|

市場調查報告書

商品編碼

1408569

Wi-Fi 7 -市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Wi-fi 7 - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

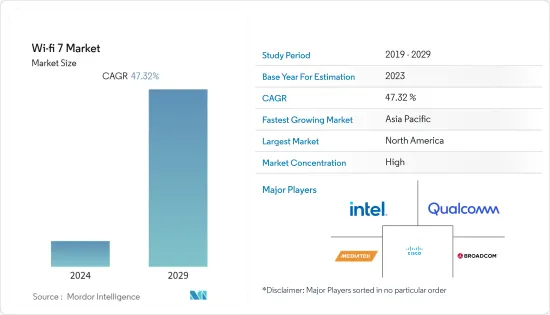

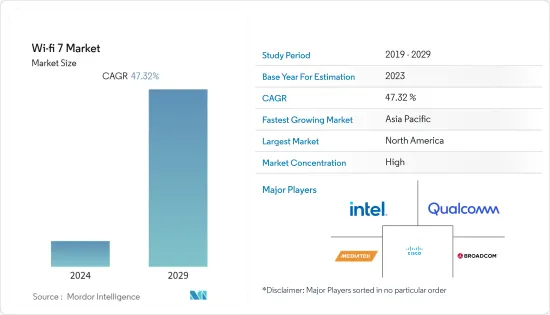

本財政年度Wi-Fi 7市場規模為8,7,521萬美元,預估未來五年將達6,07323萬美元,預測期內複合年成長率為47.32%。

主要亮點

- Wi-Fi 7 稱為 IEEE 標準 802.11be。可在多種不同的無線電頻率上運行,包括 2.4GHz、5GHz 和 6GHz。提供速度高達 40,000 Mbit/s 的連結。 16 個空間串流和 MIMO(多輸入多輸出)技術提高了視訊串流品質和解析度。 HARQ(混合式自動重複請求)是 Wi-Fi 7 的一項功能,可促進多連結自適應。

- IEEE 802.11 標準的下一個版本稱為 IEEE 802.11be,是 EHT(極高吞吐量)。在 802.11ax 之上,WLAN 在 2.4、5 和 6 GHz頻寬以步行和穩定的速度運行,突出室內和室外。速度預計可與 Thunderbolt 的 40Gbps 相當。

- 隨著4k/8k影片的引入,影片分發所需的吞吐量預計將繼續上升至數十Gbps。線上遊戲、擴增實境(AR)、虛擬實境(VR)和其他新鮮的、高吞吐量、低延遲的視訊應用也在爆炸性成長。由於涉及嚴格的要求,在無線區域網路 (WLAN) 上支援這些應用遠遠超出了最新 WLAN 標準 IEEE 802.11ax 的能力。

- 為了滿足這些不斷成長的需求,IEEE802.11 將宣布新的修訂標準 IEEE 802.11be-極高吞吐量 (EHT),通常稱為無線保真 (Wi-Fi) 7。越來越多的客戶參與電子商務交易、網頁瀏覽、行動學習和其他線上相關活動,增加了對更快網路存取的需求。因此,經常用於筆記型電腦、個人電腦和平板電腦設備的無線 LAN 路由器已成為人類生存的必需品。 Wi-Fi 路由器正在為許多國家/地區消費者對可靠網路連線不斷成長的需求以及加強 Wi-Fi 連線做出重大貢獻。

- 此外,醫療保健、教育、商業、金融服務和其他應用中連網裝置的使用不斷增加也是全球 Wi-Fi 7 市場的主要驅動力之一。此外,中小企業採用自備設備政策也對市場成長產生正面影響。此外,政府對智慧城市計劃的舉措預計將在預測期內激增,為市場擴張創造利潤豐厚的機會。

- 隨著為遏制冠狀病毒(COVID-19) 傳播而實施的行動限制,經濟合作暨發展組織(OECD) 國家中估計有 13 億人在家工作或開始學習的人數不斷增加。重要的國際政策協調是在七國集團和二十國集團等論壇上線上進行的。在整個網際網路價值鏈中,網際網路流量分佈在固定和移動寬頻營運商、內容和雲端提供商以及網際網路網路連接交換流量的點上,稱為網際網路交換點(IXP),與之前相比增加了 60%暴發。這些因素對疫情後的 Wi-Fi 7 需求產生了正面影響。

