|

市場調查報告書

商品編碼

1403968

氣霧罐:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

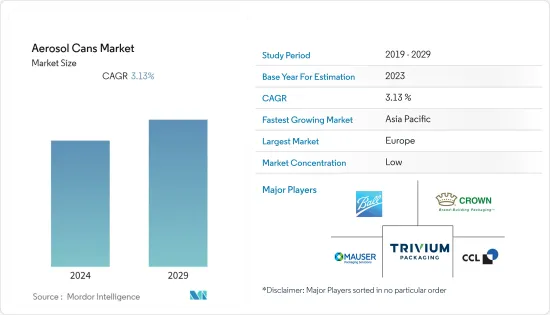

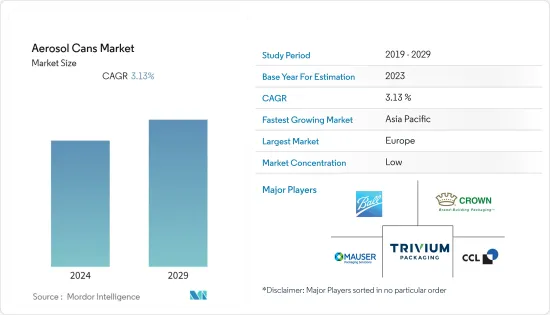

氣霧罐市場規模預計將從2024年的191.2億個擴大到2029年的223.1億個,在預測期內(2024-2029年)複合年成長率為3.13%。

主要亮點

- 氣霧罐具有防漏性,可保護其內容物免受污染和蒸發,並促進許多工業流程,例如噴漆、拋光和潤滑。此外,氣霧罐也用於除臭劑、髮膠、清潔劑家用包裝產品。氣溶膠噴霧劑用於空氣淨化和害蟲防治技術。

- 氣霧罐的可重複使用性和可回收性是推動市場成長的主要因素。氣霧罐可以無限期回收,因為它們由金屬製成,並且是按照環境法規製造的。用戶可以受益於包裝的成本優勢,同時消除浪費問題。供應商可以透過他們的產品為永續性目標做出貢獻。

- 此外,化妝品和個人護理行業的成長也是推動市場成長的主要因素。由於可支配收入的增加、消費者生活方式的改變、產品展示和差異化以及對除臭劑和髮膠等產品的需求不斷增加,氣霧罐可能會被消費。由於需求量大,鋁製氣霧罐正迅速獲得市場認可。

- 鋁氣霧罐具有高度彈性,已成為該行業的重要方面。此外,可回收材料的可用性也有助於提高易用性,從而推動需求。透過創新設計,公司可以節省材料並用有限的材料生產更多的鋁製氣霧罐。

- 在化妝品和個人護理品產業,消費者俱有很高的議價能力。這是由於競爭加劇以及來自不同製造商的化妝品的可用性。購買競爭產品的消費者可以迫使製造商降低產品價格,這是氣霧罐市場的主要限制。此外,由於人們越來越擔心氣霧罐對環境的影響,有關氣霧罐處置的法規可能繼續對市場構成挑戰。

- 各種藥品的開發激增,對氣霧罐的需求增加,但供應鏈陷入困境,導致通貨膨脹。除此之外,俄羅斯和烏克蘭戰爭因能源危機對市場產生了負面影響。新冠疫情過後,化妝品和個人護理等終端用戶行業開始全面高效營運,以滿足不斷成長的需求,最終對市場產生積極影響。

