|

市場調查報告書

商品編碼

1406159

低發泡介面活性劑:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Low Foam Surfactants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

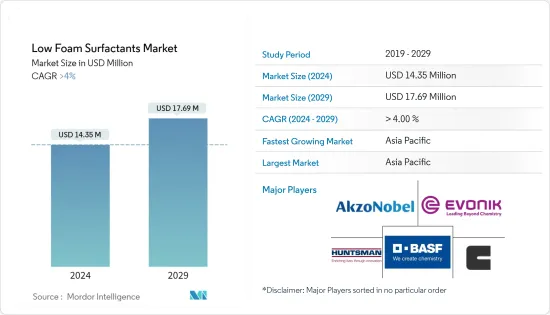

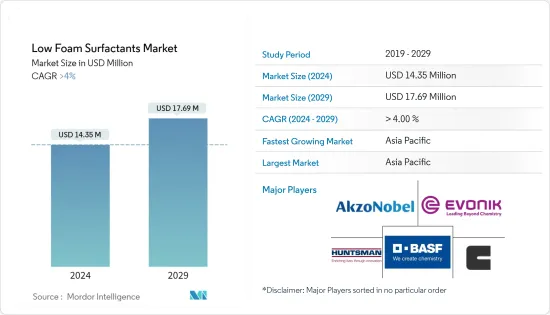

低發泡介面活性劑市場規模預計到2024年為1435萬美元,預計到2029年將達到1769萬美元,在預測期內(2024-2029年)複合年成長率將超過4%。

COVID-19大流行在一定程度上對低發泡介面活性劑市場產生了積極影響。世界各國政府安全措施的實施和衛生意識的提高對清潔劑和清洗劑的市場需求產生了積極影響,從而帶動了低發泡介面活性劑的市場需求。在 COVID-19之後,由於農業化學品、食品和乳製品加工、清洗產品、清潔劑和清洗以及油田化學品對低發泡介面活性劑的需求增加,市場不斷成長。

主要亮點

- 清潔劑和清洗劑的顯著成長、對永續介面活性劑的需求不斷增加以及對個人護理產品的需求不斷成長預計將推動當前的研究市場。

- 另一方面,嚴格的環境法規和其他替代品的可用性預計將阻礙市場成長。

- 生物基介面活性劑的開拓預計將在預測期內創造市場機會。

- 預計亞太地區將主導市場。由於農業化學品和農業化學品中對低發泡介面活性劑的需求不斷成長,預計其成長也將達到最高。

低發泡介面活性劑的市場趨勢

清潔劑和清洗劑終端用戶產業主導市場

- 低發泡介面活性劑廣泛用於居家護理應用,例如洗衣精、洗碗機清潔劑、地毯清潔劑、地板清潔劑和多種類型的織物整理加工劑。此外,它不受水硬度的影響。

- 非離子介面活性劑與其他介面活性劑混合,廣泛用於工業清洗應用。對更環保和永續的介面活性劑的需求預計將成為低發泡介面活性劑市場的最新趨勢。玩家正在轉向使用草藥和生物分解性介面活性劑製造低泡沫表面活性劑。

- 北美和亞太地區是全球最大的清潔劑和清洗產品市場。在亞太地區,清潔劑的需求主要在中國和印度等國家增加。對清潔劑的需求不斷成長,促使寶潔等公司在印度投資清潔劑業務。例如,2022 年 5 月,寶潔公司投資約 20 億印度盧比(2,605 萬美元)在印度特倫甘納邦新建液體清潔劑製造工廠。因此,液體清潔劑產量的增加可能會推動低發泡介面活性劑市場的發展。

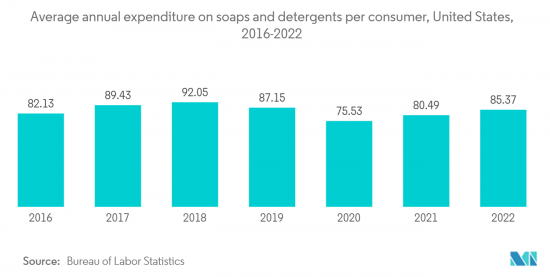

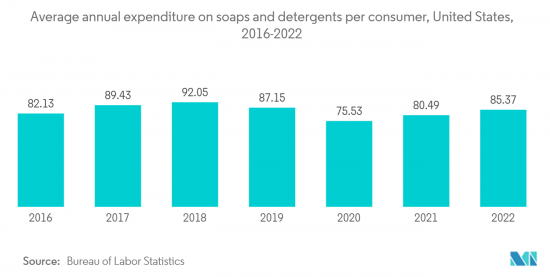

- 美國是世界上最大的肥皂和清潔劑市場之一。根據美國勞工統計局的數據,2022 年美國每位消費者在肥皂和清潔劑上的平均年支出將達到約 85.37 美元,比與前一年同期比較成長 6%。

