|

市場調查報告書

商品編碼

1403867

電動液壓轉向系統-市場佔有率分析、產業趨勢與統計、2024年至2029年的成長預測Electrically Powered Hydraulic Steering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

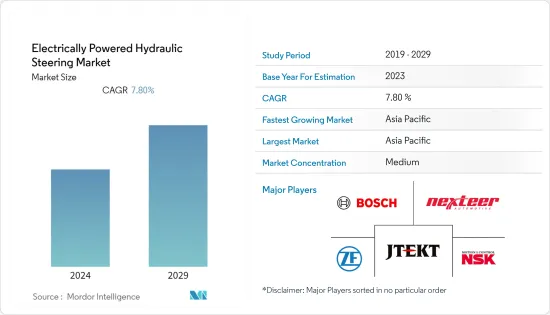

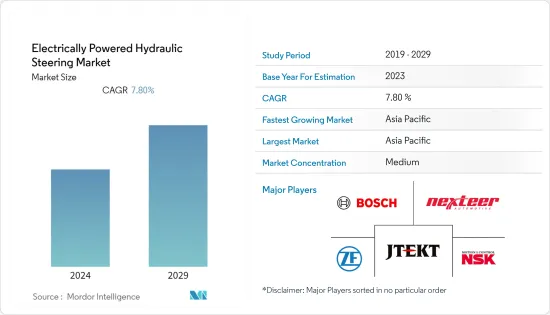

目前電動液壓轉向器市場規模為16億美元。

預計未來五年將成長至 25.1 億美元,預測期內收益複合年增率為 7.8%。

從中期來看,隨著客戶對新安全系統和技術的了解越來越多,他們將擴大選擇具有改進安全功能的汽車。對乘客安全的日益擔憂迫使汽車製造商為其車輛配備駕駛員輔助系統,尤其是轉向輔助系統。這些因素將推動未來幾年的需求。

現在,透過使用電動液壓油壓混合動力系統,可以在不使用引擎驅動的液壓泵的情況下操作傳統的液壓轉向。相反,不由引擎提供動力的電動幫浦單元提供液壓。該技術在使用傳統液壓轉向作為主要技術的車輛中最有用,但也可用於混合動力電動車模型。

電動液轉向的優點是操控輕便,轉向時舒適度高。另一方面,高速時轉向強勁。功率攝取量根據需求而變化,從而提高整體燃油經濟性。預計亞太地區的銷售額在預測期內將大幅成長。

電動液壓轉向幫浦 (EHPS) 為中型和重型商用車的油壓輔助轉向系統精確供應適量的油。在恆定供給速率下,EHPS 與傳統轉向幫浦相比可節省高達 70% 的能源,且能源使用適應駕駛環境。

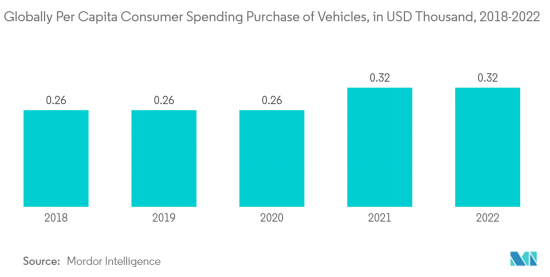

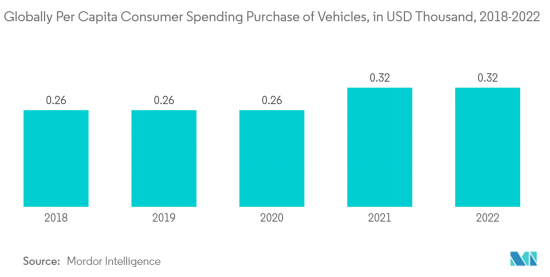

按地區分類,亞太地區在汽車 EPS 市場佔據主導地位。亞太地區EPS市場的推動因素包括汽車產量和銷售的增加、車輛的快速電動、更嚴格的排放氣體法規以及消費者可支配收入的增加。因此,人們對安全性和舒適性的偏好日益增強,從而增加了汽車銷售的需求。

