|

市場調查報告書

商品編碼

1405722

汽車邊緣運算 -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Edge Computing In Automotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

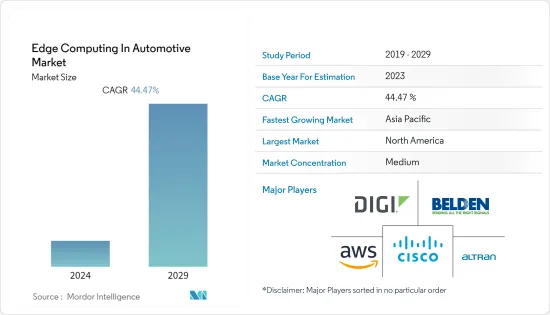

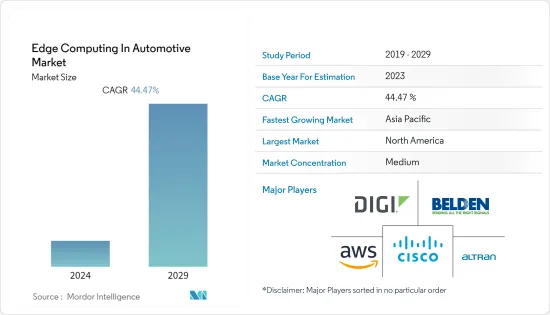

汽車邊緣運算市場目前市場規模為14.3億美元,預計未來五年將成長至90.1億美元,預測期內複合年成長率為44.47%。

自動駕駛汽車和聯網汽車基礎設施的發展,以及對提高邊緣運算解決方案效率的輕量級框架和系統的需求,預計將為邊緣運算供應商創造豐富的機會。

主要亮點

- 汽車行業的公司開始透過實施各種技術創新來追求新的性能和生產力水平,包括感測器、其他資料生成和收集設備以及分析工具。傳統上,資料管理和分析是在雲端或資料中心完成的。然而,隨著智慧製造和智慧城市等網路相關技術和措施的日益普及,這種情況似乎正在改變。

- 為了讓連網型汽車提供預期價值,需要能夠即時合成這些資料的設備。邊緣運算是一種處理 IoT(物聯網)設備產生的資料的方法。在邊緣,收集的資料在源頭進行審查。

- 此外,以更快的速度處理配備各種感測器的工業連網型和連網汽車產生的越來越多的資料是一個問題,而5G應用將以低延遲和高可靠性解決此類問題,從而輕鬆卸載一些資料。此處理需要雲端基礎的伺服器,從而最大限度地降低複雜性。

- 此外,單一所有者的生態系統不存在「全球」邊界,由大量必須透過網路協作的個人管理,這使得生態系統更加脆弱。您的基礎設施的某些部分可能會受到高度局部的攻擊,並產生局部影響。

- COVID-19 大流行對 5G 和多接入邊緣運算 (MEC) 部署產生了積極影響,因為企業將服務速度和低延遲作為差異化因素制定了策略。網路和運算的更緊密整合以支援次世代應用程式是未來的課題。

汽車邊緣運算市場趨勢

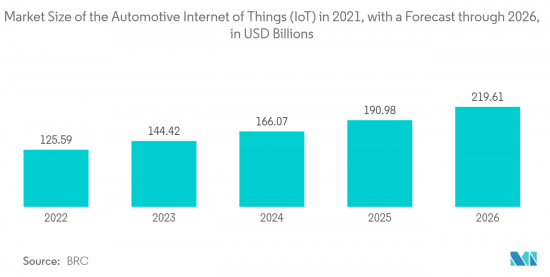

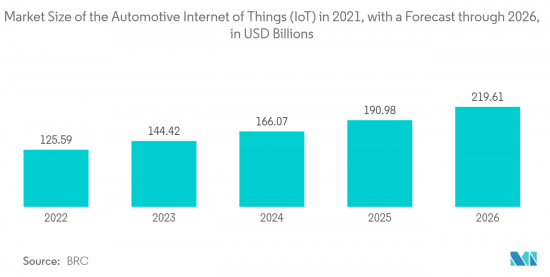

物聯網的普及正在推動汽車邊緣運算市場的成長

- 物聯網技術正在克服製造業的勞動力短缺問題。對於越來越多的企業來說,機器人化等工業4.0技術的使用正成為日常業務的一部分。

- 使用邊緣網路上的物聯網設備收集和傳輸資料的機器人可以比使用雲端基礎的設計更快地檢測異常並消除低效率。此類系統由於其分散式設計而更具彈性,並且還保證了更高水準的執行時間生產力。

- 5G 營運將加速物聯網在汽車產業的日益普及,這主要得益於低延遲和網路切片功能。很大一部分工業IoT服務供應商和聚合商現在提供支援 5G 的網路選項,並預計在未來幾年內整合邊緣運算來處理大量資料。

