|

市場調查報告書

商品編碼

1406260

數位徽章:市場佔有率分析、行業趨勢和統計、2024-2029 年成長預測Digital Badges - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

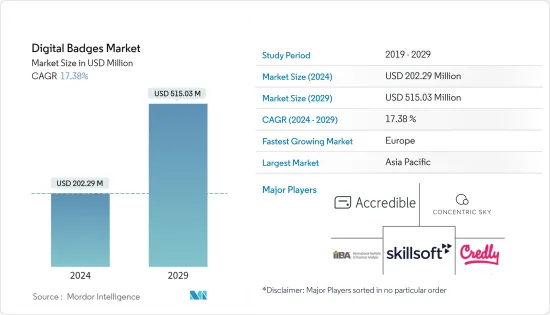

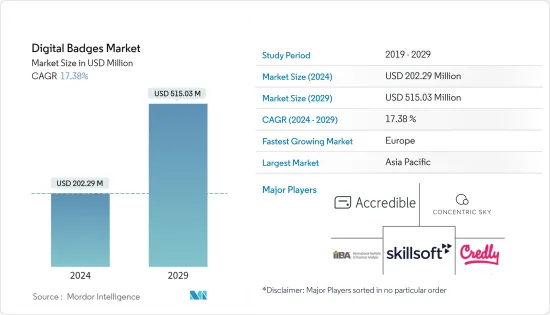

數位徽章市場規模預計到2024年為2.0229億美元,預計到2029年將達到5.1503億美元,預計在預測期內(2024-2029年)複合年成長率為17.38%。

主要亮點

- 數位徽章是一種微證書,可作為評估、認可和檢驗技能、學習和成就的機制。這些徽章被 Adobe、Dell、IBM、Microsoft 和Oracle等眾多教育機構和公司廣泛使用,為該市場的成長做出了重大貢獻。

- 此外,學生擴大使用線上作品集在一個地方記錄實習、小組計劃、志工經驗和其他成就,以及線上上和課堂上學習的課程。這有助於增加學生和專業人士的交流機會,並刺激市場成長。

- 美國勞工統計局預測,從 2018 年到 2028 年,電腦和資訊技術職位將成長 12%,高於所有職位的平均成長率。這些行業的新增就業人數估計約為 546,000 個。在預測期內,對雲端運算、資料收集和安全性的更加重視將推動對此類員工的需求,從而擴大市場成長的廣度。

- 此外,行動徽章解決方案可協助確保所有企業應用程式(無論是 Web 還是行動應用程式)提供全面且一致的安全體驗。當發生網路安全問題時,企業會收到直接通知,以便他們能夠立即採取適當的行動。鑑於這些關鍵優勢,預計該市場在未來幾年將顯著成長。

- 在非洲和亞洲等新興地區,由於需要良好的IT基礎設施,人們對數位徽章的認知不足,這是市場成長的主要阻礙因素。

- 冠狀病毒的爆發促使數位徽章的採用增加,因為員工和人力資源部門致力於縮小與在家工作文化之間的技能差距。此外,由於最終用戶擴大使用數位學習系統,數位徽章市場預計將在後 COVID-19 時期出現顯著成長。預計這將推動預測期內的市場成長。

數位徽章市場趨勢

學術領域佔據主要市場佔有率

- 將數位徽章引入教育提供了一種新的、更有效的方式來根據學生的個人學習風格進行評估。徽章根據學生的整體表現來獎勵,而不僅僅是促進學習的測驗。

- 數位徽章允許教師評估學生的成績。這些結果可能與學習、良好行為、努力、技能等有關。透過激勵和鼓勵學習,努力取得成功的學生也可能會得到獎勵。

- 數位徽章可以為所有學習領域做出重大貢獻,特別是在目標和目標方面。徽章在高等教育中最重要和最重要的用途之一是虛擬認證系統,該系統允許學生展示他們透過學習獲得的新技能和知識。由於這些優勢,預計該市場在未來幾年將出現強勁的需求。

