|

市場調查報告書

商品編碼

1404412

汽車地毯:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Automotive Carpeting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

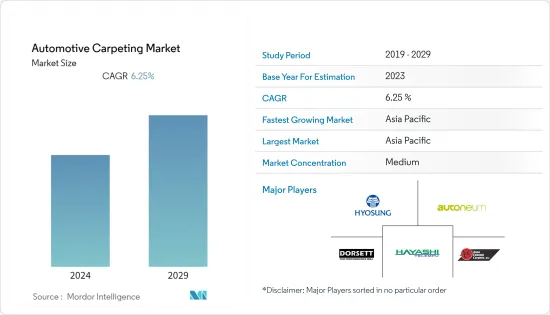

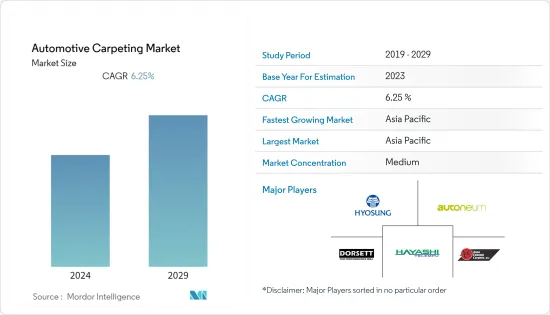

汽車地毯市場目前市場規模為56億美元,預計未來五年將達75.8億美元,預測期內複合年成長率為6.25%。

從長遠來看,消費者越來越偏好使用環保、輕量化的汽車內裝產品、電動車銷量的增加以及將輕量化部件整合到車輛中的需求將推動汽車地毯市場的快速成長。轎廂地板上的地毯可以最大限度地減少噪音、改善內部美觀並提供隔熱作用。隔離噪音、熱量和污垢是汽車地板地毯和行李箱裝飾的主要特徵。消費者越來越喜歡在汽車中使用高品質的地毯,因為地毯具有多種優點。

此外,地板地毯根據要求由各種材料製成。全球汽車製造業的成長預計將成為預測期內市場成長的關鍵因素之一。此外,人們對車內更高水準的舒適性和安全性的需求日益成長,預計將推動產品需求。然而,先進的乙烯基地板材料不僅適用於小客車,也適用於商用車,對汽車地毯產業構成了嚴重威脅。預計在預測期內市場成長將受到輕微限制。

汽車內裝產業正在經歷技術創新,以提供乘客舒適度。傳統的多層發泡體已被由再生棉製成的輕質防水纖維所取代,使其比傳統纖維輕 50%。像 Autoneum Holding Ltd. 這樣的公司正在花費大量資金為汽車製造商開發可回收的地毯材料,以解決環境問題並將其產品定位為環保產品。未來幾年,汽車地毯市場可能會推出各種環保且美觀的地毯,以滿足汽車製造商的先進需求。

汽車地毯市場趨勢

小客車領域預計將主導市場

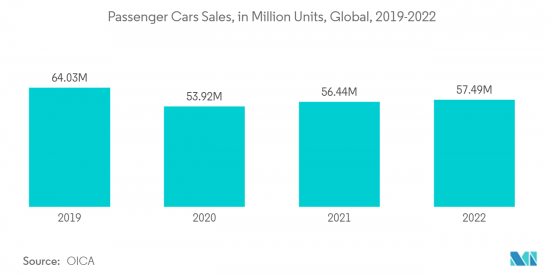

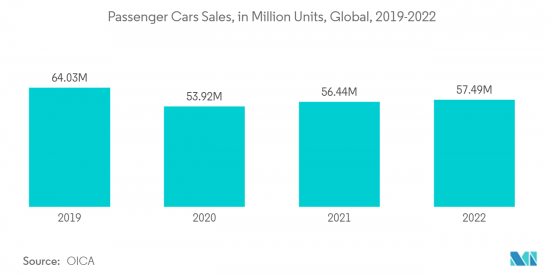

小客車領域在汽車地毯市場中佔據最大的市場佔有率。這是由於消費者對車輛中先進且環保的地毯系統的需求不斷增加,因為地毯系統具有降噪功能。 2022年全球新小客車銷量達5,740萬輛,而2021年為5,640萬輛,2021年至2022與前一年同期比較成長1.9%。

