|

市場調查報告書

商品編碼

1407010

實驗室滴定儀 -市場佔有率分析、產業趨勢與統計、成長預測,2024-2029 年Lab Titration Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

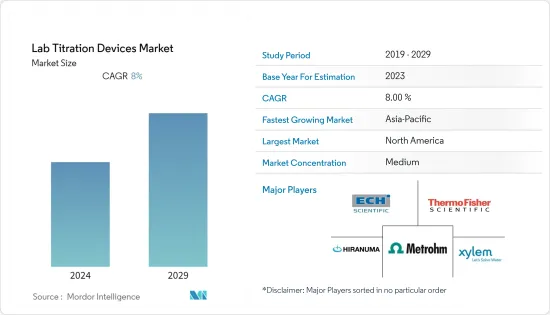

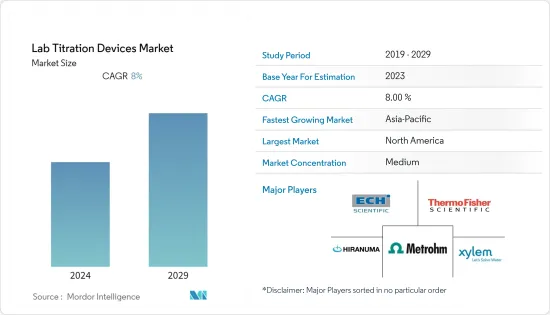

實驗室滴定儀市場預計在預測期內複合年成長率為 8%。

主要亮點

- COVID-19 影響了實驗室滴定儀,對實驗室業務造成了輕微限制,從而減少了大流行早期階段對實驗室滴定儀的需求。例如,2021 年 3 月發表在《歐洲呼吸期刊》上的一篇論文指出,德國對實驗室內滴定和親自造訪的限制較少。在美國和義大利,如果在空氣傳播感染隔離室中進行實驗室滴定是允許的。因此,由於上述因素,COVID-19對研究市場產生了重大影響。

- 然而,隨著COVID-19疫情得到控制,市場對滴定儀的需求正恢復到疫情前的性質。此外,由於對自動化實驗室滴定儀的需求不斷增加以及滴定儀在化學實驗室、研究和製藥中的應用不斷增加,預計市場在預測期內將顯著成長。

- 由於自動化實驗室滴定具有易於存取、節省時間、易於使用、最大限度地減少人為錯誤以及對自動化實驗室滴定的需求不斷增加等優勢,預計該市場將會成長。例如,根據2021年1月發表在《藥物安全治療進展》上的一篇論文,藥物滴定是一種透過以盡可能低的劑量為患者提供適當且有效的結果來最大程度地減少不必要的藥物使用和副作用的治療。滴定的好處和需求預計將在預測期內吸引市場成長機會。

- 此外,不斷增加的研發活動以及創新設備的推出也推動了整個區域市場的發展。例如,2022年12月,國家化學實驗室(NCL)主任鼓勵年輕人到從事研發的行業工作。此類措施預計將增加實驗室工作人員的流動,從而增加對滴定儀的需求,因為滴定儀對於所有藥品的配方至關重要。此外,DKK-TOA於2021年11月發布了具有自動清洗和校準功能的pH計「MAC-1600」。此 pH 計可現場安裝,使用 JIS 標準溶液自動清洗電極和進行兩點校準。

- 因此,上述因素預計將在預測期內推動市場成長。然而,缺乏訓練有素的人力資源預計將限制市場成長。

實驗室滴定儀市場趨勢

預計自動化領域將在預測期內實現健康成長

- 預計自動滴定領域將在預測期內實現健康成長。這主要是由於對自動化實驗室滴定過程的需求不斷成長,該過程可以實現所需的功能,同時最大限度地減少人為錯誤。此外,全球醫療保健支出的增加預計將促進利用先進實驗室設備進行藥物開發的研究和開發,預計將進一步促進該領域的成長。

- 此外,多項研究證明了自動滴定技術相對於手動技術的有效性,也帶動了市場對自動滴定儀的需求。例如,2021 年 11 月在美國化學會發表的一篇論文提到了執行自動化化學實驗的機器人實驗室平台。在這項研究中,電腦視覺用於執行自動滴定。校準和自動滴定是利用 OpenCV 電腦視覺庫透過開放原始碼Python 腳本執行的。使用電腦視覺自動滴定的一個主要優點是使用開放原始碼軟體。自動滴定研究的不斷增加預計將導致先進自動滴定設備的開發,並有助於預測期內的市場成長。

- 此外,主要製造商正在活性化研發力度,以滿足實驗室滴定產品不斷成長的需求,預計這將支持該產業的成長。例如,2021 年 5 月,The Wiggens 推出了自動滴定儀 CAT,旨在準確執行最廣泛的電位滴定。該設備是一款易於使用的自動滴定儀,無需特殊培訓或深入了解自動滴定知識即可用於任何應用。設備技術的不斷進步預計將增加對自動滴定儀的需求,從而擴大該領域的成長。

