|

市場調查報告書

商品編碼

1404328

IP 多媒體子系統 (IMS) 服務 -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測IP Multimedia Subsystem (IMS) Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

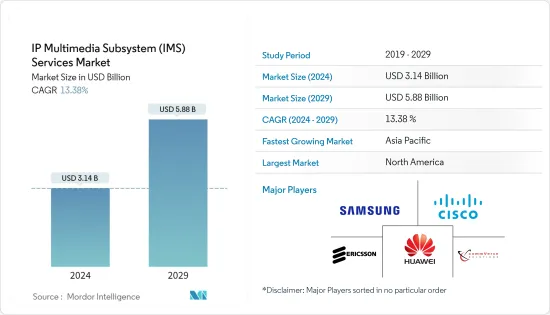

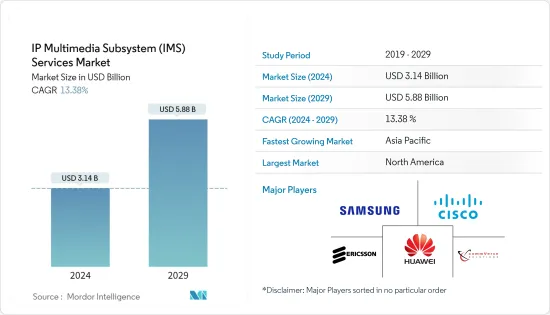

IP多媒體子系統服務市場規模預計2024年為31.4億美元,預計到2029年將達到58.8億美元,在預測期內(2024-2029年)複合年成長率為13.38%,預計將成長。

LTE 和 VoLTE 的普及、5G 的普及以及各種多媒體服務的日益使用是顯著推動市場成長機會的因素。

主要亮點

- 網路管理是任何企業的關鍵要素,因此在企業營運中扮演重要角色。在當今的數位時代,管理網路基礎設施至關重要。透過投資各種先進的網路基礎設施技術,如雲端服務、資料中心、SDN、NFV、IP網路、固定無線寬頻網路、企業移動性、網路編配等,企業可以為其業務系統釋放新的機遇,改善業務系統。日常表現。我們正在簡化業務。

- 長期演進技術(LTE) 技術在行動網路中的普及正在加速基於 IMS 的服務在全球的全面採用。該技術在美國、歐洲和亞洲的 LTE資料和高畫質語音服務中經歷了強勁成長,推動了巨大的市場成長機會。

- 行動網路營運商 (MNO) 正在大量利用 IP 多媒體子系統 (IMS) 來實現其現有服務的現代化。例如,2023 年 2 月,透過雲端原生解決方案創造網路未來的網路軟體供應商 Mavenir 和 Virgin Media O2虛擬,他們正在創建虛擬化服務來提供 Wi-Fi 語音 (VoWiFi) 和 LTE 語音 (VoLTE) ).宣布O2 Mobile 客戶完全遷移至IMS(IP 多媒體子系統)解決方案。

- 然而,缺乏使用和管理下一代網路和虛擬解決方案所需的經驗豐富、技術精湛的網路工程師可能會限制整個預測期內的市場成長。

- 通訊服務業是IMS服務的重要終端使用者之一。從行動通訊業者到寬頻營運商再到資料中心營運商,眾多營運商都受益於 COVID-19 大流行期間語音和資料流量的大幅成長。因此,與其他行業相比,電訊業在大流行期間表現良好,預計在 COVID-19 後的情況下也將如此。

IP多媒體子系統(IMS)服務市場趨勢

5G的出現提供了潛在的機會

- 5G技術可望從根本上改變通訊技術在社會中的作用。它還實現了超連網型社會的廣泛數位化,每個人在需要的時候都可以連接到網路,並虛擬地連接到許多其他設備,從而創建一個全連接的社會。這很有可能會到來。真的。

- 支援 5G 的 IMS 核心具有許多顯著的優勢。 5G IMS 通常需要使用微服務方法來建構雲端原生,這提供了許多好處,包括比虛擬機器更有效率的基於容器的作業系統虛擬。

- 此外,5G IMS 將支援各種豐富多媒體應用的快速成長,例如高畫質內容的 OTT 串流、遊戲和擴增實境,並將允許物聯網 (IoT) 連接裝置在高系統頻譜下運作。與通訊骨幹網路的機載連接具有高效且無所不在的連接性。

