|

市場調查報告書

商品編碼

1689946

脂醇類-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Fatty Alcohol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

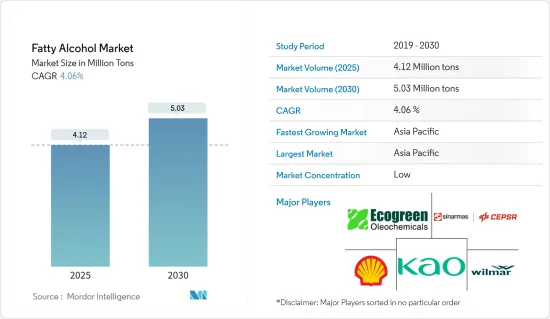

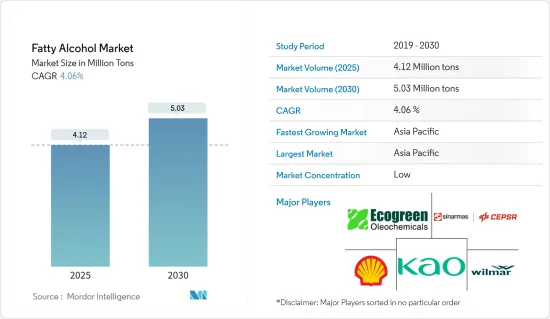

脂醇類市場規模預計在 2025 年為 412 萬噸,預計在 2030 年達到 503 萬噸,預測期內(2025-2030 年)的複合年成長率為 4.06%。

市場受到了 COVID-19 的負面影響。為了遏止疫情蔓延,一些國家已進入封鎖狀態。許多企業和工廠關閉,擾亂了全球供應鏈,影響了全球的生產、交貨計劃和產品銷售。目前,脂醇類市場正在從新冠疫情的影響中恢復,並呈現顯著成長。

主要亮點

- 從中期來看,製藥業需求的增加以及個人護理和化妝品中脂醇類使用量的增加預計將成為市場的主要推動要素。

- 另一方面,原料價格上漲預計將對市場產生抑製作用。

- 對生物基脂醇類產品日益成長的需求可能會在未來幾年為市場帶來福音。

- 亞太地區佔據了最大的市場佔有率,預計在預測期內將繼續佔據主導地位。

脂醇類的市場趨勢

市場主導的表面活性劑應用

- 脂醇類主要用於生產清潔劑和界面活性劑。脂醇類是雙親性的,因此可用作非離子表面活性劑。

- 脂醇類是碳原子數從C6到C22的一級醇,通常為直鏈,清潔劑產業中使用的就是這種類型的醇。現代清潔劑最初都是以脂醇類原料製成的界面活性劑為主。這些包括天然油、脂肪和蠟,最近,人們從各種碳氫化合物來源合成了更高分子量的醇。

- 全球大部分脂醇類被轉化成界面活性劑,作為清潔劑洗衣精和其他家用清洗產品的基本原料。

- 根據國際貿易中心的數據,德國是肥皂和有機界面活性劑的最大出口國,出口額預計將從2019年的118.2億美元大幅增加至2022年的145.4億美元。這一成長意味著國際市場對這些產品的需求增加,進而導致對脂肪酸作為製造界面活性劑的關鍵成分的需求增加。

- 中國化學工業的產出對於包括肥皂、清潔劑和化妝品在內的多種產品至關重要。 60多家洗衣、護理和清洗產品製造商的存在證明了該行業的競爭性質。此外,中國每100戶家庭擁有約98.7台洗衣機,清洗產品的消費群不斷成長。中國電器產品製造商的崛起及其對平價產品的關注,增加了洗衣機的普及度,並刺激了對清潔劑的需求。

- 此外,印度是世界領先的肥皂生產國之一。該國人均香皂和沐浴皂消費量量約800公克。該國人均香皂和沐浴皂消費量量約為800克,顯示該國對肥皂產品的需求穩定。此外,家居和個人護理領域約佔印度快速消費品市場的 50% 佔有率。合成清潔劑中間體的產量從 2019 年的 714,680 噸持續增加到 2022 會計年度的 78 萬多噸,顯示對清潔劑產品的需求不斷增加。因此,隨著印度清潔劑市場的擴大,作為界面活性劑生產原料的脂肪酸的需求也將成長。

- 預計這些因素將在未來幾年推動對脂醇類的需求。

亞太地區佔市場主導地位

- 預計中國、印度和日本等主要國家對錶面活性劑、個人護理和化妝品以及製藥等各行業的高需求將在市場估計和預測期內推動市場研究。

- 中國是世界第二大化妝品消費國。根據歐萊雅的報告,2022年,中國美容和個人護理市場總產值達553億美元。在經歷了因經濟不確定性、大量企業倒閉和其他疫情政策變化而導致的放緩之後,中國美容市場在2022年呈現強勁復甦。

