|

市場調查報告書

商品編碼

1404465

半導體材料:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Semiconductor Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

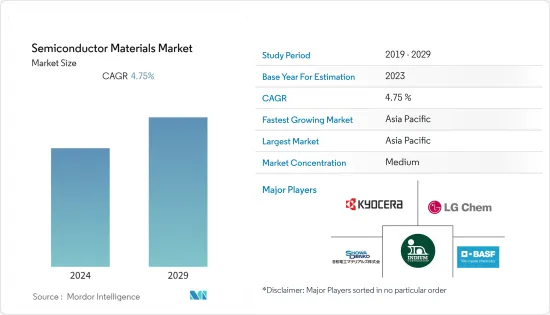

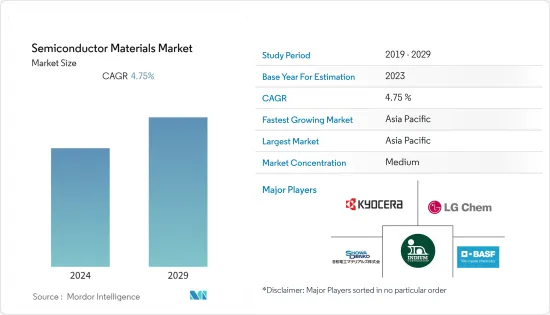

本會計年度半導體材料市場規模預估為703億美元。

預計未來五年將達886.6億美元,預測期內複合年成長率為4.75%。半導體材料是電子產業的關鍵創新之一。矽 (Si)、鍺 (Ge) 和砷化鎵 (GaAs) 等材料使電子製造商能夠取代傳統的熱電子裝置,這些裝置使電子裝置變得笨重且昂貴。自從半導體裝置問世以來,先進的小型化取得了進展,電子設備變得更小、更移動。

主要亮點

- 隨著半導體產業繼續加速其小型化趨勢,需要更多的處理步驟來製造先進節點 IC、異質整合和 3D 記憶體架構,預計對半導體材料的需求將會成長。

- 半導體正在從剛性基板轉向更軟性的塑膠材料和紙張。更軟性基板的趨勢催生了從發光二極體到太陽能電池和電晶體的多種裝置。

- 半導體產業隨著小型化而不斷發展,該領域的進步和創新對所有下游技術產生直接影響。隨著高階封裝解決方案需求的激增和封裝成本的不斷上升,OSAT供應商正在見證所有最終用戶產業,尤其是家用電子電器和汽車應用的需求大幅激增。

- 半導體產業是最複雜的產業之一,因為製造不同產品涉及 500 多個加工步驟,而產業工人面臨著充滿挑戰的環境,包括不穩定的電子市場和不可預測的需求。據認為。根據製造流程的複雜程度,僅半導體晶圓製造就可能涉及多達 1,400 個步驟。重複此過程,在底層形成電晶體,並組裝許多電路以創建最終產品。

- 俄羅斯-烏克蘭戰爭正在影響半導體供應鏈。它是製造半導體和電子元件(包括各種設備)的原料的重要供應商。衝突可能會擾亂供應鏈,導致這些原料短缺和價格上漲,從而影響製造商並導致最終用戶的成本更高。

- 此外,據 UkraineInvest 稱,2022 年 3 月初,銅價升至 10,845 美元/噸。俄羅斯和烏克蘭之間持續的戰爭、高能源成本以及歐洲更嚴格的廢氣法規被認為是銅持續短缺的主要原因。

半導體材料市場趨勢

家電需求增加帶動市場

- 消費電子 (CE) 是一個價值數十億美元的行業,它正在穩步推進技術並增加新的產品線,以滿足不斷變化的生活方式。隨著物聯網的出現,各個終端用戶產業正在採用先進的家用電器來增強業務。

- 據思科稱,物聯網 (IoT) 已成為一個通用系統,人員、流程、設備和資料可以連接到網際網路並相互連接。全球整體M2M 連線預計將從 2018 年的 61 億增加到 2023 年的 147 億。此外,思科預測,到 2023 年,全球每人將擁有 1.8 個機器對機器 (M2M) 連線。

