|

市場調查報告書

商品編碼

1431018

消費性智慧穿戴裝置的全球市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Global Consumer Smart Wearable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

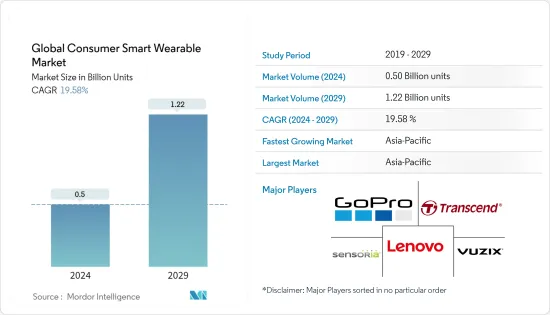

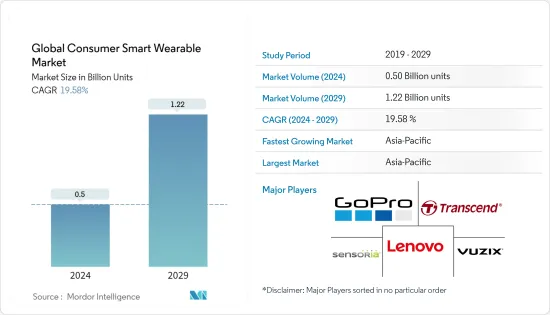

消費性智慧穿戴裝置的全球市場規模預計到2024年將達到5億台,預計到2029年將達到12.2億台,在預測期內(2024-2029年)複合年成長率為19.58%。

穿戴式科技是一種新興趨勢,它將電子產品融入日常活動並適應不斷變化的生活方式,能夠穿著在身體的任何部位。連接網際網路以及提供網路和設備之間交換資料的選項等趨勢正在推動穿戴式技術的發展趨勢。

主要亮點

- 隨著世界許多地區都市化進程的不斷深入,人們對先進、美觀的產品的需求不斷成長。此外,世界各地大量的千禧世代很快就採用了智慧型手錶,因為他們追蹤正常工作時間和奢侈品消費的能力不斷增強。

- 機器學習和人工智慧功能將把您的技能提升到一個新的水平,特別是在當今的醫療保健行業。與此相佐證的是,相容物聯網的智慧穿戴感測器的價格也在下降,這將導致製造商以更實惠的價格提供智慧穿戴設備,從而增加各行業的需求。我們鼓勵企業採用適合自己系統和應用的產品。業務。此外,近年來消費性智慧穿戴裝置的銷售量大幅成長。此外,穿戴式感測器設備已在體育產業中發揮重要作用,使客戶能夠追蹤他們的日常生活,並提供有關他們編程監測的各種參數的重要資訊。

- 隨著蘋果和 Fitbit 等穿戴式裝置製造商添加了健康監測功能,吸引老年人並即時更新他們的健康狀況,智慧穿戴裝置的新用戶數量迅速增加,其中包括老年人。我看到更多。

- 過去幾年,穿戴式裝置的採用已變得普遍,但對資料隱私的擔憂仍然存在。儘管智慧型穿戴裝置的資料對攻擊者來說沒有什麼價值,但智慧手錶等智慧智慧型手錶裝置卻帶來了更大的風險。如果設備配備 LTE 連接,則風險可能會更高,因為它可以透過配對設備進行遠端操作。

- COVID-19 的爆發和世界各地的封鎖法規正在影響世界各地的消費者。封鎖的影響包括供應鏈中斷、製造過程中使用的原料缺乏、勞動力短缺、價格波動可能導致最終產品產量增加並超出預算,以及出貨問題。

消費性智慧穿戴市場趨勢

技術進步不斷推動市場成長

- 可支配收入的增加和生活方式的改變正在增加對穿戴式科技的需求。此外,物聯網時代穿戴式裝置提供的功能增加也導致軍事、運動健身、醫療保健和娛樂等產業的需求增加。

- 這種需求得到了新產品發布和新市場進入的支持。隨著越來越多的公司進入消費者智慧穿戴裝置市場,其產品的差異化將變得至關重要。例如,2022年6月,Ambrane宣布擴大其產品組合,推出Wise Roam智慧型手錶系列。這款智慧型手錶具有藍牙通話功能,提供 100 多種雲端基礎的錶盤,並具有 IP68 防水等級。

