|

市場調查報告書

商品編碼

1432334

下一代儲存:市場佔有率分析、行業趨勢/統計、成長預測(2024-2029)Next-generation Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

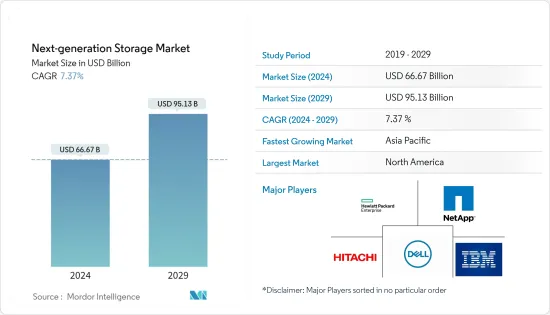

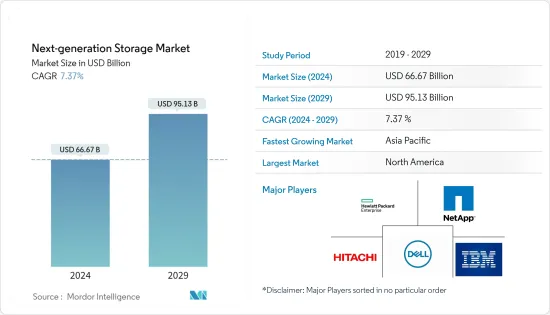

下一代儲存市場規模預計到 2024 年為 666.7 億美元,預計到 2029 年將達到 951.3 億美元,在預測期內(2024-2029 年)複合年成長率為 7.37%。

數位世界的快速發展正在加速行動服務、巨量資料、雲端運算和社交網路應用的發展。下一代儲存技術涵蓋先進的產品和解決方案組合,可協助各種最終用戶產業儲存資料,包括 IT 公司、汽車公司和資料中心。隨著檔案大小、大量非結構化資料和大資料的不斷增加,IT 公司在管理資料方面面臨許多課題。

傳統的資料儲存技術無法處理我們每天遇到的大量資料。新一代資料儲存基礎設施提供可靠、快速且經濟高效的解決方案,以滿足不斷成長的資料儲存需求。

此外,下一代儲存技術市場正在進入資訊技術領域,並具有廣泛的應用,例如巨量資料儲存、企業資料儲存和其他雲端基礎的服務。儲存以及如何處理它會對您的收入和利潤產生巨大影響。 IT 組織預計將更積極地從投資安全儲存轉向投資有利於業務的新技術。

2023 年 4 月, 資料宣布慧與 (HPE) 已將資料領先的檔案軟體平台涵蓋新的 HPE GreenLake 檔案儲存服務中。利用新的 HPE GreenLake for File Storage 上的 Bast 資料獨特的創新橫向擴展軟體架構,企業客戶可以大規模管理非結構化資料,並獲得更快的資料洞察。

然而,雲端基礎的儲存存在許多安全性問題,包括配置錯誤、資料管治不善和存取控制不足。此類雲端儲存安全問題可能會將企業資料暴露給未經授權的第三方,限制了市場成長。

COVID-19大流行對下一代儲存市場產生了積極影響,尤其是雲端儲存中使用的解決方案。儲存供應商免費提供一些硬體和軟體技術,以幫助研究人員、企業、在家工作的用戶和合作夥伴在 COVID-19 冠狀病毒大流行期間經營業務和遠端工作。

下一代儲存市場趨勢

直連儲存 (DAS) 顯著成長

直連儲存(DAS)是最古老、最正統的資料儲存系統,它直接連接到電腦(例如 PC 或伺服器),與其他透過網路連接到電腦的儲存系統不同。

與其他儲存系統相比,DAS 具有一定的優勢,例如高效能、易於設定和配置、快速存取資料以及與其他儲存系統相比成本較低,這些優勢在許多組織的儲存策略中發揮著重要作用。

DAS 可以為使用者提供比網路儲存更好的效能,因為伺服器不必遍歷網路來讀寫資料。因此,許多組織依賴 DAS 來實現需要高效能的應用程式。 DAS 也不像基於網路的儲存系統那麼複雜,因此更容易部署、更容易維護且成本更低。

