|

市場調查報告書

商品編碼

1405365

墊片和密封件 -市場佔有率分析、行業趨勢和統計、2024 年至 2029 年成長預測Gaskets and Seals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

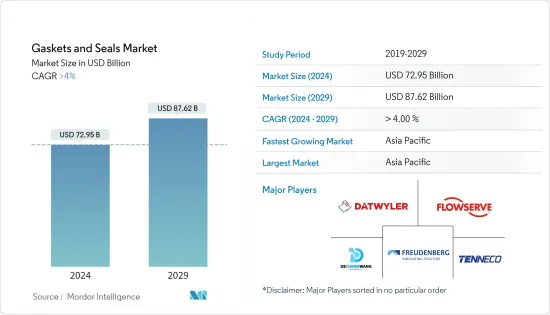

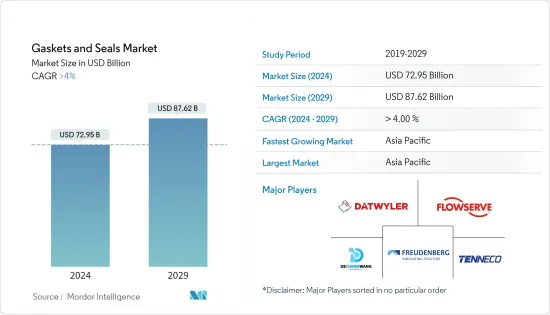

墊片和密封件市場規模預計到 2024 年為 729.5 億美元,預計到 2029 年將達到 876.2 億美元,在預測期內(2024-2029 年)複合年成長率將超過 4%。

COVID-19 大流行擾亂了墊片密封市場,由於關閉、社會疏遠措施和貿易制裁,對全球供應鏈造成了大規模破壞。然而,市場此後已恢復至大流行前的水平。

墊片和密封件市場的成長是由石油和天然氣行業墊片和密封件的使用不斷增加以及化學和石化行業不斷成長的需求所推動的。

另一方面,定期維護和潤滑的需求可能會阻礙市場成長。

電動車需求的成長預計將為汽車產業的市場繁榮提供機會。

預計亞太地區將主導全球市場,因為預計在預測期內中國和印度等國家的需求將會龐大。

墊片/密封件市場趨勢

石油和天然氣應用預計將主導市場

- 石油和天然氣產業的營運環境要求極高,需要最高的營運效率和設備運作。在這個行業中,防止閥門、泵浦、管道、附件、儲存槽和其他關鍵部件中潛在危險的石化產品洩漏至關重要。

- 由於石油和天然氣探勘的活性化以及化學加工行業的擴張,預計管道和熱交換器系統對墊片的需求將會增加。

- 各種設備都需要墊圈和密封件以保持其及時運行,因為這些產品有助於防止任何型態的液體或氣體處理洩漏。石油和天然氣產業的所有墊片均符合 ANSI/ASME 標準。

- 全球石油和天然氣產業具有創造工業設備需求的巨大潛力,預計未來將同時推動墊圈和密封件的消費。一些石油和天然氣計劃已處於開發階段,而另一些項目仍處於規劃階段。

- 據IBEF(印度品牌股權基金會)稱,到2045年,印度的石油需求預計將加倍,達到每天1,100萬桶。 2023年2月,印度石油需求達到24年來的最高水準。

- 2022 年 5 月,ONGC 宣布計劃在 22-25 會計年度投資 40 億美元,以加強在印度的探勘活動。這種探勘需要在計劃中使用墊片和密封件,同時也增加了市場的成長。

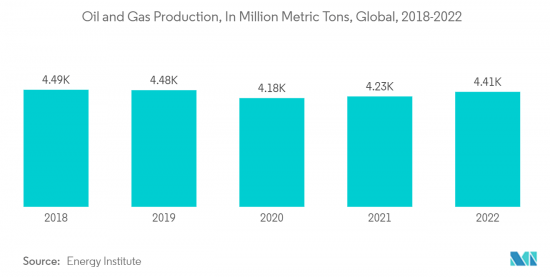

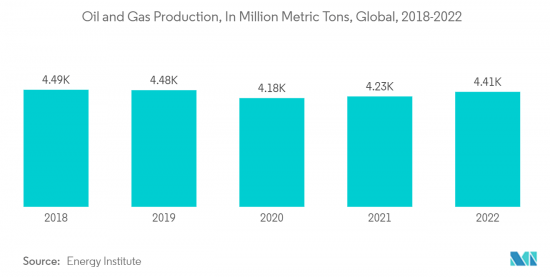

- 隨著世界各地探勘和產量的增加,石油和天然氣行業的價格明顯回升。亞太和北美地區石油和天然氣海上探勘和生產活動顯著增加。美國、沙烏地阿拉伯、俄羅斯、加拿大和中國等國家是世界市場上主要的石油生產國。