- Wise Roam智慧型手錶配備了心率、血壓、SpO2、月經健康、睡眠和其他健康指標的感測器。此外,它還提供呼吸訓練、天氣預報、高 AR 警報和久坐提醒。這款智慧型手錶擁有 60 多種運動模式,並配備可在 Android 和 iOS 裝置上運行的 Da Fit 軟體。此外,這款手錶還可以與 Apple Health 和 Google Fit 整合。

- LG化學和Panasonic等公司協助開發了可為穿戴式裝置供電的可印刷軟性電池。憑藉如此靈活和複雜的設計電池,市場上的供應商現在可以利用額外的空間添加更多組件並增加電池容量。

- 感測器(特別是壓力感測器和激活器)的進步和小型化也擴大了消費性智慧穿戴裝置市場的範圍。許多公司正在投資開發先進的MEMS和數位感測器,這些感測器變得越來越小,從而涵蓋了更廣泛的市場應用。

亞太地區預計將錄得最快成長

- 與低成本製造地相比,政府的支持使中國成為突出的創新領導者,這也推動了市場的發展,因為許多中國公司正在大力投資研發。例如,KUMI 已成功供應 40 萬隻智慧型手錶,並進行國際擴張,在印度、美國、歐洲和許多東南亞國家等各個市場進行競爭。

- 中國公司正在為具有內建連接功能的新興穿戴式裝置市場開發先進技術,例如健身手環和智慧型手錶。小米和華為等設備製造商活躍在這個市場,與微信和行動電話公司等線上服務供應商合作。

- 在日本,頭戴式顯示器 (HMD) 正在進一步發展。 HMD 像護目鏡一樣配戴,將影像直接投射在使用者的眼前。日本公司擴大生產具有 3D 功能的 HMD 視訊娛樂系統。這些系統結合了日本在電腦圖形(CG)和高清平板顯示技術方面的優勢。

- 根據印度品牌股權基金會(IBEF)預測,印度家電和消費電子(ACE)市場複合年成長率將達9%,到2022年將達到3.15兆印度盧比(約483.7億美元)。預計。預計這將在預測期內推動消費者智慧穿戴裝置市場的成長。

- 此外,亞洲纖維公司也提供iQmax品牌的智慧紡織品,旨在透過結合紡織品和電子產品,為各個市場提供功能性和創新性的服裝產品。 iQmax產品線以照明模組開發,具備LED紗線、DC插孔、動力電池和控制器整合兩大功能。此產品線提供可折疊、柔軟、輕巧、防水和可水洗的服裝類紡織品。

消費性智慧穿戴產業概況

全球消費性智慧穿戴設備市場競爭激烈。近年來,市場競爭更加激烈。此外,為了在這個快速成長的市場中獲得競爭優勢,參與者不斷湧現,主要是為了滿足千禧世代的需求。公司不斷投資於產品開發以及合作和收購,以推出新產品和開拓市場。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 價值鏈分析

- COVID-19 對消費者智慧穿戴裝置市場的影響

第5章市場動態

- 市場促進因素

- 技術進步不斷推動市場成長

- 市場挑戰

- 對高成本和資料安全的擔憂

第6章市場區隔

- 依產品

- 智慧型手錶

- 頭戴式顯示器

- 智慧穿戴

- 耳掛式

- 健身追蹤器

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Vuzix Corporation

- Lenovo

- Transcend Information Inc.

- GoPro Inc.

- Sensoria Inc.

- AIQ Smart Clothing Inc.

- Axon Enterprise Inc.

- Withings

- Huami Corporation

- Omron Healthcare Inc.

- Nuheara Limited

- Polar Electro Oy

- Microsoft Corporation

- Sony Corporation

- Huawei Technologies Co. Ltd

- Fitbit LLC

- Fossil Group Inc.

