|

市場調查報告書

商品編碼

1406075

活性白土-市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Activated Bleaching Earth - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

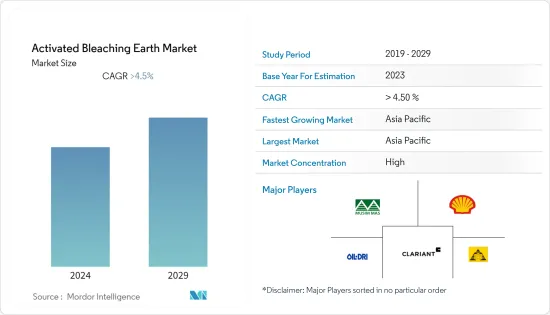

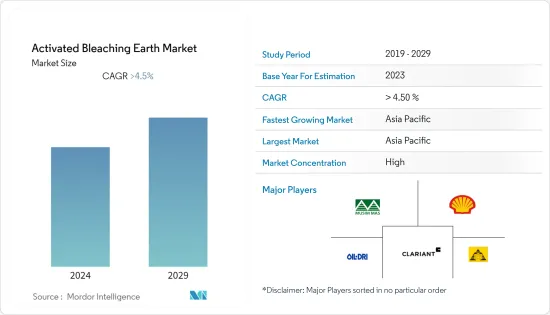

預計年終活性白土市場規模將達38.9956億美元。

預計未來五年將達487,353萬美元,預測期內複合年成長率將超過4.5%。

COVID-19 對活性白土產業產生了負面影響。由於全球停工以及世界各國政府實施的嚴格監管,大多數生產基地被關閉,造成毀滅性打擊。儘管如此,業務自 2021 年以來已經復甦,預計未來幾年將大幅成長。

主要亮點

- 市場成長的主要驅動力是食用油需求的增加。

- 然而,替代產品和技術的存在正在阻礙市場成長。

- 生物柴油產量的增加預計將在未來幾年為市場參與者提供利潤豐厚的成長機會。

- 亞太地區在全球市場中佔據主導地位,其中中國、印度和日本等國家的消費量最高。

活性白土市場趨勢

食用油脂需求增加

- 活性白土用於精製食用油、廢食用油(UCO)、污泥油、酸性油以及用於生產生質柴油和可再生柴油的其他廢油。廣泛用於食用油脂的精製、脫色、漂白。

- 活性白土比天然漂白土具有更高的吸附雜質的能力。

- 用於精製多種食用油脂,包括大豆油、棉籽油、棕櫚油、菜籽油、葵花籽油、紅花油、米糠油、玉米油、芥花籽油、橄欖油、芝麻油等。

- 2022/23年度全球棕櫚油產量為7,722萬噸,高於2021/22年度的7,383萬噸。

- 2022/23年度全球豆油產量為61,494,000噸,較2021/22年度的59,259,000噸增加3.0%。

- 全球整體菜籽油產量從2021/22年度的2,907萬噸增加到2022/23年度的3,180萬噸。

- 2022/23年度全球葵花油產量為2,036萬噸,高於2021/22年度的1,984萬噸。

- 2022/23年度全球棉籽油產量為502萬噸,高於2021/22年度的497萬噸。

- 然而,由於一些國家(包括歐洲和南美洲的主要生產國)乾旱加劇,橄欖油產量下降。 2022/23年度全球橄欖油產量為282萬噸,較2021/22年度的327萬噸下降。

- 因此,食用油脂中活性白土的產量增加和需求激增預計將為全球市場提供成長機會。

亞太地區主導市場

- 預計亞太地區將佔據活性白土市場的最大佔有率。中國佔亞太地區植物油消費量和生產的最大佔有率。雖然產量很大,但消費量超過生產,因此進口大於出口。

- 根據國際油脂公司統計,2021-22年中國食用油產量為2800萬噸,比上年的2815萬噸減少15萬噸。產量下降的原因是油籽進口量減少和食用植物油產量減少。

- 根據中國政府報告,2022年7月中國棕櫚油和豆油進口量分別比上年度的370萬噸和63萬噸減少30萬噸和17萬噸。

- 根據印度植物油生產商協會(IVPA)統計,印度本會計年度(2022年10月至2023年9月)進口了約1,437萬噸植物油。

- 根據國際能源總署(IEA)的數據,就能源供應總量而言,石油仍是韓國最重要的能源來源。韓國擁有非常重要的精製工業,除石化原料以外的產品大多能自給自足。

- 此外,根據加拿大農業、農業和食品部 (AAFC) 的報告,2021 年該國食用油零售總額達 4.787 億美元。到 2026 年,食用油銷售額預計將達到 5,223 億美元。同時,預計2026年食用油消費量將達到近100萬噸。