Wi-Fi 7市場趨勢

正在進行的智慧城市計劃專注於新興地區的室外 Wi-Fi 部署

- 消費者和企業的智慧型手機在各種應用中使用大量資料,增加了對彈性和高頻寬的需求。隨著技術的發展,市場供應商對更高資料速率、更低延遲和更好網路容量的需求日益成長,從而為 Wi-Fi 7 等先進技術創造了商機。

- 根據電訊(ITU) 估計,到 2022 年,將有 53 億人(即世界人口的 66%)使用網路。這比 2019 年成長了 24%,預計屆時將有 11 億人加入網路。網路普及的提高將為國內外Wi-Fi 7供應商創造重大機會推出新產品並擴大頻寬以佔領主要市場佔有率。

- 除了提供免費的公共網路存取之外,智慧城市還可以使用 Wi-Fi、以電子方式路由交通、監控空氣污染、節約用水和連接、在確保安全的同時與當地居民合作等等。例如,Wi-Fi 連線正在成為當地人和遊客的重要便利設施。持續獲得導航和旅遊服務至關重要,特別是對於想要在出國旅行時避免高昂漫遊費的遊客。智慧城市的興起可能會對市場產生正面影響。

- 美洲各國政府也正在推動智慧城市的實施,Wi-Fi 7的採用也正在取得進展。例如,拉斯維加斯正在測試三個先導計畫,政府已撥款5億美元尋找到2025年連接整個城市的方法。政府增加智慧城市計劃是影響Wi-Fi路由器市場需求的另一個因素。

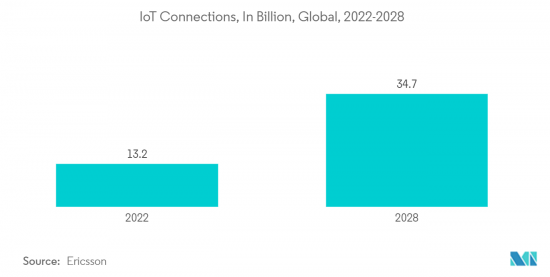

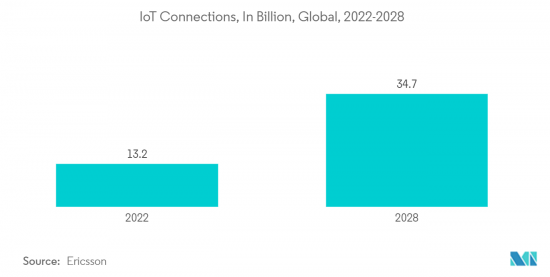

- 此外,政府支持智慧城市計劃的擴張也是市場的一個主要趨勢。在住宅和城市事務部的支持下,印度的目標是到2023年發展4000個人口達到500萬的城市。因此,如圖所示,分析了物聯網透過智慧城市的擴展,以在預測期內對 Wi-Fi 7 技術產生巨大需求。

分析顯示北美佔最大市場佔有率

- 北美地區由兩個新興經濟體組成:美國和加拿大。該地區智慧工廠的日益普及是推動北美市場成長的關鍵因素。 Wi-Fi晶片組、工業用電腦、閘道設備、PLC、工業機器人和無線感測器都廣泛應用於智慧工廠系統。由於智慧工廠中無線連接設備和物聯網基礎設施的擴展,Wi-Fi 7 市場預計將高速成長。

- 由於對節能和低排放解決方案的需求,該地區擴大採用智慧家庭。能源效率是一個國家經濟繁榮的重要因素。由於全球暖化和政府法律規章的加劇,該地區對盡量減少能源使用和碳排放的需求日益成長。智慧家庭功能需要智慧型設備,這為北美的 Wi-Fi 7 創造了機會。

- 此外,許多全球和地區公司正在開發先進的 Wi-Fi 晶片組,以將其整合到該地區的智慧型裝置中。例如,2022年3月,美國博通一年內供應了5億顆Wi-Fi 6/6E晶片中的10億顆Wi-Fi 6/6E晶片。該公司計劃未來根據需要生產Wi-Fi 7晶片組。

- 2022年8月,高通技術公司承諾追加支出42億美元,使格羅方德美國工廠生產的半導體晶片總支出達到74億美元。與該公司的價值 32 億美元的交易涵蓋 5G 收發器、Wi-Fi、汽車和物聯網 (IoT) 晶片。高通宣布,將在 2028 年底年終確保 GlobalFoundries 紐約工廠的晶圓供應並提高產能。

