|

市場調查報告書

商品編碼

1690960

工程服務外包:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Engineering Services Outsourcing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

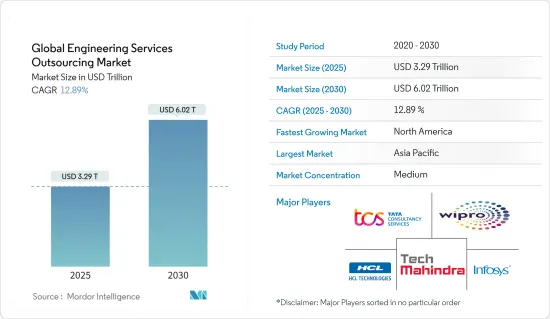

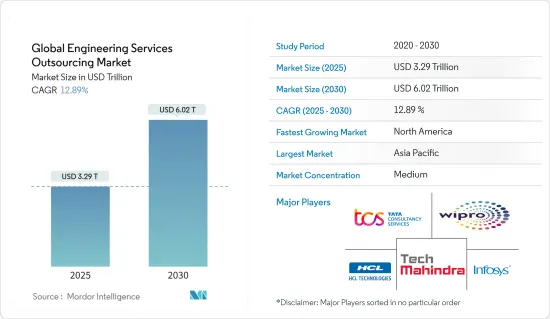

2025 年全球工程服務外包市場規模預估為 3.29 兆美元,預計到 2030 年將達到 6.2 兆美元,預測期間(2025-2030 年)的複合年成長率為 12.89%。

主要亮點

- 研發活動的全球化、對產品中最新技術整合的需求不斷成長、產品生命週期的縮短以及降低成本的需求不斷增加,預計將促進市場的成長。

- COVID-19 疫情及其後在世界各地實施的封鎖措施對終端產業和商業部門的影響各不相同。為了遏止疫情蔓延,工業設施、製造工廠和公共交通已暫時關閉。

- 隨著封城措施的放鬆、工業企業復工復產、海外貿易成長,工程服務外包產業從2021年第一季開始逐步復甦。

- 工程服務外包 (ESO) 日益普及的關鍵促進因素之一預計是目標商標產品製造商 (OEM) 與工程服務供應商(ESP) 之間合作的加強。

- 對於縮短產品生命週期和降低成本的需求不斷成長,以及對採用最新技術的產品選擇的需求不斷成長,都有望推動市場擴張。

- ESO 市場的持續成長是由消費者對外包各種服務作為節約成本措施的需求不斷成長所推動的。

- 近年來,由於自動化程度的提高、數位化的轉變以及工業 4.0 的採用,對自動化工程服務供應商的需求急劇增加。目前佔據市場 60% 以上佔有率的 CNC 工具機市場預計在預測期內將大幅成長。

- 電腦輔助設計(CAD)和繪圖是最外包的工程服務之一。這些服務包括組裝圖紙、繪製電子設計、使用軟體創建詳細圖紙以及將其轉換為 3D 或 2D 格式等任務。

工程服務外包市場趨勢

整合解決方案的採用日益增多推動了市場成長

- 工程系統分析和設計的整合解決方案的採用日益增多以及工業自動化的提高是推動市場成長的主要因素。此外,電腦輔助設計 (CAD)、電腦輔助工程 (CAE)、電腦輔助製造 (CAM) 和電子設計自動化 (EDA) 軟體等工程系統的日益廣泛使用也在推動市場成長。該軟體有助於提高生產過程的整體效率,使用者可以透過智慧型手機、筆記型電腦或平板電腦進行操作。

- 各種技術進步和數位轉型服務的採用也在推動成長。預計進一步推動市場發展的其他因素包括汽車、船舶和海上領域戰略外包服務的使用增加,以及 3D 列印解決方案市場的發展。

