|

市場調查報告書

商品編碼

1404461

臉部辨識:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Facial Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

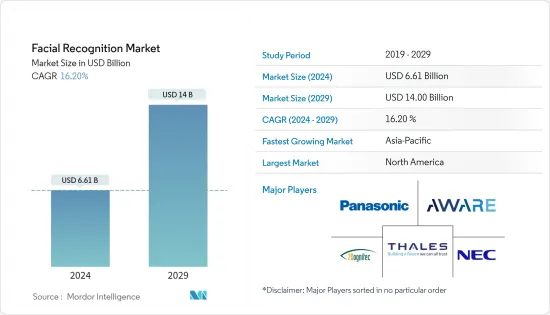

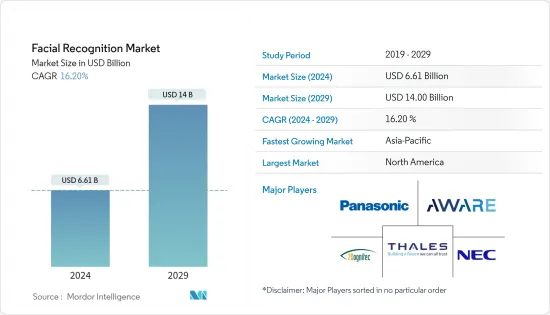

臉部辨識市場規模預計到 2024 年為 66.1 億美元,預計到 2029 年將達到 140 億美元,在預測期內(2024-2029 年)複合年成長率為 16.20%。

臉部辨識是指利用人臉來辨識或驗證一個人的身分。臉部辨識系統可用於識別照片、影片或即時中的人。

主要亮點

- 全球犯罪活動的增加導致各行業監控系統的安裝增加。例如,根據刑事司法委員會的數據,2022 年上半年美國主要城市的竊盜和搶劫案件增加了約 20%。將臉部辨識涵蓋安全系統可以顯著提高所有領域安全和監控的有效性並降低整體成本。

- 市場正在見證私人和公共實體的各種開拓,進一步推動了市場的成長。例如,2022 年 8 月,DRDO(國防研究與發展組織)開發了先進的臉部辨識技術(FRT)來增強監視。 DRDO 開發 FRSD 是為了解決野外的臉部辨識問題,這些問題普遍存在解析度攝影機等問題。

- 政府舉措預計將有助於此類技術的顯著成長。例如,截至 2022 年 7 月,CBP 已在 32 個離開美國的旅客機場和所有進入美國的旅客機場部署了臉部辨識技術。

- 隨著大流行的爆發,臉部辨識系統得到了更廣泛的採用,用於追蹤需要留在家中的新冠病毒感染者。此外,自 COVID-19 爆發以來,臉部辨識軟體供應商透過添加新功能(例如識別戴口罩的臉部)來升級其演算法。

- 但與密碼或信用卡資訊不同,臉部資訊無法輕易更改,因此涉及臉部辨識資料的資料外洩增加了身分盜竊、追蹤和騷擾的可能性。這些因素可能會阻礙市場成長。

臉部辨識市場趨勢

零售和電商預計將佔據較大佔有率

- 儘管臉部辨識技術最初並未吸收零售業的大規模需求,但過去幾年為該技術提供了充足的潛力。三個技術領域的進步在該領域的臉部辨識技術普及中發揮重要作用:神經網路、巨量資料和圖形處理單元(GPU)。例如,服裝零售商正在利用技術為訪問其商店的顧客提供客製化產品。

- 臉部辨識技術預計將有助於防止盜竊和入店行竊,因為零售商可以分析不同 SKU 的情緒和臉部表情,進一步改善購物體驗並有助於加強商店層面的安全性。

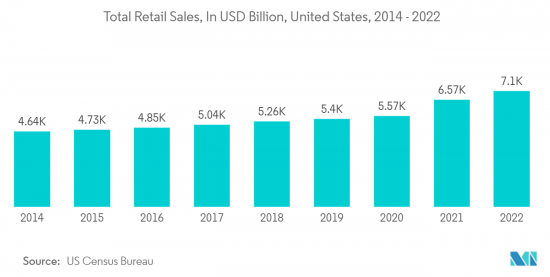

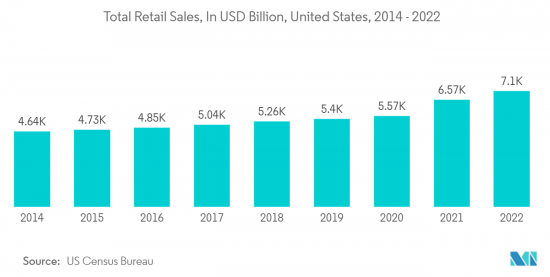

- 預計在預測期內,商店對配備臉部辨識技術的攝影機的需求將激增。除了安全和監控之外,用於增強消費者洞察以提供更好的客戶體驗的不斷成長的應用程式也推動了該行業的技術需求。

