|

市場調查報告書

商品編碼

1404367

碳複合材料 -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Carbon Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

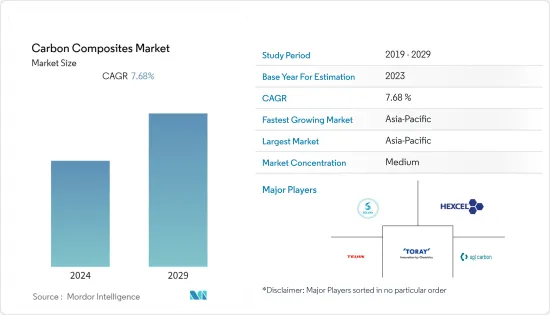

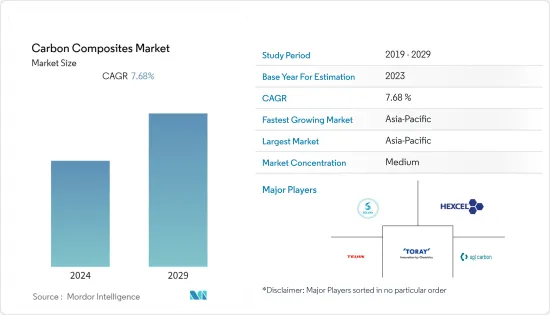

預計年終碳複合材料市場將達到205.90千噸。

預計未來五年將達298.10千噸,預測期內複合年成長率超過7.68%。

COVID-19 對碳複合材料產業產生了負面影響。全球封鎖和政府實施的嚴格規定摧毀了大多數生產基地。儘管如此,業務自 2021 年以來已經復甦,預計未來幾年將大幅成長。

主要亮點

- 推動市場的關鍵因素是航太和國防工業需求的增加以及風力發電領域需求的增加。

- 然而,與其他複合材料相比,製造成本較高以及替代品的存在阻礙了市場成長。

- 然而,碳複合材料在 3D 列印中的日益普及以及燃料電池電動車(FCEV) 需求的不斷增加帶來了市場機會。

- 亞太地區佔據最高的市場佔有率,預計在預測期內將主導市場。

碳複合材料市場趨勢

航太和國防應用主導市場

- 航太和國防工業是碳複合材料市場的最大最終用戶。最初,航太製造嚴重依賴鋁、鋼和鈦等金屬,這些金屬約佔飛機總重量的 70%。然而,近年來,由於人們對減重、極端耐用、隔熱和雷達吸收等性能的日益偏好,碳複合材料在航太製造中的使用激增。

- 這些複合材料由嵌入碳基體中的碳纖維組成。這些複合材料還可以降低飛機的維護成本,因為它們不會生鏽或腐蝕。

- 碳纖維複合材料在航太工業中的主要應用包括用於生產飛機零件,例如夾子、夾板、支架、肋骨、支柱、橫樑、尖端、翼尖和其他特殊零件。

- 此外,航太也在探索將這些複合材料用於大型結構,例如機翼抗扭箱和機身面板。在國防工業中,碳複合材料用於飛彈防禦、地面防禦和軍艦。

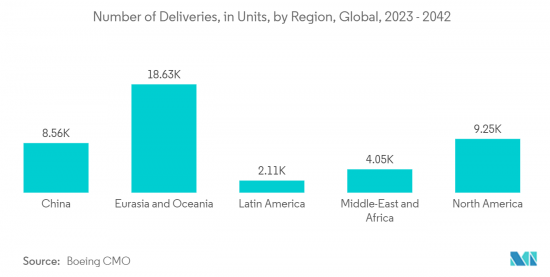

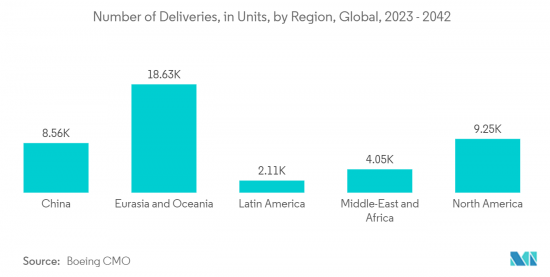

- 波音《2023-2042年商業展望》預測,隨著國際交通量回升和國內航空旅行恢復到疫情前的水平,到2042年全球對新商用噴射機的需求將達到42,595架,預計其價值將達到8兆美元。

