|

市場調查報告書

商品編碼

1406199

微學習:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Microlearning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

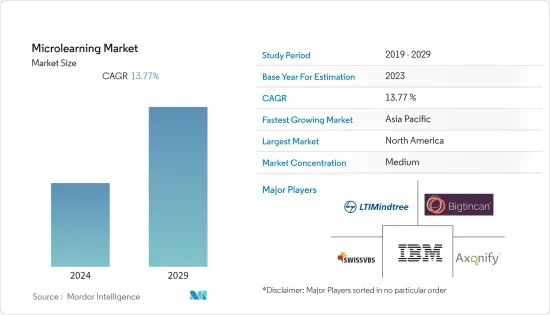

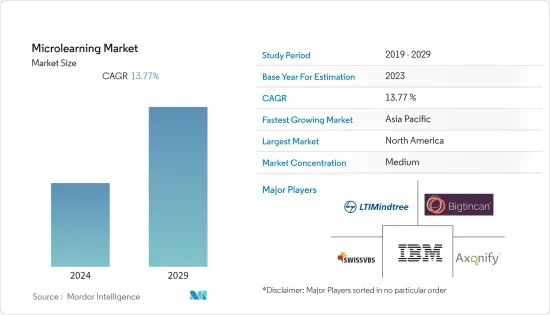

未來五年,微學習市場規模預計將從目前的23.1億美元成長至44億美元,複合年成長率為13.77%。

微學習的使用在職場、家庭和教育機構中迅速普及。根據NTL應用行為科學研究所的學習金字塔模型,傳統的聽、讀、觀察等學習方法效果不佳。人們可能只能記住20%到30%的內容。基於模擬學習的技術進步展示了很高比例的學習成果,並有效促進了市場成長。

主要亮點

- 眾多全球組織對行動工作人員進行培訓的需求是推動全球微學習市場成長的關鍵因素。另一個主要的市場促進因素是對基於技能和結果導向的培訓的需求不斷成長,這些培訓可以為公司帶來可衡量的結果。

- 微學習是一種整體的數位學習方法,主要涉及使用小型學習單元來提供培訓。微學習涉及設計小型學習區塊,每個區塊都滿足特定的學習成果,以幫助學習者更好地獲取和保留知識。微學習是數位學習中一種很有前景的學習方法,因為它為學習者和教師提供了多種好處。

- 雲端基礎的解決方案的普及和可用性的不斷提高也是市場的主要驅動力。雲端解決方案提供了平台和必要的基礎設施,以解決傳統本地微學習的擴充性限制。此外,微學習擴大被應用到現有的應用程式和平台中,包括用於客戶參與和價值創造的遊戲化。

- 此外,千禧世代對工作彈性和多樣性的需求不斷成長,促使自由工作者頻繁更換職位,在不同組織中從事不同計劃,而不是從事例行的、長時間的工作。 :因此,這些自由工作者是微學習解決方案提供者的潛在目標受眾。

- 此外,透過培訓和教育遊戲化來提高微學習的可接受性,將為微學習產業的進一步發展創造機會。然而,學習者動機的缺乏可能會為微學習市場的擴張帶來進一步的課題。

- 在疫情期間,多個行業使用微學習方法來教導員工如何使用最新的技術和程序來進行企業活動,從而促使微學習市場的顯著成長。微學習計畫透過利用視訊、音訊和各行業專家的個人經驗幫助人們學習新技能。 COVID-19 為各個最終用戶行業提供了微學習的巨大機會,從長遠來看,市場可能會成長。

微學習市場趨勢

對基於技能和結果導向的培訓的需求不斷成長推動了市場成長

- 公司發現基於技能的流程有效解決了疫情爆發以來增加的困難。雇主需要幫助招募和留住關鍵職位的合格申請人。採用基於技能的方法的公司能夠增加空缺職位申請者的數量和質量,並且其員工會看到公司內部更大的晉升潛力,從而提高員工保留率。

- 此外,隨著千禧世代在工作中尋求更多的彈性和多樣性,自由工作者不再是例行公事的長時間工作,而是經常更換工作並在不同的組織中從事不同的計劃,可用勞動力的數量顯著增加。因此,這些自由工作者是微學習解決方案提供者的潛在目標受眾。

