|

市場調查報告書

商品編碼

1431452

電解電容器:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Aluminum Electrolytic Capacitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

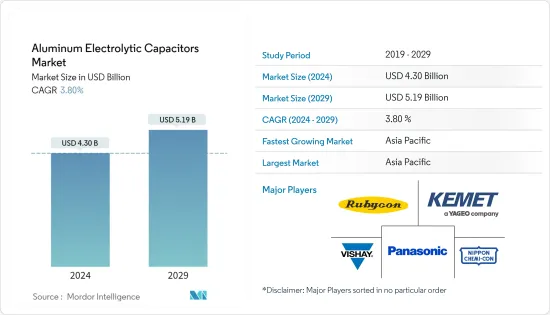

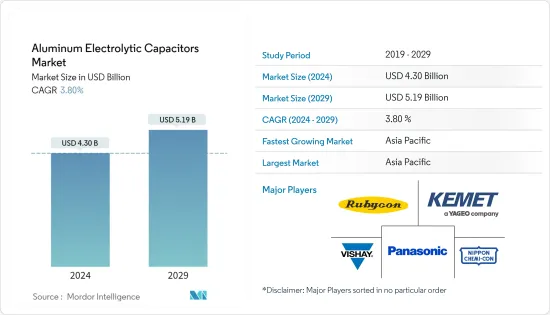

鋁電解電解市場規模預計到2024年為43億美元,預計2029年將達到51.9億美元,在預測期內(2024-2029年)複合年成長率為3.80%。

主要亮點

- 電解電容器被高度認為是極其可靠和穩定的被動元件。電解電容器因其卓越的承受極端溫度的能力而被廣泛應用於商業、工業和汽車等各個領域。這些電容器在很寬的溫度範圍內都非常有效,可以承受高達 250°C 的溫度。此外,它還表現出優異的穩定性和絕緣電阻。在漏電流-溫度特性方面,電解電容器優於目前市場上的許多其他高溫電容器。

- 電解電容器用於多種應用,包括電源和電腦主機板。這些電容器主要用於需要大電容且漏電流不重要的情況。這些電容器有各種尺寸和形狀,主要取決於使用的電壓、電解類型和應用等特性。

- 電解電容器的電容量由多種因素決定,主要是極板面積和電解的厚度。這也意味著需要大電容的電容器體積龐大且尺寸引人注目。

- 另外,環宇未來表示,軍用電解電容器的可靠性選擇是鉭電容器和電解電容器。電解電容器的主要優勢之一是其可得性,鋁在中國分佈廣泛,且價格低廉,適合大規模生產。此外,由於這種金屬重量輕且具有自癒特性,因此成為電解電容器的首選。

- 然而,使用鋁殼的非氣密封元件很常見,且可靠性較低。另外,據說對環境溫度的適應範圍較窄,特別是在負溫度特性方面,一般為-20度C(個別軍品為-40度C,軍用STANDARD CDK系列為-55度C) 。因此,電解電容器多適用於對環境要求不高的一般消費性電子產品。另外,有些電容器用於所有地面軍用電子設備,可靠性要求不高。

- 此外,市場上的供應商正在透過推出新型電解電容器來擴大其產品範圍。例如,2023年,產品將包括濕式電解電容器“REH”、“REF”和“REH系列”,導電聚合物電解電容器“RPA”和“RPF系列”,以及混合電解電容器“RHA”推出Kypcera AVX,採用徑向引線選擇。這條擴展的產品線提供了多種零件號,可以滿足商業和工業可靠性要求,同時保持有競爭力的價格。

- 疫情期間,世界各地的新計畫被擱置,模擬半導體的需求下降。然而,在疫情後的情況下,世界各地在疫情期間面臨挑戰的工廠透過採用新型電解電容器獲得了優勢。此外,經濟和工業從疫情中復甦引發了各行業製造業活動的復甦,從而提振了所研究市場的需求。

- 儘管電解電容器具有許多優點,但它們也存在壽命短、等效串聯電阻、低容值和漏電流高等限制。這些因素阻礙了其在各行業的廣泛應用,影響了電解電容器的銷售。此外,越來越多的客戶在新型行動電話、娛樂系統和其他運算解決方案中更喜歡多層陶瓷電容器 (MLCC),這減少了對電解電容器的需求。

