|

市場調查報告書

商品編碼

1408487

遠端整合解決方案:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Remote Integration Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

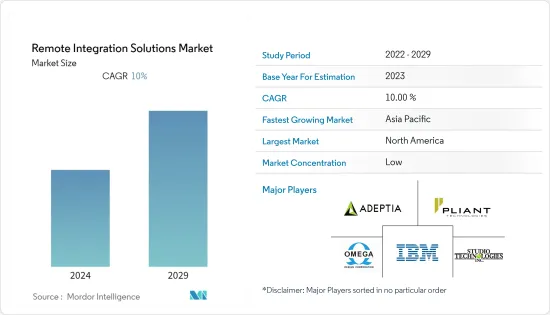

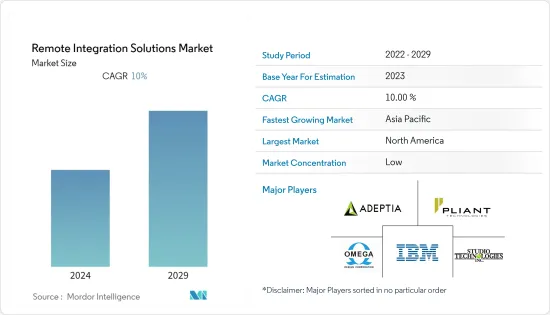

遠端整合解決方案市場預計在預測期內複合年成長率為 10%

主要亮點

- 隨著企業中的資料量呈指數級成長,所有資料都需要轉換、分析、監控和解釋,這使得業務流程成為當務之急。此外,額外軟體的引入增加了IT基礎設施的複雜性。

- 因此,企業正在採用企業應用整合(EAI)系統來建立具有成本效益的解決方案,將不同的應用程式轉換為常規的、可識別的平台,以防止這種複雜性。透過這種方式,公司將連接眾多公司系統的媒體與網路和無線應用程式結合,以促進這一過程。因此,這些特徵預計將在預測期內推動遠端整合解決方案的成長。

- 分析和巨量資料服務的遠端整合解決方案的採用正在不斷成長,因為它們有助於將分散式 IT 系統與後端技術整合並在集中式 IT 環境中探索資料。此外,它還可以幫助公司解釋他們產生的大量資料並提供業務見解。

- 實施遠端整合解決方案的大型IT計劃時的關鍵問題之一是技術故障和整合過程中故障的發生。這些技術故障和不確定性的一個主要來源是與大公司組織結構規模相關的複雜性。

- 因此,此類技術故障會阻礙大型企業的系統實施效率,進而影響其整體績效。衡量關鍵績效指標 (KPI) 已成為重中之重,而延誤是業務順利營運的主要障礙。因此,預計這些因素將對整個預測期內遠端整合解決方案的成長構成挑戰。

- 在COVID-19疫情期間,由於數位化和雲端服務的採用增加,全球遠端整合解決方案市場呈現顯著成長,帶來了新的業務環境,從而產生了對自動化服務和解決方案的需求。

遠端整合解決方案市場趨勢

大型企業部門預計將佔據主要市場佔有率

- 整合是在不同的軟體元件之間實現通訊的過程。過去二十年來,整合一直是大型企業面臨的一個緊迫問題,70% 的實施和開發預算都花在整合複雜且不同的後端和前端 IT 系統。必須整合現有的應用程式,以支援更新、更快、更準確的業務流程,並提供有意義且一致的管理資訊。

- 從歷史上看,整合是從點對點方法開始的,後來發展為更簡單的中心輻射型拓撲。這些拓撲與自訂遠端進程呼叫、以訊息為導向的中間件 (MOM)、分散式物件技術相連接,並繼續與企業應用程式整合 (EAI) 相連接,使用應用程式伺服器作為整合的直接手段。

