|

市場調查報告書

商品編碼

1430500

AC馬達:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)AC Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

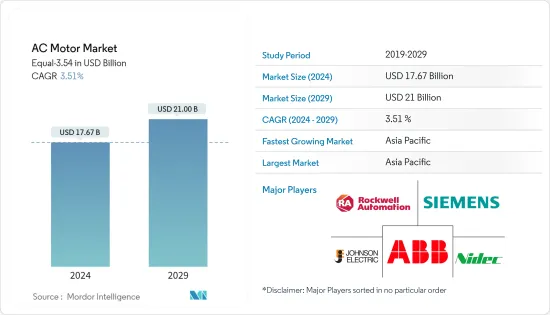

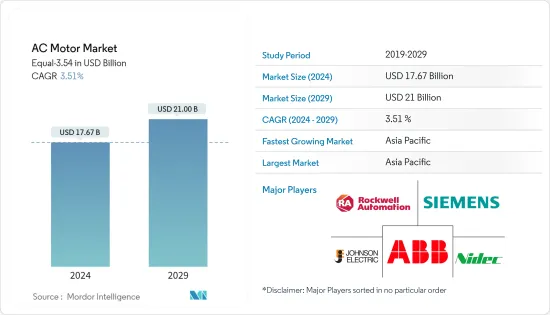

AC馬達市場規模預計到 2024 年為 176.7 億美元,預計到 2029 年將達到 210 億美元,在預測期內(2024-2029 年)年複合成長率為 3.51%。

主要亮點

- AC馬達AC馬達是利用電磁感應現象將交流電轉換為機械能的馬達。交流電驅動該馬達。定子和轉子是交流馬達最重要的部件。定子是馬達的靜止部分,轉子是馬達的旋轉部分。AC馬達有兩種類型:單相和三相。

- 三相AC馬達主要在工業上用於大容量電能到機械能的轉換。單相交流AC馬達主要用於小功率轉換。單相交流AC馬達幾乎很小,可以在家庭、辦公室、商業關係、工廠等場所提供多種服務。單相交流馬達用於大多數電器產品,例如冰箱、電風扇、洗衣機、烘乾機和攪拌機。

- 電動車的普及預計將在預測期內支持市場成長。多年來,汽車業的日產汽車銷量大幅成長。根據國際汽車工業協會(OICA)統計,去年全球汽車產量約8,500萬輛,較與前一年同期比較成長6%。中國、日本和德國是去年最大的汽車和商用車生產國。

- AC馬達將各種其他組件整合到一個物理單元中。典型配置包括引擎和驅動器、整合編碼器、控制器、電纜和通訊埠。這增加了整個系統的成本。AC馬達所需的資本投資高於其他傳統馬達,這給市場成長帶來了挑戰。

- COVID-19全球大流行對市場的影響是巨大的,多個國家政府實施的門鎖等各種遏制措施對工業部門的成長產生了重大影響。因此,供應鏈問題減緩了所研究市場的成長,尤其是在早期階段。然而,隨著主要最終用戶行業滿載恢復營運,對智慧AC馬達的需求預計將在 COVID-19 之後成長。

AC馬達市場趨勢

石油和天然氣產業佔主要市場佔有率

- 石油和天然氣產業作為市場成長的驅動力發揮重要作用。AC馬達因其簡單、可靠且經濟實惠而廣泛應用於該行業。AC馬達為鑽機系統和設備提供可靠、穩定的動力,在石油和天然氣產業中發揮至關重要的作用。這些馬達產生促進原油、天然氣和石油等寶貴資源的開採、加工、儲存和運輸所需的能量。感應馬達和同步發電機用於為陸上和海上鑽井作業的各種應用提供電力。

- 石油和天然氣產業對AC馬達的需求不斷成長,因為人們越來越關注惡劣運行環境下的能源效率和可靠性。此外,交流馬達還提供卓越的速度控制和監控功能。交流電動在陸上石油和天然氣工業流程中的採用顯著增加,因為它們能夠在不同的環境條件下有效運行,並且與其他類型的馬達相比具有更長的生命週期。