- 邊緣運算的潛力正在改變工業製造。未來幾十年,邊緣運算應用將從根本上改變製造業,因為它們可以提高效率和產量,同時降低成本。這可能會與新一代智慧型物聯網邊緣設備結合來實現。預計這將對預測期內的市場成長產生積極影響。

- 此外,企業採用雲端主要是因為其彈性、擴充性和成本效益,這有助於在所研究的市場中提高車輛功能。

北美佔最大市場佔有率

- 北美佔據最大的市場佔有率,由於該地區的消費者和商業部門依賴物聯網設備,預計在整個預測期內將保持其主導地位。該地區擴大採用雲端技術並走向技術化。該地區還正在經歷自動駕駛汽車等創新概念的市場開拓,預計這將在未來幾年推動該地區的市場成長。

- 此外,由於邊緣運算供應商數量龐大以及北美公司對利用 5G 等新技術的接受程度不斷提高,該地區將在預測期內佔據最大的市場。

- 2022 年 3 月,聯邦機動車輛安全監管機構為無人駕駛汽車的開發和使用開了綠燈,無人駕駛汽車沒有方向盤或踏板等手動控制裝置。

- 5G技術仍處於實驗階段。不過,希望未來能結出碩果。例如,在美國,AT&T和Verizon正在進行現場測試。其中一些得到了企業合作夥伴的支持,例如美國最大的行動電話網站營運商 Crown Castle 以及邊緣運算專家 VaporIO 的投資者。

汽車邊緣運算概述

汽車市場邊緣運算的競爭非常激烈,多家主要公司紛紛進入該市場。目前,佔據大部分市場佔有率的大公司寥寥無幾,佔有率最大的是新興市場,主要是北美和歐洲。在日本和中國等新興市場,市場高度混亂,區域和本地經銷商佔據主導地位。國際參與者已經意識到潛在商機的巨大性,並逐漸建立供應網路並透過併購進入這些非結構化市場。

2023 年 1 月,百通宣布推出單對乙太網路 (SPE) 連接產品組合,旨在最佳化乙太網路連接在惡劣環境(包括工業和運輸業務)中的潛力。 SPE 產品組合包括用於潔淨區域連接的 IP20 級 PCB 插孔、插線和電線組,以及用於可靠現場設備工業乙太網連接的 IP65/IP67 級圓形 M8/M12插線、電線組和電線組。包含插座。

2022 年 11 月,Belden Inc. 宣布推出網路安全、強化和部署簡單性解決方案,包括 Hirschmann GDME 重型閥門連接器和 Belden HorizonTM 邊緣編配平台。該平台管理的軟體能夠安全地存取遠端設備,同時保持 OT 設備和應用程式的安全且輕鬆的部署、連接和管理。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場動態

- 市場促進因素

- 物聯網的採用率提高

- 資料量和網路流量呈指數級成長

- 市場抑制因素

- 初始基礎建設投資

- 隱私和安全問題

第6章市場區隔

- 依用途

- 連網型汽車

- 交通管理

- 智慧城市

- 運輸/物流

- 其他用途

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Altran Inc

- Belden Inc.

- Digi International Inc.

- Cisco Systems, Inc.

- Amazon Web Services(AWS), Inc.

- General Electric Company

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Litmus Automation

- Azion Technologies Ltd.

第8章投資分析

第9章 市場機會及未來趨勢

The Edge Computing in Automotive Market is valued at 1.43 billion in the current year and is expected to register a CAGR of 44.47% during the forecast period to become 9.01 billion by the next five years. The evolution of autonomous vehicles and connected car infrastructure and the requirement for lightweight frameworks and systems to heighten the efficiency of edge computing solutions are anticipated to generate abundant opportunities for edge computing vendors.

Key Highlights

- Enterprises across automotive are beginning to drive new levels of performance and productivity by deploying different technological innovations, like sensors and other data-producing and collecting devices, along with analysis tools. Traditionally, data management and analysis are performed in the cloud or data centers. However, the scenario seems to be changing with the increasing penetration of network-related technologies and initiatives, such as smart manufacturing and smart cities.

- For connected cars to give the value they are expected to, there is a device that can concoct this data in real time. Edge computing is the method of processing data from IoT (Internet of Things) devices where it is generated. With the edge, the data being gathered gets examined right at the source.

- Moreover, processing increasing amounts of data at a faster pace, generated by industrial robots and connected cars equipped with various sensors, is problematic, and 5G applications are solving such issues with their low latency and high reliability, making it easier to offload part of this processing need to edge or cloud-based servers, thus, minimizing the complexity.

