|

市場調查報告書

商品編碼

1849905

智慧功率模組(IPM):市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Intelligent Power Module (IPM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

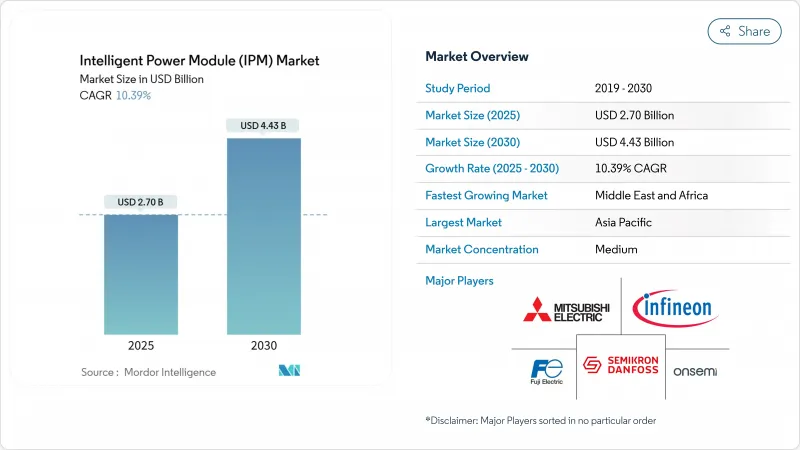

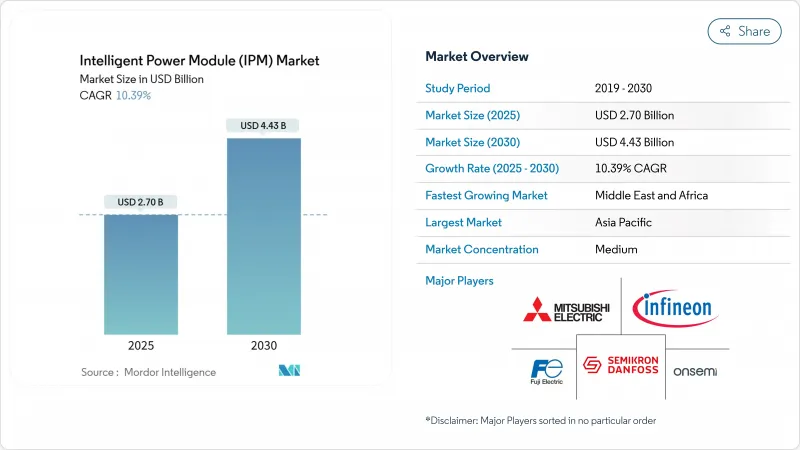

預計到 2025 年,智慧功率模組市場規模將達到 27 億美元,到 2030 年將達到 44.3 億美元,年複合成長率為 10.39%。

這一發展軌跡反映了電動車、可再生能源、工業自動化和先進家電領域向高效轉換的轉變。政策主導的電氣化、日益嚴格的能源效率要求以及緊湊型模組快速取代分離式功率裝置(從而縮短設計週期)推動了這一需求。寬能能隙半導體(尤其是碳化矽 (SiC) 和氮化鎵 (GaN))的整合,實現了更高的開關頻率、更低的損耗和更小的散熱器,樹立了矽基IGBT無法企及的全新性能標準。供應商隨即推出了基於SiC的整合式電源管理 (IPM),這些IPM整合了片上閘極驅動器和保護邏輯,從而實現了提升汽車續航里程的牽引逆變器和降低平準化電力成本的太陽能微型逆變器。同時,圍繞SiC晶圓產能和鎵出口限制的供應鏈風險凸顯了垂直整合和多源採購策略的重要性。

全球智慧功率模組(IPM)市場趨勢與洞察

中國高效率電動車變頻器用SiC基IPM需求快速成長

中國汽車製造商正在加速以碳化矽(SiC)MOSFET智慧功率模組取代牽引逆變器中的矽IGBT,從而將開關損耗降低高達50%,逆變器體積縮小30%,進而延長車輛續航里程並降低電池成本。比亞迪等行業一體化企業透過建造國內SiC晶體生長生產線、縮短前置作業時間並規避出口限制,確保了晶圓供應。預計到2027年,中國電動車中SiC智慧功率模組的採用率將超過65%,這一里程碑迫使國際競爭對手加快推進各自的SiC藍圖。這種區域領先地位再形成了全球智慧功率模組市場格局,使量化學習曲線提前兩年完成,並比預期更快實現了SiC與矽的成本持平。

