|

市場調查報告書

商品編碼

1408616

英國資料中心冷卻:市場佔有率分析、產業趨勢與統計、2024-2030 年成長預測Uk Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

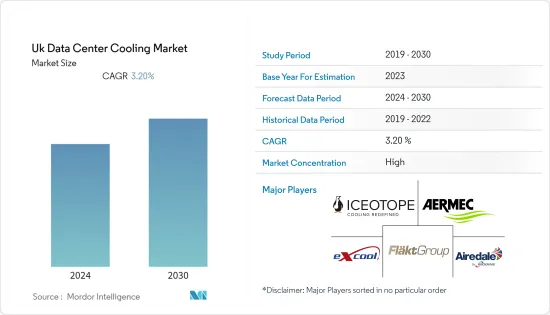

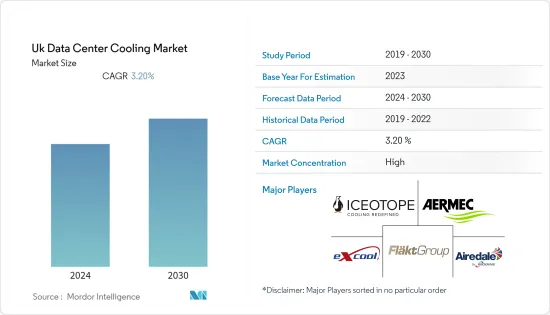

上年度,英國資料中心冷卻市場規模達到 9.221 億美元,預計在預測期內複合年成長率為 3.2%。

主要亮點

- 資料中心設計公司開始考慮過去的天氣資訊已經過時,並依賴預測的未來溫度。根據世界氣象組織 (WMO) 的數據,從現在到 2026 年,日本有 93% 的可能性將經歷創紀錄的高溫。大型資料中心通常有數千加侖的水可供冷卻。這些因素顯示市場需求旺盛。

- 英國資料中心市場未來IT負載容量預計到2029年將達到3,600MW。預計到 2029 年,該國的占地面積將增加到 1,780 萬平方英尺。

- 到2029年安裝的機架總數預計將達到88萬個。預計到 2029 年,倫敦將安裝最多的機架。

- 有近 58 個海底電纜系統連接英國,其中許多正在建設中。其中之一是2Africa,計劃於2023年開始服務,將是一條橫跨超過45,000公里的海底電纜,將從英國布德卸載。

英國資料中心冷卻市場趨勢

IT和電訊佔很大佔有率

- 通訊業旨在監督和推動數位轉型,並將其製度化,作為數位經濟和社會發展的基礎。電訊業佔英國GDP的4%至5%,在國家經濟和社會福祉中扮演重要角色。 2021 年,英國居民在行動網路上撥打的電話時間約為 1,870 億分鐘,而固定網路上的通話時間約為 400 億分鐘。

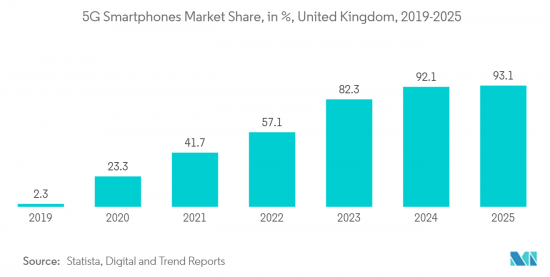

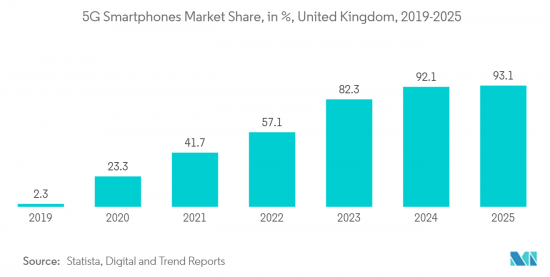

- 產業研究顯示,考慮升級的智慧型手機用戶比例正在增加,超過 35% 的人計劃在 2022 年升級到 5G,而 2019 年這一比例還不到 28%。由於 5G 用戶平均消耗的行動資料是 4G 用戶的 2.7 倍,因此預計將出現資料流量擁塞。總體而言,隨著流量的增加,由於高功耗以及對低碳排放的關注,通訊資料中心對冷卻解決方案的需求不斷增加。

- 2021 年 3 月,資料中心 IT 設備浸沒式冷卻解決方案的領先供應商 Green Revolution Cooling (GRC) 被選入 Essentia Trading Limited 的零碳交付框架 (ZCF)。這項策略包容性將使電信業者能夠獲得永續和綠色基礎設施投資,並簡化採用低碳和零碳技術解決方案的流程。

- 在研發方面,英國電信創新網路 (UKTIN) 充當獲取研發資金和測試設施的聯絡點。該技術被認為對英國政府的 2.5 億英鎊(3.425 億美元)策略至關重要,該策略旨在降低尋求進入英國電訊供應鏈的公司的壁壘,從而增加競爭並提高產品品質。這將促使資料量呈指數級成長,從而顯著增加交通堵塞和資料中心冷卻需求。