- 額定電壓低於 1 kV 的交流馬達經常用於小型設備,例如石油和天然氣設施中的泵浦、風扇、鼓風機和小型壓縮機。AC馬達電壓為1kV至6.6kV以及6.6kV以上的AC馬達廣泛應用於石油和天然氣產業的中高功率應用。這些馬達常見於大型壓縮機、發電機、泵浦和其他重型設備中。額定電壓6.6kV以上的交流馬達具有幾個顯著的特點,包括增加功率輸出、提高效率和提高過載能力。

- 國際能源總署(IEA)最新預測顯示,即使當前政策設定到位,全球石油和天然氣需求也將在未來幾年達到頂峰。 IEA 預測,10 年內全球需求將增加約 800 萬桶/日,增加了對海上活動的需求。由於海上作業和投資的增加,預計對AC馬達的需求將激增。這些馬達用於各種海上應用,包括鑽機、生產平台、浮式生產儲油卸油設備(FPSO) 船、海底系統和其他海上設備。

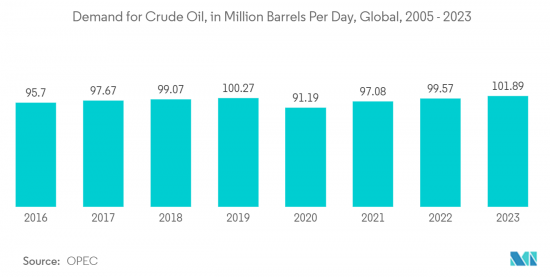

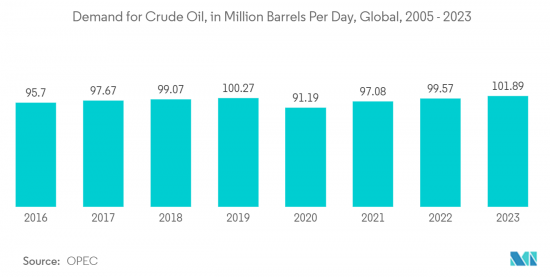

- 此外,根據歐佩克報告,近期全球原油消費量(包括生質燃料)為每天9,957萬桶。預計未來幾年將增加至1.0189億桶/日,最終達到1.098億桶/日。輕質石油和天然氣需求預計將從 2,760 萬桶/天增加到 3,010 萬桶/天。這些因素可能會推動工業界對AC馬達的需求。

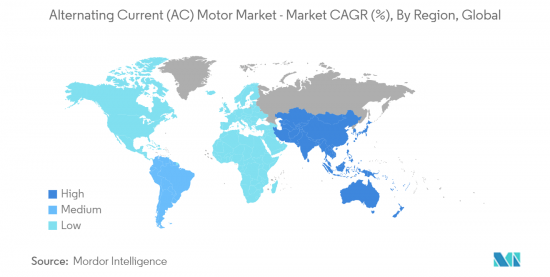

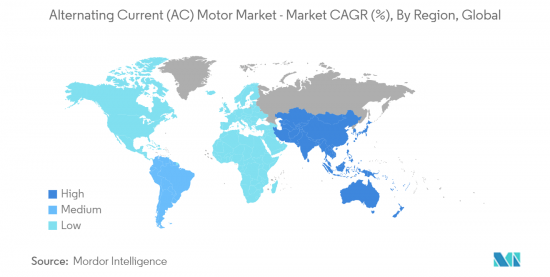

亞太地區預計將出現顯著成長

- 中國正在經歷快速工業化和製造業、汽車、電子等各領域的發展。AC馬達廣泛應用於泵浦、壓縮機、輸送機和風扇等工業機械和設備,推動了對AC馬達的需求。

- 中國專注於高階製造業、電力公共事業和石油天然氣產業,低壓和中壓變頻器均在該國使用。例如,中國政府雄心勃勃的「中國製造2025」舉措部分受到德國工業4.0的啟發,旨在提高中國製造業的競爭力。

