|

市場調查報告書

商品編碼

1404530

邊緣人工智慧硬體:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Edge AI Hardware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

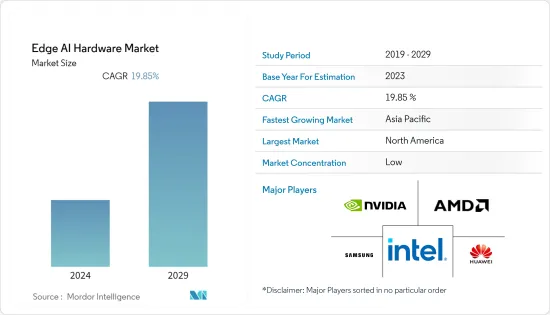

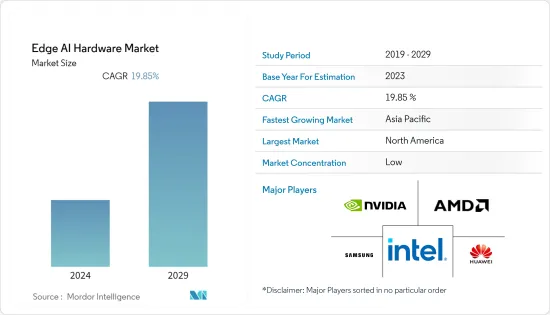

上一年邊緣AI硬體市場規模為26.2億美元,預計未來五年將以19.85%的複合年成長率成長,達到75.2億美元。

邊緣運算產品和服務的快速成長以及邊緣設備即時延遲的降低是推動邊緣AI硬體市場成長的主要因素。值得注意的是,物聯網中對邊緣運算的需求以及用於設備上影像分析的專用人工智慧處理器是邊緣人工智慧設備市場發展的有前景的領域。

主要亮點

- Edge Al 設備是處理和驅動基於人工智慧的機器人和設備的先進系統。透過將人工智慧融入該設備來實現資料處理,以提高其效能。邊緣人工智慧硬體市場的重大機會包括對基於物聯網的邊緣運算解決方案不斷成長的需求、擴大採用 5G 網路來統一 IT 和通訊,以及用於設備上影像分析的專用人工智慧處理器。

- 隨著工業4.0在各行各業的廣泛部署,對邊緣人工智慧的需求不斷增加。據估計,人工智慧、物聯網和5G技術在BFSI、政府、飯店、零售和消費品等各行業的快速滲透正在支撐邊緣AI硬體產業的成長。在不傳輸資料的情況下執行人工智慧推理的可能性正在為邊緣人工智慧硬體市場創造巨大的需求。隨著邊緣人工智慧設備數量的不斷增加,企業可以在準確性和延遲至關重要的關鍵情況下降低營運成本。

- 作為邊緣人工智慧硬體市場的趨勢,智慧家庭和智慧城市的需求正在不斷增加。現在人們可以使用智慧型設備從世界任何地方控制他們的家。智慧城市是利用人工智慧、機器學習、巨量資料和區塊鏈等最尖端科技建造的。這些技術在各行各業中普及廣泛,並且擴大在世界各地的智慧城市中被採用。這種模式正在推動邊緣人工智慧硬體市場的發展。

- 與邊緣人工智慧設備相關的安全問題是阻礙市場成長的抑制因素。風險發生在邊緣人工智慧主要運作的地方層級。作為針對堅決個人的任何線上違規行為的開放原始碼,本地層面的人為錯誤很容易導致資料遺失。與邊緣人工智慧程式設計相容的機器類型也存在很大差異,有些則不相容。不幸的是,不相容的機器一起工作很容易出現故障和故障,這阻礙了市場的發展。

- COVID-19 對邊緣人工智慧 (AI) 硬體產業產生了重大影響,因為幾乎所有國家都選擇關閉所有製造設施。政府採取了多項嚴格措施來遏制病毒的傳播,包括暫停非必需品的生產和銷售以及擾亂國際貿易。但目前情勢下,各行各業都已重啟,邊緣AI公司正在生產最好的人工智慧解決方案,預計未來將積極帶動市場。

