|

市場調查報告書

商品編碼

1406581

諮詢服務:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Consulting Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

諮詢服務市場規模預計將從2024年的3,238.8億美元成長到2029年的4,318.9億美元,預測期間(2024-2029年)複合年成長率為4.96%。

主要亮點

- 管理顧問公司提供幫助組織提高效率的服務。這些公司分析其業務並了解現有的組織效率低下的情況,從原料成本到組織的人力資源政策。

- 由於歐洲市場經濟的強勁成長、金融部門的監管改革、後端業務外包給低成本經濟體以及公共投資,對管理諮詢服務的需求不斷增加。經濟成長加速、數位諮詢的興起和全球化的興起預計將在預測期內推動進一步成長。

- 許多公司不斷尋求降低成本並提高效率,以便將成本節省惠及客戶並在面臨的激烈競爭中生存。因此,對業務流程改進和與業務效率相關的諮詢的需求不斷增加。英國脫歐和歐盟通用資料保護規範 (GDPR) 等監管變化正在推動主要服務領域的諮詢需求。跨國公司尋求高價值的建議以遵守法規,從而推動了對管理諮詢服務的需求。

- 計劃日益複雜是諮詢業面臨的主要挑戰。計劃管理是諮詢服務的核心,顧問公司依賴結構化的計劃團隊和強大的管理流程。導致計劃複雜性的關鍵因素之一是保持成本和付加要素透明度的壓力越來越大。

- COVID-19 的疫情促使全國各地的組織採取一切必要措施,確保員工和社區的安全。由於遠距工作的增加和公司數位轉型的擴大,COVID-19 的爆發使市場受益。公司希望業務流程無縫、高效且可從任何地方存取。

- 此外,許多公司已經完成了數位轉型,並決定保持完全遠端或混合模式運作。隨著遠距工作模式的擴展,企業正在增加向雲端和人工智慧技術轉型的投資,預計這將推動營運諮詢服務市場的發展。

諮詢服務市場趨勢

生命科學和醫療保健增速最高

- 醫療保健諮詢公司的角色是最佳化效率、產生收入和結構改進。這個角色有型態,從而催生了醫療保健諮詢領域的各種專業化。在某些情況下,大型醫療機構選擇諮詢公司作為聘用者,並接受持續的評估和諮詢服務,以提高長期績效。對於有財力聘請多種諮詢服務(包括業務、策略和技術諮詢服務)的大型醫療保健組織來說尤其如此。

- 隨著現代醫療基礎設施、患者照護單位的開拓、政府投資以及醫療保健行業數位工具的整合,醫療保健行業的競爭逐漸變得更加激烈,從而產生了市場對戰略諮詢服務的需求。

- 醫療機構必須遵守營運法律準則,但僅獲得一次許可證是不夠的,因為法律法規不斷變化。因此,在醫療保健領域,對法律諮詢和諮詢服務的需求不斷成長,以加強日常業務、患者資訊管理和治療契約,為普華永道和安永等供應商創造了商機。

- 此外,GE Healthcare 和Siemens Healthineers 等醫療技術和設備公司正在實施數位化策略,以提高工廠效率,為諮詢服務創造機會。例如,2023年8月,塔塔諮詢服務公司(TCS)贏得了GE醫療科技公司的契約,透過諮詢和工程專業知識幫助醫療保健公司轉變其IT營運模式,這表明市場對醫療保健領域技術諮詢服務的需求。

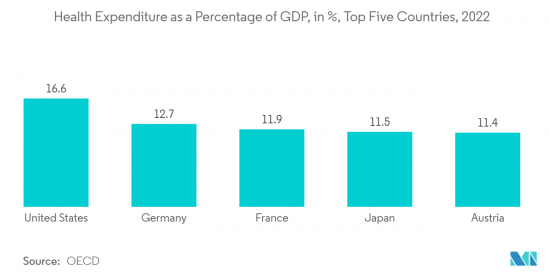

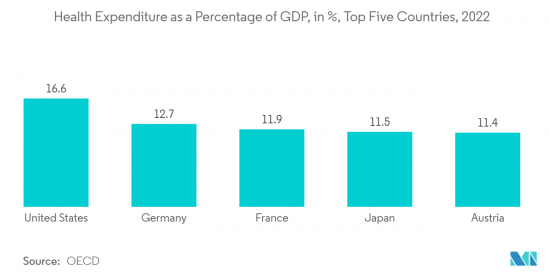

- 該市場擁有支持其成長的合作夥伴關係和收購。這是因為該市場的供應商正在與分析公司合作,以增強他們在醫療保健領域的諮詢和諮詢服務的能力。此外,美國和德國等國家將其GDP的10%以上用於醫療保健,這表明他們正在優先考慮醫療保健產業的未來成長。