氣霧罐市場趨勢

個人護理和化妝品行業需求的增加推動市場

- 由於技術和產品的突破、知名公司的併購、虛擬試妝的出現以及線上市場的出現,美容和個人護理領域正在發生巨大的變化,對化妝品和護膚品的需求增加。

- 隨著西方風格的巨大影響力和氣霧罐製造商的崛起,國內外許多製造商正在逐漸增加他們的存在。在美容和零售行業,每年都會開發許多產品。

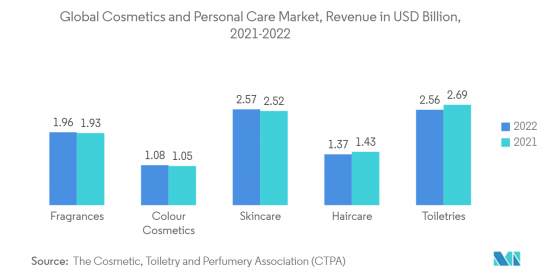

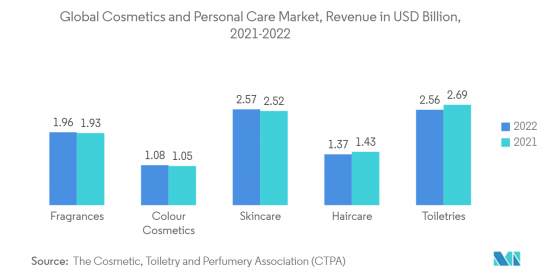

- 提高客戶對外觀的敏感度是推動氣霧罐市場擴張的關鍵因素之一。彩妝品、護膚和護髮是千禧世代日常使用的美容和個人護理產品。含有天然、無毒、有機成分的化妝品的出現也推動了市場的擴張。香水、彩妝、護膚、護髮等各類化妝品及個人護理領域在2021-2022年都呈現正成長。

- 已開發地區和新興地區個人護理和化妝品行業的成長正在推動市場成長。人口的增加、人們對外表的關注度的改變以及消費者購買力的提高是推動市場成長的因素。

歐洲可望成為重要市場

- 氣霧罐在除臭劑和香水產業的使用不斷增加,是法國等歐洲國家市場的關鍵成長要素。法國香水產業是全球化妝品產業最受歡迎的領域之一。近年來,法國香水市場經歷了顯著成長。根據化妝品、洗護用品和香水協會(CTPA)預測,2022年法國將成為全球第二大化妝品和個人護理國內市場。

- 至2022年,香水產業約佔歐洲化妝品和個人護理市場的16%。這一成長得益於新產品發布方面的持續創新。世界領先香水製造商之間的廣泛研究、開發和合作正在推動香水行業的發展,並推動對氣霧劑包裝(包括氣霧劑罐)的需求。

- 德國的汽車工業不斷發展,對氣霧罐的需求也不斷增加。根據德國貿易投資署(GTAI)的數據,德國是歐洲最大的汽車生產和銷售市場,約佔小客車製造量的25%。

- 鋼製氣霧罐被廣泛認為是油漆和被覆劑的優秀包裝解決方案。此外,它還具有特殊高溶劑塗料所需的高擴散阻隔性能。此外,隨著通用機械、電子馬達、汽車和精密設備等機械產業的擴大,市場預計將會成長。

- 義大利化妝品市場提供了許多商機,國際公司正在投資在該國促銷其產品和品牌。它還使公司能夠有效地推廣自有品牌並迎合義大利偏好和時尚偏好。主要進口為彩妝和護膚品,義大利幾乎進口所有化妝品原料,原料需求預計將持續成長。所有這些因素都在推動該國氣霧罐市場的發展。

- 在英國,由於收入增加、生活便利,對氣霧罐的需求不斷增加。由於人們對環境問題的日益關注,最終用戶行業尋求氣霧罐,因為其對環境的影響較小。氣霧罐的高可回收性是研究市場的關鍵促進因素之一。

氣霧罐產業概況

氣霧罐市場競爭對手之間的競爭非常激烈,並且由於現有參與者的存在,預計在預測期內將保持不變。市場上的知名企業有 Ball Corporation、Crown Holdings Inc.、Nampak Ltd.、CCL Containers、Trivium Packaging BV 等。每個參與者都專注於開拓創新產品和擴大設備,以回應市場並在競爭激烈的市場中獲得佔有率。

- 2022 年 8 月,波爾公司推出了輕質 ReAl 合金,同時加入了使用再生能源來源的鋁和 50% 的回收成分,將包裝的碳排放減少了一半。推出了一種新型鋁氣霧罐。

- 2022年8月,Colep Packaging收購了西班牙鋁氣霧劑製造商ALM Envases 40%的股權。此次收購是為了擴大公司的包裝解決方案。這是公司策略實施的另一個舉措,為市場提供更有效的答案,並加強與客戶的合作關係。此次收購也將使 Challenge 能夠利用 ALM 的技術和專業知識來應對更具挑戰性的氣霧罐市場。