- 到 2023 年,消費者將佔所有設備(包括固定和行動裝置)的 74%,企業將佔剩餘的 26%。然而,據思科稱,與業務部門的複合年成長率預計為 12.0% 相比,消費者佔有率的複合年成長率預計將略慢於 9.1%。

- NB-IoT 和 Cat-M 等大規模物聯網技術的部署(主要是涉及大量低成本、低複雜性、電池壽命長、吞吐量低的設備的廣域使用案例)正在增加。因此,預計到2023 年,透過Cat-M 和NB-IoT 技術連接的物聯網設備數量將超過2G/3G 連接的物聯網設備。到 2027 年,寬頻物聯網將佔當時所有蜂巢式物聯網連線的 51%(資料來源:愛立信)。這些趨勢預計將顯著改變消費性電子產業的格局,從而導致對支援連接功能的半導體晶片的需求增加。

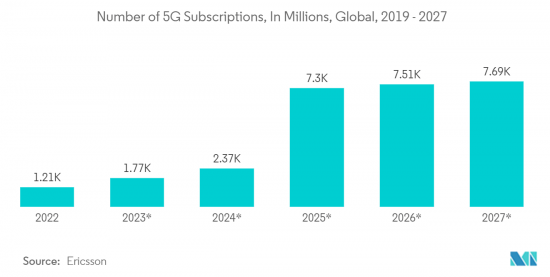

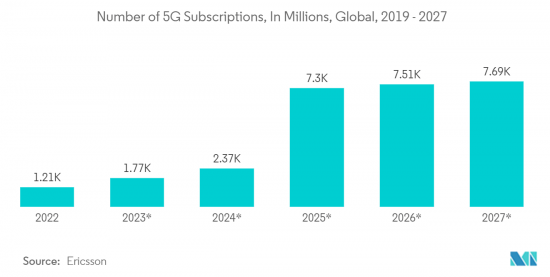

- 該領域半導體的主要消費者是智慧型手機市場。近年來,智慧型手機市場的競爭變得異常激烈。行動電話使用量的增加預計將推動全球市場的發展。例如,愛立信表示,到 2027 年,智慧型手機用戶數量預計將從 2021 年的 63 億增加到 78 億。

- 需求成長的其他主要促進因素是 5G 和物聯網的推出。隨著通訊業者投資和推出5G技術的興趣增加,對5G設備的需求預計將增加,消費者和產業將選擇5G設備。例如,愛立信預計,全球5G行動用戶數量預計將從2020年的2.7396億增加到2021年的6.6418億,並在2027全球整體達到43.8977億,並在此過程中帶動對半導體晶片和半導體材料的需求。

- 5G網路採用大規模MIMO,在基地台放置大量天線,並廣泛使用半導體晶片。因此,5G 在預測期內將為所研究的市場帶來巨大的機會。

中國正在經歷顯著的成長

- 中國政府的國家戰略計畫「中國製造2025」是該國半導體產業成長的關鍵要素。該計劃的中心目標是半導體行業的成長。此外,中國國家智慧財產局(CNIP)2021年預算目標是到2023年每年註冊量達到200萬件,這有望重振半導體材料市場。

- 中國政府於2021年3月公佈的2021-2025年新五年規劃中,將加強基礎研究列為重要優先事項。 2021年中央財政基礎研究支出預期成長11%,遠高於計畫中國內生產總值整體投入7%及GDP成長6%的目標。半導體被列為應優先獲得資金和資源的七個領域之一。設計公司開發奈米級積體電路,執行電子設備運作的關鍵任務,包括運算、儲存、網路連接和電源管理。

- 此外,穿戴式電子產品的成長也導致了新型微型晶片的採用,推動了半導體成長,增加了晶圓需求,並進一步推動了研究市場。根據Cisco,中國的連網穿戴裝置數量預計將從 2021 年的 3.788 億台增至 2022 年的 4.39 億台。此外,愛立信預計,2022年全球智慧型手機行動網路用戶數量預計將達到約66億,到2028年將超過78億。這有望進一步推動研究目標市場的發展。

- 此外,中國汽車工業不斷發展,中國在全球汽車市場中的地位日益重要。中國政府將汽車工業,包括汽車零件產業,視為其重點產業之一。政府預計,2020年中國汽車產量將達3,000萬輛,到2025年將達到3,500萬輛。