- 臉部辨識還允許零售商為客戶提供個人化的購物體驗。例如,該技術可用於在顧客進入商店時進行識別,並在店內數位顯示器上顯示個人化的產品推薦和優惠。

- 此外,接收有關在任何給定時間訪問商店的顧客的實際屬性的最新資訊可能是零售商店管理的主要挑戰。透過部署臉部辨識技術,商店管理人員可以每小時訪問商店訪客的人口統計數據,並據此做出業務決策。

亞太地區預計將錄得最快成長

- 由於技術的發展、基礎設施的成長以及許多領域的應用不斷增加,亞太地區是採用臉部辨識最突出的地區之一。該地區的大規模工業化和消費性電子產業的成長為市場參與者帶來了令人興奮的機會和巨大的成長潛力。

- 印度目前是世界上最大的零售目的地之一。近年來,隨著新參與企業的增加,印度零售業變得越來越充滿活力和快節奏。該產業佔國內生產總值(GDP) 的 10% 以上,就業人數約 8%(根據 IBEF)。因此,該地區零售業的擴張為市場帶來了巨大的成長機會。

- 此外,2022 年 8 月,海得拉巴國際機場宣布使用臉部辨識技術來實現無縫、無憂的旅行。根據 DigiYatra 計劃,海得拉巴國際機場透過 DigiYatra 平台推出了乘客數位處理,作為概念驗證。

- 中國長期以來一直在使用臉部辨識技術。此外,該國正在為其警察部隊部署臉部辨識眼鏡,以定位公民和遊客,並使用即時身份驗證來打擊犯罪,主要是在慶祝活動期間。

- 該國還推出臉部辨識付款。中國最大的付款應用程式支付寶已開始在中國南方的肯德基分店試用「微笑支付」功能。

臉部辨識行業概況

臉部辨識市場競爭溫和,NEC、Gemalto NV、Panasonic 等主要公司進入該市場。隨著新興企業數量大幅增加,市場競爭預計將很快加劇。

2023年6月,日立株式會社和Panasonic Connect合作開發了一項新服務,該服務結合了日立的生物資訊防洩漏技術和Panasonic Connect的臉部辨識技術。

2022年11月,NEC將把NEC的臉部辨識技術與人員重認證技術結合,即使人們轉過臉或隱藏身體,也能進行匹配,實現無門、快速、可靠的出入控制。使用生物識別的進入/退出控制系統。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

- 技術簡介

第5章市場動態

- 市場促進因素

- 對監控系統的需求不斷增加,以加強安全保障

- 消費性電子產品中擴大採用臉部辨識

- 市場抑制因素

- 隱私問題

第6章市場區隔

- 依技術

- 3D臉部辨識

- 2D臉部辨識

- 臉部分析

- 按申請

- 存取控制

- 安全/監控

- 其他

- 按最終用戶

- 安全/執法

- 衛生保健

- 零售/電子商務

- BFSI

- 汽車/交通

- 通訊/IT

- 媒體娛樂

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Panasonic Corporation

- Thales Group

- NEC Corporation

- Cognitec Systems GmbH

- Aware Inc.

- FacePhi Biometria SA

- Animetrics Inc.

- Ayonix Corporation

- Face First Inc.

- Idemia France SAS

- Daon Inc.

第8章投資分析

第9章市場的未來

The Facial Recognition Market size is estimated at USD 6.61 billion in 2024, and is expected to reach USD 14 billion by 2029, growing at a CAGR of 16.20% during the forecast period (2024-2029).

Facial recognition refers to the way of identifying or confirming an individual's identity using their face. Facial recognition systems can be utilized to identify people in photos, videos, or in real-time.

Key Highlights

- Rising criminal activities worldwide have resulted in the increasing installation of surveillance systems across all verticals. For instance, according to the Council on Criminal Justice, thefts and robberies in major cities across the United States increased by around 20% in the first half of 2022. Integrating facial recognition in security systems can significantly enhance the effectiveness of security and surveillance across sectors and reduce overall costs.

- The market is witnessing various developments from private and public organizations, further boosting market growth. For instance, in August 2022, DRDO (Defence Research and Development Organization) developed an advanced Facial Recognition Technology (FRT) to increase surveillance. The DRDO has developed FRSD to solve the issue of facial recognition in the wild, where there are wide-ranging issues like low-resolution cameras.

- Government initiatives are expected to contribute to the significant growth of such technologies. For instance, As of July 2022, the CBP had deployed facial recognition technology to 32 airports for travelers leaving the U.S. and all airports for travelers entering the country.

- With the outbreak of the pandemic, facial recognition systems were adopted for wider use as they were used to track COVID-positive people who needed to stay home. Moreover, since the outbreak of COVID-19, facial recognition software vendors have upgraded their algorithms with new features, such as recognizing faces with a mask on.

