|

市場調查報告書

商品編碼

1406083

矽藻土-市場佔有率分析、產業趨勢與統計、2024年至2029年的成長預測Diatomite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

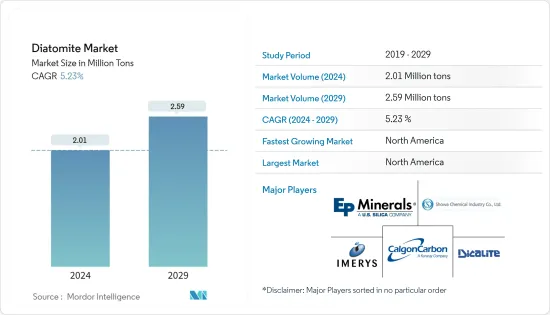

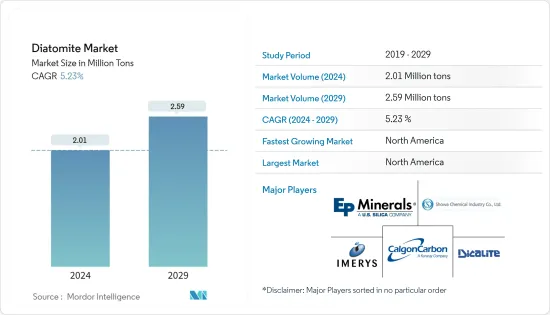

預計2024年矽藻土市場規模為201萬噸,預計2029年將達259萬噸,在預測期間(2024-2029年)複合年成長率為5.23%。

矽藻土市場受到COVID-19大流行的影響,導致生產和運輸停滯。封鎖導致添加劑、吸收劑等的生產暫停。目前,市場已經從疫情中恢復過來,並正在以顯著的速度成長。

水處理應用需求的增加預計將推動市場成長。

然而,矽藻土替代品(例如膨脹珍珠岩和矽砂)的出現預計將阻礙市場擴張。

農藥生產中對矽藻土的需求不斷成長可能是未來幾年市場研究的機會。

北美地區預計將主導市場,美國和加拿大等國家的消費量最高。

矽藻土市場趨勢

矽藻土作為過濾介質的需求不斷成長

- 矽藻土,又稱為矽藻土,是一種天然存在的矽藻化石。矽藻土是一種多孔岩石,顆粒細小,比重低。這些特性使其可用作橡膠、油漆和塑膠中的過濾介質、吸附劑和輕質填充材。

- 矽藻土的高孔隙率,加上其低密度和惰性,使其成為優異的過濾介質,能夠經濟地從大量液體中去除細小的懸浮固體。

- 隨著世界各地電力需求的持續增加,對矽藻土的需求可能會持續增加。

- 對淡水消耗日益成長的健康擔憂正在推動用於飲用水處理的膜水系統市場。因此,水處理應用的增加可能會推高矽藻土的消耗量。

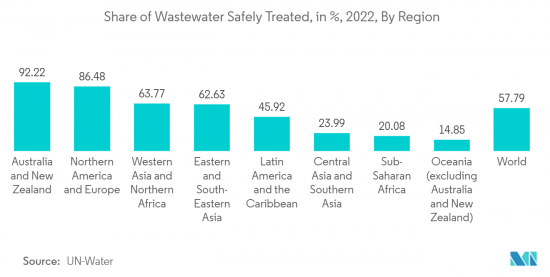

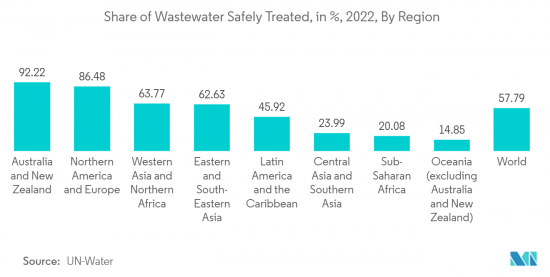

- 據聯合國水機制稱,北美和歐洲約 86.5% 的生活廢水得到了安全處理。然而,只有不到 25% 在撒哈拉以南非洲以及中亞和南亞得到安全加工。

- 2022年6月,專門從事水環境治理的環保公司中國光大水務拿下山東省博市張店東部工業園區工業污水處理擴容改造計劃。該計劃將以建設-營運-移交(BOT)模式營運,設計日處理工業污水規模約為5000立方米。因此,它支持市場的成長。

