|

市場調查報告書

商品編碼

1642132

固定無線存取:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Fixed Wireless Access - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

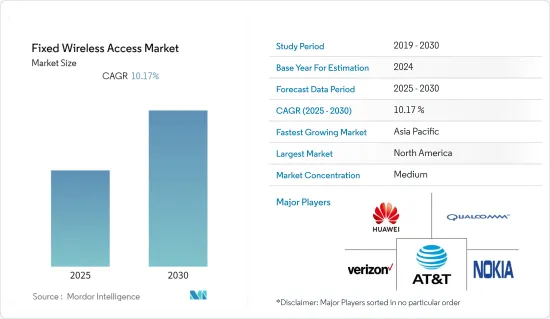

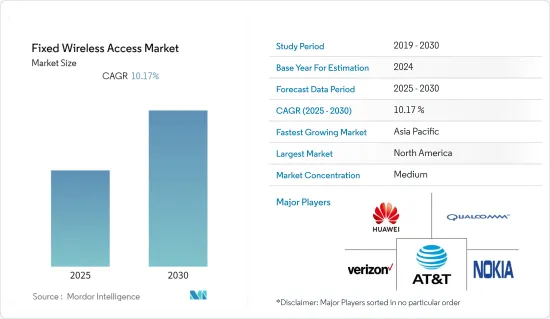

預測期內,固定無線接取市場預計將以 10.17% 的複合年成長率成長。

主要亮點

- 連網型設備的興起推動了家庭網路連線的需求。此外,穿戴式技術在新興國家正在不斷改進,增加了對無線寬頻連線的需求。

- 此外,過去十年來無線寬頻技術的穩定發展與電氣及電子工程師學會(IEEE) 制定的標準的進步保持同步。這些標準正在進行現代化改造,以提高最大速度和傳輸容量方面的網路吞吐量。這些升級鼓勵了市場參與者進行創新,滿足了客戶對更高頻寬和更快網路速度的需求,從而顯著促進了市場成長。

- 此外,由於資料量越來越大以及連接設備數量不斷增加,消費者對更快網際網路連接的需求也刺激了對高效連接固定無線接入的需求。此外,預計在預測期內,連網裝置數量的增加以及使用智慧設備的智慧家庭的日益關注和採用將推動市場需求。此外,全球範圍內擴大採用智慧家庭架構,例如遠端存取、語音控制和無縫連接,進一步推動了所調查市場的需求。

- 此外,隨著 5G 網路的推出,預計亞太地區的新興國家將在研究期間推動固定無線存取市場的發展。根據愛立信的行動報告,預計年終5G用戶數將達到10億人。今年,我們預計智慧型 5G 設備的數量將增加,且功能更加強大。五年後,5G用戶數預計將超過50億,而固定無線接取(FWA)連線數預計將達到約3億,其中5G約佔FWA連線的80%。

- 然而,一些國家對頻譜分配的依賴性不斷增加以及與毫米波技術相關的成本和環境挑戰等方面可能會在預測期內抑制市場成長。

- 在 COVID-19 危機期間,固定無線存取 (FWA) 解決方案可能會見證對光纖寬頻網路的需求和供應的增加。這是由於全球有條件的員工突然大規模採用遠距在家工作在家工作所致。據固定無線網路品質監控和最佳化平台 Preseem 稱,業務時段的需求成長尤為明顯。

固定無線接取市場趨勢

住宅市場預計將佔最大佔有率

- 由於家庭和個人寬頻連線的增加,住宅應用領域預計將見證最高的普及率。 FWA(固定無線接取)使用無線行動網路技術而非固網提供家庭網路連線。隨著網路和行動用戶的普及率不斷提高,對連續資料來源和網路的需求逐年增加。

- 5G固定無線存取是住宅客戶的理想選擇,因為它以有競爭力的價格提供速度,並且沒有安裝問題。此外,在許多新興國家,建造固定寬頻基礎設施在經濟上不可行。

- 根據思科最新的視覺網路指數報告,智慧家庭預計將成為未來幾年物聯網連接成長的主要驅動力之一。該公司預測,今年的設備連接數量將達到 285 億,其中約 50% 將是 IoT/M2M(機器對機器)。