電動液壓轉向器市場趨勢

電動轉向技術的進步推動成長

事故數量的大幅增加也促使最終用戶採用更好的安全系統。道路和車輛設計的改進穩步降低了所有第一世界國家的傷害和死亡率。然而,由於一些開發中國家的事故率仍然很高,各國政府正在專注於實施嚴格的安全標準並支持在汽車中採用各種安全增強子系統。

在這些因素的推動下,汽車製造商正在將多種安全增強系統整合到他們的車輛中。先進的安全和安全功能不再僅限於豪華車。消費者現在更關心安全系統和技術。因此,他們有興趣選擇一輛安全系統更好的汽車。

世界上多個國家針對車輛污染和燃油效率制定了嚴格的法規。美國NHTSA(運輸部交通安全管理局)和歐洲ICCT(國際清潔交通理事會)等監管機構均已採用車隊等級的要求。這些標準規定了汽車製造商必須遵守的平均排放氣體量。

在過去的十年中,汽車行業越來越傾向於在世界各地的小客車和商用車中使用電動轉向系統,以配合日益嚴格的法規。該系統消除了轉向泵浦、軟管、液壓油和其他隨著時間的推移而劣化並需要頻繁更換的汽車零件的需要。因此,在最近的新車中,已經更換為電動轉向系統。隨著 EPS 組件數量的減少,以及全球更嚴格的排放法規增加了對輕型車輛的需求,對 EPS 系統以及擴展馬達的需求正在顯著增加。

這些需求迫使汽車製造商增加對電動轉向等節能轉向技術的投資。為了滿足這些需求,各公司正在共同開發先進的轉向系統。例如

- 2022 年 3 月,蒂森克虜伯與日本精工株式會社 (NSK) 達成協議,探討蒂森克虜伯汽車與 NSK 轉向部門於 2022 年 3 月成立合資企業。該合作備忘錄尋求蒂森克虜伯汽車公司的汽車業務與 NSK 的轉向部門之間建立技術和戰略合作夥伴關係。

由於上述全球市場的開拓,預計該市場在預測期內將顯著成長。

亞太地區可望成為市場領導者

中國在亞太汽車市場佔據主導地位。隨著汽車安全措施和先進安全技術如ESC(電子電子穩定控制)、ADAS(先進駕駛輔助系統)等的接受度不斷提高,市場在預測期內可能會大幅成長。

在中國,隨著小客車需求的增加,感測器在汽車中的使用迅速增加。中國推出了安全法規並實施了新車評估計畫(C-NCAP),制定了與歐洲同等的標準。這些規定實施後,中國立即發生了重大的法律和社會變化。

汽車電動的不斷成長趨勢是推動汽車轉向感測器市場的關鍵因素。因此,汽車製造商擴大與感測器製造商合作,以滿足消費者的需求。此外,較低的系統價格也將支援最新感測器和半導體產品在中國的快速普及,對目標市場的成長產生正面影響。

- 2022年4月,中國爆發的COVID-19疫情日益頻繁,給市場相關人員帶來了挑戰,也給中國經濟帶來了負面壓力。在此期間,汽車產業和供應鏈面臨終極挑戰。此外,一些主要汽車製造商已經停產,並面臨巨大的物流挑戰,導致交付能力崩壞。

此外,COVID-19 的爆發削弱了整體購買力和消費者信心。儘管市場逐漸復甦,仍面臨疫情帶來的挑戰。

參與轉向感測器供應和銷售的公司期待在其他機會區域進行大規模部署。多家OEM正在與汽車製造商合作,將增強型產品推向市場。例如

- 2021年7月,中國領先的轉向零件和系統供應商中國汽車系統股份有限公司表示,為阿爾法羅密歐開發新型方向盤已進入OTOP(Off Tool Off Process)階段。

由於上述國家的發展,未來幾年對電動液壓轉向系統的需求可能會增加。

電動液壓轉向器產業概況

電動液壓轉向器市場由 JTEKT Corporation、Nexteer Automotive Group Ltd、ZF Friedrichshafen AG、NSK Ltd 等主要企業主導。汽車零件製造商正在全球迅速擴張,市場可能在預測期內顯著成長。

- 2023 年 5 月,NSK Ltd. 擴大了在中國的研發設施。透過此次擴張,該公司擴大了在產品系列。

- 2022年1月,博世與大眾集團子公司Cariad同意建立廣泛的合作關係,共同努力實現這一目標。兩家公司希望使部分和高度自動駕駛適合大規模生產,從而為廣大消費者提供服務。此次合作旨在為大眾汽車集團品牌銷售的車輛提供一項功能,讓駕駛者可以暫時將手從方向盤上移開。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 政府措施和對安全的日益重視推動市場發展

- 市場抑制因素

- 線控轉向系統的採用阻礙了市場成長

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模(美元))

- 依組件類型

- 方向盤/轉向柱

- 感應器

- 方向盤馬達

- 其他

- 按車型

- 小客車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區 中東/非洲

- 南美洲

- 中東/非洲

- 北美洲

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- NSK Ltd.

- ZF Friedrichshafen AG

- Showa Corporation

- Robert Bosch GmbH

- Continental AG

- JTEKT Corporation

- Mando Corporation

- Mitsubishi Electric Corporation

- Nexteer Automotive

- Danfoss

- ThyssenKrupp AG

第7章 市場機會及未來趨勢

The Electrically Powered Hydraulic Steering market is valued at USD 1.60 billion in the current year. It is anticipated to grow to USD 2.51 billion by the next five years, registering a CAGR of 7.8% in terms of revenue during the forecast period.

Over the medium term, as customers are becoming more aware of new safety systems and technology, they are increasingly selecting vehicles with improved safety features. Automotive manufacturers are forced to equip their vehicles with driver assistance systems, particularly steering assistance systems, as passenger safety concerns grow. Such factors are pushing the demand in the coming years.

Traditional hydraulic steering can now be operated without the use of an engine-driven hydraulic pump owing to the usage of electro-hydraulic hybrid systems. Instead, an electric motor pump unit that does not take power from the engine provides hydraulic pressure. This technique is most useful in vehicles that use traditional hydraulic steering as their primary technology, but it is also available in hybrid-electric vehicle types.

The advantage of electro-hydraulic power steering is greater comfort: steering is light to handle when maneuvering. The steering, on the other hand, is strong at high speeds. As the power uptake changes as needed, this improves overall fuel economy. Sales in Asia-Pacific are expected to hold a significant rise throughout the forecast period.

The electro-hydraulic power steering pump (EHPS) delivers precisely the proper amount of oil for hydraulic steering systems in medium and heavy commercial vehicles. EHPS provides up to 70% energy savings over traditional power steering pumps with a constant supply volume, and energy usage adapts to the driving environment.

Among regions, Asia-Pacific dominated the automotive EPS market. The Asia-Pacific EPS market is primarily driven by growing vehicle production and sales, rapid electrification of vehicles, rising stringency of emission norms, and increasing disposable income of consumers. It, in turn, is increasing the demand for vehicle sales, owing to the growing preference for safety and comfort.

Electrically Powered Hydraulic Steering Market Trends

Advancements in Electric Power Steering Technology is Driving Growth

A significant increase in the number of accidents also encouraged end users to adopt better safety systems. Improvements in roadway and motor vehicle designs steadily reduced injury and death rates in all first-world countries. However, the accident rates are still higher in some developing countries, and governments are focusing on implementing stringent safety norms and supporting the adoption of various subsystems in vehicles that enhance the aspects of safety.

Driven by these factors, automobile manufacturers are incorporating several systems in the vehicles that enhance safety. Advanced safety and security features are no longer restricted to premium vehicles. Consumers are now more concerned about safety systems and technologies. They are therefore interested in opting for vehicles that are equipped with better safety systems.

Several countries throughout the world enacted strict vehicle pollution and fuel economy rules. Fleet-level requirements are adopted by regulatory authorities such as the National Highway Traffic and Safety Administration (NHTSA) in the United States, the International Council on Clean Transportation (ICCT) in Europe, and other organizations. These standards establish an average emission level that carmakers must adhere to.

An increasing preference for electric power steering systems is witnessed for the past decade across the automotive industry with respect to both passenger cars and commercial vehicles around the world to complement the growing regulations. This system eliminates the need for a power steering pump, hoses, hydraulic fluids, and several other such automotive components that are prone to wear over time and require replacement very often. It can make the cost of maintenance for the vehicle high and is therefore replaced by electrically powered steering systems in the newer vehicles today. With a lesser number of components for EPS and an increasing need for lightweight vehicles due to the stringent emission norms across the world, the need for EPS systems and, consequently, the motor is immense.