此外,虛擬技術的進步為 DAS 注入了新的活力,尤其是市場上的超融合基礎架構 (HCI) 系統。 HCI系統由多台伺服器和DAS儲存節點組成,儲存空間集中到邏輯資源池中,提供比傳統DAS更靈活的儲存解決方案。

由於 SAS 和 SATA 等高速電腦匯流排介面的優點,以及資料與系統 RAM 和處理器的接近性,DAS 通常為直接連接的電腦系統提供更高的儲存效能。

2022年5月,鐵威馬為需要集中位置儲存大量資料的客戶發布了新的8盤位DAS(直連儲存)設備。與 NAS 不同,DAS 透過直接連接到 PC 或其他裝置的電纜在本地使用。新款TerraMaster D8-332是容量高達160TB的商務用RAID儲存。

DAS 的常見用途是資料中心。 DAS 用於網頁寄存等應用程式,客戶希望將專用儲存裝置連接到專用伺服器。 DAS 也常用於資料使用中心,作為啟動作業系統和虛擬機器管理程式的儲存。

北美佔最大市場佔有率

由於全球供應商和消費者的區域集中度不斷提高,北美下一代儲存市場預計將呈現高成長率。

美國是全球資料中心的最大市場之一。此外,2022 年 4 月,Google宣布計劃投資 95 億美元建造全國資料中心和辦公室。這家巨頭公司計劃在美國建造和擴建 14 個資料中心,包括喬治亞、德克薩斯州、紐約州和加利福尼亞州。對資料中心的投資增加也為市場創造了巨大的成長機會。

此外,資料密集型物聯網 (IoT) 設備構成了下一代儲存的另一個新興市場。這些應用主要是廣泛的。 Factory 4.0 形式的工業自動化就是其中之一。但物聯網包括穿戴式裝置、醫療保健、航空以及一切以智慧為起點的領域,包括智慧家庭、智慧農場、智慧電錶、智慧物流等等。

根據史丹佛大學和 Avast 的研究,北美家庭擁有世界上物聯網設備密度最高的地區。值得注意的是,該地區 66% 的家庭擁有至少一台物聯網設備。此外,25% 的北美家庭擁有三台或更多設備。

此外,不斷增加的網路流量和用戶生成的資料也促進了市場的成長,其中北美的 IP 流量最高。據 CISCO 稱,到 2022 年,該地區的 IP 流量將達到每月 108.4 EB。

根據愛立信的報告,到 2028 年,北美每部智慧型手機的平均每月行動資料使用量預計將達到 55GB。改進的 5G 網路和無限資料方案可能會吸引該地區更多的 5G用戶。基於影片的應用程式、虛擬實境/擴增實境和遊戲會產生大量資料流量。該公司預計,到 2028 年,北美將擁有全球 90% 以上的 5G 用戶,是所有地區中最高的。

下一代儲存產業概述

下一代儲存市場競爭適度,由幾個主要企業組成。從市場佔有率來看,目前該市場由幾家主要企業佔據。然而,隨著記憶體封裝技術的創新,許多公司正在增加其在新興國家開拓的新市場的佔有率。

2023 年 5 月,NetApp 宣布推出最先進的新區塊儲存產品和保證,突顯 NetApp 從勒索軟體攻擊中恢復的一流能力。透過此次發布,NetApp 旨在解決關鍵的客戶課題,包括有限的 IT 預算、不斷增加的 IT 複雜性、永續性的緊迫性以及網路威脅的持續擴散。

2023年4月,Pure Storage宣布推出新一代區塊檔案統一儲存服務。這種新的儲存服務提供從單一全域資源池存取本機區塊和檔案服務。統一的儲存架構支援區塊儲存和檔案儲存格式,允許企業以多種方式儲存和查看資料。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 評估 COVID-19 對產業的影響

- 技術簡介

- 磁性儲存

- 固態儲存

- 軟體定義儲存 (SDS)

- 雲端儲存

- 統一儲存

- 其他儲存技術

第5章市場動態

- 市場促進因素

- 數位資料量的增加

- 固態設備的採用增加

- 智慧型手機、筆記型電腦和平板電腦的普及

- 市場限制因素

- 雲端和基於伺服器的服務缺乏資料安全性

第6章市場區隔

- 儲存系統

- 直接附加儲存 (DAS)

- 網路附加儲存 (NAS)

- 儲存區域網路 (SAN)

- 儲存架構

- 基於檔案物件的儲存 (FOBS)

- 區塊儲存

- 最終用戶產業

- BFSI

- 零售

- 資訊科技和電訊

- 衛生保健

- 媒體娛樂

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Dell Inc.

