|

市場調查報告書

商品編碼

1404498

FPGA(現場可程式閘陣列):2024-2029 年市場佔有率分析、產業趨勢與統計、成長預測Field Programmable Gate Array (FPGA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

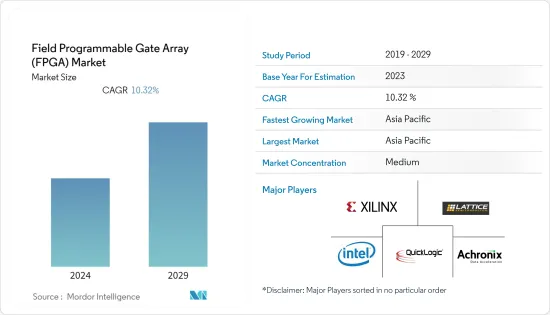

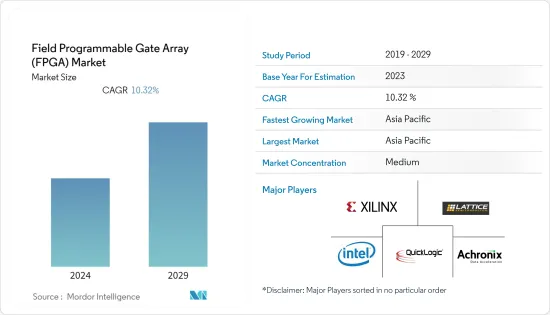

FPGA(現場可程式閘陣列)市場上年度為69億美元,預計未來五年將達到124.4億美元,複合年成長率為10.32%。

資料中心和高效能運算的高度部署預計將在預測期內推動 FPGA 需求。例如, 資料年 3 月,NTT 計劃未來三個月在印度推出 6 個資料中心,另外 3 個正在建設中。 NTT India MD Sharad Sanghi 表示,這些資料中心近 70% 的相同容量已被預留。該公司計劃在 6 月底前再推出 6 個資料中心,使印度運作的資料中心總數達到 11 個。

主要亮點

- FPGA(現場可程式閘陣列)包含具有可程式硬體結構的電路。與 ASIC 和 GPU 不同,FPGA 晶片內的電路不是硬蝕刻的,可以根據需要重新編程。這項特性使 FPGA 成為 ASIC 的合適替代品,因為 ASIC 需要較長的開發時間和大量的設計和製造投資。

- FPGA 在科技產業中用於機器學習和深度學習。微軟研究院展示了過去十年來在 FPGA 上使用人工智慧的首批使用案例之一,作為該公司加速網路搜尋努力的一部分。 FPGA 結合了可編程性、速度和彈性,可提供高效能,而無需開發客製化專用積體電路 (自訂) 的高成本和複雜性。 FPGA 也用於微軟的搜尋引擎Bing,展示了 FPGA 在深度學習應用上的實用性。據該公司稱,Bing 使用 FPGA 來加速搜尋排名,實現吞吐量提高 50%。

- 此外,FPGA 還支援整合 AI 的硬體客製化,並且可以透過程式設計提供類似 ASIC 和 GPU 的行為。 FPGA 的可重新配置和可重新編程特性使其非常適合快速發展的人工智慧領域,使設計人員能夠快速測試演算法並將其快速推向市場。與 ASIC 相比,高功耗限制了市場成長。能源效率一直是各行業關注的重點。電子設備產業一直在尋找低功耗的設備。 FPGA 功耗較高,程式設計師無法控制功耗最佳化。

- 此外,5G 網路基礎設施技術開發的成長和進步、FPGA 在各個最終用戶產業中的使用不斷增加是推動所研究的市場成長的一些因素。例如,2022年6月,愛立信在德克薩斯州投資超1億美元建設節能5G智慧工廠。該工廠展示了由 5G 連接支援的創新技術,包括自主機器人和擴增實境(AR) 培訓。

