|

市場調查報告書

商品編碼

1405693

圓二色光譜儀:市場佔有率分析、產業趨勢與統計、成長預測,2024-2029 年Circular Dichroism Spectrometers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

圓二色光譜儀市場預計在預測期(2024-2029年)複合年成長率為6.5%

主要亮點

- 由於各國為遏制病毒傳播而實施的封鎖規定,COVID-19 大流行最初對市場產生了重大影響,並影響了研發活動。然而,在大流行的後期,為了尋找 SARS-CoV-2 病毒感染的治療方法,開展了非常深入的研究和開發工作,並使用圓二色光譜儀來檢測蛋白質和 DNA 等生物分子。了解分子結構和掌性活性。

- 例如,根據 2021 年 6 月發表在 NCBI 上的一項研究顯示,圓二色性是生物化學、結構生物學和藥物化學中的常用技術,廣泛用於研究蛋白質結構和結構變化。因此,疫情的爆發加速了研究活動,增加了對圓二色光譜儀的需求。正因如此,市場在疫情期間呈現可觀的成長。此外,大流行後,由於在 COVID-19 疫苗開發中更多地採用圓二色光強度,市場激增。

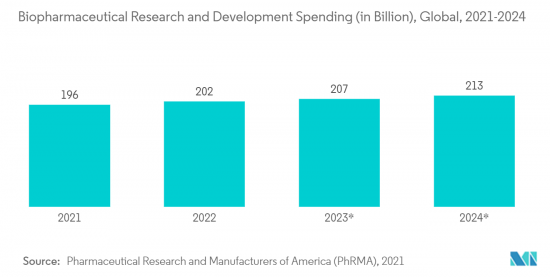

- 生技藥品的日益普及以及私營和公共部門對生技藥品研究和開發的投資增加是推動市場成長的主要因素。圓二色光譜法用於研究生物分子的分子結構和掌性活性,其用途可用於治療各種慢性和罕見疾病(例如疫苗)的生物製藥或生技藥品,預計隨著普及和使用的不斷增加而增加基因和細胞療法、融合蛋白、胰島素、干擾素、單株抗體(mAb 等)。

- 例如,根據美國癌症協會 2022 年 4 月的報告,生技藥品以多種方式用於治療癌症,並廣泛用於治療。此外,2022年6月,安進宣布其Rituxan生物學名藥RIABNI(rituximab marx)經美國食品藥物管理局核准,以一種或多種腫瘤壞死因子(TNF)拮抗與甲氨蝶呤聯合治療時無效。患有中度至重度活動性類風濕性關節炎(RA)的患者。因此,生技藥品的使用日益增加及其在治療各種疾病中的潛力預計將增加圓二色光譜儀用於生物分子分析的密集研究和開發活動。因此,預計對圓二色光譜儀的需求在預測期內增加,預計將推動研究市場的成長。

- 此外,不斷增加的研發活動以及政府和私人實體對該領域的新投資預計將在預測期內推動圓二色光譜儀市場的成長。例如,2022年8月,中國信達生物和總部位於巴黎的賽諾菲將向生物製藥集團投資24.2億美元,在中國共同開發兩種抗癌藥物。據信達生物介紹,SAR408701(tusamitamab ravtansine)用於治療肺癌、胃癌等,SAR444245(non-alpha IL-2)針對皮膚癌、頭頸腫瘤等正在進行II期試驗。 。

- 同樣在 2022 年 6 月,Astra Zeneca旗下罕見疾病部門 Alexion 宣布將投資約 6,500 萬歐元(6,860 萬美元)擴大其在愛爾蘭的生產能力,該公司計劃透過這筆投資提高其生技藥品生產能力並加強在該國的研究和開發舉措。因此,由於上述因素,圓二色光譜儀的需求預計將增加,並預計在預測期內出現可觀的市場成長。

- 因此,增加對生技藥品製劑和生物製藥市場開拓的投資,以及增加私營和公共部門對研發的投資,預計將成為推動市場成長的因素。然而,在預測期內,缺乏熟練的專業人員預計將限制圓二色光譜儀市場的成長。

