|

市場調查報告書

商品編碼

1408578

電子輪班業務管理解決方案:市場佔有率分析、產業趨勢與統計、2024年至2029年的成長預測Electronic Shift Operations Management Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

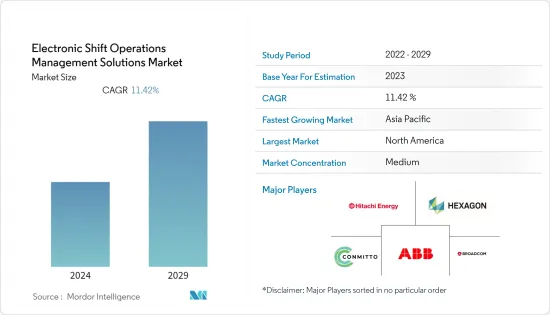

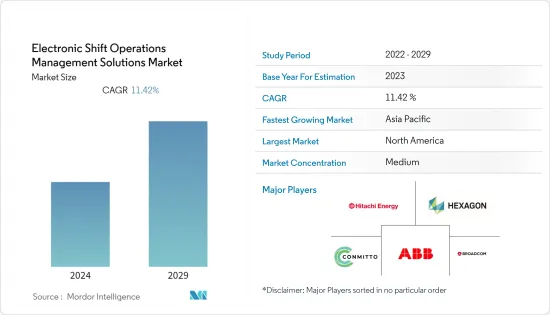

電子輪班業務管理解決方案市場上年度估值為75.7億美元,預計未來五年複合年成長率為11.42%,達130.1億美元。

主要亮點

- 電子輪班業務管理解決方案 (eSOMS) 是一款整合軟體,透過自動化和整合發電和製造等關鍵工廠流程來實現關鍵功能。電子業務管理解決方案採用高效的模組化設計,可實現最大的彈性,同時自動化和整合產業中的所有關鍵流程。

- 按行業來看,對改善客戶體驗、業務敏捷性和員工敬業度的變革性技術的需求不斷成長,推動了對電子輪班業務管理解決方案的需求。數位轉型的興起正在推動公司如何利用客戶洞察、技術力和研發來推動收益成長的方式發生根本性變化。

- 全球工業場地的擴張增加了對高效資料收集工具的需求,以管理關鍵的人工程序,例如輪班交接和記錄每日或輪班事件。傳統的資料登錄方法未與工業軟體整合,因此 eSOMS 透過將日常維護任務和資料組織到單一電子套件中來簡化操作。

- 低效率的輪班交接流程會導致致命事故,您始終需要準確的資料。為了解決此類挑戰,電子輪班業務管理解決方案的採用市場正在不斷增加。該解決方案為企業提供擴充性高效的營運管理解決方案。

- 高階 eSOMS 解決方案可以提供一致、安全和資訊的輪班交接,增強溝通,並最大限度地降低危險事件的風險。 eSOMS 包括連續的工作訂單流程,並確保有效率地完成任務。

- 由於 COVID-19 的爆發,組織擴大採用電子輪班營運管理解決方案,以確保以最少的投資安全、高效、可靠地運行和維護關鍵任務設備。我做到了。軍事、核能和化學品生產等關鍵產業的活動需要一致、有組織和綜合的方法,這增加了大流行後 eSOMS 的部署。例如,ABB推出了Ability Asset Suite eSOMS來簡化資料中心營運。

電子輪班業務管理解決方案市場趨勢

化學工業顯著成長

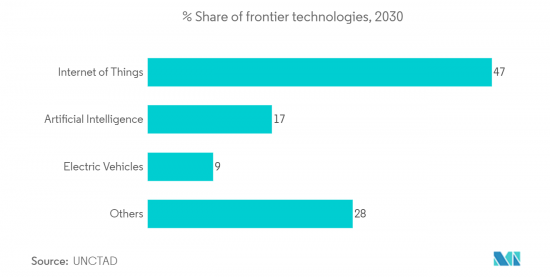

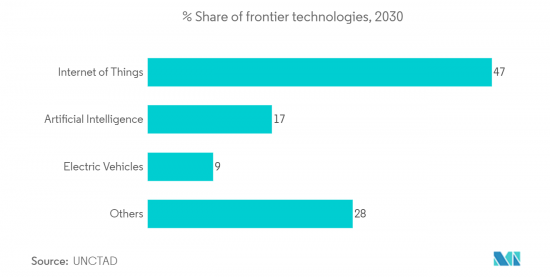

- 在全球範圍內,第四次工業革命結合了生產流程和工業營運中的創新技術,正在迅速成長,並推動了對電子輪班營運管理解決方案 (eSOMS) 的需求。物聯網、人工智慧、機器人、電動車和積層製造等先進技術的興起正在推動全球 eSOMS 市場需求的成長。化工材料及零件在各行業的生產過程中都至關重要。因此,化工設備的運作效率非常重要。