- 北美地區將佔據最大佔有率,共交付9,250 架飛機,其次是歐亞大陸和中國,預計到 2042 年,新飛機交付總量將達到 9,645 架,顯示產業需求增加。

- 2022年,全球領先的飛機製造商之一空中巴士公司向84家客戶交付了約661架民航機,較2021年成長8%。此外,我們在 2022 年又獲得了 820 個新淨訂單。截至年終,空中巴士的訂單訂單為7,239架飛機,為2019年以來的最高水準。同時,波音公司報告稱,2022 年商業訂單約為 774 架飛機,其中約 480 架飛機將於 2022 年交付。

- 因此,由於上述因素,航太和國防領域預計將主導所研究的市場。

亞太地區主導市場

- 亞太地區佔據全球碳複合材料市場的最高佔有率。碳複合材料的需求大多來自航太和國防、汽車以及運動和休閒應用。

- 碳複合材料由於其高強度重量比、耐腐蝕性和可加工性等特點,在汽車產業有著巨大的需求。由於它們重量輕、強度高並且有助於降低燃料消耗,因此它們在各種汽車應用中擴大取代金屬。

- 根據國際汽車建設組織(OICA)預計,2022年中國汽車產量將達2,702萬輛,較2021年同期成長3%。儘管受到COVID-19疫情、結構性晶片短缺、區域地緣政治衝突等負面因素的影響,2022年中國汽車市場仍實現成長。

- 根據國際貿易管理局(ITA)的數據,以年銷售量和產量計算,中國仍是全球最大的汽車市場。預計2025年國內產量將達3,500萬台。

- 印度汽車工業呈現正向發展態勢,各領域成長顯著。根據印度汽車工業商協會(SIAM)統計,2022年4月至2023年3月,國內汽車工業總合生產了2,599,318,867輛汽車,包括小客車、商用車、三輪車、兩輪車和四輪車。2021年4月至2022年3月期間成長約12.5%。

- 日本汽車流通協會聯合會(Jikaren)和全國輕型汽車協會聯合會(Keijikyo)發布的統計數據顯示,2022年國內新車銷量為4,201,321輛,與前一年同期比較下降5.6%,這是四年來最低,這是連續年比下降。隨著全球半導體短缺的持續,汽車製造商被迫限制生產。

- 此外,航太和國防工業是碳複合材料市場的最大最終用戶。由於人們越來越偏好減重、極端耐用、隔熱和雷達吸收等性能,碳複合材料在航太製造中的使用正在迅速成長。

- 根據航太航太公司空中巴士公司2023年4月發布的新聞稿,未來20年,中國空中交通量預計將以每年5.3%的速度成長,顯著高於3.6%的全球平均水準。到 2041 年,這將需要 8,420 架客機和貨機,約 39,500 架新飛機,或未來 20 年全球新飛機需求的 20% 以上。

- 根據國際航空運輸協會(IATA)的報告,預計到預測期結束時,印度將成為全球第三大航空市場,並將超越中國和美國,成為全球第三大航空客運市場到2030 年。一定會的。

- 此外,碳複合材料由於其優越的強度、輕質和韌性而擴大用於運動器材。因此,運動器材需求的成長預計將對預測期內的市場成長產生正面影響。

- 官方資料顯示,2022年中國電子產業穩定成長,支撐生產和投資穩健成長。根據工業資訊部統計,2021年該產業主要企業增加增加價值額年增7.6%,超過全部工增加價值額4個百分點。因此,電子產品需求的大幅成長支撐了產業對碳複合材料的需求。

- 由於2022年北京冬奧會的舉辦,中國體育用品市場正見證成長。奧運熱潮加速了我國運動產業的發展。體育用品製造商和行業相關人員期望該行業能夠激發消費者參與體育活動的慾望並增加消費。

- 所有上述因素預計將在未來幾年推動碳複合材料市場的發展。預計亞太地區將在預測期內主導市場。

碳複合材料產業概況

全球碳複合材料材料市場因其性質而部分分散。主要參與企業(排名不分先後)包括東麗工業公司、索爾維、赫氏公司、帝人有限公司和西格里碳素公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 航太和國防工業的需求增加

- 風力發電領域需求增加

- 抑制因素

- 與其他複合材料相比製造成本較高

- 替代品的存在

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 矩陣

- 混合

- 金屬

- 陶瓷

- 碳

- 聚合物

- 熱固性

- 熱塑性塑膠

- 過程

- 預灰化過程

- 牽引和纏繞

- 濕式層壓和灌注工藝

- 壓制和注射工藝

- 其他工藝

- 目的

- 航太/國防

- 車

- 風力發電機

- 運動、休閒

- 土木工程

- 海洋

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Carbon Composites Inc.

