Market

- Asia-Pacific dominated the distributed solar power generation market in 2022 and is expected to continue its dominance in the coming years. The region holds vast potential for expanding distributed energy systems (DES), notably off-grid and residential solar. Inefficiencies in the power grid infrastructure, power supply shortages, and the scalability of decentralized technology pave the way for the deployment in the region, particularly in China and India.

- The electricity demand in China has been increasing due to economic growth and urbanization. Since 2015, the country's power demand has risen by 7% per year. The power demand rose by 3.6% in 2022, reaching 8,637 TWh.

- According to International Renewable Energy Agency, China had a total installed solar PV capacity of about 3924.4 GW in 2022, witnessing an increase of 28% compared to 2021. According to China's National Energy Administration (NEA), China's 20.37 GW new solar PV capacity to have been installed in January 2023 and February 2023, taking the country's total solar fleet to exceed 413 GW, out of which the majority came from distributed solar power generation projects, and the remaining share came from large-scale solar plants accounting for the remaining share.

- China has been focusing on increasing distributed solar power generation by encouraging residential and commercial end-users to install rooftop solar panels for quite some time.

- The solar power capacity in Singapore has risen over the past several years. According to the International Renewable Energy Agency, Singapore's total installed solar PV capacity reached 572 MW in 2022, recording a 15% growth compared to 2021. Furthermore, the country aims to generate at least 2 GWp of solar energy by 2030.

- India is another country in Asia-Pacific where distributed solar power generation has a noticeable development. India's cumulative installed solar power capacity reached about 62.8 GW in 2022, adding around 13 GW in 2022.

- The Ministry of New and Renewable Energy is implementing the Rooftop Solar Programme Phase-II for the country's accelerated deployment of solar rooftop systems. The scheme provides financial assistance of up to 4 GW of solar rooftop capacity to the residential sector. There is a provision to incentivize the companies for incremental achievement over the previous year.

- Therefore, owing to the above points, Asia-Pacific is expected to dominate the distributed solar power generation market during the forecast period.

Distributed Solar Power Generation Industry Overview

The distributed solar power generation market is fragmented. Some of the major players in the market (in no particular order) include Suntech Power Holdings Co. Ltd, First Solar Inc., Tesla Inc., and Canadian Solar Inc., Sharp Energy Solutions Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 North America

- 5.1.2 Europe

- 5.1.3 Asia-Pacific

- 5.1.4 South America

- 5.1.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Suntech Power Holdings Co. Ltd

- 6.3.2 First Solar Inc.

- 6.3.3 Activ solar Schweiz Gmbh

- 6.3.4 Yingli Energy Developent Co., Ltd.

- 6.3.5 Trina Solar Limited

- 6.3.6 Sharp Solar Energy Solutions Group

- 6.3.7 Canadian Solar Inc.

- 6.3.8 Tesla Inc.

- 6.3.9 JinkoSolar Holding Co. Ltd.