- 因此,石油和天然氣應用預計將主導市場。

亞太地區預計將主導市場

- 在亞太地區,工業化的加速和許多最終用戶行業需求的增加正在推動市場的成長。

- OICA預計,2022年中國和印度的汽車產量將比2021年同期分別成長3%和24%。

- 中國是化學品加工中心,佔全球化學品生產的很大一部分。由於全球對各種化學品的需求不斷增加,該行業對墊圈和密封件的需求預計在預測期內將成長。

- 中國計劃透過連接中亞和俄羅斯的新管道來擴大其州際管道網路。中國石油天然氣集團公司(CNPC)計劃完成俄羅斯黑龍江省東北部巨型石油和天然氣管道的大部分建設。

- 印度目前在全球10大製造業國家中排名第6。石化產業約佔化學工業原料的30%,預計2025年將達3,000億美元。

- 此外,中國、印度等新興經濟體工業、電氣和電子產業的成長等因素預計將進一步推動該地區對墊片和密封件的需求。

- 所有這些因素預計都會影響預測期內該地區的市場成長。

墊片和密封件行業概述

墊圈和密封件市場高度分散。主要參與企業(排名不分先後)包括德誠旺、福斯公司、科德寶密封技術公司、德特威勒控股公司和天納克公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 石油和天然氣行業中墊圈和密封件的使用增加

- 化學和石化產業的需求增加

- 汽車產業需求增加

- 抑制因素

- 定期維護和潤滑

- 原物料價格波動

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(以金額為準))

- 產品

- 墊片

- 金屬墊片

- 橡膠墊片

- 軟木墊片

- 無石棉墊片

- 纏繞墊片

- 其他墊片(半金屬墊片)

- 貼紙

- 軸封

- 模壓密封件

- 汽車車體密封件

- 其他密封件(叉形密封件、活塞密封件)

- 墊片

- 材質

- 纖維

- 石墨

- PTFE

- 橡皮

- 其他材料(金屬、軟木、聚合物、毛氈)

- 目的

- 航太

- 車

- 電子產品

- 油和氣

- 發電

- 其他用途(工業)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AMG Sealing Limited

- BRUSS Sealing Systems GmbH

- Cooper Standard

- Datwyler Holding Inc.

- Dana Limited

- Dechengwang

- ElringKlinger AG

- Flowserve Corporation

- Freudenberg Sealing Technologies

- Garlock, an Enpro Industries, Inc.

- IGP Engineers Private Limited

- John Crane

- KLINGER Holding GmbH

- Phelps

- Saunders

- SKF

- Smiths Group plc

- Trelleborg AB

- Tenneco Inc.

第7章 市場機會及未來趨勢

- 電動車需求不斷成長

- 政府正在增加投資以增強國內製造能力

The Gaskets and Seals Market size is estimated at USD 72.95 billion in 2024, and is expected to reach USD 87.62 billion by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The COVID-19 pandemic disrupted the gaskets and seals market, causing massive disruptions to global supply chains due to lockdowns, social distancing measures, and trade sanctions. However, the market has since recovered to pre-pandemic levels.

The growth of the gaskets and seals market is driven by the increasing use of gaskets and seals in the oil and gas industry, as well as the growing demand from the chemical and petrochemical sectors.

On the flip side, the need for regular maintenance and lubrication is likely to hinder market growth.

The growing demand for electric vehicles is expected to provide opportunities for the market to flourish from the automotive sector.

Asia-Pacific is expected to dominate the global market, owing to the huge demand expected from countries like China and India during the forecast period.

Gaskets & Seals Market Trends

The Oil and Gas Application is Expected to Dominate the Market

- The oil and gas industry operates in a challenging environment with maximum operational efficiency, which requires it to maximize the equipment uptime. In the industry, preventing leakage of potentially hazardous petrochemical products in valves, pumps, piping, fittings, storage tanks, and other vital components is paramount.

- The rising activity in oil and gas exploration and the expanding chemical processing sector is expected to increase demand for gaskets in pipeline and heat exchanger systems.

- Gaskets and seal tors are required in various equipment to maintain their timely function as these products help prevent leakage of any form of liquid and gas processing. All gaskets in the oil and gas industry adhere to ANSI/ASME standards.

- The global oil and gas industry holds enormous potential to create demand for industrial equipment, which is projected to drive the consumption of gaskets and seals simultaneously in the future. Numerous oil and gas projects are already lined up for development, while some are still under the planning stage.