- 基於技能的方法可以幫助公司找到並吸引更大的人才庫,由合適的人員組成,以長期填補這些職位的空缺。這種方法也為履歷表缺乏特定或典型資格的非典型申請人打開了大門。

- 2022 年 9 月,Coursera, Inc. 宣布擴展 Clips。 Clips 讓員工可以存取近 2,000,000 個短影片和課程,旨在幫助員工在 10 分鐘內開始學習所需的技能。

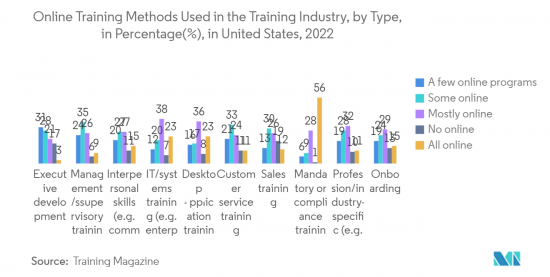

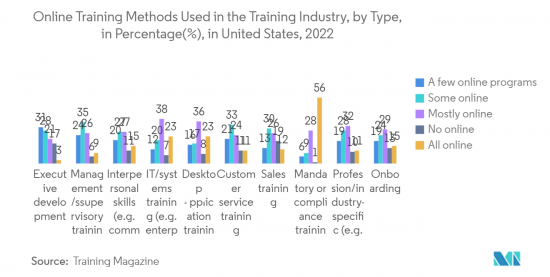

- 根據《培訓雜誌》在美國進行的一項研究,今年大部分線上培訓都是針對義務教育或合規教育。超過一半的培訓機構提供強製或合規培訓。該類別中不到 10% 的公司僅提供線上高階主管發展培訓。

北美預計將佔據很大佔有率

- 北美數位學習市場在該行業中佔有重要佔有率。這是因為許多組織正在迅速採用技術為其員工提供適當的培訓。數位學習的發展為該地區的微學習提供者提供了巨大的機會。

- 另一個影響因素是數位設備的日益普及。根據 GSMA 的數據,到 2025 年,北美智慧型手機用戶數量預計將達到 3.28 億。此外,到 2025 年,該地區的行動用戶(86%) 和網路 (80%)普及可能會增加,位居世界第二。設備的日益普及預計將對該地區的虛擬實境市場產生積極影響。

- 得到政府支持並專注於現代學習的組織正在推動市場擴張。加拿大 21 世紀學習與創新協會 (C21 Canada) 是一個致力於 21 世紀教育學習模式的全國性非營利組織。舉措是致力於為 21 世紀學習創造願景和框架、激勵加拿大人的舉措。

- 微學習解決方案中的遊戲化透過使用各種技術來提高員工的整體生產力,例如計劃管理中任務完成的獎勵以及知識管理中資料貢獻和存取的獎勵。它也是一個有用的工具然而,該行業也面臨缺乏應用遊戲化的標準化指南。

- 根據 IBM 的一份報告,75% 的 Z 世代更喜歡智慧型手機而不是其他行動裝置。因此,未來微學習中針對行動裝置的培訓策略可能會成長,以提高他們的學習興趣。這些經濟、社會和行為方面的變化可能會促使技術接受度呈指數級成長,促進該地區微學習市場的成長,並使其成為永續的解決方案。

微學習行業概況

市場適度分散,許多本地和區域參與者在快速成長的微學習市場中競爭。微學習市場的參與者透過互動式媒體提供內容,引起學習者對這些培訓平台的高度興趣。市場參與者正在採取聯盟和收購等策略來增強其服務產品並獲得永續的競爭優勢。市場參與企業包括 Mindtree Limited、IBM Corporation、SwissVBS、Axonify 和 Bigtincan。

2022 年 6 月,第一線員工培訓和溝通領域的領導者之一 Axonify 宣布收購頂級員工溝通和執行平台之一 Nudge。此次合作預計將利用 Axonify 的自我調整微學習方法和 Nudge 的雙向通訊和任務管理平台,提供一種整合的學習、參與和執行方法。