- 工作生態系統正在迅速發展,自疫情爆發以來,員工重新考慮如何向雇主展示自己的經驗。雇主尤其希望快速可靠地了解員工的技能。為此,ACT 與 Credly 合作將 WorkKeys NCRC數位化。因為 Credly 被譽為提供檢驗的數位憑證以證明員工成功的全球領導者之一。透過在 ACT、WorkKeys、NCRC、ACT 和 Credly 中添加數位徽章,員工和職場生態系統可以針對不斷發展的勞動力隊伍而變得更加強大。

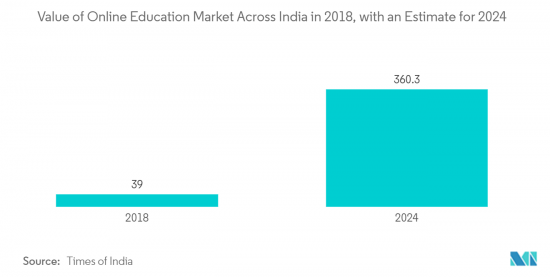

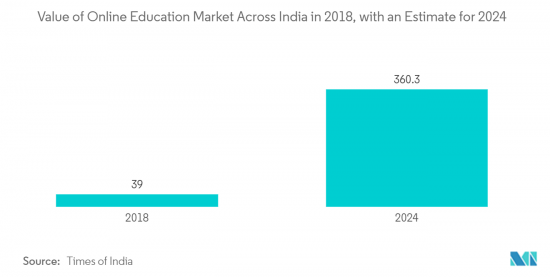

- 此外,COVID-19 大流行極大地加速了印度高等教育機構向線上學習的轉變。根據《印度時報》估計,該國線上教育市場將從 2018 年的約 390 億印度盧比(4.8 億美元)成長到 2024 年的 3,600 億印度盧比(43.9 億美元),預計將成為主要推動力。

歐洲預計將佔據較大市場佔有率

- 預計歐洲將佔據很大的市場佔有率,主要是因為全部區域存在主要企業。此外,該地區的大學程度學習正在迅速增加,歐洲國家正在製定試點計劃,以更多地使用數位徽章。

- 總部位於芬蘭的維美德學習服務公司於今年 1 月推出了用於客戶培訓的數位徽章。 因此,維美德學習服務項目的學生將獲得數位徽章,以推廣和慶祝他們的技能。 這允許為所有類型的培訓頒發徽章,包括現場教學、在線學習和課堂教學。

- 據英國教育部稱,去年 4 月,英國英國向英國地方政府和教育機構發送了超過 195 萬台設備,以支持與當前疫情相關的遠距學習。該公司聲稱,它為透過提供筆記型電腦和平板設備擴大市場佔有率。

- 在來自不同地區的領先公司的參與下,進行了多項產品發佈和技術創新。 例如,去年11月,總部位於英國的Imparta Ltd.宣佈推出新的數位徽章和身份驗證解決方案。 這是Imparta繼續擴展其解決方案以增加客戶和學習者價值的最新功能版本。 Imparta 的數字認證和徽章使組織的團隊能夠輕鬆識別成就、幫助發展和學習以及慶祝成功。

- 此外,推進實踐中心去年 12 月推出了數位徽章。從業者可以使用電子徽章來證明整個高級實踐計劃的完成。根據英格蘭健康教育一部分的高級實踐中心提供的新計劃,高級從業者現在將能夠以數位方式安全地展示他們認可的教育和培訓。

數位徽章產業概述

隨著 IBM 和思科等越來越多的公司向員工提供認證計劃,以及大學和學校更加重視正式和非正式學習,數位徽章市場變得越來越分散。

2023 年 6 月,國際商業分析研究所宣佈了 ChatGPT 學習之旅,這是一系列生成式人工智慧課程中的第一門,旨在為組織和工人提供高效和合乎道德地使用技術所需的技能。 在此之前,Skillsoft 一直在努力幫助組織瞭解和利用人工智慧的潛力來推動業務增長,並對 AI 平台進行了改進