- 儘管疫情對中國汽車產業產生了明顯影響,但最近的資料顯示,中國汽車產業預計將實現2025年的目標。例如,根據中國工業協會(CAAM)的數據,2021年,中國生產的汽車總數約為2,610萬輛。此外,2022年,汽車產業將穩定成長。例如,2022年9月,該國銷售了約260萬輛汽車。

- 根據半導體設備與材料國際公司統計,2022年中國半導體設備收益達129.7億美元。對半導體晶片不斷成長的需求以及對製造設施和設備的投資增加預計將為在該市場營運的供應商提供新的成長機會。

半導體材料產業概況

鑑於最終用戶對半導體製造商的品質期望的重要性,品牌標識在半導體材料市場中發揮重要作用。此外,由於BASF、LG 化學有限公司和京瓷公司等現有主要公司的存在,市場滲透率很高。總體而言,競爭公司之間的敵意預計在預測期內將溫和成長。

2022 年 11 月,美國電子組裝和半導體封裝公司的全球材料供應商 Indium Corporation 在美國檳城開設了一家最先進的 37,500 平方英尺生產設施。新工廠將開始製造業務並提高產能,以更好地服務馬來西亞及週邊地區的客戶,特別是泰國和越南。

LG化學將於2022年5月開始開發用於半導體後端製程的抗蝕劑(PR),旨在將其提供給全球半導體業務。在半導體前端製程雕刻超精細電路設計後,該公司為後端製程開發PR,以提高晶片性能。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估主要宏觀趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 電子材料技術進步與產品創新

- 家電需求不斷成長

- OSAT/封裝公司的需求增加

- 市場抑制因素

- 製造流程複雜

第6章市場區隔

- 按用途

- 製造

- 過程化學

- 光罩

- 電子氣體

- 抗蝕劑

- 濺鍍靶材

- 矽

- 其他製造材料

- 包裝

- 基板

- 引線框架

- 陶瓷封裝

- 鍵合線

- 封裝樹脂(液體)

- 晶片貼裝材料

- 其他包裝應用

- 製造

- 按最終用戶產業

- 消費性電子產品

- 通訊業

- 製造業

- 車

- 能源/公共產業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章競爭形勢

- 公司簡介

- BASF SE

- LG Chem Ltd

- Indium Corporation

- Showa Denko Materials Co. Ltd(showa Denko KK)

- KYOCERA Corporation

- Henkel AG & Company KGAA

- Sumitomo Chemical Co. Ltd

- Dow Chemical Co.(Dow Inc.)

- International Quantum Epitaxy PLC

- Nichia Corporation

- CAPLINQ Europe BV

- ShinEtsu Microsi

第8章投資分析

第9章市場的未來

The semiconductor materials market size is estimated at USD 70.30 billion in the current year. It is expected to reach USD 88.66 billion by the next five years, registering a CAGR of 4.75% during the forecast period. Semiconductor materials represent one of the significant innovations in the electronics industry. By using materials such as silicon (Si), germanium (Ge), and gallium arsenide (GaAs), electronics manufacturers can replace traditional thermionic devices that make electronic devices heavy and expensive. Since the introduction of semiconductor devices, advanced miniaturization has progressed, and electronic devices have become more compact and mobile.

Key Highlights

- With the miniaturization trend gaining momentum in the semiconductor industry, the demand for semiconductor materials is also expected to grow as manufacturing advanced node ICs, heterogeneous integration, and 3D memory architectures require more processing steps; this drives higher wafer fabrication and packaging materials consumption.

- Semiconductors are moving away from rigid substrates to more flexible plastic material and paper, all due to new material and fabrication discoveries. The trend toward more flexible substrates has led to numerous devices, from light-emitting diodes to solar cells and transistors.

- The semiconductor industry has been growing with miniaturization, and advancements and innovations in this field have directly impacted all downstream technologies. With the surging demand for high-end packaging solutions and rising packaging costs, OSAT vendors witnessed a considerable surge in demand from all the end-user industries, especially consumer electronics and automotive applications.

