|

市場調查報告書

商品編碼

1432332

錐形軋碎機:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Cone Crusher - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

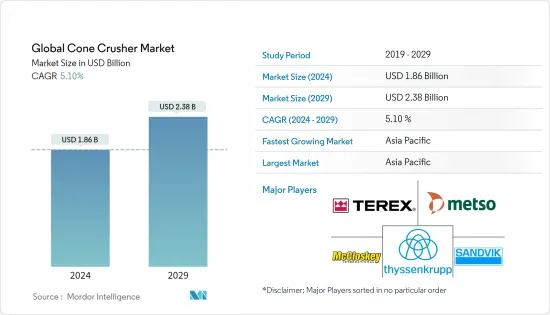

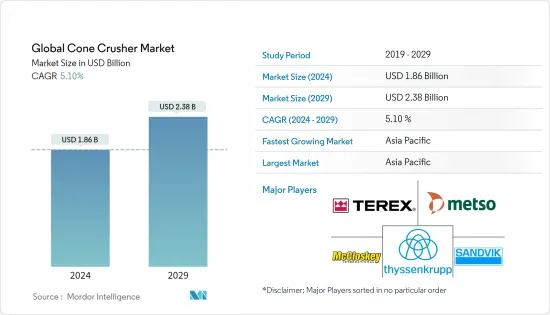

預計2024年錐形軋碎機的全球市場規模為18.6億美元,預計到2029年將達到23.8億美元,在預測期內(2024-2029年)複合年成長率為5.10%。 。

過去20年來,採礦、建築、加工和拆除等行業的碾碎和破碎要求發生了巨大變化。碾碎主要是一種固定設備,用於將粗料轉化為更優質的材料,最後將其傳遞到三次碾碎設備。目前,移動式破碎機和可攜式破碎機的需求正在迅速增加。

主要亮點

- 營運碾碎設備的產業專注於降低成本、提高產量和提高能源效率。例如,彈藥消耗了採礦作業所用能源的最大部分,大約為 30-70%。據賽默飛世爾稱,礦石破碎和碾碎是能源集中,約佔全球用電量的 3-5%。這導致市場上的各種供應商提供節能且節省成本的解決方案。例如,美卓的新型 Lokotrack LT4MX 移動錐形軋碎機據稱可透過直接V帶驅動提供卓越的能源效率。

- 新型錐形軋碎機採用液壓壓緊夾緊裝置,使工業能夠以比以往更大的功率實現更高的破碎能力。由於市場供應商注重提高其產品的產能,錐形軋碎機的自動控制最大限度地提高了功耗及其處理能力。例如,美卓的 Nordberg HP900 系列錐形軋碎機採用了新的潤滑系統、改進的運動學、升高的樞軸點以及可提供 15% 以上產能的電源。擴大規模可以提高採礦業的產量和產出,而採礦業的產能和吞吐量至關重要。

- 錐形軋碎機在建築工程和道路鋪設材料中的使用正在顯著增加。隨著回收概念的不斷增強,現代破碎機可以分離瀝青和骨料,並將其作為新瀝青重新利用。新的瀝青站可以使用高達 70% 的回收材料生產獨特的瀝青混合料,多家公司正在引進圓錐破碎機和顎式破碎機,以提高速度和產能。例如,總部位於芬蘭托爾尼奧的 Veljekset Paupek 公司採用了 Lokotrack LT200HP錐形軋碎機和 Lokotrack LT106 顎式破碎機,實現了兩級碾碎工藝。這使得整個 10,000 噸批次在短短兩週內就被碾碎。

- 除此之外,最近爆發的COVID-19嚴重限制了全球採礦和建築業的營運,該行業面臨嚴重的勞動力短缺和資本投資不足。這些發展預計將影響這些產業對設備的全球需求,企業預計將在今年剩餘時間內避免或延後採購決定。未來兩年,採礦和建設產業預計將採用更高程度的自動化,以減少對勞動力的依賴。此舉可能會吸引對提供移動和自動化解決方案的圓錐破碎機的更多投資。總體而言,預計在預測期內需求將會增加。