2023 年 4 月,Accredible 將與 Cengage 合作提供數位徽章和微證書,以縮小技能差距。參加入門課程並使用 Cengage 線上學習平台 Mind Tap 的學生可以透過完成評估並展示 Microsoft Office 365 技能的熟練程度來獲得成就徽章。學生可以將徽章添加到他們的數位履歷、線上作品集或 LinkedIn 中,無需額外付費。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 越來越注重線上學習

- 市場抑制因素

- 發展中地區缺乏IT基礎設施

第6章市場區隔

- 最終用戶

- 學術的

- 公司

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Accredible

- Credly Inc.

- Concentric Sky Inc.

- International Institute of Business Analysis

- Skillsoft Corporation

- AXELOS

- Forall Systems Inc.

- ARMA International

- ProExam

- Portfolium Inc.

- Badgecraft

第8章投資分析

第9章市場的未來

The Digital Badges Market size is estimated at USD 202.29 million in 2024, and is expected to reach USD 515.03 million by 2029, growing at a CAGR of 17.38% during the forecast period (2024-2029).

Key Highlights

- Digital badges are micro-credentials that serve as a mechanism for assessing, recognizing, and verifying a skill, learning, or achievement. These badges are commonly used by an extensive range of education institutions and businesses, e.g., Adobe, Dell, IBM, Microsoft, or Oracle, which contribute substantially to the growth of this market.

- In addition, students increasingly use online portfolios to record their internship experiences, group projects, volunteer experiences, and other achievements, as well as courses taken both online and in the classroom, in one place. This helps improve networking opportunities for students and professionals, stimulating the market's growth.

- In the US Bureau of Labor Statistics, computer and information technology jobs are expected to increase by 12% between 2018 and 2028 compared with an average growth rate in all occupations. The number of new jobs in these sectors is estimated at around 546,000. This demand for such workers will be driven by a greater emphasis on cloud computing, data collection, and security over the forecast period, giving rise to an increased scope of market growth.

- Moreover, the mobile badging solution helps ensure a comprehensive and consistent safety and security experience for all your company's corporate apps, whether web or mobile. It notifies companies directly at the door in case of cybersecurity issues so they can take appropriate action without delay. The market is expected to grow significantly in the coming period, given these key benefits associated with it.

- The need for good IT infrastructure in emerging regions like Africa and Asia, which will lead to insufficient awareness of digital badges, has been a primary limiting factor for market growth.

- Since employees and HR focus on bridging skills gaps due to their workfrom home cultures, the spread of novel coronaviruses has led to an increased adoption of digital badges. Moreover, owing to end users' growing uptake of digital learning systems, the digital badges market is expected to experience significant growth during the post-COVID-19 period. In the forecast period, this is expected to boost market growth.

Digital Badges Market Trends

Academic Segment to Occupy a Significant Market Share

- A new and more efficient way of evaluating students based on their individual learning styles has been provided by introducing digital badges in education. The badges will reward students based on their overall performance rather than just a test that promotes learning.

- The digital badge gives teachers an appreciation for the achievements of their students. These achievements could be linked to learning, good behavior, efforts, skills, etc. Students who struggle to succeed by motivating and encouraging their learning may also be rewarded.

- In all areas of learning, particularly the objectives and targets, digital badges can contribute significantly. Virtual credentialing systems, allowing students to demonstrate the new skills and knowledge they have acquired due to their studies, are among the most important and essential uses for badges in higher education. Due to these benefits, the market is anticipated to show strong demand in the coming years.