同時,電動車銷量的增加也推動了汽車地毯市場的成長。銷售量的快速成長是各個組織和政府為控制排放水準和普及零排放汽車而收緊監管標準的結果。因此,汽車製造商繼續參與並專注於增加電動車研發支出,這可能會刺激對汽車地毯的需求,以改善汽車的內部外觀。

自2018年以來,全球電動車市場(包括電池式電動車、燃料電池電動車和插電式混合)的登記銷量逐年大幅成長。幾乎所有細分市場都出現了這一成長,包括小客車和商用車。例如

- 2022年全球純電動車(BEV)銷量達730萬輛,而2021年為460萬輛,2021年至2022與前一年同期比較增58.7%。

隨著消費者偏好轉向環保的私人交通途徑以及世界各地小客車數量的持有,未來幾年乘用車的需求將會成長。因此,預計將有助於該細分市場汽車地毯市場的快速成長。

在預測期內,亞太地區將繼續主導市場

亞太地區主導汽車地毯市場。由於大多數汽車在亞太地區生產,該地區佔全球汽車地毯需求的最大佔有率。而且,隨著印度、中國、東南亞國協等國家的快速都市化,小客車的需求和銷售量不斷增加,帶動了汽車產業對地毯的需求。

此外,由於電子商務行業的活性化和各地區建設活動的增加,中國和印度等國家商用車市場的擴張也促進了汽車地毯需求的成長。汽車地毯在這一領域很容易買到。例如,

- 2022年印度商用車與前一年同期比較為93.3萬輛,而2021年為67.7萬輛,2021年至2022年年增37.8%。

- 同樣,2022年印尼新車銷量達到26.4萬輛,而2021年為22.7萬輛,2021年至2022與前一年同期比較增16.3%。

除小客車外,由於該地區消費者和政府對環境問題的日益關注,電動車的採用率將大幅增加,尤其是在中國,也預計將推動地毯市場的發展。隨著電動車在該地區越來越普及,對環保先進材料的需求不斷增加。預計這將在預測期內推動聚丙烯地毯的需求。此外,該地區汽車數量的持有也推動了售後市場對地毯產品的需求,預計將推動市場成長。

汽車地毯產業概況

由於各種國際和地區參與企業的存在,汽車地毯市場適度分散且競爭激烈。主要參與企業包括曉星、Autoneum Holding Ltd.、Dorsett Industries、Hayashi Telempu Corporation、Auto Custom Carpets、Alliance Interiors、UGN Inc、Faurecia SA、豐田紡織 Corp. 和 Grand Carpet Industries。該行業的各種公司正在積極與主要汽車製造商建立合作夥伴關係,以提高其品牌影響力。

- 2023 年 2 月,大眾汽車宣布其 ID.3、ID.4、ID.5 和 ID.7 車型將採用 Seeku Al Yarn,這是一種由海洋塑膠和回收寶特瓶製成的環保材料。該公司的目標是在地毯隔熱層和座椅套中利用回收材料。這標誌著一家大型汽車製造商對推廣在汽車內裝中使用環保材料的重大承諾。

- 歐拓宣佈於 2022 年 11 月推出新的 100% 聚酯地毯系統。推出的創新地毯系統完全可回收,為電動車報廢後的改進和永續回收鋪平了道路。此外,該公司新型單一材料針刺和簇絨地毯的碳足跡將進一步改善,因為其回收 PET 含量高、零廢棄物和能源集中生產過程較少。

預計未來幾年市場將推出各種先進且環保的汽車地毯解決方案,這些參與企業希望透過多樣化的產品系列來競爭。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 電動小客車和商用車銷量成長

- 市場抑制因素

- 乙烯基地板材料的整合阻礙了市場成長

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模-美元)

- 按材質

- 尼龍

- 丙烯酸纖維

- 聚酯纖維

- 聚丙烯

- 其他(發泡體等)

- 按類型

- 地板地毯

- 行李箱裝飾

- 按車型

- 小客車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 中東和非洲其他地區

- 北美洲

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- Alliance Interiors LLC

- UGN Inc

- Faurecia SA

- Hyosung

- Autoneum Holding Ltd.