- 因此,由於上述因素,矽藻土在界面活性劑中的應用很可能在預測期內佔據主導地位。

北美市場佔據主導地位

- 預計北美地區將在預測期內主導矽藻土市場。由於美國和加拿大等已開發國家的人口和技術發展,對水過濾介質的需求不斷成長,預計將推動該地區對矽藻土的需求。

- 最大的矽藻土生產商位於北美地區。生產矽藻土的主要公司包括 Imerys SA、EP Minerals、Calgon Carbon Corporation、 工業和 Diatomit CJSC。

- 根據美國地質調查局統計,2022年美國矽藻土蘊藏量約2.5億噸。北美是礦床的主要生產地,因為加州、內華達州、華盛頓州和奧勒岡州擁有大量矽藻土礦藏。

- 此外,根據國際開發協會的數據,全球約17%的海水淡化能力位於北美地區。預計這將在預測期內推動北美矽藻土的消費。

- 此外,矽藻土經常用作水泥砂漿和混凝土中的火山灰添加劑,增加了建築業的投資並推動了該地區的需求。

- 由於上述因素,預計北美地區的矽藻土市場在研究期間將顯著成長。

矽藻土產業概況

矽藻土市場因其性質而部分分散。著名公司(排名不分先後)包括 EP Minerals、Calgon Carbon Corporation、 工業、Imerys 和 Dicalite Management Group, LLC。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 矽藻土作為濾材的需求不斷增加

- 水處理應用的需求不斷增加

- 其他司機

- 抑制因素

- 矽藻土替代品的可得性,例如膨脹珍珠岩和矽砂

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 來源

- 淡水矽藻土

- 鹽水矽藻土

- 過程

- 自然等級

- 燒成等級

- 助焊劑燒製等級

- 目的

- 濾材

- 水泥添加劑

- 填料

- 吸收劑

- 殺蟲劑

- 其他用途(磨料、隔熱材料等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Calgon Carbon Corporation

- CECA

- Chuanshan inte

- Diatomit CJSC

- Diatomite Direct

- Dicalite Management Group, LLC

- EP Minerals

- Imerys

- Jilin Yuan Tong Mineral Co., Ltd.

- Qingdao Best diatomite co.ltd.,

- Shenzhou Xinglong Products of Diatomite Co,.Ltd

- Showa Chemical Industry Co., Ltd

- US SILICA

第7章 市場機會及未來趨勢

- 農藥生產對矽藻土的需求不斷增加

- 其他機會

The Diatomite Market size is estimated at 2.01 Million tons in 2024, and is expected to reach 2.59 Million tons by 2029, growing at a CAGR of 5.23% during the forecast period (2024-2029).

The Diatomite market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility. Lockdowns caused the halt of manufacturing additives, absorbents, etc. Currently, the market has recovered from the pandemic and is growing at a significant rate.

The increasing demand for water treatment applications is expected to fuel market growth.

However, the availability of substitutes for diatomite, such as expanded perlite and silica sand, is anticipated to hamper market expansion.

The growing demand for diatomite in the manufacturing of insecticides is likely to act as an opportunity for the market studied in the coming years.

North America region is expected to dominate the market with the largest consumption from countries such as the United States and Canada.

Diatomite Market Trends

Growing Demand of Diatomite as Filter Media

- Diatomite, also known as diatomaceous earth, is naturally occurring fossilized remains of diatoms. It is a very porous rock with a fine particle size and a low specific gravity. These properties make it useful as a filter media, an absorbent, and a lightweight filler for rubber, paint, and plastics.

