|

市場調查報告書

商品編碼

1431254

鈷:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Cobalt - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

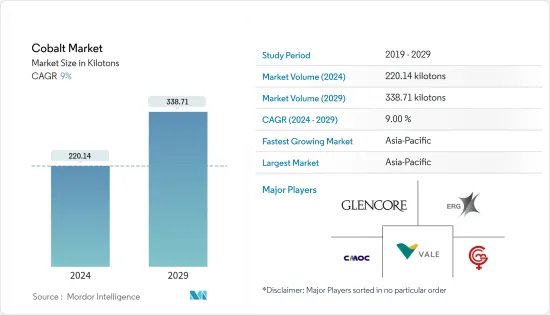

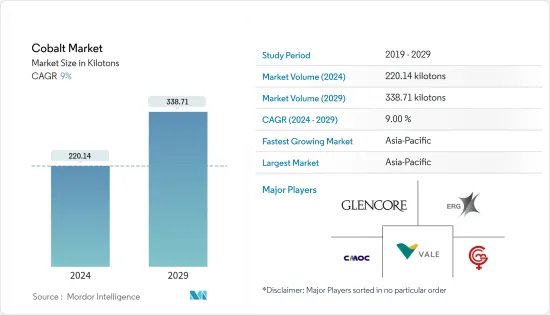

預計2024年鈷市場規模為220.14千噸,預計2029年將達到338.71千噸,在預測期(2024-2029年)複合年成長率為9%。

由於影響汽車、電子和石油和天然氣行業的全球限制因素,COVID-19大流行對鈷及其各類市場產生了重大影響。然而,由於終端用戶產業的成長,鈷市場在疫情後顯著反彈。

可充電電池在製造上的廣泛使用是推動市場研究的主要因素。此外,高速切削刀俱生產中使用量的增加預計也將推動市場向前發展。

然而,鈷的稀有性和由於從礦床中提取鈷所需的密集精製過程而導致的高成本可能會阻礙市場成長。

此外,環保和可回收鈷的商業化可能為鈷市場的未來成長提供機會。

亞太地區佔據了最高的市場佔有率,預計在預測期內也將主導市場。

鈷市場趨勢

充電電池領域佔據市場主導地位

- 鈷廣泛用於各種應用,最常見的是二次電池。鈷在鋰離子二次電池(LIB)的應用可以追溯到眾所周知的LiCoO2(LCO)正極。

- 鈷是鋰離子電池的必要成分。鈷可以防止正極過熱,從而縮短電池壽命。因此,鈷在延長電池壽命方面發揮著重要作用,行動電話和其他電池供電設備中使用的大多數可充電電池中都含有鈷。

- 由於對汽油和柴油車的監管更加嚴格,電動車市場經歷了顯著成長。根據電動車數據,2022年新增純電動車(BEV)和插電式混合(PHEV)交付量為1,050萬輛,較2021年成長55%。

- 全球範圍內,對智慧型手機的需求大幅增加。據Telefonaktiebolaget LM Ericsson稱,2021年全球智慧型手機用戶數將達到62.59億部,而前一年為59.24億部。此外,預計到2027年這項合約數量將達到76.9億份,從而推動鈷在智慧型手機領域的使用。

- 在北美,尤其是美國,電子產業預計將經歷溫和成長。在美國,電子產業技術進步和研發活動方面技術創新的快速步伐增加了對更新更快的電子產品的需求。根據消費者科技協會的數據,2022 年美國消費性電子產品或科技銷售的零售收入預計為 5,050 億美元,而 2021 年為 4,610 億美元。

- 根據經濟分析局統計,2022年第三季美國電氣產品、設備及零件付加價值約738億美元,較去年同期成長8%。前三季度,我國付加價值總額接近2,200億美元。

- 此外,2022年前三季美國電腦及電子產品製造業總產值約1.3兆美元。與去年同期(1.2兆美元)相比,這段期間成長了7%。

- 新興國家電動車數量的增加和電子設備使用的增加正在推動對二次電池的需求,這可能會在未來幾年推動鈷市場的發展。

亞太地區主導市場

- 預計亞太地區將主導全球鈷市場。

- 在中國和印度,內燃機禁令和對內燃機汽車徵收高額稅收在過去幾年加速了電動和混合動力汽車的生產。

- 中國是最大的電動車生產國和消費國,約佔全球市場的一半。根據中國工業協會預測,2022年中國新能源汽車總產量預計約700萬輛。與2021年的產量(354萬台)相比,大幅增加了近97%。

- 印度近年來也一直關注該國的電動車市場。根據CEEW能源金融中心的一項研究,印度預計到2030年電動車將擁有2,060億美元的機會,這將需要在國內汽車製造和充電基礎設施方面投資1,800億美元。

- 印度品牌股權基金會(IBEF)預測,到2025年,印度電子製造業價值將達到5,200億美元。政府透過「印度製造」、「國家電子政策」、「電子產品淨零進口」、「零缺陷」、「零效應」等政策舉措,有助於發展國內製造業,減少進口依賴,提振出口和製造業。促進印度電氣和電子產品的快速成長。