- 目前的開發階段是與產業服務總線(ESB)整合的服務導向的架構(SOA)。如上所述,對兩種技術的技術因素進行了分析和比較。其結果是為大型企業整合策略。

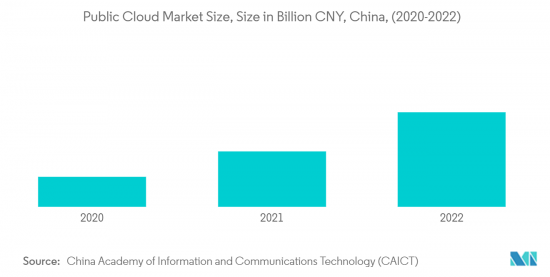

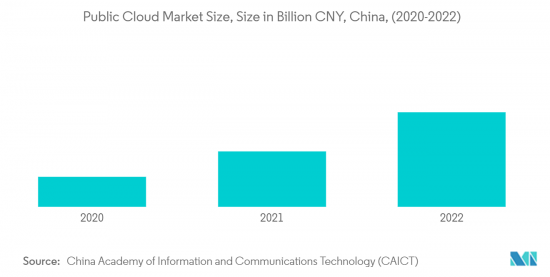

北美佔有很大佔有率

- 隨著企業升級IT基礎設施並獲得更好的業務效率和市場競爭優勢,該地區在預測期內擁有有效的遠端整合解決方案。此外,對雲端運算的需求不斷成長等因素在輕鬆部署和整合多個IT基礎設施和服務平台方面發揮關鍵作用,這些因素極大地促進了該地區企業應用服務市場的成長。

- 透過雲端進行客戶關係管理 (CRM) 的採用也越來越多,公司更喜歡結合本地和公共雲端的混合模式來滿足他們的需求。因此,這些方面預計將推動該地區遠端整合解決方案的成長。

- 2023 年 7 月,在媒體和娛樂、國防市場和執法領域提供、捕獲和管理高品質即時視訊及相關資料的全球技術領導者 Vislink Technologies, Inc. 宣布將使用 Amazon Web Services (AWS ) 宣布推出LinkMatrix 遠端控制管理平台LinkMatrix實現對直播設備的全面管理。與 AWS 的整合為使用者提供了更高的控制力、速度和彈性,以改善製作工作流程並推動現場直播和效能的創新。

- 遠端整合服務在北美的各個行業中已被廣泛採用,包括製造、IT 和醫療保健。北美市場催生了尖端創新的採用,例如行動、雲端和人工智慧(AI)技術與傳統綜合服務的融合。造成這種情況的主要原因之一是北美國家的網路普及異常高。預計那裡的商業服務使用量將進一步增加。重要的是要記住,重視客戶參與的服務提供者可以期望從經常性收益模式中獲得更多收益。

遠端整合解決方案產業概覽

遠端整合解決方案市場的競爭對手之間的競爭仍然很低,幾個主要企業主導了競爭形勢。該領域的一些知名公司包括 IBM Corporation、Omega Design Corporation、Studio Technologies Inc. 和 Adeptia Inc.。這些行業領導者透過持續的產品創新和關注領先於消費者需求,保持了穩固的立足點並保持競爭力。這些公司透過大力投資研發、策略併購以及建立有價值的合作夥伴關係來實現這一目標,所有這些都為其不斷成長的市場佔有率做出了貢獻。

2023年9月,智慧型連結和自動化領域的知名領導者Boomi宣布與著名數位轉型諮詢服務供應商Sazae Japan建立策略合作夥伴關係。 Boomi 與 Sazae Japan 之間的合作夥伴關係標誌著 Sazae 的一個重要里程碑,成為日本首個整合平台即服務 (iPaaS) 合作夥伴。隨著日本企業對雲端運算需求的增加,在雲端實現系統無縫整合的iPaaS解決方案受到關注。這項合作關係最初將專注於協助 Sazae Japan 的客戶整合內容管理系統,包括 ServiceNow 和 Drupal 等流行平台。

