|

市場調查報告書

商品編碼

1403927

農業薄膜:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Agriculture Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

全球農膜市場規模預計將從2024年的117億美元成長到2029年的160.3億美元,預測期內複合年成長率為6.40%。

主要亮點

- 擴大採用保護性耕作、注重提高農業產量、採用地膜以及對生物分解性薄膜的需求不斷成長正在推動農膜市場的發展。由於世界人口的增加和耕地面積的減少,世界各地對糧食安全的擔憂日益加劇,對農業薄膜提高農業生產力的需求不斷增加。農用薄膜可用於土壤保護、溫室栽培和覆蓋。其他好處包括減少土壤侵蝕和板結、溫度調節、營養保護、種子發芽、雜草控制和紫外線防護。

- 隨著人們對環境問題的興趣不斷成長,對生物分解性農用薄膜的需求預計在未來一段時間內將繼續成長。這些環保替代品在雜草控制、溫度調節、土壤養分和保水以及提高植物穩定性方面發揮著重要作用。此外,世界各國政府正積極推廣永續農業和環境友善農業實踐,進一步增強未來幾年的市場前景。

農膜市場趨勢

向保護性農業的轉變推動了農業薄膜的需求

- 隨著世界人口的成長和人們對糧食安全的日益關注,保護性農業越來越受歡迎,因為它有助於延長作物的生長季節並提高產量。因此,對農用塑膠的需求不斷成長,以確保並顯著提高每公頃產量,同時提高農作物的品質。這些薄膜還可以降低與天氣、害蟲和雜草相關的作物腐敗風險,並有助於提高作物整個生命週期的作物質量,尤其是在溫室中。此外,聚乙烯廣泛用作農用薄膜的材料,以保護作物並提高溫室和隧道的產量。

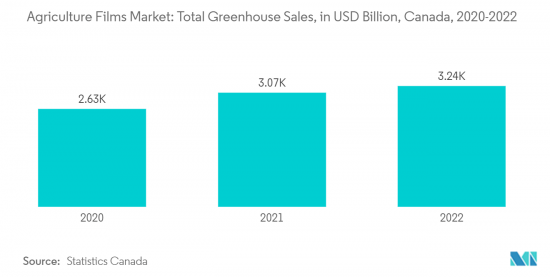

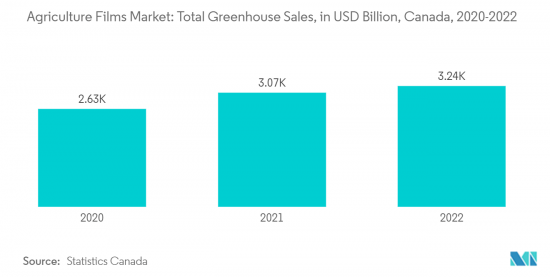

- 根據 StatCan 的數據,2021 年加拿大有 892 個溫室水果和蔬菜種植園,高於前一年的 858 個。加拿大水果和蔬菜消費的增加正在推動溫室投資,並推動該國對農業薄膜的需求。由於溫室種植面積的擴大和保護性耕作方法的日益採用,農膜市場預計在預測期內將成長。

- 除此之外,製造商還使用各種添加劑,例如抗農藥劑、紫外線 (UV) 吸收劑和防霧劑,以提高農用薄膜的使用壽命和有效性。利用奈米技術和超高溫薄膜等技術開發先進農業薄膜可能很快會對農業薄膜的需求產生積極影響。

亞太地區主導市場

- 亞太地區佔全球溫室蔬菜種植面積的近一半。大面積的溫室蔬菜種植、水果和蔬菜的高價值種植和出口導向的日益重視以及農業的蓬勃發展是推動該地區農膜市場的主要因素。由於環保意識的提高,消費者對生物分解性薄膜的興趣轉變也是市場成長的重要催化劑。