- 加拿大也決定加入許多其他國家的行列,為 Wi-Fi 開放 6GHz 頻段。據 ISED 稱,6GHz 頻率的變化將為所有加拿大人帶來最大的 Wi-Fi 改善。儘管Wi-Fi 6E設備最近才推出,但業界預計Wi-Fi 7將在2024年推出,頻寬將有更顯著的成長。這些因素對該地區 Wi-Fi 7 市場的成長做出了重大貢獻。

Wi-Fi 7產業概況

Wi-Fi 7市場的特徵是市場佔有率大的主要企業集中。這些主要企業正在積極推出多種產品,以在整個預測期內保持競爭力。

2023 年 6 月,Broadcom Inc. 發布了一項關於發布和推出專為 Wi-Fi 7 生態系統量身定做的第二代無線連接晶片組解決方案的重要公告。這些解決方案包括廣泛的產品,包括 Wi-Fi 路由器、企業網路基地台、住宅閘道器和用戶端設備。這些新晶片具有增強的功能,可以滿足更廣泛的客戶群。此外,這些晶片建立在 Broadcom 第一代 Wi-Fi 7 的基礎上,這使得它們能夠用於核心市場以外的各種市場。

2022 年 6 月,Qualcomm Technologies, Inc. 宣布推出一系列 RFFE 模組,旨在提供一流的 Wi-Fi 和藍牙體驗。這款不斷擴展的產品組合支援藍牙、Wi-Fi 6E 和即將推出的 Wi-Fi 7 標準。這些模組旨在滿足不同的裝置細分市場,包括智慧型手機以及汽車、擴充實境 (XR)、個人電腦 (PC)、穿戴式裝置、行動寬頻和物聯網 (IoT)。

2022 年 4 月,Broadcom Inc. 宣布推出專用Wi-Fi 7 生態系統設計的全面端對端晶片組解決方案。這項全面的產品陣容涵蓋 Wi-Fi 路由器、住宅閘道器、企業網路基地台和用戶端設備。特別是,Broadcom 最新的 Wi-Fi 7 晶片組預計將透過提供 320 MHz 通道將 Wi-Fi 通道頻寬增加一倍。這項進步對市場來說是一個有價值的補充,因為它與 6 GHz 頻段全球 Wi-Fi頻譜的擴展完美契合。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- Wi-Fi 標準與法規的演變

- 影響市場的宏觀經濟因素

第5章市場動態

- 市場促進因素

- 主要市場對智慧家電的需求不斷增加

- 正在進行的智慧城市計劃專注於新興地區的室外 Wi-Fi 部署

- 市場抑制因素

- 高密度環境中的操作挑戰

- 對戶外區域實施的擔憂

第6章市場區隔

- 按類型

- 硬體

- 網路基地台

- 閘道

- 路由器和中繼器

- 按服務

- 硬體

- 按用途

- 室內的

- 戶外的

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Intel Corporation

- Broadcom Inc.

- Cisco Systems Inc.

- Qualcomm

- MediaTek Inc.

- Huawei Technologies Co. Ltd

- TP-Link

- Rohde & Schwarz

- HFCL

- Netgear

第8章投資分析

第9章 市場機會及未來趨勢

The Wi-Fi 7 market market was valued at USD 875.21 million in the current year and is expected to reach USD 6073.23 million in the next five years, registering a CAGR of 47.32% over the forecast period.

Key Highlights

- Wi-Fi 7 is known as the IEEE standard 802.11be. It works with several different radio frequencies, including 2.4GHz, 5GHz, and 6GHz. It offers links at a maximum speed of 40,000 Mbit/s. The quality and resolution of video streaming are improved by 16 spatial streams and Multiple Input Multiple Output (MIMO) technology. Hybrid Automatic Repeat Request (HARQ), a feature of Wi-Fi 7, facilitates multiple link adaptation.

- The upcoming revision of the IEEE 802.11 standard, called IEEE 802.11be, is Extremely High Throughput (EHT). On top of 802.11ax, it will emphasize WLAN indoor and outdoor operating at pedestrian and stationary speeds in the 2.4, 5, and 6 GHz frequency bands. It is anticipated that the speeds will match Thunderbolt at 40 Gbps.