歐洲工業4.0維修中IPM伺服驅動器的快速應用

一家德國中小型機械製造商對其原有運動系統維修,採用基於IPM的伺服驅動器,實現了25%至40%的節能,並增加了預測性維護功能,以便整合到數位雙胞胎平台中。標準化的外形尺寸和內建的安全功能,例如KEB的COMBIVERT F6控制器,簡化了試運行,並減少了設備中期升級的停機時間。改裝避免了整機更換,符合歐洲能源效率補貼的條件,並為模組供應商釋放了利潤豐厚的市場。這一趨勢也推動了對600V和650V IPM的需求,這些IPM在30kW以下馬達的成本和性能之間取得了平衡,鞏固了歐洲作為高階自動化市場的地位。

寬能能隙晶圓供應受限

中國限制鎵(氮化鎵生產的關鍵原料)出口後,碳化矽晶圓的前置作業時間超過40週,導致市場兩極化,汽車級基板的供應受到優先保障。配額政策有利於現有客戶,阻礙了新進入者,並延緩了組件供應多元化。製造商紛紛加緊建造晶體生長設施,但爐體安裝和晶錠認證需要24至30個月,這意味著在2027年之前不太可能出現實質緩解。

細分市場分析

600V級產品滿足了家用電器和太陽能微型逆變器的需求,並支撐著智慧功率模組市場的中階領域,預計到2024年將維持39.5%的收入成長。設計人員青睞600V級產品,是因為其成熟的供應鏈、廣泛的閘極驅動器生態系統以及具有吸引力的價格分佈。然而,在800V電池電動車和三相組串式逆變器的推動下,1200V級產品以14.2%的複合年成長率快速成長。在該領域,SiC CoolSiC MOSFET IPM實現了45 mΩ的導通電阻和低於100ppm的故障率,證明了其在安全至關重要的電動車傳動系統中的應用潛力。 650-900V產品系列在工業UPS和機器人領域保持了其市場佔有率,而1700V產品則面向軌道交通和中壓驅動等對長絕緣距離要求極高的應用領域。因此,開發人員擴大根據系統級效率目標而不是設備限制來選擇電壓等級,從而增強了智慧功率模組市場的多樣性。

此次電壓轉變對散熱架構和匯流排設計產生了影響。例如,1200V智慧功率模組(IPM)採用了無底板佈局,從而降低了熱阻並減輕了牽引組件的重量。同時,閘極驅動IC也得到了發展,能夠支援負閘極電壓、增強隔離並適應快速開關邊緣。由於寬能能隙成本的下降,預計1200V智慧功率模組的市場規模將顯著擴大,並提升其在該細分市場的佔有率。

到2024年,IGBT IPM將繼續佔據71.5%的收入佔有率,這主要得益於數十年來在製程方面的累積以及在家用電器和通用驅動領域的成本優勢。然而,由於SiC MOSFET模組具有更高的擊穿場強和更快的開關速度,能夠降低導通損耗和關斷損耗,從而實現更高的功率密度,因此其複合年成長率將達到27.8%。電動車牽引逆變器正在採用SiC IPM來提高每千瓦時的續航里程並滿足重量目標,這促使汽車OEM廠商簽署多年晶圓合約。

儘管GaN FET智慧功率模組在智慧功率模組產業仍處於起步階段,但已被應用於開關頻率為1MHz、磁路尺寸不斷縮小的緊湊型電源。 Si MOSFET智慧功率模組則繼續應用於低壓馬達驅動器和電動工具領域,在這些應用中,成本因素遠比效率更為重要。因此,裝置的選擇變得更加重視應用細節,系統設計人員也擴大在不同子系統中混合使用不同的技術,這不僅拓寬了市場競爭的領域,也使得整合設計服務成為一項重要的差異化優勢。