2023 年 8 月,澳洲偏遠地區著名醫療服務供應商皇家飛行醫生服務中心 (RFDS)運作運行在 Oracle 雲端基礎設施 (OCI) 上的 OracleOracle資料庫,宣佈在全國範圍內建立電子健康記錄(EHR)系統使用這項創新措施旨在簡化臨床資訊的收集和分析,並促進醫療保健專業人員更快、更資訊做出決策。透過遷移到雲端,RFDS 顯著減少了管理業務,並將資料管理成本降低了約 20%。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 快速採用整合巨量資料和分析服務

- 體育迷對體育賽事直播的需求迅速增加,預計將增加對遠端整合解決方案的需求

- 市場抑制因素

- 連接不同廣播位置的頻寬高成本

第6章市場區隔

- 按用途

- 運動的

- pod送

- 政府機關

- 醫療保健

- 按類型

- 主要企業

- 中小企業

- 依產品

- 發射機

- 交換器

- 解碼器

- 配件

- 接收者

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 非洲/中東

第7章 競爭形勢

- 公司簡介

- Adeptia Inc.

- Accelerated Media Technologies Inc.

- IBM Corporation

- Microsoft Corporation

- Omega Design Corporation

- Calrec Audio Ltd

- Oracle Corporation

- Salesforce

- Pliant Technologies

- Grass Valley

- Net Insight AB

- VidOvation

- Nevion

- Studio Technologies Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The remote integration solutions market is expected to register a CAGR of 10% during the forecast period.

Key Highlights

- The need to transform, analyze, monitor, and interpret all this data has become a preference to facilitate business processes as there is an exponential increase in the volume of data across enterprises. Additionally, due to the introduction of additional software, there is increasing complexity within the IT infrastructure.

- Hence, companies are incorporating enterprise application integration (EAI) systems to establish a cost-effective solution to change heterogeneous applications into a normal, recognizable platform to prevent this sophistication. Thus, companies combine media to link numerous enterprise systems with the web and wireless applications to facilitate the process. Hence, such characteristics are expected to drive the growth of remote integration solutions during the forecast period.

- There is a growing adoption of remote integration solutions for analytics and big data services as it helps to incorporate distributed IT systems with back-end techniques to examine the data in a centralized IT environment. Further, it helps interpret large volumes of data generated by companies, thereby delivering them with business insights.

- One of the critical issues in executing large-scale IT projects for remote integration solutions is experiencing technical faults and holds during integration. The primary reason for these technical faults and uncertainties is the intricacies involved in the scale of the organizational structure in large enterprises.

- Consequently, these technical glitches impede the efficiency of system implementation within large organizations, subsequently impacting their overall business performance. The measurement of key performance indicators (KPIs) has assumed paramount importance, making any delays a significant impediment to smooth business operations. Therefore, these factors are expected to pose challenges to the growth of remote integration solutions throughout the forecast period.

- During the COVID-19 pandemic, the global remote integration solutions market witnessed substantial growth due to the rise in the adoption of increased digitization and cloud services, leading to a new business environment resulting in the demand for automation services and solutions.

Remote Integration Solutions Market Trends

Large enterprise segment is expected to hold major share of the market

- Integration is the process of enabling communication between disparate software components. Integration has been a burning issue for large enterprises in the last twenty years since 70% of the deployment and development budget is spent on integrating complicated and heterogeneous back-end and front-end IT systems. Integrating existing applications is needed to support newer, faster, more accurate business processes and provide meaningful, consistent management information.

- Historically, integration started with point-to-point approaches, evolving into simpler hub-and-spoke topologies. These topologies were connected with custom remote process calls, message-oriented middleware (MOM), and distributed object technologies, continued with enterprise application integration (EAI), and used an application server as an immediate vehicle for integration.

- The present phase of the development is service-oriented architecture (SOA) integrated with an industry service bus (ESB). As mentioned, the technical elements of comparing the technologies are analyzed and presented. The result of the study is the guided integration strategy for large enterprises.

North America to hold the Significant share

- As enterprises upgrade their IT infrastructure to gain more suitable operational efficiency and a competitive advantage in the market, the region has an effective remote integration solution during the forecast period. Furthermore, factors such as the rising need for cloud computing, which plays a vital role in the easy adoption and integration of multiple IT infrastructures and service platforms, immensely contribute to the growth of the enterprise application services market in the region.