- 生物分解性的農用薄膜由多種可再生原料製成,如玉米澱粉、稻殼、果膠和食品廢棄物,對環境的影響為零或極小。除此之外,主要企業也專注於紫外線(UV)防護、近紅外線(NIR)防護、螢光和超高溫薄膜等產品創新,預計將在預測期內擴大市場成長。

- 例如,2021年4月,澳洲科學家設計的一款名為Smart Glass ULR-80的農業薄膜上市,用於商業溫室。據說這可以讓植物光合作用和生長所需的波長通過,同時阻擋有助於增熱的太陽輻射。該薄膜中使用的兩種新原型技術,節能「智慧玻璃」薄膜 ULR-80 (SG) 和 LLEAF-Red 薄膜,將綠光轉變為紅光,以最大限度地促進植物生長。我們計劃使這是現實。

- 此外,亞太地區的農民,特別是中國的農民,正在採用保護性耕作方法來提高作物生產力和品質。在中國,近330萬公頃農地實施保護耕作。印度、日本和韓國等該地區其他大國也使用農膜進行溫室和覆蓋,特別是在蔬菜種植方面。因此,透過溫室種植擴大水果和蔬菜種植預計將推動該地區的農膜市場。

農膜業概況

整個農膜市場較為分散,只有少數幾家主導企業和幾家規模較小的區域性企業。 Berry Global Inc.、 BASF SE、Armando Alvarez Group、RKW SE、Plastika Kritis SA 是市場上的一些主要企業。主要產業參與者正在大力投資研發,以將可生物分解性、長保存期限的產品商業化。主要企業正在與生物技術公司合作,以確保未來永續的產品創新。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場抑制因素

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 類型

- 低密度聚乙烯

- 線型低密度聚乙烯

- 高密度聚苯乙烯

- 乙基醋酸乙烯酯(EVA)/乙烯丙烯酸丁酯(EBA)

- 回收產品

- 其他類型

- 目的

- 溫室

- 青貯飼料

- 覆蓋

- 其他用途

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 埃及

- 其他非洲

- 北美洲

第6章競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- AB Rani Plast Oy

- BASF SE

- Berry Global Inc.

- Plastika Kritis SA

- Novamont SpA

- ExxonMobil Chemical

- Armando Alvarez Group

- Group Barbier

- RKW SE

- INDVECO Group

第7章 市場機會及未來趨勢

The global agricultural films market size is expected to grow from USD 11.7 billion in 2024 to USD 16.03 billion by 2029, at a CAGR of 6.40% during the forecast period.

Key Highlights

- The increasing adoption of protected cultivation practices, the focus on enhancing agricultural output, the adoption of mulching films, and the escalating demand for biodegradable films are driving the agricultural film market. The rising global population and declining arable land are raising food security concerns worldwide, bolstering the demand for agricultural films to improve agricultural productivity. Agricultural films help in soil protection, greenhouse farming, and mulching. They also provide the benefits of reduced soil erosion and compaction, temperature control, nutrient conservation, seed germination, weed control, and UV protection.

- As environmental concerns continue to rise, the demand for biodegradable agricultural films is poised to grow in the foreseeable future. These eco-friendly alternatives play a vital role in weed suppression, temperature regulation, soil nutrient and moisture preservation, and enhancing plant stability. Additionally, various governments worldwide are actively promoting sustainable agriculture and eco-friendly farming practices, further bolstering the market's prospects in the coming years.

Agriculture Films Market Trends

Shift Towards Protected Agriculture Drives the Demand for Agriculture Films

- Due to the growing global population and increasing food security concerns, protected agriculture is gaining immense traction as it helps extend the growing season of crops and produce higher yields. This, in turn, drives the demand for agricultural plastics for securing and significantly increasing produced output per hectare while enhancing crop quality. These films also aid in reducing the crop spoilage risk associated with weather, pests, and weeds and improving the overall crop quality, particularly in greenhouses, throughout their life cycle. Moreover, polyethylene is a widely used material for agricultural films to protect crops and improve crop yield in greenhouses and tunnels.