圓二色光譜儀市場趨勢

預計醫藥產業在預測期內將健康成長

- 由於製藥業廣泛參與生技藥品和其他藥物分子的研發活動,因此成為各種分析儀器的最大最終用戶之一。因此,圓二色光譜儀在製藥公司中的使用將會增加,市場預計將會成長。

- 例如,根據英國國家統計局 (ONS) 2021 年 11 月的報告,英國製藥業的年度研發支出成長 6%,達到 50.2 億英鎊(59.9 億美元),創歷史新高。這約佔英國研發支出總額的18.6%。

- 此外,圓二色光譜儀在生物製藥分析開發中的重要性預計將推動該領域的成長。例如,根據 JASCO Corporation 發表的一項研究,圓二色性 (CD) 測量可以提供有關少量樣品中蛋白質結構變化的資訊。由於蛋白質結構和活性密切相關,CD 測量被廣泛接受用於蛋白質(包括生物製藥)的品管。由於製藥業對圓二色光譜儀的需求增加,此類研究正在推動該領域的發展。

- 此外,該領域主要市場參與者增加對藥物研發活動的投資預計將進一步增加對圓二色光譜儀的需求並促進該領域的成長。例如,2022年5月,輝瑞投資約2,000萬美元在印度馬德拉斯印度理工學院(IIT)推出全球醫藥研發中心。因此,由於上述因素,預計製藥業在預測期內將在調查市場中佔據重要佔有率。

- 因此,由於上述因素,預計在預測期內該細分市場將出現相當大的成長。

預計在預測期內,北美將佔據圓二色光譜儀市場的主要佔有率

- 由於製藥業廣泛參與生技藥品和其他藥物分子的研發活動,因此成為各種分析儀器的最大最終用戶之一。因此,圓二色光譜儀在製藥公司中的使用將會增加,市場預計將會成長。

- 例如,英國國家統計局(ONS)2021年11月報告稱,英國英國業的年度研發支出成長6%,達到50.2億英鎊(59.9億美元),創歷史最高水平,約佔總額的18.6%英國研發支出。

- 此外,圓二色光譜儀在生物製藥分析開發中的重要性預計將推動該領域的成長。例如,根據 JASCO Corporation 發表的一項研究,圓二色性 (CD) 測量可以提供有關少量樣品中蛋白質結構變化的資訊。由於蛋白質結構和活性密切相關,CD 測量被廣泛接受用於蛋白質(包括生物製藥)的品管。由於製藥業對圓二色光譜儀的需求增加,此類研究正在推動該領域的發展。

- 此外,該領域主要市場參與者增加對藥物研發活動的投資預計將進一步增加對圓二色光譜儀的需求並促進該領域的成長。例如,2022年5月,輝瑞投資約2,000萬美元在印度馬德拉斯印度理工學院(IIT)推出全球醫藥研發中心。因此,由於上述因素,預計製藥業在預測期內將在調查市場中佔據很大佔有率。

- 因此,由於上述因素,預計在預測期內該細分市場將出現相當大的成長。

圓二色光譜儀產業概況

圓二色光譜儀市場已整合,並由幾個主要企業組成。競爭形勢包括多家擁有市場佔有率的國際知名公司,包括 Jasco、Applied Photophysicals Ltd.、On-Line Instrument Systems, Inc. (Olis)、Bruker 和 Bio-Logic Science Instrument, Inc.。當地企業。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 生技藥品日益普及

- 增加私營和公共部門對生物製藥研發的投資

- 市場抑制因素

- 需要專門的基礎設施和熟練的操作員

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模,以金額為準)

- 依產品

- 線偏振光源

- 圓偏振光源

- 多個光源

- 按最終用戶

- 製藥業

- 政府/私人研究機構

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東/非洲

- GCC

- 南非

- 其他中東和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章競爭形勢

- 公司簡介

- Jasco

- Applied Photophysics Ltd.

- On-Line Instrument Systems, Inc.(Olis)

- Bruker

- Bio-Logic Science Instrument, Inc

- A.KRUSS Optronic GmbH

- Hinds Instruments, Inc.

第7章 市場機會及未來趨勢

The GCircular Dichroism Spectrometers Market is expected to register a CAGR of 6.5% during the forecast period(2024-2029).