- The work ecosystem has developed quickly, with staff reassessing how they represent their experiences to employers since the outbreak. Employers are particularly interested in understanding the skills of their employees rapidly and reliably. For this reason, ACT has partnered with Credly to digitally digitize the WorkKeys NCRC because of its reputation as one of the world's leaders in providing verifiable digital credentials that certify workforce success. By adding digital badging to the ACT, WorkKeys, NCRC, ACT, and Credly are helping employees and workplace ecosystems become more resilient in an evolving workforce.

- Moreover, the COVID-19 pandemic dramatically accelerated India's higher education institutions' shift to online learning. According to estimates from the Times of India, the country's online education market is likely to grow from roughly 39 billion Indian rupees (0.48 USD billion) in 2018 to 360 billion rupees (4.39 USD Billion) in 2024, driving the market significantly.

Europe is Anticipated to Hold a Significant Market Share

- Europe is expected to have a significant share of the market, mainly as a result of the fact that there are key players throughout the region. In addition, there is a sharp increase in university-level learning throughout the region, and countries across Europe are working on pilot schemes to develop significant use of digital badges.

- As part of its strategy for improving business and presence to reach customers, as well as meeting their requirements about A broad range of applications and markets, witnessing mergers, acquisitions, or investments by key players, for instance, Valmet Learning Services, based in Finland, introduced a digital badge for customer training in January this year. Therefore, Digital badges can be awarded to those participating in Valmet Learning Services to promote and celebrate their skills. This allows for the award of badges for all kinds of training, including on-site instruction, online learning, and teaching in a classroom.

- The United Kingdom Ministry of Education claimed that in April last year, the UK Government provided over 1.95 million laptop or tablet devices to local authorities and education providers across England to give them more remote support for learning related to the ongoing pandemic, significantly contributing to increasing market share.

- Several product launches and innovations have taken place with a range of regional major players involved. For instance, in November last year, Imparta Ltd., headquartered in the United Kingdom, declared the launch of a new digital badge and certification solution, the latest feature release as Imparta continues to extend its solution to drive increased value for clients and learners. Imparta digital certification and badges make it easy for the organizations' teams to recognize achievement, support development and learning, and celebrate success.

- Moreover, the Center for Advancing Practices launched a digital badge in December last year. The practitioners could demonstrate that the entire advanced practice program has been completed using electronic badges. The Advanced Practitioners would thus be able to evidence their accredited education and training digitally and securely under a new scheme that the Center would deliver for Advancing Practice, which is part of Health Education England.

Digital Badges Industry Overview

The market for digital badges is getting fragmented due to the increasing number of corporations, such as IBM and Cisco, that offer certification programs for their employees and the rising focus of colleges and schools on formal and informal learning.

In June 2023, the International Institute of Business Analysis announced its ChatGPT Learning Journey, the first in a series of generative AI courses designed to equip organizations and the workforce with the skills required to use the technology productively and ethically. This indicates Skillsoft's continuing efforts to help organizations understand and exploit the potential of artificial intelligence for boosting business growth, coming on the heels of several AI platform enhancements.

In April 2023, Accredible Partners with Cengage to Offer Digital Badging and Microcredentials to Bridge the Skills Gap. Students who take Introduction to Computing courses and use Cengage's online learning platform, Mind Tap, can earn achievement badges when they complete assessments and demonstrate proficiency in Microsoft Office 365 skills. Students can add the badges to their digital resume, online portfolio, or LinkedIn at no additional charge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus on Online Learning

- 5.2 Market Restraints

- 5.2.1 Lack of IT Infrastructure in Developing Regions

6 MARKET SEGMENTATION

- 6.1 End-user

- 6.1.1 Academic

- 6.1.2 Corporate

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Accredible

- 7.1.2 Credly Inc.

- 7.1.3 Concentric Sky Inc.

- 7.1.4 International Institute of Business Analysis

- 7.1.5 Skillsoft Corporation

- 7.1.6 AXELOS

- 7.1.7 Forall Systems Inc.

- 7.1.8 ARMA International

- 7.1.9 ProExam

- 7.1.10 Portfolium Inc.

- 7.1.11 Badgecraft