- 同樣,歐洲對清潔劑和清洗產品的需求也在增加。根據 AISE(國際肥皂、清潔劑和保養產品協會)的數據,2022 年洗衣精市場價值將達到 171.4 億美元(158 億歐元),高於前上年度的162.1 億美元(149.4 億歐元)。成長率為5.4%。因此,洗衣護理清潔劑市場的擴張預計將推動當前的研究市場。

- 因此,預計清潔劑和清洗劑最終用戶產業將在預測期內主導低發泡介面活性劑市場。

亞太地區是成長最快的市場

- 由於印度、中國和日本等國家各種最終用戶應用的需求不斷增加,預計亞太地區在預測期內將主導低發泡清潔劑市場。

- 在中國和印度等國家,生活方式的改變和產品的廣泛適用性正在推動低發泡清潔劑市場的發展。可支配收入和購買力的增加支持了成長,從而推動了家庭和個人護理行業對低發泡介面活性劑的需求。

- 在個人護理應用中,由於其抗菌、發泡、調理、溫和清洗和防腐性能,被用於洗髮精、洗面乳、護膚護膚霜等。全部區域個人護理產品需求的增加,該產品的需求預計將激增。

- 在中國,個人護理行業是成長最快的行業之一。根據CHINABRIEF報告,預計2025年,中國化妝品及個人護理市場規模將達780億美元。

- 同樣,在印度,個人護理和衛生市場正在經歷高速成長,因為它響應了不斷變化的消費者價值觀和期望。據印度投資局稱,2022 年個人護理和衛生用品市場價值為 150.5 億美元,預計到 2026 年將達到 173.4 億美元。因此,中國和印度個人護理和衛生市場的成長將推動該地區當前的研究市場。

- 此外,在中國,隨著石油和天然氣探勘活動的活性化,油田化學品市場正在不斷擴大。多家跨國公司正在中國擴大其油田化學品業務。

- 因此,清潔劑和清洗產品、個人護理產品和油田化學品製造中對低發泡介面活性劑的需求不斷成長,預計將在預測期內推動該地區的市場。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 清潔劑和清洗產品顯著成長

- 對永續介面活性劑的需求不斷成長

- 個人護理產品需求不斷成長

- 抑制因素

- 嚴格的環境法規

- 其他替代品的可得性

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 類型

- 雙性戀

- 陽離子

- 非離子型

- 最終用戶產業

- 農藥

- 食品和乳製品清洗劑

- 清潔劑和清洗劑

- 紙漿/造紙製造

- 金屬清洗/金屬加工油

- 油田化學品

- 其他(紡織品、個人護理品等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太地區其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AkzoNobel NV

- BASF SE

- Clariant AG

- Croda International plc

- Dow

- Evonik Industries AG

- Huntsman International LLC

- KAO CORPORATION

- Nufarm

- Oxiteno SA

- Solvay

- Stepan Company

第7章 市場機會及未來趨勢

- 生物基介面活性劑的開發

- 其他機會

The Low Foam Surfactants Market size is estimated at USD 14.35 million in 2024, and is expected to reach USD 17.69 million by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The COVID-19 pandemic positively affected the market for low-foam surfactants to some extent. The implementation of safety measures by various governments across the globe and the increasing awareness about hygiene positively impacted the market demand for detergents and cleaning agents, thereby driving the market demand for low-foam surfactants. Post-COVID-19, the market grew due to the increasing demand for low-foam surfactants in agrochemicals, food and dairy processes, cleaners, detergents and cleaning agents, and oilfield chemicals.

Key Highlights

- The significant growth in detergents and cleaning agents, increased demand for sustainable surfactants, and the rising demand for personal care products are expected to drive the current studied market.

- On the flip side, the stringent environmental regulations and the availability of other substitutes are expected to hinder the growth of the market.

- The development of bio-based surfactants is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest growth due to the rising demand for low foam surfactants in agrochemicals and agrochemicals.

Low Foam Surfactants Market Trends

Detergents and Cleaning Agents End-user Industry Segment to Dominate the Market

- Low foam surfactants are extensively employed in home care applications like laundry detergents, dishwasher detergents, carpet cleaners, floor cleaners, and several types of fabric softeners. In addition, they are not affected by the hardness of water.

- Non-ionic surfactants are mixed with other surfactants and are widely used in industrial cleaning applications. Demand for greener & sustainable surfactants is anticipated to be the latest trend in the low foam surfactants market. Players are transitioning towards manufacturing low-foam surfactants with herbal and biodegradable compounds.