- Also, a growing adoption of customer relationship management (CRM) via the cloud has become significant among organizations that mostly prefer the hybrid model, a combination of the on-premises and public cloud models, to meet their enterprise needs. Hence, such aspects are anticipated to drive the region's growth of remote integration solutions.

- In July 2023, Vislink Technologies, Inc., a global technology leader in the delivery, capture, and management of high-quality, live video and associated data in the media and entertainment, defense markets, and law enforcement, announced the availability of its LinkMatrix remote control management platform on Amazon Web Services (AWS). LinkMatrix allows for comprehensive management of its live broadcast devices. The integration with AWS delivers users improved control, speed, and flexibility, elevating production workflows and facilitating innovation in live broadcasts and performance in the field.

- Remote integrated services have been widely adopted in North America across various industries, including manufacturing, IT, and healthcare. The North American market led to the adoption of cutting-edge technical innovations, such as blending mobile, cloud, and artificial intelligence (AI) technologies into a traditional integrated service. The unusually high Internet penetration in North American nations is one of the leading causes. There, it is anticipated that company usage of services will increase even further. It is important to remember that service providers who focus on client involvement should expect to benefit more from the recurring revenue model.

Remote Integration Solutions Industry Overview

Competitive rivalry in the remote integration solutions market remains low, with several key players dominating the landscape. Prominent companies in this sector include IBM Corporation, Omega Design Corporation, Studio Technologies Inc., Adeptia Inc., and many others. These industry leaders have established a strong foothold and are well-positioned to maintain a competitive edge through continuous product innovation and a keen focus on anticipating consumer needs. They have achieved this by making substantial investments in research and development, engaging in strategic mergers and acquisitions, and forming valuable partnerships, all of which have contributed to their substantial market share.

In September 2023, Boomi, a renowned leader in intelligent connectivity and automation, announced a strategic partnership with Sazae Japan, a prominent digital transformation consulting service provider. Boomi's partnership with Sazae Japan marks a significant milestone as it becomes the first integration platform as a service (iPaaS) partner for Sazae in Japan. With the growing demand for cloud computing among Japanese businesses, iPaaS solutions have garnered increased attention for achieving seamless system integration in the cloud. Initially, this partnership will focus on assisting Sazae Japan's customers in integrating content management systems, including popular platforms like ServiceNow and Drupal.

In August 2023, the Royal Flying Doctor Service (RFDS), a prominent provider of rural and remote health services in Australia, unveiled a nationwide electronic health record (EHR) system powered by Oracle autonomous database, operating on Oracle cloud infrastructure (OCI). This transformational move aims to streamline the collection and analysis of clinical information, facilitating quicker and more informed decision-making by medical personnel. By migrating to the cloud, RFDS has achieved a notable reduction in administrative workloads and a nearly 20 percent reduction in data management costs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid implementation of big data and analytics integration services

- 5.1.2 Surge in need for live streaming of sporting events by sports fans is anticipated to fuel the need for remote integration solutions

- 5.2 Market Restraints

- 5.2.1 High cost of bandwidth to connect differing broadcasting locations

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Sports

- 6.1.2 Broadcast

- 6.1.3 Government

- 6.1.4 Healthcare

- 6.2 By Type

- 6.2.1 Large Enterprise

- 6.2.2 SME

- 6.3 By Products

- 6.3.1 Transmitters

- 6.3.2 Switches

- 6.3.3 Decoders

- 6.3.4 Accessories

- 6.3.5 Receivers

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Africa & Middle East

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Adeptia Inc.

- 7.1.2 Accelerated Media Technologies Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Omega Design Corporation

- 7.1.6 Calrec Audio Ltd

- 7.1.7 Oracle Corporation

- 7.1.8 Salesforce

- 7.1.9 Pliant Technologies

- 7.1.10 Grass Valley

- 7.1.11 Net Insight AB

- 7.1.12 VidOvation

- 7.1.13 Nevion

- 7.1.14 Studio Technologies Inc.