邊緣人工智慧 (AI) 硬體市場趨勢

智慧家庭和智慧城市需求的增加預計將推動市場成長

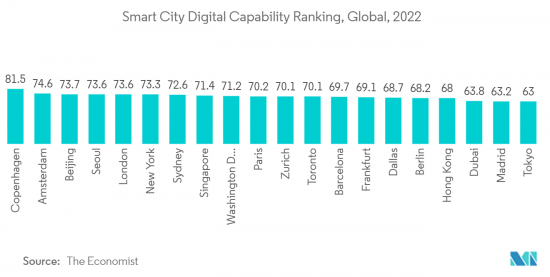

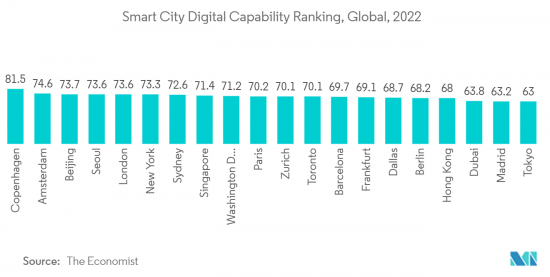

- 智慧城市是複雜的結構,包含支持人類生命週期的各種系統。智慧醫療、智慧交通、智慧製造、智慧建築、智慧型能源和智慧農業只是其中的一些系統。根據《經濟學人》報道,哥本哈根在 2022 年指數排名中以 80.3 分領先全球數位城市。首爾、北京、阿姆斯特丹和新加坡進入最佳數位城市前五名。

- 隨著這些人工智慧技術在各行業的普及,世界各地的智慧城市也逐漸採用人工智慧技術。隨著智慧城市的普及,越來越多的人對智慧家居的概念感興趣。隨著越來越多的人遷移到城市,人們日常生活中對自動化服務的需求預計將會增加。智慧家居正從奢侈品演變為必需品。由於智慧家庭和智慧城市的需求不斷增加,邊緣人工智慧硬體市場預計將在未來五年內擴大。

- 在世界各地,各國政府正在利用最尖端科技來解決人口安全和保護的關鍵問題。為了利用都市化帶來的機遇,許多國家正在製定計劃,將其城市轉變為智慧城市。智慧城市可以提高營運效率、環境永續性以及為居民創造新的服務。例如,阿拉伯聯合大公國(UAE)啟動了一項將其城市轉變為智慧城市的計劃。阿拉伯聯合大公國政府還制定了總體區塊鏈戰略,以提高安全性、不變性、彈性和透明度。無人機和監視錄影機是政府組織為此目的部署的兩種尖端人工智慧硬體。

- 由於邊緣運算能力的增強以及深度學習和機器學習的大量使用,邊緣設備變得越來越創新。邊緣人工智慧使設備能夠提供即時洞察和預測分析,而無需將資料傳送到遠端雲端伺服器。許多公司現在正在利用這一點,在製造中實施智慧型解決方案。借助現代工廠中安裝的許多工業IoT設備、邊緣人工智慧硬體增加的市場需求,製造商可以了解供應鏈中的問題,並主動避免計劃外停機。

亞太地區預計將佔據主要市場佔有率

- 由於5G的出現和該地區物聯網整合設備的增加,預計亞太地區將創下全球邊緣人工智慧硬體市場的最高成長率。中國、日本、印度和韓國的智慧型手機普及不斷提高,人工智慧硬體市場的採用預計也會增加。

- 中國是該地區最大的市場,其次是日本。多家大型汽車、電子和半導體供應商大力投資人工智慧技術,正在推動該地區邊緣人工智慧硬體市場的成長。從去年提交的專利申請數量來看,中國邊緣人工智慧產業在邊緣運算和硬體解決方案方面的創新呈爆炸式成長,顯示中國產業正在快速創新。

- 6月至7月一個月內,北京經濟資訊化委員會統計,中國人工智慧企業約4,040家。此外,許多製造業的存在使該地區成為採用人工智慧技術的工業機器人的有吸引力的市場。這些趨勢正在推動邊緣人工智慧硬體市場的需求。

- 穿戴式裝置在與視覺處理單元整合以加速人工智慧任務的需求不斷成長方面也發揮著關鍵作用。Cisco預測,到年終,連網穿戴裝置數量將達到11.05億台。製造業、通訊和汽車等終端用戶產業在該地區擁有巨大潛力,很快將為人工智慧硬體市場創造巨大需求。

邊緣人工智慧(AI)硬體產業概覽

邊緣人工智慧硬體市場高度分散,主要參與者包括英特爾公司、華為科技公司、英偉達公司、超微半導體公司和三星集團。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 人工智慧在邊緣設備中的普及

- 智慧家庭和智慧城市的需求增加

- 市場抑制因素

- 有關邊緣人工智慧設備的安全問題

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場區隔

- 按處理器

- CPU

- GPU

- FPGA

- ASIC

- 按設備

- 智慧型手機

- 相機

- 機器人

- 穿戴式的

- 智慧音箱

- 其他

- 按最終用戶產業

- 政府

- 房地產

- 消費性電子產品

- 車

- 運輸

- 衛生保健

- 製造業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他地區

第6章競爭形勢

- 公司簡介

- Intel Corporation

- Huawei Technologies Co. Ltd

- Nvidia Corporation

- Advanced Micro Devices Inc.