- North America and Asia-Pacific are the largest markets for detergents and cleaning agents across the world. In the Asia-Pacific region, the demand for detergents is mainly increasing in countries like China and India. Owing to the rising demand for detergents, firms such as Procter & Gamble are investing in a detergent business in India. For instance, in May 2022, Procter & Gamble started a new liquid detergent manufacturing unit in Telangana, India, with an investment of around INR 2,000 million (USD 26.05 million). Thus, the rising production volumes of liquid detergents will drive the market for low-foam surfactants.

- The United States is one of the largest markets for soaps and detergents across the world. According to the Bureau of Labor Statistics, the average annual expenditures for soaps and detergents in the United States amounted to roughly USD 85.37 per consumer unit in 2022, reflecting an increase of 6% compared to the previous year.

- Similarly, in Europe, the demand for detergents and cleaning agents is increasing. According to A.I.S.E ( International Association for Soaps, Detergents and Maintenance Products), the market for laundry care detergents is registered at USD 17.14 billion (EUR 15.8 billion) in 2022, as compared to USD 16.21 billion (EUR 14.94 billion) reported in the previous year at a growth rate of 5.4%. Thus, the increasing market for laundry care detergents is expected to drive the current studied market.

- Thus, the detergents and cleaning agents end-user industry segment will dominate the market for low foam surfactants during the forecast period.

Asia Pacific Region to be the Fastest Growing Market

- The Asia-Pacific region is expected to dominate the market for low-foam detergents during the forecast period due to increased demand from various end-user applications in countries like India, China, and Japan.

- In countries like China and India, the changes in the lifestyle and wide scope of application of the product are driving the market for low-foam detergents. The increasing disposable income and purchasing power support the growth, which in turn has increased the demand for low-foam surfactants in the home & personal care industry.

- In personal care applications, they exhibit antimicrobial properties, foaming & conditioning properties, mild detergency actions, and preservative properties and hence are being used in shampoos, face washes, and skincare creams. The increasing demand for personal care products across the region is expected to surge the demand for the product.

- In China, the personal care industry is one of the fastest-growing sectors. According to CHINABRIEF, the cosmetics and personal care market in the country is expected to reach USD 78 billion by 2025.

- Similarly, in India, the personal care and hygiene market is growing at a higher rate to deal with evolving consumer values and expectations. According to Invest India, the personal care and hygiene market is valued at USD 15.05 billion in 2022 and is expected to reach USD 17.34 billion by 2026. Thus, the growth in the personal care and hygiene markets in China and India will drive the current studied market in the region.

- Furthermore, in China, the market for oilfield chemicals is increasing with the rising oil and gas exploration activities in the country. Several global companies are expanding their operations of oil field chemicals in China. For instance, in March 2023, Aramco, one of the world's major integrated energy and chemicals companies, signed definitive agreements to acquire a 10% interest in Shenzhen-listed Rongsheng Petrochemical Co. Ltd in China. The acquisition will help to increase the production volume of oilfield chemicals in the country, thereby driving the market for low-foam surfactants.

- Thus, the rising demand for low-foam surfactants in the manufacturing of detergents and cleaning agents, personal care products, and oil field chemicals is expected to drive the market in the region during the forecast period.

Low Foam Surfactants Industry Overview

Low Foam Surfactants market is partially consolidated in nature. Some of the major players in the market (not in any particular order) include AkzoNobel N.V., BASF SE, Clariant AG, Evonik Industries AG, and Huntsman International LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Significant Growth in Detergents and Cleaning Agents

- 4.1.2 Increased Demand for Sustainable Surfactants

- 4.1.3 The rising demand for personal care products

- 4.2 Restraints

- 4.2.1 The Stringent Enviornmental Regulations

- 4.2.2 The Availability of Other Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Amphoteric

- 5.1.2 Cationic

- 5.1.3 Non-ionic

- 5.2 End-user Industry

- 5.2.1 Agrochemicals

- 5.2.2 Food and Dairy Process Cleaners

- 5.2.3 Detergents and Cleaning Agents

- 5.2.4 Pulp and Paper

- 5.2.5 Metal Cleaning and Metal Working Fluids

- 5.2.6 Oilfield Chemicals

- 5.2.7 Others (Textiles, Personal care, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AkzoNobel N.V.

- 6.4.2 BASF SE

- 6.4.3 Clariant AG

- 6.4.4 Croda International plc

- 6.4.5 Dow

- 6.4.6 Evonik Industries AG

- 6.4.7 Huntsman International LLC

- 6.4.8 KAO CORPORATION

- 6.4.9 Nufarm

- 6.4.10 Oxiteno SA

- 6.4.11 Solvay

- 6.4.12 Stepan Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based Surfactants

- 7.2 Other Opportunities