|

市場調查報告書

商品編碼

1404432

乙烯醋酸乙烯酯 (EVA) -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Ethylene Vinyl Acetate (EVA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

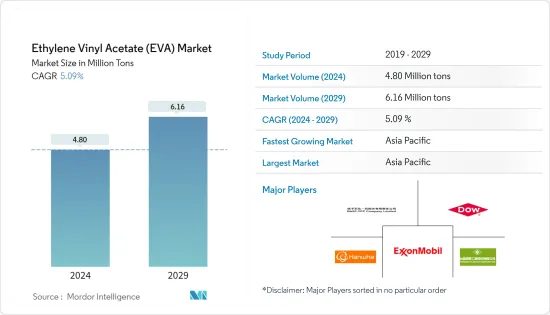

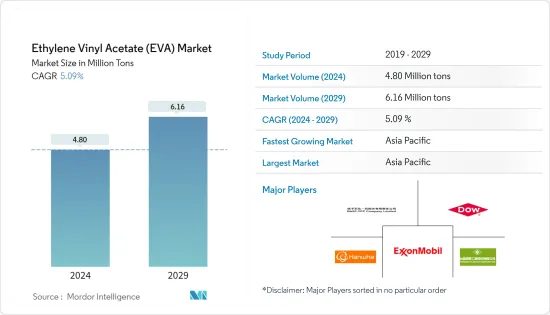

乙烯醋酸乙烯酯市場規模預計到2024年為480萬噸,預計到2029年將達到616萬噸,在預測期內(2024-2029年)複合年成長率為5.09%。

COVID-19 大流行影響了 2020 年的市場。這導致國際旅行禁令、零售店關閉以及許多最終用戶群體的銷售、購買和使用減少。然而,2021年和2022年乙烯醋酸乙烯(EVA)的需求增加。

主要亮點

- 短期內,包裝產業和農業應用對乙烯醋酸乙烯酯(EVA)需求的增加預計將推動市場發展。

- 相反,替代品威脅的增加預計將阻礙市場成長。

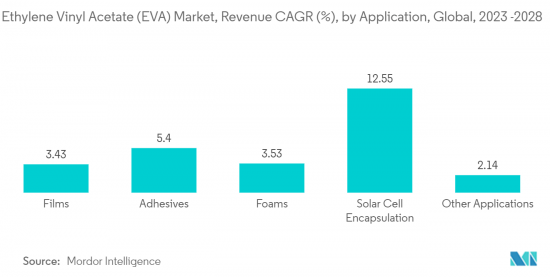

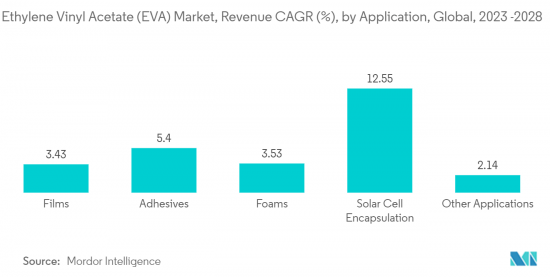

- 對光伏(太陽能電池)封裝的需求不斷成長預計將在預測期內為市場提供成長機會。

- 預計亞太地區將主導市場,並可能在預測期內保持最高的複合年成長率。這是因為該地區的經濟帶動了市場,導致人們消費能力的增強。

乙烯醋酸乙烯酯市場趨勢

薄膜應用主導市場

- 乙烯醋酸乙烯酯是一種共聚物樹脂,在透過平晶粒擠出之前加熱並充分混合後會形成 EVA 薄膜。該薄膜有白色、透明和多種其他顏色可供選擇,並提供光滑、不粘的表面光潔度。 EVA 薄膜通常夾在兩片塑膠或玻璃片之間作為中間層。

- 當EVA薄膜使用率較低時,用於冷凍食品包裝(EVA 6%)、麵包袋(EVA 2%)、冰袋(EVA 4%)等。此外,EVA 含量高達 20% 的薄膜還可用於低熔點/全批次封裝袋等應用。同樣,在太陽能電池板中,高達 33% 的 EVA 薄膜被用作面板的黏合層。