由於採用氧化鋁或氮化鋁陶瓷,直接鍵合銅(DBC)基板在導熱性和成本之間取得了良好的平衡,預計到2024年,DBC基板的市場佔有率將達到46.1%。然而,活性金屬硬焊(AMB)銅基板憑藉其更牢固的陶瓷-銅鍵合,將以16.1%的複合年成長率成長。 AMB基板優異的疲勞壽命使其在30千瓦以上的牽引和工業驅動應用中價格更高。

雖然鋁絕緣金屬基板仍然是家用逆變器的低成本選擇,但Si3N4陶瓷基板已在機械衝擊要求極高的領域(例如電子軸)佔據了一席之地。基板技術的創新與寬能能隙的普及同步發展。因此,組件供應商透過垂直整合基板工廠或建立長期供應夥伴關係關係來確保產能。

智慧功率模組市場按工作電壓(600V 模組,其他)、功率元件(基於 IGBT 的 IPM,其他)、基板材料(絕緣金屬基板,其他)、電路拓撲(半橋,其他)、額定電流(高達 50A,其他)、終端用戶產業(電器產品,其他)、銷售管道(OEM,售後市場/地區進行市場改造和區域市場(OEM,售後市場/地區進行市場改裝。

區域分析

預計亞太地區在2024年智慧功率模組市場收入中將維持48.3%的佔有率,這主要得益於中國積極的電動車生產、日本的消費性電子產業基礎以及韓國電池供應鏈的擴張。中國國內的碳化矽晶體生長計畫和電動車補貼政策促進了本地模組採購;日本三菱電機率先研發出1700V鐵路模組,以支持該地區的高速鐵路建設。印度的「印度製造」計畫加速了工業自動化的普及,推動了對650V驅動器的需求。東南亞的契約製造採用基於IPM的AC馬達以滿足能源法規要求,從而擴大了區域銷售量。

北美地區電動車產業的復甦推動了電動車的發展,工廠化生產的電動車外殼、太陽能微型逆變器以及本地化的逆變器和充電器工廠都得到了發展。美國提高了待機效率標準,促進了整合功率級的發展;而加拿大的可再生能源組合則刺激了串接型逆變器中對600V整合功率模組(IPM)的需求。墨西哥則崛起為汽車電力電子產品的出口中心,其組件需求符合美墨加協定(USMCA)的含量要求。

歐洲堅持以技術為中心的發展模式,將工業4.0維修與嚴格的環境設計規範結合。德國的中型機械製造商採用了符合SIL3安全等級的7級IPM(綜合蟲害管理),義大利對紡織機械改裝,法國升級了暖通空調系統。西班牙和希臘的太陽能強制規定促使它們採用了3級IPM。

中東和非洲地區成長最快,複合年成長率達13.9%。由沙烏地阿拉伯和阿拉伯聯合大公國牽頭的可再生大型企劃整合了智慧電網逆變器,這些逆變器需要性能強大的整合式電源模組(IPM)。南非升級了礦用輸送機,採用IPM驅動裝置以降低能耗。土耳其投資電動車充電器製造,創造了對1200V碳化矽(SiC)模組的本地需求。

在巴西的太陽能發電競標和阿根廷的風能走廊中,南美洲公用事業規模的逆變器中使用1700V組件的比例正穩步成長。各地區政府已提供稅收優惠,鼓勵提高工業效率,以促進水泥廠和造紙廠安裝整合式電源管理(IPM)系統。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 中國高效率電動車變頻器用SiC基IPM需求快速成長

