|

市場調查報告書

商品編碼

1403112

半導體封裝:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Semiconductor Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

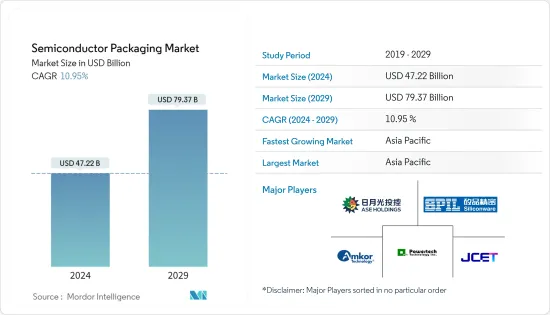

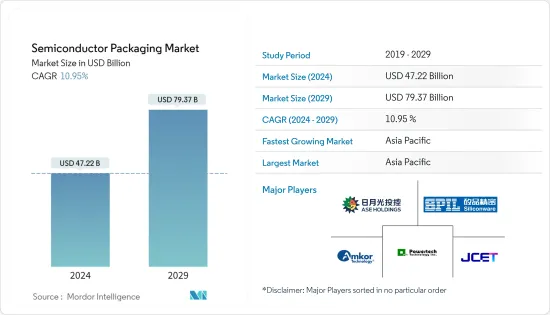

預計2024年半導體封裝市場規模為472.2億美元,預計2029年將達793.7億美元,在預測期內(2024-2029年)複合年成長率為10.95%。

先進封裝可以透過將多個晶片整合到一個封裝中來提高效能。使用穿透矽通孔、內插器、橋樑和簡單電線等因素連接這些晶片可以提高訊號速度並減少驅動這些訊號所需的能量。此外,先進的封裝允許混合在不同製程節點開發的組件。

主要亮點

- 先進封裝 (AP) 產業目前正處於重大發展的令人興奮的時刻。隨著莫耳定律的放緩以及 2nm 節點以下元件的進步吸引了台積電、英特爾和三星等行業領導者的大量研發投資,先進封裝已成為提高產品價值的寶貴工具。

- 開發電子硬體需要獲得高效能、高速、高頻寬、低延遲和低功耗的運算能力。此外,硬體必須能夠提供廣泛的功能、在系統級整合並且具有成本效益。先進封裝技術非常適合滿足這些多樣化的效能需求和複雜的異質整合要求,使企業有機會利用高效能運算、人工智慧和 5G 不斷變化的需求。

- 由於對高效能運算、物聯網和 5G 設備的需求增加,主要半導體封裝供應商的銷售成長強勁。例如,Amkor 的計算部門(包括資料中心、基礎設施、PC/筆記型電腦和儲存)佔總銷售額的 20%,高於 2022 年季度的 18%。世界各國政府實施鼓勵排放和永續交通的政策,正加速向車輛電動的轉變。

- 設計、開發和安裝半導體封裝設備以滿足各種行業的要求,包括汽車、消費性電子、醫療、IT/通訊和航太/國防,需要大量的初始投資。這可能會限制半導體封裝市場的成長。

- COVID-19大流行迫使製造業重新評估傳統生產流程,主要推動跨生產線的數位轉型和智慧製造實踐。根據半導體產業協會預測,2023年全球半導體銷售額預計將達到5,151億美元。半導體是電子設備的重要零件,產業競爭激烈。 2023年年與前一年同期比較率為10.3%,但預計2024年將快速復甦。著名的半導體晶片製造商包括英特爾和三星電子,2022年英特爾的半導體收益為584億美元,三星為656億美元,是半導體產業收益最大的公司之一。

半導體封裝市場趨勢

超高密度扇出先進封裝領域佔主要市場佔有率

- 超高密度扇出 (UHD FO) 每平方毫米有超過 18 個輸入/輸出 (I/O),線路重布(RDL) 中的線距 (L/S) 尺寸為 5 m2,即 5 m。它可以被認為是高密度 (HD) FO 的升級版本,L/S 適用於網路和資料中心伺服器等 HPC 應用的更廣泛的封裝尺寸。