2022 年 11 月,Broadcast 被選為屢獲殊榮的學習科技公司 Learning Pool 的行為合規微學習內容合作夥伴。這項新的合作允許客戶使用Learning Pool 的平台來確定特定的合規培訓需求,應用Broadcat 的實際工作輔助工具(決策樹、清單和資訊圖表)來幫助他們的組織。這意味著可以提高普通但關鍵技能的員工留任率減少員工的潛在責任。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 對無辦公桌和移動工作人員的訓練需求增加

- 對基於技能和結果導向的培訓的需求不斷成長

- 訓練和教育遊戲化

- 市場抑制因素

- 本公司不願花費大量資金將現有培訓內容轉換為微內容

第6章市場區隔

- 依成分

- 解決方案

- 服務

- 依組織規模

- 主要企業

- 中小企業

- 依部署方式

- 本地

- 雲

- 依最終用戶

- 零售

- 製造業

- 銀行/金融服務/保險

- 通訊/IT

- 其他(醫療保健/生命科學、物流)

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 其他地區

第7章 競爭形勢

- 公司簡介

- Mindtree Limited

- IBM Corporation

- SwissVBS

- Axonify Inc

- Bigtincan

- Saba Software

- iSpring Solutions Inc.

- Epignosis

- Qstream, Inc.

- Cornerstone OnDemand, Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Microlearning Market size is expected to grow from USD 2.31 billion in the current year to USD 4.40 billion by the next five years, registering a CAGR of 13.77%.

The use of microlearning is rapidly becoming more common across workplaces, homes, and educational institutions. According to the NTL Institute of Applied Behavioral Science Learning Pyramid model, the traditional learning methods based on listening, reading, and observing are ineffective. The person might recall only 20% to 30% of the contents. The advancement in technology based on simulation learning is effectively driving the market's growth, with a high percentage of learning outcomes.

Key Highlights

- The need to train mobile workers in numerous global organizations is a crucial element driving the growth of the global microlearning market. Another major market-driving factor is the expansion of the growing need for skill-based and result-oriented training that may give measurable results for businesses.

- Microlearning is a holistic approach toward e-learning that majorly deals with using small learning units to deliver training. Microlearning involves designing bite-sized learning nuggets to help learners acquire and retain knowledge better, each meeting a specific learning outcome. It is a promising learning approach in e-learning because of its several benefits to learners and instructors.

- Also, the increased adoption and availability of cloud-based solutions have been significant drivers for the market. They provide the platform and necessary infrastructure to address the scalability limitation of the traditional on-premise microlearning experiences. Moreover, microlearning has been witnessing an increased implementation in existing applications and platforms, which includes gamification for customer engagement and value creation.

- Furthermore, the growing demand from millennials for higher flexibility and variation of jobs has significantly resulted in a considerable workforce consisting of freelancers changing their positions frequently and working on different projects at different organizations instead of doing routine long-hour jobs. Therefore, these freelancers have become a potential target audience for microlearning solution providers.

- Furthermore, the gamification of training and education to enhance microlearning acceptability will create further opportunities for the microlearning industry to develop. However, a lack of motivation among learners could further challenge the expansion of the microlearning market.

- During the pandemic, several industry verticals used micro-learning approaches to teach their staff about using the latest technology and procedures to run company activities, leading to considerable micro-learning market growth. The micro-learning program helped people acquire new skills by utilizing videos, audio, and the personal experiences of diverse industry experts. COVID-19 provided immense opportunities for microlearning in various end-user industries, and thus, the market will grow in the long run.

Microlearning Market Trends

Growing Need for Skills-based and Result-oriented Training Driving the Market Growth

- Companies have realized that skills-based processes effectively solve the increased difficulties since the epidemic. Employers need help to recruit qualified applicants for critical open positions and keep the talent they have hired. Companies that use a skills-based approach can increase the quantity and quality of people who apply for available jobs and help employees discover more possibilities to progress internally, which can help employers improve retention.

- Furthermore, the growing demand from millennials for higher flexibility and variation of jobs has significantly resulted in a considerable workforce consisting of freelancers changing their positions frequently and working on different projects at different organizations instead of doing routine long-hour jobs. Therefore, these freelancers have become a potential target audience for microlearning solution providers.

- Skills-based methods assist companies in locating and attracting a larger pool of talent comprised of individuals who are more equipped to fill these roles in the long run. Such approaches also open doors for atypical applicants, such as those who lack particular or usual qualifications on their resumes.