- Baidu Inc.

- Alphabet Inc.

- Qualcomm Incorporated

- Samsung Group

- Apple Inc.

- Amazon.com Inc.

- Alibaba Group Holding Limited

- Continental AG

- Denso Corporation

- Robert Bosch GmbH

- KALRAY Corporation

- MediaTek Inc.

- Xilinx Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The Edge AI Hardware Market was valued at USD 2.62 billion the previous year and is expected to grow at a CAGR of 19.85%, reaching USD 7.52 billion by the next five years. Rapid growth in edge computing products and services and increasing real-time low latency on edge devices are significant factors for the edge AI hardware market growth. Notably, the need for edge computing in IoT and dedicated AI processors for on-device image analytics are promising areas of market advancement in edge AI devices.

Key Highlights

- An edge Al device is an advanced system that processes and powers artificial intelligence-based robots and devices. Data processing is possible with this equipment by integrating artificial intelligence into it and improving its performance. The significant opportunities for the edge AI hardware market include the growing demand for IoT-based edge computing solutions, the rising adoption of 5G networks to bring IT and telecom together, and dedicated AI processors for on-device image analytics.

- The demand for edge AI is growing due to Industry 4.0's widespread deployment across all sectors. The burgeoning penetration of artificial intelligence, IoT & 5G technologies across varied industry verticals, including BFSI, government, hospitality, retail, and consumer goods, is speculated to support the growth of the edge AI Hardware industry. The possibility of performing AI inference without transferring data has generated huge demand for the edge AI Hardware market. Businesses can cut operating costs in critical situations when accuracy and latency are crucial due to the increase in edge AI devices.

- A trend in the edge AI hardware market anticipated to have a beneficial effect in the following years is the rise in demand for smart homes and smart cities. People can now control their homes from anywhere in the world using smart devices. Smart cities are being built using cutting-edge technology like AI, machine learning, big data, and blockchain. Because these technologies are becoming more prevalent across a wide range of industries, smart cities worldwide are increasingly adopting them. This pattern fuels the market for edge AI hardware.

- Security concerns related to edge AI devices are a restraining factor hindering the market's growth. The risk occurs at the local level, where edge AI functions primarily. Since it is open source to any online breaching from determined individuals, human error at the local level is prone to data loss. There is also a significant variation in machine types that are compatible with Edge AI programming, while some are incompatible. Unfortunately, it's likely for faults and failures to happen when incompatible machines work together, which restrains the market.

- COVID-19 significantly impacted the edge artificial intelligence (AI) hardware sector as nearly every nation chose to shut down all manufacturing facilities. The government has implemented several stringent measures to stop the virus from spreading, including halting the manufacturing and sale of non-essential commodities and obstructing international trade. However, with the current situation, all the industries are reopened, and Edge AI companies are producing some of the best artificial intelligence solutions, which are expected to drive the market positively in the future.

Edge Artificial Intelligence (AI) Hardware Market Trends

Increase Demand for Smart Homes and Smart Cities is Expected to Drive the Market Growth

- Smart cities are complex structures incorporating various systems to support a human life cycle. Smart healthcare, smart transportation, smart manufacturing, smart buildings, smart energy, and smart farming are just some of these systems. According to the Economist, In 2022, the leading global digital city on the index ranking was Copenhagen, with a score of 80.3. Seoul, Beijing, Amsterdam, and Singapore ranked in the top 5 for the best digital cities.

- As these AI technologies become more prevalent across various industries, smart cities are gradually adopting them worldwide. More people are becoming intrigued by the idea of a smart home as smart cities become more common. The need for automated services in people's daily lives is expected to rise as more people relocate to cities. Smart homes are evolving from a luxury to a need. Due to the increasing demand for smart homes and smart cities, the edge AI hardware market is anticipated to expand throughout the next five years.

- Globally, governments are utilizing cutting-edge technologies to handle the crucial issue of safeguarding the security and protection of residents. To take advantage of the opportunities presented by urbanization, many nations have developed programs to transform their cities into smart cities. Operational efficiencies, environmental sustainability, and the creation of new services for residents are all made possible by smart cities. For instance, the United Arab Emirates has started a program to make its cities smart cities. The UAE government has also developed a general blockchain strategy for improved security, immutability, resilience, and transparency. Drones and surveillance cameras are two leading-edge AI hardware deployed by government organizations for this purpose.