- 中小型工程服務供應商對外包工程服務的偏好日益增加;這些服務包括從概念設計到最終產品開發和檢驗的新產品介紹、流程工程、自動化、企業資產管理和整體業務流程增強。這有利於全球工程服務外包市場的良好成長。

- 處理無數種機械和設備的工業企業承擔著僱用大量勞動力來操作這些機械和設備的負擔。此外,與所有工人的協調變得非常複雜,特別是對於使用各種設備的公司(例如工程服務)。

- 對於這樣的公司來說,自動化是最好的解決方案,也是日益數位化的世界中前進的方向。自動化降低了成本並提高了工作品質。人類工人雖然高效,但容易犯錯,而自動化流程和操作可以幫助避免錯誤。

- 自動化也提高了人類的安全性。這些好處使得外包工業自動化服務變得值得。工業自動化服務為企業提供更好的基礎設施,最佳化效能,更有效地解決安全問題,並最終提高生產力。

數位轉型服務與各種技術發展

- 推動工程服務外包市場的關鍵因素是由於行動性和智慧產品等顛覆性技術的出現,各個垂直產業的技術整合日益增強。業務範圍橫跨各行業領域的 ESP 在採用不相關行業的最佳實踐和技術方面具有優勢。

- 過去十年,人工智慧、物聯網、數位孿生等數位技術迅速發展。新冠肺炎疫情引發跨產業、跨區域的數位化浪潮。此次疫情及其後果成為加速企業數位轉型進程的催化劑。

- 它推動了數位化推動器的採用,這些推動器有可能透過快速的產品開發、企業範圍的連接、客戶體驗再造和卓越的營運來最佳化汽車和航太等工業領域的工程流程。隨著技術採用的緩慢讓位給數位化的快速加速,全球企業正在逐步適應新的生態系統。

- 隨著科技的民主化和5G網路的出現,數位工程能力正在加速發展。例如在航太工業中,數位化使飛機的組裝時間減少了95%,同時提高了品質。疫情期間數位協作工具的興起,使去中心化成為工程服務外包的另一個成長方向。工程服務供應商和OEM之間日益加強的合作以及研發活動的全球化正在推動外包活動。

- 轉向工程服務供應商(ESP) 來支援核心工程業務導致了境外外包力度的增加,尤其注重技術支援的遠端產品開發等活動。在外包方面,透過建立結合原始設備OEM、供應商和純軟體參與者的角色和專業知識的產業合作,核心活動和非核心活動之間的界線變得模糊。

- 回顧過去二十年工程服務的轉型,技術成長的角色怎麼強調也不為過。僅在過去幾年裡,工程密集型領域就見證了物聯網、雲端、數位雙胞胎分析、擴增實境(AR/VR)和人工智慧等支援技術的湧現。

- 在歐洲,整個產業都出現了自動化、分析、網路安全和服務化等趨勢。隨著生產車間透過其控制系統產生大量資料,越來越多的公司意識到利用這些資訊做出複雜、明智決策的好處。 IIoT 透過機器對機器 (M2M) 系統、AI、邊緣分析和可託管整個 PLM/MES 系統的雲端解決方案等技術使這一目標成為可能。

工程服務外包產業概況

全球工程服務外包市場分散且競爭激烈。近十餘年來,全球各工程公司之間的併購與聯盟成為一大趨勢,幫助它們在市場上站穩腳步。與新興企業新興企業(包括製造業新創公司)和其他產業生態系統參與者的合作有望為工程服務外包市場的成長提供新的機會。該公司在研發業務方面投入了大量資金,並專注於為客戶提供客製化服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場洞察

- 當前市場狀況

- 科技趨勢

- 產業價值鏈分析

- 政府法規和舉措

- 成本會計見解

- COVID-19 市場影響

第5章 市場動態

- 驅動程式

- 限制因素

- 機會

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/購買者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第6章 市場細分

- 按服務

- 設計

- 原型製作

- 系統整合

- 測試

- 其他

- 按最終用戶

- 車

- 產業

- 家電和半導體

- 電訊

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 印尼

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Tech Mahindra Limited

- Tata Consultancy Services Limited

- Infosys Limited

- HCL Technologies Limited

- Wipro Ltd.