- The high degree of porosity, combined with its low density and inertness, makes diatomite an excellent filtration medium, providing the ability to economically remove microscopically small suspended solids from large volumes of liquid.

- With the ever-increasing requirement for power across the world, the demand for diatomite is likely to increase in the future.

- Increasing health concerns over the consumption of freshwater have driven the market for membrane water systems in household water treatment for drinking purposes. Thus, increasing water treatment application is likely to boost the consumption of diatomite.

- According to the UN-Water, about 86.5 % of household wastewater flow is treated safely in North America and Europe. Still, less than 25 % is treated safely in Sub-Saharan Africa and Central and Southern Asia.

- In June 2022, China Everbright Water, an environmental protection company that focuses on water environment management, secured the expansion and upgrading project of the ZhangdianEast Chemical Industry Park Industrial Wastewater Treatment in Zibo City, Shandong Province. This project will be operated on a BOT (Build-Operate-Transfer) model, with a designed daily industrial wastewater treatment capacity of around 5,000 m3. Thus supporting the market growth.

- Hence, owing to the factors mentioned above, the application of diatomite in surfactants is likely to dominate during the forecast period.

North America Region to Dominate the Market

- North America region is expected to dominate the market for diatomite during the forecast period. The rising demand for water filter media with the growing population and technologies in developed countries like the United States and Canada is expected to drive the demand for diatomite in this region.

- The largest producers of diatomite are located in the North American region. Some of the leading companies in the production of diatomite are Imerys S.A, EP Minerals, Calgon Carbon Corporation, Showa Chemical Industry Co., Ltd., and Diatomit CJSC, among others.

- According to the US Geological Survey, in 2022, the reserves of diatomite in the United States amounted to around 250 million metric tons. The presence of large deposits of diatomite in California, Nevada, Washington, and Oregon makes North America the major producer of diatomite.

- Furthermore, according to the International Development Association, approximately 17% of the global desalination capacity was located in the North American region. This is expected to boost the consumption of diatomite in North America during the forecast period.

- Additionally, diatomite is being used very frequently as a pozzolanic additive in cement mortar and concrete; thereby, increasing investment in the construction sector will drive the demand in the region.

- Owing to the factors mentioned above, the market for diatomite in the North American region is projected to grow significantly during the study period.

Diatomite Industry Overview

The diatomite market is partially fragmented in nature. The major players (not in any particular order) include EP Minerals, Calgon Carbon Corporation, Showa Chemical Industry Co., Ltd, Imerys, and Dicalite Management Group, LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand of Diatomite as Filter Media

- 4.1.2 Growing Demand From Water Treatment Application

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes of Diatomite Such as Expanded Perlite and Silica Sand

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Source

- 5.1.1 Fresh Water Diatomite

- 5.1.2 Salt Water Diatomite

- 5.2 Process

- 5.2.1 Natural Grades

- 5.2.2 Calcined Grades

- 5.2.3 Flux-Calcined Grades

- 5.3 Application

- 5.3.1 Filter Media

- 5.3.2 Cement Additive

- 5.3.3 Filler

- 5.3.4 Absorbent

- 5.3.5 Insecticides

- 5.3.6 Other Applications (Abrasives, Insulation, etc)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Calgon Carbon Corporation

- 6.4.2 CECA

- 6.4.3 Chuanshan inte

- 6.4.4 Diatomit CJSC

- 6.4.5 Diatomite Direct

- 6.4.6 Dicalite Management Group, LLC

- 6.4.7 EP Minerals

- 6.4.8 Imerys

- 6.4.9 Jilin Yuan Tong Mineral Co., Ltd.

- 6.4.10 Qingdao Best diatomite co.ltd.,

- 6.4.11 Shenzhou Xinglong Products of Diatomite Co,.Ltd

- 6.4.12 Showa Chemical Industry Co., Ltd

- 6.4.13 U.S. SILICA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand of Diatomite in Manufacturing of Insecticides

- 7.2 Other Opportunities

![矽藻土市場:市場規模、趨勢、成長分析 [2024-2030]](/sample/img/cover/42/default_cover_5.png)