液冷保持大幅成長

- 在英國,資料中心嚴重依賴水來調節和維持內部溫度,特別是那些使用傳統冷卻塔系統的資料中心,與更有效率的混合或絕熱系統相比,高度依賴。

- 液體的熱容量比空氣高得多,而水的熱效率是空氣的 4,000 倍。機架密度估計超過 50kW,與風冷站點相比,該技術提供了提高資料中心整體能源效率的機會。

- 科技巨頭營運的超大規模資料中心經常使用大量的水。 Google 已簽署一份契約,保證為一個資料中心每天提供 100 萬加侖的冷卻量。由於其規模龐大,有空間增加冷卻能力以適應不斷上升的溫度。

- 英國數千個泳池目前面臨能源問題。深綠安裝了一套28kW的系統,為雲端用戶提供HPC集群。該技術以 Deep Green 的浸入式冷卻浴為藍本,利用油吸收伺服器的熱量,並透過熱交換器循環以加熱水池。 Deep Green 將為埃克斯茅斯休閒中心提供免費熱量,同時支付其消耗的電費。

- 該地區正在進行多項推出、聯盟、合作夥伴關係和創新活動,以增加資料中心的浸入式冷卻技術。 2023 年 3 月,一個被稱為「數位鍋爐」的小型邊緣資料中心將用於提供加熱德文郡埃克斯茅斯休閒設施游泳池所需的部分能源。

- 此外,隨著雲端儲存的使用逐年擴大,對液體資料中心冷卻系統的需求也可能增加。谷歌和微軟等雲端儲存公司正在擴大該國的儲存容量,以實現更有效率的雲端工作流程,這可能會促使對液體冷卻的強勁需求。

英國資料中心冷卻產業概述

英國資料中心冷卻市場的主要企業,近年來這些參與者的競爭變得更加激烈。該領域著名的市場領導包括 Iceotope Technologies Limited、Aermec SPA 和 FlaktGroup Holding GmbH。這些行業領導者擁有巨大的市場佔有率,正在積極努力擴大其在全部區域的基本客群。他們的成長策略主要依賴旨在增加市場佔有率和整體盈利的策略合作。

2022 年 3 月,江森自控宣布推出業界首個超大規模資料中心平台,由其 Silent Air 解決方案提供支持,專門為幫助雲端供應商實現其永續性目標而量身定做。江森自控的資料中心解決方案平台提供了廣泛的創新解決方案來節約水資源和減少能源消耗。這些解決方案包括風冷式冷卻器、液體冷卻系統、組合空氣處理機組、面向未來的環保冷媒、預製模組化資料中心等。這一發展代表著朝著促進資料中心冷卻行業的永續性和效率邁出的重要一步。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 電信和雲端運算促使數位資料量增加

- 可可再生資料中心的出現

- 市場抑制因素

- 適應要求和停電

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 影響評估

第5章市場區隔

- 冷卻技術

- 風冷

- 液基冷卻

- 蒸發冷卻

- 最終用戶

- 資訊科技/通訊

- BFSI

- 政府機關

- 媒體與娛樂

- 其他最終用戶

第6章 競爭形勢

- 公司簡介

- Iceotope Technologies Limited

- Aermec SPA

- FlaktGroup Holding GmbH

- Excool Ltd.

- Airedale International Air Conditioning Ltd

- STULZ UK Ltd

- Rittal GMBH & Co.KG

- Mitsubishi Electric Corporation

- Johnson Controls International PLC(York International)

- Schneider Electric SE

- Daikin Applied(UK)Ltd

- EcoCooling Ltd

- Green Revolution Cooling Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The United Kingdom data center cooling market reached a value of USD 922.1 million in the previous year, and it is further projected to register a CAGR of 3.2% during the forecast period.

Key Highlights

- Data center design companies are starting to consider the historical weather information outmoded and beginning to use projected future temperatures. The World Meteorological Organization (WMO) says there is a 93% chance that one year between now and 2026 will be the hottest on record in the country. Major data centers often have thousands of gallons of water at their disposal for cooling. Such a factor indicates major market demand.

- The upcoming IT load capacity of the United Kingdom data center market is expected to reach 3,600 MW by 2029. The country's construction of raised floor area is expected to increase to 17.8 million sq. ft by 2029.

- The country's total number of racks to be installed is expected to reach 880K units by 2029. London is expected to house the maximum number of racks by 2029.

- There are close to 58 submarine cable systems connecting the United Kingdom, and many are under construction. One such submarine cable that is estimated to start service in 2023 is 2Africa, which stretches over 45,000 km with landing points from Bude, United Kingdom.

Uk Data Center Cooling Market Trends

IT and Telecom to Hold Significant Share

- The telecommunications industry is looking toward institutionalization to supervise and promote digital transformation, making the process a foundation for developing the digital economy and society. The telecom industry contributes 4-5% of the UK's GDP and plays a vital role in the economic and social well-being of the country. In 2021, inhabitants of the UK made around 187 billion minutes worth of calls over mobile networks compared to about 40 billion minutes over fixed networks.