- 此外,市場上的各個參與者都在不斷投資最新技術來開發創新產品。例如,2023 年 1 月,FPGA新興企業Rapid Silicon 籌集了 1,500 萬美元,將其首款晶片推向市場。本輪資金籌措將用於投資 Rapid Silicon 的產品系列,幫助推出低階 FPGA 領域的優質產品,並鞏固公司將開放原始碼軟體應用於商業應用的勢頭。

- 由於 COVID-19大流行,政府、企業和學術機構對資料中心、人工智慧和機器學習的需求激增。這種成長對 FPGA 需求產生了正面影響。預計在預測期內將保持相同的速度,有助於普及FPGA 在各個最終用戶產業中的影響力和重要性。

FPGA(現場可程式閘陣列)市場趨勢

物聯網需求的增加預計將推動市場成長

- 並行執行是 FPGA 的關鍵優勢,因為多個感測器(例如濕度和溫度檢測器)檢測器處於活動狀態。 FPGA 對於物聯網來說非常節能,因為無需花時間循環或暫停延遲。根據《2022 年物聯網現況》報告,全球連網物聯網設備將增加 18%,達到 144 億台。到 2025 年,這一數字預計將超過 300 億,平均每人擁有近 4 個連網物聯網設備。

- 預計在預測期內,物聯網的需求將進一步增加,這意味著對半導體和其他組件的需求增加。根據SEMI預測,到2025年,物聯網設備所需的半導體和感測器規模預計將達到1,142億美元。

- 隨著物聯網設備的快速增加,建構物聯網設備的晶片需求預計也會在預測期內上升。加上晶片小型化,降低消費量成為製造商的首要任務。

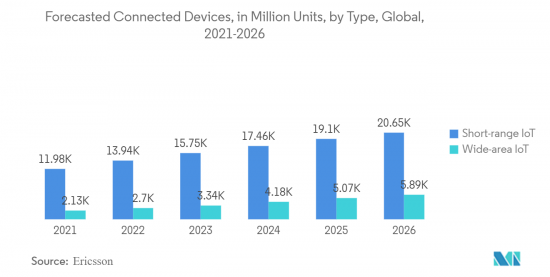

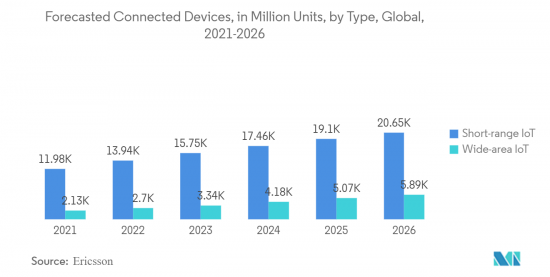

- 根據愛立信的數據,2022 年短距離物聯網連接設備的銷售額為 139.39 億美元,廣域物聯網連接設備的銷售額為 26.96 億美元。此外,預計到2026年將分別達到206.49億美元和58.85億美元。

- 物聯網有望成為產生重大創新、推廣新商業模式並以多種方式加強全球社會的主要驅動力。市場開拓供應商正在開發 FPGA 並將其整合到物聯網設備和解決方案中。例如,Intel Stratix 10 等英特爾 FPGA 解決方案由於其固有的軟體和硬體可編程性,可實現可擴展性和彈性,以滿足物聯網要求。

亞太地區預計將佔據主要市場佔有率

- 亞太地區是 FPGA 產業參與者的重要地區。在亞太地區,中國、印度、韓國和台灣等許多國家的消費性電子產業在過去幾年中出現了顯著成長。因此,該地區的 FPGA 需求被視為一個影響點。

- 根據SEMI(半導體設備與材料國際)的數據,中國在半導體設備的支出最多,其次是韓國、台灣和日本。此外,預計中國大陸今年仍將是半導體製造設備的最大支出國,而台灣地區預計將在 2024 年重返榜首。此外,中國政府鼓勵國家龍頭企業和頂尖數位公司發展國內半導體製造能力,以恢復中國對海外半導體需求的依賴平衡。這些努力可能會進一步提振半導體市場並推動對 FPGA 的需求。