Key Highlights

- The COVID-19 pandemic significantly impacted the market initially due to the lockdown restrictions imposed by the countries to control the spread of the virus, thereby impacting research and development activities. But during the late pandemic, very intensive research and development activities were started to find a cure for SARS-CoV-2 virus infection in which circular dichroism spectrometers were also used for the understanding of the molecular structure and chiral activities of biomolecules such as protein and DNA.

- For instance, according to the research study published in June 2021 in NCBI, circular dichroism is a common technique in biochemistry, structural biology, and pharmaceutical chemistry, and it is a widely used method for examining the structures and conformational changes of proteins. Therefore, the outbreak of the pandemic increased research activities, which in turn propelled the demand for circular dichroism spectrometers. Thus, the market witnessed considerable growth during the pandemic. Furthermore, the market has seen a surge post-pandemic due to the increased adoption of circular dichroism spectrophotometers in the development of vaccines for COVID-19.

- The increasing popularity of biologics and increasing investments by private and public sectors in the R&D of biopharmaceuticals are the major factors propelling the market growth. The circular dichroism spectrometers are used in the study of molecular structure and chiral activities of biomolecules, and their use is expected to increase with the growing popularity and usage of biopharmaceuticals or biologics (for example, vaccines, gene and cellular therapies, fusion proteins, insulin, interferon, and monoclonal antibody (mAb) among others) that are used in the treatment of various chronic and rare diseases.

- For instance, according to the April 2022 report of the American Cancer Society, biologics are used in the treatment of cancer in many ways and are being used widely for the treatment. Furthermore, in June 2022, Amgen Inc. received approval for RIABNI (rituximab-Marx), a biosimilar to Rituxan, from the United States Food and Drug Administration for adults with moderate to severely active rheumatoid arthritis (RA) who have had an inadequate response to one or more tumor necrosis factor (TNF) antagonist therapies in combination with methotrexate. Hence, the growing usage of biologics drugs and their potential in treating various diseases is expected to increase intensive research and development activities, where circular dichroism spectrometers are used in the analysis of biomolecules, and thus, the demand for circular dichroism spectrometers is expected to increase over the forecast period that is expected to boost growth in the studied market.

- Moreover, the growing research and development activities, along with new investments in the area by the government as well as private entities, are expected to fuel growth in the circular dichroism spectrometers market over the forecast period. For instance, in August 2022, Innovent Biologics of China and Paris-based Sanofi would invest USD 2.42 billion in the biopharma group to jointly develop two cancer drugs in China. As per Innovent Biologics, SAR408701, or tusamitamab ravtansine, would be used to treat lung, gastric, and other cancers, while SAR444245, or non-alpha IL-2, was under phase-II studies for skin cancer, head, and neck tumors, among others.

- In addition, in June 2022, the Rare Disease division of AstraZeneca, Alexion, spent about EUR 65 million (USD 68.6 million) to expand its manufacturing capabilities in Ireland, and over the next 18 months, the investment will be used by the company to build up its biologics manufacturing capacity and increase research and development initiatives in the country. Therefore, due to the above-mentioned factors, the demand for circular dichroism spectrometers is expected to increase; thereby considerable market growth is anticipated over the forecast period.

- Therefore, the rising investments in the development of biologics and biopharmaceuticals, along with the increasing investments by private and public sectors in R&D, are the factors expected to drive the market growth. However, the lack of skilled professionals is expected to restrain the growth of the circular dichroism spectrometers market over the forecast period.

Circular Dichroism Spectrometers Market Trends

Pharmaceutical Industry is Expected to Witness Healthy Growth Over the Forecast Period

- The pharmaceutical industry is one of the largest end-users of various analytical instruments as they are intensively involved in the research and development activities of biologics and other drug molecules; hence, the use of circular dichroism spectrometers is expected to increase among the pharmaceutical companies, and the market is expected to grow.

- For instance, according to the November 2021 report of the Office for National Statistics (ONS) of the United Kingdom, the amount spent on research and development annually in the pharmaceutical industry in the United Kingdom has increased by 6% to an all-time high of GBP 5.02 billion (USD 5.99 billion), which is about 18.6 of the total research and development spending of the United Kingdom.