- 電子情報技術產業協會(JEITA)預計,到2022年11月,日本電子產業總產值將超過10.1兆日圓(845億美元),約為與前一年同期比較的100.7%。

- 該地區節能設備的持續成長和對高效能電池的需求不斷增加預計將在未來幾年推動鈷市場的發展。

鈷行業概況

鈷市場部分整合,少數參與者佔了大部分市場佔有率。市場主要企業(排名不分先後)包括嘉能可、淡水河谷、歐亞資源集團、Gecamines SA 和洛陽鉬業。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 在二次電池製造的廣泛應用

- 高速切削刀俱生產中的使用增加

- 抑制因素

- 從礦床中提取需要大量的精製過程

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 價格趨勢

第5章市場區隔(市場規模:基於數量)

- 型態

- 化合物

- 金屬

- 購買廢品

- 目的

- 電池

- 合金

- 催化劑

- 工具材料

- 磁鐵

- 陶瓷和顏料

- 其他用途

- 地區

- 生產分析

- 澳洲

- 加拿大

- 中國

- 剛果

- 古巴

- 印度

- 印尼

- 馬達加斯加

- 摩洛哥

- 巴布亞紐幾內亞

- 菲律賓

- 俄羅斯

- 美國

- 世界其他地區

- 消費分析

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 世界其他地區

- 南美洲

- 中東/非洲

- 生產分析

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- BHP

- CMOC

- Cobalt Blue Holdings Limited

- Eramet

- Eurasian Resources Group

- Gecamines SA

- Glencore

- Huayou Cobalt Co., Ltd.

- Jervois

- Jinchuan Group International Resources Co. Ltd

- Panoramic Resources

- Sherritt International Corporation

- Umicore NV

- Vale

- Wheaton Precious Metals Corp

第7章 市場機會及未來趨勢

- 環保可回收鈷的商業化

The Cobalt Market size is estimated at 220.14 kilotons in 2024, and is expected to reach 338.71 kilotons by 2029, growing at a CAGR of 9% during the forecast period (2024-2029).

Because of global constraints affecting the automobile, electronics, and oil and gas industries, the COVID-19 pandemic had a substantial impact on the market for cobalt and its different types. However, the cobalt market recovered significantly in the post-pandemic era, owing to the growing end-user industries.

The extensive use in the manufacturing of rechargeable batteries is a major factor driving market research. Rising usage in the production of high-speed cutting tools is also expected to drive the market forward.

However, the high cost of cobalt due to its scarcity and the intensive refining process required to extract it from ore deposits is likely to hamper market growth.

Additionally, the commercialization of environmentally friendly recyclable cobalt will likely provide opportunities for the future growth of the cobalt market.

The Asia-Pacific region accounts for the highest market share and is expected to dominate the market during the forecast period.

Cobalt Market Trends

Rechargeable Batteries Segment to Dominate the Market

- Cobalt is widely employed in a variety of applications, although it is most commonly found in rechargeable batteries. Cobalt's application in lithium-ion batteries (LIBs) may be traced back to the well-known LiCoO2 (LCO) cathode, which provides good conductivity and structural stability during charge cycling.

- Cobalt is a necessary component in lithium-ion batteries. It prevents cathodes from overheating, which can shorten the battery's life. As a result, cobalt plays a major role in battery life extension and is found in practically every rechargeable battery used in a mobile phone or other battery-powered devices.

- The electric vehicle market has experienced significant growth as a result of increased regulation on gasoline and diesel-powered automobiles. According to EV volumes, 10.5 million new battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) were delivered in 2022, representing a 55% increase over 2021.

- Globally, the demand for smartphones is increasing at a significant rate. According to Telefonaktiebolaget LM Ericsson, the number of smartphone subscriptions accounted for 6,259 million in 2021 globally, compared to 5,924 million in the prior year. Moreover, the subscription is likely to reach 7,690 million by 2027, enhancing the usage of cobalt in the smartphone segment.

- In North America, especially in the United States, the electronics industry is expected to grow at a moderate rate. In the United States, the rapid pace of innovation in terms of the advancement of technologies and R&D activities in the electronics industry is driving the demand for newer and faster electronic products. According to the Consumer Technology Association, the retail revenue from consumer electronics or technology sales in the United States was estimated at USD 505 billion in 2022, compared to USD 461 billion in 2021.

- According to the Bureau of Economic Analysis, the value added by the manufacturing of electrical appliances, equipment, and components in the United States in the third quarter of 2022 was around USD 73.8 billion, representing an 8% rise over the same period the previous year. Throughout the first three quarters, the country's total value added was close to USD 220 billion.

- Furthermore, the gross output of computer and electronic products manufacturing in the United States was approximately USD 1,300 billion in the first three quarters of 2022. When compared to the same period the previous year (USD 1,200 billion), this period showed a 7% growth.