- 2022年2月,Trivium Packaging在美國和巴西的工廠投資4,000萬美元,擴大鋁氣霧罐和飲料瓶的生產。此次擴張可能有助於該公司滿足快速成長的氣霧劑包裝需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 烏克蘭和俄羅斯衝突對市場的影響

第5章市場動態

- 市場促進因素

- 氣霧罐的可回收性

- 個人護理和化妝品行業需求不斷成長

- 市場抑制因素

- 關於氣霧罐的使用和處置的規定

第6章市場區隔

- 依材料類型

- 鋼

- 鋁

- 其他材料

- 按最終用戶產業

- 個人護理

- 家庭用品

- 車

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 法國

- 德國

- 義大利

- 西班牙

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 阿根廷

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- Ball Corporation

- Crown Holdings, Inc.

- Trivium Packaging

- Mauser Packaging Solutions

- Toyo Seikan Co. Ltd.

- CCL Container

- Colep Packaging

- CPMC Holdings Limited

- TUBEX Holding GmbH

第8章投資分析

第9章市場的未來

The Aerosol Cans Market size is expected to grow from 19.12 billion units in 2024 to 22.31 billion units by 2029, growing at a CAGR of 3.13% during the forecast period (2024-2029).

Key Highlights

- Aerosol cans are leakeproof which helps in protecting the content from contamination & evoporation and make many industrial processes, such as painting, polishing, and lubricating, easier. Additionally, aerosol cans are used for domestic packaging products, including deodorants, hairsprays, and detergents. Aerosol sprays are used in air purification and pest control techniques.

- The reusability and recyclability of aerosol cans are key factors driving the growth of the market. The aerosol cans can be recycled indefinitely as they are made of metal manufactured as per environmental regulations; users benefit from the cost advantages of packaging while eliminating disposal concerns. It helps the vendors contribute to sustainability goals through the products.

- Further, the growing cosmetics and personal care industries are significant factors behind the market's growth. Aerosol cans will likely be consumed by rising disposable incomes, changing consumer lifestyles, product presentation and differentiation, and increased demand for products such as deodorants, hairsprays, and more. Due to high demand, aluminum aerosol can is rapidly gaining acceptance in the market studied.

- Aluminium aerosol cans offer high flexibility, a crucial industry aspect. Additionally, the eased recyclable material availability adds to its usability, thus driving the demand. With companies innovating in design, material savings enable companies to produce more aluminum aerosol cans with limited material.

- Consumers have high bargaining leverage in the cosmetics and personal care industry. This is owing to increased competition and the availability of cosmetics from different manufacturers. The consumers buying competitors' products can force manufacturers to lower their product prices which is a significant limitation for the aerosol cans market. Also, the regulation over the dispose of aerosol cans may remain the challegene for the market due to the increased focus on environmental effects.

- The surge in development of different pharmaceutical products resulted in increased demand for aerosol cans during the pandmeic but the supply chain struggled which led to inflation. Besides this, Russia-Ukraine war had adverse impact on the market due to the energy crisis. Post-COVID the end-user industries such as cosmetics & personal care started to operate at full efficiencies to cater the growing demand which ultimately has positive impact on the market.

Aerosol Cans Market Trends

Growing Demand from the Personal Care and Cosmetic Industry to Drive the Market

- The beauty and personal care sector is changing dramatically due to increased demand for cosmetics and skin care products because of technology and product breakthroughs, high-profile mergers and acquisitions, the advent of virtual try-on, and the emergence of online marketplaces.

- With the significant influence of western styles and the rise of aerosol cans providers, many domestic and international manufacturers have progressively increased their presence. The beauty and retail industry has seen more items developed over the years.

- The increased sensitivity of customers about their appearance is one of the critical elements driving aerosol cans market expansion. Color cosmetics, Skincare, and hair care are among the beauty and personal care goods millennials use daily. The emergence of cosmetics, including natural, non-toxic, and organic components, has also aided market expansion. The different cosmetics & personal care segment such as fragrances, color cosmetics, skincare, haircare, and others have showcased positive growth during 2021-2022.

- The growing personal care and cosmetic industry in developed and developing regions contribute to market growth. The rising population, shifting concern of people toward appearance, and rising consumer purchasing power is some factors driving the market growth.