電解電容器市場趨勢

汽車預計將佔據較大市場佔有率

- 自動駕駛技術、車對車 (V2V)通訊、高級駕駛員輔助系統 (ADAS) 以及倒車相機和車道偏離偵測器等安全和偵測系統等新的汽車功能和特性正在推動對汽車電解電容器的需求.它正在被拖走。

- 電動車、插電式混合動力汽車和其他採用電力傳動系統的車輛。這些傳動系統對電容器和子系統提出了巨大的要求。在這些車輛中,電解電容器用於動力傳動系統應用,例如昇壓逆變器、DC/DC 轉換器、馬達逆變器、汽車充電器和壁式充電器。

- 電解電容器在再生煞車系統中也發揮著重要作用,該技術用於流行的豐田普銳斯混合動力汽車。再生煞車系統將汽車減速時以熱形式損失的動能轉化為電能。這些電能會短暫儲存在電容器中,然後重新用於再次加速。

- 此外,快速擴張的電動車 (EV) 市場正在增加對汽車充電器 (OBC) 的需求。這些 OBC 不僅可以在快速充電直流站而且可以在交流電源上提供及時充電的便利機會。重要的是要認知到 OBC 在提高電動車吸引力方面發揮關鍵作用。

- 考慮到此類系統的複雜性,OBC 需要一定的大容量,以確保電池充電所用直流電壓的穩定性。電解電容器在這方面表現出色,因為它們可以滿足重要標準,例如高達 500V 的高電壓額定功率、高達 820 F 的大電容以及在 -40°C 至 105°C 的動作溫度範圍內出色的紋波電流特性。是一個有利的選擇。

- 因此,TDK 公司推出了採用咬接式端子的愛普科斯 (EPCOS)電解電容器新系列 B43548*。 B43548 系列支援的最大漣波電流為 9.80A(400V、100Hz、60°C)。

亞太地區預計將佔據主要市場佔有率

- 亞太地區的市場投資也在增加。例如,2022年1月,Excelia宣布已完成愛爾康電子的多數股權收購。 Alcon Electronics是一家印度公司,設計和製造目錄電容器和電解電容器,主要服務於可再生能源發電、醫療影像處理、感應加熱設備、發電和鐵路等終端市場。愛爾康電子提供各種用於電力電子應用的薄膜和螺絲端子電解電容器。

- 該地區的供應商正在擴大在該地區的生產足跡。例如,在疫情期間,印度第一家也是最大的國有電子公司 Keltron 宣布計劃在其位於坎努爾的中心建立電容器製造工廠。該工廠將採用 VSSC 和 ISRO 開發的最尖端科技。

- 例如,日本造紙工業公司開發了一項新技術,最終將使電動車中使用的鋰離子電池變得毫無用處。透過精製木漿,該公司希望開發出比傳統電池技術更有效地儲存和釋放電能的電解電容器。

- 該區域市場的參與者一直在尋求投資交易,包括併購。例如,2022年3月,京瓷AVX與羅姆半導體達成協議,從2022年8月開始將羅姆的所有電容器製造部門和相關智慧財產權轉讓給京瓷AVX。

- 此外,日本政府的目標是到 2050 年在日本銷售的所有新車均為電動或混合動力汽車。還計劃提供補貼,以加速電動車電池和馬達的私人開發。日本是最早推出電動車的國家之一,十多年前推出了日產 Leaf 和三菱 i-MIEV。

- 2023年上半年,進口電動車(EV)銷量佔國內進口車銷量的9%。根據JAIA的數據,期內電動車總銷量為10,968輛,較去年同期大幅成長94.5%。

電解電容器產業概況

電解電容器市場較為分散,有幾家主要公司。這些擁有大量市場佔有率的大公司正專注於擴大海外基本客群。提供電解電容器的一些領先公司包括 KEMET Corporation、Panasonic Corporation、Vishay Intertechnology Inc.、Rubycon Corporation 和 Nippon Chemi-Con Corporation。這些公司也利用策略合作措施來提高市場佔有率和盈利。