- 我國合成清潔劑生產主要集中在廣東省、浙江省和四川省,年生產量分別為325萬噸、114萬噸及109萬噸。

- 中國製藥業是世界上最大的製藥業之一。我們參與學名藥、治療藥物、原料藥和草藥的生產。日本註冊的藥品90%以上都是學名藥。截至 2022 年,該國擁有龐大且多元化的國內製藥業,由約 5,000 家製造商組成,其中許多是中小型企業。

- 根據國家投資促進和便利化機構 (Invest India) 的數據,印度在美容和個人護理 (BPC) 市場排名第八。意識的增強、獲取的便利性以及生活方式的改變等因素正在推動市場的發展。預計今年底印度個人衛生市場規模將達 150 億美元。

- 洗髮精中使用的脂肪酸甲酯可有效去除頭髮上的皮脂和固態顆粒等污垢。據Invest India稱,印度護髮市場規模預計將達到48.9億美元,未來兩年的複合年成長率為6.6%。

- 為了促進日本化妝品產業的發展,東京化妝品工業協會、日本化妝品工業協會、西日本化妝品工業協會和中部化妝品工業協會於2023年4月合併成立了日本化妝品工業協會(JCIA)。日本化妝品產業主要企業之一花王株式會社發布的報告顯示,去年日本整體化妝品市場成長了3%以上,預計未來幾年將進一步成長。

- 由於該地區終端用戶產業的快速成長,預測期內對脂醇類的需求也預計將增加。

脂醇類產業概況

全球脂醇類市場分散,由幾家大中型公司組成。市場的主要企業(不分先後順序)包括 PT.Ecogreen Oledochemicals、Shell PLC、Kao Corporation、Wilmar International Ltd 和 Sinarmad Cepsa Pte.Ltd。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 製藥業需求不斷成長

- 脂醇類在個人護理和化妝品中的使用日益增多

- 市場限制

- 原物料價格上漲

- 其他阻礙因素

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按類型

- 自然資源

- 石化原料

- 按應用

- 界面活性劑

- 製藥

- 潤滑劑

- 個人護理

- 食物

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Arkema

- Croda International PLC

- Godrej Industries Limited

- Kao Corporation

- KLK OLEO

- Musim Mas

- Procter & Gamble

- PT. Ecogreen Oledochemicals

- SABIC

- Sasol

- Shell PLC

- Sinarmad Cepsa Pte. Ltd

- VVF LLC

- Wilmar International Ltd

第7章 市場機會與未來趨勢

- 生物基脂醇類產品需求不斷成長

- 其他機會

The Fatty Alcohol Market size is estimated at 4.12 million tons in 2025, and is expected to reach 5.03 million tons by 2030, at a CAGR of 4.06% during the forecast period (2025-2030).

The market was negatively impacted due to COVID-19. Several countries went into lockdown to curb the spread of the pandemic. The shutdown of numerous companies and factories disrupted supply networks worldwide and harmed global production, delivery schedules, and product sales. Currently, the fatty alcohol market has recovered from the impacts of the COVID-19 pandemic and is growing at a significant rate.

Key Highlights

- Over the medium term, the growing demand from the pharmaceutical industry and the increasing usage of fatty alcohol in personal care and cosmetics products are expected to be the major driving factors for the market.

- On the flip side, high volatility in raw material prices is likely to pose as a restraint for the market.

- The growing demand for bio-based fatty alcohol products is likely to act as an opportunity for the market in the coming years.

- The Asia-Pacific region accounts for the highest market share, and the region is likely to continue its dominance in the market during the forecast period.

Fatty Alcohol Market Trends

Surfactants Application to Dominate the Market

- Fatty alcohols are mainly used in the production of detergents and surfactants. Due to their amphipathic nature, fatty alcohols behave as nonionic surfactants.

- Fatty alcohol is primary alcohol from C6 to C22, usually straight-chain, which is the type used by the detergent industry. Modern detergents were initially based on surfactants made from fatty alcohol raw materials. These include natural fats, oils, and waxes, and more recently, high molecular weight alcohols have been produced synthetically from various hydrocarbon sources.

- A substantial majority of fatty alcohols worldwide are converted into surfactants or surface active agents, the basic materials used to produce laundry detergent, dishwashing detergent, and other household cleaning products.

- According to the International Trade Centre, Germany stands out as the largest exporter of soap and organic surface-active products, witnessing a substantial increase in export value from USD 11.82 billion in 2019 to USD 14.54 billion in 2022. This growth signifies a growing demand for these products in international markets, translating to increased demand for fatty acids as key components in producing surfactants.