- Garmin Ltd

- Samsung Electronics Co. Ltd

- Apple Inc.

第8章投資分析

第9章 市場未來展望

The Global Consumer Smart Wearable Market size is estimated at 0.5 Billion units in 2024, and is expected to reach 1.22 Billion units by 2029, growing at a CAGR of 19.58% during the forecast period (2024-2029).

Wearable technology, an emerging trend, integrates electronics into daily activities and addresses the changing lifestyles with the ability to be worn on any part of the body. Factors such as the ability to connect to the internet and provide data exchange options between a network and a device are leading to the trend of wearable technology.

Key Highlights

- The rising penetration rates of urbanization in various parts of the world have driven the demand for advanced, aesthetically appealing products that possess the ability to serve the consumers' requirements better, such as multiple features in one device and time schedules. Moreover, the vast millennial population across the globe has been quick to adopt smartwatches, owing to the increased spending ability on their regular work hours tracking and luxury standards.

- Machine learning and AI capabilities take skills to the next level, especially in the current healthcare industry. In support of this, IoT compatibles smart wearable sensors are also witnessing a decline in pricing, which leads to manufacturers offering smart wearable devices at a more affordable rate, thus, encouraging various industries to adopt products catered to their systems and operations. Additionally, there has been a significant increase in consumer smart wearable devices being sold over the past few years. Additionally, wearable sensor devices have emerged to be a significant part of the sports industry, thereby helping customers to stick to daily routines and providing crucial information regarding the different parameters it is programmed to monitor.

- Smart wearables are further witnessing a surge in the number of new users, including the older age population, owing to the fact that wearable makers, such as Apple and Fitbit, among others, are adding health-monitoring features that appeal to old age people and keep them updated about their health status in real-time.

- Although the adoption of wearables has been widely gaining traction over the past few years, the concern over data privacy persists. Even though data from smart wearables may be of little value to attackers, the risk increases for smart wearables like smartwatches. Risks are likely to increase further if the device comes with an LTE connection, as they can be operated away from the paired device.

- The COVID-19 outbreak and the lockdown restrictions across the globe have affected the consumer across the world. Some of the effects of lockdown include supply chain disruptions, lack of availability of raw materials used in the manufacturing process, labor shortages, fluctuating prices that could cause the production of the final product to inflate and go beyond budget, and shipping problems, among others.

Consumer Smart Wearable Market Trends

Incremental Technological Advancements Aiding the Market Growth

- Increasing disposable incomes and changing lifestyles have led to the demand for wearable technology. Demand from industries like military, sports and fitness, healthcare, and entertainment, among others., have also increased due to the increased functionality wearables offer in the era of IoT.

- This demand has been supported by new product launches and new entrants into the market. As more companies venture into the consumer smart wearables market, the need for differentiating their product offerings becomes essential. For instance, in June 2022, Ambraneannounced its portfolio expansion with the Wise Roam smartwatch series launch. The smartwatch is offered with Bluetooth calling and provides 100+ cloud-based watch faces and is IP68 water-resistant.

- The Wise Roam smartwatch has sensors for heart rate, blood pressure, SpO2, menstrual health, sleep, and other wellness metrics. Additionally, it offers breath training, weather forecasts, High AR Alert, and sedentary reminders. The smartwatch offers more than 60 different sports modes and the Da Fit software, which works with both Android and iOS devices. Additionally, the wristwatch can be linked to Apple Health and Google Fit.

- Companies like LG Chem and Panasonic have been instrumental in developing printable and flexible batteries that can power wearable devices. Using these flexible and sleek designs of the batteries, vendors in the market were able to utilize the additional space to add more components and improve battery capacity, which translates into longer battery life.

- The growing advancement and reduction in the size of sensors, especially pressure sensors and activators, also expanded the scope of the consumer smart wearables market. Many companies are investing in developing advanced MEMS and digital sensors, which are further decreasing their sizes, hence covering a wide range of market applications.