錐形軋碎機市場趨勢

建築領域預計將佔據主要市場佔有率

- 錐形軋碎機主要用於碾碎堅硬、磨蝕性和緻密的材料,例如建築業使用的花崗岩。這些破碎機目前有多種類型,包括定置型、履帶式和移動式。

- 建設產業是破碎機的最大需求來源之一。該行業使用的骨料是碾碎的主要需求驅動力。隨著全球基礎設施開發建設的快速推進,確保骨料極為重要。

- 公司主要從事混凝土道路建設,骨料品質每天40公里以上,三級,我們正在要求一個四級破碎站。

- 在開發中國家,住宅和商業建築領域的新政策以及對道路和橋樑等基礎設施建設的需求都促進了碾碎需求的增加。

- 據聯合國稱,到2050年,世界三分之二的人口將居住在城市。目前,已知全球約 55% 的人口居住在都市區,預計這一比例在未來幾十年內將增加至約 68%。因此,預計建設產業安裝碾碎等設備的資本投資將會增加。

- 此外,許多國家正在推出許多新的道路計劃,道路從兩車道拓寬到四車道,從四車道拓寬到六車道,這推動了對碾碎廠的需求。此外,有限的計劃時間表迫使承包部署先進的機械,以最少的停機時間和最短的設置時間提供可靠的性能。製造商透過升級機器來回應這些需求,以更快地提供更好的產品。

亞太地區預計將經歷最高成長

- 中國已成為全球最大的建築市場之一。根據中國國家統計局預測,2020年中國建築業規模將達1.49兆美元。隨著中國政府計畫重點發展中小城市基礎建設,建設產業預計將維持每年5%左右的持續成長。 2021年,中國建築業市場價值將達到1,1174.2億美元。該國建設活動的強勁成長預計將為開拓所研究的市場提供有利可圖的機會。

- 此外,中國的「一帶一路」計劃正在促進與週邊國家的合作和貿易,從而吸引建築領域的大規模投資,並有望帶動該國的施工機械。中國還計劃在2021年至2026年期間設計150個物流中心,作為其供應鏈產業重大擴張和轉型的一部分,預計這將對該地區市場產生積極影響。

- 隨著中國對更高品質鐵礦石的需求增加(以減少污染並提高效率),澳洲礦商正在提高產能並投資更換老化和廢棄的礦山。由於澳洲是中國最大的鐵礦石出口國之一,這些採礦趨勢可能會導致對錐形軋碎機等加工設備的強勁需求。此外,越南、緬甸和印尼等新興經濟體預計將在預測期內核准更多生產和探勘計劃,因為它們推出了有利於投資者的法規和法律。

- 此外,印度是該地區成長最快的建築市場之一,根據印度品牌股權基金會的數據,到 2030 年,建築業的支出預計將達到約 13 兆美元。由於都市化和可支配收入的增加,中國不斷成長的人口正在創造巨大的住宅需求。對加強基礎設施以改善其經濟地位的重視也刺激了該地區的市場機會,導致錐形軋碎機市場進一步成長,該市場在該國建築行業中廣泛部署。

錐形軋碎機產業概況

錐形軋碎機市場雲集了許多老牌廠商,他們在產品創新的基礎上展開激烈的市場競爭。除了技術創新之外,各個市場供應商還進行多次併購,以獲得市場佔有率、區域影響力和技術力。

- 2022 年 6 月 - McCloskey 在 Hillhead 2022 上宣布推出新型 C2C 緊湊型圓錐破碎機。新型 C2C 將 MC200 圓錐破碎機的強大功能融入緊湊的佔地面積中,為操作員提供了高度攜帶性和高度攜帶的錐形軋碎機,其功能齊全,可最大限度地提高生產率。

- 2021 年 10 月 - 美卓奧圖泰擴大了 Lokotrack 破碎和篩檢設備系列,增加了兩台新的移動錐形軋碎機。該機器被描述為“緊湊而高效”,專為處理建築骨料而設計,與以前的同類型號相比,吞吐量增加了 30%。 LT200HPX 和 LT220GP 採用全新底盤,配備 Cat C9.3B 動力傳動裝置,並有兩種高產能錐形軋碎機選項可供選擇:適用於硬岩碾碎的 Nordberg HP200 或 GP220。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 新興市場採礦業需求增加

- 建築業的成長

- 市場限制因素

- 碳排放,噪音和污染

第6章市場區隔

- 類型

- 西蒙斯

- 油壓

- 旋轉樹

- 其他類型

- 提供

- 移動式破碎機

- 可攜式破碎機

- 固定式破碎機

- 動力來源

- 電氣連接

- 柴油連接

- 雙連接

- 最終用戶使用情況

- 採礦和冶金

- 建造

- 骨料加工

- 拆解

- 其他最終用戶/應用程式

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 亞太地區其他地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 北美洲

第7章 競爭形勢

- 公司簡介

- Terex Corporation

- Metso Corporation

- McCloskey International Limited

- WESTPRO Machinery Inc

- Astec Industries Inc

- SANDVIK AB

- Puzzolana Machinery Fabricators LLP

- Keestrack NV

- FLSmidth & Co. A/S

- Thyssenkrupp AG

- Tesab Engineering Ltd

第8章投資分析

第9章市場的未來

The Global Cone Crusher Market size is estimated at USD 1.86 billion in 2024, and is expected to reach USD 2.38 billion by 2029, growing at a CAGR of 5.10% during the forecast period (2024-2029).