- Dorsett Industries

- Toyota Boshoku Corp.

- Hayashi Telempu Corporation

- Automotive Trimmings Company

- Grand Carpet Industries Sdn Bhd

- DuPont

- Auto Custom Carpets

- Bharat Seats Limited

- Reyes Amtex

第7章 市場機會及未來趨勢

- 強化技術開發環保地毯

The Automotive Carpeting Market is valued at USD 5.60 billion in the current year and is anticipated to reach a net valuation of USD 7.58 billion within the next five years, registering a CAGR growth of 6.25% over the forecast period.

Over the long term, the consumers' growing preference for utilizing eco-friendly and lightweight vehicle interior products, rising sales of electric vehicles, and the demand for integrating lightweight components in vehicles are driving the surging growth of the automotive carpeting market. Carpets on the floor of a vehicle minimize noise, improve the aesthetic aspect of the inside, and offer insulation. Isolation from noise, heat, and dirt are the major characteristics of floor carpets and trunk trims in vehicles. Due to the various benefits offered by installing a carpeting system, consumers are increasingly preferring the usage of high-quality carpets in their vehicles.

Additionally, the floor carpet is made of various materials depending on the requirements. Increased global automotive manufacturing is predicted to be one of the key drivers of market growth during the forecast period. Furthermore, the growing desire for higher levels of comfort and safety in automobile passenger cabins is likely to boost product demand. However, the development of advanced vinyl flooring in passenger as well as commercial vehicles poses a severe threat to the automotive carpeting industry. It is expected to marginally limit the market growth during the forecast period.

Innovations in the automotive interior industry are gaining traction to provide enhanced comfort to passengers. Conventional multi-layer foams are replaced by lightweight, water-repellent fibers made from recycled cotton, which offers a 50% weight reduction than that of traditional fibers. Companies such as Autoneum are spending hefty sums to develop recyclable carpet material for auto manufacturers to address environmental issues and position their products as environmentally friendly. In the coming years, the automotive carpeting market will witness the launch of various environmentally friendly and aesthetic carpets to cater to the advanced demand of auto manufacturers.

Automotive Carpeting Market Trends

Passenger Cars Segment is Anticipated to Dominate the Market

The passenger cars segment accounted for the largest market share in the automotive carpeting market. It is owing to the increasing demand of consumers to install advanced and eco-friendly carpeting systems in their vehicles due to its noise-reduction capability, among other characteristics. The global new sales of passenger cars in 2022 touched 57.4 million units in 2022, compared to 56.4 million units in 2021, recording a Y-o-Y growth of 1.9% between 2021 and 2022.

On the other hand, the rise in sales of electric vehicles is also aiding the growth of the automotive carpeting market. The spike in sales is the result of an increase in regulatory norms by various organizations and governments to control emission levels and to propagate zero-emission vehicles. As a result, automakers are continually working and focusing on increasing their expenditure on the R&D of electric vehicles, which may fuel the demand for automotive carpets to enhance the interior look of the vehicle.

The global electric vehicles (including battery electric vehicles, fuel cell electric vehicles, and plug-in hybrid vehicles) market observed a tremendous increase in the number of sales registered every year since 2018. This increase was registered in almost all segments of vehicles, which include passenger vehicles and commercial vehicles. For instance-

- In 2022, global sales of battery electric vehicles (BEVs) touched 7.3 million units, compared to 4.6 million units in 2021, representing a 58.7% Y-o-Y growth between 2021 and 2022.

With the consumer's shifting preference toward availing of environmentally friendly modes of private transportation and growth in vehicle parc across the world, there will exist a greater demand for passenger vehicles in the coming years. It, in turn, is expected to contribute to the surging growth of the automotive carpeting market for this segment.