- 2023 年 8 月 TDK 公司宣布推出咬合端子的新系列電解電容器「EPCOS B43657」。這些電容器在最高工作溫度 105°C 下的最短使用壽命為 2000 小時。這些電容器專門設計用於覆蓋450V DC至475V DC的額定功率電壓範圍,電容值範圍為120 Tuo F至1250 Tuo F。這些電容器的主要特點之一是其令人難以置信的高漣波電流能力,高達 8.54A(120Hz,60°C)。此外,AlCap Tool 有助於在特定應用條件下進行準確的壽命計算。

- 2023 年 2 月 先進電子元件製造商 KYOCERA AVX 推出全系列徑向引線電解電容器,專為工業、通訊和消費性電子領域的各種應用而設計。這些電容器的供貨週期為 24 週,與市場上其他競爭性電容器相比,這是目前交貨時間最短的電容器之一。新推出的徑向引線系列包括 REH、REF 和 REH 系列濕式電解電容器。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 對小型化的偏好日益增加

- 對可再生能源解決方案的需求不斷成長

- 市場限制因素

- 金屬價格上漲影響零件製造成本

第6章市場區隔

- 電壓

- 高電壓

- 低電壓

- 目的

- 工業的

- 用於通訊

- 家用電子電器

- 車

- 能源/電力

- 其他用途

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- KEMET Corporation(Yageo company)

- Panasonic Corporation

- Vishay Intertechnology Inc.

- Rubycon Corporation

- Nippon Chemi-Con Corporation

- Lelon Electronics Corp.

- Samwha Capacitor Group

- Nantong Jianghai Capacitor Co., Ltd.

- NIC Components Corp.

- Hitano Enterprise Corp.

- Samyoung Electronics Co., Ltd.

- Taiwan Chinsan Electronics Industrial Co., Ltd.

第8章投資分析

第9章 市場未來展望

The Aluminum Electrolytic Capacitors Market size is estimated at USD 4.30 billion in 2024, and is expected to reach USD 5.19 billion by 2029, growing at a CAGR of 3.80% during the forecast period (2024-2029).

Key Highlights

- Aluminum Electrolytic capacitors have gained a reputation for being extremely reliable and stable passive components. They are extensively utilized in different sectors, such as commercial, industrial, and automotive, mainly due to their remarkable ability to withstand extreme temperatures. These capacitors are highly effective within a broad temperature range and can endure temperatures as high as 250°C. Moreover, they demonstrate outstanding stability and insulation resistance. In terms of leakage current-temperature characteristics, electrolytic capacitors outperform numerous other high-temperature capacitors currently available in the market.

- Aluminum electrolytic capacitors exist in multiple applications, such as power supplies and computer motherboards. These capacitors are mainly used when large capacitance is required, and leakage current is not essential. These capacitors are available in different sizes and shapes, primarily depending on properties such as working voltage, type of electrolyte, and applications.

- Various factors, such as the plate area and the thickness of the electrolyte, primarily determine the capacity of an aluminum electrolytic capacitor. This also means that a capacitor required for large capacitance can be bulky and more prominent in size.

- Moreover, according to HuanYu Future Technologies, the reliability selection of military electrolytic capacitors is directed toward tantalum capacitors and aluminum electrolytic capacitors. One of the significant advantages of aluminum electrolytic capacitors is their availability, as aluminum is widely distributed in China and is made available at lower prices for large production. In addition, the metal is preferred for electrolytic capacitors due to its characteristics, such as its lightweight and self-healing properties.

- However, the non-gas sealing element with the aluminum shell is generally used, which makes it unreliable. Also, its adaptation to the environment temperature range is considered narrow, especially regarding negative temperature characteristics, generally -20°C (individual military products can reach -40°C, and the military STANDARD CDK series is -55°C). Therefore, aluminum electrolytic capacitors are mostly suitable for general civilian electronic products with low environmental requirements. Some of the capacitors are also used in ground military electronic whole machines, which also require low reliability requirements.