The crushing and grinding requirement of industries, such as mining, construction, processing, and demolition, changed drastically in the last two decades, where crushers were primarily stationary equipment that was used to convert coarse materials to more elegant materials, and eventually, pass them onto the tertiary crushing equipment. Nowadays, the demand for mobile and portable crushers is observing significant growth.

Key Highlights

- Industries that operate crushing equipment are focusing on lowering costs, increasing production, and becoming more energy-efficient, as crushing equipment is a primary reason behind increased energy consumption in these industries. For instance, ammunition consumes the most significant part of the energy used in mining operations, of about 30-70%. According to Thermo Fisher, grinding and crushing of ore are energy-intensive and account for about 3-5% of the world's power usage. Owing to this, various vendors in the market are increasingly offering solutions that are energy efficient and save costs. For example, Metso's new Lokotrack LT4MX mobile cone crusher is said to provide excellent energy efficiency with the direct v-belt drive.

- New cone crushers that operate with hydraulic hold-down clamping enable industries to crush at a higher capacity with increased power than ever before. The automatic control of cone crushers has maximized power draw and their throughput, owing to which vendors in the market are focusing on increasing the capacity of their offerings. For example, the Nordberg HP900 series cone crusher from Metso comes with a new lubrication system, improved kinematics, a raised pivot point, and increased power to offer a 15% increase in its capacity. The increased size provides increased production and output in the mining industries, where production capacity and throughput are vital.

- The application of cone crushers in construction work and road laying material is significantly rising. With the growing concept of recycling, current crushers can separate bitumen and aggregates for reuse as new asphalt. New asphalt stations can create a unique asphalt mix with up to 70% recycled material, and various businesses are deploying cone crushers, along with jaw crushers, to enhance the speed and capacity. For example, Veljekset Paupek, based in Tornio, Finland, adopted the Lokotrack LT200HP cone crusher and the Lokotrack LT106 jaw crushing plant to create a two-stage crushing process. This enabled it to crush an entire batch of 10,000 metric tons in just two weeks.

- In addition to this, the recent outbreak of COVID-19 significantly restricted the global mining and construction operations, with the industry facing a severe shortage of workforce and capital investment. Such developments are expected to influence the global demand for equipment in these industries, as enterprises are expected to either avoid or postpone their buying decisions during the year. Over the next two years, the mining and construction industries are expected to adopt a larger scale of automation to reduce the dependency on the workforce. Such developments may attract higher investment in cone crushers that are mobile and offer automated solutions. Overall, the demand is expected to rise during the forecast period.

Cone Crusher Market Trends

The Construction Segment is Expected to Hold a Major Market Share

- Cone crushers are primarily used for crushing hard, abrasive, and dense materials, such as granite, used in the construction industry. These crushers are currently available in multiple types, such as stationary, track, and mobile designs.

- The construction industry is one of the largest demand generators for crushers. Aggregates used in the industry are a major demand driver for crushers. The availability of aggregates has been very crucial with the pace at which infrastructure development and construction are happening across the world.

- The companies primarily engaged in the construction of more than 40 km of pavement quality concrete roads per day are demanding three and four-stage crusher plants of 300-500 tph capacity to produce fine aggregates of (-) 20 mm and sand plants.

- In developing nations, renewed policies in the residential and commercial construction sector and the demand for more infrastructure buildings, such as roads and bridges, are all contributing to the increasing demand for crushing equipment.

- According to the United Nations, two-thirds of the global population is expected to live in cities by 2050. Currently, around 55% of the worldwide population is known to be living in urban areas or cities, and the share is poised to increase to about 68% over the coming decades. Therefore, the construction industry is expected to increase capital spending for the installation of equipment, including crushers and other equipment.

- Moreover, a large number of new road projects are being rolled out across various countries, along with road widening from 2 to 4-lane and from 4 to 6-lane, which is boosting the demand for crushing plants. Also, the restricted timelines of the project are forcing contractors to deploy advanced machines that give assured performance with minimum set-up time coupled with minimum downtime. Manufacturers are meeting their requirements by upgrading their machines to deliver better and faster.