- Capgemini Technology Services India Limited

- Globallogic Inc.

- Accenture

- RLE International Inc.

- ASAP Holding GmbH

- Tata Technologies*

第 8 章:市場的未來

第 9 章 附錄

The Global Engineering Services Outsourcing Market size is estimated at USD 3.29 trillion in 2025, and is expected to reach USD 6.02 trillion by 2030, at a CAGR of 12.89% during the forecast period (2025-2030).

Key Highlights

- The globalization of R&D activities, the rising demand for integrating the latest technologies in product offerings, and the growing need to shorten the product lifecycles and cut costs are expected to contribute to the growth of the market.

- The impact of the outbreak of the COVID-19 pandemic and the subsequent lockdowns in various countries across the world varied depending on the end-use industries and industry verticals. Industrial facilities, manufacturing plants, and public transport were shut down temporarily as part of the efforts to arrest the spread of the disease.

- Due to the ease of lockdown restrictions, the reopening of industrial firms, and increased foreign trade, the Engineering Services Outsourcing sector began progressively recovering from the first quarter of 2021.

- One of the primary drivers of the expanding popularity of engineering services outsourcing (ESO) is expected to be the growing cooperation between Original Equipment Manufacturers (OEM) and Engineering Service Providers (ESP).

- The increasing need to shorten product lifecycles and cost-cutting and the rising desire for product options that incorporate the most outdated technology are all expected to support market expansion.

- The increasing desire among consumers to outsource various services as a part of cost-cutting initiatives has led to continuous growth in the ESO market.

- Due to increased automation, a move toward digitalization, and the adoption of Industry 4.0, the need for automated Engineering Service Providers has risen dramatically in recent years. The market for CNC machines, which currently accounts for more than 60% of the market, is expected to grow significantly over the forecast period.

- Computer-aided design (CAD) and drafting are among the most outsourced engineering services. Tasks such as assembling drawings, drafting electronic blueprints, and creating detailed illustrations using software and converting to 3D or 2D formats, are included in these services.

Engineering Services Outsourcing Market Trends

Rising Adoption of Integrated Solutions Driving the Growth of the Market

- Increasing industrial automation, along with the rising adoption of integrated solutions for analyzing and designing engineering systems, represents one of the key factors driving the growth of the market. Furthermore, the widespread utilization of engineering systems, such as computer-aided design (CAD), computer-aided engineering (CAE), computer-aided manufacturing (CAM), and electronic design automation (EDA) software, is also driving market growth. This software aid in enhancing the overall efficiencies of the production processes and can be operated by the user over smartphones, laptops, and tablets.

- Various technological advancements and the incorporation of digital transformational services are acting as other growth-inducing factors. Other factors, including the increasing utilization of strategic outsourcing services by the automotive, marine, and offshore sectors, along with the development of 3D printing solutions, are expected to drive the market further.

- There is a rise in preference for the outsourcing of engineering services among small and medium-sized engineering service providers, these services include, new product induction from conceptual design to final product development and validation, process engineering, automation, enterprise asset management, and overall business process enhancement. This attributes to witness lucrative growth of the global engineering services outsourcing market.

- Industrial firms that handle countless types of machinery and equipment have the burden of hiring a considerable workforce to operate them. It also gets very complicated to coordinate with all the workers, especially for companies that work with different equipment like engineering services.

- For such companies, automation is the best solution and way to advance in an increasingly digitized world.Automation reduces costs and enhances the quality of work. While human workers are efficient, they're prone to making errors that can be avoided when one automates the processes and operations.

- Automation also offers increased human safety. All these benefits make it worthwhile to outsource industrial automation services.Industrial automation and control services that empower companies to have better infrastructure and optimize their performance, address safety concerns more efficiently, and ultimately increase productivity.