- 歐洲工業4.0維修中IPM伺服驅動器的快速應用

- 一級汽車OEM廠商車用充電器整合趨勢

- 促進北美地區對超低待機功耗電器進行監管

- 美國採用微型/奈米逆變器進行太陽能發電將提升對 600V IPM 的需求。

- 市場限制

- 寬能能隙晶圓供應受限

- 熱介面可靠性超過 1200 V 額定值

- 汽車零件製造商的 AEC-Q101檢驗成本不斷上升

- 亞洲價格分佈供應商侵害智慧財產權和價格下跌

- 價值鏈分析

- 監理展望

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀趨勢的影響

第5章 市場規模與成長預測

- 透過工作電壓

- 600V模組

- 650-900V 模組

- 1200V模組

- 1700V以上模組

- 功率元件

- 基於IGBT的IPM

- 基於矽MOSFET的IPM

- 基於SiC MOSFET的IPM

- 基於GaN FET的IPM

- 材質基板

- 絕緣金屬基板(Al)

- DBC陶瓷(AlN/Al2O3)

- AMB銅

- Si3N4陶瓷

- 透過電路配置

- 半橋

- 六塊肌

- 七包等等。

- 按目前評級

- 最大電流 50A

- 51-100 A

- 100安培或以上

- 按最終用途行業分類

- 家用電器

- 工業自動化和伺服驅動器

- 電動和混合動力汽車

- 可再生能源和儲能系統

- 鐵路牽引和基礎設施

- 暖通空調和建築系統

- 其他(醫療、航太)

- 按銷售管道

- OEM

- 售後/改裝

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mitsubishi Electric Corporation

- Infineon Technologies AG

- Fuji Electric Co., Ltd.

- ON Semiconductor Corporation

- Semikron Danfoss GmbH & Co. KG

- ROHM Co., Ltd.

- Vincotech GmbH

- STMicroelectronics NV

- Powerex Inc.

- Toshiba Electronic Devices & Storage Corp.

- Wolfspeed, Inc.

- Microchip Technology Inc.(Microsemi)

- Renesas Electronics Corporation

- Littelfuse, Inc.(IXYS)

- Dynex Semiconductor Ltd.

- CRRC Times Electric Co., Ltd.

- StarPower Semiconductor Ltd.

- Hitachi Energy Ltd.

- Navitas Semiconductor Corp.

- Alpha & Omega Semiconductor Ltd.

- Sanken Electric Co., Ltd.

- BYD Semiconductor Co., Ltd.

- Nanjing SilverMicro Electronics Co., Ltd.

- Vishay Intertechnology Inc.

- Danfoss Silicon Power GmbH

第7章 市場機會與未來展望

The Intelligent Power Module market size was valued at USD 2.70 billion in 2025 and is forecast to reach USD 4.43 billion by 2030, expanding at a 10.39% CAGR.

This trajectory reflected the shift toward high-efficiency conversion in electric vehicles, renewable energy, industrial automation, and advanced consumer appliances. Demand was reinforced by policy-driven electrification, tighter energy-efficiency mandates, and rapid substitution of discrete power devices with compact modules that shorten design cycles. The integration of wide-bandgap semiconductors, especially silicon carbide (SiC) and gallium nitride (GaN), allowed higher switching frequencies, lower losses, and smaller heat sinks, setting new performance baselines that silicon IGBTs could not match. Vendors responded by releasing SiC-based IPMs with on-chip gate drivers and protection logic, enabling traction inverters that improve vehicle range and solar micro-inverters that lower the levelized cost of electricity. At the same time, supply-chain risk surrounding SiC wafer capacity and gallium export controls underscored the importance of vertical integration and multi-sourcing strategies.

Global Intelligent Power Module (IPM) Market Trends and Insights

Surge in SiC-Based IPMs for High-Efficiency EV Inverters in China

Chinese automakers accelerated the replacement of silicon IGBTs with SiC MOSFET Intelligent power modules in traction inverters to cut switching losses by up to 50% and shrink inverter volume by 30%, thereby extending vehicle range and reducing battery cost. Vertically integrated players such as BYD secured wafer supply by adding domestic SiC crystal growth lines, shortening lead times, and insulating themselves from export restrictions. The adoption rate of SiC IPMs in Chinese EVs is projected to exceed 65% by 2027, a benchmark that forces international competitors to accelerate their own SiC roadmaps. This regional leadership reshaped the global Intelligent power module market by shifting volume learning curves two years ahead of schedule, driving cost parity between SiC and silicon earlier than expected.