- 2023 年 7 月,建立網路未來(尤其是在任何雲端上運行的雲端原生解決方案)的網路軟體供應商 Mavenir 宣布,圭亞那網路、電視和 ICT 解決方案的主要供應商 ENet 將宣布我們已經開始全國全面運作4G、5G語音和收費服務。 ENet的新網路服務由Mavenir的雲端原生IMS和Mavenir的數位啟用平台、數位業務支撐系統和融合計費系統提供支援。

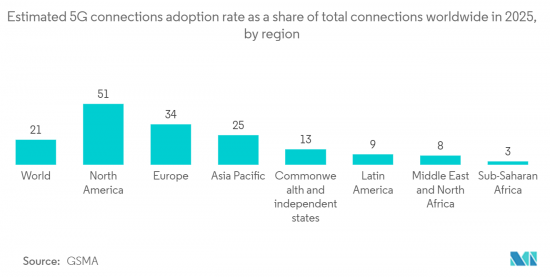

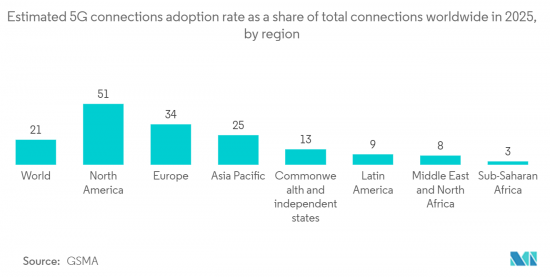

- 此外,5G 預計還將支援智慧農業、智慧城市、物流和公共機構等新使用案例。根據GSMA預計,到2025年,全球連線的約21%將是5G連線。其中大部分將發生在北美,預計該地區所有連接的 51% 是 5G 連線。因此,5G的成長預計將為IP多媒體子系統(IMS)服務市場提供重大繁榮機會。

亞太地區成長率最高

- 世界上成長最快的經濟體是亞太地區。該地區正在見證智慧城市、自動駕駛汽車、物聯網 (IoT) 應用、家庭自動化、工業自動化和智慧型處理技術等智慧技術的快速普及。這些關鍵因素預計將推動市場擴張。

- 此外,該地區最大的電信市場之一是印度。此外,印度網路和行動協會預測,到2025年,印度的活躍線上用戶將超過9億。曾幾何時,活躍的都市區和農村網路用戶之間存在著鴻溝,但科技的快速進步正在縮小這一差距。

- 此外,印度政府也促進了電信業者的發展。例如,政府推出了「數位印度」計劃,以解決醫療保健和零售等各個行業的問題,這些行業預計將透過網路變得更加互聯。由於這些重要舉措的實施,IP 多媒體子系統 (IMS) 服務市場預計將在該地區呈指數級成長。

- 亞太地區是5G最重要的市場之一,新興市場高度開拓,基本客群龐大。此外,該地區正在大力投資 5G 市場。印度、中國、日本、新加坡、澳洲和韓國等國家正大力投資開拓國內 5G 市場,預計也將促進該地區的市場研究。

- 此外,中國正在見證主要領先公司的各種收購、合併和投資,作為其策略的一部分,以改善其整體業務和影響力、接觸客戶並滿足各種應用的要求。例如,2022年12月,中國移動與愛立信將聯合推出節能5G站點,加速節能排放工作。愛立信聯合中國移動江蘇省推出無碳700MHz 5G智慧站點。愛立信也與中國移動廣東省合作推出了2.6GHz頻段的節能站點。

IP多媒體子系統(IMS)服務產業概述

由於眾多主要企業的存在,IP 多媒體子系統 (IMS) 服務市場競爭非常激烈。領先公司利用策略合資、聯盟和收購來增加市場佔有率和盈利。這些擁有大量市場佔有率的公司也致力於擴大其國際基本客群。

2023 年 2 月,網路軟體供應商 Mavenir 和 Virgin Media O2 透過各種雲端原生解決方案建置網路的未來,宣布 O2 Mobile 客戶將能夠使用虛擬IMS,提供 LTE 語音和 Wi-Fi 語音服務。Fi. 我們致力於全面過渡到解決方案。此外,Virgin Media O2 擴大對其網路虛擬,打破了硬體和軟體之間的連結。虛擬使 Virgin Media O2 能夠提供更敏捷和高效的網路,使客戶能夠利用同一平台上託管的各種應用程式。