- According to IBEF (India Brand Equity Foundation), Oil demand in India is projected to register a 2x growth to reach 11 million barrels per day by 2045. In February 2023, India's oil demand rose to a 24-year high, which resulted due to a boost in industrial activity.

- In May 2022, ONGC announced plans to invest USD 4 billion from FY22-25 to increase its exploration efforts in India. This exploration demands the use of gaskets and seals in their projects and increases market growth as well.

- With recovery prices becoming visible in the oil and gas industry, exploration and production have increased worldwide. The significant increase in oil and gas offshore exploration and production activities is noticed in Asia-Pacific and North America. Countries such as the United States, Saudi Arabia, Russia, Canada, and China are the leading oil producers in the global market.

- This is expected to make the oil and gas application the dominant one in the market.

The Asia-Pacific Region is Expected to Dominate the Market

- In Asia-Pacific, the factors that add to the market's growth are accelerated industrialization and augmented demand from numerous end-user industries.

- A significant amount of the gasket and seal market is also subjected to growth in the automotive sector, and according to OICA, automobile production in China and India was to increase by 3% and 24% in 2022 compared to the same period in 2021.

- China is a hub for chemical processing, accounting for a significant chunk of the chemicals produced globally. With the growing demand for various chemicals globally, the demand for gaskets and seals from this sector is projected to grow during the forecast period.

- China has plans to expand its network of inter-country pipelines, with new pipeline connections to Central Asia and Russia. China National Petroleum Corporation (CNPC) plans to complete significant sections of the massive Russian oil and gas pipelines in the northeastern province of Heilongjiang.

- India has now been ranked sixth among the world's ten largest manufacturing countries. The petrochemical industry contributes about 30% of raw materials to the chemical industry, which is expected to reach USD 300 billion by 2025.

- Furthermore, factors such as the growing industrial, electrical, and electronics sectors in the developing economies, including China, India, and ASEAN countries, are further expected to boost the demand for gaskets and seals in the region.

- All these factors are projected to impact the market growth in the region during the forecast period.

Gaskets & Seals Industry Overview

The gaskets and seals market is highly fragmented. The major players (not in any particular order) include Dechengwang, Flowserve Corporation, Freudenberg Sealing Technologies, Datwyler Holding Inc., and Tenneco Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in the Use of Gaskets and Seals in the Oil and Gas Industry

- 4.1.2 Growing Demand from the Chemical and Petrochemical Sectors

- 4.1.3 Increasing Demand from the Automotive Industry

- 4.2 Restraints

- 4.2.1 Regular Maintenance and Lubrication

- 4.2.2 Price Volatility of Raw Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Product

- 5.1.1 Gaskets

- 5.1.1.1 Metallic Gasket

- 5.1.1.2 Rubber Gasket

- 5.1.1.3 Cork Gasket

- 5.1.1.4 Non-asbestos Gasket

- 5.1.1.5 Spiral Wound Gasket

- 5.1.1.6 Other Gaskets (Semi-Metallic Gasket)

- 5.1.2 Seals

- 5.1.2.1 Shaft Seals

- 5.1.2.2 Molded Seals

- 5.1.2.3 Motor Vehicle Body Seals

- 5.1.2.4 Other Seals (Fork Seal and Piston Seal)

- 5.1.1 Gaskets

- 5.2 Material

- 5.2.1 Fiber

- 5.2.2 Graphite

- 5.2.3 PTFE

- 5.2.4 Rubber

- 5.2.5 Other Materials (Metal, Cork, Polymers and Felt)

- 5.3 Application

- 5.3.1 Aerospace

- 5.3.2 Automotive

- 5.3.3 Electronics

- 5.3.4 Oil and Gas

- 5.3.5 Power Generation

- 5.3.6 Other Applications (Industrial)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMG Sealing Limited

- 6.4.2 BRUSS Sealing Systems GmbH

- 6.4.3 Cooper Standard

- 6.4.4 Datwyler Holding Inc.

- 6.4.5 Dana Limited

- 6.4.6 Dechengwang

- 6.4.7 ElringKlinger AG

- 6.4.8 Flowserve Corporation

- 6.4.9 Freudenberg Sealing Technologies

- 6.4.10 Garlock, an Enpro Industries, Inc.

- 6.4.11 IGP Engineers Private Limited

- 6.4.12 John Crane

- 6.4.13 KLINGER Holding GmbH

- 6.4.14 Phelps

- 6.4.15 Saunders

- 6.4.16 SKF

- 6.4.17 Smiths Group plc

- 6.4.18 Trelleborg AB

- 6.4.19 Tenneco Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Electric Vehicles

- 7.2 Government is Increasing Investments to Enhance Domestic Manufacturing Capabilities