- 與 2.5D矽穿孔電極(TSV) 中介層封裝相比,這些 UHD FO 是一種經濟高效的解決方案,並且有利於低階/中端 2.5D 應用,例如 HPC 和伺服器網路。超高密度扇出封裝提供高密度互連、卓越的電氣性能以及將多個不同晶粒整合到經濟高效的薄型半導體封裝中的能力。未來,UHD FO 將透過創新的 FO-on- 基板和 FO 整合橋接解決方案取代 Si 中介層。

- 隨著網際網路的發展和人工智慧產業的興起,高性能半導體積體電路已成為半導體產業的必備品。具有超密集 I/O 的 2.5D IC 封裝是最早應用於 GPU 等高效能運算 (HPC) 的結構之一。

- 超高密度 FOWLP 可實現更小的2D連接,從而在更大的區域上重新分配晶粒的功率,從而在現代設備中實現高 I/O 密度、高頻寬和高性能。

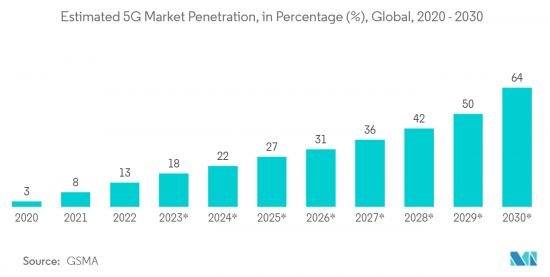

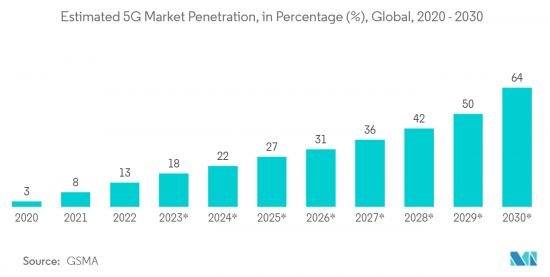

- 半導體 IC 的品質是自動駕駛和安全監控等關鍵任務、低延遲 5G 服務成功的基本要素。根據GSMA預測,5G全球市場普及預計將從2022年的13%增加到2030年的64%。隨著美國、中國、印度、英國和加拿大等國家 5G 使用量的增加,我們預計使用 5G 連線的行動用戶將大幅增加。預計這將增加對 IC 超高密度扇出實施的需求。

亞太地區預計將出現顯著成長

- 中國有一個非常雄心勃勃的半導體議程,並有 1500 億美元的巨額資金支持。該國正在發展國內積體電路產業,以增加晶片產量。由香港、中國和台灣組成的大中華區是一個地緣政治熱點。美國之間持續的貿易戰進一步加劇了該地區的緊張局勢,該地區是所有主要工藝技術的所在地,促使多家中國公司投資半導體產業。

- 例如,2023年9月,中國宣布計劃推出一個新的國有投資基金,為半導體產業籌集約400億美元。 2022年12月,中國宣布承諾提供超過1兆元(1,430億美元)支持半導體產業。該舉措是實現晶片生產自給自足的重要一步,也是對美國旨在阻礙中國技術進步的行動的回應。預計在預測期內,對包裝服務的需求將大幅增加。

- 日本在半導體和電子產業也佔有重要地位,因為它是主要積體電路晶片組製造商的所在地。根據WSTS預測,2022年日本半導體產業銷售額將成長14.2%,並有望在未來幾年進一步成長。日本封裝需求不斷成長的一個關鍵原因是日本在半導體和整合晶片業務方面的顯著進步。日本正在透過向市場主要參與者提供大量資金和財務支援來快速重振其晶片製造基地,以確保汽車製造商和 IT 公司不會耗盡必要的零件。

- 例如,2023年2月,台積電宣布計畫斥資70億美元在九州建造一座晶片工廠,並計畫於2024年開始生產12奈米和16奈米晶片。為了支持這項投資,日本政府提供了4,760億日圓的補貼,相當於工廠建設成本的一半左右。此外,Rapidus也宣布將與IBM合作開發生產尖端2奈米晶片,目標是在2025年推出原型生產線。