北美市場佔有率最大

- 美國是世界上最大的諮詢服務市場,因為它是為廣泛的最終用戶行業提供服務的全球頂級諮詢公司的所在地。此外,美國經濟市場的高度波動,加上政府監管的持續改革,導致企業轉向管理諮詢提供者尋求其國內財務業務的協助。

- 美國也是市場先驅,在將技術進步推向全球市場方面發揮著重要作用。麥肯錫公司、科爾尼公司、波士頓顧問公司和貝恩公司等美國諮詢服務提供者是美國市場上的頂級供應商。

- 該國的高創新率和先進技術的採用也支持了對技術諮詢的需求。此外,該國的顧問公司正致力於建立合作夥伴關係,提供特定行業的諮詢服務,這正在迅速推動市場發展。

- 加拿大也是全球諮詢服務提供者的重要市場。該國擴大採用數位服務以及許多美國諮詢公司的存在也激勵許多本地供應商擴大其業務。

- 自疫情爆發以來,數位轉型已成為各行業的首要任務,大多數最終用戶供應商都在尋找新的方法來利用技術來獲得競爭優勢。由於政府投資和對數位化效率計畫的承諾,醫療保健製藥和生技領域的諮詢服務市場也呈現成長。

- 此外,國內諮詢服務公司正在加強技術和IT諮詢服務,以有效挖掘業務數位轉型的機會。預計這將在預測期內為該國的技術諮詢服務創造重大成長機會。

諮詢服務業概況

諮詢服務市場的特點是適度分散,國內外參與者都擁有數十年的產業經驗。這些供應商利用其專業知識並在廣告工作中投入大量資源,採用強而有力的競爭策略。影響贏得新契約的主要因素包括品質認證、服務內容、成本和技術力。總而言之,該市場競爭對手之間的競爭非常激烈,預計這種趨勢將在整個預測期內持續下去。市場上的知名參與者包括德勤Tohmatsu、Accenture公司、普華永道會計師事務所、安永國際有限公司和Capgemini SA公司。

2023 年 5 月,貝恩公司發布了與 Ashling Partners(專注於自動化的諮詢和實施服務提供者)建立合作夥伴關係的策略公告。此外,貝恩將直接投資 Ashling Partners,加強貝恩 Vector Digital 業務內部的合作。此次擴大的合作夥伴關係旨在幫助客戶更有效、更快速地開發、建立和擴展其自動化程序,從而充分發揮其潛力和價值。

2023 年 1 月,麥肯錫宣布收購人工智慧和機器學習專家 Iguagio。這項收購不僅讓麥肯錫獲得了 Iguagio 的技術,還增加了一支由 70 多名資料和人工智慧專家組成的團隊。因此,麥肯錫將能夠顯著加速和擴大人工智慧的採用,為我們的客戶帶來更大的影響。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

- 產業生態系統分析

- 區域重點熱點

- 工業4.0和數位轉型對諮詢服務市場的影響

- 數位化在諮詢服務市場中的作用分析

- 管理顧問領域常見的經營模式

第5章市場動態

- 市場促進因素

- 擴大對新興技術的投資

- 市場挑戰

- 計劃複雜性不斷增加,諮詢市場不斷變化

第6章市場區隔

- 按服務類型

- 營運諮詢

- 策略諮詢

- 財務諮詢

- 技術諮詢

- 其他

- 按最終用戶產業

- 金融服務

- 生命科學/醫療保健

- 資訊科技/通訊

- 政府機關

- 能源

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國(包括愛爾蘭)

- 德國

- 法國

- 義大利

- 比荷盧經濟聯盟

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 拉丁美洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Deloitte Touche Tohmatsu Limited

- Accenture PLC

- Pricewaterhousecoopers LLP

- Ernst & Young Global Limited

- Capgemini SE

- KPMG International

- Boston Consulting Group Inc.

- AT Kearney Inc(Kearney)

- Mckinsey & Company

- Bain & Company Inc.