- 此外,各大公司正在推出服務來擴大其客戶覆蓋範圍,尤其是家庭和個人用戶。例如,諾基亞和 Ooredoo 於去年 6 月在阿曼推出了超高速、可靠的 4G 和 5G 固定無線 (FWA) 存取。最初預計將有 15,000 家企業和家庭連接到該網路。此外,城市地區的 3,000 戶家庭將配備諾基亞 FastMile 5G FWA。

- 據物管稱,用於控制和連接目的的智慧家庭物聯網 (IoT) 設備的總數預計在未來一年將會增加。預計到年終將有近 2.84 億台設備投入使用。因此,隨著智慧家庭物聯網 (IoT) 設備的整體興起,預計市場將在整個預測期內展現出各種有利可圖的成長機會。

北美佔據市場主導地位

- 預計預測期內北美將佔據全球固定無線接取市場的最大佔有率。美國對高速網路連線的需求正在激增,這推動企業投資固定無線連線。固定無線連接的部署不僅可以提供高速網際網路,而且還有助於為服務不足地區的用戶提供服務。

- 固定無線解決方案中使用的小型基地台更靠近最終用戶,這對於物聯網來說具有天然優勢。小型基地台的廣泛部署將把設備連接到通訊網路,並幫助營運商成功建構物聯網。

- 過去兩年來,北美對固定無線寬頻技術的興趣和投資顯著增加。美國偏遠和農村地區仍有約 30% 的家庭無法享受高速寬頻連接,但固定無線寬頻正在成為縮小這一差距的關鍵技術。目前,約有 2,000 家無線網路服務供應商為全美 50 個美國的小城鎮和農村地區的 400 多萬家庭提供固定無線寬頻服務。

- 將 Wi-Fi 與小型基地台結合,可為無縫資訊服務提供經濟高效的容量和額外的覆蓋範圍。這種整合優勢最終可以轉化為收益的增加和總擁有成本 (TCO) 的節省。

- 此外,作為其主要成長策略的一部分,各市場參與者正致力於推出多種 5G 服務。例如,2023 年 1 月,T-Mobile US 與思科合作宣布推出可擴展、分散式、全國性的雲端原生融合核心閘道。新的融合核心閘道器將簡化 T-Mobile 的營運,使該非營運商能夠更靈活地轉移資源來推出 5G 家庭網際網路等服務。

固定無線接取產業概況

固定無線接入市場較為分散,全球各地的重要解決方案供應商都在不斷努力爭取市場吸引力。公司正在建立策略夥伴關係和聯盟,籌集資金推出新的解決方案,並改善現有的解決方案以提高市場知名度。讓我們來看看一些最近的市場發展趨勢。

2023 年 2 月,諾基亞和中國聯通網路通訊Group Limited (CUC) 宣布,他們將擴大合作,在現有網路上試用基於諾基亞整合多接取閘道器的 5G 固定無線存取 (FWA) 解決方案。這將是在中國市場的首次嘗試。透過固定和行動網路的無縫結合,CUC 將能夠擴展其網路頻寬並為消費者提供額外的網路服務。

2022 年 10 月,諾基亞宣布 NBN 已選擇它為其固定無線網路升級提供 5G 固定無線存取 (FWA) mmWave 用戶端設備 (CPE)。該計劃將為澳洲區域、半鄉村和偏遠地區的數千個家庭和企業帶來更快的通訊。諾基亞的用戶端設備 (CPE) 是全球首個支援高頻「mmWave」頻段的設備,可在無線基地台七公里半徑範圍內提供Gigabit速度。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

- FWA 採用的關鍵推動因素分析

- 知名供應商的主要舉措

- 關鍵業務考量與假設

- FWA、FTTH 和 FTTdp 的比較分析

- 分析農村、半都市區和都市區的主要經營模式和使用案例

- COVID-19 對固定無線接取市場的影響評估

第5章 市場動態

- 市場促進因素

- 對採用先進技術的高速資料連接的需求日益增加

- 透過 5G 產業各相關人員之間的策略合作來促進應用

- 市場挑戰

- 對某些國家頻率分配的依賴

- 毫米波技術的成本與環境挑戰

- 市場機會

第6章 市場細分

- 按類型

- 硬體

- 消費者場所設備 (CPE)

- 接入單元(毫微微蜂窩和微微型基地台)

- 按服務

- 硬體

- 按應用

- 住宅

- 商業的

- 產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Huawei Technologies Co. Limited

- Nokia Corporation

- Qualcomm Technologies

- AT & T, Inc.