Asia Pacific is Expected to Witness the Highest Growth

- China has become one of the largest construction markets globally. According to the National Bureau of Statistics of China, in 2020, the construction industry value in China amounted to USD 1,049 billion. As the Chinese government plans to focus on improving the infrastructure in small and medium-sized cities, the construction industry is forecasted to maintain continuous growth at around 5% annually. In 2021, the market value of China's construction industry totaled USD 1,117.42 billion. The country's robust growth in construction activities is anticipated to offer lucrative opportunities for the development of the studied market.

- Further, China's 'one belt, one road initiative is propelling the cooperation and trade with its neighboring countries, thereby drawing massive investments in the construction sector, which is anticipated to drive the country's construction equipment. China is also planning to design 150 logistics hubs during 2021 - 2026 as part of the significant expansion and transformation of its supply chain industry, which is expected to impact the market in the region positively.

- With China's growing need for higher-quality iron ore (to cut down on pollution and improve efficiency), Australian miners are increasing their production capacities and investing in replacing older and exhausted mines. With Australia being one of the largest exporter of iron ore to China, such mining trends would contribute to the positive demand for processing equipment, like cone crushers. Further, with the introduction of investor-friendly regulations and laws in emerging economies, such as Vietnam, Myanmar, and Indonesia, these countries are expected to approve numerous production and exploration projects during the forecast period.

- Additionally, India is one of the fastest-growing construction markets in the region, and its expenditure is expected to be around USD 13 trillion in construction industry by 2030, according to India Brand Equity Foundation. The country's expanding population is generating a vast demand for housing projects due to the increase in urbanization and disposable income. The focus on enhancing infrastructure to boost the economic position is also adding to the market opportunity in the region and creating more growth for the cone crushers market in the country, as they are highly deployed in the country's construction sector.

Cone Crusher Industry Overview

The cone crushers market is home to various established vendors that are intensely competing in the market based on product innovations. Apart from innovation, various market vendors are involved in several mergers and acquisitions to gain market share, regional presence, and technological capabilities.

- June 2022 - McCloskey introduced a new C2C Compact Cone Crusher at Hillhead 2022. Bringing the power of the MC200 cone to a compact footprint, the new C2C is described to offer operators a highly maneuverable, highly portable cone crusher packed with features to maximize productivity.

- October 2021 - Metso Outotec expanded its Lokotrack crushing and screening equipment range, adding two new mobile cone crushers to the lineup. Described as 'compact and efficient,' the machines are designed to work with construction aggregates and provide 30% more capacity than previous comparable models. The LT200HPX and LT 220GP are powered by a Cat C9.3B power transmission and are built on a new chassis that enables customers to choose between two high-capacity cone crusher options; the Nordberg HP200 or the GP220 cone crusher, which are suitable for hard rock crushing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand in the Mining Sector in the Emerging Market

- 5.1.2 Growth of the Construction Industry

- 5.2 Market Restraint

- 5.2.1 Carbon Emission, Noise, and Pollution

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Symons

- 6.1.2 Hydraulics

- 6.1.3 Gyratory

- 6.1.4 Other Types

- 6.2 Offering

- 6.2.1 Mobile Crushers

- 6.2.2 Portable Crushers

- 6.2.3 Stationary Crushers

- 6.3 Power Source

- 6.3.1 Electric Connection

- 6.3.2 Diesel Connection

- 6.3.3 Dual Connection

- 6.4 End-user Application

- 6.4.1 Mining and Metallurgy

- 6.4.2 Construction

- 6.4.3 Aggregate Processing

- 6.4.4 Demolition

- 6.4.5 Other End-user Applications

- 6.5 Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia Pacific

- 6.5.3.1 India

- 6.5.3.2 China

- 6.5.3.3 Japan

- 6.5.3.4 Rest of Asia Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Argentina

- 6.5.4.3 Mexico

- 6.5.4.4 Rest of Latin America

- 6.5.5 Middle East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 South Africa

- 6.5.5.4 Rest of Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Terex Corporation

- 7.1.2 Metso Corporation

- 7.1.3 McCloskey International Limited

- 7.1.4 WESTPRO Machinery Inc

- 7.1.5 Astec Industries Inc

- 7.1.6 SANDVIK AB

- 7.1.7 Puzzolana Machinery Fabricators LLP

- 7.1.8 Keestrack NV

- 7.1.9 FLSmidth & Co. A/S

- 7.1.10 Thyssenkrupp AG

- 7.1.11 Tesab Engineering Ltd