- 因此,由於自動滴定儀相對於傳統滴定儀的優勢以及市場參與者的技術進步等因素,預計該細分市場將在預測期內呈現顯著成長。

預計北美將在市場中佔據重要佔有率,並且在預測期內仍將保持這一地位。

- 由於實驗室滴定儀的技術創新,預計北美地區將佔據重要的市場佔有率。由於該地區製藥業研發活動的增加,實驗室滴定儀市場預計將成長。

- 創新研究和基於結構的藥物開發的投資和資金籌措活動的增加推動了實驗室滴定儀的強勁成長。例如,2021年4月,加拿大政府公共服務和採購部長向研究機構投資5,890萬美元,以支持加拿大的科學研究。漢密爾頓實驗室設施的建設預計將於 2021 年 5 月完成,密西沙加設施的建設預計將於 2023 年夏季完成。因此,新實驗室的建設和政府資助預計將增加滴定設備的採購,以支持該地區的研發,從而推動市場成長。

- 此外,市場參與企業為增強市場地位和擴大實驗室滴定儀產品所採取的策略性措施預計將促進市場成長。例如,2021 年6 月,Amalgam Rx, Inc. 是一家透過支援SaaS 的數位市場和產品平台連接醫療保健提供者和生命科學公司的開發商,與諾和諾德在全球擴展了其胰島素滴定解決方案。此次合作預計將促進基於證據的胰島素啟動和滴定。

- 因此,政府為擴大研發規模提供資金以及市場參與企業之間的聯盟等因素預計將在預測期內推動該地區的市場成長。

實驗室滴定儀產業概述

實驗室滴定儀市場是一個分散且競爭激烈的市場,由多家大型企業組成。從市場佔有率來看,少數大公司佔據市場主導地位。目前主導市場的公司包括 ThermoFisher Scientific、Metrohm AG、Xylem Analytic 德國、ECH Scientific、Hanna Instruments、Diagger Scientific Inc、COSA Xentaur、CSC Scientific Company、Hiranuma Sangyo 和 DKK-TOA Corporation。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 對自動化實驗室滴定儀的需求增加

- 滴定儀在化學實驗室、研究和製藥的使用越來越多

- 市場抑制因素

- 缺乏訓練有素的人員

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 手動型

- 自動化

- 按最終用戶

- 研究機構

- 學術機構

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東/非洲

- GCC

- 南非

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭形勢

- 公司簡介

- ThermoFisher Scientific

- Metrohm AG

- Xylem Analaytics Germany

- ECH Scientific

- Hanna Instruments

- Diagger Scientific Inc

- COSA Xentaur

- CSC Scientific Company

- Hiranuma Sangyo Co., Ltd

- DKK-TOA corporation

第7章 市場機會及未來趨勢

The lab titration devices market is projected to register a CAGR of 8% during the forecast period.

Key Highlights

- COVID-19 impacted lab titration devices due to slight restrictions in laboratory operations, which reduced the demand for lab titration devices during the initial phase of the pandemic. For instance, an article published in the European Respiratory Journal in March 2021 mentioned fewer restrictions for in-laboratory titrations and in-person visits in Germany. In the United States and Italy, in-laboratory titrations were permitted if they were conducted in an airborne infection isolation room. Hence, due to the abovementioned factors, COVID-19 had a significant impact on the studied market.

- However, with the COVID-19 cases in control, the market is re-gaining its pre-pandemic nature in terms of demand for titration devices. Furthermore, due to an increase in the demand for automated lab titration devices and a rise in applications of titration systems in chemical laboratories, research, and pharmaceuticals, the market is expected to witness significant growth over the forecast period.

- The market is expected to grow owing to the benefits of automated lab titration, such as accessibility, time-saving, easy-to-use, minimizing human errors, and increasing demand for automated lab titration. For instance, according to an article published in Therapeutic Advances of Drug Safety in January 2021, drug titration gives the patient adequate and effective treatment at the lowest dose possible to minimize unnecessary medication use and side effects. The advantages and demand for titration are expected to attract market growth opportunities during the forecast period.

- Furthermore, an increase in research and development activities, along with launches of innovative devices, are driving the overall regional market forward. For instance, in December 2022, the National Chemical Laboratory (NCL) Director motivated youths to work in an industry that does research and development. Such initiatives are expected to increase the flow of people working in the laboratories, which is believed to augment the demand for titration devices as they are a vital part of any drug formulation. Also, in November 2021, the DKK-TOA corporation launched the MAC-1600, a pH meter with an automatic cleaning/calibration function. This pH meter can be installed in the field, automating electrode cleaning and two-point calibration with JIS standard solution.

- Therefore, the abovementioned factors are expected to boost the market's growth during the forecast period. However, a shortage of trained personnel is expected to restrain the market growth.