- In September 2022, Coursera, Inc. announced the expansion of Clips, which provides employees access to nearly 2,00,000 short videos and lessons designed to help them begin learning high-demand skills in less than 10 minutes.

- According to a survey conducted by Training Magazine in the United States, most online trainings were offered for compulsory or compliance training this year. More than half of the training businesses supplied mandatory or compliance training. Less than ten percent of organizations in this category supplied only online executive development training, whereas 17 percent of the same companies said they would offer such training in person this year.

North America is Expected to Hold Major Share

- The North American eLearning market accounts for a significant share of the industry. It is increasing due to the fast technological adoption by numerous organizations to provide adequate training to their employees. The growth of e-learning will provide immense opportunities to microlearning providers in the region.

- Another influencing factor is the increased penetration of digital devices. According to GSMA, the number of smartphone subscribers in North America is expected to reach 328 million by 2025. Moreover, by 2025, the region may witness an increase in the penetration rates of mobile subscribers (86%) and the internet (80%), the second-highest in the world. Increased device penetration will positively impact the virtual reality market in the region.

- Organizations that are focusing on modern learning, supported by the government, are leading to market expansion. Canadians for 21st Century Learning and Innovation (C21 Canada) is a national, non-profit organization that aims to 21st-century models of learning in education. It handles initiatives dedicated to creating a 21st-century learning vision and framework that inspires Canadians.

- Gamification in microlearning solutions is also a handy tool for increasing the overall productivity of employees by using various methods, such as rewards for task completion in case of project management or data contribution or access in case of knowledge management. However, the industry is also facing an absence of standardized guidelines for applying gamification due to the need for substantial academic research.

- According to a report from IBM, 75% of Gen Z'ers prefer to use a smartphone compared to other mobile devices. So, a mobile-focused training strategy in microlearning will grow in the future to interest them in learning. Changing economic, social, and behavioral aspects such as these leading to acceptance of technology at an exponential rate will only boost the market growth of microlearning in the region, making them sustainable solutions.

Microlearning Industry Overview

The market is moderately fragmented, with many local and regional players competing in a fast-growing microlearning market. Players in the microlearning market are engaged to offer their content through the interactive medium that will develop a high interest of the learners in these training platforms. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their service offerings and gain sustainable competitive advantage. Some market players are Mindtree Limited, IBM Corporation, SwissVBS, Axonify, and Bigtincan.

In June 2022, Axonify, one of the leaders in frontline employee training and communications, announced the acquisition of Nudge, one of the top-rated employee communication and execution platforms. The partnership was expected to deliver an integrated approach to learning, engagement, and execution that leveraged Axonify's adaptive microlearning methodology with Nudge's two-way communications and task management platform.

In November 2022, Broadcast was selected as the behavioral compliance micro-learning content partner of an award-winning learning technologies company with Learning Pool. This new collaboration was to mean customers could use Learning Pool's platform to identify specific compliance training needs, then apply Broadcat's practical job aids (decision trees, checklists, and infographics) to improve employee retention of routine yet vital skills that can mitigate potential liability for an organization.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Training Deskless and Mobile Workers

- 5.1.2 Growing Need for Skills-Based and Result-Oriented Training

- 5.1.3 Gamification of Training and Education

- 5.2 Market Restraints

- 5.2.1 Reluctance of enterprises to spend huge amount on transforming existing training content into microcontent

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.2 Services

- 6.2 By Organization Size

- 6.2.1 Large Enterprises

- 6.2.2 Small and Medium-Sized Enterprises

- 6.3 By Deployment Mode

- 6.3.1 On-Premise

- 6.3.2 Cloud

- 6.4 By End User

- 6.4.1 Retail

- 6.4.2 Manufacturing

- 6.4.3 Banking, Financial Services and Insurance

- 6.4.4 Telecom and IT

- 6.4.5 Other End Users (Healthcare and Life Sciences, Logistics)

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Mindtree Limited

- 7.1.2 IBM Corporation

- 7.1.3 SwissVBS

- 7.1.4 Axonify Inc

- 7.1.5 Bigtincan

- 7.1.6 Saba Software

- 7.1.7 iSpring Solutions Inc.

- 7.1.8 Epignosis

- 7.1.9 Qstream, Inc.

- 7.1.10 Cornerstone OnDemand, Inc.