2022年11月,Plintron開發並部署了主要基於IETF和3GPP定義的標準的內部IP多媒體子系統平台,透過公共雲端在義大利成功部署VoLTE。 Plintron MVNE平台的升級主要是為了適應IMS的各種網元和現有網元。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- LTE和VoLTE的普及以及5G的到來

- 多媒體服務的使用增加

- 市場抑制因素

- 缺乏技術純熟勞工

第6章市場區隔

- 按服務

- 即時通訊

- VoIP

- VoLTE

- VoWiFi

- 其他服務

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 中東和非洲其他地區

- 北美洲

第7章競爭形勢

- 公司簡介

- Samsung Networks

- Cisco Systems Inc.

- CommVerge Solutions

- Ericsson AB

- Huawei Technologies Co. Ltd.

- IBM Corporation

- Nokia Corporation

- Oracle Corporation

- Ribbon Communications

- ZTE Corporation

第8章投資分析

第9章 市場機會及未來趨勢

The IP Multimedia Subsystem Services Market size is estimated at USD 3.14 billion in 2024, and is expected to reach USD 5.88 billion by 2029, growing at a CAGR of 13.38% during the forecast period (2024-2029).

The increasing popularity of LTE and VoLTE, the emergence of 5G, and the increasing usage of various multimedia services are significant factors that significantly boost the market's growth opportunities.

Key Highlights

- Network Management is a significant factor for any business and thus plays a critical role in business operations. In today's modern digital era, managing the network infrastructure is essential. By investing in various advanced network infrastructure technologies like cloud services, data centers, SDN, NFV, IP networks, fixed wireless broadband networks, enterprise mobility, and network orchestration, organizations are thus opening new opportunities in business systems and streamlining their daily operations.

- The surge in the Long-Term Evolution (LTE) technology in mobile networks has accelerated the overall implementation of IMS-based services worldwide. The technology has grown significantly across the United States, Europe, and Asia with LTE data as well as HD voice services, driving the market's growth opportunities significantly.

- Mobile network operators (MNOs) significantly leverage the IP Multimedia Subsystems (IMS) to modernize their existing services. For instance, in February 2023, Mavenir, the network software provider creating the future of networks with cloud-native solutions, and Virgin Media O2 declared the complete migration of O2 mobile customers to its virtualized IMS (IP Multimedia Subsystem) solution offering voice over Wi-Fi (VoWiFi) as well as voice over LTE (VoLTE).

- However, the lack of experienced and skilled network engineers for using and managing next-generation networking and virtualized solutions can restrict market growth throughout the forecast period.

- The telecommunications services industry is one of the crucial end-users of IMS services. From mobile to broadband to data center operators, a broad spectrum of telecom players benefitted from a significant rise in voice and data traffic during the COVID-19 pandemic. Hence, as a result, the telecom sector is performing well as compared to other industries amid the pandemic and is anticipated to do so during the post-COVID-19 situation.

IP Multimedia Subsystem (IMS) Services Market Trends

Emergence of 5G Offers Potential Opportunities

- 5G technology is anticipated to transform telecommunications technology's role in society fundamentally. Moreover, it is also likely to enable the pervasive digitalization of a hyper-connected society, where all people are connected to the network whenever needed and to many other devices virtually, creating a society with everything connected.

- A 5G-ready IMS Core offers various significant advantages. A 5G IMS must usually be built cloud native using microservices methodologies, thereby affording numerous benefits, including containerized OS virtualization, which is more efficient than virtual machines.

- Additionally, 5G IMS can accommodate the rapid growth of various rich multimedia applications like OTT streaming of HD content, gaming, and augmented reality, among others, while enabling devices connected to the Internet of Things (IoT) to onboard the telecommunication backbone with high system spectral efficiency and ubiquitous connectivity.

- In July 2023, Mavenir, the provider of network software building the future of networks, especially with cloud-native solutions that run on any cloud, declared that the ENet, Guyana's significant provider of internet, television, and ICT solutions, has gone live with 4G and 5G voice and billing services nationwide, across Guyana. ENet's new network services are driven by Mavenir's Cloud-Native IMS and Mavenir's Digital Enablement Platform, a Digital Business Support System, and Converged Charging System.