- Verizon Communications, Inc.

- Airspan Networks Inc.

- Siklu Communication Limited

- Arqiva(UK)

- Telefonaktiebolaget LM Ericsson

- Samsung Electronics Co. Ltd

第8章投資分析

第9章:市場的未來

The Fixed Wireless Access Market is expected to register a CAGR of 10.17% during the forecast period.

Key Highlights

- The demand for internet connectivity among households has increased with the growth in connected devices. Additionally, wearable technology has improved in various emerging economies, contributing to the need for better wireless broadband connectivity.

- Additionally, the steady evolution of wireless broadband technology over the past decade keeps pace with advances in standards set by the Institute of Electrical and Electronics Engineers (IEEE). These standards are modernized to improve the network throughput regarding maximum speed and transmission capability. These upgrades have given the companies in the market the means to strive for innovation and successfully satisfy the customers' demand for higher bandwidth and faster internet, driving the market's growth significantly.

- Also, the increasing demand for faster internet connectivity among consumers, owing to the data size becoming more prominent and the rise in the number of devices connected to the device, is spurring the demand for fixed wireless access with effective connectivity. Further, the increase in the number of connected devices and increasing focus and implementation of smart homes using smart devices are expected to fuel the market demand during the forecast period. Moreover, the growing adoption of smart home architecture worldwide, including remote access, voice control, and seamless connectivity, further drives the demand in the market studied.

- Furthermore, with the 5G network launch, the emerging economies in the Asia-Pacific region are expected to propel the market for fixed wireless access during the study period. According to the Ericsson Mobility Report, 5G subscriptions are expected to reach 1 billion by the end of the year. More smart 5G devices with additional capabilities are expected this year. In five years, the 5G subscriptions are anticipated to surpass 5 billion, and Fixed Wireless Access (FWA) connections will reach around 300 million, where 5G will account for about 80 % of FWA connections.

- However, aspects like the rising dependence on Spectrum Allocation in Some Countries and Cost and Environmental Challenges Associated with Millimeter-wave Technology might be some factors that can restrain the market's growth throughout the forecasted period.

- Amid the COVID-19 crisis, fixed wireless access (FWA) solutions would likely witness increased demand and fill in fiber broadband networks. This results from a sudden and widespread explosion in telecommuting by employees worldwide who can work from home. According to Preseem, a quality monitoring and optimization platform for fixed wireless networks, the increased demand is especially significant during business hours.

Fixed Wireless Access Market Trends

Residential Segment Expected to Depict the Maximum Application

- The household application segment is expected to depict the maximum adoption due to growing broadband connectivity in households or for individuals. Fix6ed Wireless Access, or FWA, provides home internet access using wireless mobile network technology rather than fixed lines. Due to the increasing internet and mobile penetration amongst users, the need for a continuous source of data and the internet has been increasing over the years.

- 5G fixed wireless access is an ideal alternative for residential customers as users get speeds at a competitive price with no installation issues. Also, building fixed broadband infrastructure in many developing countries is not economically viable.

- According to Cisco's latest Visual Networking Index Report, smart homes are expected to be one of the primary drivers for the growth of IoT connectivity during the next few years. The company expects around 50% of the 28.5 billion device connections predicted by this year to be IoT/machine-to-machine (M2M).

- Moreover, major companies are introducing their services to expand their reach to customers, especially for households or individual users. For instance, in June last year, Nokia and Ooredoo introduced super-fast and reliable 4G and 5G fixed wireless (FWA) access throughout Oman. The scope of work would initially witness 15,000 businesses and homes connected. In addition, 3,000 homes in city centers would get Nokia FastMile 5G FWA.

- As per property management, the total number of smart home IoT (Internet of Things) devices utilized for control and connectivity purposes was anticipated to rise in the upcoming year. Nearly 284 million devices are predicted to be in use by the end of the following year. Hence, with the rise in the overall smart home IoT (Internet of Things) devices, the market is expected to witness various lucrative growth opportunities throughout the forecast period.