- Furthermore, the importance of circular dichroism spectrometers in the analytical development of biopharmaceuticals is expected to drive segment growth. For instance, according to the study published by JASCO Corporation, circular dichroism (CD) measurements can provide information regarding changes in protein structure in small quantities of samples. Since protein structure and activity are closely related, CD measurements are widely accepted in the quality control of protein, which includes biomedicines. Such studies propel the segment growth due to increased demand for circular dichroism spectrometers in the pharmaceutical industry.

- Moreover, the growing investment in drug research and development activities by the key market players in the area is further expected to increase the demand for circular dichroism spectrometers, which is expected to boost the segment's growth. For instance, in May 2022, Pfizer Inc. launched a global drug research and development center at the Indian Institute of Technology (IIT) Madras, India, with an investment of about USD 20.0 million. Therefore, due to the aforementioned factors, the pharmaceutical industry is expected to hold a significant share of the studied market over the forecast period.

- Therefore, owing to the above-mentioned factors, considerable segment growth is anticipated over the forecast period.

North America is Expected to Hold a Significant Share in the Circular Dichroism Spectrometers Market Over the Forecast Period

- The pharmaceutical industry is one of the largest end-users of various analytical instruments as they are intensively involved in the research and development activities of biologics and other drug molecules; hence, the use of circular dichroism spectrometers is expected to increase among the pharmaceutical companies, and the market is expected to grow.

- For instance, according to the November 2021 report of the Office for National Statistics (ONS) of the United Kingdom, the amount spent on research and development annually in the pharmaceutical industry in the United Kingdom has increased by 6% to an all-time high of GBP 5.02 billion (USD 5.99 billion), which is about 18.6 of the total research and development spending of the United Kingdom.

- Furthermore, the importance of circular dichroism spectrometers in the analytical development of biopharmaceuticals is expected to drive segment growth. For instance, according to the study published by JASCO Corporation, circular dichroism (CD) measurements can provide information regarding changes in protein structure in small quantities of samples. Since protein structure and activity are closely related, CD measurements are widely accepted in the quality control of protein, which includes biomedicines. Such studies propel the segment growth due to increased demand for circular dichroism spectrometers in the pharmaceutical industry.

- Moreover, the growing investment in drug research and development activities by the key market players in the area is further expected to increase the demand for circular dichroism spectrometers, which is expected to boost the segment's growth. For instance, in May 2022, Pfizer Inc. launched a global drug research and development center at the Indian Institute of Technology (IIT) Madras, India, with an investment of about USD 20.0 million. Therefore, due to the aforementioned factors, the pharmaceutical industry is expected to hold a significant share of the studied market over the forecast period.

- Therefore, owing to the above-mentioned factors, considerable segment growth is anticipated over the forecast period.

Circular Dichroism Spectrometers Industry Overview

The circular dichroism spectrometers market is consolidated and consists of a few major players. The factors owing to the competition include competitive landscape includes an analysis of a few international as well as local companies that hold the market shares and are well known, including Jasco, Applied Photophysics Ltd., On-Line Instrument Systems, Inc. (Olis), Bruker, and Bio-Logic Science Instrument, Inc. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defination

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Popularity of Biologics

- 4.2.2 Increasing Investments by Private and Public Sectors in R&D of Biopharmaceuticals

- 4.3 Market Restraints

- 4.3.1 Requirement of Specialized Infrastructure and Skilled Operators

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Product

- 5.1.1 Linearly Polarized Light Sources

- 5.1.2 Circularly Polarized Light Sources

- 5.1.3 Multiple Light Sources

- 5.2 By End-User

- 5.2.1 Pharmaceutical Industry

- 5.2.2 Government and Private Research Organizations

- 5.2.3 Other End-Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Jasco

- 6.1.2 Applied Photophysics Ltd.

- 6.1.3 On-Line Instrument Systems, Inc. (Olis)

- 6.1.4 Bruker

- 6.1.5 Bio-Logic Science Instrument, Inc

- 6.1.6 A.KRUSS Optronic GmbH

- 6.1.7 Hinds Instruments, Inc.

![圓二色性 [CD] 光譜儀市場(產品:線偏振光源、圓偏振光源和多光源)- 2023-2031 年全球產業分析、規模、佔有率、成長、趨勢和預測](/sample/img/cover/42/default_cover_6.png)