Rapid Adoption of IPM Servo Drives in European Industry 4.0 Retrofits

Small and medium-sized German machine builders retrofitted legacy motion systems with IPM-based servo drives, achieving 25-40% energy savings while adding predictive maintenance hooks that integrate into digital-twin platforms. Standardized form factors with embedded safety functions, such as KEB's COMBIVERT F6 controllers, simplified commissioning, and reduced downtime for mid-life equipment upgrades. Retrofits avoided full machine replacement and qualified for European energy-efficiency subsidies, unlocking a high-margin niche for module suppliers. The trend also stimulated demand for 600 V and 650 V IPMs that balance cost and performance for motors below 30 kW, reinforcing Europe's position as a premium automation market.

Wide-Band-Gap Wafer Supply Constraints

SiC wafer lead times stretched beyond 40 weeks after China restricted gallium exports critical to GaN production, creating a bifurcated market where automotive-grade substrates commanded priority access. Allocation policies favored incumbent customers, delaying new entrants and slowing diversification of module supply. Manufacturers raced to add crystal-growth capacity, yet furnace installations and crystal ingot qualification required 24-30 months, meaning meaningful relief is unlikely before 2027.

Other drivers and restraints analyzed in the detailed report include:

- On-Board Charger Integration Trend Among Tier-1 Automotive OEMs

- Regulatory Push for Ultra-Low-Standby Appliances in North America

- Thermal-Interface Reliability Beyond 1200 V Ratings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 600 V class retained 39.5% revenue in 2024 because it matched appliance and solar micro-inverter needs, anchoring the mid-range of the Intelligent Power Module market. Designers favored its mature supply chain, broad gate-driver ecosystem, and attractive price points. Yet the 1200 V segment expanded swiftly at a 14.2% CAGR, propelled by 800 V battery electric vehicles and three-phase string inverters. Here, SiC CoolSiC MOSFET IPMs achieved an on-resistance of 45 mΩ and failure rates under 100 ppm, validating their use in safety-critical EV drivelines. The 650-900 V range preserved share in industrial UPS and robotics, while 1700 V products addressed rail traction and medium-voltage drives where high insulation distances matter. Consequently, developers now select voltage classes by system-level efficiency targets rather than device limitations, reinforcing a diverse Intelligent power module market.

This voltage migration influenced cooling architecture and busbar design. For instance, 1200 V IPMs adopted baseplate-less layouts that lowered thermal resistance and trimmed weight in traction packs. At the same time, gate-driver ICs evolved to support negative gate voltages and reinforced isolation, aligning with rapid switching edges. As wide-bandgap costs fell, the Intelligent power module market size for 1200 V designs is projected to lift the segment's Intelligent power module market share at a significant rate.

IGBT IPMs still commanded 71.5% revenue in 2024, owing to decades of process learning and competitive cost positioning across appliances and general-purpose drives. However, SiC MOSFET modules posted a 27.8% CAGR because their higher breakdown field and faster switching cut conduction and turn-off losses, enabling higher power density. Electric-vehicle traction inverters adopted SiC IPMs to squeeze extra kilometers per kilowatt-hour and meet weight targets, pushing automotive OEMs to lock multi-year wafer agreements.

GaN FET IPMs gained traction in compact power supplies where 1 MHz switching shrinks magnetics, though they remained a nascent slice of the Intelligent power module industry. Si MOSFET IPMs continued in low-voltage motor drives and power tools, where cost weightings trumped efficiency. As a result, device selection became application-specific; system designers increasingly mixed technologies across sub-systems, broadening the competitive field and elevating design-in services as a differentiator.

Direct bonded copper (DBC) substrates held 46.1% in 2024 because their alumina or AlN ceramics balanced thermal conductivity and cost. Yet active-metal-brazed (AMB) copper rose at a 16.1% CAGR by offering stronger ceramic-copper bonds that survived more than 20,000 power cycles, a key metric for automotive warranties. AMB's superior fatigue life justified its higher price in traction and industrial drives above 30 kW.