- Hewlett Packard Enterprise Company

- NetApp Inc.

- Hitachi Ltd

- IBM Corporation

- Toshiba Corp.

- Pure Storage Inc.

- DataDirect Networks.

- Scality Inc.

- Fujitsu Ltd.

- Netgear Inc.

第8章投資分析

第9章市場的未來

The Next-generation Storage Market size is estimated at USD 66.67 billion in 2024, and is expected to reach USD 95.13 billion by 2029, growing at a CAGR of 7.37% during the forecast period (2024-2029).

With the sizeable and exponential growth in the digital world, there has been an accelerating development in mobile services, Big Data, cloud computing, and social networking applications. Next-generation storage technology deals with an advanced portfolio of products and solutions, which help store data across various end-user industries, including IT firms, automotive companies, and data centers. With the increasing file sizes and a massive amount of unstructured and Big Data, IT companies face plenty of problems while dealing with data management.

Conventional data storage technologies cannot handle a large amount of everyday data. The next-generation data storage infrastructure offers a reliable, faster, cost-effective solution to meet the growing data storage demands.

Further, the next-generation storage technology market is moving into the information technology sector, with an extensive range of applications across Big Data storage, enterprise data storage, and other cloud-based services. Storage and how it is addressed can significantly impact the top and bottom lines. IT organizations are expected to be more willing to move from making a safe storage investment to investing in new technologies that can benefit the business.

In April 2023, VAST Data announced that Hewlett Packard Enterprise (HPE) had incorporated VAST Data's leading file software platform into the new HPE GreenLake for File Storage service. By leveraging VAST's unique and innovative scale-out software architecture for the new HPE GreenLakefor File Storage, enterprise customers can manage unstructured data with massive performance and achieve faster data insights.

However, many security issues are associated with cloud-based storage, such as misconfiguration, insufficient data governance, and poor access controls, among others. Such cloud storage security issues that can expose enterprise data to unauthorized parties can act as a restraint on market growth.

The COVID-19 pandemic outbreak positively impacted the next-generation storage market, especially solutions used in cloud storage. Storage vendors were making some of their hardware and software technology available for free to help researchers, businesses, work-from-home users, and partners run their businesses and work remotely during the COVID-19 coronavirus pandemic.

Next-generation Storage Market Trends

Direct Attached Storage (DAS) to Witness Significant Growth

Direct Attached Storage (DAS) is the oldest and most conventional data storage system connected directly to a computer, such as a PC or server, unlike other storage systems connected to a computer over a network.

DAS offers specific benefits compared to other storage systems that play an essential role in many organizations' storage strategies: high performance, easiness during the setup and configuration, fast access to data, and low cost.

DAS can provide users with better performance than network storage because the server does not have to traverse the network to read or write data. For this reason, many organizations utilize his DAS for applications that require high performance. DAS is also less complex than network-based storage systems, making them easier to implement and maintain and less expensive.

Moreover, growing advances in virtualization technology are breathing new life into DAS, especially in the market's hyper-converged infrastructures (HCI) systems. The HCI system consists of multiple servers and DAS storage nodes, and the storage is aggregated into logical resource pools, providing a more flexible storage solution than traditional DAS.

Generally, DAS offers high storage performance to the computer system it is directly attached to, owing to the advantage of fast computer bus interfaces, such as SAS and SATA, and the close location of data to the system's RAM and processor.

In May 2022, TerraMaster recently released a new 8-bay Direct Attached Storage (DAS) appliance for customers who need a central location to store large amounts of data. Unlike NAS, DAS is used locally via a cable connected directly to a PC or other device. The new TerraMaster D8-332 is professional RAID storage with up to 160TB capacity.