- Moreover, 5G is expected to allow new use cases, such as smart agriculture, smart cities, logistics, and public safety agencies. As per GSMA, In 2025, it is estimated that around 21% of all connections worldwide will be 5G connections. Most of these would be found in North America, where 51 percent of all connections are forecasted to be 5G connections. Thus, the growth of 5G is expected to offer a massive opportunity for the IP multimedia subsystem (IMS) services market to flourish.

Asia-Pacific to Register Highest Growth Rate

- The fastest-growing economic area in the world is the Asia-Pacific region. Smart technologies, including smart cities, autonomous vehicles, Internet of Things (IoT) applications, home automation, industrial automation, intelligent processing technologies, and others, are rapidly proliferating in the area. These crucial elements are anticipated to fuel the market expansion.

- Additionally, one of the biggest telecom marketplaces in the area is in India. Furthermore, the Internet and Mobile Association of India predicts that by 2025, there will be over 900 million active online users in India. Although there used to be a divide between active urban and rural internet users, the surge in technological advancements has closed that distance.

- Additionally, the Government of India has enabled telecom companies to grow. For instance, the government introduced its Digital India program under various sectors, such as healthcare, retail, etc., which are further expected to be connected through the Internet. As a result of these vital initiatives, the IP Multimedia Subsystem (IMS) services market is expected to grow drastically within the region.

- Asia Pacific is also one of the most significant markets for 5G, owing to the highly developing telecom sector and large customer base. Additionally, the region is heavily investing in the 5G market. Countries like India, China, Japan, Singapore, Australia, and South Korea are investing a hefty sum of money in developing the domestic 5G market, which is also anticipated to drive the market studied in the region.

- Moreover, China is witnessing various acquisitions, mergers, and investments by key major players as part of its strategy to improve its overall business and its presence to reach customers and meet their requirements for various applications. For instance, in December 2022, China Mobile and Ericsson jointly launched energy-efficient 5G sites to accelerate their energy conservation and carbon emission reduction efforts. Ericsson and China Mobile Jiangsu have launched a 5G smart site on the 700MHz band that does not produce carbon dioxide. Ericsson has also partnered with China Mobile Guangdong to launch an energy-efficient site on the 2.6GHz band.

IP Multimedia Subsystem (IMS) Services Industry Overview

The IP Multimedia Subsystem (IMS) Services Market is incredibly competitive, mainly due to the presence of various prominent players. The major companies use strategic joint ventures, partnerships, acquisitions, etc., to raise their market share and profitability. Having a sizable market share, these players also focus on growing their client base internationally.

In February 2023 - Mavenir, the network software provider proficient in building the future of networks with various cloud-native solutions, and Virgin Media O2 declared the complete migration of O2 mobile customers to its virtualized IMS solution offering voice over LTE and voice over Wi-Fi. Moreover, Virgin Media O2 is virtualizing its network, breaking the linkage between hardware and software. Virtualization gives Virgin Media O2 the ability to deliver a more agile, efficient network, allowing customers to utilize an array of applications, all hosted under the same platform, driving down costs and paving the way for future innovations and new services.

In November 2022, Plintron developed and deployed an internal IP multimedia subsystem platform primarily based on standards defined by the IETF and 3GPP and successfully implemented VoLTE deployment in Italy via the public cloud. The Plintron MVNE platform was upgraded primarily to accommodate various network elements of IMS and existing network elements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Popularity of LTE and VoLTE and Emergence of 5G

- 5.1.2 Increasing Use of Multimedia Services

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Instant Messaging

- 6.1.2 VoIP

- 6.1.3 VoLTE

- 6.1.4 VoWiFi

- 6.1.5 Other Services

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Mexico

- 6.2.4.2 Brazil

- 6.2.4.3 Rest of Latin America

- 6.2.5 Middle East and Africa

- 6.2.5.1 United Arab Emirates

- 6.2.5.2 South Africa

- 6.2.5.3 Rest of Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Networks

- 7.1.2 Cisco Systems Inc.

- 7.1.3 CommVerge Solutions

- 7.1.4 Ericsson AB

- 7.1.5 Huawei Technologies Co. Ltd.

- 7.1.6 IBM Corporation

- 7.1.7 Nokia Corporation

- 7.1.8 Oracle Corporation

- 7.1.9 Ribbon Communications

- 7.1.10 ZTE Corporation