These requirements forced automakers to invest more in fuel-efficient steering technology like electric power steering. To cater to these requirements, players are collaborating and co-developing advanced steering systems. For instance,

- In March 2022, Thyssenkrupp and NSK Ltd. (NSK) agreed to explore a joint venture between Thyssenkrupp Automotive and NSK's steering division. The MoU calls for a technological and strategic alignment between ThyssenKrupp's automotive business with NSK's steering division.

With the development mentioned above across the globe, it is likely to witness major growth for the market during the forecast period.

Asia-Pacific is Expected to Be Market Leader

China is dominating the vehicle market in the Asia-Pacific region. Increased acceptance of car safety measures, as well as a rise in advanced technology for safety such as ESC, Advanced Driver Assistance Systems (ADAS), etc., are likely to witness major growth for the market during the forecast period.

The use of sensors in vehicles rapidly increased with the increase in demand for passenger vehicles in China. The country introduced safety regulations to run a New Car Assessment Program, C-NCAP, with standards that will match those of Europe. There are significant legal and social changes in China soon after the implementation of these regulations.

The growing trend of vehicle electrification is a significant factor driving the automotive steering sensors market. As a result, automotive manufacturers are increasingly collaborating with sensor manufacturers to suit the needs of their consumers. Additionally, lower system prices also aided in the rapid adoption of modern sensors and semiconductor products in China, which will positively impact the target market's growth.

- In April 2022, the increased frequency of COVID-19 incidences in China created challenges for market players and put negative pressure on the Chinese economy. During this time, the automobile industry and supply chain were pushed to the ultimate challenge. Furthermore, some of the major automakers shut down production and faced enormous logistical challenges, resulting in a collapse in delivery capacity.

Furthermore, the COVID-19 epidemic weakened total buying power and consumer confidence. Although the market recovered over time, it is still facing hurdles as a result of the pandemic.

Companies operating in the supply and distribution of steering sensors are looking forward to their mass expansion in other opportunity regions. Several OEMs are partnering with carmakers to bring enhanced products to market. For instance,

- In July 2021, China Automotive Systems Inc., a major provider of power steering components and systems in China, stated that it reached the OTOP (Off Tool Off Process) phase of new steering development for Alfa Romeo.

With the development mentioned above across the country, the demand for electro-hydraulic power steering in the coming years will increase.

Electrically Powered Hydraulic Steering Industry Overview

Electrically-Powered Hydraulic Steering Market is dominated by several key players such as JTEKT Corporation, Nexteer Automotive Group Ltd, ZF Friedrichshafen AG, NSK Ltd, and Others. The rapid expansion of automotive component manufacturers across the globe is likely to witness major growth for the market during the forecast period. For instance,

- In May 2023, NSK Ltd. expanded its research and development facility in China. Through this expansion, the company expanded its product portfolio across the country.

- In January 2022, Bosch and the Volkswagen Group subsidiary Cariad are now collaborating to achieve this objective and agreed to form an extensive partnership. The companies want to make partially and highly automated driving suitable for volume production and thus available to the broad mass of consumers. For the vehicles sold under the Volkswagen Group brands, the alliance aims to make functions available that will allow drivers to temporarily take their hands off the steering wheel.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Government Initiatives and the Growing Emphasis on Safety is Driving the Market

- 4.2 Market Restraints

- 4.2.1 Adoption of Steer-By-Wire System Hindering the Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Component Type

- 5.1.1 Steering Wheel/Column

- 5.1.2 Sensors

- 5.1.3 Steering Motor

- 5.1.4 Others

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicle

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 NSK Ltd.

- 6.2.2 ZF Friedrichshafen AG

- 6.2.3 Showa Corporation

- 6.2.4 Robert Bosch GmbH

- 6.2.5 Continental AG

- 6.2.6 JTEKT Corporation

- 6.2.7 Mando Corporation

- 6.2.8 Mitsubishi Electric Corporation

- 6.2.9 Nexteer Automotive

- 6.2.10 Danfoss

- 6.2.11 ThyssenKrupp AG