- The output from the Chinese chemical industry is essential in various products, which include soaps, detergents, cosmetics, etc. The presence of over 60 washing, care, and cleaning agent manufacturers underscores this sector's competitive nature. Furthermore, with approximately 98.7 washing machines per one hundred households in China, there is a growing consumer base for cleaning products. The rise of Chinese household appliance producers and their focus on affordable products have increased access to washing machines, resulting in a higher demand for detergents.

- Moreover, India is one of the largest producers of soaps in the world. The per capita consumption of toilet/bathing soaps in the country is around 800 grams. The per capita consumption of toilet/bathing soaps, averaging around 800 grams, further indicates the country's steady demand for soap products. Additionally, the household and personal care segment accounts for around 50% share of the FMCG market in India. The consistent increase in the production of synthetic detergent intermediates, from 714.68 thousand metric tons in 2019 to over 780 thousand metric tons in FY 2022, indicates the rising demand for detergent products. Consequently, the demand for fatty acids as raw materials in surfactant production experiences growth alongside the expansion of the detergent market in India.

- These factors are expected to enhance the demand for fatty alcohol over the coming years.

Asia-Pacific Region to Dominate the Market

- The high demand from various industries, like surfactants, personal care and cosmetics, pharmaceuticals, and others, in major economies, such as China, India, and Japan, is estimated to boost the market studied during the forecast period.

- China is the second-largest consumer of cosmetic products across the world. According to a report by L'Oreal, the country generated a total of USD 55.3 billion in the beauty and personal care market in 2022. The country's beauty market witnessed a strong rebound in 2022 after facing a slowdown due to economic uncertainties, numerous lockdowns, and other pandemic policy changes.

- In China, the production of synthetic detergents is mainly concentrated in Guangdong, Zhejiang, and Sichuan, with an annual production capacity of 3.25 million tons, 1.14 million tons, and 1.09 million tons, respectively.

- The pharmaceutical industry in China is one of the largest in the world. The country is involved in the production of generics, therapeutic medicines, active pharmaceutical ingredients, and traditional Chinese medicine. More than 90% of the drugs registered in the country are generic. As of 2022, the country has a large and diverse domestic drug industry comprising around 5,000 manufacturers, many of which are small or medium-sized companies.

- According to the National Investment Promotion and Facilitation Agency (Invest India), India stands 8th in the beauty and personal care (BPC) market. Factors such as growing awareness, easier access, and changing lifestyles are driving the market. The personal hygiene market in India is expected to reach a value of USD 15 billion by the end of this year.

- The fatty acid methyl esters used in shampoos effectively remove soils, such as sebum and solid particulates, from the hair. According to the National Investment Promotion and Facilitation Agency (Invest India), the Indian hair care market is expected to reach a value of USD 4.89 billion with a CAGR of 6.6% in the next two years.

- To facilitate the growth of the Japanese cosmetic industry, the Japan Cosmetic Industry Association (JCIA) was established in April 2023 by integrating the Tokyo Cosmetic Industry Association, the Japan Cosmetic Industry Federation, the West Japan Cosmetic Industry Association, and the Chubu Cosmetic Industry Association. According to a report published by Kao Corporation, one of the key players in the Japanese cosmetic industry, the overall market in Japan grew by over 3% last year, with further growth anticipated in the upcoming years.

- With the rapidly growing end-user industries in the region, the demand for fatty alcohol is also expected to increase over the forecast period.

Fatty Alcohol Industry Overview

The global fatty alcohol market is fragmented in nature, with the presence of several large-scale and medium-scale companies in the market. Some of the major companies in the market (not in any particular order) include PT. Ecogreen Oledochemicals, Shell PLC, Kao Corporation, Wilmar International Ltd, and Sinarmad Cepsa Pte. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand from Pharmaceutical Industry

- 4.1.2 Increasing Usage of Fatty Alcohol in Personal Care and Cosmetics Products

- 4.2 Market Restraints

- 4.2.1 High Volatility in Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Natural Sources

- 5.1.2 Petrochemical Sources

- 5.2 By Application

- 5.2.1 Surfactants

- 5.2.2 Pharmaceuticals

- 5.2.3 Lubricants

- 5.2.4 Personal Care

- 5.2.5 Foods

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Croda International PLC

- 6.4.3 Godrej Industries Limited

- 6.4.4 Kao Corporation

- 6.4.5 KLK OLEO

- 6.4.6 Musim Mas

- 6.4.7 Procter & Gamble

- 6.4.8 PT. Ecogreen Oledochemicals

- 6.4.9 SABIC

- 6.4.10 Sasol

- 6.4.11 Shell PLC

- 6.4.12 Sinarmad Cepsa Pte. Ltd

- 6.4.13 VVF LLC

- 6.4.14 Wilmar International Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Bio-Based Fatty Alcohol Products

- 7.2 Other Opportunities