Europe is Expected to Emerge as a Significant Market

- The increasing use of aerosol cans in the deodorants and perfume industry is a significant factor of growth for the market in European countries such as France. The French fragrance industry is one of the most popular segments in the global cosmetics industry. The fragrance market in France has witnessed substantial growth over recent years. France was the second largest national market in 2022 for cosmetics & personal care in the world, according to the Cosmetic, Toiletry and Perfumery Association (CTPA).

- The fragrance segment accounted for around 16% of the European cosmetic & personal care market in 2022. The increase results from ongoing innovation in terms of new product launches. Extensive research, development, and collaboration by the world's leading perfume producers drive the fragrance industry, which bolsters the demand for aerosol packaging, including aerosol cans.

- With the growing automotive industry in Germany, the country's demand for aerosol cans is increasing. According to the German Trade and Invest (GTAI), Germany is the Europe's biggest automotive market in terms of production as well as sales, accounting for around 25 percent of all the passenger cars manufactured.

- Steel aerosol cans are widely recognized as an excellent packaging solution for paint and coatings, being robust and able to offer the kind of protection a chemical product, such as paint, needs. In addition, it has a high diffusion barrier required for special high-solvent paints. The market is also expected to grow with the expansion of the machinery industry in a broad sense, including general machinery, electronic motors, vehicles, precision appliances, etc.

- The Italian cosmetics market offers many opportunities, and international businesses invest in promoting their products and brands in the country. Also, companies can effectively promote their brand and appeal to Italian tastes and fashion preferences. The main imports are make-up and skin care products, Italy imports almost all cosmetic ingredients, and demand for raw materials will continue to grow. All such factors leverage the market for aerosol cans in the country.

- The United Kingdom is undergoing demand for aerosol cans with rising income, ease, and convenience. The end-user industries demand aerosol cans, owing to their low environmental impact due to the increasing environmental concerns. The high recyclability of aerosol cans is one of the significant driver for the market studied.

Aerosol Cans Industry Overview

The intensity of competitive rivalry in the aerosol cans market is high and expected to remain the same throughout the forecast period due to the presence of established players. Prominent players in the market include Ball Corporation, Crown Holdings Inc., Nampak Ltd., CCL Containers, Trivium Packaging B.V., etc. The players are focusing on developing innovative product and expanding facilities to cater the market and gain the market share in the competitive market.

- In August 2022, Ball Corporation introduced a new aluminum aerosol can made with its lightweight ReAl alloy while incorporating 50% recycled content and aluminum smelted using renewable energy sources in a bid to half the pack's carbon footprint.

- In August 2022, Colep Packaging acquired a 40% stake in ALM Envases, an aluminum aerosols provider from Spain. The acquisition was to enlarge the packaging solutions of the company. This is one more step in the strategic implementation that gives the company a more effective answer to the market and a strengthened partnership with its customers. Also, the acquisition will allow Colep to use ALM's technology and expertise to cater to the more challenging market in aerosol cans.

- In February 2022, Trivium Packaging invested USD 40 million in United States and Brazil facilities to expand the production of aluminum aerosol cans and beverage bottles. The expansion will help the company meet the fastest growing demand for aerosol packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Ukraine-Russia Standoff on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Recyclability of Aerosol Cans

- 5.1.2 Growing Demand from the Personal Care & Cosmetics Industry

- 5.2 Market Restraints

- 5.2.1 Regulations over the Usage and Dispose of Aerosol Cans

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Steel

- 6.1.2 Aluminium

- 6.1.3 Other Materials

- 6.2 By End-user Industry

- 6.2.1 Personal Care

- 6.2.2 Household Care

- 6.2.3 Automotive

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 France

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 Spain

- 6.3.2.5 United Kingdom

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Argentina

- 6.3.4.2 Brazil

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Corporation

- 7.1.2 Crown Holdings, Inc.

- 7.1.3 Trivium Packaging

- 7.1.4 Mauser Packaging Solutions

- 7.1.5 Toyo Seikan Co. Ltd.

- 7.1.6 CCL Container

- 7.1.7 Colep Packaging

- 7.1.8 CPMC Holdings Limited

- 7.1.9 TUBEX Holding GmbH