- However, data breaches involving facial recognition data increase the potential for identity theft, stalking, and harassment as, unlike passwords and credit card information, faces cannot easily be changed. Such factors may hinder the market growth.

Facial Recognition Market Trends

Retail and E-commerce is Expected to Hold Significant Share

- While facial recognition technology did not initially absorb a massive demand from the retail industry, it provided adequate potential for the technology over the past few years. The advancement in three technical fields, neural networks, big data, and graphical processing units (GPU), has played a significant role in the widespread use of facial recognition technology in the sector. For instance, apparel retailers leverage technology to deliver customized products to customers visiting their stores.

- Facial recognition technology is expected to help retailers analyze mood and facial expressions at different SKUs and further enhance their shopping experience, preventing theft and shoplifting, as the technology helps increase security at the store level.

- The demand for cameras equipped with facial recognition technology among the stores is expected to surge over the forecast period. In addition to security and surveillance, the demand for technology in the industry is fueled by the growing application of enhancing consumer insights to offer a better customer experience.

- Facial recognition also allows retailers to personalize the shopping experience for customers. For instance, the technology could be used to identify a customer as they enter the store and then display personalized recommendations or offers on digital displays throughout the store.

- Moreover, receiving updates about the actual demographics of customers visiting the store at any given point can be a major challenge for any retail store management. Implementing facial recognition technology can help store authorities access the demographics of the footfall entering the store hourly and create business decisions based on that.

Asia-Pacific is Expected to Register Fastest Growth

- The Asia-Pacific is one of the most prominent regions for adopting facial recognition, owing to technological development, rising infrastructure growth, and increasing application in numerous areas. Massive industrialization and the growing consumer electronics industry in the region showcase exciting opportunities for the players in the market and the scope for significant growth.

- Currently, India is one of the largest global destinations in the retail space. In recent years, the retail industry in India has been becoming increasingly more dynamic and fast-paced, owing to the entry of many new players. The industry accounts for over 10% of the country's gross domestic product (GDP) and about 8% of the employment (as per IBEF). Thus, the expanding retail sector in the region offers considerable growth opportunities for the market.

- Further, in August 2022, Hyderabad International Airport announced using facial recognition to enable seamless and hassle-free travel. In line with the DigiYatra program, the Hyderabad International Airport rolled out the digital processing of passengers as a proof of concept through the DigiYatra platform.

- China has used facial recognition technology for a long time. Moreover, the country has deployed facial recognition glasses for the country's police force to spot citizens and tourists and use real-time ID authentication to primarily fight crimes during celebrations.

- The country is also embracing facial authenticated payments. Alipay, China's biggest payment app, started a trial for the smile-to-pay feature at a branch of KFC in Southern China, which uses facial recognition to identify customers and automatically charges them through the app.

Facial Recognition Industry Overview

The facial recognition market is moderately competitive, with significant players operating in the market, such as NEC Corporation, Gemalto NV, Panasonic Corporation, etc. With the number of startups growing substantially, the market studied is expected to witness a highly competitive scenario shortly.

In June 2023, Hitachi, Ltd. and Panasonic Connect Co., Ltd. collaborated to develop a new service that combines Hitachi's technology for preventing biometric data leakage with Panasonic Connect's facial recognition technology.

In November 2022, NEC Corporation developed a Gateless Access Control System using Biometric Recognition that combines NEC's face recognition technology with person re-identification technology, which matches people even if they are facing away or their bodies are occluded, to provide fast and reliable entry control that is free from gates.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Industry

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Surveillance Systems to Enhance Safety and Security

- 5.1.2 Increasing Adoption of Facial Recognition in Consumer Electronics

- 5.2 Market Restraints

- 5.2.1 Privacy Concerns

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 3D Facial Recognition

- 6.1.2 2D Facial Recognition

- 6.1.3 Facial Analytics

- 6.2 By Application

- 6.2.1 Access Control

- 6.2.2 Security and Surveillance

- 6.2.3 Other Applications

- 6.3 By End User

- 6.3.1 Security and Law Enforcement

- 6.3.2 Healthcare

- 6.3.3 Retail and E-commerce

- 6.3.4 BFSI

- 6.3.5 Automobile and Transportation

- 6.3.6 Telecom and IT

- 6.3.7 Media and Entertainment

- 6.3.8 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Panasonic Corporation

- 7.1.2 Thales Group

- 7.1.3 NEC Corporation

- 7.1.4 Cognitec Systems GmbH

- 7.1.5 Aware Inc.

- 7.1.6 FacePhi Biometria SA

- 7.1.7 Animetrics Inc.

- 7.1.8 Ayonix Corporation

- 7.1.9 Face First Inc.

- 7.1.10 Idemia France SAS

- 7.1.11 Daon Inc.