- 根據內務部,從 2021 年 3 月到 2023 年 1 月,植物油的零售價格上漲了 67%,遠遠超過大多數其他主食的價格漲幅。

- 此外,2023年7月國內大豆進口額達2,1,398萬美元,高於2023年6月的1,9,005萬美元。豆油出口17萬美元,進口243萬美元,貿易出現負平衡。

- 因此,由於上述原因,預計亞太地區將在預測期內主導市場。

活性白土產業概況

活性白土市場較為分散。市場上的主要企業(排名不分先後)包括科萊恩、春金集團、殼牌、Oil-Dri Corporation of America 和 Ashapura Perfoclay Limited。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 食用油需求不斷增加

- 抑制因素

- 替代產品和技術的存在

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

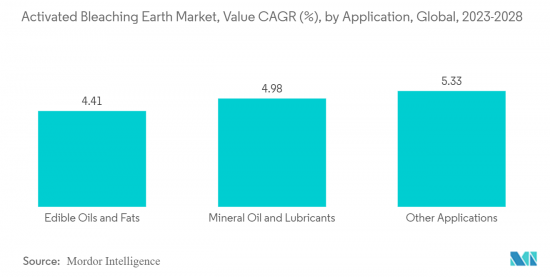

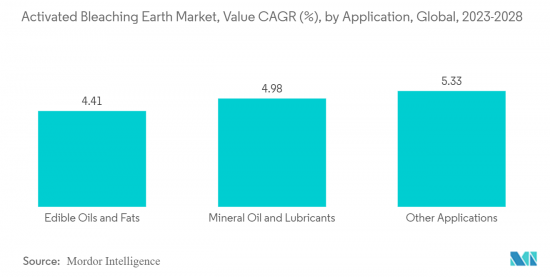

第5章市場區隔(市場規模)

- 目的

- 食用油脂

- 礦物油和潤滑油

- 其他應用(化學、生質柴油等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Ashapura Perfoclay Limited(APL)

- Clariant

- Global Bleach Chem Pvt. Ltd

- Hrp Industries

- Indian Clay And Mineral Co.

- Musim Mas Holdings Pte Ltd

- Oil-dri Corporation of America

- Phoenix Chemicals(Pvt.)Ltd

- Refoil Earth Pvt. Ltd

- Shell Plc(ecooils Limited)

- Taiko Group of Companies(Taiko Bleaching Earth Sdn. Bhd.)

- The W Clay Industries Sdn Bhd

第7章 市場機會及未來趨勢

- 增加生質柴油產量

The activated bleaching earth market is estimated to be at USD 3,899.56 million by the end of this year. It is projected to reach USD 4,873.53 million in the next five years, registering a CAGR of over 4.5% during the forecast period.

COVID-19 had a negative impact on the activated bleaching earth sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- The major factor driving the market growth is the growing demand for edible oils.

- However, the presence of alternative products and technologies is hindering the market growth.

- Increasing production of bio-diesel is expected to provide lucrative growth opportunities to the market players in the coming years.

- The Asia-Pacific region dominates the global market, with the largest consumption from countries such as China, India, and Japan.

Activated Bleaching Earth Market Trends

Increasing Demand for Edible Oil & Fats

- Activated bleaching earth is used to purify edible oils, used cooking oil (UCO), sludge oils, acid oils, and other waste oils that are utilized in the manufacture of biodiesel and renewable diesel. It is widely used in the refining, decolorizing, and bleaching of edible oil and fats.

- Activated bleaching earths have a higher ability to absorb impurities in comparison to natural bleaching earths.

- It is used for the purification of various edible oils and fats, including soya bean oil, cotton seed oil, palm oil, rapeseed oil, sunflower oil, safflower oil, rice bran oil, corn oil, canola oil, olive oil, and sesame oil.

- In 2022/23, the global production volume of palm oil stood at 77.22 million metric tons, up from 73.83 million metric tons in 2021/22.