- 化學設施採用多種管理系統,包括工廠控制系統、記錄和管理運作狀態的資訊管理系統以及管理產品品質的系統。 eSOMS 透過數位化所有重要的工廠資訊、操作員工作指示、工作日誌、工作流程資訊等來實現整合管理。

- 化學工業的電子輪班營運管理系統透過標準化的工作程序和簡化的流程,有助於確保安全、可靠、高效的工廠運作和法規合規性。例如,橫河電機的營運管理系統是一個集中平台,可將工廠營運資訊標準化和數位化,並提出智慧型提案。基於工作流程的執行可讓您透過核准生命週期和電子郵件警報有效地自動化任務、權限和變更。

- Innovapptive 的行動操作員查房解決方案以行動和穿戴式技術取代了紙本流程。該解決方案可確保在儀器的工廠資產上收集的資料、關鍵環境和安全檢查按計劃進行,並且操作員可以輕鬆獲取資訊。

- ABB 提供化學製造營運管理軟體,其中包括所有 ABB 能力製造營運管理 (MOM) 應用程式的資料以及 MOM資訊服務託管的外部資料來源。

- 據印度品牌股權基金會稱,印度政府推出了生產連結獎勵(PLI)計劃,以鼓勵國內農藥生產。特種化學品的需求佔印度化學品和石化市場總量的22%,去年大幅成長。

- 印度政府在 2023-24 年聯邦預算中向化學和石化部撥款 2,093 萬美元。此類措施可能會加速對電子輪班管理解決方案的需求,這些解決方案可以透過連續、即時的資料有效管理業務經理的工作,以最佳化工作流程。

亞太地區預計將出現顯著成長

- 在亞太地區,各行業對可配置性和擴充性的需求不斷成長。電子業務管理解決方案可以輕鬆管理員工和人員的出勤情況。隨著產業擴充性的提高,eSOMS 有助於防止人員不足、人員過多和時間浪費等問題。

- 亞太地區對工業自動化和智慧工廠的投資強勁,這可能會在預測期內推動對 eSOMS 的需求。新加坡在先進製造技術方面處於領先地位。據威斯康辛州經濟發展公司稱,新加坡最近宣布了其 10 年藍圖“製造業 2030”,旨在將其製造業成長 50%。

- 去年,現代汽車集團與 JTC 簽署了協議。該政府機構監督新加坡的工業發展,並將在新加坡下一代工業的運輸和物流方面進行合作。馬來西亞也計劃在這十年將工業生產力提高30%,泰國政府推出了泰國4.0,這是一項旨在向創新主導經濟轉型的20年國家發展計畫。

- 亞太地區的供應商正在採用新方法,透過先進的工業軟體解決方案實現整個工業設施的自動化。 ABB 和日立能源是亞太地區領先的 eSOMS 供應商。與生態系統參與者合作,新工具的開發速度比以往任何時候都快。

- 亞太地區供應商提供的 eSOMS 軟體可以自動適應您公司的結構。智慧型工廠的出現促使製造商對智慧工廠的投資增加了 30%。中國和日本等國家是智慧型工廠的早期採用者,其次是韓國。

- 在印度和中國等國家,許多中小型組織正在興起,eSOMS 解決方案正在迅速被採用,以最大限度地提高效率、提高生產力,並在降低成本的同時增加利潤。市場需求由 eSOMS 可靠地提供滿足消費者需求的高品質服務的能力所驅動。

電子輪班業務管理解決方案產業概述

由於大量公司的存在,電子輪班業務管理解決方案市場的特徵是分散。該市場的主要企業,包括 ABB、日立能源有限公司、Hexagon AB、Conmitto, Inc 和 Broadcom,不斷推出創新產品並建立合作夥伴關係和協作,以提高競爭力。

2023 年 7 月,富士通作為製造雲端合作夥伴與微軟合作,將數位工廠解決方案引進微軟市場。富士通的平台旨在最佳化企業營運並提高製造客戶的可用性、性能和品質。該解決方案將所有流程整合到端到端業務價值鏈中,並解決了製造車間熟練技工短缺和勞動力可用性等挑戰。製造商依靠富士通的製造管理解決方案來增強製造流程並提高生產力。

2023年3月,ENEOS Materials公司和橫河電機公司向ENEOS Materials公司的化工廠引入了基於強化學習的AI演算法「FKDPP(因子核動態策略編程)」。此自主控制系統在管理工廠蒸餾塔的同時確保了高性能,也是案例正式採用強化學習人工智慧來直接控制工廠。兩家公司正在策略合作,探索創新方法,利用人工智慧實現工廠管理和基於狀態的工廠維護的數位轉型。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 宏觀經濟因素及其對市場影響的評估

第5章市場動態

- 市場促進因素

- 任務關鍵型工業應用對自動化和整合的需求不斷成長

- 能源和公共產業領域的需求不斷成長

- 市場抑制因素

- 初始實施成本高

- 缺乏熟練的工程師

第6章市場區隔

- 按申請

- 有限運作條件 (LCO) 追蹤

- 管理

- 追蹤與管理

- 人員、資格和日程安排

- 其他應用

- 按最終用戶

- 化學

- 油和氣

- 軍隊

- 車

- 能源和公共產業

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Conmitto, Inc.