- 印度預計將在全球AC馬達市場中佔據主要佔有率。該國市場的推動因素是製造業對馬達的需求不斷成長以及能源效率意識的提高。能源成本的馬達在各行業的採用。由於印度有許多馬達製造商,預計該國在預測期內將保持重要的市場佔有率。

- 日本政府積極努力減少碳排放,並推出了支持性政策,鼓勵工業界採用節能解決方案。這進一步增加了AC馬達在交通和工業自動化等廣泛行業中的採用。

- 透過工業4.0策略,日本實現了亞太地區自動化工業經濟的重大轉型,並成為向亞太地區其他區域市場供應工廠自動化產品的製造中心。

- 根據國土交通省的報告,截至去年5月,電動車(EV)約佔韓國汽車市場的1.8%。韓國政府設定的目標是在未來幾年內將電動和氫動力車在新車銷售的比例提高到33%。電動車領域新興市場的開拓將為廠商投資製造設備提供重大機遇,並有望成為市場驅動力。

AC馬達產業概況

交流 (AC)馬達市場高度分散,主要參與者包括羅克韋爾自動化公司、西門子公司、德昌電機、日本電產公司和 ABB 有限公司。市場參與者正在採取聯盟和收購等策略來加強其產品陣容並獲得永續的競爭優勢。

- 2023 年 9 月 - 羅克韋爾自動化公司和 Infinitum 宣布達成獨家協議,共同開發和行銷新型高效能整合電壓驅動和馬達技術類別。該解決方案使世界各地的工業客戶能夠顯著節省能源並降低成本,同時提高永續性並減少碳排放。

- 2023 年 5 月 - 西門子董事會核准將齒輪馬達和低壓業務(包括相關客戶服務業務)分拆至西門子股份公司的完全子公司西門子大型傳動印度有限公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 高能源效率的需求不斷增加

- 工業自動化的興起

- 市場挑戰

- 初始成本高

第6章市場區隔

- 感應交流AC馬達

- 單相

- 多態性

- 同步交流AC馬達

- 直流勵磁轉子

- 永久磁鐵

- 磁滯馬達

- 磁阻馬達

- 按最終用戶產業

- 油和氣

- 化學/石化

- 發電

- 用水和污水

- 金屬/礦業

- 食品與飲品

- 離散製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 義大利

- 法國

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 北美洲

第7章 廠商排名分析

第8章 競爭形勢

- 公司簡介

- Rockwell Automation Inc.

- Siemens AG

- Johnson Electric

- Nidec Corporation

- ABB Ltd.

- Franklin Electric Co.Inc.

- WEG Electric Corporation

- Yaskawa Electric Corporation

- Kirloskar Electric Co. Ltd.

- Bosch Rexroth AG(ROBERT Bosch GMBH)

- Regal Rexnord Corporation

- SEVA-tec GmbH

第9章投資分析

第10章投資分析市場的未來

The AC Motor Market size is estimated at USD 17.67 billion in 2024, and is expected to reach USD 21 billion by 2029, growing at a CAGR of 3.51% during the forecast period (2024-2029).

Key Highlights

- An AC motor is an electric motor that converts the alternating current into mechanical power using an electromagnetic induction phenomenon called an AC motor. An alternating current drives this motor. The stator and the rotor are the two most essential parts of an AC motor. The stator is the stationary part of the motor, and the rotor is the rotating part of the motor. The AC motor may be single-phase or three-phase.

- Three-phase AC motors are primarily applied in the industry for bulk power conversion from electrical to mechanical. Single-phase AC motors are mainly used for small power conversion. Single-phase AC motors are nearly small and provide various services in the home, office, business concerns, factories, etc. Almost all domestic appliances, such as refrigerators, fans, washing machines, hair dryers, mixers, etc., use single-phase AC motors.