- China Composites Group Corporation Ltd

- Epsilon Composite

- Hexcel Corporation

- Mitsubishi Chemical Corporation

- Nippon Carbon Co. Ltd

- Plasan

- Rockman

- SGL Carbon

- Solvay

- Teijin Limited

- Toray Industries Inc.

第7章 市場機會及未來趨勢

- 擴大碳複合材料在 3D 列印的應用

- 對燃料電池電動車(FCEV)的需求增加

The carbon composites market is estimated to be at 205.90 kilotons by the end of this year. It is projected to reach 298.10 kilotons in the next five years, registering a CAGR of over 7.68% during the forecast period.

COVID-19 had a negative impact on the carbon composites sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- The major factors driving the market are increasing demand from the aerospace and defense industry and increasing demand from the wind energy sector.

- However, the high cost of manufacturing in comparison to other composites and the presence of substitutes are hindering the market growth.

- Nevertheless, the growing adoption of carbon composites in 3D printing and increasing demand from fuel cell electric vehicles (FCEVs) will be the market opportunities.

- The Asia-Pacific region accounts for the highest market share and is expected to dominate the market during the forecast period.

Carbon Composites Market Trends

Aerospace and defense applications to dominate the market

- The aerospace and defense industry is the largest end-user of the carbon composite market. Initially, aerospace manufacturing used to rely heavily on metals like aluminum, steel, and titanium, which used to account for around 70% of the total aircraft weight. However, in recent years, owing to increasing preferences for properties like weight reduction, extreme resistance, insulation, and radar absorption, the usage of carbon composites in aerospace manufacturing has been growing rapidly.

- These composites consist of carbon fibers embedded in a carbon matrix. These composite materials also bring down the maintenance cost of the airplane as the materials do not rust or corrode.

- In the aerospace industry, some key applications of carbon-fiber-based composites include their use in manufacturing aircraft parts, such as clips, cleats, brackets, ribs, struts, stringers, chips, wing-leading edges, and other special parts.

- Moreover, the aerospace industry is also exploring the uses of these composites in larger structures, like wing torsion boxes and fuselage panels. In the defense industry, carbon composites are used in missile defense, ground defense, and military marine.

- According to the Boeing Commercial Outlook 2023-2042, with a resurgence in international traffic and domestic air travel back to pre-pandemic levels, the company is projected to exhibit a global demand for 42,595 new commercial jets by 2042, valued at USD 8 trillion.

- North America accounts for the largest share with 9,250 deliveries, followed by Eurasia and China, with the total deliveries of new airplanes estimated to be 9,645 units by 2042, indicating rising demand from the industry.

- In 2022, Airbus, one of the major aircraft manufacturers across the world, delivered around 661 commercial aircraft to 84 customers, which is an 8% increase compared to 2021. It also has received an additional 820 net new orders in 2022. At the end of 2022, Airbus' backlog was 7,239 aircraft, the highest number since 2019. On the other hand, Boeing has reported around 774 commercial orders for 2022 and has delivered around 480 aircraft in 2022.

- Hence, due to the aforementioned factors, the aerospace and defense sector is expected to dominate the market studied.

Asia Pacific to dominate the market

- Asia-Pacific accounts for the highest share of the global carbon composites market. Most of the demand for carbon composites comes from applications in aerospace and defense, automotive, sports and leisure, etc.

- Carbon composites have been witnessing tremendous demand in the automotive industry owing to their high strength-to-weight ratios, corrosion resistivity, and workability features. They have been replacing metals in various automotive applications due to their lightweight but tough features, which contribute to lesser fuel consumption.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), vehicle production in China reached a total of 27.02 million units in 2022, an increase of 3% over 2021 for the same period. China's auto market experienced growth in 2022 despite the impact of several negative factors, including the outbreak of COVID-19, a structural chip shortage, and local geopolitical conflicts.

- According to the International Trade Administration (ITA), China remains the world's largest auto market in terms of both annual sales and production. Domestic production is expected to reach 35 million units by 2025.

- The Indian automotive industry showed a positive development with remarkable growth across various sectors. According to the Society of Indian Automobile Manufacturers (SIAM), the automotive industry in the country produced a total of 2,59,31,867 vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles from April 2022 to March 2023, registering a growth of around 12.5% compared to April 2021-March 2022.

- According to statistics released by the Japan Automobile Dealers Association and the Japan Light Motor Vehicle Association, a total of 4,201,321 new cars were sold in Japan in 2022, down by 5.6% Y-o-Y, marking the fourth consecutive year of decline. The continuing global shortage of semiconductors has forced automakers to limit production.

- Furthermore, the aerospace and defense industry is the largest end user of the carbon composites market. With increasing preferences for properties like weight reduction, extreme resistance, insulation, and radar absorption, the usage of carbon composites in aerospace manufacturing has been growing rapidly.

- According to a press release from the aerospace company Airbus, in April 2023, over the next 20 years, China's air traffic is projected to grow at an annual rate of 5.3%, well above the global average of 3.6%. This would require 8,420 passengers and freighters by 2041, or more than 20% of the world's need for new aircraft over the next 20 years, around 39,500.

- According to the International Air Transport Association (IATA) Report, India is poised to become the third-largest aviation market in the world by the end of the forecast period, overtaking China and the United States as the world's third-largest air passenger market by 2030.

- Moreover, carbon composites are increasingly used in sports equipment owing to their superior strength, lightweight, and toughness. Thus, the rising demand for sports goods is anticipated to benefit the market's growth over the forecast period.

- According to official data, China's electronics sector recorded stable growth in 2022, supporting solid growth in terms of production and investment. According to the Ministry of Industry and Information Technology, the value added of major enterprises in the sector increased by 7.6% over the same period in 2021, exceeding the value added of all industries by four percentage points. Thus, a significant boost in demand for electronics goods supports the demand for carbon composites from the industry.

- The sports equipment market in China has witnessed growth owing to the Beijing Winter Olympic Games in 2022. The craze of the Olympics accelerated the sports industry in the country. Sports equipment makers and industry practitioners expect the sector to fuel consumers' appetite for sports activities and consumption.

- All the above-mentioned factors are expected to drive the market for carbon composites in the coming years. Asia-Pacific is expected to dominate the market studied during the forecast period.

Carbon Composites Industry Overview

The global carbon composites market is partially fragmented in nature. The major players (not in any particular order) include Toray Industries Inc., Solvay, Hexcel Corporation, Teijin Limited, and SGL Carbon SE, among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Aerospace and Defense Industry

- 4.1.2 Increasing Demand from the Wind Energy Sector

- 4.2 Restraints

- 4.2.1 High Cost for Manufacturing in Comparison to Other Composites

- 4.2.2 Presence of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Matrix

- 5.1.1 Hybrid

- 5.1.2 Metal

- 5.1.3 Ceramics

- 5.1.4 Carbon

- 5.1.5 Polymer

- 5.1.5.1 Thermosetting

- 5.1.5.2 Thermoplastic

- 5.2 Process

- 5.2.1 Prepeg Layup Process

- 5.2.2 Pultrusion and Winding

- 5.2.3 Wet Lamination and Infusion Process

- 5.2.4 Press and Injection Processes

- 5.2.5 Other Processes

- 5.3 Application

- 5.3.1 Aerospace and Defense

- 5.3.2 Automotive

- 5.3.3 Wind Turbines

- 5.3.4 Sport and Leisure

- 5.3.5 Civil Engineering

- 5.3.6 Marine Applications

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Carbon Composites Inc.

- 6.4.2 China Composites Group Corporation Ltd

- 6.4.3 Epsilon Composite

- 6.4.4 Hexcel Corporation

- 6.4.5 Mitsubishi Chemical Corporation

- 6.4.6 Nippon Carbon Co. Ltd

- 6.4.7 Plasan

- 6.4.8 Rockman

- 6.4.9 SGL Carbon

- 6.4.10 Solvay

- 6.4.11 Teijin Limited

- 6.4.12 Toray Industries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Carbon Composites in 3D-Printing

- 7.2 Increasing Demand from Fuel Cell Electric Vehicle (FCEV)