Asia Pacific is Expected to Register the Fastest Growth

- The government's support for making China one of the prominent innovation leaders compared to a low-cost manufacturing hub is also driving the market, as many Chinese companies are investing tremendously in research and development. For instance, KUMI successfully supplied 400 thousand smartwatches and moved internationally to compete in various markets, including India, the United States, Europe, and many Southeast Asian nations.

- Chinese companies are developing advanced technologies for the emerging market of wearable devices, such as fitness bands and smartwatches, with built-in connectivity. Device manufacturers, such as Xiaomi and Huawei, are very active in the market and are partnering with, as are online service providers, such as WeChat and mobile operators.

- In Japan, head-mounted displays (HMD) are becoming more advanced. An HMD, worn like a pair of goggles, projects video pictures directly in front of the user. Japanese firms have been producing HMD video entertainment systems with 3D capabilities one after the other. These systems combine computer graphics (CG), which Japan specializes in, with high-definition flat-panel display technology.

- According to the India Brand Equity Foundation (IBEF), the Indian appliances and consumer electronics (ACE) market is expected to register a 9% CAGR to reach INR 3.15 trillion (USD 48.37 billion) in 2022. This is expected to boost the consumer smart wearable market growth over the forecast period.

- Further, Asiatic FiberCorporation offers the iQmaxbrand of smart textiles, which aims to combine fiber with electronics to offer a functional, innovative product for use in apparel for a variety of markets. The iQmaxproduct line was developed with a lighting module, and it features an LED Yarn, a DC jack, and a two-in-one power battery and controller. The product line offers a textile for bendable, soft, lightweight, waterproof, and washable clothing that is also designed to endure folding over time.

Consumer Smart Wearable Industry Overview

The Global Consumer Smart Wearable Market is highly competitive. The market has gained a competitive edge in recent years. Additionally, the players are being taken to gain a competitive edge in this fast-growing market, mainly catering to the demand from the millennial generation population. The companies are introducing new offerings and continuously investing in making partnerships and acquisitions along with product development to increase the market share.

- April 2022 - VuzixCorporation signed a distribution agreement with RobotiquesCyborg, a France-based multi-national distributor of high-technology solutions. As a part of the agreement, Vuzixhas received and shipped against an initial USD 300,000 order from the new partner for its smart glasses.

- August 2021 - Lenovo and RealWearannounced an international collaboration to bring assisted reality solutions to enterprise customers. The combination of resources and technologies of both companies will enable customers to select, deploy and scale the required extended reality (XR) technologies globally. According to the collaboration, Lenovo has certified the RealWearHMT-1 devices to utilize its ThinkRealityplatform to expand frontline workers' access to optimized, hands-free 2D applications. Further, the company will offer RealWear'sHMT-1 family of assisted reality wearable devices through its international sales network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Value Chain Analysis

- 4.4 Impact of COVID-19 on the Consumer Smart Wearable Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Incremental Technological Advancements Aiding the Market Growth

- 5.2 Market Challenges

- 5.2.1 High Cost and Data Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Smartwatches

- 6.1.2 Head-mounted Displays

- 6.1.3 Smart Clothing

- 6.1.4 Ear Worn

- 6.1.5 Fitness Trackers

- 6.1.6 Body-worn Cameras

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.3.5 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vuzix Corporation

- 7.1.2 Lenovo

- 7.1.3 Transcend Information Inc.

- 7.1.4 GoPro Inc.

- 7.1.5 Sensoria Inc.

- 7.1.6 AIQ Smart Clothing Inc.

- 7.1.7 Axon Enterprise Inc.

- 7.1.8 Withings

- 7.1.9 Huami Corporation

- 7.1.10 Omron Healthcare Inc.

- 7.1.11 Nuheara Limited

- 7.1.12 Polar Electro Oy

- 7.1.13 Microsoft Corporation

- 7.1.14 Sony Corporation

- 7.1.15 Huawei Technologies Co. Ltd

- 7.1.16 Fitbit LLC

- 7.1.17 Fossil Group Inc.

- 7.1.18 Garmin Ltd

- 7.1.19 Samsung Electronics Co. Ltd

- 7.1.20 Apple Inc.