- 台灣半導體產業依賴外包半導體組裝和測試(OSAT)的公司。日月光科技控股是致力於傳統和先進封裝及先進測試的行業領導者。除了代工服務外,台灣在半導體價值鏈的晶片封裝和無晶圓廠領域也取得了重大進展。根據SEMI 2022年6月發布的最新季度全球晶圓廠預測,預計2022年台灣半導體製造設備支出將領先全球,成長52%至340億美元。這些令人印象深刻的功能將推動對包裝服務的需求,並鼓勵供應商增強其產品。

半導體封裝產業概況

半導體封裝市場正朝向半固體發展,主要企業包括日月光科技控股公司、Amkor Technology Inc.、英特爾公司、台灣半導體製造有限公司和長電科技集團。市場參與企業正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2023 年 10 月 - 日月光科技控股公司宣布推出整合設計生態系統,以提高晶片封裝設計的效率,將週期時間縮短一半。整合設計生態系統 (IDE) 是一個經過最佳化的協同設計工具集,可系統地增強整個 VIPackTM 平台的先進封裝架構。

- 2023 年 8 月 - Amkor Technology Inc. 宣布擴大先進封裝產能。 2.5D封裝的月產量預計將從2023年初的3,000片晶圓增加到2024年上半年的5,000片晶圓。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估 COVID-19 和宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 各行業半導體元件消費擴大

- 政府政策及新興國家政策利多

- 市場抑制因素

- 半導體IC設計初始投資高且複雜

第6章市場區隔

- 按封裝平台

- 先進封裝

- 覆晶

- SIP

- 2.5D/3D

- 嵌入式晶粒

- 扇入式晶圓級封裝 (FI-WLP)

- 扇出晶圓級封裝 (FO-WLP)

- 傳統包裝

- 先進封裝

- 按最終用戶產業

- 消費性電子產品

- 航太/國防

- 醫療設備

- 通訊/電訊

- 汽車產業

- 能源/照明

- 按地區

- 北美洲

- 歐洲

- 亞太地區

第7章競爭形勢

- 公司簡介

- ASE Group

- Amkor Technology

- JCET/STATS ChipPAC

- Siliconware Precision Industries Co. Ltd(SPIL)

- Powertech Technology Inc.

- Tianshui Huatian Technology Co. Ltd

- Fujitsu Semiconductor Ltd

- UTAC Group

- Chipmos Technologies Inc.

- Chipbond Technology Corporation

- Intel Corporation

- Samsung Electronics Co. Ltd

- Unisem(M)Berhad

- Interconnect Systems Inc.(ISI)

第8章投資分析

第9章市場的未來

The Semiconductor Packaging Market size is estimated at USD 47.22 billion in 2024, and is expected to reach USD 79.37 billion by 2029, growing at a CAGR of 10.95% during the forecast period (2024-2029).

Advanced packaging can help achieve performance gains by integrating multiple chips in a package. By connecting these chips using fatter, such as through-silicon vias, interposers, bridges, or simple wires, the speed of signals can be increased, and the amount of energy required to drive those signals can be reduced. Additionally, advanced packaging allows for mixing components developed at different process nodes.

Key Highlights

- The advanced packaging (AP) industry is currently going through a fascinating phase of significant progress. As Moore's Law slows down and the advancement of devices under 2nm nodes gains significant research and development investments from industry leaders such as TSMC, Intel, and Samsung, advanced packaging has become a valuable tool for enhancing product value.

- The development of electronic hardware necessitates the utilization of computing power that is capable of delivering high performance, high speed, and high bandwidth, as well as low latency and power consumption. Additionally, the hardware must be able to provide a wide range of functionalities, as well as be able to integrate at the system level, and must be cost-effective. Advance packaging technologies are ideally suited to meet these diverse performance demands and the intricate heterogeneous integration requirements, thus providing businesses with the opportunity to capitalize on the changing demands of high-performance computing, artificial intelligence, and 5G.