Various Technical Developments Along With Digital Transformational Services

- A key factor behind the engineering services outsourcing market is the quantum of technological convergence across varied verticals due to the advent of disruptive technologies like Mobility and Smart Products, which are driving customers to a more connected world. ESPs with a footprint across industry segments are better positioned to adopt best practices and technologies from unrelated industries.

- Digital technologies such as AI, IoT, and digital twins have rapidly grown over the last decade. The onset of COVID-19 gave rise to waves of digitalization that swept across industries and geographies. The pandemic and its subsequent impact have catalyzed enterprises accelerating their digital transformation journeys.

- It boosted the adoption of digital enablers that have the potential to optimize engineering processes across industrial sectors like automotive and aerospace through rapid product development, enterprise-wide connectivity, re-engineering of customer experiences, and operational excellence. With the slow uptake of technology being replaced by rapid digital acceleration, global players are gradually adapting to the new ecosystem.

- Digital engineering capabilities are being accelerated by the democratization of technology and the advent of 5G networks. For example, in the aerospace industry, digitalization reduces fuselage splice times by 95% at a higher quality. The rise of digital collaboration tools during the pandemic has introduced decentralization as another growth vector for outsourcing engineering services. Increasing collaboration between engineering service providers and OEMs and the globalization of R&D activities have increased outsourcing activities.

- The growing involvement of engineering services providers (ESPs) in supporting core engineering practices has reinforced offshoring efforts with a particular focus on activities like remote product development using technologies. When it comes to outsourcing, the blurring of the line between core and non-core activities has been marked by establishing industry-wide collaboration frameworks that combine the role and expertise of OEMs, suppliers, and pure software players.

- When considering the transformation of engineering services during the last twenty years, the role of technological growth cannot be overstated. In the past few years alone, engineering-intensive sectors have witnessed the advent of enablers like IoT, cloud, digital twins, analytics, extended realities (AR/VR), and AI.

- In Europe, automation, analytics, cybersecurity, and servitization are some trends observed across industries. With the manufacturing shop floor generating incredible volumes of data through control systems, more and more organizations realize the benefit of harnessing this information to make complex and informed decisions. IIoT has enabled this with technologies like machine-to-machine (M2M) systems, AI, edge analytics, and cloud solutions capable of hosting entire PLM/MESsystems.

Engineering Services Outsourcing Industry Overview

Global Engineering Services Outsourcing Market is fragmented and competitive. A significant trend of mergers and alliances of various global engineering firms has been seen over the past decade to increase foothold in the market. Partnerships with start-up companies including manufacturing start-ups and other industry ecosystem players are expected to provide new opportunities for the growth of the Engineering Services Outsourcing Market. Companies are extensively investing in R&D operations and are focusing on providing customized services to their customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Government Regulations and Initiatives

- 4.5 Insights on Costing

- 4.6 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION (Market Size by value)

- 6.1 By Services

- 6.1.1 Designing

- 6.1.2 Prototyping

- 6.1.3 System Integration

- 6.1.4 Testing

- 6.1.5 Others

- 6.2 By End User

- 6.2.1 Automotive

- 6.2.2 Industrial

- 6.2.3 Consumer Electronics And Semiconductors

- 6.2.4 Telecom

- 6.2.5 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Thailand

- 6.3.3.6 Indonesia

- 6.3.3.7 Rest of Asia-pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Tech Mahindra Limited

- 7.2.2 Tata Consultancy Services Limited

- 7.2.3 Infosys Limited

- 7.2.4 HCL Technologies Limited

- 7.2.5 Wipro Ltd.

- 7.2.6 Capgemini Technology Services India Limited

- 7.2.7 Globallogic Inc.

- 7.2.8 Accenture

- 7.2.9 RLE International Inc.

- 7.2.10 ASAP Holding GmbH

- 7.2.11 Tata Technologies*