- 此外,冠狀病毒引發的居家趨勢大流行推動對半導體晶片的需求。例如,根據WSTS預測,2023年亞太地區半導體產業收入預計將達到4,119.7億美元。這些趨勢正在鼓勵主要半導體製造商進入亞太市場。例如,市場上最著名的參與者之一 ASML 最近在台南開設了一個獨特的、最先進的培訓設施。

- 同樣,2022年11月,日月光半導體工程(ASE)宣布將投資3億美元擴大馬來西亞生產基地。此外,中國國務院《國家積體電路產業發展指南》提出了2030年在半導體所有領域成為全球領導者的目標。

- 此外,「中國製造2025」計畫支持獲取有關先進半導體製造的知識,這是中國未來經濟和社會的關鍵要素。此外,該國最近在醫療保健領域投資了 5,740 億美元,這可能會進一步推動所研究的市場成長。

- 此外,5G 的採用在網路和裝置領域都在蓬勃發展。根據愛立信移動的報告,5G用戶預計比4G早兩年達到10億。主要因素包括中國比4G更早進行5G,設備由多個供應商及時提供。近年來,中國通訊業經歷了快速發展,預計這種情況將持續到2025年。人口、通訊服務和智慧型手機使用的成長正在刺激該行業的發展。中國的市場開拓大部分以優質連結和內容服務為主。

- 中國正在為FPGA市場的擴張鋪路。由於其作為國際家用電子電器製造商的重要地位,該國的需求正在成長。中國是全球最大的製造地,生產全球36%的電子產品,包括智慧型手機、電腦、雲端伺服器和通訊基礎設施,成為全球電子供應鏈中最重要的節點。人工智慧在中國的普及,為中國電力市場帶來了新的開拓。智慧家庭和物聯網 (IoT) 可能是 FPGA 製造商未來十年的主要發展方向。

FPGA(現場可程式化閘陣列)產業概述

FPGA(現場可程式閘陣列)市場較為分散。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 宏觀經濟走勢對產業的影響

第5章市場動態

- 市場促進因素

- 物聯網需求增加

- 市場抑制因素

- 與 ASIC 相比功耗較高

第6章市場區隔

- 按配置

- 高階FPGA

- 中端 FPGA/低階 FPGA

- 依架構

- 基於SRAM的FPGA

- 基於耐熔熔絲的 FPGA

- 基於快閃記憶體的FPGA

- 按最終用戶產業

- 資訊科技/通訊

- 消費性電子產品

- 車

- 工業的

- 軍事/航太

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- Xilinx Inc.

- Lattice Semiconductor Corporation

- Quicklogic Corporation

- Intel Corporation

- Achronix Semiconductor Corporation

- GOWIN Semiconductor Corporation

- Microchip Technology Incorporated

- Efinix Inc.

第8章供應商市場佔有率分析

第9章投資分析

第10章市場的未來

The Field Programmable Gate Array (FPGA) Market was valued at USD 6.9 billion in the previous year and is expected to grow at a CAGR of 10.32%, reaching USD 12.44 billion by the next five years. High deployment of data centers and high-performance computing is expected to propel the demand for the FPGA in the forecasted period. For instance, in March 2023, NTT intends to launch six data centers in India over the next three months, with three more in the works. Almost 70 percent of the identical capacity in these data centers has already been booked, according to NTT India MD Sharad Sanghi. The company will launch six additional data centers by the end of June, bringing its total number of operating data centers in the country to 11.

Key Highlights

- Field programmable gate arrays (FPGAs) incorporate circuits with a programmable hardware fabric. Unlike ASICs or graphics processing units (GPUs), the circuitry inside an FPGA chip is not hard etched; it can be reprogrammed as required. This capability makes FPGAs a suitable alternative to ASICs, which need a long development time and a significant investment to design and fabricate.

- FPGAs are used in the technology industry for machine learning and deep learning. Microsoft Research displayed one of the first use cases of AI on FPGAs in the last decade as part of the company's efforts to speed up web searches. FPGAs provide a combination of programmability, speed, and flexibility, delivering performance without high cost and complexity to develop custom application-specific integrated circuits (ASICs). Microsoft's Bing search engine also uses FPGAs in production, indicating their value for deep learning applications. According to the company, Bing realized a 50% increase in throughput using FPGAs to accelerate search ranking.