- Roland Berger Holding Gmbh & Co. KGAA

- Simon-Kucher & Partners

- Oc&c Strategy Consultants LLP

第8章投資分析

第9章市場的未來

The consulting services market size is expected to grow from USD 323.88 billion in 2024 to USD 431.89 billion by 2029, at a CAGR of 4.96% during the forecast period (2024-2029).

Key Highlights

- Management consulting firms provide services that help organizations improve their efficiency. These firms analyze the operations and understand the existing organizational inefficiencies, ranging from the cost of raw materials to the HR policies in the organization.

- There is a growing need for management consulting services, owing to the strong economic growth in the European markets, the regulatory reforms in the financial sector, the outsourcing of back-end operations to low-cost economies, and public investments. Over the forecast period, faster economic growth, the emergence of digital consulting, and the rise of globalization are expected to drive further growth.

- Many companies are constantly trying to reduce costs and increase their efficiency to transfer the costs saved to the customer and withstand the intense competition they face. This leads to increased demand for business process improvisations and consulting related to operational efficiency. Regulatory changes, such as Brexit and the EU General Data Protection Regulation (GDPR), have increased demand for consulting across all major service lines. Multinational organizations seek high-value advice to comply with regulations, boosting the demand for management consulting services.

- The growing complexity of projects presents a significant challenge in the consulting industry. Project management is the core of consulting services, with consulting firms relying on well-organized project teams and robust management processes. One key factor contributing to project complexity is the mounting pressure to maintain transparency regarding costs and value-added components.

- The outbreak of COVID-19 prompted organizations across the country to undertake all the necessary steps to ensure the safety of their employees and the community. The COVID-19 pandemic benefited the market, owing to the rise in remote working and the expanding digital transformation of enterprises. Businesses are looking for business processes that are seamless, efficient, and accessible from any location.

- Furthermore, many businesses have completed their digital transformation, and many have decided to remain fully remote or operate on a digital and in-office hybrid model. With the growing remote working model, companies are increasing investments in the shift to cloud and AI-powered technologies, which is expected to boost the operations consulting services market.

Consulting Service Market Trends

Life Sciences and Healthcare to Witness the Highest Growth Rate

- The role of a healthcare consulting firm is to optimize efficiency, revenue generation, and structural improvements. This can take many forms, with various specializations emerging within the healthcare consulting sector. Some larger healthcare organizations could have a consulting firm on retainer and continuously receive evaluation and advisory services to improve performance over a longer period. This is especially the case with large healthcare organizations with the financial power to employ many types of consulting services, such as operational, strategy, and technology advisory services.

- The healthcare sector has been gradually becoming competitive with the development of modern healthcare infrastructure, patient care units, governmental investments, and the integration of digital tools in the healthcare sector, which would create a demand for strategy consultancy services in the market because, with diverse business knowledge and a deep understanding of, these service provider can guide healthcare facilities to target audience's pain points.

- Healthcare organizations should comply with legal guidelines to be operational, and getting a license once is not enough because the laws and regulations constantly change, which fuels the need for legal advisory consulting services in the healthcare sector which can enable the businesses to enhance their day-to-day operations, patient information management, treatment contracts, and would create an opportunity for the market vendors, including PWC, E&Y, among others.

- Additionally, healthcare technology and equipment firms, such as GE Healthcare and Siemens Healthineers, are implementing digital strategies in their operations to increase their plants' efficiency, which is creating opportunities for consulting services. For instance, in August 2023, Tata Consultancy Services (TCS) gained a contract from GE HealthCare Technologies Inc. to support the healthcare company in transforming its IT operating model through its consulting and engineering expertise, which shows the demand for technology consulting services in the healthcare sector in the market.

- The market has been witnessing partnerships and acquisitions, which are supporting growth because market vendors are partnering with analytical firms to increase their consulting and advisory services capabilities in the healthcare sectors. Additionally, countries such as the United States and Germany are spending more than 10% of their GDP on healthcare, which shows the priority on the future healthcare segment's growth, fueling the need for consulting services in the healthcare sector.

North America Holds Largest Market Share

- The United States is the world's largest revenue-generating consulting service market, owing to being the home of top global consultancy firms catering across a broad range of end-user verticals. Furthermore, the highly volatile marketplace across the US economy, along with the sustained reforms in government regulation, is driving companies to turn to management consulting providers for acquiring assistance in their financial operations across the country.