- According to StatCan, there were 892 greenhouse fruit and vegetable operations in Canada in 2021, up from 858 the previous year. This increased consumption of fruits and vegetables in Canada drives investments in greenhouses, boosting the demand for agricultural films in the country. With expanding greenhouse farming areas and the rising adoption of protected farming practices, the agricultural film market is expected to grow during the forecast period.

- Apart from this, manufacturers are using a wide range of additives, such as agrochemical resistance, ultraviolet (UV) absorbers, and anti-fogging agents, to improve the lifespan and effectiveness of agricultural films. Developing advanced agricultural films with technologies such as nanotechnology and ultra-thermic films will likely positively impact the demand for agricultural films shortly.

Asia-Pacific Dominates the Market

- The Asia-Pacific region occupies nearly half of the world's total area under greenhouse vegetable cultivation. Large strips of the area under greenhouse vegetables, growing emphasis on high-value and export-oriented cultivation of fruits and vegetables, and the thriving agriculture industry are key factors driving the market for agricultural films in the region. The shifting focus of consumers toward biodegradable films due to rising environmental consciousness is further acting as a significant catalyst for market growth.

- Biodegradable agricultural films are developed from various renewable feedstocks, such as corn starch, rice husk, pectin, and food waste, with zero to minimal environmental impact. Besides this, key players are focusing on product innovations like ultraviolet (UV) blocking, NIR blocking, and fluorescent and ultra-thermic films, which are expected to augment the market growth over the forecast period.

- For instance, in April 2021, an agriculture film called Smart Glass ULR-80, which Australian scientists designed for use in commercial greenhouses, was launched. This was claimed to block the solar radiation contributing to heat gain while transmitting the wavelengths plants require for photosynthesis and growth. The impacts of two novel prototype technologies, energy-reducing 'Smart Glass' film ULR-80 (SG) and LLEAF-Red film, used in this film were claimed to shift green light to red for maximum vegetative growth.

- Moreover, farmers in Asia-Pacific, particularly in China, are adopting protected agricultural practices to enhance crop productivity and quality. Almost 3.3 million hectares of crop area in China come under protected cultivation. Other large countries in the region, such as India, Japan, and South Korea, also use agricultural films in greenhouses and mulching, especially in cultivating vegetables. Therefore, the expanding cultivation of fruits and vegetables through greenhouse methods is expected to drive the market for agricultural films in the region.

Agriculture Films Industry Overview

The overall market for agricultural films is fragmented due to the presence of a few prominent players and several small-scale and regional players. Berry Global Inc., BASF SE, Armando Alvarez Group, RKW SE, and Plastika Kritis SA are some of the major players in the market. Major industry participants have been investing heavily in R&D for commercializing biodegradable and longer shelf-life products. The key companies are partnering with biotechnology firms to ensure sustainable product innovation in the future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Low-Density Polyethylene

- 5.1.2 Linear Low-Density Polyethylene

- 5.1.3 High-Density Polyethylene

- 5.1.4 Ethyl Vinyl Acetate (EVA)/Ethylene Butyl Acrylate (EBA)

- 5.1.5 Reclaims

- 5.1.6 Other Types

- 5.2 Application

- 5.2.1 Greenhouse

- 5.2.2 Silage

- 5.2.3 Mulching

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North Amercia

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Egypt

- 5.3.5.3 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AB Rani Plast Oy

- 6.3.2 BASF SE

- 6.3.3 Berry Global Inc.

- 6.3.4 Plastika Kritis SA

- 6.3.5 Novamont SpA

- 6.3.6 ExxonMobil Chemical

- 6.3.7 Armando Alvarez Group

- 6.3.8 Group Barbier

- 6.3.9 RKW SE

- 6.3.10 INDVECO Group