- In addition, FPGAs deliver hardware customization with integrated AI and can be programmed to provide behavior like an ASIC or a GPU. The reconfigurable, reprogrammable nature of an FPGA makes itself well suited for a rapidly evolving AI landscape, enabling designers to test algorithms quickly and get to market fast. High Power Consumption Compared to ASIC restraining the market growth. Energy efficiency has always been a significant concern across various industries. Industries incorporating electronic devices always seek low-power-consuming devices. In FPGAs, power consumption is higher, and programmers do not have any control over power optimization.

- Furthermore, growth and advancement in technology development for 5G networking infrastructure and an increase in the use of FPGA in various end-user industries are some of the factors driving the studied market growth. For instance, in June 2022, Ericsson invested over USD 100 million in its energy-efficient 5G smart factory in Texas, where the equipment powering 5G networks across the United States is constructed. The factory showcases innovation powered by 5G connectivity, with abilities such as autonomous robots, augmented reality training, and many more.

- In addition, various players in the market are continuously investing in the latest technology to develop innovative products. For instance, in January 2023, FPGA startup Rapid Silicon landed USD 15 million to bring its first chip to market. The round of funding will be used to invest in Rapid Silicon's product portfolio, support its premier low-end FPGA product launch, and build on the company's momentum in adopting open-source software for commercial applications.

- The demand for data centers, artificial intelligence, and machine learning across government, enterprises, and academic entities is witnessing exponential growth due to the COVID-19 pandemic. This growth has positively impacted the need for FPGAs. It is predicted to maintain the same pace in the forecasted period, helping spread the impact and significance of FPGAs in various end-user industries.

Field Programmable Gate Array (FPGA) Market Trends

Increasing Demand for IoT is Expected to Drive the Market Growth

- Parallel execution is a crucial benefit of FPGAs, as several sensors, like humidity and temperature detectors, operate constantly. Since no time is required to be spent on looping and pausing for the delay, FPGAs are more power-efficient for IoT. According to the State of the IoT 2022 report, connected IoT devices are increasing by 18% to 14.4 billion globally. By 2025, this number is predicted to be over 30 billion, nearly 4 IoT devices per person on average.

- The demand for IoT is anticipated to increase even further during the forecast period, which signifies a boost in demand for semiconductors and other components. According to SEMI, the size of the semiconductor and sensor needed for IoT devices is expected to reach USD 114.2 billion by 2025.

- With the rapid increase in the number of IoT devices, chip requirement for building IoT instruments is also expected to rise during the forecast period. Reducing energy consumption, combined with the miniaturization of chips, will be prioritized by manufacturers.

- According to Ericsson, short-range IoT-connected devices recorded USD 13,939 million, and wide-area IoT-connected instruments recorded USD 2,696 million in 2022. Further, it is anticipated to reach USD 20,649 million and USD 5,885 million in 2026.

- IoT promises to be a major driving force that would create significant innovation, facilitate new business models, and enhance global society in multiple ways. Market vendors develop FPGAs to integrate them into IoT devices and solutions. For instance, Intel FPGA solutions, such as Intel Stratix 10, allow scalability and flexibility to address IoT requirements with inherent software and hardware programmability.

Asia Pacific is Expected to Hold Significant Market Share

- The Asia Pacific is a significant region for the players operating in the FPGA industry. Within the Asia Pacific, many nations, including China, India, South Korea, Taiwan, and others, have seen an enormous increase in the consumer electronics industry in the past few years. As a result, the FPGA demand in the area is seen as an influence point.

- According to the Semiconductor Equipment and Material International (SEMI), China is a significant spender on semiconductor equipment, followed by South Korea, Taiwan, and Japan. Furthermore, China is expected to maintain the top position in semiconductor equipment spending this year, while Taiwan is anticipated to regain the lead in 2024. In addition, the Chinese government encouraged its national champions and top digital enterprises to develop their domestic semiconductor manufacturing capacities to rebalance China's reliance on overseas semiconductor demand. Such an initiative may further boost the semiconductor market, propelling the demand for FPGA.