- In 2022/23, the global production volume of soybean oil increased by 3.0% to 61,494 thousand metric tons, up from 59,259 thousand metric tons in 2021/22.

- The global production of rapeseed oil across the world increased to 31.8 million metric tons in 2022/23, up from 29.07 million metric tons in 2021/22.

- In 2022/23, the global production of sunflower seed oil stood at 20.36 million metric tons, up from 19.84 million metric tons in 2021/22.

- The global production of cottonseed oil stood at 5.02 million metric tons in 2022/23, up from 4.97 million metric tons in 2021/22.

- However, the world witnessed a decline in the production of olive oil owing to the rising drought conditions in several countries, including major producers in Europe and South America. In 2022/23, the global production of olive oil stood at 2.82 million metric tons, which is lower in comparison to 3.27 million metric tons in 2021/22

- Thus, the increase in production and surge in demand for activated bleaching earth in edible fats and oils are expected to provide growth opportunities in the global market.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to account for the largest share of the activated bleaching earth market. China holds the largest share of vegetable oil consumption and production in Asia-Pacific. Though the production volume is high, consumption exceeds production, resulting in higher import volumes when compared to export volumes.

- According to Oils & Fats International, during the crop year 2021-22, China produced 28 million tonnes of edible oil, a 150,000 tonnes decrease from the previous year's volume of 28.15 million tonnes. The decrease in the production volume is due to the drop in the oilseed imports, leading to a downgrade in edible vegetable oil production.

- As per the reports by the Government of China, in July 2022, the palm oil and soyabean oil imports to the country declined by 300,000 tonnes and 170,000 tonnes as compared to their previous year's volume of 3.7 million tonnes and 630,000 tonnes, respectively.

- According to the Indian Vegetable Oil Producers' Association (IVPA), during the current oil year (October 2022-September 2023), India imported around 14.37 million tonnes of vegetable oil, as compared to 14.07 million tonnes imported in the previous year.

- According to the International Energy Agency (IEA), oil continues to be the most important energy source in South Korea in terms of total energy supply. South Korea has a very important refining industry and is self-sufficient in most products other than petrochemical feedstocks.

- Furthermore, according to a report by Agriculture and Agri-Food Canada (AAFC), the total retail sales of cooking oils in the country were valued at USD 478.7 million in 2021. The sales of cooking oil are projected to reach USD 522.3 billion by the year 2026. While edible oil consumption is expected to reach nearly one million metric tons by 2026.

- According to the Ministry of Internal Affairs and Communications, the retail price for vegetable oil grew by 67% from March 2021 to January 2023, far above the price increase for most other staple foods.

- Additionally, the import value of soybeans in the country reached USD 213.98 million in July 2023 from USD 190.05 million in June 2023. The soybean oil exports in the country accounted for USD 0.17 million, whereas imports accounted for USD 2.43 million, resulting in a negative trade balance.

- Hence, due to the above-mentioned reasons, Asia-Pacific is anticipated to dominate the market during the forecast period.

Activated Bleaching Earth Industry Overview

The activated bleaching earth market is fragmented in nature. Some of the major players in the market (not in any particular order) include Clariant, Musim Mas, Shell, Oil-Dri Corporation of America, and Ashapura Perfoclay Limited, among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Edible Oils

- 4.2 Restraints

- 4.2.1 Presence of Alternative Products and Technologies

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Edible Oil and Fats

- 5.1.2 Mineral Oil and Lubricants

- 5.1.3 Other Applications (Chemical, Biodiesel, etc.)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ashapura Perfoclay Limited (APL)

- 6.4.2 Clariant

- 6.4.3 Global Bleach Chem Pvt. Ltd

- 6.4.4 Hrp Industries

- 6.4.5 Indian Clay And Mineral Co.

- 6.4.6 Musim Mas Holdings Pte Ltd

- 6.4.7 Oil-dri Corporation of America

- 6.4.8 Phoenix Chemicals (Pvt.) Ltd

- 6.4.9 Refoil Earth Pvt. Ltd

- 6.4.10 Shell Plc (ecooils Limited)

- 6.4.11 Taiko Group of Companies (Taiko Bleaching Earth Sdn. Bhd.)

- 6.4.12 The W Clay Industries Sdn Bhd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Production of Bio-diesel