- 鑑於關鍵應用領域對EVA薄膜的需求不斷增加,一些主要的EVA薄膜製造商正在加大對擴產計劃的投資。主要進展包括:

- 2023年2月,中國最大的光電模組EVA薄膜供應商SVECK宣布,決定投資約13.6億元人民幣(約2.03億美元)進行擴產計劃。新廠將在中國江蘇省鹽城市分兩期建設,年產能將達4.2億平方公尺。第一階段計畫於2023年第三季開始商業營運,年產能1.2億平方公尺,共有16條生產線。階段將再部署40條生產線,總產能達3億平方公尺。 SVECK預計透過該計劃每年將額外產生34億元人民幣(約5億美元)的收益。

- 2022年6月,全球大型公司的EVA薄膜製造商杭州第一應用材料公司宣布,決定投資2.26億美元擴大在越南的EVA薄膜產能。該公司計劃在越南建造新的製造地,並支持推出年產能約2.5億平方公尺的高效能太陽能電池EVA薄膜計劃。該計劃預計將在未來三年內實現商業化。

- 非食品應用、太陽能電池封裝和太陽能板對 EVA 薄膜的需求不斷成長,預計將在預測期內加強 EVA 薄膜市場。

亞太地區主導市場

- 亞太市場是最大的乙烯醋酸乙烯酯(EVA)市場。由於中國和印度的強勁需求(主要用於黏劑和包裝產業),預計在預測期內仍將是最大的市場。

- 乙烯醋酸乙烯酯共聚物 (EVA) 是包裝應用中常用的樹脂,可取代聚氯乙烯。 EVA 共聚物不需要硬化劑或塑化劑,無味。由於其相對於傳統包裝塑膠的優勢,EVA在包裝領域的使用量大幅增加。

- 中國包裝產業預計將成長。據政府預測,該產業預計將實現近6.8%的成長率。中國政府發布的報告預計,到2025年,該產業價值將達到2兆元(約2,900億美元)。中國食品工業位居世界前列,其成長預計將對 EVA 市場產生影響。

- 由於其減震性能,EVA 也擴大應用於鞋類、曲棍球墊片、武術手套和其他運動器材。

- 亞運會由亞洲奧林匹克理事會(OCA)主辦,將於2023年9月23日至10月8日在杭州舉行。亞運會通常吸引全部區域。收入增加、健康意識增強、體育專業化水平提高以及都市區健身選擇多樣化等因素預計將推動對運動服和休閒服的需求。

- 中國鞋業由14,400多家企業組成。中國是世界上最大的鞋類生產國。中國佔鞋類出口的50%以上。 2022年,鞋子出口量將超過90億雙。

- 印度擁有世界上最大的包裝工業之一。由於出口增加以及微波爐、零食和冷凍食品等食品行業客製化包裝的使用增加,預計預測期內將實現穩定成長。

- 根據印度包裝工業協會(PIAI)預測,印度包裝產業在預測期內預計將成長 22%。印度包裝市場預計到 2025 年複合年成長率為 26.7%,達到 2,048.1 億美元。因此,該地區的EVA市場預計將成長。

- 根據貿易、工業、消費者事務、食品、公共分配和紡織品聯盟部長表示,由於政府和產業的努力,印度有潛力成為鞋類和皮革領域的世界領導者。例如,由於與阿拉伯聯合大公國簽訂自由貿易協定(FTA),皮革業預計將成長,2022年11月出口量將成長64%。

- 印度是世界第二大鞋類和皮革服飾生產國,擁有約 30 億平方英尺的製革廠。此外,2021 年,該中心通過了 170 億印度盧比(2.058 億美元)的支出,用於將於 2021 年至 2026 年實施的印度鞋類和皮革發展計畫 (IFLDP)。

- 所有上述因素預計將在預測期內增加調查市場的需求。

乙烯醋酸乙烯酯產業概況

全球乙烯醋酸乙烯酯市場已與佔據重要全球市場佔有率的主要企業部分整合。研究市場的主要企業包括(排名不分先後)埃克森美孚、韓華解決方案、陶氏化學、台塑公司、BASF揚子石化有限公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 包裝產業的需求不斷增加

- 農業應用需求增加

- 抑制因素

- 替代品的威脅日益增大

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 交付的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 年級

- 低密度

- 中等密度

- 高密度

- 目的

- 電影

- 黏劑

- 發泡體

- 太陽能電池封裝

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Arlanxeo

- Asia Polymer Corporation

- Basf-ypc Company Limited

- Benson Polymers

- Braskem

- Celanese Corporation

- China Petrochemical Corporation

- Clariant

- Dow

- Exxonmobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions

- Hd Hyundai Oilbank Co.