- Furthermore, the stay-at-home trend spurred by the coronavirus pandemic continues to drive the demand for semiconductor chips. For instance, according to WSTS, the estimated semiconductor industry revenue in the Asia Pacific region will reach USD 411.97 billion in 2023. Such trends encourage leading semiconductor manufacturers to enter the Asia Pacific market. For instance, ASML, one of the most prominent players in the market, recently opened a unique state-of-the-art training facility in Tainan.

- Similarly, in November 2022, Advanced Semiconductor Engineering (ASE) announced a USD 300 million investment to expand its production site in Malaysia. Moreover, China's State Council's "National Integrated Circuit Industry Development Guidelines" set the aim of becoming a global player in all semiconductor industry segments by 2030.

- In addition, the Made in China 2025 initiative supports achieving knowledge about advanced semiconductor manufacturing as a critical component of China's future economy and society. In addition, the country recently spent USD 574 billion in the healthcare sector, which may further drive the studied market growth.

- Furthermore, 5G adoption is rising in momentum for both the network and device domains. According to the report, Ericson Mobility 5G subscriptions are predicted to reach 1 b, two years earlier than 4G. Key factors include China's earlier engagement with 5G, compared to 4G, and the timely availability of instruments from several vendors. The Chinese telecom sector experienced rapid evolution in recent years, which is expected to continue until 2025. Increased population, communication services, and smartphone use fuel the industry's development. Premium connectivity and content services in China account for the majority of the market development in the country.

- China is paving the way for the FPGA market to expand. The country's demand is extending due to its significant position as the international manufacturer of consumer electronics gadgets. China is the world's largest manufacturing hub, producing 36% of the world's electronics, including smartphones, computers, cloud servers, and telecom infrastructure, establishing the country as the global electronics supply chain's most important node. The popularity of AI in China opened up a new development potential for the Chinese consumer electronics market. Smart homes and IoT (Internet of Things) will likely be significant development potential for manufacturers of FPGA in the next decade.

Field Programmable Gate Array (FPGA) Industry Overview

The Field Programmable Gate Array (FPGA) Market is moderately fragmented with the presence of major players like Xilinx Inc., Lattice Semiconductor Corporation, Quicklogic Corporation, Intel Corporation, and Achronix Semiconductor Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2022- Lattice announced its first devices based on this latest platform, Lattice Avant-E FPGAs, which are developed to solve critical customer challenges at the Edge by combining class-leading energy efficiency, size, and performance with an optimized characteristic set tailored to the requirements of edge applications like data processing and AI.

- February 2022- QuickLogic Corporation announced that its PolarPro 3 family of low-power, SRAM-based FPGAs was available to solve semiconductor supply availability challenges. This favorably flexible family features power consumption lower than 55uA and a tiny footprint in small packages and die options.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of Macro Economic trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for IoT

- 5.2 Market Restraints

- 5.2.1 High Power Consumption Compared to ASIC

6 MARKET SEGMENTATION

- 6.1 By Configuration

- 6.1.1 High-end FPGA

- 6.1.2 Mid-range FPGA/Low-end FPGA

- 6.2 By Architecture

- 6.2.1 SRAM-based FPGA

- 6.2.2 Anti-fuse Based FPGA

- 6.2.3 Flash-based FPGA

- 6.3 By End-user Industry

- 6.3.1 IT and Telecommunication

- 6.3.2 Consumer Electronics

- 6.3.3 Automotive

- 6.3.4 Industrial

- 6.3.5 Military and Aerospace

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 South Korea

- 6.4.3.5 Rest of the Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Xilinx Inc.

- 7.1.2 Lattice Semiconductor Corporation

- 7.1.3 Quicklogic Corporation

- 7.1.4 Intel Corporation

- 7.1.5 Achronix Semiconductor Corporation

- 7.1.6 GOWIN Semiconductor Corporation

- 7.1.7 Microchip Technology Incorporated

- 7.1.8 Efinix Inc.