Insulated metal substrate aluminium remained the low-cost option for residential inverters, while Si3N4 ceramics gained footholds where mechanical shock mattered, such as e-axles. Substrate innovation progressed hand in hand with wide-bandgap adoption, because higher power density required better thermal spreading. Consequently, module vendors vertically integrated substrate shops or formed long-term supply partnerships to secure capacity.

The Intelligent Power Module Market is Segmented by Operational Voltage (600 V Modules, and More), by Power Device (IGBT-Based IPMs, and More), by Substrate Material (Insulated Metal Substrate, and More), by Circuit Configuration (Half-Bridge, and More), by Current Rating (Up To 50 A, and More), by End-Use Industry (Consumer Electronics and Home Appliances, and More), by Sales Channel (OEM and Aftermarket/Retrofit), and Geography.

Geography Analysis

Asia-Pacific retained 48.3% of 2024 revenue for the Intelligent Power Module market, underpinned by China's aggressive EV production, Japan's consumer electronics heritage, and South Korea's battery supply chain scaling. China's domestic SiC crystal growth programs and EV subsidies anchored local module sourcing, while Japan's Mitsubishi Electric pioneered 1700 V rail modules that served regional high-speed trains. India accelerated industrial automation adoption through "Make-in-India," boosting demand for 650 V drives. Southeast Asia's contract manufacturers adopted IPM-based AC motors to meet energy codes, broadening regional volume.

North America followed, driven by factory-built housing, solar micro-inverters, and a resurgent EV industry that localized inverter and charger plants. The United States mandated tighter standby efficiency that favored integrated power stages, while Canada's renewable portfolios spurred demand for 600 V IPMs in string inverters. Mexico emerged as an export base for automotive power electronics, tying module demand to USMCA content rules.

Europe maintained a technology-centric profile, combining Industry 4.0 retrofits with stringent eco-design rules. Germany's Mittelstand machine builders adopted seven-pack IPMs with SIL3 safety, Italy's retrofit textile machinery, and France's upgraded HVAC networks. Solar mandates in Spain and Greece favored three-level IPMs.

The Middle East and Africa posted the fastest growth at 13.9% CAGR on renewable mega-projects led by Saudi Arabia and the UAE, which integrated smart-grid inverters requiring rugged IPMs. South Africa upgraded mining conveyors with IPM drives to cut energy intensity. Turkey invested in EV charger manufacturing, creating local demand for 1200 V SiC modules.

South America remained smaller yet steadily rising, with Brazil's solar auctions and Argentina's wind corridors utilizing 1700 V modules for utility-scale converters. Regional governments offered tax incentives for industrial efficiency, encouraging IPM installations in cement and paper mills.

- Mitsubishi Electric Corporation

- Infineon Technologies AG

- Fuji Electric Co., Ltd.

- ON Semiconductor Corporation

- Semikron Danfoss GmbH & Co. KG

- ROHM Co., Ltd.

- Vincotech GmbH

- STMicroelectronics N.V.

- Powerex Inc.

- Toshiba Electronic Devices & Storage Corp.

- Wolfspeed, Inc.

- Microchip Technology Inc. (Microsemi)

- Renesas Electronics Corporation

- Littelfuse, Inc. (IXYS)

- Dynex Semiconductor Ltd.

- CRRC Times Electric Co., Ltd.

- StarPower Semiconductor Ltd.

- Hitachi Energy Ltd.

- Navitas Semiconductor Corp.

- Alpha & Omega Semiconductor Ltd.

- Sanken Electric Co., Ltd.

- BYD Semiconductor Co., Ltd.

- Nanjing SilverMicro Electronics Co., Ltd.

- Vishay Intertechnology Inc.