- Major semiconductor packaging vendors are experiencing significant growth in sales owing to increasing demand for high-performance computing, IoT, and 5G devices. For instance, Amkor's computing segment, which includes data center, infrastructure, PC/laptop, and storage, registered a 20% share in the total revenue, up from 18% in Q2 2022. The shift toward vehicle electrification is being accelerated by the implementation of policies by governments around the world to reduce emissions and encourage sustainable transportation.

- A significantly high initial investment is required in the designing, developing, and setting up of semiconductor packaging units as per the requirements of different industries such as automotive, consumer electronics, healthcare, IT & telecommunication, and aerospace and defense. This can restrict the growth of the semiconductor packaging market.

- The COVID-19 pandemic forced manufacturing industries to re-evaluate their traditional production processes, primarily driving digital transformation and smart manufacturing practices across the production lines. According to the Semiconductor Industry Association, in 2023, semiconductor sales were expected to reach USD 515.1 billion worldwide. Semiconductors are crucial components of electronic devices, and the industry is highly competitive. The year-on-year decline rate in 2023 was 10.3%, although a swift recovery is expected in 2024. Notable semiconductor chip makers include Intel and Samsung Electronics, with Intel generating USD 58.4 billion and Samsung generating USD 65.6 billion in semiconductor revenue in 2022, placing them among the largest companies in terms of semiconductor industry revenues.

Semiconductor Packaging Market Trends

Ultra High-density Fan-Out Advanced Packaging Segment to Hold Significant Market Share

- The ultra-high-density fan-out (UHD FO) has more than 18 inputs and outputs (I/O) per square millimeter and line and spacing (L/S) measurements in the redistribution layer (RDL) of 5µm and 5µm. It can be considered an upgraded version of High Density (HD) FO where the L/S suits a more extensive package size for HPC applications like networking and data center servers.

- These UHD FO are beneficial for low/mid-end 2.5D applications with cost-effective solutions such as HPC or server networks compared to 2.5D silicon Through Silicon Via (TSV) interposer packaging. The ultra-high-density fan-out packaging offers dense interconnection, better electrical performance, and the ability to integrate multiple heterogeneous dies in a cost-effective, low-profile semiconductor package. UHD FO will replace Si Interposers in the future through innovative FO-on-substrate and FO-embedded bridge solutions.

- With the development of the internet and the rise of the artificial intelligence industry, high-performance semiconductor integrated circuits have become critical in the semiconductor industry. The 2.5D IC package with ultra-high-density I/O is one of the first structures applied to high-performance computing (HPC) like GPU.

- Ultra-high-density FOWLP enables manufacturers to make smaller two-dimensional connections that redistribute the output of the silicon die to a greater area, enabling higher I/O density, higher bandwidth, and higher performance for modern devices.

- A semiconductor IC quality is a fundamental component contributing to the success of mission-critical, low-latency 5G services such as autonomous driving and security monitoring. According to GSMA, 5G is forecasted to increase from a global market penetration of 13 percent in 2022 to 64 percent in 2030. The increasing number of 5G applications across countries like the United States, China, India, the United Kingdom, Canada, etc., is expected to significantly increase the number of mobile subscribers that use 5G connectivity. This is expected to increase the demand for ultra-high-density fan-out packaging for ICs.

Asia-Pacific Expected to Witness Major Growth

- China has a highly ambitious semiconductor agenda, supported by a substantial funding of USD 150 billion. The nation is developing its domestic IC industry to increase its chip production. The Greater China region, comprising Hong Kong, China, and Taiwan, is a significant geopolitical hotspot. The ongoing US-China trade war has further intensified tensions in this area, which houses all the leading process technology, prompting several Chinese firms to invest in their semiconductor industry.

- For instance, in September 2023, China announced its plans to launch a new state-backed investment fund to raise about USD 40 billion for its semiconductor sector. In December 2022, China announced its commitment to a support package exceeding YUAN 1 trillion (USD 143 billion) for its semiconductor industry. This initiative is a crucial step towards achieving self-sufficiency in chip production and is a response to U.S. actions aimed at hindering China's technological progress. The demand for packaging services is anticipated to rise considerably over the forecasted period, owing to the country's intensified efforts to enhance domestic chip manufacturing.