Lab Titration Devices Market Trends

The Automated Segment is Expected to Register a Healthy Growth During The Forecast Period

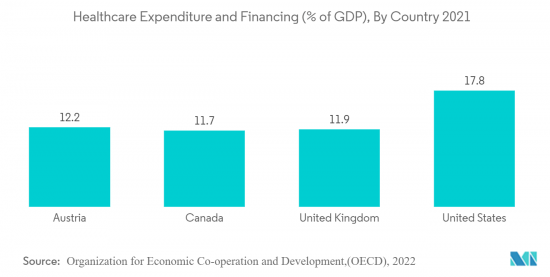

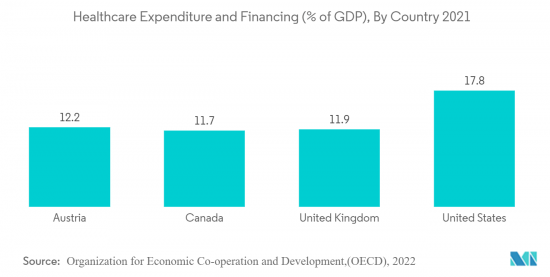

- The automated titration segment is expected to register healthy growth during the forecast period. This is mainly due to the rising demand for an automated lab titration process, which favors the desired functionality with minimal human error. In addition, the rising healthcare spending worldwide is expected to boost research and development utilizing advanced laboratory devices for drug development, which is further expected to augment the segment growth.

- In addition, several research studies proving the effectiveness of the automated titration techniques compared to the manual technique also led to the market demand for automated titration devices. For instance, the article published in the American Chemical Society in November 2021 mentioned that robotic laboratory platforms perform automated chemical experiments. The research study used computer vision in performing an automated titration. The calibration and automatic titration were performed with the open-source Python script that utilized the OpenCV computer vision library. A significant advantage of computer vision automation is the use of open-source software. The rising research studies on automated titration are expected to develop advanced automated titration devices, thereby contributing to the market's growth during the forecast period.

- Also, key manufacturers' increasing research and development to meet the growing demand for lab titration products are expected to drive the segment's growth. For instance, in May 2021, The Wiggens launched Automatic Titrator CAT designed to precisely perform the widest range of potentiometric titrations. The instrument is an easy-to-use automatic titrator for any application without any special training or a deeper knowledge of automatic titration. The rising technological advancements in devices are projected to augment the demand for automated titrators, thereby expanding the segment's growth.

- Thus, the segment is anticipated to witness significant growth over the forecast period owing to factors such as the advantages of automated titration devices over conventional titration devices and technological advancements by market players.

North America is Expected to Hold a Significant Share in the Market and is expected to do the Same in the Forecast Period.

- The North American region is projected to hold a significant market share due to technological innovations in lab titration devices. The lab titration devices market is expected to grow due to the increase in research and development activities in the pharmaceutical sector in the region.

- The robust growth of lab titration devices can be attributed to the rising investment and funding activities for innovative research and the development of structure-based drugs. For instance, in April 2021, the Government of Canada Minister of Public Services and Procurement invested USD 58.9 million in laboratories to support science and research in Canada. Construction at the Hamilton laboratory facility was completed in May 2021, while construction at the Mississauga facility is expected to be completed in the summer of 2023. Therefore, the construction of new research laboratories and funding by the government is expected to increase the procurement of titration devices to boost the R&D in the region, thereby augmenting the market growth.

- Additionally, the strategic initiatives by market players to boost their market position and expand their offerings in laboratory titration devices are expected to boost market growth. For instance, in June 2021, Amalgam Rx, Inc., the developer in connecting healthcare providers and life sciences companies through a SaaS-enabled digital marketplace and product platform, expanded its insulin titration solution with Novo Nordisk at a global level. The partnership is projected to facilitate evidence-based insulin initiation and titration.

- Therefore, factors such as government funding and partnerships between the market players to expand research and development are projected to bolster the market growth in the region during the forecast period.

Lab Titration Devices Industry Overview

The lab titration devices market is fragmented and competitive and consists of several major players. In terms of market share, a few major players dominate the market. Some companies currently dominating the market are ThermoFisher Scientific, Metrohm AG, Xylem Analytic Germany, ECH Scientific, Hanna Instruments, Diagger Scientific Inc, COSA Xentaur, CSC Scientific Company, Hiranuma Sangyo Co., Ltd, and DKK-TOA Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in the Demand for Automated Lab Titration Devices

- 4.2.2 Rise in Applications of Titration Systems in Chemical Laboratories, Research and Pharmaceuticals

- 4.3 Market Restraints

- 4.3.1 Shortage of Trained Personnel

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Type

- 5.1.1 Manual

- 5.1.2 Automated

- 5.2 By End-User

- 5.2.1 Research laboratories

- 5.2.2 Academic Institutions

- 5.2.3 Other End-Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ThermoFisher Scientific

- 6.1.2 Metrohm AG

- 6.1.3 Xylem Analaytics Germany

- 6.1.4 ECH Scientific

- 6.1.5 Hanna Instruments

- 6.1.6 Diagger Scientific Inc

- 6.1.7 COSA Xentaur

- 6.1.8 CSC Scientific Company

- 6.1.9 Hiranuma Sangyo Co., Ltd

- 6.1.10 DKK- TOA corporation