North America to Dominate the Market

- North America is expected to hold the most significant global fixed wireless access market share during the forecast period. In the United States, the demand for high-speed internet connections is increasing rapidly, owing to which companies are rigorously investing in fixed wireless connections. Deploying fixed wireless connections not only offers high-speed internet but also helps users in unserved areas to avail of the service.

- Small cells used in fixed wireless solutions are deployed close to end-users; therefore, they have natural advantages in the Internet of Things. Extensive small cell deployments connect devices to communication networks, helping operators build a successful Internet of Things.

- North America witnessed a significant increase in interest and investment in fixed wireless broadband technology in the last two years. Though approximately 30% of US households in remote and rural communities still lack access to a high-speed broadband connection, fixed wireless broadband is emerging as a key technology to bridge this gap. About 2,000 wireless internet service providers currently provide fixed wireless broadband services to more than 4 million residences in small towns and rural communities in all 50 US states.

- Integrating Wi-Fi with small cells can offer cost-effective capacity and additional coverage for seamless data services. Benefits from such integration may eventually lead to increases in revenue and savings in the total cost of ownership (TCO).

- Moreover, various market players are well involved in launching multiple 5G offerings as a part of their crucial growth strategy. For instance, in January 2023, T-Mobile US announced its collaboration with Cisco to launch a scalable and distributed nationwide cloud native converged core gateway. The new converged core gateway also simplifies operations for T-Mobile, allowing the Un-carrier to shift resources with better agility and roll out services like 5G home internet.

Fixed Wireless Access Industry Overview

The fixed wireless access market is fragmented due to the presence of significant solution providers across the globe who are incessantly working towards gaining more market traction. The companies are entering into strategic partnerships and alliances, raising funds to introduce new solutions, and improvising on the existing ones to increase market visibility. Some of the recent developments in the market are

In February 2023, Nokia and China United Network Communication Group Co. (CUC) announced today that they are expanding their collaboration by trialing a 5G fixed wireless access (FWA) solution based on Nokia's integrated Multi-Access Gateway in an existing network. This is the first test of its kind in the Chinese market. CUC will be able to grow network bandwidth and provide additional internet services to its consumers in the future by smoothly combining fixed and mobile networks.

In October 2022, Nokia declared that NBN had selected it to supply 5G fixed wireless access (FWA) mmWave Customer Premises Equipment (CPE) for NBN's fixed wireless network upgrade. The program would help deliver faster speeds to thousands of homes and businesses across regional, semi-rural, and remote Australia. In a world-first, the customer premise equipment (CPE) provided by Nokia supports high frequency 'mmWave' bands, capable of Gigabit speeds for premises within a 7 km radius of a radio base station.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.4.1 Analysis of Key Enablers for the Adoption of FWA

- 4.4.2 Key Initiatives Undertaken by Notable Vendors

- 4.4.3 Key Business Considerations and Pre-requisites

- 4.4.4 Comparative Analysis of FWA With FTTH and FTTdp

- 4.4.5 Analysis of Key Business Models and Use Cases in Rural, Semi-urban, and Urban Areas

- 4.5 Assessment of COVID-19 impact on the Fixed Wireless Access Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for High-speed Data Connectivity Through Advanced Technologies

- 5.1.2 Strategic Collaborations Between Various Stakeholders in the 5G Industry to Drive Adoption

- 5.2 Market Challenges

- 5.2.1 Dependence on Spectrum Allocation in Some Countries

- 5.2.2 Cost and Environmental Challenges Associated with Millimeter-wave Technology

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Consumer Premise Equipment (CPE)

- 6.1.1.2 Access units (Femto & Picocells)

- 6.1.2 Services

- 6.1.1 Hardware

- 6.2 By Application

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huawei Technologies Co. Limited

- 7.1.2 Nokia Corporation

- 7.1.3 Qualcomm Technologies

- 7.1.4 AT & T, Inc.

- 7.1.5 Verizon Communications, Inc.

- 7.1.6 Airspan Networks Inc.

- 7.1.7 Siklu Communication Limited

- 7.1.8 Arqiva (UK)

- 7.1.9 Telefonaktiebolaget LM Ericsson

- 7.1.10 Samsung Electronics Co. Ltd