Asia-Pacific Remain to Dominate the Market during the Forecast Period

The Asia-Pacific region dominates the automotive carpeting market. As the majority of the vehicle is manufactured in the Asia-Pacific region, the region accounts for the largest share in terms of demand for automotive carpeting across the globe. Additionally, with rapid urbanization in countries such as India, China, and ASEAN Countries, the demand for and sales of passenger vehicles is continually increasing, in turn boosting the demand for carpeting in the automotive industry.

Coupled with that, the growing commercial vehicle segment in countries such as China and India, owing to the expanding e-commerce industry and rise in construction activity across regions, is also contributing to the increased demand for automotive carpets. It can be readily utilized in this vehicle segment. For instance,

- In 2022, India witnessed sales of 933 thousand units of commercial vehicles, compared to 677 thousand units in 2021, recording a Y-o-Y growth of 37.8% between 2021 and 2022.

- Similarly, new sales of commercial vehicles in Indonesia touched 264 thousand units in 2022, compared to 227 thousand units in 2021, representing a 16.3% Y-o-Y between 2021 and 2022.

Apart from passenger cars, with growing environmental concerns among both consumers and governments in the region, the adoption of electric vehicles increased significantly, especially in China, which is also expected to drive the market for carpeting. With the rising adoption of electric vehicles in the region, there remains a greater need for environmentally friendly advanced materials. It is expected to drive the demand for polypropylene carpets during the forecast period. Further, the growing vehicle parc in the region also assists in the demand for carpet products in the aftermarket, which is expected to fuel the market growth.

Automotive Carpeting Industry Overview

The automotive carpeting market is moderately fragmented and highly competitive due to the presence of various international and regional players operating in this space. Some of the major players include Hyosung, Autoneum Holding Ltd., Dorsett Industries, Hayashi Telempu Corporation, Auto Custom Carpets, Alliance Interiors, UGN Inc, Faurecia SA, Toyota Boshoku Corp., and Grand Carpet Industries, among others. Various companies operating in the industry actively engage in forming partnerships with major auto manufacturers to enhance their brand presence.

- In February 2023, Volkswagen announced its commitment to integrate eco-friendly material, Seaqual yarn, derived from ocean plastic and recycled PET bottles, in its ID.3, ID.4, ID.5, and ID.7 models. The company aims to utilize recycled materials for the insulating layer of the vehicle carpet as well as seat covers. It marks a major commitment from a leading auto manufacturer to promote the usage of eco-friendly materials for car interiors.

- In November 2022, Autoneum announced the introduction of its new carpet system that is made up of 100% polyester. The innovative carpet systems introduced are fully recyclable, thus paving the way for an improved and more sustainable end-of-life recycling of electric vehicles. In addition, the high content of recycled PET, as well as the zero waste and less energy-intensive production process, further improve the carbon footprint of the company's new monomaterial needle punch and tufted carpets.

The market is anticipated to witness the launch of various advanced and eco-friendly vehicle carpet solutions in the coming years as these players try to gain a competitive edge with the diversification of their product portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growth in Electric Passenger and Commerical Vehicle Sales

- 4.2 Market Restraints

- 4.2.1 Integration of Vinyl Flooring Deters the Growth of the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Material

- 5.1.1 Nylon

- 5.1.2 Acrylic

- 5.1.3 Polyester

- 5.1.4 Polypropylene

- 5.1.5 Others (Foam, etc.)

- 5.2 By Component Type

- 5.2.1 Floor Carpet

- 5.2.2 Trunk Trim

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Argentina

- 5.4.4.4 Rest of Latin America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Alliance Interiors LLC

- 6.2.2 UGN Inc

- 6.2.3 Faurecia SA

- 6.2.4 Hyosung

- 6.2.5 Autoneum Holding Ltd.

- 6.2.6 Dorsett Industries

- 6.2.7 Toyota Boshoku Corp.

- 6.2.8 Hayashi Telempu Corporation

- 6.2.9 Automotive Trimmings Company

- 6.2.10 Grand Carpet Industries Sdn Bhd

- 6.2.11 DuPont

- 6.2.12 Auto Custom Carpets

- 6.2.13 Bharat Seats Limited

- 6.2.14 Reyes Amtex

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Enhancement in Technology to Develop Eco-Friendly Carpets