- The growing adoption of electric vehicles is expected to support the market growth during the forecast period. The automotive sector witnessed a significant increase in daily units produced over the years. According to the International Organization of Motor Vehicle Manufacturers (OICA), in the previous year, approximately 85 million motor vehicles were produced worldwide, an increase of 6% compared to the year before it. China, Japan, and Germany were the largest producers of cars and commercial vehicles last year.

- AC motor integrates various other components into one physical unit. Standard configurations include the engine and drive, integrated encoders, controllers, cabling, and communication ports. This increases the overall cost of the system. The capital investment required for AC motors is greater than that required for other traditional motors, posing a challenge to the market's growth.

- A notable impact of the global outbreak of COVID-19 has been observed on the market as various containment measures taken by governments across multiple countries, such as the implementation of lockdown, significantly impacted the growth of the industrial sector. As a result, a slowdown was witnessed in the studied market, especially during the initial phase, due to supply chain issues. However, with significant end-user industries resuming operations at total capacity, the demand for smart AC motors is anticipated to grow post-COVID-19.

AC Motor Market Trends

Oil and Gas Industry to Hold Major Market Share

- The oil and gas industry plays a significant role in driving market growth. AC motors are extensively utilized within this industry due to their simplicity, reliability, and affordability. Electric AC motors play a crucial role in the oil and gas industry by delivering dependable and steady power to drill rig systems and equipment. These motors generate the necessary energy to facilitate the extraction, processing, storage, and transportation of valuable resources such as crude oil, natural gas, and petroleum. Induction motors and synchronous generators are employed to supply power for a wide range of applications in both onshore and offshore drilling operations.

- The rising demand for AC motors in the oil and gas sectors can be attributed to the growing emphasis on energy efficiency and reliability in challenging operational environments. Moreover, AC electric motors provide exceptional speed control and monitoring capabilities. The adoption of AC electric motors in onshore oil and gas industrial processes has witnessed a substantial increase owing to their ability to operate effectively in diverse environmental conditions and exhibit longer life cycles compared to alternative motor types.

- AC electric motors with a voltage rating below 1 kilovolt (kV) are frequently utilized in smaller equipment such as pumps, fans, blowers, and smaller compressors within oil & gas facilities. AC electric motors with a voltage rating ranging from 1 kV to 6.6 kV, as well as those exceeding 6.6 kV, are extensively employed in medium to high-power applications within the oil & gas industry. These motors are commonly found in larger compressors, generators, pumps, and other heavy-duty equipment. AC electric motors with a voltage rating exceeding 6.6 kV possess several notable characteristics, including increased power output, enhanced efficiency, and improved overload capacity.

- According to the International Energy Agency (IEA), the latest projections indicate that global demand for oil and gas will reach its peak in the coming years, even with the current policy settings in place. The IEA anticipates that global demand will rise by approximately eight million barrels per day (bpd) by the end of the decade, leading to an increased need for offshore activities. As a result of this growth in offshore operations and investments, there is an expected surge in demand for AC motors. These motors are utilized in various offshore applications, such as drilling rigs, production platforms, floating production storage and offloading (FPSO) vessels, subsea systems, and other offshore equipment.

- Furthermore, as per OPEC's report, the worldwide consumption of crude oil (including biofuels) recently stood at 99.57 million barrels per day. It is estimated to rise to 101.89 million barrels per day in the coming years and eventually reach 109.8 million barrels per day. Diesel and gas oil demand is forecasted to amount to 30.1 million barrels per day, up from 27.6 million barrels. Such factors will encourage the demand for AC motors in the industry.

Asia-Pacific Expected to Witness Significant Growth

- China has been witnessing rapid industrialization and development across various sectors, such as manufacturing, automotive, and electronics. AC motors are widely used in industrial machinery and equipment for applications such as pumps, compressors, conveyors, and fans, driving the demand for AC motors.