- Danfoss Silicon Power GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in SiC-based IPMs for high-efficiency EV inverters in China

- 4.2.2 Rapid adoption of IPM servo drives in European Industry 4.0 retrofits

- 4.2.3 On-board charger integration trend among Tier-1 automotive OEMs

- 4.2.4 Regulatory push for ultra-low-stand-by home appliances in North America

- 4.2.5 Solar micro-/nano-inverter build-outs boosting 600 V IPM demand in the US

- 4.3 Market Restraints

- 4.3.1 Wide-band-gap wafer supply constraints

- 4.3.2 Thermal-interface reliability beyond 1200 V ratings

- 4.3.3 High automotive AEC-Q101 validation costs for module makers

- 4.3.4 IP infringement and price erosion by low-end Asian vendors

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macro Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Operational Voltage

- 5.1.1 600 V Modules

- 5.1.2 650-900 V Modules

- 5.1.3 1200 V Modules

- 5.1.4 1700 V and Above Modules

- 5.2 By Power Device

- 5.2.1 IGBT-based IPMs

- 5.2.2 Si MOSFET-based IPMs

- 5.2.3 SiC MOSFET-based IPMs

- 5.2.4 GaN FET-based IPMs

- 5.3 By Substrate Material

- 5.3.1 Insulated Metal Substrate (Al)

- 5.3.2 DBC Ceramic (AlN / Al2O3)

- 5.3.3 AMB Copper

- 5.3.4 Si3N4 Ceramic

- 5.4 By Circuit Configuration

- 5.4.1 Half-Bridge

- 5.4.2 Six-Pack

- 5.4.3 Seven-Pack and Others

- 5.5 By Current Rating

- 5.5.1 Up to 50 A

- 5.5.2 51-100 A

- 5.5.3 Above 100 A

- 5.6 By End-Use Industry

- 5.6.1 Consumer Electronics and Home Appliances

- 5.6.2 Industrial Automation and Servo Drives

- 5.6.3 Electric and Hybrid Vehicles

- 5.6.4 Renewable Energy and ESS

- 5.6.5 Rail Traction and Infrastructure

- 5.6.6 HVAC and Building Systems

- 5.6.7 Others (Medical, Aerospace)

- 5.7 By Sales Channel

- 5.7.1 OEM

- 5.7.2 Aftermarket / Retrofit

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Italy

- 5.8.3.5 Spain

- 5.8.3.6 Russia

- 5.8.3.7 Rest of Europe

- 5.8.4 Asia-Pacific

- 5.8.4.1 China

- 5.8.4.2 Japan

- 5.8.4.3 India

- 5.8.4.4 South Korea

- 5.8.4.5 South-East Asia

- 5.8.4.6 Rest of Asia-Pacific

- 5.8.5 Middle East and Africa

- 5.8.5.1 Middle East

- 5.8.5.1.1 Saudi Arabia

- 5.8.5.1.2 United Arab Emirates

- 5.8.5.1.3 Turkey

- 5.8.5.1.4 Rest of Middle East

- 5.8.5.2 Africa

- 5.8.5.2.1 South Africa

- 5.8.5.2.2 Nigeria

- 5.8.5.2.3 Rest of Africa

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Mitsubishi Electric Corporation

- 6.4.2 Infineon Technologies AG

- 6.4.3 Fuji Electric Co., Ltd.

- 6.4.4 ON Semiconductor Corporation

- 6.4.5 Semikron Danfoss GmbH & Co. KG

- 6.4.6 ROHM Co., Ltd.

- 6.4.7 Vincotech GmbH

- 6.4.8 STMicroelectronics N.V.

- 6.4.9 Powerex Inc.

- 6.4.10 Toshiba Electronic Devices & Storage Corp.

- 6.4.11 Wolfspeed, Inc.

- 6.4.12 Microchip Technology Inc. (Microsemi)

- 6.4.13 Renesas Electronics Corporation

- 6.4.14 Littelfuse, Inc. (IXYS)

- 6.4.15 Dynex Semiconductor Ltd.

- 6.4.16 CRRC Times Electric Co., Ltd.

- 6.4.17 StarPower Semiconductor Ltd.

- 6.4.18 Hitachi Energy Ltd.

- 6.4.19 Navitas Semiconductor Corp.

- 6.4.20 Alpha & Omega Semiconductor Ltd.

- 6.4.21 Sanken Electric Co., Ltd.

- 6.4.22 BYD Semiconductor Co., Ltd.

- 6.4.23 Nanjing SilverMicro Electronics Co., Ltd.

- 6.4.24 Vishay Intertechnology Inc.

- 6.4.25 Danfoss Silicon Power GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment