|

市場調查報告書

商品編碼

1687272

電源管理積體電路(PMIC) -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Power Management Integrated Circuit (PMIC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

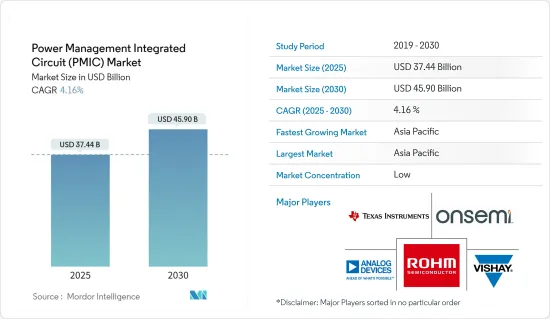

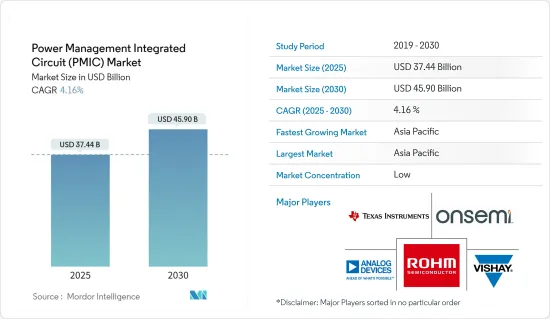

電源管理積體電路市場規模預計在 2025 年為 374.4 億美元,預計到 2030 年將達到 459 億美元,預測期內(2025-2030 年)的複合年成長率為 4.16%。

這種成長很大程度上是由於每個電子元件都需要控制和供電,無論所需電壓或最終應用如何。隨著主要企業尋求透過開發新製程、封裝和電路設計技術來突破功率界限以提供適合應用的設備,市場正在獲得發展動力。電源管理IC在提高功率密度、延長電池壽命、減少電磁干擾、維護電源和訊號完整性以及維護高壓條件下的安全性方面的效用越來越大。

關鍵亮點

- 從功率密度因素開始,隨著功率需求的增加,基板面積和高度正在成為限制因素。為了使他們的產品與眾不同,電源設計人員在他們的應用中加入更多的電路,同時提高效率並改善熱性能。此外,在電池供電系統中,需要在空載或輕載條件下實現高效率,這為調節輸出同時嚴格保持超低電流的電源解決方案鋪平了道路。

- 電磁干擾 (EMI) 是電子系統中越來越重要的要求,尤其是在汽車和工業等新應用中。因此,開發低 EMI IC 可以顯著縮短開發週期,同時減少基板面積和解決方案成本。監控、調節和處理電力鏈訊號的能力對於最大限度地提高系統效能和可靠性至關重要。高度精密系統需要低噪音、精確的參考和低噪音、低漣波的電源軌。因此,迫切需要先進的電源管理 IC 來提高精度並最大限度地減少失真。

- 電源管理積體電路是電子設備中的關鍵元件,旨在實現電源管理效率。然而,在PMIC設計過程中,設計人員經常面臨從功率損耗到溫度控管的多重挑戰,這些挑戰會影響電子設備的效率和效能。預計這些因素將阻礙市場成長。

- 此外,汽車領域對電源管理IC也前景看好。這是由 ADAS 的引入和汽車電氣化推動的,並得到了蓬勃發展的地區和新興國家的大力支持。

- 此外,電動車已成為道路運輸脫碳的關鍵技術,道路運輸佔全球能源相關排放的 15% 以上。近年來,電動車銷量呈指數級成長,續航里程不斷增加,車型種類不斷豐富,性能不斷提升。乘用電動車越來越受歡迎,國際能源總署預測,2023 年銷售的新車中 18% 將是電動車。歐洲、中國和美國仍然是主要的電動車市場。

電源管理積體電路(PMIC)市場趨勢

汽車作為終端用戶產業正在快速成長

- 汽車是本研究市場中主要的終端使用者之一。汽車及其製造業的進步也推動了對更小、更節能的設備的需求。汽車產量的增加和汽車先進功能的增加是推動汽車領域對電源管理 IC 需求的關鍵因素。

- 汽車應用的電源需要高可靠性、高效率和各種安全功能。對寬電壓輸入、多相電源、汽車安全完整性等級 (ASIL) 支援以及高功率系統晶片(SoC) 全系統能源的需求不斷成長,推動了汽車領域對電源管理積體電路 (PMIC) 的需求。高級駕駛輔助系統 (ADAS),包括攝影機和雷達技術、資訊娛樂和叢集系統、主動安全功能、車身電子和照明控制、電動、混合動力和動力傳動系統傳動系統等,是 PMIC 的一些主要應用領域。

- 考慮到汽車行業日益成長的需求,供應商定期推出創新解決方案,以支持所研究市場的成長。例如,2022年3月,運動控制和節能系統感測和電源解決方案供應商Allegro MicroSystems Inc.出貨了第30億個馬達驅動器積體電路(IC),展現了其運動控制業務的實力。

- 近年來,隨著全球環境問題日益嚴重,消費者意識不斷增強,政府監管不斷加強,電動車產業經歷了顯著成長。例如,根據國際能源總署(IEA)的預測,2022年全球道路上將有約2,590萬輛電動車。同年,純電動車在插電式電動車的比例約為69.5%。

- 此外,根據國際能源總署的預測,2023 年插電式電動車 (PEV) 的銷量將達到 1,370 萬輛左右。隨著對插電式輕型電動車的需求持續成長,研究市場在預測期內可能會出現更高的需求。

亞太地區佔市場主導地位

- 由於消費性電子產品銷售不斷成長、政府推動電子產品製造業發展的舉措、多家公司的存在以及對其他行業的投資,亞太市場預計將擴大。

- 由於主要半導體製造商的存在、消費性電子市場的快速擴張以及智慧型設備的日益普及,亞太地區成為電源管理 IC 市場的焦點。區域市場的主要企業包括中國、印度、韓國和日本,這些國家在半導體產業取得了重大進展。由於先進電子設備的普及,該地區佔有相當大的市場佔有率。

- 此外,5G 網路的引入和該地區通訊領域投資的增加預計將推動 PMIC 市場的發展。根據台灣網路資訊中心的調查,19% 的台灣受訪者將在 2022 年使用 5G,較 2020 年的 2% 大幅成長。如此快速的普及預計將推動該地區通訊業的蓬勃發展,從而大幅增加對強大晶片的需求以及對 OSTA 服務的需求。

- 根據 GSMA 預測,到 2030 年底,亞太地區的 5G 連線數預計將達到約 14 億。這一成長預計將受到 5G 設備平均成本下降、許多國家網路快速擴張以及主要政府的共同努力的推動。此外,5G領域的進步也促進了市場擴張。根據韓國科學、資訊通訊技術和通訊部報告,截至2023年2月,韓國5G用戶數為2,913萬,較2021年2月的1,366萬大幅成長113%。

- 此外,印度、中國和日本等國家汽車產業的崛起預計將進一步刺激市場需求。例如,中國汽車產業正在快速擴張,在全球汽車產業的地位日益重要。中國是率先採用電動車的國家之一,電動車正變得越來越受歡迎。 2022年,中國乘用車市場資訊聯席會報告稱,由於政府獎勵和油氣價格上漲導致消費者放棄耗油車型,中國電動車和插電式汽車銷量為567萬輛。電動汽車產業預計將推動對汽車電源管理解決方案的快速需求,從而推動對 PMIC 設備的需求。

電源管理積體電路(PMIC)市場概況

電源管理積體電路 (PMIC) 市場高度分散,主要企業包括德州儀器公司、安森美半導體元件有限責任公司 (onsemi)、ADI 公司、ROHM 和 Vishay Intertechnology Inc.。市場主要企業正在積極推行各種策略,包括聯盟和收購,以加強產品系列建立永續的競爭優勢。

2023 年 4 月,德州儀器 (TI) 發布了有關其最新產品 SimpleLink 系列 Wi-Fi 6伴同性積體電路 (IC) 的重要公告。這些 IC 專為在高密度或高溫環境下運作的應用而設計,可承受高達 1050°C 的溫度。 TI 新 CC33xx 系列的初始成員包括僅支援 Wi-Fi 6 連接的選項,以及支援 Wi-Fi 6 和低功耗藍牙 5.3 連接的選項,全部整合到單一 IC 中。這種創新解決方案在與微控制器單元 (MCU) 或處理器連接時,可透過可靠的射頻效能實現安全的物聯網連接,特別是在電網基礎設施、醫療和建築自動化等工業領域。

2023 年 5 月,Semiconductor Components LLC(Onsemi)宣布與 Vitseco Technologies 建立戰略合作夥伴關係,旨在加強其 SiC(碳化矽)技術能力。兩家公司簽署了一份為期10年、價值19億美元的長期供應協議,主要集中在SiC產品。根據協議,Vitseco 將向 Onsemi 投資 2.5 億美元,用於購買專門用於 SiC 晶圓製造、晶錠生長和外延製程的新設備。這項策略性舉措旨在確保未來穩定、強大的碳化矽生產能力,使兩家公司能夠滿足不斷成長的市場需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 宏觀趨勢如何影響市場

第5章市場動態

- 市場促進因素

- 節能電池供電設備的需求不斷增加

- 汽車領域的電氣化趨勢

- 市場限制

- 高功率應用中的設計複雜性與效能限制

第6章市場區隔

- 按產品

- 電壓穩壓器

- 馬達控制IC

- 電池管理IC

- 多通道PMIC

- 更多產品

- 按最終用戶

- 汽車

- 家用電子電器

- 工業的

- 通訊設備

- 計算

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Texas Instruments Incorporated

- Semiconductor Components Industries LLC(Onsemi)

- Analog Devices Inc.

- ROHM Co. Ltd

- Vishay Intertechnology Inc.

- NXP Semiconductors NV

- Infineon Technologies AG

- Qualcomm Incorporated

- Renesas Electronic Corporation

- STMicroelectronics NV

第8章投資分析

第9章:市場的未來

The Power Management Integrated Circuit Market size is estimated at USD 37.44 billion in 2025, and is expected to reach USD 45.90 billion by 2030, at a CAGR of 4.16% during the forecast period (2025-2030).

This growth is largely owing to the fact that every electronic component needs to be controlled and powered, irrespective of the required voltage or the final application. The market has been gaining momentum as major players have been looking toward pushing the limits of power by developing new processes, packaging, and circuit design technologies for delivering suitable devices as per the application. Power management IC has been gaining usability in enhancing power density, extending battery life, reducing electromagnetic interference, preserving power and signal integrity, and maintaining safety in the presence of high voltages.

Key Highlights

- Starting with the power density factor, the board area and height are becoming limiting factors as power demands increase. Power designers are squeezing more circuitry into their applications to differentiate their products while also increasing efficiency and enhancing thermal performance. Moreover, in battery-operated systems, the need to achieve high efficiency at no or light-load conditions has been paving the way for power solutions to regulate the output while maintaining ultra-low supply current tightly.

- Electromagnetic interference (EMI) is a key requirement of increasing importance in electronic systems, especially in new applications such as automotive and industrial. Thus, designing for low EMI IC can save significant development cycle times while also reducing board area and solution cost. The ability to monitor, condition, and process signals in the power chain is critical in order to maximize system performance and reliability. High-precision systems require accurate low-noise references, as well as supply rails with low noise and ripple. Thus, advanced power management ICs are significantly required for increased accuracy and minimum distortion.

- Power management integrated circuits are crucial components in electronic devices and are designed to achieve efficiency in power management. However, in the PMIC design process, designers often face multiple challenges ranging from power losses to thermal management, affecting the electronic device's efficiency and performance. Such factors are expected to hinder the growth of the market.

- Furthermore, the automotive segment is also promising for the power management IC, driven by the introduction of ADAS as well as the electrification of vehicles, which are largely gaining support from strong regional and developing countries.

- In addition to this, electric vehicles have evolved as the key technology to decarbonize road transport, a sector that accounts for over 15% of global energy-related emissions. Recent years have observed exponential growth in the sale of EVs, together with improved range, wider model availability, and increased performance. Passenger electric cars are gaining popularity, and IEA estimates that 18% of new cars sold in 2023 will be electric. Europe, China, and the United States remain the leading electric vehicle markets.

Power Management Integrated Circuit (PMIC) Market Trends

Automotive to be the Fastest Growing End-user Industry

- The automotive is one of the significant end users of the market studied. The advancement in automotive and its manufacturing is also driving the need for compact, power-efficient devices. The growing automotive production and the addition of advanced features in the automotive are some of the major factors driving the demand for power management ICs in the automotive sector.

- Power in automotive applications demands high reliability, efficiency, and different safety functionality. The growing need for broad voltage input or multiphase power, support for automotive safety integrity level (ASIL), or full-system energy for high-powered system-on-chips (SoCs) is fueling the demand for power management integrated circuits (PMICs) in the automotive sector. Advanced driver assistance systems (ADAS) encompassing camera and radar technologies, infotainment and cluster systems, active safety features, body electronics and lighting control, as well as electric, hybrid, and powertrain systems, represent some of the significant scopes for PMIC applications.

- Considering the growing demand from the automobile industry, vendors are launching innovative solutions regularly, which is supporting the growth of the market studied. For instance, in March 2022, Allegro MicroSystems Inc., a provider of motion control and energy-efficient systems sensing and power solutions, shipped the three billionth motor driver integrated circuit (IC), demonstrating the strength of its motion control business.

- In recent years, the electric vehicle industry has witnessed remarkable growth, driven by growing consumer awareness and supporting government regulations as global environmental concerns rise. For instance, according to the International Energy Agency (IEA), there were approximately 25.9 million electric vehicles worldwide in 2022. All-electric vehicles accounted for about 69.5% of plug-in electric vehicles that year.

- Furthermore, according to IEA, It is estimated that 2023 saw plug-in electric light vehicle (PEV) sales of around 13.7 million units. As the demand for EVs in the plug-in light vehicles continues to grow, the studied market will witness a higher demand during the forecast period.

Asia-Pacific to Dominate the Market

- The market in Asia-Pacific is expected to increase owing to rising consumer electronics sales, government initiatives to boost electronics manufacturing, the presence of several companies, and investments in other industries.

- The Asia-Pacific region has gained prominence in the Power Management IC Market, owing to the presence of major semiconductor manufacturers, the rapid expansion of consumer electronics markets, and the growing adoption of smart devices. Key players in the region's market include China, India, South Korea, and Japan, which have made significant strides in the semiconductor industry. The region commands a substantial market share due to the widespread adoption of advanced electronic devices.

- Moreover, the region's adoption of the 5G network and the rising investments in the telecom sector are expected to drive the market for PMICs. According to a survey conducted by the Taiwan Network Information Center, in 2022, 19% of Taiwanese respondents have availed themselves of 5G, a significant increase from 2% in 2020. This rapid adoption is anticipated to fuel the telecom industry in the region, resulting in a substantial demand for potent chips, thereby necessitating OSTA services.

- As per the GSMA, the Asia-Pacific region is projected to witness approximately 1.4 billion 5G connections by the conclusion of 2030. This growth is expected to be propelled by a decline in the average cost of 5G devices, swift network expansion in numerous nations, and concerted efforts by prominent governments. Furthermore, the 5G domain advancements have also contributed to market expansion. The Ministry of Science and ICT has reported that as of February 2023, the nation has 29.13 million 5G subscribers, indicating a 113% surge compared to 13.66 million 5G subscribers in February 2021.

- Moreover, the rising region's automotive sector across various countries like India, China, Japan, and others is expected to drive the demand for the market further. For instance, The automotive industry in China is expanding rapidly, and the region is assuming a more prominent position in the global auto industry. China is among the leading nations in adopting electric vehicles, which are gaining popularity. In 2022, the China Passenger Car Association reported that 5.67 million EVs and plug-ins were sold in China as consumers shifted from gas-guzzling models due to government incentives and elevated oil prices. The EV industry is expected to drive a rapid increase in demand for car power management solutions, thereby driving the need for PMIC devices.

Power Management Integrated Circuit (PMIC) Market Overview

The power management integrated circuit (IC) market is characterized by a high degree of fragmentation, featuring prominent players like Texas Instruments Incorporated, Semiconductor Components LLC (onsemi), Analog Devices Inc., ROHM Co. Ltd, and Vishay Intertechnology Inc. These key players in the market are actively pursuing various strategies, including partnerships and acquisitions, to enhance their product portfolios and establish sustainable competitive advantages.

In April 2023, Texas Instruments made a significant announcement regarding its latest offering, the SimpleLink family of Wi-Fi 6 companion integrated circuits (ICs). These ICs are designed to cater to applications operating in high-density or high-temperature environments, with the capability to withstand temperatures up to 1050C. The initial products within TI's new CC33xx family encompass options for Wi-Fi 6 connectivity alone, as well as Wi-Fi 6 paired with Bluetooth Low Energy 5.3 connectivity, all integrated into a single IC. This innovative solution facilitates a secure IoT connection with dependable RF performance when interfacing with a microcontroller unit (MCU) or processor, particularly in industrial sectors like grid infrastructure, medical, and building automation.

In May 2023, Semiconductor Components LLC (onsemi) announced a strategic partnership with Vitseco Technologies aimed at bolstering SiC (Silicon Carbide) technology capacity expansion. The two companies have entered into a substantial 10-year long-term supply agreement valued at USD 1.9 billion, primarily centered on SiC products. Under the terms of this agreement, Vitseco will inject USD 250 million in investment to Onsemi for the acquisition of new equipment dedicated to SiC wafer production, boule growth, and epitaxy processes. This strategic move is intended to secure a stable and robust SiC capacity for the future, ensuring both companies are well-positioned to meet growing market demands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Energy-efficient Battery-powered Devices

- 5.1.2 Electrification Trend in the Automotive Sector

- 5.2 Market Restraints

- 5.2.1 Design Complexity and Performance Limitations in High-power Applications

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Voltage Regulators

- 6.1.2 Motor Control ICs

- 6.1.3 Battery Management ICs

- 6.1.4 Multi-channel PMIC

- 6.1.5 Other Products

- 6.2 By End-User

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Industrial

- 6.2.4 Communication

- 6.2.5 Computing

- 6.2.6 Other End-Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 Semiconductor Components Industries LLC (Onsemi)

- 7.1.3 Analog Devices Inc.

- 7.1.4 ROHM Co. Ltd

- 7.1.5 Vishay Intertechnology Inc.

- 7.1.6 NXP Semiconductors N.V.

- 7.1.7 Infineon Technologies AG

- 7.1.8 Qualcomm Incorporated

- 7.1.9 Renesas Electronic Corporation

- 7.1.10 STMicroelectronics N.V.