- Additionally, it is mentioning that vendors in the market are broadening their product range by introducing new aluminum electrolytic capacitors. For instance, In 2023, Kypcera AVX, which features a radial-leaded selection consisting of the REH, REF, and REH Series wet aluminum electrolytic capacitors, the RPA and RPF Series conductive polymer aluminum electrolytic capacitors, and the RHA and RHD Series hybrid aluminum electrolytic capacitors. This expanded range offers a diverse array of part numbers, catering to both commercial and industrial reliability requirements, all while maintaining a competitive pricing structure.

- During the pandemic, new projects around the world were put on hold, which decreased the demand for analog semiconductors. However, in the post-pandemic situation, global factories that faced challenges during the pandemic are now gaining an advantage by incorporating new aluminum electrolytic capacitors. Furthermore, recovering economies and industries from the pandemic have triggered the revival of manufacturing activities across various sectors, thereby boosting the demand for the market under study.

- Although aluminum electrolytic capacitors have many benefits, they are hindered by certain limitations such as a short lifespan, equivalent series resistance, less value tolerance, and significant leakage currents. These factors prevent their widespread use in various industries, which is affecting the sales of aluminum electrolytic capacitors. Additionally, the increasing preference of customers for multilayered ceramic capacitors (MLCCs) in new cellphones, entertainment systems, and other computing solutions is reducing the demand for electrolytic capacitors.

Aluminum Electrolytic Capacitors Market Trends

Automotive is Expected to Hold Significant Market Share

- The new automotive features and functionality due to autonomous vehicle technologies, vehicle-to-vehicle (V2V) communications, advanced driver-assistance systems (ADAS), and other safety and sensing systems, like backup cameras and lane-departure detectors, are driving the demand for aluminum electrolytic capacitors in automotive applications.

- Electric vehicles, plug-in hybrids, and other motor vehicles deploy electric drive trains. These drive trains are creating a significant demand for capacitors and subsystems. In these vehicles, aluminum electrolytic capacitors are used in drive-train applications, including boost inverters, DC/DC converters, motor inverters, onboard chargers, and wall chargers.

- Aluminum electrolytic capacitors also play a crucial role in regenerative braking systems, a technology that was employed in the popular Toyota Prius hybrid. A regenerative braking system takes the kinetic energy lost as heat when a car decelerates and turns it into electricity. This electricity can be stored for a short period of time in a capacitor before it is recycled to make the vehicle accelerate again.

- Additionally, due to the rapidly expanding market for electrified vehicles (EVs), there is a growing demand for on-board chargers (OBCs). These OBCs offer the opportunity to conveniently charge the car not only at fast-charging DC stations but also with AC sources in a timely manner. Presently, these systems can reach up to 22 kW with operating voltages of up to 800 V. It is crucial to recognize that OBCs play a vital role in enhancing the appeal of EVs.

- Considering the intricate nature of these systems, it is necessary for the OBC to have a specific amount of bulk capacitance in order to ensure stability of the DC voltage used for battery charging. Aluminum electrolytic capacitors present themselves as a favorable option in this regard, as they are capable of meeting important criteria such as having high voltage ratings of up to 500 V, offering a large capacitance of up to 820 µF, and demonstrating excellent ripple current capabilities within an operating temperature range of -40 °C to 105 °C.

- Therefore, TDK Corporation announced the new EPCOS aluminum electrolytic capacitor series B43548* with snap-in terminals. The series B43548 capacitors feature a suitable maximum ripple current capability of 9.80 A (400 V, 100 Hz, 60 °C).

Asia-Pacific is Expected to Hold Significant Market Share

- The region is also witnessing increasing investments in the market. For instance, in January 2022, Exxelia announced that it had completed the majority acquisition of Alcon Electronics. Alcon Electronics is an Indian designer and manufacturer of catalog and aluminum electrolytic capacitors, mainly serving the renewable energy, medical imaging, induction heating equipment, power generation, and railway end markets. Alcon Electronics provides a wide range of film and screw-terminal aluminum electrolytic capacitors for use in power electronic applications.