- The United States is also a pioneer in the market and plays a significant role in bringing technological advancement to the global market. The US-based consulting services providers, like McKinsey & Company, A. T. KEARNEY INC, the Boston Consulting Group, and Bain & Company, among others, are some of the top market vendors globally.

- The country's high rate of innovation and adoption of advanced technologies have also fueled the demand for technology consulting. In addition, consulting firms in the country are focusing on partnerships to offer industry-specialized consulting services, which drives the market rapidly.

- Canada is also a significant market for global consultancy service providers. The country's growing adoption of digital services and the presence of many US-based consultancy companies also motivated many local vendors to expand their presence.

- Since the pandemic, digital transformation has become a top priority across sectors, as most of the end-user vendors are finding new ways to use technology to gain a competitive edge. The consulting services market also witnessed growth in the healthcare pharma and biotech segments, which also benefited from government investment and commitment to digitized efficiency programs.

- Further, consulting service companies in the country are enhancing their technology and IT consulting services to capitalize on the opportunity of digital transformation of businesses effectively. This, in turn, is expected to create substantial growth opportunities for Technology consulting services in the country over the forecast period.

Consulting Service Industry Overview

The consulting services market is characterized by a moderate degree of fragmentation, featuring both local and international players boasting decades of industry experience. These vendors employ a potent competitive strategy by harnessing their expertise and allocating significant resources to advertising efforts. Key factors influencing their ability to attract new contracts include quality certification, service offerings, costs, and technical capabilities. In sum, the competitive rivalry in this market is notably intense, and this trend is expected to persist throughout the forecast period. Among the prominent players in the market are Deloitte Touche Tohmatsu Limited, Accenture PLC, PricewaterhouseCoopers LLP, Ernst & Young Global Limited, and Capgemini SE.

In May 2023, Bain & Company made a strategic announcement regarding their partnership with Ashling Partners, a consulting and implementation services provider specializing in automation. Additionally, Bain is making a direct investment in Ashling Partners to strengthen their collaboration within Bain's Vector digital practices. This expanded partnership aims to assist clients in more effectively and rapidly developing, building, and scaling their automation programs to unlock their full potential and value.

In January 2023, McKinsey & Company disclosed its acquisition of Iguazio, a company specializing in AI and machine learning. This acquisition not only grants McKinsey access to Iguazio's technology but also brings onboard a team of over 70 data and AI experts. As a result, McKinsey can significantly accelerate and scale its AI deployments, thereby driving greater impact for its clients

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Industry Ecosystem Analysis

- 4.5 Key Regional Hotspots

- 4.6 Impact of Industry 4.0 and Digital transformation -Related Practices on the Consulting Services Market

- 4.7 Analysis of the Role of Digitization in the Consulting Services Market

- 4.8 Prevalent Business Models in the Management Consulting Domain

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investment in Emerging Technologies

- 5.2 Market Challenges

- 5.2.1 Project Complexities and Shift in Consulting Marketplace

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Operations Consulting

- 6.1.2 Strategy Consulting

- 6.1.3 Financial Advisory

- 6.1.4 Technology Advisory

- 6.1.5 Other Service Types

- 6.2 By End-user Industry

- 6.2.1 Financial Services

- 6.2.2 Life Sciences and Healthcare

- 6.2.3 IT and Telecommunication

- 6.2.4 Government

- 6.2.5 Energy

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom (Including Ireland)

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Benelux

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Middle East & Africa

- 6.3.4.1 Saudi Arabia

- 6.3.4.2 United Arab Emirates

- 6.3.4.3 Qatar

- 6.3.4.4 South Africa

- 6.3.5 Latin America

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Deloitte Touche Tohmatsu Limited

- 7.1.2 Accenture PLC

- 7.1.3 Pricewaterhousecoopers LLP

- 7.1.4 Ernst & Young Global Limited

- 7.1.5 Capgemini SE

- 7.1.6 KPMG International

- 7.1.7 Boston Consulting Group Inc.

- 7.1.8 A. T. Kearney Inc (Kearney)

- 7.1.9 Mckinsey & Company

- 7.1.10 Bain & Company Inc.

- 7.1.11 Roland Berger Holding Gmbh & Co. KGAA

- 7.1.12 Simon-Kucher & Partners

- 7.1.13 Oc&c Strategy Consultants LLP