- The throughput needed for video distribution will continue to rise to tens of Gbps with the introduction of 4k/8k video. Online gaming, augmented reality (AR), virtual reality (VR), and other fresh, high-throughput, and low-latency video applications are also exploding. Supporting these applications over a wireless local area network (WLAN) is much beyond the capabilities of the latest WLAN standard, IEEE 802.11ax, because of the associated strict requirements.

- The IEEE 802.11 will publish a new amendment standard, IEEE 802.11be - Extremely High Throughput (EHT), often known as Wireless-Fidelity (Wi-Fi) 7, to satisfy these growing demands. A growing number of customers are engaging in e-commerce transactions, web browsing, mobile learning, and other online-related activities, driving the demand for faster internet access. As a result, the wireless router, frequently utilized in laptops, PCs, and tablets, has become essential for human existence. Wi-Fi routers are mostly responsible for the rising need among consumers to stay linked to dependable Internet and for enhancing Wi-Fi connections in numerous nations.

- Moreover, the increasing use of connected devices in healthcare, education, business, financial services, and other applications is one of the key drivers of the worldwide Wi-Fi 7 market. Additionally, the market growth is positively impacted by small and medium businesses adopting a bring your device policy. Further, during the projected period, a surge in government initiatives for smart city projects is anticipated to create lucrative opportunities for market expansion.

- As mobility restrictions were enforced to contain the spread of the coronavirus (COVID-19), more and more of the estimated 1.3 billion citizens of Organization for Economic Cooperation and Development (OECD) countries worked and studied from home. Critical international policy coordination was conducted online in fora, such as the G7 or G20. Along the entire Internet value chain, fixed and mobile broadband operators, content and cloud providers, and points where Internet networks connected to exchange traffic, called Internet exchange points (IXPs), experienced as much as 60% more Internet traffic than before the outbreak. These factors positively affected the demand for Wi-Fi 7 post-pandemic.

Wi-fi 7 Market Trends

Ongoing Smart City Projects Focused on Deployment of Outdoor Wi-Fi in Emerging Regions

- As smartphones have a combination of volume and heavy data usage across a wide variety of applications in both consumer and enterprise settings, the need for high bandwidth with flexibility is increasing. As technology evolves, market vendors have been getting the increased need for higher data rates, lower latency, and better network capacity, thus creating opportunities in advanced technologies such as Wi-Fi 7.

- In 2022, the International Telecommunication Union (ITU) estimated that 5.3 billion people, or 66% of the world's population, utilize the Internet. This marks a 24% growth from 2019, with an expected 1.1 billion people joining the Internet throughout that time. Such a rise in internet penetration will significantly create opportunities for local and international Wi-Fi 7 vendors to introduce new products and increase the bandwidth to capture the major market share.

- In addition to providing free public Internet access, smart cities use Wi-Fi for various purposes, including e-routing traffic, monitoring air pollution, conserving water and connection, and cooperating with locals while ensuring their safety. For instance, Wi-Fi connection is becoming a more important amenity for both locals and visitors. It can be vital for tourists who may want continual access to navigation and sightseeing, especially if they are traveling abroad and wish to avoid exorbitant roaming fees. The rise in smart cities will create a positive impact on the market.

- Various governments in the American region are also promoting the adoption of smart cities and, therefore, the adoption of Wi-Fi 7. For instance, Las Vegas is testing three pilot projects, with the government allocating USD 500 million to find ways to connect the entire city by 2025. The increase in the number of smart city projects undertaken by governments is another factor influencing the demand for the Wi-Fi router market.

- Further, national governments aiding the expansion of smart city projects is also a key trend in the market. With the help of the Ministry of Housing and Urban Affairs in India, the nation aims to develop 4,000 cities to house a population of 5,00,000 each by 2023. Therefore, as indicated in the graph, the growing IoT with the smart cities is analyzed to create significant demand for the Wi-Fi 7 technology during the forecast period.

North America is Analyzed to Hold Largest Share in the Market

- The North American region consists of two developed economies, the USA and Canada. The growing adoption of smart factories in the region is the primary factor driving the market growth in North America. Wi-Fi chipsets, industrial PCs, gateway devices, PLCs, industrial robots, and wireless sensors are all broadly used in the systems of smart factories. High-growth prospects are being created for the Wi-Fi 7 market by expanding wirelessly connected devices and IoT infrastructure in smart factories.