One common application of DAS is in data centers. Applications like web hosting use DAS, where customers want their private storage devices connected to their dedicated server. DAS is also commonly utilized in data use centers as storage for booting operating systems and hypervisors.

North America Occupies the Largest Market Share

The country's next-generation storage market will witness a high growth rate due to the increasing regional concentration of global vendors and consumers.

The United States remains one of the top markets for data centers globally. Also, in April 2022, Google announced plans to invest USD 9.5 billion in data centers and offices nationwide. The tech giant will be building or expanding 14 data centers in the US states like Georgia, Texas, New York, and California, among others. Such increasing investments in data centers are also creating considerable growth opportunities for the market.

Moreover, the data-heavy Internet of Things (IoT) devices constitute another emerging market for next-generation storage. These applications primarily cover a wide range. Industrial automation in the form of Factory 4.0 is one segment. Still, the IoT also includes wearables, healthcare, aviation, plus about anything that begins with smart, such as smart homes, smart farms, smart metering, and smart logistics, among others.

According to a Stanford University and Avast study, homes in the North American region have the highest density of IoT devices installed worldwide. Notably, 66% of households in the region have at least one of her IoT devices. Additionally, 25% of North American homes have three or more devices.

Additionally, increasing Internet traffic and user-generated data contribute to the market growth, with North America having the highest volume of IP traffic. According to CISCO, IP traffic in the region will reach 108.4 EB per month by 2022.

According to Ericsson's report, the average monthly mobile data usage per smartphone is likely to reach 55 GB in 2028 in North America. The improved 5G network and unlimited data plans will attract more 5G subscribers in the region. Video-based apps, virtual/augmented reality, and gaming generate huge data traffic. In 2028, the company predicts that 5G subscriptions in North America will be more than 90%world's, the highest among all regions.

Next-generation Storage Industry Overview

The next-generation storage market is moderately competitive and consists of some major players. In terms of market share, few of the key players currently dominate the market. However, with innovation in memory packaging technology, many companies are increasing their market presence across untapped new markets of emerging economies.

In May 2023, NetApp announced a new modern block storage offering and a guarantee highlighting NetApp's best-in-class ability to recover from ransomware attacks. Through this launch, the company aims to address critical customer challenges, including restricted IT budgets, increasing IT complexity, increased urgency around sustainability, and the continued exponential growth of cyber threats.

In April 2023, Pure Storage Inc. announced introduction of a next-generation unified block and file storage service. This new storage service provides access to native block and file services from a single, global pool of resources. A unified storage architecture supports block and file storage formats, allowing organizations to store and view data in various ways.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

- 4.4 Technology Snapshot

- 4.4.1 Magnetic Storage

- 4.4.2 Solid State Storage

- 4.4.3 Software Defined Storage (SDS)

- 4.4.4 Cloud Storage

- 4.4.5 Unified Storage

- 4.4.6 Other Storage Technologies

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volume of Digital Data

- 5.1.2 Rising Adoption of Solid-state Devices

- 5.1.3 Increasing Proliferation of Smartphones, Laptops, and Tablets

- 5.2 Market Restraints

- 5.2.1 Lack of Data Security in Cloud- and Server-based Services

6 MARKET SEGMENTATION

- 6.1 Storage System

- 6.1.1 Direct Attached Storage (DAS)

- 6.1.2 Network Attached Storage (NAS)

- 6.1.3 Storage Area Network (SAN)

- 6.2 Storage Architecture

- 6.2.1 File and Object-based Storage (FOBS)

- 6.2.2 Block Storage

- 6.3 End User Industry

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 IT and Telecom

- 6.3.4 Healthcare

- 6.3.5 Media and Entertainment

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Dell Inc.

- 7.1.2 Hewlett Packard Enterprise Company

- 7.1.3 NetApp Inc.

- 7.1.4 Hitachi Ltd

- 7.1.5 IBM Corporation

- 7.1.6 Toshiba Corp.

- 7.1.7 Pure Storage Inc.

- 7.1.8 DataDirect Networks.

- 7.1.9 Scality Inc.

- 7.1.10 Fujitsu Ltd.

- 7.1.11 Netgear Inc.