- Globorise Technologies LLC

- ABB

- Hitachi Energy Ltd

- Trinoor.com

- Hexagon AB

第8章投資分析

第9章 市場機會及未來趨勢

The electronic shift operations management Solutions Market was valued at USD 7.57 billion in the previous year and is expected to grow at a CAGR of 11.42%, reaching USD 13.01 billion by the next five years.

Key Highlights

- An electronic shift operations management solution (eSOMS) is an integrated software that achieves critical functions by automating and integrating the factory's essential processes, such as power generation and manufacturing. Electronic shift operations management solution comes with highly efficient modular designs that allow for maximum flexibility while automating and integrating all major processes in industries.

- Growing demand for transformation technologies to improve customer experiences, business agility, and employee engagement in industry verticals is driving the demand for Electronic Shift Operations Management Solutions. The rise of digital transformation has steered a radical shift in how businesses harness customer insights, technology capabilities, and research and development to drive revenue growth.

- The expansion of industrial sites worldwide is increasing the demand for efficient data collection tools for managing crucial human procedures like shift handover and capturing the events of the day or shift. As the conventional data logging methods are not integrated with industrial software, eSOMS simplifies operations by organizing routine maintenance operations and data in a single electronic suite.

- Inefficient shift handover processes have caused fatal incidents, requiring constant and precise data. To fix these challenges, there is a rising adoption of electronic shift operations management Solutions to offer an efficient operations management solution with enterprise scalability.

- High-end eSOMS solutions can achieve consistent, safe, and fully informed shift handovers, enhance communication, and minimize the risk of dangerous incidents. The software solution is designed to record, track, and manage events within various departments in industrial setups. eSOMS contains a continuous stream of work instructions and ensures the productive completion of tasks.

- With the outbreak of COVID-19, electronic shift operation management solutions had been increasingly deployed by organizations to ensure a safe, efficient, and reliable operation and maintenance of mission-critical facilities with minimum investment. The need for a consistent, organized, and integrated approach to activities in critical industries, including military, nuclear power, chemical production, and others, had increased the deployment of eSOMS post-pandemic. For instance, ABB had deployed its Ability Asset Suite eSOMS to simplify operations in data centers.

Electronic Shift Operations Management Solutions Market Trends

Chemicals industry to witness significant growth

- The world is witnessing rapid growth in the fourth Industrial revolution that combines innovative technologies in production processes and industrial operations, driving the demand for electronic shift operations management Solutions (eSOMS). The rise of frontier technologies such as the Internet of Things, artificial intelligence, robotics, electric vehicles, and additive manufacturing adds to the growing demand of the global eSOMS market. Chemical materials and components are crucial throughout the entire production process across a wide range of industries. Therefore, operational efficiency in chemical facilities is important.

- Chemical facilities utilize multiple management systems, such as plant control systems, information management systems for recording and managing operational conditions, and systems for managing product quality. This has increased the demand for eSOMS owing to its advantages over traditional methods wherein plant operators use handwritten notes to share information and to give instructions on operations. eSOMS enables integrated management by digitizing all critical plat information, operator task instructions, task logs, and workflow information.

- Electronic shift Operations Management System in the chemicals sector helps to ensure safe, reliable, and efficient plant operations and regulatory compliance through standardized work practices and streamlined processes. For instance, Yokogawa Electric Corporation's Operations Management system is a centralized platform that standardizes and digitizes plant operations information to provide intelligent recommendations. Its workflow-based execution helps to automate tasks, permits, and changes effectively through approval lifecycle and email alerts.

- Innovapptive's Mobile Operator Rounds solutions replace paper-based processes with mobile and wearable technology. The solution checks that data collected on non-instrumented plant assets, critical environmental and safety inspections are performed on schedule and operators have the information at their fingertips.

- ABB offers chemical manufacturing operations management software that includes data across all ABB ability manufacturing operations management (MOM) Applications and external data sources hosted by MOM data services.