- The semiconductor industry is one of the most complex because of the more than 500 processing steps involved in manufacturing different products and the challenging environment faced by industry workers, including volatile electronics markets and unpredictable demand. It is considered. Depending on the complexity of the manufacturing process, there can be up to 1,400 process steps in semiconductor wafer manufacturing alone. Transistors are formed on the bottom layer, and the process is repeated as many circuits are assembled to create the final product.

- The Russia-Ukraine war is impacting the supply chain of semiconductors. Being a significant supplier of raw materials for producing semiconductors and electronic components, including various equipment. The dispute has disrupted the supply chain, causing shortages and price increases for these materials, impacting manufacturers and potentially leading to higher costs for end-users.

- Further, according to UkraineInvest, copper prices escalated to USD 10,845/mt in early March 2022. The ongoing war between Russia and Ukraine, high energy costs, and stricter emissions standards in Europe have been noted as the primary reasons for the continued shortage of copper.

Semiconductor Materials Market Trends

Rising Demand for Consumer Electronics Goods to Drive the Market

- Consumer electronics (CE) forms a multibillion-dollar industry, steadily progressing and developing technology and adding new product lines toward changing lifestyles. With the advent of IoT, various end-user industries are increasingly adopting advanced consumer electronic products to enhance their operations.

- According to Cisco, the Internet of Things (IoT) has become a prevalent system by which people, processes, devices, and data connection to the Internet and each other. M2M connections are anticipated to grow from 6.1 billion in 2018 to 14.7 billion globally in 2023. Furthermore, Cisco predicts that, by 2023, there will be 1.8 M2M (machine-to-machine) connections for each member of the global population.

- By 2023, the consumer share of the total devices, including fixed and mobile devices, will be 74 percent, with businesses claiming the remaining 26 percent. However, according to Cisco, consumer share will grow at a slightly slower rate, at a 9.1 percent CAGR relative to the business segment, which is expected to witness a 12.0 percent CAGR.

- With the growing deployment of massive IoT technologies such as NB-IoT and Cat-M - primarily consisting of wide-area use cases involving large numbers of low-cost, low-complexity devices with long battery life and low throughput, the number of IoT devices connected by Cat-M and NB-IoT technologies is expected to overtake 2G/3G connected IoT devices in 2023. Broadband IoT in 2027 made up 51 percent of all cellular IoT connections at that time (Source: Ericsson). Such trends are expected to significantly transform the outlook of the consumer electronics industry, which in turn will drive the demand for semiconductor chips to support connectivity features.

- The smartphone market is the major consumer of semiconductors in this segment. The smartphone market has been very competitive in recent years. The increasing usage of cell phones is anticipated to drive the global market. For instance, according to Ericsson, smartphone subscriptions are expected to reach 7.8 billion by 2027, from 6.3 billion in 2021.

- Other significant drivers behind the demand growth are the 5G rollout and IoT. The growing interest of telecom operators to invest and launch in 5G technology is expected to fuel the demand for 5G capable devices, where consumers and industries are expected to opt for 5G devices. For instance, according to Ericsson, 5G mobile subscription, which grew from 273.96 million in 2020 to 664.18 million in 2021, is expected to reach 4,389.77 million globally by 2027, driving the demand for semiconductor chips and semiconductor materials in the process.

- 5G networks use massive MIMO in which many antennas are deployed at the base station, wherein semiconductor chips are widely used. Therefore, 5G will offer an enormous opportunity for the market studied during the forecast period.

China to Witness Significant Growth

- The Chinese government's national strategic plan, ``Made in China 2025,'' has become a key factor in the growth of the country's semiconductor industry. A central goal of this plan is the growth of the semiconductor industry. Furthermore, the 2021 budget of the China National Intellectual Property Administration (CNIP) targets 2 million registrations per year by 2023, which is expected to revitalize the semiconductor materials market.

- China's new five-year plan for 2021-25, announced in March 2021 by the government, establishes boosting basic research as a critical priority. Central government spending on basic research was expected to increase by 11 percent in 2021, well above the 7 percent planned for the overall R&D investment and the 6 percent target for GDP (Gross Domestic Product) growth. Semiconductors have been identified as one of seven areas for priority funding and resources. Design companies develop nanoscale integrated circuits that perform important tasks that make electronic devices work, such as computing, storage, network connectivity, and power management.