- Additionally, the absence of a "global" border and an ecosystem with a single owner that is governed by numerous individuals who must cooperate through networks makes it even more vulnerable. A piece of the infrastructure may be under the control of highly localized attacks with localized impact.

- The COVID-19 pandemic positively affected the 5G and multi-access edge computing (MEC) deployments as businesses strategized service speed and low latency as key differentiators. Tight integration of network and compute to support next-generation apps is the way forward.

Edge Computing In Automotive Market Trends

Rising Adoption of IOT to Witness the Growth Edge Computing in Automotive Market

- IoT technologies are overcoming the labor shortage in the manufacturing sector. For more organizations, using Industry 4.0 technologies, like robotization, is part of day-to-day operations.

- Robots collecting and transferring data using IoT devices on an edge network can detect anomalies and eliminate inefficiencies far faster than they could use a cloud-based design. Such a system is substantially more resilient due to its distributed design, which also ensures higher levels of uptime productivity.

- The growing use of IoT in the automotive industry is accelerated by 5G operations, principally fueled by lower latency and network slicing capabilities. A sizable portion of industrial IoT service providers and aggregators currently offer 5 G-enabled network options, which are anticipated to incorporate edge computing over the next few years to handle the massive volume of data.

- Due to the potential of edge computing, industrial manufacturing is transforming. In the upcoming decades, edge computing applications will radically alter manufacturing to increase efficiency and production while lowering costs. This would be accomplished by combining them with a new generation of intelligent IoT edge devices. Over the projected period, this is expected to have a favorable effect on the market's growth.

- Furthermore, the adoption of the cloud in enterprises is primarily due to flexibility, scalability, and cost-effectiveness, which can help the advancement of vehicle capabilities in the studied market.

North America Occupies the Largest Market Share

- North America has accounted for the largest market share and is projected to maintain dominance throughout the forecast years as the consumer and business sectors in the region rely on IoT devices. Higher cloud adoption in the region contributes to the continued transition toward technology. The development of innovative concepts, such as autonomous cars, within the area is also expected to propel regional market growth in the years to come.

- Additionally, the region is anticipated to represent the largest market during the forecast period due to a significant number of edge computing suppliers and the growing acceptance of technology among North American businesses for utilizing new technologies, such as 5G.

- In March 2022, Federal vehicle safety regulators gave the go-ahead for developing and using driverless cars without manual controls like steering wheels or pedals.

- 5G technology is still in the testing stage. However, it is hoped that it will be fruitful in the future. For example, AT&T and Verizon conduct field tests in the United States. Some are backed by corporate partners, such as Crown Castle, the largest US mobile phone website operator and an investor in his Vapor IO, an edge computing specialist.

Edge Computing In Automotive Industry Overview

Edge computing in the automotive market is moderately competitive and consists of several major players. Few major companies today hold a disproportionate amount of the market share, which continues to be significant in all developed nations, particularly in North America and Europe. The market is highly disorganized in developing nations like Japan and China, where regional or local sellers predominate. International players are gradually creating supply networks and entering these unstructured marketplaces through mergers and acquisitions as they become aware of the significant potential opportunities.

In January 2023, Belden introduced its Single Pair Ethernet (SPE) portfolio of connectivity products designed to optimize Ethernet connection possibilities in harsh environments, including industrial and transportation operations. The SPE portfolio includes IP20-rated PCB jack, patch cords, and cord sets for clean-area connections and IP65/IP67-rated circular M8/M12 patch cords, cord sets, and receptacles for reliable field device industrial ethernet connections.

In November 2022 - Belden Inc. announced the launch of solutions for network security, ruggedization, and simplified deployment, including the Hirschmann GDME Heavy-Duty Valve Connectors and the Belden HorizonTM edge orchestration platform. The platform manages software that allows secure access to remote equipment while sustaining secure and easy deployment, connection, and management of OT devices and applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of IOT

- 5.1.2 Exponentially Growing Data Volumes And Network Traffic

- 5.2 Market Restraints

- 5.2.1 Initial Capital Expenditure For Infrastructure

- 5.2.2 Privacy and Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Connected Cars

- 6.1.2 Traffic Management

- 6.1.3 Smart Cities

- 6.1.4 Transportation & Logistics

- 6.1.5 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Altran Inc

- 7.1.2 Belden Inc.

- 7.1.3 Digi International Inc.

- 7.1.4 Cisco Systems, Inc.

- 7.1.5 Amazon Web Services (AWS), Inc.

- 7.1.6 General Electric Company

- 7.1.7 Hewlett Packard Enterprise Development LP

- 7.1.8 Huawei Technologies Co., Ltd.

- 7.1.9 Litmus Automation

- 7.1.10 Azion Technologies Ltd.