- Edge devices have become increasingly innovative because of increased edge computing power and the sparing use of deep learning and machine learning. Edge AI enables devices to deliver real-time insights and predictive analytics without sending data to distant cloud servers. Now, many companies are utilizing this by putting intelligent solutions in manufacturing. Manufacturers may be informed of problems in their supply chain and proactively avoid unplanned downtime with the help of the many industrial IoT devices installed in modern factories, which increases demand for the edge AI hardware market.

Asia Pacific is Expected to Hold Significant Market Share

- Asia Pacific region is expected to experience the highest growth rate in the global edge AI hardware market due to the advent of 5G in the region and the increasing number of IoT-incorporated devices. The growing penetration of smartphones in China, Japan, India, and South Korea is expected to increase the adoption of AI hardware market adoption.

- China is the largest market in the region, followed by Japan. The presence of several significant vendors in the automobile, electronics, and semiconductor companies, who are investing significantly in AI technology, is driving the growth of the edge AI hardware market in the region. China's edge AI industry has seen explosive growth in innovation in the last year for edge computing and hardware solutions through the number of patents filed, which shows that China's industries are innovating rapidly.

- During one month between June and July, the Beijing Municipal Commission of Economy and Information Technology counted around 4,040 AI companies in China. Besides, the presence of many manufacturing companies makes the region an attractive market for industrial robots that implement AI technology. Such trends strive for the demand for the edge AI hardware market.

- Wearable devices also play a significant role in the increasing demand for integration with vision processing units to accelerate AI tasks. Cisco Systems estimates that the number of connected wearable devices could reach 1,105 million units by the end of 2022. End-user industries like manufacturing, telecommunications, and automotive have huge potential in the region, creating a huge demand for the AI hardware market shortly.

Edge Artificial Intelligence (AI) Hardware Industry Overview

Edge AI Hardware Market is highly fragmented, with the presence of major players like Intel Corporation, Huawei Technologies Co. Ltd, Nvidia Corporation, Advanced Micro Devices Inc., and Samsung Group. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- August 2023 - Intel and Synopsys announced their definitive agreement to expand the companies' long-standing IP (intellectual property) and EDA (electronic design automation) strategic partnership by developing a portfolio of IP on Intel 3 and Intel 18A for Intel's foundry customers. Synopsys would enable a range of its standardized interface IP portfolio on Intel's leading-edge process technologies as part of the transaction. As a result, Intel's foundry consumers would gain access to industry-leading IPs built on Intel's advanced process technologies and be able to accelerate design execution and project schedules for system-on-chips (SoCs).

- November 2022: Israeli AI solutions firm Run:ai has launched an MLOps Compute Platform (MCP) with support from NVIDIA's DGX systems. The platform is a full-stack AI tool for enterprises that would help them avoid issues associated with AI model deployment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Penetration of AI in Edge Devices

- 4.2.2 Increasing Demand for Smart Homes and Smart Cities

- 4.3 Market Restraints

- 4.3.1 Security Concerns Related to Edge AI Devices

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Processor

- 5.1.1 CPU

- 5.1.2 GPU

- 5.1.3 FPGA

- 5.1.4 ASICs

- 5.2 By Device

- 5.2.1 Smartphones

- 5.2.2 Cameras

- 5.2.3 Robots

- 5.2.4 Wearables

- 5.2.5 Smart Speaker

- 5.2.6 Other Devices

- 5.3 By End-User Industry

- 5.3.1 Government

- 5.3.2 Real Estate

- 5.3.3 Consumer Electronics

- 5.3.4 Automotive

- 5.3.5 Transportation

- 5.3.6 Healthcare

- 5.3.7 Manufacturing

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Intel Corporation

- 6.1.2 Huawei Technologies Co. Ltd

- 6.1.3 Nvidia Corporation

- 6.1.4 Advanced Micro Devices Inc.

- 6.1.5 Baidu Inc.

- 6.1.6 Alphabet Inc.

- 6.1.7 Qualcomm Incorporated

- 6.1.8 Samsung Group

- 6.1.9 Apple Inc.

- 6.1.10 Amazon.com Inc.

- 6.1.11 Alibaba Group Holding Limited

- 6.1.12 Continental AG

- 6.1.13 Denso Corporation

- 6.1.14 Robert Bosch GmbH

- 6.1.15 KALRAY Corporation

- 6.1.16 MediaTek Inc.

- 6.1.17 Xilinx Inc.