- The vendors in the region are expanding their production footprint in the region. For instance, during the pandemic, Keltron, India's first and largest electronic corporation in the state sector, announced its plan to set up a production facility for manufacturing capacitors at its center in Kannur. The facility would use the most advanced technology developed by VSSC and ISRO in aluminum electrolytic capacitor production.

- For instance, Nippon Paper Industries developed a new technology that could eventually render lithium-ion batteries useless in electric vehicles. The company hopes to develop aluminum electrolytic capacitors to store and release electrical energy more efficiently than conventional battery technology by refining wood pulp to microscopic dimensions.

- Players in the regional market have followed investment deals, including mergers and acquisitions. For instance, in March 2022, KYOCERA AVX agreed with ROHM Semiconductor to transfer all of ROHM's capacitor manufacturing units and relevant intellectual property to KYOCERA AVX, effective August, 2022.

- Further, the Japanese government aims to have all the new cars sold in Japan, be they electric or hybrid vehicles, by the year 2050. The country also plans to offer subsidies to accelerate the private sector's development of batteries and motors for electricity-powered vehicles. Japan is one of the countries that were early adopters of electric vehicles, with the launch of the Nissan LEAF and Mitsubishi i-MIEV more than a decade ago.

- During the first half of 2023, the sales of imported electric vehicles (EVs) accounted for 9% of all domestically imported vehicles sold. According to the JAIA, the total number of EVs sold during this period was 10,968, indicating a significant year-on-year increase of 94.5%.

Aluminum Electrolytic Capacitors Industry Overview

The aluminum electrolytic capacitors market is fragmented and has several major players. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. Some leading players offering aluminum electrolytic capacitors are KEMET Corporation, Panasonic Corporation, Vishay Intertechnology Inc., Rubycon Corporation, Nippon Chemi-Con Corporation, and many others. Additionally, these companies leverage strategic collaborative initiatives to increase their market shares and profitability.

- August 2023: TDK Corporation announced the release of the new EPCOS B43657 aluminum electrolytic capacitor series with snap-in terminals. These capacitors have a service life of at least 2000 hours at a maximum operating temperature of 105 °C. They are specifically designed to cover a rated voltage range from 450 V DC to 475 V DC, with capacitance values ranging from 120 µF to 1250 μF. One key feature of these capacitors is their impressive high ripple current capability, reaching up to 8.54 A (120 Hz, 60 °C). Furthermore, the AlCap Tool easily allows for accurate lifetime calculation under specific application conditions.

- February 2023: KYOCERA AVX, a manufacturer of advanced electronic components, has launched a comprehensive range of radial-leaded aluminum electrolytic capacitors specifically designed for various applications in industrial, communications, and consumer electronics sectors. These capacitors are readily available with a lead time of 24 weeks, which is currently one of the shortest lead times compared to other competing capacitors in the market. The newly introduced radial-leaded range consists of REH, REF, and REH Series wet aluminum electrolytic capacitors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Miniaturized Design Preferences

- 5.1.2 Rising Demand for Renewable Energy Solutions

- 5.2 Market Restraints

- 5.2.1 Rising Metal Prices Impacting Component Production Costs

6 MARKET SEGMENTATION

- 6.1 Voltage

- 6.1.1 High Voltage

- 6.1.2 Low Voltage

- 6.2 Applications

- 6.2.1 Industrial

- 6.2.2 Telecommunications

- 6.2.3 Consumer Electronics

- 6.2.4 Automotive

- 6.2.5 Energy & Power

- 6.2.6 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 KEMET Corporation (Yageo company)

- 7.1.2 Panasonic Corporation

- 7.1.3 Vishay Intertechnology Inc.

- 7.1.4 Rubycon Corporation

- 7.1.5 Nippon Chemi-Con Corporation

- 7.1.6 Lelon Electronics Corp.

- 7.1.7 Samwha Capacitor Group

- 7.1.8 Nantong Jianghai Capacitor Co., Ltd.

- 7.1.9 NIC Components Corp.

- 7.1.10 Hitano Enterprise Corp.

- 7.1.11 Samyoung Electronics Co., Ltd.

- 7.1.12 Taiwan Chinsan Electronics Industrial Co., Ltd.