- Furthermore, the growth in wearable electronic devices has also been leading to the adoption of new miniaturized chips, propelling the semiconductor's growth and increasing the demand for wafers, further driving the studied market. As per Cisco Systems, the number of connected wearable devices in China is expected to reach 439 million by 2022 from 378.8 million in 2021. Additionally, according to Ericsson, the number of smartphone mobile network subscriptions is expected to reach approximately 6.6 billion worldwide in 2022 and exceed 7.8 billion by 2028. This will further promote the studied market.

- Furthermore, China's automotive industry has been increasing, and the country plays an increasingly important role in the global automotive market. The Chinese government positions the automobile industry, including the auto parts sector, as one of its key industries. The government predicted that China's car production would reach 30 million vehicles by 2020 and 35 million by 2025.

- Although the pandemic had a notable impact on the country's automobile industry, recent data suggests that the country's automotive industry is on track to its 2025 goals. For instance, according to the China Association for Automobile Manufacturers (CAAM), in 2021, the total number of cars produced in China was about 26.1 million. Furthermore, in 2022, the automotive industry has reported steady growth. For instance, in September 2022, about 2.6 million vehicles were sold in the country.

- According to Semiconductor Equipment and Materials International, China's revenue from semiconductor equipment reached USD 12.97 billion in 2022. The growing demand for semiconductor chips and increasing investment in manufacturing facilities and equipment are expected to create new growth opportunities for the vendors operating in the market.

Semiconductor Materials Industry Overview

Brand identity plays a major role in the Semiconductor Materials market, considering the importance of quality that the end-users expect from a semiconductor manufacturing player. The market penetration is also high with the presence of large market incumbents, such as BASF, L.G Chem Ltd., and KYOCERA Corporation. Overall, the intensity of competitive rivalry is expected to grow moderately over the forecast period.

In November 2022, Indium Corporation, a worldwide materials provider to the electronics assembly and semiconductor packaging company in the United States, opened its newest 37,500-square-foot production plant in Penang, Malaysia. The new plant has begun manufacturing operations and will increase production capacity to service better the company's clients in Malaysia and the neighboring area, notably Thailand and Vietnam.

In May 2022, L.G. Chem began developing photoresist (P.R.) utilized in the semiconductor back-end processes with the intention of providing it to worldwide semiconductor businesses. After engraving ultra-fine circuit designs on the front-end procedure of semiconductors, the company is creating P.R. for the back-end technique to improve chip performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of Key Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technical Advancements and Product Innovation of the Electronic Materials

- 5.1.2 Rising Demand for Consumer Electronics Goods

- 5.1.3 Increased Demand From OSAT/Packaging Companies

- 5.2 Market Restraints

- 5.2.1 Complexity in the Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Fabrication

- 6.1.1.1 Process Chemicals

- 6.1.1.2 Photomasks

- 6.1.1.3 Electronic Gases

- 6.1.1.4 Photoresists Ancilliaries

- 6.1.1.5 Sputtering Targets

- 6.1.1.6 Silicon

- 6.1.1.7 Other Fabrication Materials

- 6.1.2 Packaging

- 6.1.2.1 Substrates

- 6.1.2.2 Lead-frames

- 6.1.2.3 Ceramic Packages

- 6.1.2.4 Bonding Wire

- 6.1.2.5 Encapsulation Resins (Liquid)

- 6.1.2.6 Die Attach Materials

- 6.1.2.7 Other Packaging Applications

- 6.1.1 Fabrication

- 6.2 By End User Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Telecommunication

- 6.2.3 Manufacturing

- 6.2.4 Automotive

- 6.2.5 Energy and Utility

- 6.2.6 Other End User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BASF SE

- 7.1.2 LG Chem Ltd

- 7.1.3 Indium Corporation

- 7.1.4 Showa Denko Materials Co. Ltd (showa Denko K.K)

- 7.1.5 KYOCERA Corporation

- 7.1.6 Henkel AG & Company KGAA

- 7.1.7 Sumitomo Chemical Co. Ltd

- 7.1.8 Dow Chemical Co. (Dow Inc.)

- 7.1.9 International Quantum Epitaxy PLC

- 7.1.10 Nichia Corporation

- 7.1.11 CAPLINQ Europe BV

- 7.1.12 ShinEtsu Microsi