- As per industry surveys, the percentage of smartphone users looking to upgrade is increasing, with more than 35% intending to upgrade to 5G as of 2022 compared to less than 28% as of 2019. 5G users, on average, consume up to 2.7x more mobile data compared to 4G users, which is expected to increase data traffic congestion. Overall, with increasing traffic, the demand for cooling solutions is increasing in the telecom data center due to high power consumption along with a focus on low carbon emission.

- In March 2021, Green Revolution Cooling (GRC), a leading provider of immersion cooling solutions for data center IT equipment, secured a spot in the Essentia Trading Limited Zero Carbon Delivery Framework (ZCF). This strategic inclusion empowers telecommunications companies to access sustainable and environmentally friendly infrastructure investments, streamlining the process of adopting low and zero-carbon technology solutions.

- In terms of R&D, the UK Telecoms Innovation Network (UKTIN) acts as an information point to access funding or testing facilities for R&D. The technology is considered crucial to the government's GBP 250 million (USD 342.5 million) strategy to lower the barriers for firms seeking to enter the UK telecoms supply chain, which will increase competition and drive up the quality of products. This will increase the surge in data, leading to a major increase in traffic congestion and data center cooling demand.

Liquid Cooling to Hold Significant Growth

- In the United Kingdom, data centers rely heavily on water in order to regulate and maintain internal temperature, especially in facilities using traditional cooling tower methods compared to more efficient hybrid or adiabatic systems.

- Liquids offer a far higher heat capacity than air, and water is 4,000 times more efficient than air. With rack density estimates north of 50kW, this technology offers opportunities to achieve increased energy efficiency across the data center compared with air-cooled sites.

- Hyperscale data centers run by technology giants often use vast amounts of water. Google struck a deal that guarantees it 1 million gallons a day to cool one data center. Because of their large size, they have space to add extra cooling capacity to cope with temperature spikes.

- Thousands of swimming pools in Britain are currently experiencing an energy problem. In order to provide cloud users with an HPC cluster, Deep Green installed a 28 kW system. The technology, which is modeled after Deep Green's own immersion cooling tubs, makes use of oil to absorb heat from the servers and then circulates it through a heat exchanger to warm the pool. Deep Green provides the Exmouth Leisure Centre with free heat while paying for the electricity it consumes.

- The region is witnessing multiple launches, collaborations, partnerships, and innovation activities, which are increasing immersion cooling technology in data centers. In March 2023, a small Edge data center known as a "digital boiler" is being used by a recreational facility in Exmouth, Devon, to supply some of the energy required to heat its swimming pool.

- Furthermore, cloud storage use has expanded over the years, which is likely to raise demand for liquid data center cooling systems. Cloud storage companies like Google and Microsoft are expanding their storage capacity in the country to enable more efficient cloud workflow, which will lead to a major demand for liquid cooling.

Uk Data Center Cooling Industry Overview

The United Kingdom data center cooling market exhibits a moderate level of consolidation among key industry players, having sharpened their competitive edge in recent years. Notable market leaders in this segment include Iceotope Technologies Limited, Aermec SPA, FlaktGroup Holding GmbH, and others. These industry giants, boasting significant market shares, are actively engaged in expanding their customer base throughout the region. Their growth strategies primarily hinge on strategic collaborative efforts aimed at enhancing market share and overall profitability.

In March 2022, Johnson Controls made a significant move by harnessing its Silent-Aire solutions to introduce an industry-first hyperscale data center platform specifically tailored to assist cloud providers in achieving ambitious sustainability goals. The Johnson Controls Data Center Solutions platform offers a range of innovative solutions designed to preserve water resources and reduce energy consumption. These solutions encompass air-cooled chillers, liquid cooling systems, combination air handler units, environmentally-friendly refrigerants ready for future use, and prefabricated modular data centers. This development signifies a crucial step towards promoting sustainability and efficiency in the data center cooling industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Volume of Digital Data Due to Telecom and Cloud Computing

- 4.2.2 Emergence of Renewable Data Centers

- 4.3 Market Restraints

- 4.3.1 Adaptability Requirements and Power Outages

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 Cooling Technology

- 5.1.1 Air-based Cooling

- 5.1.2 Liquid-based Cooling

- 5.1.3 Evaporative Cooling

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Iceotope Technologies Limited

- 6.1.2 Aermec SPA

- 6.1.3 FlaktGroup Holding GmbH

- 6.1.4 Excool Ltd.

- 6.1.5 Airedale International Air Conditioning Ltd

- 6.1.6 STULZ UK Ltd

- 6.1.7 Rittal GMBH & Co.KG

- 6.1.8 Mitsubishi Electric Corporation

- 6.1.9 Johnson Controls International PLC (York International)

- 6.1.10 Schneider Electric SE

- 6.1.11 Daikin Applied (UK) Ltd

- 6.1.12 EcoCooling Ltd

- 6.1.13 Green Revolution Cooling Inc.