- China has been focusing on high-end manufacturing industries, power utilities, and oil & gas industries, boosting the usage of both low and medium-voltage drives in the country. For instance, the Chinese government's ambitious 'Made in China 2025' initiative, partially inspired by Germany for Industry 4.0, aims to boost the country's competitiveness in the manufacturing sector.

- India is expected to hold a significant global AC Motor Market share. The country's market is driven by rising demand for electric motors in manufacturing industries and rising awareness about energy efficiency. Also, the rising energy costs are expected to accelerate the adoption of synchronous electric motors in various industries. Due to the presence of many electric motor manufacturers in India, the country is expected to maintain a considerable market share during the forecast period.

- Japanese government's proactive approach to reducing carbon emissions has led to supportive policies that encourage industries to embrace energy-efficient solutions. This has further increased the adoption of AC motors in a wide range of industries, including transportation and industrial automation.

- Japan has been significantly transforming into an automated industrial economy in Asia-Pacific through its Industrial version 4.0 strategies, and the country has emerged as a manufacturing hub for factory automation products and supplies to other regional markets in the Asia-Pacific region.

- As of May last year, Electric vehicles (EVs) represented approximately 1.8% of the South Korean automobile market, as the Ministry of Land, Infrastructure and Transport reported. The government of South Korea has set a target to raise the proportion of electric and hydrogen vehicles in new vehicle sales to 33% in the coming years. Such developments in the EV sector will create significant opportunities for the vendor to invest in manufacturing facilities, thereby driving the market.

AC Motor Industry Overview

The Alternating Current(AC) Motor Market is highly fragmented, with the presence of major players like Rockwell Automation Inc., Siemens AG, Johnson Electric, Nidec Corporation, and ABB Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- September 2023 - Rockwell Automation, Inc. and Infinitum announced an exclusive agreement to jointly develop and distribute a new high-efficiency, integrated voltage drive and motor technology class. This solution would significantly save energy and cut costs for industrial customers globally while helping them become more sustainable and reduce their carbon footprint.

- May 2023 - Siemens Ltd's board approved the divestiture of its geared motors and low voltage business, including related customer service operations, to Siemens Large Drives India Pvt. Ltd, a wholly-owned subsidiary of Siemens AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 and other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for High Energy Efficiency

- 5.1.2 Rise in Industrial Automation

- 5.2 Market Challenges

- 5.2.1 High Initial Cost

6 MARKET SEGMENTATION

- 6.1 Induction AC Motors

- 6.1.1 Single Phase

- 6.1.2 Poly Phase

- 6.2 Synchronous AC Motors

- 6.2.1 DC Excited Rotor

- 6.2.2 Permanent Magnet

- 6.2.3 Hysteresis Motor

- 6.2.4 Reluctance Motor

- 6.3 By End-user Industry

- 6.3.1 Oil and Gas

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Power Generation

- 6.3.4 Water and Wastewater

- 6.3.5 Metal and Mining

- 6.3.6 Food and Beverage

- 6.3.7 Discrete Industries

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 Italy

- 6.4.2.4 France

- 6.4.2.5 Russia

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 South Korea

- 6.4.3.5 Australia and New Zealand

- 6.4.3.6 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 VENDOR RANKING ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Rockwell Automation Inc.

- 8.1.2 Siemens AG

- 8.1.3 Johnson Electric

- 8.1.4 Nidec Corporation

- 8.1.5 ABB Ltd.

- 8.1.6 Franklin Electric Co.Inc.

- 8.1.7 WEG Electric Corporation

- 8.1.8 Yaskawa Electric Corporation

- 8.1.9 Kirloskar Electric Co. Ltd.

- 8.1.10 Bosch Rexroth AG (ROBERT Bosch GMBH)

- 8.1.11 Regal Rexnord Corporation

- 8.1.12 SEVA-tec GmbH