- Smart home adoption in the region is increasing due to the demand for energy-saving and low-emission solutions. An essential component of a nation's economic prosperity is energy efficiency. As a result of escalating global warming and governmental laws, there has been an increasing demand to minimize energy use and carbon emissions in the region. Smart homes need smart devices to be functional, which is creating an opportunity for Wi-Fi 7 in North America.

- Further, many global and regional companies are developing advanced Wi-Fi Chipsets to integrate those into the smart devices in the region. For example, in March 2022, Broadcom, an American company, supplied a billion Wi-Fi 6/6E chips, out of which 500 million Wi-Fi 6/6E chips were supplied in a year. The company will produce Wi-Fi 7 chipsets in the future according to the need.

- In August 2022, Qualcomm Technologies committed to spending an additional USD 4.2 billion, bringing the total amount spent on semiconductor chips produced at a US facility of GlobalFoundries to USD 7.4 billion, out of which the USD 3.2 billion contracts with the corporation cover chips for 5G transceivers, Wi-Fi, vehicles, and the Internet of Things (IoT). Qualcomm announced that it has secured wafer supply and pledges to increase the capacity of GlobalFoundries' New York factory by the end of 2028, which will drive the Wi-Fi-Chipset market in the region.

- Canada has also decided to open up 6GHz for Wi-Fi, joining many other nations. According to ISED, the largest Wi-Fi improvement for all Canadians would be brought about by the 6 GHz spectrum modification. The industry anticipates Wi-Fi 7 to launch by 2024 with still another significant increase in bandwidth, even though Wi-Fi 6E devices have only recently launched. These factors are significantly contributing to the Wi-Fi 7 market growth in the region.

Wi-fi 7 Industry Overview

The Wi-Fi 7 market is characterized by a significant concentration of major players who collectively hold a substantial market share. These key players are actively introducing multiple products to maintain their competitive edge throughout the projected period.

In June 2023, Broadcom Inc. made a noteworthy announcement regarding the release and availability of its second-generation wireless connectivity chipset solutions tailored for the Wi-Fi 7 ecosystem. These solutions encompass a wide range of products, including Wi-Fi routers, enterprise access points, residential gateways, and client devices. What sets these new chips apart is their enhanced functionality, catering to a broader customer base. Additionally, these chips are built on the foundation of Broadcom's original generation Wi-Fi 7, enabling their use in various markets beyond the primary one.

In June 2022, Qualcomm Technologies, Inc. unveiled a series of RFFE modules designed to deliver top-notch Wi-Fi and Bluetooth experiences. This expanded portfolio caters to Bluetooth, Wi-Fi 6E, and the upcoming Wi-Fi 7 standard. These modules are thoughtfully crafted to serve a diverse range of device segments, extending beyond smartphones to include automotive, extended reality (XR), personal computers (PCs), wearables, mobile broadband, Internet of Things (IoT), and more.

In April 2022, Broadcom Inc. announced the full availability of its comprehensive end-to-end chipset solutions designed specifically for the Wi-Fi 7 ecosystem. This comprehensive lineup covers Wi-Fi routers, residential gateways, enterprise access points, and client devices. Notably, Broadcom's latest Wi-Fi 7 chipsets are expected to double the Wi-Fi channel bandwidth by offering 320 MHz channels. This advancement aligns perfectly with the expanded global Wi-Fi spectrum in the 6 GHz band, making it a valuable addition to the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of Wi-Fi Standards and Regulations

- 4.4 Macro Economic Factors Impacting the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Demand for Smart Consumer Electronics Devices in the Major Markets

- 5.1.2 Ongoing Smart City Projects Focused on Deployment of Outdoor Wi-Fi in Emerging Regions

- 5.2 Market Restraints

- 5.2.1 Operational Challenges in Denser Environments

- 5.2.2 Concerns Related to Implementation in Outdoor Areas

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Access Points

- 6.1.1.2 Gateways

- 6.1.1.3 Routers and Extenders

- 6.1.2 Services

- 6.1.1 Hardware

- 6.2 By Application

- 6.2.1 Indoor

- 6.2.2 Outdoor

- 6.3 By Region

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Broadcom Inc.

- 7.1.3 Cisco Systems Inc.

- 7.1.4 Qualcomm

- 7.1.5 MediaTek Inc.

- 7.1.6 Huawei Technologies Co. Ltd

- 7.1.7 TP-Link

- 7.1.8 Rohde & Schwarz

- 7.1.9 HFCL

- 7.1.10 Netgear