- According to the India Brand Equity Foundation, the government of India has introduced a production-linked incentive (PLI) scheme to facilitate the domestic manufacturing of agrochemicals. The demand for specialty chemicals, which constitute 22% of India's total chemicals and petrochemicals market, increased significantly in the previous year.

- The Indian government allocated USD 20.93 million under the Union Budget 2023-24 to the Department of Chemicals and Petrochemicals. Such initiatives will accelerate the demand for electronic shift operation management systems to effectively manage an operations manager's efforts with continuous, real-time data to optimize workflows.

Asia-Pacific is Expected to Grow at a Significant Rate

- Asia-Pacific is registering an increasing demand for configurability and scalability across industry verticals. Electronic shift operation management facilitates the supervision of employee and personnel attendance. With the growing scalability in industry verticals, eSOMS helps prevent issues like understaffing, overstaffing, and time wastage.

- The Asia-Pacific region is observing a significant investment in industrial automation and smart factories, which is likely to boost the demand for eSOMS during the forecast period. Singapore is the leader in advanced manufacturing technologies. According to the Wisconsin Economic Development Corporation, Singapore recently announced Manufacturing 2030, a 10-year roadmap aiming to grow the manufacturing sector by 50%.

- Last year, Hyundai Motor Group signed an agreement with JTC. This government agency oversees industrial progress in Singapore to collaborate on transportation and logistics for Singapore's next-generation industrial parks. Malaysia also plans to increase industrial productivity by 30% by this decade, and Thailand's government launched Thailand 4.0, a 20-year national development plan to transition into an innovation-driven economy.

- Vendors in the Asia Pacific region are embracing new ways of achieving automation across industrial setups with advanced industrial software solutions. ABB and Hitachi Energy Ltd are some of the major providers of eSOMS in the Asia Pacific. New tools are being developed much faster than ever in collaboration with ecosystem players.

- Vendors across the Asia Pacific are providing eSOMS software that schedules shifts to rotate automatically according to the company's structure. With the advent of intelligent factories, manufacturers are devoting significant investments, as much as 30%, to smart factories. Countries such as China and Japan are among the early adopters of intelligent factories, followed by South Korea.

- With the rise of numerous small and medium organizations in countries such as India and China, eSOMS solutions are rapidly being adopted to maximize efficiency, increase productivity, and increase profits while reducing costs. The ability of eSOMS to ensure the delivery of high-quality services that suit consumers' necessities is driving the market demand.

Electronic Shift Operations Management Solutions Industry Overview

The electronic shift operations management solutions market is characterized by fragmentation due to the presence of numerous companies. Key players in this market, including ABB, Hitachi Energy Ltd, Hexagon AB, Conmitto, Inc., and Broadcom, among others, are continually introducing innovative products and forging partnerships and collaborations to gain a competitive edge.

In July 2023, Fujitsu established a partnership with Microsoft as a Cloud for Manufacturing partner and introduced its Digital Factory solution on Microsoft's commercial marketplace. Fujitsu's platform is designed to optimize enterprise operations and enhance availability, performance, and quality for customers in the manufacturing sector. This solution aligns all processes with end-to-end business value chains, addressing challenges such as a shortage of skilled craftsmen and enabling labor at manufacturing sites. Manufacturers are leveraging Fujitsu's manufacturing management solutions as a foundation to enhance manufacturing processes and boost productivity.

In March 2023, ENEOS Materials Corporation and Yokogawa Electric Corporation collaborated to implement a reinforcement learning-based AI algorithm known as Factorial Kernel Dynamic Policy Programming (FKDPP) for use at an ENEOS Materials chemical plant. This autonomous control system ensures a high level of performance while managing a distillation column at the plant, marking the first formal adoption of reinforcement learning AI for direct plant control. These two companies are strategically working together to explore innovative approaches for carrying out digital transformation through AI for plant management and condition-based plant maintenance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Macro-economic factor and its Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand for automation and integration across mission-critical industrial applications

- 5.1.2 Rising demand across the energy and utilities sector

- 5.2 Market Restraints

- 5.2.1 High cost of initial installation

- 5.2.2 Lack of skilled technical expertise

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Limited Condition of Operation (LCO) Tracking

- 6.1.2 Administration

- 6.1.3 Tracking and Control

- 6.1.4 Personnel, Qualification & Scheduling

- 6.1.5 Other Applications

- 6.2 By End-User

- 6.2.1 Chemicals

- 6.2.2 Oil and gas

- 6.2.3 Military

- 6.2.4 Automotive

- 6.2.5 Energy and Utilities

- 6.2.6 Other End-Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Conmitto, Inc.

- 7.1.2 Globorise Technologies LLC

- 7.1.3 ABB

- 7.1.4 Hitachi Energy Ltd

- 7.1.5 Trinoor.com

- 7.1.6 Hexagon AB