- Japan also holds a significant position in the semiconductor and electronics industries as it is home to some of the essential integrated circuits chipset manufacturers. According to WSTS, the semiconductor industry revenue in Japan grew by 14.2% in 2022, and it is expected to grow further over the coming years. The nation's packaging demand is expanding primarily due to the country's significant advancements in the semiconductor and integrated chip businesses. Japan is quickly reviving its chip manufacturing base to ensure that its automakers and IT firms do not run out of essential components by providing significant funding and financial support to major players active in the market.

- For instance, in February 2023, Taiwan Semiconductor Manufacturing Co (TSMC) announced a plan to build a USD 7 billion chip plant on Kyushu island, with 12 and 16-nanometre chips slated to begin in 2024. To support this investment, the Japanese government has offered a JPY 476 billion subsidy, or about half the expected cost of the factory. Further, Rapidus announced entering a tie-up with IBM for developing and producing cutting-edge 2nm chips, aiming to launch a prototype line in 2025.

- Taiwan's semiconductor industry depends on companies outsourcing semiconductor assembly and testing (OSAT). ASE Technology Holding is the industry leader with its efforts in traditional and sophisticated packaging and advanced testing. Taiwan has made significant strides in the chip packaging and fabless segments of the semiconductor value chain, in addition to its foundry services. According to the latest quarterly World Fab Forecast by SEMI, published in June 2022, Taiwan is expected to lead the world in semiconductor manufacturing equipment expenditure in 2022, with a 52% increase to USD 34 billion. These impressive capabilities are expected to drive demand for packaging services, prompting vendors to enhance their offerings.

Semiconductor Packaging Industry Overview

The Semiconductor Packaging Market is semi-consolidated with the presence of major players like ASE Technology Holding Co., Ltd, Amkor Technology Inc., Intel Corporation, Taiwan, Semiconductor Manufacturing Company Limited, and JCET Group Co. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023 - ASE Technology Holding Co., Ltd announced to launch of its Integrated Design Ecosystem to enable silicon package design efficiencies that reduce cycle time by half. Integrated Design Ecosystem (IDE) is a collaborative design toolset optimized to boost advanced package architecture across its VIPackTM platform systematically.

- August 2023 - Amkor Technology Inc. announced the expansion of its advanced packaging production capacity. Monthly production of 2.5D packaging is expected to increase from 3,000 wafers in early 2023 and reach 5,000 wafers in the first half of 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 and Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Consumption of Semiconductor Devices Across Industries

- 5.1.2 Favorable Government Policies and Regulations in Developing Countries

- 5.2 Market Restraints

- 5.2.1 High Initial Investment and Increasing Complexity of Semiconductor IC Designs

6 MARKET SEGMENTATION

- 6.1 By Packaging Platform

- 6.1.1 Advanced Packaging

- 6.1.1.1 Flip Chip

- 6.1.1.2 SIP

- 6.1.1.3 2.5D/3D

- 6.1.1.4 Embedded Die

- 6.1.1.5 Fan-in Wafer Level Packaging (FI-WLP)

- 6.1.1.6 Fan-out Wafer Level Packaging (FO-WLP)

- 6.1.2 Traditional Packaging

- 6.1.1 Advanced Packaging

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Aerospace and Defense

- 6.2.3 Medical Devices

- 6.2.4 Communications and Telecom

- 6.2.5 Automotive Industry

- 6.2.6 Energy and Lighting

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ASE Group

- 7.1.2 Amkor Technology

- 7.1.3 JCET/STATS ChipPAC

- 7.1.4 Siliconware Precision Industries Co. Ltd (SPIL)

- 7.1.5 Powertech Technology Inc.

- 7.1.6 Tianshui Huatian Technology Co. Ltd

- 7.1.7 Fujitsu Semiconductor Ltd

- 7.1.8 UTAC Group

- 7.1.9 Chipmos Technologies Inc.

- 7.1.10 Chipbond Technology Corporation

- 7.1.11 Intel Corporation

- 7.1.12 Samsung Electronics Co. Ltd

- 7.1.13 Unisem (M) Berhad

- 7.1.14 Interconnect Systems Inc. (ISI)