- Innospec

- Jiangsu Sailboat Petrochemical Co. Ltd

- Levima Advanced Materials Corporation

- LG Chem

- Lyondellbasell Industries Holdings BV

- Repsol

- Sinochem Holdings Corporation Ltd

- Sipchem Company

- Sumitomo Chemical Co. Ltd

- Zhejiang Petroleum & Chemical Co. Ltd

第7章 市場機會及未來趨勢

- 對太陽能電池封裝的需求增加

The Ethylene Vinyl Acetate Market size is estimated at 4.80 Million tons in 2024, and is expected to reach 6.16 Million tons by 2029, growing at a CAGR of 5.09% during the forecast period (2024-2029).

The COVID-19 pandemic impacted the market in 2020. As a result, international travel bans and retail business closures, sales, purchases, and usage fell across many end-user segments. However, the demand for ethylene-vinyl acetate (EVA) increased in 2021 and 2022.

Key Highlights

- Over the short term, the growing demand for ethylene-vinyl acetate (EVA) from the packaging industry and agricultural applications is expected to drive the market.

- Conversely, the increasing threat of substitutes is expected to hinder the market's growth.

- The increasing demand for photovoltaic (PV) solar cell encapsulants is expected to offer growth opportunities for the market during the forecast period.

- Asia-Pacific is expected to dominate the market and is likely to witness the highest CAGR during the forecast period as the economies in the region are driving the market, leading to increased spending capacities among the people.

Ethylene Vinyl Acetate Market Trends

Films Application to Dominate the Market

- Ethylene Vinyl Acetate is a copolymer resin that, when heated and mixed thoroughly before being extruded through a flat die, forms EVA films. These films are available in white, clear, and other different colors and provide a non-sticky and smooth surface finish. EVA films are generally sandwiched between two plastic or glass sheet pieces as an interlayer.

- In lower percentages, EVA films have been used for frozen food packaging (at 6% EVA), bread bags (at 2% EVA), and ice bags (at 4% EVA), as it helps provide enhanced sealability for such applications. Further, in higher percentages, with up to 20% EVA, these films are used in applications involving low melt/total batch inclusion bags. Similarly, in solar panels, films with up to 33% EVA are used as a bonding layer for these panels.

- Some of the key manufacturers of EVA films have been increasingly investing in production expansion projects in view of the growing demand for EVA films in critical applications. Some of the key developments include:

- In February 2023, SVECK, one of the largest suppliers of EVA films for PV modules in China, announced its decision to invest around CNY 1.36 billion (~USD 203 million) into its production expansion project. The new factory will be built in two phases, in Yancheng, China's Jiangsu, at a planned annual capacity of 420 million square meters. The first phase is expected to begin commercial operations by Q3 2023, with an annual capacity of 120 million square meters spread across 16 production lines. The second phase will deploy an additional 40 production lines with a total capacity of 300 million square meters. SVECK has projected an additional annual revenue of CNY 3.4 billion (~USD 500 million) through this project.

- In June 2022, Hangzhou First Applied Material Co., Ltd., another leading manufacturer of EVA films across the globe, announced its decision to invest USD 226 million into the expansion of its EVA film production capacity in Vietnam. The company intends to build a new manufacturing base in Vietnam to support the launch of its EVA film project specifically designed for high-efficiency solar cells, with an annual output of around 250 million square meters. The project is expected to be commercialized in the next three years.

- The rising demand for EVA films in non-food applications, photovoltaic encapsulations, and solar panels is anticipated to strengthen the EVA films market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific market is the largest ethylene vinyl acetate (EVA) market. It is also expected to remain the largest market during the forecast period, owing to the major demand from China and India, mainly for the adhesive and packaging industry applications.