- These rising numbers of electric vehicles and the increasing usage of electronic equipment in developing countries are driving the demand for rechargeable batteries, which may drive the market for cobalt through the coming years.

Asia-Pacific Region to Dominate the Market

- Due to the highly developed electronics, automotive, ceramics and pigments, and glass industries in China, India, Japan, and Korea, as well as the region's ongoing investments made to advance the battery technology sector over time, the Asia-Pacific region is predicted to dominate the global cobalt market.

- Internal combustion engine bans and high taxes on internal combustion vehicles in China and India have accelerated the production of electric and hybrid vehicles during the past few years in both countries.

- China has been the highest producer as well as consumer of electric vehicles, covering approximately half the market all around the globe. According to the China Association of Automobile Manufacturers (CAAM), the total production of new energy vehicles in China in 2022 was estimated to be about 7 million units. This saw a whopping increase of close to 97% when compared with the production of vehicles in 2021 (3.54 million units).

- India has also been focusing on the electric vehicle market for the country for the past few years. A study by the CEEW Centre for Energy Finance recognized a USD 206 billion opportunity for electric vehicles in India by 2030, which will necessitate a USD 180 billion investment in vehicle manufacturing and charging infrastructure in the country.

- The India Brand Equity Foundation (IBEF) predicts that the Indian electronics manufacturing industry will be worth USD 520 billion by 2025. Government initiatives with policies such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect, Zero Effect, which offer a commitment to growth in domestic manufacturing, lowering import dependence and energizing exports and manufacturing, are expected to drive rapid growth in electrical and electronic products in India.

- The Japan Electronics and Information Technology Industries Association (JEITA) estimated that the whole production value of Japan's electronics sector was over JPY 10.1 trillion (USD 84.5 billion) by November 2022, which is around 100.7% of the previous year's figure.

- Continuous growth in energy-saving devices along with the increasing need for high-efficiency batteries in the region are expected to drive the market for cobalt through the coming years.

Cobalt Industry Overview

The cobalt market is partially consolidated in nature with a few players holding the majority of the market share. Some of the market's major players (not in any particular order) include Glencore, Vale, Eurasian Resources Group, Gecamines SA and CMOC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Extensive Usage in the Manufacturing of Rechargeable Batteries

- 4.1.2 Rising Usage in the Production of High Speed Cutting Tools

- 4.2 Restraints

- 4.2.1 Intensive Refining Process Required to Extract From Ore Deposits

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Chemical Compound

- 5.1.2 Metal

- 5.1.3 Purchased Scrap

- 5.2 Application

- 5.2.1 Batteries

- 5.2.2 Alloys

- 5.2.3 Catalysts

- 5.2.4 Tool Materials

- 5.2.5 Magnets

- 5.2.6 Ceramics and Pigments

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Production Analysis

- 5.3.1.1 Australia

- 5.3.1.2 Canada

- 5.3.1.3 China

- 5.3.1.4 Congo

- 5.3.1.5 Cuba

- 5.3.1.6 India

- 5.3.1.7 Indonesia

- 5.3.1.8 Madagascar

- 5.3.1.9 Morocco

- 5.3.1.10 Papua New Guinea

- 5.3.1.11 Philipppines

- 5.3.1.12 Russia

- 5.3.1.13 United States

- 5.3.1.14 Rest of the World

- 5.3.2 Consumption Analysis

- 5.3.2.1 Asia-Pacific

- 5.3.2.1.1 China

- 5.3.2.1.2 India

- 5.3.2.1.3 Japan

- 5.3.2.1.4 South Korea

- 5.3.2.1.5 Rest of Asia-Pacific

- 5.3.2.2 North America

- 5.3.2.2.1 United States

- 5.3.2.2.2 Canada

- 5.3.2.2.3 Mexico

- 5.3.2.3 Europe

- 5.3.2.3.1 Germany

- 5.3.2.3.2 United Kingdom

- 5.3.2.3.3 Italy

- 5.3.2.3.4 France

- 5.3.2.3.5 Rest of Europe

- 5.3.2.4 Rest of the World

- 5.3.2.4.1 South America

- 5.3.2.4.2 Middle-East and Africa

- 5.3.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BHP

- 6.4.2 CMOC

- 6.4.3 Cobalt Blue Holdings Limited

- 6.4.4 Eramet

- 6.4.5 Eurasian Resources Group

- 6.4.6 Gecamines SA

- 6.4.7 Glencore

- 6.4.8 Huayou Cobalt Co., Ltd.

- 6.4.9 Jervois

- 6.4.10 Jinchuan Group International Resources Co. Ltd

- 6.4.11 Panoramic Resources

- 6.4.12 Sherritt International Corporation

- 6.4.13 Umicore N.V.

- 6.4.14 Vale

- 6.4.15 Wheaton Precious Metals Corp

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Commercialization of Environmentally Friendly Recyclable Cobalt