- Ethylene vinyl acetate copolymers (EVA) are commonly used in packaging applications, replacing polyvinyl chloride as the most used resin. EVA copolymers require no curing or plasticizer and have no odor. The use of EVA in the packaging sector is increasing tremendously, owing to its advantages over the conventional packaging plastics used.

- The Chinese packaging industry is expected to grow. As projected by the government, the industry is expected to achieve a growth rate of nearly 6.8%. The report published by the Chinese government foresees the industry achieving a valuation of CNY 2 trillion, equivalent to approximately USD 290 billion, by the year 2025. The growing Chinese food industry, which ranks among the largest globally, is expected to affect the EVA market.

- EVA is also increasingly used in footwear, hockey pads, martial arts gloves, and other sports goods due to its shock absorber properties.

- The Asian Games will take place in Hangzhou from September 23 to October 8, 2023, per the Olympic Council of Asia (OCA). The Asian Games generally attract more than 10,000 athletes across the region. Factors such as rising income, increased health awareness, the growing level of sports specialization, and the diversity of urban fitness options are expected to boost the demand for sportswear and recreational wear.

- China's footwear industry consists of over 14,400 businesses. China is the largest footwear producer in the world. China accounts for over 50% of the exports of footwear. The country exported more than 9,000 million pairs of shoes in 2022.

- India has a huge packaging industry in the world. The country is expected to witness consistent growth during the forecast period, owing to the rise of customized packaging in the food segment, like microwave, snack, and frozen foods, along with increasing exports.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at 22% during the forecast period. The Indian packaging market is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% till 2025. Therefore, the EVA market is expected to grow in the region.

- According to the Union Minister for Trade Industries, Consumer Affairs, Food, and Public Distribution and Textiles, India has the potential to become a world leader in the footwear and leather sector due to government and industry efforts. For instance, the leather industry is expected to grow, owing to a free trade agreement (FTA) with the United Arab Emirates, which saw exports increase by 64% in November 2022.

- India is the second largest producer of footwear and leather garments, boasting nearly 3 billion sq. ft of tanneries worldwide. In addition, in 2021, the Center passed an expenditure of INR 1,700 crore (USD 205.8 million) to the Indian Footwear and Leather Development Program (IFLDP) for implementation from 2021 to 2026.

- All the aforementioned factors are expected to boost the demand for the market studied during the forecast period.

Ethylene Vinyl Acetate Industry Overview

The global ethylene-vinyl acetate market is partially consolidated, with top-level players accounting for a sizeable global market share. The key players in the market studied (not in any particular order) include Exxon Mobil Corporation, Hanwha Solutions, Dow, Formosa Plastics Corporation, and BASF-YPC Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Packaging Industry

- 4.1.2 Rising Demand from Agricultural Applications

- 4.2 Restraints

- 4.2.1 Increasing Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buters

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Grade

- 5.1.1 Low Density

- 5.1.2 Medium Density

- 5.1.3 High Density

- 5.2 Application

- 5.2.1 Films

- 5.2.2 Adhesives

- 5.2.3 Foams

- 5.2.4 Solar Cell Encapsulation

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arlanxeo

- 6.4.2 Asia Polymer Corporation

- 6.4.3 Basf-ypc Company Limited

- 6.4.4 Benson Polymers

- 6.4.5 Braskem

- 6.4.6 Celanese Corporation

- 6.4.7 China Petrochemical Corporation

- 6.4.8 Clariant

- 6.4.9 Dow

- 6.4.10 Exxonmobil Corporation

- 6.4.11 Formosa Plastics Corporation

- 6.4.12 Hanwha Solutions

- 6.4.13 Hd Hyundai Oilbank Co.

- 6.4.14 Innospec

- 6.4.15 Jiangsu Sailboat Petrochemical Co. Ltd

- 6.4.16 Levima Advanced Materials Corporation

- 6.4.17 LG Chem

- 6.4.18 Lyondellbasell Industries Holdings BV

- 6.4.19 Repsol

- 6.4.20 Sinochem Holdings Corporation Ltd

- 6.4.21 Sipchem Company

- 6.4.22 Sumitomo Chemical Co. Ltd

- 6.4.23 Zhejiang Petroleum & Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Photovoltaic (PV) Solar Cell Encapsulants